By Lee Adler of The Wall Street Examiner, courtesy Testosterone Pit

Shortly after I completed this post, the BoE announced a 200 billion yuan ($32.6 billion) swap line with the PBoC, according to the Financial Times. This is the first time a G7 country has taken a step to provide funding for the PBoC, although Japan already has such a line, according to the FT. Might not the Fed be far behind? What a firestorm that would ignite. The headline, “Bernanke bails out China?” I can’t see it but it would certainly make things interesting if they did.

The world’s major central banks are now working at cross purposes, creating massive crosscurrents that are making life extremely difficult for investors. This isn’t likely to end soon. In fact, conditions should get worse.

The 4 big central banks in the world are the Fed, ECB (European Central Bank), BoJ (Bank of Japan), and PBoC (Peoples Bank of China). The BoE, (Bank of England) is far smaller but important from a policy signaling perspective and because of who its counterparties are. They include not only the 3 mammoth British banks that are US primary dealers but all the other major players in world markets, who all have big operations in London.

The Fed, ECB, BoJ, and BoE all deal with the same banks and the securities dealers affiliates of those banks. For example, of the Fed’s 21 Primary Dealers who are the Fed’s sole counterparties, only seven are US domiciled. Three are Canadian banks. Eight are European, including three British banks, and three are Japanese. All of these banks are also major players in Europe and Japan.

These banks are all playing in the same sea of liquidity. When one central bank pumps, that action may impact not only the central bank’s home market, but any or all of the world’s markets. When central banks buy securities, those purchases cash out the counterparty banks and dealers, who then use the cash and the leverage it creates to buy other securities and push asset prices higher. What they buy is up to them. They deploy the funds where their money gets the love. Over the past 7 months, until last week, that was mostly US equities.

The situation with the PBoC is different. Its system is not fully integrated with the world financial system. China’s central bank serves only its domestic banks, and they in turn serve only domestic financial institutions, including the out-of-control shadow financial system. However, many of those institutions are significant players in the world markets.

US and European banks who were engulfed by bad loans and their own horrendous practices were bailed out by the Fed, ECB, and BoE. Unlike them, the major central banks are not there to bail out China’s miscreants. Apparently the PBoC has also decided, no more! It has slammed the door on them to put a stop to the wild speculative bubbles they have blown. Now that they are swamped with trillions in bad loans these players have no place to go and no means to raise the needed cash other than to sell whatever liquid assets they can, wherever they can around the world. If not the primary impetus for last week’s selloff, this selling was at least a major contributor to it.

While the PBoC doesn’t play directly in the world liquidity sea, it has dammed a major tributary and has inserted massive reverse flow pumps into the pool. As a result, the players along that tributary have not only stopped the flow of liquidity into the world sea, but in order to replenish their own liquidity which has run dry, they are pulling cash out of world markets that they had previously pumped in. These institutions are largely insolvent. The reverse flows going back into China aren’t likely to turn back toward the rest of the world again anytime soon unless the PBoC relents and prints money.

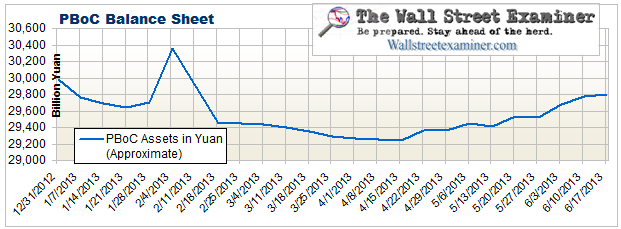

PBoC Balance Sheet- (Data-Reuters) Click to enlarge

As it grew its balance sheet, the PBoC in the past provided funds to the world cash pool indirectly via its shadow financial institutions. This year it pulled the punch bowl. It shrunk its balance sheet early in the year, then has grown it by only 1.3% since April, hardly enough to prop up massive overhangs of bad loans in both the banks and shadow financial system. Its assets remain below the peak levels reached early in the year.

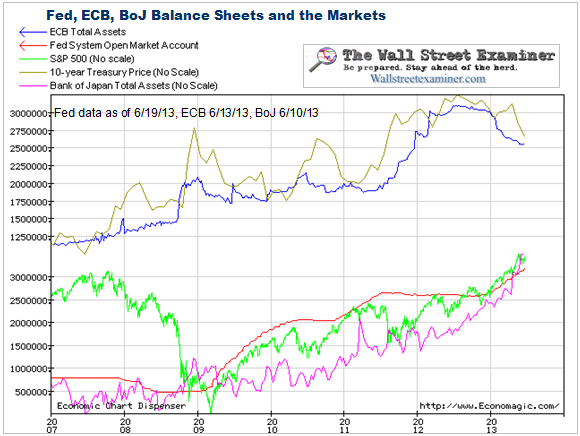

The Fed and BoJ are still furiously pumping cash into the world pool, and markets were responding accordingly until the last few weeks, or at least the equities markets were. However, the European banks have been pulling funds out of the pool to repay loans from the ECB. Some of them who did not want the funds originally but were forced to take them, had bought Treasuries. When the ECB opened the repayment window early this year the banks liquidated the Treasuries they had bought with the funds. Others sold other sovereign bonds they had bought. Still others who had reached for yield in emerging markets began selling those securities. The process began to snowball over the past few weeks.

Fed ECB and BoJ – Click to enlarge

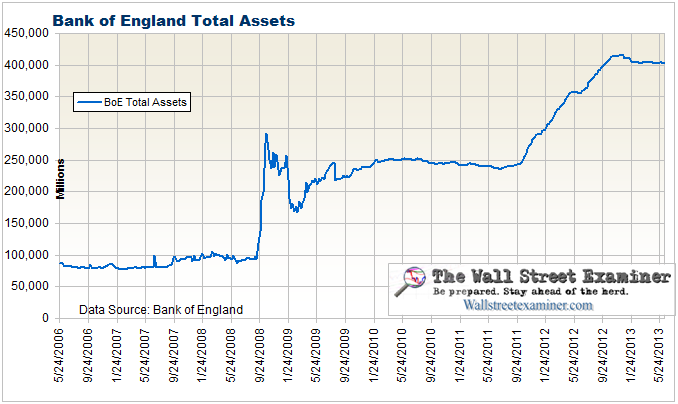

The BoE has also stopped providing funds to the pool. After growing its assets by 50% from Q4 2011 to Q4 2012, it too has stopped supplying funds to the markets.

Bank of England Total Assets – Click to enlarge

The Fed and BoJ are the last two major central banks still adding cash to the system. They are fighting the PBoC, BoE, and ECB. Unlike the other central banks, the ECB’s money printing involved mostly loans rather than direct asset purchases. The ECB is allowing banks to pay down loans, with the resulting liquidation pressures beginning to snowball. As those loans are repaid they create liquidation pressures in world markets. It started with US Treasuries and has spread to other sovereigns and emerging markets, and last week it hit US stocks.

Central banks working at cross purposes have generated liquidity crosscurrents that have buffeted the markets in recent months. Those crosscurrents are likely to turn more difficult to navigate as the Fed begins to wind down QE, assuming it does what Bernanke said that it would do. But until that happens, there should still be net liquidity growth overall as the Fed and BoJ continue to pump. It depends on just how bad things become in China and just how much selling and asset price decline the PBoC is willing to tolerate. China holds massive stores of assets around the world including US Treasuries, and it’s not clear how much pain it is willing and able to bear. It’s also not clear how much difference it will make if the PBoC does decide to print money.

As the world’s Last Ponzi Game Standing, the US is likely to see most of the benefit of whatever positive liquidity flows remain, particularly in equities where most of the recent funding has headed. The cross currents of liquidation will make the seas far more choppy and treacherous to navigate, fun for traders who strictly trade the charts both long and short, but longer term investors probably won’t be able to keep their ships afloat.

Question. How are you defining long-term investors? Do you mean long-term bond purchasers, stocks? Or do you count people who merely start an actual business?

I’m not the author, but I would hazard he means anyone who is not willing to trade on a daily basis (which does not mean you actually trade every day, but you watch the markets closely enough that trading every day would not be something that would bother you).

I think Wolf Richter’s footnote to this post at the Pit, re Q-Eternity, is telling:

As the only remaining buyer of MBS toxic dreck I’m sure Benny finally realizes he’s created the mother of all bubbles everywhere, including employment stats — though not actual jobs of course. He’s been buying mortgages, bonds, and stocks solely to backstop his casino cartel: domestic and foreign banksters, speculators, currency traders, derivative insurers, and REO rentiers. Although the market is still screaming for its heroin fixes, the jig is finally up for supply-siders. It’s time for real demand-side stimulus.

Where his neoliberal policies have fueled wars, painful austerity, historic inequality, and unrest worldwide, Benjamin now has a limited number of non-extradition retirement options for escaping the lamppost. Snowden has better chances for asylum.

QE has been beneficial to the top 10-15% as th middle class has been lest behind. Now that it is starting to negatively impact the top 5%, they are looking at ways to protect their loot, this means squeezing out another percentage off the wealth curve.

The next target is pensions…

1) Adler, for whatever reason, does not explain that the Bank of England is not loaning the Chinese yuan. It is swapping out British Pounds so that Chinese liabilities denomitated in pounds can be met. Adler makes it seem as though the BoE has a yuan factory and is supplying China with its own currency. This sort of writing makes confusion all but inevitable.

2) There is no “global pool”. Dollars don’t leave the U.S., pounds don’t leave Britain and yen stay in Japan. Imprecise descriptions conceal more than they illuminate.

Huh?

1. Did you miss the fact that Eurobanks carry large dollar assets which they fund in Europe, to the point where the Fed had to extend dollar swaps lines so they could fund their dollar books during the crisis? And some were purely domestic players. The Landesbanken were big buyers of dollar assets.

2. Did you not hear about the yen carry trade, borrowing in yen prior to the crisis, swapping out of yen and using that to fund purchases of non-yen assets?

3. The Treasury market trades in big volumes in all time zones.

4. Even in the stone ages of my youth, it was routine to create synthetic govvies, for instance, a synthetic DB via a Treasury and currency swaps. That was a plain vanilla operation 30 years ago.

Everything you say is correct, and I don’t argue that. What bothers me is the image being constructed, that currencies get physically mixed in some giant market spread across the planet. In other words someone not familiar with the process would be led to think by this article, for example, that trillions of U.S. Dollars are in Chinese banks located in China thanks to Fed “money printing.”

In reality the dollars China “owns” are located in accounts in the United States. China might spend those dollars to buy oil from Iraq but the dollars don’t actually go to Iraq, they just end up in an account owned by Iraq at another American bank. The reserves being issued remain in the U.S. banking system.

Maybe I’m being pedantic but there’s so much confusion out there on this stuff (I believe in the principle of an informed citizenry) that I get annoyed with descriptions like Adler’s which can mislead the uninitiated.

No, that is 100% not correct.

The biggest FX market in the world is in London. There’s also a big dollar FX market in Japan.

All the major banks, including the big Japanese, British, and European banks, have direct access to dollar clearing via Fedwire. They run FX desks and execute all the major currency crosses. Barclays does not need to go to a US bank for dollars, which is what you are suggesting. They keep a running tally during the day and net out their daily during US time but there is no way the Fed is gonna deny a major bank who is already on Fedwire dollar clearing. Again, this isn’t new either, it goes back for decades.

It has been WIDELY reported that foreign banks run large dollar positions, as in they hold dollar assets. That is both for their own account and to execute transactions for customers. They fund those US dollars .Many provide foreign currency products (the Swiss and Japanese have long offered RETAIL foreign currency products, for instance). Your statement about needing to go to US banks and the US time zone is just plain wrong.

It has, for instance, been widely reported (this via regular analyses of the Treasury International Capital Report) that most of China’s purchases of Treasuries take place via UK banks and thus show up as UK inflows in the TIC, so you need to back out an estimate of what the Chinese have done from the apparent UK activity.

To gain access to dollar reserves a bank must have a reserve account at the Fed.

Why wouldn’t it? It’s not like we are talking about paper bills here, just numbers on an electronic ledger.

so long black pools

nǐ hǎo black seas

~

Nothing is wasted, nothing is in vain:

The seas roll over but the rocks remain.

a.p.herbert

Very good article. Shows how important it is to have fiscal guidance over monetary policy and why QE misses the mark.

The fed is providing cash to the banks that they are using to pump the stock market for essentially short term artificial gains not based on fundamentals.

It’s interesting that China may be the first to recognize the bubble and is in effect making a margin call on other countries. It’s responsibly reining in it’s overheated property markets. And now the liquidity search is pulling money out of the artificially elevated stock markets.

Fiscal policies need to get money targeted to the right people which are not the bank execs.

I think the Ponzi scheme nature is mostly due to the artificial process of asset appreciation. This is not the right path for sustainable economic development.

Who would have thought, 20 years ago, that all “isms” lead to a planned economy. LOL!

I would like to say, however, that there are still differences in who does the planning…

Currently, in our neck of the Western world, we could say the private sector is getting squeezed out as our leaders do QE, then everyone closes their eyes, prays real hard and waits to see where the chips fall.

But it will eventually lead to a full blown planned economy… when government/central banks decide who gets the money, that’s what it is.

This is sick. The money makers have completely taken over and they are out of control.

I believe in printing but in a different sequence. You let companies go bust first and then you prop up and stimulate.

This QE thingy is like shooting in the dark. Nobody has any idea what anything is worth anymore… who cares about the ROI when the fed can just print without any scrutiny?

If you want printing to work, there has to be some form of scrutiny and measure of ROI. Right now there is none.

This is a very important article because it could portend to what happened to European banks during GFC. Even before the onset of global financial crisis, the FED swap operations went into full panic mode beginning in December 2007.

But these are pounds? Nice goings on in London?

Excellent overview. Political dynamics bringing BoE and PBoC convergence would be an interesting line of inquiry.

Thank you for an enlightening post, Lee Adler, and to Yves for posting this. Setting aside the central banks and BIS for a moment, it seems to me that the Primary Dealers have flown under the radar. I wonder what role they serve at this point and whether they are in fact irreplaceable.

Gee, following the chain of proximate cause, turns out the Achilles heel of QE-ZIRP is the real economy. Ironic, no?

Charles Hugh Smith (who I don’t follow to the end of the earth) put out a fair estimate of financialisation on Zerohedge today – http://www.zerohedge.com/news/2013-06-25/guest-post-financialization-inequality

There are no doubt inaccuracies but I guess he gets the size of what is going on right enough.

I largely agree Lee’s analysis as part of the trap Smith alludes to. We need more detail on what the Ponzi actually is, perhaps especially in terms of lost and misdirected production as these FX and other games are played.

Hello my family member! I wish to say that this post is amazing, great written and include approximately all important

infos. I would like to see extra posts like this .

If you desire, you can choose one from the Las Vegas hotels because the

setting to your Las Vegas NV marriage ceremony, reception and honeymoon.

Mostly the history of business was able to control various inventions and

technologies. Body Language is nonverbal, usually unconscious, communication by using

postures, gestures, and facial expressions.

My dumb question of the day: why would BoE need to set up a swap line with the PBoC? China has > $1tril in foreign exchange reserves and still generates a capital account surplus. Why would they need some piddly $35bil swap line?

I think that’s a good question. I don’t have a complete feel for it but the PBoC is an issuer of rembini but primarily only domestically to soak up foreign exchange from its exports. The swap lines allow rembini to leave the country and become an asset of another central bank. This doesn’t increase the monetary base at home so doesn’t lead to further credit expansion. This seems to be a big change in its capital controls policy. It also seems to spread the rembini out more internationally making it a better possibility for a reserve currency. Using the pound also helps diversify it’s holdings from USD and Euros.

Currently, in our neck of the Western world, we could say the private sector is getting squeezed out as our leaders do QE, then everyone closes their eyes, prays real hard and waits to see where the chips fall.