By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

You know, post June-2012, I genuinely thought we’d moved past the back and forth, chicken and egg arguments within the Eurozone, but alas, we are here again:

German central bank head Jens Weidmann has strongly criticized French efforts to reduce its budget deficit, just days after the European Union granted Paris more time to meet EU requirements. He warns that French delays could damage the credibility of euro-zone rules.

France needs more time to get its budget deficit under control. That much was made clear last Friday when the European Commission announced it was granting Paris until 2015 to bring its budget deficit below the maximum 3 percent of gross domestic product allowed by European Union rules ensuring the stability of the euro.

But on Wednesday evening, Jens Weidmann, the president of Germany’s central bank, the Bundesbank, said he is adamantly opposed to the move. “You can’t call that savings, as far as I am concerned,” he told the daily Westdeutsche Allegemeine Zeitung in an interview. “To win back trust, we can’t just establish rules and then promise to fulfil them at some point in the future. They have to be filled with life,” Weidmann said.

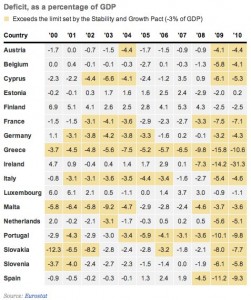

I would advise readers to take note of this chart to appreciate the irony of comments about “damaged credibility” in breaking treaty rules.

And there’s more from Germany:

Germany wants further reforms and savings in crisis-hit euro zone states, according to a report obtained by German magazine Spiegel in which Berlin evaluates progress made under strengthened EU budget rules.

The rules have managed to spur in all euro zone countries a “general political mobilization towards structural reforms and greater competitiveness”, Spiegel cited the report as saying in its edition published on Sunday.

However, in Italy there remained “further room for labor market liberalization”, while in Greece and Spain further reforms to overcome rigid labor laws were “essential”.

In order to improve its finances, France had increased its revenue intake, but also needed to cut spending, the report, prepared by Chancellor Angela Merkel’s office continued.

And then some more from Schäuble:

Germany’s finance minister has signaled his opposition to any move by the European Central Bank to buy asset-backed securities to help indebted states, telling his party it would amount to “covert state financing”, according to German magazine Spiegel.

Spiegel said in its edition published on Sunday that Wolfgang Schaeuble made the comment during a meeting of his Christian Democrat (CDU) party last Wednesday, telling those present the purchase of asset-backed securities (ABS) by the European Central Bank (ECB) would infringe European rules.

German newspaper Die Welt, citing a central bank source, said last Wednesday a majority of ECB Governing Council members seemed to be in favor of the central bank buying ABS.

I’m not going to go through it again, you can see my most recent comments on France’s economic issues here , but it seems, at least in an election year, the German elite are happy to continue of the path that means further economic retrenchment across the zone, including the second largest Eurozone economy, France.

But that’s not the end of it. This week Schäuble has also taken a swipe at the proposed banking union, something that is supposed to be ratified in the coming months:

German Finance Minister Wolfgang Schäuble has warned that rushing to establish a European banking union could backfire if existing treaties in the bloc were violated. He called for a two-step mechanism.

Wolfgang Schäuble told the Financial Times on Monday that creating a central authority to wind up failing banks in the 17-member eurozone and beyond should not be tackled before binding treaties were amended accordingly.

Seeing the urgency of the scheme to prevent taxpayers from bailing out lenders in the future, however, the minister hastened to add that Europe did not have to choose between a legally shaky authority now and delaying repair work.

He suggested a two-step roadmap, with a first measure aimed at creating a mechanism of national authorities and relying on national funds rather than making a central institution responsible for bank resolution.

So, as we’ve seen many time previously, when it comes time to actually move in a direction of shared responsibility the Germans baulk and demand legal and/or political changes first. What’s more, you may remember that the banking union has already been diluted, mostly by demands from the Germans , to a point where is is relatively useless to any country that is already in strife.

Equity can only be injected in good banks, not bad ones , and there can be no external help given for “legacy” issues unless the burden is taken on by the sovereign. So any country that is already having banking systems issues, namely Spain, Greece and Cyprus couldn’t actually access the banking unions safe-guards even if they were in existence today. So basically they are left to fend for themselves and the entire idea of “separating the banking system and the sovereign”, as specified as the aim from the June 2012 EU Summit, has fallen by the way-side and we are back to the old “chicken and egg” arguments about fiscal responsibility and control versus moving forward with a tighter fiscal and banking union.

To make matters worse, as I discussed in late April the Bundesbank appears to want to scuttle the ECB’s OMT, or at least water it down to a point where it could potentially destabilise the current calm in the sovereign debt markets.

With France facing rising unemployment and falling industrial output, the European commission has already predicted the country will be in recession this year. It is very likely that within a few months we will start to see a fall in consumer spending and once that occurs we will see household wealth begin to fall as unemployment begins to undermine asset prices and the French economy start to show similar dynamics to that of its southern neighbours.

It would appear, for whatever reason, that the German economic elite are happy to see France head in that direction, while the nations that are already there are left to themselves to try an work out how to get back out.

“… and where it stops, nobody knows.” Still, the French don’t mess about. The Louvre opens directly onto the Tuileries Gardens these days….

I nominate the “Trust Fairy” to the Economic Muse Hall of Fame to join “Confidence.”

Make that “Trust Valkyrie.”

I do wonder if the Germans are trying to get back at France for, I dont know, taking Alsace Lorraine from them in WW1 or something… Because this just seems so needlessly sadistic at times.

Its nothing so bizarre. The simplest explanation is the ruling German political class can’t attack the wealthy of Europe/international banks without losing their primary electoral support which is the backing of that moneyed class, and at the same time, they can’t deny their rising unpopularity or rely on the other side is worse scenario such as New Labour or the Democrats. Like many regimes before them, they blame one country after another. When attacking Greeks doesn’t work, they just move on to the next ethnic group.

We are at point where Merkel can’t have a come to Jesus moment and build a new kind of coalition. The election is a little over four months away. She has to double down to win. In this country, we blame Welfare Queens, gays, gun owners (I think the Second Amendent is an antiquated and misunderstood amendment, but I’m being bipartisan at the moment), Sarah Palin, stories of teachers stealing supplies, and on and on it goes.

The next question, then, is: what are the odds that Merkel will simply lose outright? East Germany doesn’t seem fond of her, the northern and western industrial areas don’t seem fond of her — can she ride to victory on high margins in Bavaria?

I don’t remember the German political process anymore (I have this sickening feeling its NOT UNcivilized; no Senate; a mix of SMDP and PR), but I don’t think Merkel is aiming for an outright majority of the center-right’s traditional coalition. My guess is she might try to govern a pro-status quo EU coalition (they won’t call it this, but this is what it will be).

Plenty of Greens and SPDs will be too afraid to push for changes to the EU/Euro which leaves seats available for a new coalition.

I believe the incumbent party gets a real boost if they can’t form a government because the German constitution is designed to avoid certain constitutional crises. Flash-in-the-pan parties can’t run again or be seated if they are under a certain threshold, and I think the largest vote getter wins their seat allocation.

If the SPD is anything like other modern center-left parties, we can count on them to be useless at best. Who knows what the Greens want? They have sided with the center-right in the past, and judging by quirky results such as in Italy, I wouldn’t be surprised if younger people are casting protest votes which could really mess up how the election works because of seat allocation process.

I would bet the next German government is dependent on the personalities of the people who make it to the top of their party after the votes are cast rather than the votes themselves. A strong anti-EU vote (along Italian lines, not 80%) could easily scare SMDP victors into supporting Merkel and abandoning their party.

the art of nirvana? don’t get; schaeuble is seeking a structure that holds together.. but none seem to exist… i’m givng up on understanding finance. Need a new mechanism that goes beyond finance. And not trade pacts.

Kleptocrats and their servant elites will loot to a crash and then loot the crash. This is essentially why the German elites continue to push for “austerity” even though it is killing the economies of Europe and doing untold damage to its people. I would like to hear from any Europeans on whether the policies of the German elites are translating into a more general increase in anti-German sentiments in Europe. The German elites have used the euro as a weapon against their neighbors. A rejection of the euro increasingly looks to be tied to a rejection of Germany. So anti-German sentiment might give us some indication as to the timetable for the implosion of the euro.

Might be hard to disentangle from Golden Dawn or other nationalist parties.

Sorry. Ill-advised use of Golden Dawn to make my point. There are Germans and Germans. Us too.

Close to the truth I think but let’s take the next step …

What if Germany’s (or its elites) plan is to deliberately stoke anti-German feeling to sufficient level of intensity that the whole non-German part of the EZ gets so totally pissed off that either:

o Germany gets effectively thrown out of the EZ.

o Germany uses the increasing zenophobia as the excuse (emotional cover) it needs to choose one of Soros’ 2 alternatives and withdraw from the EZ all by itself.

The Bundebank’s upcoming lawsuits at the Federal court seem to be another move in this direction.

Even if this kind of consipracy explanation might seem excessively paranoid Germany’s rigid adherence to an outdated (by 80+ years) and destructive ideology seems to be leading to one of the events above.

Golden Dawn as feature, not a bug ?

Hence the only question left is really whether the consequences are “unintended” or “intended” ?

The only German plan is for Merkel’s coalition to survive the next election which is 4 months or so away.

Just checked the polls. If an SPD/Green/Linke coalition is a possibility, that is by far the most likely next government.

The FDP is likely to fall below the threshold. There’s no other party which is going to be willing to ally with the CDU/CSU. The CDU/CSU is unlikely to get an outright majority, even with all the racism it’s deploying, and current polls make it seem unlikely that it can get a majority even if the FDP make it into the Bundestag.

The questions then are (1) Is it actually possible to get an SPD/Green/Linke coalition (or will there be too much infighting, allowing a minority CDU/CSU government), and (2) Will the SPD/Green/Linke be just as stupid as many of our so-called left-wing parties and continue “austerity”.

Can Merkel do Shock Doctrine?

I wrote my thoughts on Germany above, but I think Merkel has a shot at grabbing SMDP pols from the Social Dems and Greens who might be uncomfortable leaving the EU if the SD/Greens can’t win a solid outright majority without the need for splinter parties.

The makeup of the SMDP winners and 3rd party (7th? party in Germany) performance will shape the day.

I’m Dutch and i’m not noticing an anti-German sentiment in my country whatsoever. I’m pretty sure that most of my countrymen who follow politics look at Germany as being the responsible country.

I suppose that I should really substitute “non-German” with ”Austerian-bloc” i.e. Germany, Netherlands, Austria, Finland. But not Luxembourg since I’d hazard a guess that it’ll shortly be doing a Cyprus style financial faceplant.

That said given what I’ve been reading about the collapsing state of Netherlands’ housing market you may find yourselves joining the “profligate South” before too long.

I know, things are not looking good for us. I’m more worried about government spending than the housing market, though. Since the introduction of the euro the government budget has more than doubled in size. As you can imagine, we’re now taxed to the max. If there is one country that could use some austerity, it certainly would be us.

If you had read the many posts on this website explaining MMT (and in fact, there’s a comment here that does it here pretty well while criticizcing German economic policy), you would know that the moment your (Dutch) government cut back on the deficit, the economy would go on a taislpin and you would be headed Italy or Spain’s way. Because neither the domestic private sector (because of the burst real state bubble) or the export one would be able to make up for the shortfall.

I’m so relieved we’re not in the Euro zone, ‘cos if the Germans were pushing this sh*t down British throats there’d be total f*cking uproar.

I thought the UK were the ‘lead by example’ champions of austerity? Wouldn’t require any “shoving” at all, the British would swallow it lustily.

Response to the Eurozone crisis handling has been a very marked drop in support for Europe. I hear noises about “the germans having won the war after all”, but it seems most people understand that the disastrous EU policies are the responsability of … the EU. That means Germany isn’t running the show alone.

That being said, there are still majorities for the euro, and people still believe they need a larger entity than national goverments in order to stand our ground in a globalised world.

So it’s a case of yes we want a EU but not this EU, and especially the troika catches a lot of flack.

It’s a very bad time to ramrod political and fiscal union given the increasing democratic deficit, but that is what’s likely to happen since Germany (righjtly so, to be honest) insists on those as a condition for banking union.

What we all have to wonder about, is why a banking union and a common resolution scheme are so urgent.

It isn’t sadism on the part of the Germans it’s a failure to understand that all three sectors of an economy act as an interdependent whole. Since a domestic private sector accounted for as a whole can never run a surplus in its own right it is dependent upon a net money contribution from one or both of the other two sectors. The German’s have a successful exporting economy so the inflows of export earnings make it possible for them to substantially reduce the net contribution from government borrowing. Many of their export customers, however, will not be running balanced foreign trade accounts let alone positive ones like the Germans and will rely upon net money contributions from government or private sector borrowing. Indeed if you think about it the German export model cannot apply globally only a balanced trade model is procedurally fair and government net contribution to the domestic private sector will be needed to facilitate economic growth according to available resources.

@Yves

I really admire your blog,it is one of my favorites on www and only for this reason I will tell you my opinion:

We all should avoid stereotypes.Our elites use stereotypes to steer hate between nations to reach their goals.The good old “divide and rule”-game.

When you say:”germany pushes france” what do you mean exactly?Most germans I met in germany dont have the time or the power to push anyone.40-50% of them work in low wage,part time or 400euro jobs.Millions of germans are daily blackmailed and threatened by the “jobcenter” to take any shity work they will find them.If they dont take the job they will get 10-15% less from the geramn state every month untill nothing left.

I know very well you dont mean “these germans” but the german elite.Ofcourse most people who visit your blog know this very well,nevertheless this is not my point.My point is the language we use.We should be more carefull and not fall into the same way of using the language as our elites.

“The germans”or “the french”,”the greeks” or whoever..it is not about this.All of these nations have elites who lead a war against their own people,the people in europe in general,the people everywhere.These elites are “supranational”,they dont care about their passport but only about their billions and their power.They have the best tested network since mankind ever can remember,this time it is a global network of power,they have the banks,the politicians,the media,everything you need for power.

We,the people of the streets dont have anything like they have.No banks,no politicians,no mass media.We only have our solidarity.We have to become supranational in our common resistance against them as well.No matter if german or french or what ever.The “us against them” is not “the germans vs the french”.It is the german and french elites against 99% of germans,french and all the rest 99% of the world.

Keep up your great work.I am a big fan of yours.Greetings,Xaris

I think this is the necessary corrective, Charis. Thank you very much.

Agree

Double agree. How much though is an electorate blameless in a putative democracy for the actions of its government? We must to some degree take responsibility for what we have allowed to occur before we can change it–realizing full well how difficult that is.

Its important to understand that France hides much of what a nation state would do fiscally via massive PPP schemes that suck in real resources from the periphery.

The Tours to Bordeaux High speed line is the biggest of these and is by all accounts running massively over budget which will I guess require fiscal injection.

But whats important to France is that it will have the domestic fixed capital in place to inflate if it leaves the eurozone.

Germany less so as it spends so little on itself and gives so much free capital goods to France and the UK.

In my opinion it is Germany that is cooked if the eurozone breaks up.

The entire structure of its systems is a mirror image of the PIigs…………France less so.

The longer the PIigs stay in their little piggy / shitty place the longer France has to prepare.

During a presentation regarding the present extension of tramline A Bordeaux (3.6 km)

There was talk of linking one of the tram stations to the airport with a cable car !!!!!!!

http://www.youtube.com/watch?v=feX0Mb2-Zto

welding of the rails can be seen at 5.00 m

The amount of real wealth (from the periphery & Germany) flowing into France and the UK is simply fantastic.

French article regarding the project on the SW regional paper.

http://www.sudouest.fr/2013/04/12/le-tram-dans-les-airs-1022892-660.php

They have so much usable fixed capital (by the standards of todays capital poverty) that they are not sure what to do with it all.

The Tours tram looks fantastic

Testing seems to be in the final “live” stages.

http://www.youtube.com/watch?v=JIiYDCXzQk0

Minor flooding of Tours (Loire) can also be seen near the end of this video.

Spring has sprung.

I am sooo glad somebody did a post on France, because I wrote an Irish Poem last night on another site and was just dying to find an excuse to post it here, while staying on topic. I hope you guys here enjoy it. It is about the “yen” and France’s BJY bond exposure. If puns make you groan, don’t read the title of it:

A Merde of Croesus???

There once was a country called “France,”

Which found a big load in its pants.

Not “merde,” nor kin,

It was Japanese Yen!

Sacrebleu! Voulez vous la Malchance???

Squeeky Fromm, Girl Reporter

@Squeeky

Thats cute.

I could give you a post about detailed UK or French balance of payments but I figure some people like moving pictures.

Yee computer geek financial people are obsessed with currency pairs………..that is one of the means of extraction but its not the end.

The purpose of these debt games is to extract real goods…….if those goods take 50 years to depreciate then you have won when the game is up.

The UK is up to the same no good games.

Its just that it has no physiocratic bones remaining…..it merely imports more BMWs then eveybody else in Europe.

These chief IMF shareholders wish to crush all of Europe so that the banks which control them can remain standing when everybody else is crushed into dust.

Germany is the poodle of the France & UK elite with the happy corporation of German industrialists who wish to maintain profits at all cost.

German energy self suff

(Taken from the IEA OECD energy balances publication for 2011)

Y1960 : 0.881

Y1971 : 0.5744

Y1980 : 0.5197

Y2000 : 0.4012

Y2008 : 0.3990

Y2009 : 0.3990

Y2010e : 0.3897

Its is constant decline – it must destroy other countries to sustain the sale of its “value added products” much of which flows to the UK & France.

So its a industrial country with a declining internal energy ration.

No wonder it seems so pissed off.

In contrast .

French energy self suff.

Y1960 : 0 .5718

Y1971 : 0. 3002

Y1980 : 0 .2743

Y1990 : 0.4997

Y2000 : 0.5193

Y2010e : 0.5139

Please Note German energy suff is likely to have got much worse since its Nuclear shutdown thingy…..

This only seems to work when it can transfer the losses from this policy on the euro periphery.

Under a full scale euro breakup scenario it will have to operate within its own energy hinterland which means a massive shutdown of German industrial production.

At least a small part of this is likely to transfer to France as the Germans will simply not have the POWER or the customers.

I’m more agnostic than you as to how the German energiewende plays out in the long-term — and I’m someone who’s been attacked here for advocating for the French and the pro-nuclear model.

In terms of energy generation from solar, the Germans have gotten further than many — including me — initially reckoned they would and now only need an adequate power storage/battery technology to emerge.

And candidates exist, like Donald Sadoway’s molten-salts/liquid metal batteries —

http://www.ted.com/speakers/donald_sadoway.html

In any case, the choices you point to are ones the Germans themselves made — rushed into in the case of closing down their nuclear plants — and, regarding which, they should blame nobody else.

Mark P.

The Domestic German energy density is declining and indeed falling off a cliff.

Why is the German economy doing OK ?

It is sucking in the surplus external oil / gas ration of Europe.

This is just the euro banking system sucking up resources ever higher beyond nation state borders.

Germany is in fact a black hole.

When the European entrepot economy finally implodes it will have nothing to sell so as to afford its energy imports.

France will have at least its agriculture and other primary industries.

The French tourism industry is however likely to experience a body blow.

No trip to Nice this year or the next or the next……

http://www.youtube.com/watch?v=1CPhsmT6ano

Gross Fixed Capital Formation in Germany (DEUGFCFADSMEI)

2012: 464.68000 Billions of Euros

2011: 469.85000

2010: 435.26000

2009: 408.65000

2008: 459.53000

Gross Fixed Capital Formation in France (FRAGFCFADSMEI)

2012: 409.426 Billions of Euros Hide Last 5 Observations

2011: 401.201

2010: 376.721

2009: 367.485

2008: 411.879

The German economy is strange……….it does not spend its money.

French Fixed capital consumption is just behind Germany despite its smaller economy.

http://research.stlouisfed.org/fred2/series/FRAGFCFADSMEI

A typical under the radar French project.

http://commons.wikimedia.org/wiki/Category:Travaux_de_la_branche_vers_Vieux-Cond%C3%A9_de_la_ligne_B_du_tramway_de_Valenciennes_en_f%C3%A9vrier_2013

The French not only spends its own money but Greek money also.

The French also produce this, which I am learning to sing and play on guitar:

https://www.youtube.com/watch?v=pY_mQlkiwEo

Squeeky Fromm, Girl Reporter

(Francoise Hardy and April March also have beautiful versions on youtube.)

OUCH~ what a way to go… swirling down the econned hole… nice, better that shooting each other, barricading ones self in a frame house w/hostages (mostly family), taking pot shots at crowds, etc… eh.

Skippy… thanks Squeeky and Dork… may your dorks never get corked…

“they’re a rotten crowd”,i shouted across the lawn. You’re worth the whole damn bunch put together.” – sigh…

Vanessa Paradis will soon have to get on her knees and scrub the farmhouse floor.

France is not Paris.

D of C:

I imagine she gets a healthy check each month from J. Depp. Plus she can sing really well. I wonder if she has done Tu Mens yet???

Squeeky Fromm, Girl Reporter

(PS: It’s a SONG, all you naughty minded people!

https://www.youtube.com/watch?v=M1FYKNP1jak

The ambience reminds of this classic set….

http://youtu.be/N0XFOjuuMNE

… where the protagonists are obviously France and Germany! (“If you were me, would you walk out in style?”)

LS:

That was beautiful and I downloaded it. I can get lost on youtube going from artist to artist and genre to genre. So much wonderful stuff. Maybe this one will fit Germany and France, with “Herr” Isaak putting “Mlle.” Costa up to doing bad things, in a twisted pas de deux, and enjoying it:

https://www.youtube.com/watch?v=aHSYXt1iEpE

Squeeky Fromm, Girl Reporter

The thing that saddens myself is the disconnect.

Whilst artists can imbue – project upon their audiences – sensitivity’s… with adeptness… it should be remembered it is a mental dalliance, when confronted with reality’s needs ie how do we live on this orb and not blow it up.

skippy… the pained faces of political artists today… is a gallery we probably… won’t want to revisit soon… political life is art and art is a fad.

Or maybe not.

Its just that image popped into my head for some reason………….

France IS already in recession (made official this morning). It did not take long before your prediction came true. Actually the socialist French government is doing all it can to sink the country as fast as possible. How does it achieve this wonderful goal? By scaring the best talents out of the country with the promise that, if you build a start up and make good, the state is going to steal (no other word) 65% of the money you make when you sell your company to a bigger one. Furthermore, by taxing capital like crazy as well as profits, there are no more business angels in France and private equity funds are dwindling.

Not mentioning that the French that do have work only work 1500 hours per year, the lowest of developed countries.

Without talent nor capital, ever increasing taxes, how do you think the country is going to fare in the foreseeable future?

Not well. In fact, not well at all.