Yves here. There’s been a great deal consternation in Europe of consternation over a report that found that the median Spanish and Italian households are more than three times as wealthy as the median German household. This report says that these differences aren’t what they seem to be.

By Tito Boeri, Professor of Economics at Bocconi University, Milan. Cross posted from VoxEU

The ECB’s recent survey on household finances and consumption threw up some unexpected results – counter-intuitively, the average German household has less wealth than the average Mediterranean household. In line with a recent VoxEU.org contribution from De Grauwe and Ji, this article analyses the principal differences in wealth and income between the main Eurozone countries.

The Household Survey (European Central Bank 2013) is a joint project of the ECB and all the Eurozone central banks providing harmonised information on the balance sheets of 62,000 households in 15 Eurozone countries (all except Ireland and Estonia).1

Media hype had been generated by the ranking of the countries’ median household wealth results, especially by the fact that:

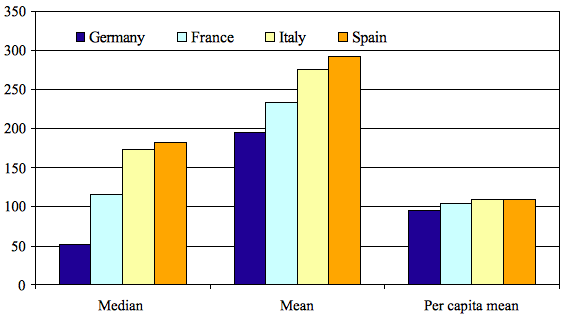

• Germany was in last place with €51,400.

• Italy and Spain were significantly above France with wealth equal to €173,500 and €182,700 respectively, compared to the French households’ €115,800.

The mean household wealth averages paint a very different picture to current narratives about the relatively wealth of nations in the Eurozone. The relative dispersion in the estimates is much smaller: the German household mean is €195,200, while for France, Italy and Spain it is €233,400, €275,200 and €291,400 respectively. Moreover, Germany climbs six places in the wealth ranking.

As already noted by De Grauwe and Ji (2013), Germany’s position at the bottom of the median ranking is simply due to its large wealth inequality compared with the others. This is confirmed by observing that the concentration of wealth, measured by a Gini index of 0.76, is much higher in Germany, while for France, Italy and Spain the estimate is smaller (0.68, 0.61 and 0.58 respectively).

Household Size Matters

This analysis does not take account of household composition in the various countries. The distribution of household wealth across countries is affected by differences in the demographic characteristics of households (age, education, household size):

• In northern countries, households are generally small, often composed of a single member.

• In the south it is not unusual to find many people, even from different generations (grandparents, parents and children), living together.

The splitting up of household members produces a sort of partition of wealth among the households they generate, as happens when young members exit the household to form a new family.

A simple way to sterilise for household size is to consider per capita averages:

• The per capita wealth figure for Italy and Spain is €108,700, slightly higher than for France (€104,100) and Germany (€95,500).

Hence, the differences between per capita averages are much smaller than those observed between household medians. Dealing with sample estimates, we observe that most of the above differences are not statistically significant, although National Accounts estimates confirm that per capita wealth in Germany is a little lower than in Italy, Spain or France (by 3%, 4% and 11 % respectively) (European Central Bank 2013).

Thus, there are no substantial differences in the averages for per capita wealth and that the media hype is the result of a specious reading of part of the results.

Income and Poverty

Other economic indicators paint pictures that are more favourable to Germany:

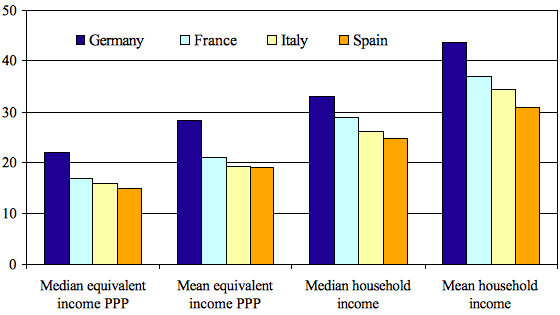

• German mean gross household income is about €43,500.

• In the other three countries the average is between €31,000 and €37,000.

If we consider household equivalent income, a measure of the resources available at the individual level that takes household size and composition into account, the income gap appears larger2: the German mean gross equivalent income is about €28,000 (the median €22,000), compared with averages ranging from €19,000 to €21,000 (and the medians from €15,000 to €17,000). Even taking into account the different purchasing power of income in the four countries, the results are similar for both means and medians. In short, Germans have a significantly higher income with respect to the citizens of the other three major Eurozone countries with similar equivalent income statistics.

Figure 1. Net wealth statistics (1000€)

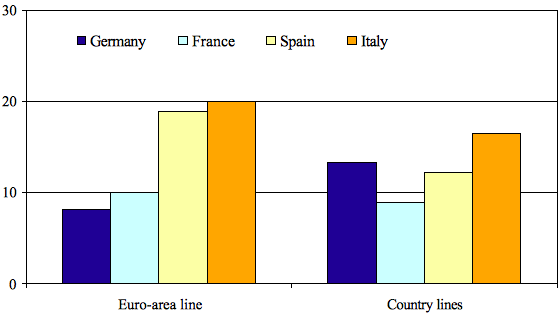

As to the poverty distribution, the proportion of relatively poor individuals is calculated by adopting a unique poverty line (half the Eurozone median equivalent income adjusted for the different price levels3) and a specific poverty line for each country.The second clearly defines poverty only in terms of the relative position (and prices) of the household in its country’s income distribution, while the first treats all households as belonging to a single area, although accounting for the different level of price among countries. Figure 3 shows that the two definitions do not produce the same picture. In the first definition:

• Poverty appears to be more widespread in Italy and Spain and less widespread in France and Germany.

• Adopting national poverty lines, poverty is more widespread in Italy and Germany than in Spain and France.

These results are only a small part of what can be obtained analysing the rich database that is available to researchers. It would be worthwhile taking the study of households’ economic behaviour in the Eurozone further by means of analyses that consider various dimensions (socio-demographic, economic and institutional) of cross-country heterogeneity while avoiding hasty conclusions.

Figure 2. Income statistics (1000€)

Figure 3. Distribution of poverty (per cent)

The Germans have cash flow because they export their wealth and get tokens for it.

But if the European entrepot economy comes to a halt they will be in a right pickle.

Look how much the UK gets in free goods from Germany……..its simply huge !!

“Figures by country are only available in value terms. The widening of the deficit with the EU in the first quarter came mainly from trade with Germany and the Netherlands. The deficit on trade with Italy reduced slightly while the UK’s surplus in trade in goods with Ireland rose with an increase in the level of exports” (this is normally refined oil products )

The trend continues…………….of increased North Sea trade but weakness in China & especially Japanese trade. The UK has posted its largest quarterly deficit with Germany ever in Q1 2013

At £ – 5,621 million

Its largest deficit with Belgium

£ – 1,565m

Largest deficit with Netherlands

£ -2,897m

And indeed Spanish austerity is working ………….for the UK:

Largest deficit with Spain

£-860m

A couple of questions:

1) Do US, UK, other Governments, or private sector analysts typically use “household equivalent income” as depicted here in their various reports, studies etc.?

2) The non-German countries are largely Catholic, while “northern” countries are not. Elsewhere in the world Catholic families typically have more children. Has family size, as in parents + number of children been accounted for? If Germans, for example, have fewer children, wouldn’t that fact alone make a substantial difference – and is that not a personal choice?

3) So we have several metrics that indicate Germans are worse off, and two non-standard, or at least lesser-known metrics indicating Germans are possibly or definitely better off – surely further investigation is required.

4) Why is it so hard to believe that Germans are not swimming in money when one considers the staggering cost of re-absorbing East Germany, and the major hit German workers took in response to the explosive growth of China and others, especially after the introduction of the neoliberal nightmare of the WTO?

5) Considering that the IMF has backed (or dictated) Germany’s policy stance from Day 1, that the US Treasury decides what the IMF does, and considering that this is exactly the sort of “structural adjustment” the IMF, at US behest, has forced on dozens of countries around the world for decades, why are critics not directing their outrage at the truly despicable creatures at the centre of the Imperial Power that’s been driving this ghastly form of globalism from the outset up to this very minute, i.e., at the US? If the US wanted a different policy in Europe, we’d see a different policy.

Corporate capitalist globalization has been an unmitigated disaster. It is essentially rendering obsolete billions of people whose “skills” are not now, and never will be of “market” value so long as the elite pecking order is determined by brains + greed + aggression.

You could not have created a global proletariat more effectively – as Yogi Berra said about Marx “It ain’t over ’til it’s over.”

“The non-German countries are largely Catholic, while “northern” countries are not”.

With the partial exception of Italy, that’s not really correct: Spain and France are essentially agnostic, non-religious.

“Elsewhere in the world Catholic families typically have more children”.

Not in Europe, excepting a handful of Opus Dei fanatics and the like. European households have 2-2.9 children on average everywhere, although it’s true that Northern countries are towards the lower end: http://airo.ie/news/eurostat-study-eu27-households-living-arrangements

“… we have several metrics that indicate Germans are worse off…”

Not really: Germans own less (and less valuable) property because the state subsidizes public housing in an effective manner (good idea!), what allows German citizens to live easily and decently on rented homes, and also significantly and strongly lowers the value of real state in general. Instead in Spain for example, rent used to be much more expensive that getting easy credit to buy a home, even if you get indebted for life. If you apply a standing debt correction to that theoretical wealth, I’m certain that Spaniards would result poorer also in terms of property-debt.

The issue here is that the value of property is considered in inflated unrealistic terms (try to sell those homes at “market price”, seriously… you can be waiting for years and years for a customer to come and buy) and that the implicit debt is not being accounted for: Spaniards are probably not wealthier than Germans in property terms, just much more indebted.

… “the staggering cost of re-absorbing East Germany”…

Which was largely paid by SW European countries, who renounced to many things in order to help not just Germany but also the other Eastern European states absorbed into EU upon the Soviet collapse. Eastern Germany was and is an industrialized region, unlike, say, Andalusia or Sicily (or Bulgaria for example). The “costs” of keeping these highly underdeveloped regions in EU, with EU-like standards of life, are necessarily high (what explains in part the desire of Northern Italians or Catalans to break apart from their respective states, which may cost them dearly, much more than to Germans).

“… the major hit German workers took in response to the explosive growth of China and others”…

China and the like (Poland anyone?) is more competency for Spain than for Germany. China does not produce high technology (German produce) yet but it does make nearly all of what Spain does, except possibly quality olive oil and wine, selling in the Eurozone with very few taxes, what benefits Germany (import cheap – export expensive) but not at all Spain (which cannot export expensive because it lacks of high tech products mostly). This also applies to most other Eurozone states, Spain being just an example.

“the IMF has backed (or dictated) Germany’s policy stance from Day 1, that the US Treasury decides what the IMF does, (…) why are critics not directing their outrage (…) at the US?”

You’re probably right on this: there is a strange ad hoc alliance between the Anglosaxon financial capital and the German high tech capital, probably not exempt of contradictions, but working in fact for the same goal: the demolition of the Eurozone.

“You’re probably right on this: there is a strange ad hoc alliance between the Anglosaxon financial capital and the German high tech capital, probably not exempt of contradictions, but working in fact for the same goal: the demolition of the Eurozone.”

So, Germany, the head of the Eurozone… Wants to destroy the Eurozone?

No wonder the other Eurozone countries are getting totally fucked over.

Maju, I would add that in countries like Spain or Portugal, housing renting is quite expensive compared with France or Germany. Thus, median disposable income after mortgage servicing or house rental is probably much lower in these countries compared with Germany. Also, the state provides less health services in Spain or Portugal compared with Germany. Thus, apart from enormous differences in employment rates, earning a decent living standard is, easier and more frequently achieved in Germany.

None of this adds up for me. I don’t know how others make any sense of it! If Germans had higher disposable incomes, and saved it, Germans must have a substantially greater net worth than those in other countries. This does not seem to be the case by any measure. On the other hand, if they spent it on imported goods, then Germany must risk a trade imbalance with other countries. This also does not seem to be the case. If spent internally, well-paying jobs are probably generated. Otherwise, the greater income must be heavily taxed, hopefully providing infrastructural social and physical wealth.

Is the large Gini coefficient a result of ‘internal’ exploitation (not consistent with their reported high incomes) or the result of family-owned mittelstand export-effective enterprises?

So, if not actually poorer, how does this greater wealth manifest itself?

Do you realize that ‘wealth’ is valued at illusory prices? Apparently economists haven’t figured out yet that marked-to-(real)market wealth is way lower in Spain than Germany and than liabilities/assets ratio is way higher in Spain than Germany.

I find your counter-points unpresuasive within the context of the overall argument. Example: when I say German workers took an enormous hit due to the German the policy decision to PREPARE for what globalization post-WTO would mean as a result of competition from “China and others” you left out the ‘others’ (both wealthy and “emerging” States)and simply repeated the “Germany ate Southern Europe” charge rather than engage the fact that the other nations of Europe neither seriously opposed neoliberal trade policies, nor prepare for what they were certain to bring.

Or you reject the Catholic argument, then state that children per household range from 2 to 2.9 “though it is true that northern households are lower in the range”. Well, 1 extra child is hardly insignificant either at the personal or macro level.

Or re the metrics which you dismiss, basing your argument on the fact Germany has good public housing policies and Spain bad – allowing a property bubble to occur is stupid, plain and simple. In any case, the standard metrics used obviously include savings, which would show up in the German stats. And again, if you insist that the property values are inflated, you’d have to knock down “household wealth” stats in the US, the Angloshpere, China, Japan, South Korea and dozens of other nations. Again, failure to enact good policies cannot be blamed on those who do so.

Or, with respect to re-absorption of East Germany, it is well-known that its industrial infrastructure was obsolete and largely beyond simple upgrading. The former East is not there yet even today. It is disingenuous to state that Southern and Southwest Europe paid for that reabsorption. As for the rest of Eastern Europe and the Soviet collapse, West Germany was the only country that made a real effort to mitigate the damage from the collapse – please note that Gorbachev was either duped or treasonous, but in any event, promises of huge amounts of assistance from the US never materialized. While I can appreciate that Southern/Southwestern Europe were hurt to some degree by so quickly bringing former Bloc States and their cheap labour into the EU and NATO, that was clearly a top US policy priority – the Americans never, ever consider collateral damage when they want something they deem to be “strategic” no matter how stupid their conception of “strategic” is.

Anyone anywhere who was paying attention could already see by the ’80’s that US financial/corporate-led globalization was turning the globe into big “winners” and even bigger “losers” both between and within States, which is why trade liberalization was fought tooth and nail by workers, environmentalists, “leftists” etc., in many countries, and essentially had to be imposed by local elites eager to throw their own peoples under the bus in favour of idiot “growth”.

I don’t think it’s any coincidence that both the anti-globalization and global environmental movements were totally disrupted in the aftermath of 9/11, the explosive growth of the US global “security state” with its horrific, racist, war on Arabs, Islam and basic freedoms only to be buried by the Great Financial Crisis, all of which I regard as a single, extended coup by the proto-fascist elite nexus now running the US.

Greece, Spain and the others were disadvantaged in terms of resources long before this crisis, as has been the case with many other countries around the globe. But those countries that succeeded under capitalism in overcoming that very large disadvantage did so because they developed and embarked on arduous, long-term policy pathways aimed at excellence in specific sectors, etc., involving present sacrifice to achieve long-term benefits.

I’m an eco-socialist. In my view, US-style globalization is a disaster for billions and the planet as a whole. Because it is so evidently destructive, it will require greater and greater amounts of “legalized” force to maintain it. A large portion of the world’s people are going to be all but written off.

To bring it full circle, the disadvantaged nations/peoples of Europe are unlikely to turn their position around inside the current structure, precisely because that structure is so heavily loaded in favour of multinational giants and central banks as against smaller, localized production, etc. I have tremendous sympathy for the peoples, but none for the elite leaderships of any of these countries, who’ve shown a singular lack of vision or courage in meeting these challenges.

I’ve said to you before, and will say again, consider Cuba, which has far fewer resources than any of the States in question, yet which has managed for over 50 years to deliver better governance, greater social cohesion and many impressive achievements despite hostility to this day from its closest neighbour and largest market in the world. Greece, Spain, Portugal, Italy and others could, with similar determination, create a “Club Med” of an entirely different kind, one which would be more diverse and wealthy than anything Cuba could attain, yet truly sustainable, with a comfortable standard of living, quality of life, etc. for all.

But you cannot get there so long as a “desirable” standard of living is defined as how much consumer crap a household can blow through in a year.

I want nothing but good things for Greece et al. I just do not believe it is reasonable to expect Germany, or even the far, far wealthier US to pay for it within the confines of a system built on lust for wealth/power and military dominion.

Before deciding if these figures mean anything, it would be nice to know the composition of ‘wealth’ in this analysis. How much is residence equity? In America, about 90% of the population has no wealth worth mentioning. Home equity has vaporized and you can’t capitalize it even where it does exist, since one must always live somewhere. The numbers given are so small as to be meaningless. Workers everwhere live paycheck to paycheck. If they have six months or one year worth of savings this doesn’t change their life all that much.

The differences could be nothing more than varrying real estate values. That would only matter if the Italians cashed out and moved to Germany. Fat chance!

How much is residence equity? Nearly all. And it’s largely offset by private debt, which is massive.

Why? Because, until a few years ago, buying a home costed much less per month or year than renting one. Credit was cheap and easy… you probably know the story if you live in the USA or Britain or in most other OECD countries, just that in Spain it was even more radical because the “growth” of the last two decades was based on real state development (bubble) almost single handedly.

Meanwhile Germany (and some other countries like Switzerland, Nordics…) kept a wiser policy: subsidizing and promoting public housing, what limited private indebtment, hepled competitivity by allowing lower salaries (at the expense of the state and real state speculators) and overall lowering the value of real state. Check Eurostat for reports: it’s very interesting.

In my opinion, comparing gross income internationally is absolutely beyond the point. What counts for defining wealth is how much the individual has in his pocket for spending resp. how much he/she was able to amass from their net income.

As Fiver said correctly, taking into account the enormous costs for the German reunification and integration of the New States into all the systems (particularly the social systems), I would dare to say that the relationship between gross and net income in Germany (after deduction of not only taxes, but also permanently rising social contributions) is less favorable than in many other European states, contributing to the obviously smaller fortunes that can be built within this system.

Plus, a very important point is how the costs for housing are distributed.

In Germany, home “ownership” is still on a rather low level, with net ownership (without paying down on a mortgage) certainly the exception, while in many other states of Europe, ownership rates have historically been high. A population of tenants is not very likely to acquire solid personal wealth, with a very high proportion of the houshold income flowing into the landlord’s pockets without a perspective of significantly reducing these costs one day.

So, to me, the results of these surviews is not really surprising…

I am beginning to think the whole 1980 crisis orbited around the Germans and their inability to export “value added products” because of domestic wage inflation in various western countries during the 70s.

More Wages = more beer.

More credit = more cars.

The German economy is the biggest absurdity in a absurd global and mini me euro economy.

How much damage are domestic elites within other euro countries willing to do for just one more BMW ? be it built in Germany and increasingly in more eastern plantations.

The Irish domestic “elite” destroyed all rational commerce in Ireland post 1979 – so as to be part of this sick club of useless value added products.

French market towns and villages post 1980 are now dead zones outside July & August.

The question is WHY ?

If Europe goes back to a more rational balance in primary and basic secondary industry Germany is sunk.

I’m not sure we have moved on much from the vast export of food from the ‘Irish colony’ during the blight. We still pay ludicrous rents to the land-owners – what was once direct payment of lease and chief rent is now through increased mortgages thanks to bank-engineered property bubbles. We have been resistant to leveling for centuries since the revolting Cromwell. Universal suffrage took centuries (1948 in the UK) and now this has been subverted by money so that none of us has any chance of voting for the change we want.

No doubt that the media highlights of the median needed putting straight. Sociology has long had a more complex set of ideas on inequality – http://www.youtube.com/watch?v=cZ7LzE3u7Bw – is a summary of the social epidemiology.

It was common in the 1970s to find economists complaining that the UK was developing very badly in comparison with Germany because they were investing in production rather than home ownership. This ‘property thing’ is still represented in {German poverty}. Of course, there are deep questions on property wealth when they take your house off you to pay for care in dotage. For most of us being mortgage slaves doesn’t work in making us really better off.

The Germans have long been very good at manufacturing. The rest of us could almost sit back and let them do all of it, much as I no longer play cricket and rugby and just watch. One might say they have competed their way to becoming the work slaves of the rest of us! They seem to be objecting to the idle kleptocracies south of the Olive Line and becoming such a good team the rest of us have changed game.

The answer is to work out how much work needs to be done on what and share this out. Many of us ‘pay’ using Monopoly money that is disconnected from real work effort, but is identical to money backs and sweat break for. The comparative advantage and competitive advantage strategies in use are ideological madness riven with contradiction. Yves is right that the figures tell a different story than the median focus. It’s hard to think of a country that has done the competition thingy better than Germany, but we can still ask (on Yves’ sensible analysis)what this has done for the average Hans and Ursula. They are, incidentally, now better off in comparison with the average Brit than before WW1.

The use of this median anomaly is typical of divide and rule and the continuation of economics as the means to prevent rational organisation for society.

There is a great danger that the Quislings in Ireland will target old peoples wealth on the pretext that they are protecting young people.

Many of the most vulnerable young people of Ireland are now living at home with mammy……

If old peoples income is cut the money will not go to domestic Irish young people as the pensioner spends money buying pints of Beamish in the local pub with a young person behind the bar and he also has post office saving bonds which earn interest at the expense of free banking operations which require deposits so that they can destroy even more capital via credit provision.

Because the European banking system is integrated the money not spent in Ireland will simply flow to the top in the UK ,Germany & France.

The Irish economy site is a cipher for these various dark agendas and is giving warning to people hiding in their homes that the money must again flow outwards of the country into the hands of under the water euro core banks.

http://www.esri.ie/UserFiles/publications/RN20130104.pdf

If the CB was so concerned for Young peoples debt it would have turned all credit deposits into national equity money back in the day and give people the keys and deeds to the houses.

Instead the free banks want MORE.

http://www.irishexaminer.com/text/ireland/cwmhkfausnau/

“Thus, there are no substantial differences in the averages for per capita wealth…. ”

…then on what basis all the hand-wringing about imbalances across the Eurozone?

I am now thoroughly confused, as befits my handle.

I wonder if German’s are poorer because they pay more in taxes. If the Spanish and Italians paid what they legally owed…

Workers pay 100% (or sometimes even more) of their legally owed taxes. Workers have no chances of cheating (unless they are in the submerged economy, then they have no chance but cheating).

But the German state gives back (redistributes) a much bigger share of their income, what is in practice a salary subsidy, as Germans can live with less than Spaniards (thanks to state subsidies), even if their salaries are much higher.

When I was in university I met a friend who lived in a duplex with her family.

The maternal grandparents lived upstairs and paid a lower than market rent. The paternal widowed grandmother lived with them and had her room. She also paid a small rent and she cooked and helped with the kids.

Had the grandparents lived on their own, they would have ALL been poorer but with this arrangement, they all enjoyed a great quality of life.

The duplex got paid off in less than 10 years, the parents had a sitter and cook, and they got to enjoy a few trips per year, many of them exotic and expensive.

Here in the Western world, most of us have been brainwashed into extreme independence which is forcing us into inefficient and frustrating lives.

All this to say that it is quite hard to measure poverty because it is usually done using our measures which are skewed by our absurd standards.

Awesome writeup. I remember thinking how bizarre that comparison sounded when I heard about it. Have things really devolved this far that basic things, like differences in household structures and inequality, are too complex to take into consideration? In the industrialized world, what matters is the distribution of wealth; there is plenty to go around.

The CIA World Fact Book uses per capita GDP. Some samples (which also shows how remarkable the US inequality is):

Luxembourg – $80,700

Norway – $55,300

US – $49,800

Austria – $42,500

Netherlands – $42,300

Canada – $41,500

Germany – $39,100

France – $35,500

Spain – $30,400

Italy – $30,100

Greece – $25,100

Portugal – $23,000

Russia – $17,700

Mexico – $15,300

China – $9,100

India – $3,900

I would argue that it is not because things have devolved but because we are trying to force feed the Anglo-Saxon economic model to the whole planet, therefore using the same yardstick for everyone when in fact, countries are still very different one form the other.

We’ve refused, from the beginning, to accept that there are cultural and geographic reasons for the economic differences but now, after having tried to homogenize the entire planet for a couple of decades, and having failed, we are scratching out heads, surprised and perplexed by these differences!

It’s shocking how many things are shocking us!

But on a serious note, my personal opinion is that this is all smoke and mirrors to distract from the bank bailouts. I think one of the big developments with the rise of the Euro and corruption/kleptocracy/whatever is that it is no longer an Anglo-American problem. I think the Yen, Dollar, Pound, Euro, and Swiss franc (!) are now all linked in some loose fashion (becoming increasingly tight over time), and the banksters are either going to all be saved by the public coffers, or all go down. I don’t think the German/Northern Europe/whatever world is meaningfully separate from the Anglo-American/Japanese world.

That’s why it’s important for the banksters to have all these stories floated out there, because when you stop and think about it, it really is absurd that average citizens in Greece and Cyprus and Ireland and Spain and so forth would even be asked to bail out the criminal enterprises in the US/UK/Germany/France.

That’s what ‘austerity’ actually is – it’s not a reduction in government spending; no one is advocating balanced budgets or fiscal responsibility. What’s happening is s a transfer of resources from the public commons to private bankers (or more shortly, theft).

“That’s what ‘austerity’ actually is – it’s not a reduction in government spending; no one is advocating balanced budgets or fiscal responsibility. What’s happening is s a transfer of resources from the public commons to private bankers (or more shortly, theft).”

Its essentially English land enclosure all over again. History doesnt repeat, but it sure as hell rhymes…

You will also notice that those who do not need to heat themselves in the winter do not suffer from the same level of urgency.

A poor article about Ireland on Automatic earth.

http://www.theautomaticearth.com/Finance/if-the-rest-are-only-half-as-bad-as-ireland.html

He does not quite get the history of Ireland in the late 17th and early 18th century leading up to the great famine some few decades later.

Wealth existed in Ireland (although was very unbalanced with small intermediate sized famines) in the 1700s …..the remaining buildings of Georgian Dublin attest to that.

There was a population bulge from that time of prosperity that was kept going during the false war boom of the early 1800s.

The spuds was just one of the mechanisms for growth.

After that time period people remained but no longer became viable economic units.

The Irish population was threading water for the last 20 or so years before implosion.

The crisis actually reached its political peak during the agrarian Rockite rebellion of the early 1820s although it was a military farce as France no longer existed as a military foe of England.

The Irish population has increased by 1 million~ since 1990 which is very considerable for a small country and is indeed the largest % population increase in Europe during that time period.

25%~ of Irish mothers are now of a non national background.

These rises in population are a nothing for a country under industrial growth but Ireland is being driven into extreme surplus as during the middle years of the 19th century.

The final years of the 19th century and early 20th century was good for Ireland on a relative basis (but only in rural areas as working class slums in Ireland were terrible)

Its just that the world was very globalized back then – many Irish (second and third sons ) left for America and England to find greater riches.

The Irish war of independence was really a farmers revolt down south – much like during the 1820s they lost income when the boom went bust.

Given that the UK was more or less destroyed after the Great War they won a marginal form of independence.

One of the reasons why Irish youth unemployment is lower then in Spain is that the birth rate in Ireland reached new lows in the early ,mid 1990s

The domestic Irish women were having less kids.

http://www.cso.ie/px/pxeirestat/Statire/SelectVarVal/Define.asp?maintable=PEA01&PLanguage=0

Just type in under one year , all sexes and all years.

The estimated number of kids under one year reached a low of 48.2 thousand in 1995 rather then the current 70+ thousand.

The 1995 group are now leaving school.

This current high birth rate is a result of external workers coming into the country – these are generally workers in the 20s to 30s age group …….prime child bearing years.

The next famine is only 20 years away now………..

“Hence, the differences between per capita averages are much smaller than those observed between household medians.”

That so-called “Professor” compares averages to medians. It’s like comparing apples to oranges. Or, saying that 2×2 is 5.

“Professor”, my ass…

Smell like a shill job trying to convince germans “no, we are not richer than you, so continue giving us money!”

Now type in the 15 to 19 group (all ages and years)

This Irish age group is back down to 1972 -73 levels.

The reason is that the Germans have not had a housing bubble to to increase “so called wealth”

http://tinypic.com/r/1tkk2e/5

Some time ago I wrote “We’re No. 24; We’re No. 24.” That post examined Credit Suisse data comparing national wealth circa roughly 2010. My post focused on the US and its position in the distribution. But My table fully supports this post.

Germans, apparently, were a lot worse off than the French, the Italians, and the Spanish, at least then. Maybe the gap has closed now because of the fierce austerity in those nations. Over all the Germans were no. 22 on median wealth per adult almost as badly off as we Americans. In addition, Germany had a high level of inequality on the ratio of mean to median wealth I used. Germany scores 3.49 on this measure. Spain is at 1.81, France at 3.25, and Italy at 1.67. So, Germany has a low rank on median wealth per adult and is higher than the others on inequality. Maybe the PTB in Germany believe that Germans can live well off their feeling of moral superiority in relation to the Southern Europeans and so don’t need to be as well off materially.

My table didn’t publish so here’s the original post with the table in it: http://www.correntewire.com/were_no_24_were_no_24

This is a fantastic example of comparing apples to oranges with junk numbers (the original report.)

What is *missing* from the debunking, and it is finally not germane:

Homes.

Southern EU types tend to own their own homes and sometimes even some land ..in a larger proportion than Germans who are tenants, to make it very brief .. and that Southern EU ‘wealth’, dodgy as it is (many are underwater or their homes are worth nothing much or the land is not productive, etc.) is added to household wealth.

For Germans, housing is not as dire a problem as German house prices and rental prices have stayed ‘more or less’ stable, thus low, which is a great boon, in comparison with say France, where housing prices have doubled or tripled (very rough) since 15-20 years (without taking Paris city into account, it would them be far more.)

Savings and debts.

Another topic for another day! – Not treated.

Household size.

Was mentioned, but not ? related to demographics. Germany has many 1 person households, that is true, but basically in EU comparisons it has few children and a lot of retirees, which will be a problem going forward, baby boomers, etc. One person households tend to be not rich, but not too poor, they survive, alone, and can accept some ‘relative’ poverty, live and love OK…That is a long standing political choice, these 1 person households have no ‘wealth’…

State Organisation and Support.

Taxes, health care, unemployment, social arrangements are not considered. Politics is ignored in favor of how much anyone can spend on Barbie Dolls or go on expensive vacs, etc. or not. Absurd.

I wonder if the fact that Germany’s pension system is pay-as-you-go rather than a deferred compensation model is part of the calculations as well. If the amount of money in one’s retirement account is included in wealth calculations and in Germany those kinds of accounts are really rare and everyone is basically covered by a more expanded version of social security that could significantly skew the data.

Given that previous generations built our farming landscape, housing and manufacturing, capacity, one wonders what wealth would be if we were just paying maintenance on this capital and working towards things we need and technology to remove work from important function in wealth distribution. The rich have achieved this.

Rich control of our lives goes much further than indicated in, say, Haring & Douglas’ ‘Economists and the Powerful: convenient theories, distorted facts, ample rewards’. Real wealth is difficult to measure, but I note that when I worked in laboratories we measured in order to be able to change what was happening. No sign of that in economics designed by people who don’t do the work. The Irish at the time of mass extinction would have looked wealthy if one examined their exports from ship manifests. The Germans have it better than that, but this doesn’t make what they are doing a model for all to follow. We might all feel much wealthier doing a lot less work. One wonders whether these national comparisons are aimed at creating xenophobic jealousy. We are excluded from sensible analysis by ‘data’ like this and trapped in the ideologies of already amassed wealth.

It is very simple.

As long as “the system” in its cuurent form is alive germans do better than the people in southern europe.The state institutions still work,the wages are paid on time,the social network is doing okay.

But the south europeans are much more “crisis-proof”-style societies due to the simple fact that NATO only in the 70s and 80s allowed them to become some sort of democracies.For this reason the first thing any greek,spaniards,portuguese or italian did during the last 30 years was to build a house and to keep the house/land of his family instead to sell it.The italians and the greeks managed a 80-90% homeownership-rate while they have the lowest private debt in europe.This does not fit into the the neoliberal PIGS-debt-stereotype they show you in the mass media,nevertheless it is a fact.

Anyway..As soon as the system goes into another 2008-style crash the germans will have the biggest problem simply due to the fact that they are 80 million people of which most own nothing than a banking account with some euros.While I lived in germany some years ago housing and paying rent for a nice appartment was no problem.But actualy this has changed during the last 2-3 years.The upper class and most of all multi-national consortiums are buying everything in the best quarters,the poor and low-middle class have to leave for the outskirts of the cities,the rent in the center and near center of the cities has risen by 20-30%,most germans I know in germany right now have to pay 40-50% of their wage for housing.

Another factor is family.This factor plays in southern europe a completey diffreent role than in the countries of northern europe.

As I said.As long as the german economy finds some one out there who still buys her products they will keep the ship afloat.As soon as we hit another 2008-crash we will have a complete different situation.It is mostly in germans interest to show now some solidarity with the people from the rest from europe.Specialy with the people in southern europe.

You don’t seem to be talking from any real knowledge, Charis: house ownership was already important under fascism and it is not different in original function as it was in the USA in the same period: to make workers proprietary of something so they lose class consciousness to at least some extent.

Also, as a minor detail, people do not build their own homes, they purchase them already built (or sometimes in project), at least over here in Europe.

However, since Thatcher and Reagan, socialdemocratic redistribution of wealth downwards was demolished everywhere (in Spain as in the USA) but, in order to keep the system working (for a while), replaced by easy credit. The infamous credit bubble, which was nevertheless blown bigger and bigger for more than two decades.

So the benefit of property was in many cases, most maybe, offset by the harm of for-life indebtment, which, in the case of Spain at least, remains even after losing the home. Most people did not but a home primarily because they were building something familiar or whatever you are speculating about, they did because it was much cheaper than renting and it was believed to be an ever-growing safe investment (typical stupid bubble mass faith, fed from above).

Now homes are worth a fraction of what they paid, of what they owe, so they are indebted forever, unless the law is changed to allow reasonable bankruptcy as European courts demand on human rights’ grounds (but nobody seems willing to actually make law in Madrid, offending the all-powerful banks).

That’s the case of Spain at least. I can only imagine somewhat similar situations in Greece, Italy, France the UK and even the USA. However the Spanish case is probably the worst of all in this aspect because the local elites, as well as the general banking system, profited and still profit brutally from these abuses, like nowhere else.

That is the real ugly reality of Spain’s home property “wealth”, which is similar in many aspects (but more exaggerated) to so many other countries (with the rare exception of Germany). So any graph which does not offset the home “wealth” with the mortgage debt is simply put: lying.

@Maju

No need to argue about that the situation in southern europe is very serious.But there is no need either to argue with wrong facts and datas.

Greece or italy are not spain which had a real estate bubble.

Greek private debt as % of the GDP was even low before the crisis in 2008.

ttp://www.nakedcapitalism.com/2010/05/german-households-owe-more-than-greeces-do.html

^^this is from 2010.Now the private debt is much lower for obvious reasons.

http://www.newmoney.gr/article/8393/apo-ta-ftohotera-noikokyria-stin-eyropi-ta-ellinika-symfona-me-tin-ekt

Only some 37% of all greeks have some sort of debt(in germany it is almost 50%,in italy 25%).

17,5% of all greek citizen have mortage debt.This is a very low %.

Let me remind you that no greek who is a homeowner has become homeless during the last few years.And even if any citizen would have so much debt that he would be in danger to loose his house..do you know the greek words “molon lave”?No greek police man or even armys special forces would ever dare to come and to even try to do an eviction in greece.They rather would shoot them selves,believe me.And this is not a joke.I know that this mentality seems strange to northern europeans and maybe it is but it is like it is.

Anyway.Greece and italy have no real estate bubbles.Spain has,not sure about portugal.

Just saw that the first link does not work.Here it is again:

http://www.nakedcapitalism.com/2010/05/german-households-owe-more-than-greeces-do.html

Russ above posted this graph: http://tinypic.com/r/1tkk2e/5

… but this one is better: http://www.doctorhousingbubble.com/wp-content/uploads/2012/01/global-housing-bubbles.jpg

Nearly everybody had a real state bubble (more or less severe) except Germany and probably other small countries around it with advanced and generous welfare systems subsidizing public housing systems like Switzerland. Maybe Portugal did not have such an acute bubble (not sure why) but that was an exception. Italy did have a housing bubble and so did most of the EU, as well as North America. The most dramatic housing bubbles were those of UK, Spain, Belgium and Ireland, with the Netherlands following close.

But the real issue here is that only Germany and to lesser extent Sweden and a few others, had no housing bubble. Why? Because of state subsidies and a legal frame that favors cheap renting instead. Today where I live an apartment rent is not lower than €700 in the best case (not growing but not falling at all either) while in Germany it seems to be for as little as €400, which can be paid even with one of those “minijobs”. With such huge costs underlying the labor market it is impossible to ask people to work for less than €1000 over here, unless you first demolish the housing bubble altogether, what they are not doing (rather the opposite).

We have to pay German or higher prices for nearly all and we are expected to live with a small fraction of the base German salary: it’s madness!

“… no greek who is a homeowner has become homeless during the last few years”.

Are you sure? I read of people killing themselves for not being able to feed their children, of pensions cut to the ridiculous figure of €180, and that 300,000 Greeks are without electricity after brutal price rises, most of them in taxes (http://www.dailymotion.com/video/xx4t3d_power-cuts-a-daily-reality-in-greece_news). But maybe nobody is losing their home because they still have better laws in protection of housing rights??? IDK, you tell me.

“No greek police man or even armys special forces would ever dare to come and to even try to do an eviction in greece.They rather would shoot them selves,believe me”.

I do not understand what you’re saying here: police has done much worse things in Greece and are heavily penetrated by the Nazis, they’d do whatever they are ordered to. However I do not know the particulars of homeownership in Greece.

“… some sort of debt”…

What kind of statement is this: when you are poor nobody lends you. What is “some sort of debt”? Does a €50 credit card debt count? There must be some sort of classification by amounts and nature of the debt: a €1000 debt to pay a holiday in Tanzania, for example, is “some sort of debt”, albeit a very much payable one with German salaries (much less so with Greek pensions).

As far as I know, Germans are still the main tourist market in this part of the World, a clear sign that they are still very well off. All the rest is total manipulation of facts and figures with colonialist purposes.

I cant remember that I ever said that things are supa dupa in greece.

Actually it is you who tries to tell us that germany is a paradise.

For us greeks 500 suicides in 2012 are the worst drama we can imagine.Same with 200.000 people at the soup kitchens and 20.000 homeless.

But for me it is hard to understand that you like to talk about our desperation while there 10.000 suicides every year in germany.Why is this number so high?Also some 2 million germans at the tafeln(german version of soup kitchens) are not exactly something you can be proud of.Numbers about homeless people in germany arehard to find since there no official numbers but serious experts talk about 500.000-600.000 homeless in germany.

These numbers are not hard to find.The question is why so few germans know about them.

I do not say and never said that Germany is any “paradise”: I know that the situation is rather bad for German workers too. All I say is that the figures of “wealth” are very relative depending on things like real prices of housing, offsetting the debt, etc. That some of the presented figures and some of the comments here, including yours, attempt to distort the reality with vagueness as “some debt” without any relation to real income or other factors. These attempts are part of the ongoing campaign to refurbish EU as some sort of German colonial empire (Hitler’s dream incidentally) and/or to destroy EU (or at least the Eurozone) altogether (Anglosaxon banksters’ project, for which Germany is just a pawn, and which will likely succeed if things continue the way they are).

@Maju

I dont understand why you are saying.The only one in here who is playing the “nazi-card” is you my friend.Neither me nor anyone else in this thread said anything about hitler or “pawns” or..I dont know.

What I am saying is that it is in germans most own interest to show solidarity with us south europeans.Because the “whole show” is not about us south europeans.And sure not about us greeks.No matter what horror news you will here in your media about us.We are much better prepared for the things to come than any northern european.

The “show” is about the huge european countries with huge economies and dozens of millions who have not even an own flat to withdraw to when SHTF happens or a piece of land to grow their own tomatoes in the worst of all cases.

Today we all hear that the recession in europe deepens.The german economy does not well too.And the german economy has never looked good during all th world wide financial woes of the last century.In 2009 your economy slumped -7%.You have been the first country which was hit hard and you needed many,many very expensive stimulus for your economy(something which was denied to us PIGS) like the “Abwrackprämie” to keep your whole system afloat.Now the next dip is approaching fast and we all have no silver-bullets anymore.

You can be happy(at least you sound so) about us PIGS and our misery but this will not change the fact that the next tsunami will hit you germans much harder than any greek or italian.

Your only real choice is to join us “PIGS” on the streets and to organize the resistance against the banksters and their dogs in politics and media together with us.And not against us.

Well, Charis, the general plan of Nazi Germany was to make Europe the colonial backyard of Germany. The emphasis then was in Eastern Europe, which was meant to become “the India of Germany”. Today we see how the Eurozone and all EU is being used for the same purpose under a barely gentler varnish.

This is not because I mean to play “the Nazi card” as some kind of gratuituous accusation but because the Nazi imperialist plan actually fits too well the current blueprint of an unequal Europe under Deutsche Mark II (= too rigid euro), austerity-for-the-poor schemes and “guest worker” brain drain strategy.

This is part of the Capitalist order of things, which effectively needs of colonies (or equivalent) and of exploitation in order to generate profits for the oligarchies, both central and colonial (but in different tiers). As the USA, with its unique advantages of the reference currency (USD) and massive military forces, tends to control more and more the traditional colonial or semi-colonial areas, the various other powers are bound to at least partly create “internal colonialism” schemes, and so do China, India, etc. in various ways.

Until recently Europe had the relative advantage of being allowed certain degree of colonial exploitation, particularly in Africa, but even this niche is falling to the ambitions of the USA, China, etc. After the fall of the Berlin Wall, Europe overall has lost at least some political relevance, and therefore the imperial order aims to load it with a much greater burden than before.

How do European oligarchies react to this, especially after the credit bubble crisis of 2007-08? In the case of Germany at least the goal is clearly (and was even before that crisis) to use the rest of Europe as their colonial backyard. Other peripheral oligarchies may play that game to a greater or lesser extent. Anglosaxon oligarchies, especially in Britain, see that development with concern, so their aim is instead to use the crisis to destroy or at least severely downgrade the EU, for which they find very convenient to play continental Europeans against each other and Germany as bourgeois state plays well into that game, knowingly or not, becoming more and more isolated from the rest of Europe.

A few years ago Germans were just other Europeans, rather respected in fact, now they are being perceived as the destructors of Europe-as-we-know-it. Of course that is not all the German People but the oligarchies (and not only German ones) but the same that the perception in Germany of other Europeans has collapsed, the perception of other Europeans of Germans has as well. Meanwhile the banksters of the City of London laugh as the game advances towards the collapse of the EU, which is almost unavoidable by now.

When that happens, Germany will be the first one to lose.

As for fascism, the German BND (secret service) is deeply involved with Neonazi organizations and the EU oligarchy in general is nowadays supporting de facto fascist terrorism all over the board: Hungary (a true fascist state already), Greece (government supporting Golden Dawn terror) and Spain (open hub for pan-European fascist networks in spite of the extremely low popular support) are the cases I know best but it’s clear that all around Europe the oligarchies are promoting brutal fascist organizations as fallback line in order to guarantee the new old order of brutal exploitation.

I totally agree however that the only way forward for Europe as People (or peoples if you wish) is to enhance solidarity all around and get on our feet to fight as hard as we can (and even more) against the pan-European and global bourgeois oligarchies. Sadly, with limited exceptions, there does not seem to be enough class consciousness in Europe and the route to fascist collapse is being paved by both the crisis and the oligarchic counter-measures.

So let us agree.Let us forget all the stereotypes we hear from our (no matter which one since all mass media is the same) propaganda and let us start fighting for our rights before it is to late.Enough talk about nazi cards,pleite griechen or PIGS.

In june there will be a huge demonstrations against the banksters in frankfurt.I will be there with my camera.I want to show to my friends in greece that germans have started to fight with us too.See you there.

Remember that only 2 decades ago the reunion brought some huge cost on households and almost 1/5 of nowadays population joined with not much wealth.

Interesting, I wonder how much it contributes to Germany’s Gini coefficient.

Paul de Grauwe already debunked this notion a month ago:

http://www.voxeu.org/article/are-germans-really-poorer-spaniards-italians-and-greeks

Easily one of the wealthiest in Europe, with a bit of an inequality problem.