When the media discusses how banks have ridden like a steamroller over borrowers and investors, the typical response is a combination of minimization and distancing: that the offense wasn’t such a big deal and that it was a mistake. Recall the PR barrage in the wake of the robosigning scandal: its was “sloppiness,” “paperwork errors”. Servicers kept claiming, despite overwhelming evidence of bad faith and the institutionalization of impermissible practices, that there was really nothing wrong with how they were operating. Remember it was important for them to take that position, because if they were to admit that the bank knew it was engaging in widespread abuses with management knowledge and approval, it would be admitting to fraud.

Two major government settlements later, this position is looking awfully strained. And the Fed, in stonewalling Elizabeth Warren’s and Elijah Cumming’s efforts to get more information about the Independent Foreclosure Reviews, presented the bad practices as servicer policies, which means that they were deliberate, hence, fraudulent.

By way of background: Warren and Cummings have been asking the OCC and Fed for some time for more information about what happened in the foreclosure reviews. Out of fourteen information requests they made in a January letter, they got only one question answered in full, and mere partial responses to three other questions. They requested, and got, a meeting yesterday. They issued a letter Wednesday that described what transpired. Key sections:

Two years ago this week, your offices issued a public report announcing that you determined that 14 mortgage servicing companies were engaging in “violations of applicable federal and state law.” You found that these abuses have “widespread consequences for the national housing market and borrowers.” You also explicitly referenced instances of abuse, including illegal foreclosures against our nation’s men and women in uniform who are protected by the Servicemembers Civil Relief Act (SCRA)….

We have requested information about the process used to conduct this review and the extent to which violations of law were found….

At the meeting yesterday, Federal Reserve staff argued that the documents relating to widespread legal violations are the “trade secrets” of mortgage servicing companies. In addition, staff from the Office of the Comptroller of the Currency (OCC) argued that these documents should be withheld from Members of Congress because producing them could be interpreted as a waiver of their authority to prevent disclosure to the public of confidential supervisory bank examination information.

Now since the Fed is apparently making this absurd argument in all seriousness, let’s look at the implications. A trade secret is a form of intellectual property. I encourage IP experts to pipe up in comments, but my understanding, based on the experience of a client who successfully sued a former employee for violating trade secrets, is that it is difficult to prove that your internal know-how rises to the level of being a trade secret. One of the key elements in making the case is that you have to show you went to some length to keep your special tricks secret, such as limiting access to them, having employees sign confidentiality agreements, etc.

Why does this matter? You can’t have internal knowledge rise to the level of being a trade secret unless their was an institutional decision to keep it secret. That means the Fed is effectively saying that servicer management, and almost certainly bank management (since servicing units don’t have their own corporate counsel) was fully aware of the nature of the practices at issue and chose to keep them secret, supposedly for competitive reasons. This is fact is one of the things lawyers have been eager to establish, namely that bank management knew full well all these servicing tricks were happening, and sought to protect them as important sources of profit. Way to go, Fed!

Now, of course, this argument is revealing in a lot of other ways. The Fed has also just admitted it thinks it is more important to protect bank knowledge of how to break the law than expose the information. So the Fed has also made explicit that it wants to preserve banks’ ability to rip off people. So the Fed’s official policy is bank profits trump the law. Not that we didn’t know that, but it has now been stated in a baldfaced manner.

The OCC’s position, that they need to preserve confidential bank examination information, is equally ridiculous (the letter gives a long-form debunking). Warren and Cummings noted,

You may protect against such a waiver by including standard language in a cover letter explaining that providing documents to Members of Congress, even if normally not disclosed to the public because of their proprietary or confidential nature, does not constitute a waiver.

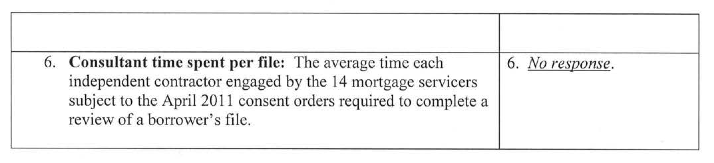

But it’s doubtful that the information at hand is “bank examination information”. The reason for keeping bank examination results confidential is to prevent bank runs. Mortgage servicing units are not banks. In fact, the OCC said repeatedly when it was pilloried for its failure to supervise servciers that didn’t have much in the way of formal authority over them. It wasn’t acting as a bank examiner of servicing units for the period that was the focus of the IFR, 2009 and 2010. Given the poor control over information during the IFR (for instance, at Bank of America, the army of temps who performed the project didn’t sign enforceable confidentiality agreements), and the fact that lots of relevant information (investor reports, court documents, including the affidavits used for the fraudulent fees) are public records, the OCC argument isn’t credible. It becomes even more of a howler when you look at the questions that the OCC and Fed are refusing to answer. Tell me how bank operations might be harmed by answering this question, for instance:

And why are the Fed and the OCC fighting Warren and Cummings so hard? It’s not as if the information they seek would help an individual borrower in litigation against a bank, except in a very general way. For instance, Warren and Cummings ask for the number of borrower files in which unsafe or unsound practices were found. If it was revealed that Bank of America had a high proportion of files with errors, as our whistleblowers found, that might persuade a judge that a borrower case not be thrown out in summary judgment.

But the real exposure of the banks is to investor litigation. The Bank of America sources who did fee reviews found virtually all their files had errors (their reflex was to say all files had errors, but most would then correct themselves and say 90% or 95% since they could not be sure someone didn’t get a batch of files that were fine). In many cases, the errors weren’t large enough to have caused a borrower to lose his house. But remember, if a home is foreclosed on, all fees (late fees, attorney fees, property inspection charges) are reimbursed first, so excessive frequency or size of foreclosure-related fees is a transfer from investors to servicers. So if the OCC and Fed were to confirm that there were large-scale abuses, investors might saddle up to go after the servicers.

This exchange also confirms something the public knows all too well: the regulators are in the business of protecting the banks, and only secondarily in enforcing the law. And until that changes, it is the safety and soundness of the population that is at risk.

That must be Theoclassical Finance commandment number one:

“trade secrets are above the law”

“Thine breaking of the law shall be unto thee as a trade secret; and woe betide any who shall try to discover thine malfeasance, for in darkness upon darkness shall they stumble. And though your sin sinketh to the heavens, the Priests of the Temple shall burn fragrant incense and utter fragrant words to protect thee from scorn, for verily thou art the Masters of the Universe and verily dost thou dwell above the laws of men.”

@diptherio, That is the BEST comment I believe I have ever read. If I may add a line?

“And though your sin sinketh to the heavens

Thine Temple shall burn you straight to HELL for your sins.”

Which leads me to (again) ask, Why did Carl Levin make pattycakes with the OCC people immediately after the roasting of the snakes from JPMorgan? If Warren and Cummings can see through them, why can’t Levin?

Speciallly when they had a rap sheet nine miles long.

Re: “If Warren and Cummings can see through them, why can’t Levin?”

Rather, why WON’T Levin see through them? (P.S. Where is Levin vacationing this year?)

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it!”

Folks, this is the bigest silly criminal game. A crime is a crime and I know first hand that these scumbag mortgage servicers are GUILTY of many crimes.

IF the protections, that are(should) be in place are not working, I can ASSURE you that we the people will take this set of criminals into our own hands. We have had just about enough of this silly dance. They ARE GUILTY and WILL see JAIL!.

The OCC has time to shill our social sits and blogs. (I have proof from a silly IT GAL that used her yahoo account however the idiot used an OCC ip address.) So, OCC, we know, we are making it public, and we will see you in jail for TREASON as well.

If there’s no functioning legal system it’s significantly harder to put criminals into jail than it is to kill them. Just sayin’.

(This, by the way, is why criminals should WANT a functioning legal system.)

RICO

A lot of good information is being posted: http://foreclosurevictims.freeforums.org/index.php

None of this is going to stop until someone brings a criminal case to trial. No senate investigation, no amount of journalism and reporting, no about of scandal or revelation is going to be a substitute for a day in open court.

One of these mortgage holders is going to have to bring a case to court. That’s all there is to it.

The crime will continue until they run out

of fools who can get ahold of OPM for nothing

down. Which means another crisis is building.

But who in their right mind would touch a

MERS-infected property, given that the big

risks on any property are what *wasn’t* recorded.

I am in middle or end of litigation…”Freddie Mac”. Have been in limbo for 2years…so I want this over. I only recieved my interrogatorie answers from the man 2 weeks ago…questions not answered (about 25). that is my discovery.Also, FM keeps pushing back court date, “to get their discovery” together. I would have thought that they would have had it by now. What could be the delay?

prolly looking for that derned note!

First, push for answers to your interrogatories. You can accuse them of being nonresponsive and demand answers again, with the right kind of filing (I forget what kind).

Second, *if* Freddie Mac started the case, move for immediate dismissal *with prejudice*, as they obviously didn’t have the information which they were supposed to have before starting a foreclosure — information which is supposed to be in their possession at all times. There’s actually a very precise legal way to state that and you should look it up.

Talking about Corporate & Government incest and ineptitude – Nakedcapitalism nailed it. Great job. In Feb. 2013, I published my book on this unholy alliance between consultants, watchdog groups and federal regulators. American Betrayal is the title, available at Amazon.com, B&N, etc.

This unholy alliance ought to be allowed to be a Qui Tam legal case and certainly should be candidate for biggest rip off of the year. Let’s look and see why and how the public was recently ripped off by a billion dollars or more. Where is Senator Elizabeth Warren when we need her?

I have been playing with Ontonix software analytics software and can see how it may have been able to save a billion dollars that should have been used to compensate homeowners harmed by actions by three large mortgage lenders. Instead, reportedly by Nakedcapital.com, a big bank consultancy in the nation’s capital, Promontory Financial Group, billed as much as a billion dollars for reviewing mortgage loan files at three large banks, following a decree-order to the banks, issued by banks regulators.

The consulting company has a cast of top government officials and chief bank regulators from each of the major government agencies. Its a “who’s who” of the big wheels who called the shots during the financial crisis. Staff and officers at Promontory include ex-chairmen of the OCC, FDIC, SEC, and top officials from the Treasury. It is surprising that there are still top officials left in these federal agencies.

The government, through the Comptroller of the Current, issues consent decree to the chief executive officer at Bank of America, Wells Fargo and PNC, requiring them to conduct an investigation of their mortgage loan files to help determine what borrowers experienced foreclosures or other significant harm due to improper actions by the banks.

Next, these banks do their own internal reviews to weed out the most egregious evidence of wrongdoing so that federal regulators and attorney generals are never any wiser as to what had occurred. Once that is done, the banks enter into contracts with a consultant to conduct the reviews in an attempt to show the reviews are independent and free from manipulation. In this situation, surprisingly, each bank selects Promontory Financial Group to conduct the reviews. Of course, Promontory does not have the expertise or manpower to conduct the reviews; so it goes out and hires contractors to perform the actual duties.

These individuals are given a few hours of training and then sent out to the banks to do the dirty work for Promontory at the request of the banks to appease bank regulators. Ironically, it was the bank examiners who were responsible for reviewing the mortgage loans files to begin with to make sure each insured bank was conducting its mortgage lending in a “safe and sound” manner. Because bankers have been able to “capture” the regulators over the past decade, each regulatory agency decided to “go easy” on the bankers by cutting way back on loan reviews to appease the bankers. Now, we have a better idea how the mortgage crisis was able to occur.

Heck, we thought it was bad how Haliburton was able to rip-off the government because of VP Cheney’s connections by having served as the head of that government contractor. Here, we have the same situation but instead of a defense contractor we have what is the world’s largest “white collar” government contractor. Any way one cares to look at it, a billion or so dollars — instead of going to the homeowners who were harmed by losing their homes because Wall Street banks carried out a type criminal enterprise — have been paid out to a bunch of bank consultants who failed to perform their assigned duties when they were bank regulators. The irony. It is the same as the government going to Bernie Madoff by paying him a billion dollars to find out which individual investors he stole millions from.

There ought to be some type of “clawback” of huge salaries and bonuses paid to ex-regulators who now are bank consultants. I write about “regulatory capture” and other major wrongdoing, including conflicts of interest by regulators in my recent book, “American Betrayal” by John Doe, whistleblower.

Feeling resigned to the fact that the citizenry lost the war to Wall Street and their enablers in D.C. and that the capture is 100% complete, I guess I should be accepting of the fact that forfeiting my home is simply an act of war reparations.

Victori spolia.

“And the Fed, in stonewalling Elizabeth Warren’s and Elijah Cumming’s efforts to get more information about the Independent Foreclosure Reviews, presented the bad practices as servicer policies, which means that they were deliberate, hence, fraudulent.”

Evidence of deliberate actions ensconced as policies is also prima facie evidence of criminal intent for RICO prosecution. This suggests that the FED and the OCC are accessories after the fact in a criminal RICO conspiracy and is guilty of misprision of a felony. See 18 USC sec. 4:

Whoever, having knowledge of the actual commission of a felony cognizable by a court of the United States, conceals and does not as soon as possible make known the same to some judge or other person in civil or military authority under the United States, shall be fined under this title or imprisoned not more than three years, or both.

Until she starts naming name of specific individuals who are blocking her efforts, no one is blocking her efforts. Make the names of problem public and let public outrage solve the problem. As long as Warren and her ilk discuss vague problems and mysterious villains, she allows voters to pretend the problem is being handled when Warren is actively part of the problem. Maybe she has good intentions, but we are long past that point where good intentions matter. Wake me when she gets results or makes it very hard for anyone to hire to these people.

I haven’t seen Liz Warren go off on Lanny Breur, Timmy Geithner, Larry Summers, and so forth. I have seen Liz Warren bring up Bill Clinton’s rescinding of the executive order about the revolving door. All she is cover for people who should have been prison years ago.

Very funny point about trade secrets being established by institutional decisions. I agree the thing they fear right now is the investors. But the detail from Yves’ audit of whistleblowers that described one of LPS’s fixes wherein to validate a note they simply erased all the allonges after the securitization deadline tells a deeper story. The biggest fear of all is not that more servicer bad behavior will be disclosed, that has pretty much run its course, but that it will become apparent that the entire MBS industry is a securitization fail. And a fraud. And an intentional one. And an intentional coverup.

This is already apparent to anyone who’s been paying attention. Who are they afraid will find out?

In short, who are still sucker investors?

Quick update. Evening News. Chris Hayes again. Showed the clip of Warren asking how homeowners were going to get the information that the banks were keeping secret. When she got shined on, she just looked pained and let it go. Then Sherrod Brown came on and CH asked if this mess ever going to be resolved. Sherrod Brown implied, but did not say, that it was an ongoing process. And he digressed into how cold hearted the regulators are that they don’t seem to understand how harmful and devastating the foreclosures were, etc. But nobody is screaming for action. In any other country it would be clear that there would indeed be a just resolution to this foreclosure mess. The committee should have Eric Holder testify and tell us all why this whole fiasco isn’t being prosecuted as flat-out illegal cover up of bank felonies.

Just for reference, it’s not true that any other country would actually demand a just fix.

Fraudulent, illegal foreclosures have been happening in the UK, Ireland, and Spain, to my knowledge.

Just now at Senate Banking Hearing on IFR – Daniel Stipano, OCC General Counsel – on the independence issue (Q from Sherrod Brown) – “it’s not realistic to expect no prior ties to the institution. “

The mere fact that all the wall street banks operated the same frauds and schemes, and behave in the same way, lays waste to the claim that its a trade secret. Unless its a trade secret direct from the FED which then directed each bank to do the same deeds. Its high time to hang Bernack from a lamp post and abolish the FED.

Yves, you are so good at seeing the ulterior motives (and opportunities to spot wrongdoing) behind boring-sounding names like “trade secret”.

More Senate Banking on IFR, paraphrasing….

Elizabeth Warren on a tear. She asked about how any settlement figure could be reached without an accurate sample figure. And of course, getting the OCC and Fed to admit they consider what they did to be privileged information, as noted in this posting by Yves.

Elizabeth Warren to Richard Ashton of the Fed – “Do you plan to give the information you have about how the banks illegally foreclosed to the families?”

Ashton – No.

Warren – So you’re protecting the banks, but not the homeowners.

Defendant: I’m a cat burglar. How I steal is a trade secret, your honor.

Judge : In that case , I’m dismissing the charges of theft.

Prosecutor: WTF !?!?!?!

Hey, that’s progress. They’re being honest about how they really feel :)

The Fed has transitioned from “it is only a crime if you get caught” to “it is only a crime if we say it is.”

At the very same time that the OCC is being grilled on their enabling of the crimes against humanity committed by these financial institutions, across town and behind closed doors the POTUS is meeting with Moynihan, Dimon and all the other non-prosecutable MOTU, as Pam Martens writes about today.

The gathered throne-folk are no doubt raising their glasses, singing in unison:

What keeps each of them in his skin?

What ancient native custom provides the needed glow?

Oh, what do simple folk do?

I think a simple rap is more befitting of the POTUS:

from Jay Z to Jamie D

to Moynihan at the B-A-C

got blinders on at the O-C-C

while my boys make off with O-P-P

That would be other peoples’ property.

Does this make OCC and the Fed Accessories to the crimes?

I think it may help at this point if the DOJ, OCC, SEC and Fed start wearing Spiderman outfits so the public is reassured our crime fighters are on the scene and hard at work protecting the public interest.

Otherwise, wtf?

bought first house early 2007. Based decision mostly on full knowledge that there could not be a housing/mortgage bubble because I was taught (CFA, etc) that OCC, Fed, SEC, are “regulating.” So they were not, my family is out a bucket full of cash, and they are still teaching at Harvard,etc how the OCC, Fed, and SEC are “regulators.” Only good news is that, after this experience, a college education/MBA has been completely devalued in my eyes so I dont feel as bad about not being able to send the kids to college.

Senate Banking Committee Hearing on IFR – Elizabeth Warren got three of the eight firms to admit they had no part in creating the “Payout List” (See “OCC Releases Embarrassing List of Foreclosure Review Payouts on Eve of Senate Hearings” yesterday). And therefore, the review wasn’t independent, the banks made up the payout document. Not the OCC, the Fed, the Auditors. The banks decided what to do.

“It now appears, the people who broke the law are the same people who determined who will be compensated from the breaking of that law… Mr. Chairman, I don’t have any other questions.”

Last I heard, a trade secret is a secret that gives a business a competitive advantage. The example my IP professor gave was selling falsely-labeled goods. It’s a secret, and it gives one a competitive advantage over one’s more honest competitors.

So, yes, a business practice of ignoring inconvenient laws would, if kept secret, potentially qualify as a trade secret. This is why all confidentiality agreements typically include language allowing those receiving the information to disclose it if obligated to do so by law.

Of course, the essence of a trade secret is keeping that knowledge secret. Now that these practices are well known to have occurred, they would not seem to be secret any more – thus voiding any “trade secret” protection.

i worked there. identified sales system fraud. reported internally. they retaliated big time. i walked into local fbi in person to evidence park while employed. they fired me. they arranged for local police to falsify a tiny crime (trespass 2, dismissed) that was used as basis for massive night swat arrest at HOME. i posted the evidence package on an archiving site and told them, they immediately put it in Dist. court. http://www.risepatriot.com (was having denial of service attack today) or via this youtube link, swat/court av on side Here is Yesterday’s Motion to Declare Holocaust. It has no holes, it is perfect. I challenge any attorney or academic to refute it: http://www.risepatriot.com/distcourtholocaust.pdf

http://www.youtube.com/watch?v=AJvG2pQqeIg

Taking down the servicers would open a direct assault on the banks… no doubt there was much collusion between them.

Well, from what I’ve seen and read, the jury is in on vacationing Carl Levin. A good showman.

The jury is still out on Warren and Brown, who both sound very sincere. Cummings — forget it.

As others in Congress have proven time and again, sounding sincere and following through are very different. That dog and pony show has stopped fooling some of the people all the time.

I have experienced this during litigation. I asked Chase for records regarding the securitization of my client’s loan. Chase claimed that those records were trade secrets, and a judge signed off on it. Sounds like the “trade secrets” defense is becoming the party line.

Blech. “True party in interest” is the key in such a litigation.

You have grounds for dismissal of the entire case if Chase never proved that it was authorized to act by the true loan owner. Let’s hope judges begin to recognize exactly what sort of frauds Chase is trying to get away with.

‘Trade secret’ means anyone in their employ who spills the beans, even to a Senate hearing, as a whistleblower will now have the Fed and the DOJ trying to squash him/her like a bug.

Remember even the former Governor of Alabama Don Seigelman was literally dragged out of Court in chains within seconds of conviction (complete garbage, with $0 profit to him) and tossed in isolation for 30 days until all hell broke loose about his situation.

Sign a petition for a commutation please. http://donsiegelman.org/

Well, by that logic, a serial killer could block evidence in court using the same argument!

Here’s the secret!

Carroll Quigley this guy was allowed access to the inner workings of the banking elite, the banks work on feudalism land law fellow serf.

Carroll Quigley quote:

“The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a* feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations. Each central bank…sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.” end.

This is how it’s done

Every bank in America uses the same law (*NCCUSL) as Fannie-Mae, (pasted below) chattel mortgages are based on the feudal land law. The king owned the land. The serfs were allowed to work the land, and pawn (pledge) personal property. To confirm this, find the Code the bank used to take your house, go to your local law library, find the first enactment (in the notes), it will be chattel mortgage law, that’s the secret!.

*National Conference of Commissioners on Uniform State Laws. NCCUSL was established in 1894.

Fannie Mae Selling Guide

Definitions:

defines “Mortgage” as: “Collectively, the security instrument, the note, the title evidence,

and all other documents and papers that evidence the debt (including the chattel mortgage, security agreement, and

financing statement for a cooperative share loan); an individual secured loan that is sold to us for retention in our

portfolio or for inclusion in a pool of mortgages that backs a Fannie Mae-guaranteed mortgage security. The term

includes a participation interest where context requires.” Selling Guide, Part XIII, Glossary.

The Fed is corrupt!