Yves here. So what is the Fed going to do, now that it has delivered a big blow to the nascent housing recovery? Risk its credibility by beating a serious retreat on taper talk, or keep whistling in the dark and wait and see what happens to July and August home sales (and remember, most housing market data is reported with a nearly two month lag…)?

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Cross posted from MacroBusiness

From Bloomberg:

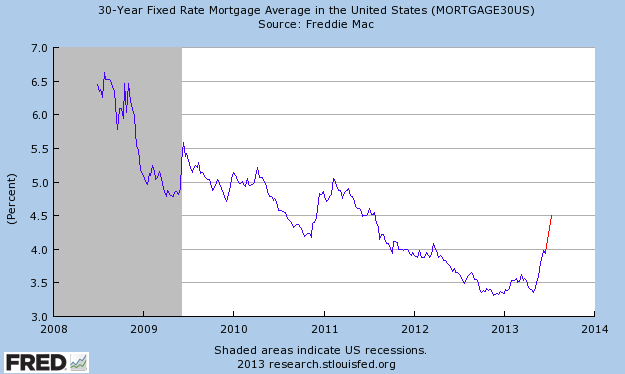

Mortgage rates for 30-year U.S. loans surged to the highest level in almost two years, increasing borrowing costs at a time when the housing market is strengthening and prices are jumping.

The average rate for a 30-year fixed mortgage rose to 4.46 percent from 3.93 percent, the biggest one-week increase since 1987, McLean, Virginia-based Freddie Mac said in a statement. The rate was the highest since July 2011 and above 4 percent for the first time since March 2012. The average 15-year rate climbed to 3.5 percent from 3.04 percent.

Here’s the chart:

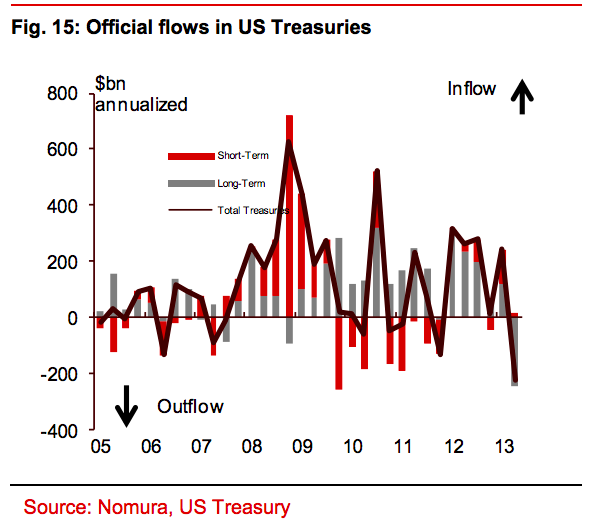

In short, the Fed has just tightened by five rate rises in two months. Why so fast? Well, as we know, central banks did blow a little bond bubble and deflating it is hard to control. For instance, foreign investors are fleeing the 30 year Treasuries that determine mortgage rates:

Still, the leap in rates is not as bad as it looks for the reason that most US mortgages are fixed-rate for the life of the loan. But it is a sore test for new lending which is showing its effects. From the MBA:

Mortgage applications decreased 3.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 21, 2013.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.0 percent on a seasonally adjusted basis from one week earlier to the lowest level since November 2011. On an unadjusted basis, the Index decreased 3 percent compared with the previous week. The Refinance Index decreased 5 percent from the previous week to the lowest level since November 2011. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 16 percent higher than the same week one year ago.

“Interest rates moved up sharply following the Federal Reserve press conference last Wednesday where it was indicated that the Fed could begin tapering their asset purchases later this year,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Mortgage rates increased by the most in a single week since 2011, and refinance application volume dropped to its lowest level in almost two years. However, applications for conventional purchase loans picked up by more than 3 percent over the week, and total purchase applications were 16 percent higher than one year ago, indicating that homebuyers are not yet dissuaded by the increase in mortgage rates. Government purchase applications dropped again, likely a function of the recent increase in FHA mortgage insurance premiums.”

Good to see applications holding up for now but refis point the way for house prices which will slow in the next few months. I’m sure the FOMC had in mind some easing in asset markets when it embarked on its “tapering” rhetoric. But in an economy growing under 2% in the first quarter, rhetoric is really all it can be for now. As stock markets have suddenly realised.

Yves here. I’m not sure the MBA information is as comforting as it appears on the surface. The reactions I’ve gotten from people who were seriously interested in buying a home is “OMG, I had better jump on this before the rates go even higher.” So I’d hazard you see a cross-current between people who have decided to accelerate their buying timetable (to the extent they can), which will have the effect of pulling forward some demand, and people suffering from rate shock, who are adjusting to the decline in their purchasing power and rethinking their plans. Some of them will presumably still go ahead over the summer and buy less or less well located homes, but others will wind up not finding anything they like in their new diminished budget. Reader input encouraged.

The reactions are likely to be some people rushing to buy in hopes of avoiding paying higher rates. Right now there’s a bit of shock, let’s face it nobody likes to pay a higher rate and there’s a kind of bragging right in paying a lower fixed rate than your friend next door, however after an adjustment process people will realize that current rates are still a lot lower than rates were a few years ago and if they otherwise were inclined to buy or able to buy they will still go ahead. A 100 bps rate rise, at this juncture only hurts refis in my opinion.

Prices are set at margin and higher monthly payment makes some marginal buyers ineligible for a mortgage wish to buy a house they might.

Quoting memes is not helpful. The question you need to ask yourself is how sensitive these marginal buyers are to the current rise in rates, and what’s the drop off rate. In other words, would a further 25 bps in rates result in a loss of 1/2% of buyers or 25% of buyers. At historic low mortgage rates, I don’t believe a rate rise is all that meaningful

I wonder if prolonged low rates, besides fueling house construction, is fueling house prices at a pace that migth not be sustainable or desirable. If I remember well house prices are increasing at a 12% annual rate. Is this fact concerning anyone?

It will be impossible to isolate the effects of a slowing economy from an increase in mortgage rates on the willingness of people to finance a home. Of course we could always deal with the demand problem leaving other effects more clearly observed, but we don’t roll that way in the U.S.

Yves, as rates rise demand will diminish. A third of homes sold have been going to cash buyers, which is double the historic rate. If those cash buyers ( Who are primarily “Investors”) can find another asset class to invest in that has a better return they will go there. And as you noted, the amount most buyers can qualify for just dropped about 15%, this wil have an affect on homes priced below the conforming limit. Inventory has begun to grow where I am, listings usuallay peak in Sonoma County in April and May, that hasn’t happpened this year, inventory continues to grow. I have seen no drop in demand yet, but it is coming and Real Estate is priced at the margin. FD, I am a Real Estate Broker.

“. A third of homes sold have been going to cash buyers, which is double the historic rate. If those cash buyers ( Who are primarily “Investors”) can find another asset class to invest in that has a better return they will go there. ”

One place investors may go for a better return, is to schools. They can buy shares in companies that offer private student loans for college students. Private student loans are currently non-dischargabble which means ZERO RISK.

Come on man, they are all up in that action. Kollege is expensive and a whole generation of youngins are reeling in debt and marginally employable. Winning!

But it’s risk free because a) the government garontees sudent loans and will make a full payout regardless, and b) its debt that can not be discharged through bankrupcey, so even after the goverment pays off the loan, they can still bleed the student dry.

So its housing all over again.

There will be a huge push to force students into the debt grinder. Some unemployment programs even require it.

It will contiue until students cut their losses, and flee higher education. That may not be too long from now.

Homes are overpriced, the rent is too high. When will Dean Baker notice that what is good for some folks means unaffordable for the masses?

I closed on my refi earlier this week. My broker told me business has suffered with the rate increse but that ARMs have filled the gap significantly. Given where the Fed seems to want to go in the not to distant future, doing an ARM might not exactly be the prudent homeowner move.

“So what is the Fed going to do?”

Nobody knows.

But what it should do is simply stay put on the taper path and allow markets to adjust Mortgage rates. Let people who can pony up the money and the rates buy the home.

May be demand will go down. So will price. Maybe the lower price would attract buyers who can afford the mortage and the price. May be absolute mortage would remain the same despite higher rates if the price goes down.

I’m willing to guess that deflation will rear its ugly head and the fed will reinstate QE N.

I’m a broker in the Houston area, and what we’ve experienced in our market is rather impressive. Trouble is, I doubt the party will last.

What happens when those cash investors can’t find any good deal, and ROI takes a hit with the inflated prices? Will those investors look for safer alternatives? Logic would suggest so. Quality inventory is almost non-existent in our market, and that suggest sluggish sales going forward. Couple that with the huge hit to purchasing power if you need a mortgage, and Ben has most certainly killed the nascent recovery in real estate.

Does the Fed even care? My working thesis is that they don’t give a rat’s ass. This whole operation was about keeping the banks solvent and maintaining credibility. Throwing piles of money at a bunch of crooks and expecting them to act responsibly with it is lunacy of the highest order.

My guess is the status quo are just feathering their nests on Elysium.

http://aaronlayman.com/2013/06/1st-quarter-gdp-revised-down-to-1-8-annualized-about-that-taper-talk/

My guess is that 100bps wont have a dramatic effect in slowing sales. For the average homeowner its only $100 more a month or so. People will look into ARMS (which they should have been doing 10-20 years ago, when rates were in a secular decline, less so now) but still make sense for a lot of homeowners who wont stay in the place for 30 years anyways (why pay the term premium if you need to refinance when you sell the place)

Most effected should be the homebuilders, as they attract new buyers who need to qualify and pay for a mortgage. High and low end, which has driven the market IMO shouldnt be as pressed as they are less likely to be the ones marginally qualified for mortgages. Once again squeeze the middle.

But this should put pressure on future home price appreciation, which is healthy as the adjustment bounce from the 2011 lows has been very fast and uneven.

I worry, however that the 30year rate is not done moving yet. That is when trouble could potentiality set in, and sets a real conundrum for the Fed.

1. We flagged on another post that the rate increase is often more like 175 bps. for significant types of mortgages since former waivers of points are no longer in effect (sorry to be working from memory here, too time pressed).

2. It does make a difference because most buyers go to the limits of affordability. It’s not a matter of “oh I’ll spend that $100 extra a month.”. It’s “Oh, the most the bank will let me spend on mortgage+escrow is X and now X buys less desirable homes than it did six weeks ago”.

not sure if anyone is still following this thread but just wanted to chime in.

the 175bps increase is for FHA, like Yves pointed out. That is a big increase for that category, but for the conventional it is only 100bps. A 300K house, 240 mortgage the increase is 140 a month. Will it hurt underwriting qualifications, for sure. But it wont stop you from buying a house. Many ppl have been living with their parents or renting for long enough. They want to buy and they will find a way.

Also, funny to see the disgust of owning real estate in the US, especially when I look around the world and the US is probably the only place (selectively) where real estate is cheap. Go to any other country (or some big US cities) and RE is very expensive. Why Americans dont want to invest in RE is beyond me. 3.5 or 4.5% either way is not onerous. And 20% down is fairly low by some international standards.

>> My guess is that 100bps wont have a dramatic effect in slowing sales. For the average homeowner its only $100 more a month or so.

Quick calculation shows that monthly mortgage payment will go $100 up based on $150,000 home price with 20% down. Not many areas left in US where one can buy a house at this price. And I would guess if somebody buys a house for $150K, $100 per month will matter to them.

But Yves’s point is that rate increses will not stop home sales, but rather reduce the effective lending of those homes sales, incresing deflationary presure.

We are not talking about the desisions of a hand-full of potenthal morgages, but its agraget effect on the money supply.

My gess is that this will actualy increse specutive home buying. They are cash-carry any way and will not be effected here. The will not have to compete with ligitimet consumers that will be sqeezed out of the market. Investors will snatch up inventory thinking they can sell on the rebound.

Here is a link which says people have survived higher rates. People have a way to adapt. What you cannot afford you learn to live without. Period!

http://www.marketwatch.com/story/scared-of-a-45-mortgage-we-survived-175-2013-06-28-710750?dist=beforebell

How bout apples to apples comparisons? Do you have an article describing the effects on consumers that parabolic moves in rates precipitate?

>> My guess is that 100bps wont have a dramatic effect in slowing sales. For the average homeowner its only $100 more a month or so.

Sure you can for a short period when prices are dropping to affordable level

Wasn’t NC reporting that over 90% of the shadow inventory was being held off the market, creating a price increase that benefited the banks at the expense of new buyers?

The 12% price increases SHOULD NOT continue, otherwise we will be back in a similiar mess five years from now. Now, it’s true that there has been a lot of demand from investors, which should decline over time, but there has also been an extraordinary amount of demand from the average new homebuyer. Given this, isn’t a rise in rates a good thing?

it’s not good if the average american hasn’t gotten a raise in income in 30 years.

it’s not good if the only people who can buy homes for cash are investors who expect to raise rents 5% per year.

We didn’t report a #. We did say that the amount of shadow inventory appeared still to be significant and that the issue was now being incorrectly treated as a nothingburger.

>> but there has also been an extraordinary amount of demand from the average new homebuyer.

Not really. It was well reported that current inventory is very low, but demand is not particularly high.

Where are housing prices today compared to their 125-year Case Shiller average? It looks me like they’re overvalued, in large part due to low rates.

When rates are at 60-year lows, there’s basically only one way for them to go–back up, eventually. No one could realistically expect the super-low rates of the last year or so could be sustained for very long. Not that long ago, 4.5% would have been seen as a screamingly good deal. It’s still, in historical terms, a pretty low rate. And yes, cooling off some of the frothier markets now wouldn’t be a bad thing.

>>No one could realistically expect the super-low rates of the last year or so could be sustained for very long.

It happened in Japan and my understanding their house prices are still lower than 30 years ago.

When it happened in Japan, they were net exporters to a Western world full of baby boomers in their most productive years buying houses and levering up.

The US is a net importer stuck in a world full of over-indebted households.

Maam;

An anecdote from the Deep South.

I just finished helping a couple “tighten up” the plumbing in a 3700 sq. ft. house in one of our higher value suburbs for a walk through prior to closing on a sale. He does “Something Important” and she teaches piano. Two of their children, all adults, have recently moved back out into their own digs. Bottom Line is that the house is too big and too much of a financial burden to these people.

They are selling the place for around $450,000, which translates into a net loss of about $25,000 to $50,000. They are happy to be getting out this lightly! He said, “We can handle that level of loss. We’re doing better renting, and our finances will heal, slowly. I’m just glad we didn’t have to do bankruptcy. That would have killed my career.”

This same upscale subdivision had three houses under construction. All, from my observation, (read the permits board,) custom projects. Yet, on three separate days, I saw only one crew at work, on one day. No one seems to be in any hurry.

On another construction related front, this environment is the perfect incubator for Greshams Dynamic. A case in point, three weeks ago I was called upon in my persona as ‘Plumbing Pro’ to help a small contractor figure out the layout of a handicapped accessible bathroom for a local restaurant. I had to get out my Handicapped Code, (no pun intended,) to show him the required dimensions. I also had to explain to him the reasoning behind the dimensions! (Try the stubborn self reliant entrepreneur act on an inspector, why don’tcha!) Wonder why the infrastructure is falling apart? The lowest bidder is getting the contracts, or City Hall is ‘in the pocket.’ (Probably both in todays’ environment.)

IMHO the real question is those cash purchase investors…Is the price low enough for them to see reasonable returns from renting out, or are they buying primarily in the anticipation of price appreciation? Eight years ago, when there was some debate about whether there WAS a RE bubble, I was saying that when the easy money dried up, bottom prices would be set by intentional landlords rather than owner-occupiers. Of course I didn’t realize that the Fed would shoot through the zero-lower bound and stay there for years.

Well, I guarantee you this increase has an effect. It’s stopped our house-hunting cold. Here in Taos, it’s hard as hell to find anything decent we can afford, but at least we had a chance for a while. Now our hypothetical monthly payment has just increased by $100 and the game is over. We fall below the threshhold of being able to pull this off.

People claiming the increase won’t have much of an effect are speaking from their own position of having money to burn. There must be tens of thousands of people like me who feel the blow. I realize rates are still historically very low, but I’m back on the sidelines again.

John,

It could also be that prices will come down and thus even with higher mortgage rate you would be able to afford the mortgage. Once the demand dries up, the price will come down. Till then rent peacefully. You probably have been saved a lot of trouble. Assume you had bought the place at the higher price (with lower mortage rates) and the price drops.

Remember the Fed by keeping the rates artifically low is not really trying to help you, they are just trying to help the banks offload the property at higher prices and thereby reduce the losses for the banks.

Rates were artificially low? Really? Ok, then can rates be artifically high too, like now? Once and for all, low rates do not hurt consumers who purchase on credit. Zero percent rates are even better for these folks. Arguing that high rates spur consumption is utter nonsense in a significantly credit basesd economy. Please stop uttering Karl Denninger talking points. Please change your name too. “killben” sounds like an incitement for harm to come to Ben.

Malmo,

I never said you should accept my view point. And I will not be asking you to change your name even though Malmo reads like More and More.

Rates more or less hovered around 7 to 8 % for decades – in comparison, rates are not that high now.

Typically, housing prices drop as interest rates go up so that the monthly payment stays about the same. Price changes lag rate increases.

Doesn’t it bother you that you are advocating stealing from some people to give to other? Shouldn’t society be built on just principles?

No. Your argument makes no sense whatsoever.

Hmm. Are societies “built”? Why do you think that is an appropriate (dead) metaphor?

I’d make sure the potential buyer know what affordable means. No realtor will ever do that, loan brokers will get away with as much as they can, even today. It’s interesting that these posters pop up when the blog goes to home buyin’. These folks are right there at the precipice, trying to “get some”. Where are these people?

I don’t get it, I would have bought in 1998 and simply never moved or even paid attention to the 1.) crime spree 2.) banksters rewards for said crimespree 3.) realtors 4.) finance blogs.

Buy cash, or don’t do it. Many leading cads today feel that stated income was somehow fair, and all the bad things that happened were the fault of borrowers.

True believers of any ideological stipe makes me ill.

Refi market is now over and done. The home loan industry is now on one leg and that’s new home loans.

I have two separate friends that have been involved in short sales for the past six months. Both have gone south with the banks pulling out of even wanting to sell them. In one case the home was listed for 290K offer accepted at 275K and the bank comes back with a sales price of 295K. Why don’t banks want to sell properties?

My dear McWatt;

It’s called “Extend and Pretend,” and has been the operational system for quite a while now.

How easily we get sucked into talk of such things as homes as if economics is what matters! What should the value a home be based on? I was able to buy one with about ten years work (losing it to divorce was much quicker). Now, with productivity higher (less than some areas) in construction, homes are more expensive – weird as the work in most of them was done long ago.

Sure with 5 years left to pay on my current shack I’d prefer UK rates to stay low, but I gave up thinking our fetish with asset price bubbles was worth spit long back. We are as radical and sensible as insects on real change. Homes should be costing more or less what it costs to service and maintain them. Our gossip only maintains neo-liberalism and demonstrates how hooked we are on it.

I bailed on a refi earlier this week. The lender farted around until the rate lock expired, and then the next day offered a rate .6% higher.

So what is the Fed going to do, now… Risk its credibility by beating a serious retreat on taper talk, or keep whistling in the dark…

Haven’t they been beating a retreat?

The taper talk was meant to cool off the markets. From the Fed’s point of view, the markets over-reacted.

Experimenting sometimes leads to shooting yourself in the foot.

If mortgage rates stay high, we’ll probably see ‘rumors’ of the Fed extending QE. They are out of policy bullets so they have to use psych-ops – which is based only this: we can still move markets and hurt you if you take a contrary position.

Not sure that’s true. I’ve had some well connected folks say (second hand, but the ultimate source is supposedly senior folks at the Fed) that the central bank now think QE was a mistake. And Tim Duy’s reading of Bullard’s remarks (and remember Bullard was party to the discussions) was the Fed is calendar-driven on this, not data driven (despite the official FOMC statement).

That implies you have to see really bad data or real stress in the financial markets for the Fed to relent. And if the Fed thinks QE was bad policy, relent merely means delay its taper.

That’s just irresponility writ large on the Fed’s part.

‘Calendar-driven’ = political

There is some merit to that thinking (I view Bernanke’s Fed as very, um… servile).

But they have ‘beated a retreat’ in that they have been trying to sooth the markets ever since:

FT: Fed Big-hitters Seek to Squash QE-fears

When savings account interest and wages start rising 4% a year, wake me up. Anything else is bullshit.

I think you left out when gasoline gets back below $3.00 a gallon. Yves point regarding less desirable locations, I read with my filters as further from work. So any reduction in house, due to higher rates, will be further exacerbated by increased energy consumption. I agree with sentiment to hang tough and wait… my crystal ball, cracked and opaque, says October will be f’gly, and we will get into QE-IV or wherever we are … QE 4 EVR Turning japanese I really think so…

Until people realize that living in a house you can not afford is not such a great deal, then the banking community will continue to use people’s need to house themselves as a way to capture their future labor-value earned.

On the coast of CA, many people spend 50% of their income on housing!! Perhaps we need to go back to a time where EVERYBODY pays cash for their house.

I suppose this might foster better decision making [saving instead of spending] and a significant elimination of the parasitic financial sector.

Don’t buy a house: boycott. TBTF need be extricated from US housing. Go Rosa Parks first, then whip out the Ghandi, let the motherf$%^ers try to put us all in jail.

Dear TT;

Be very careful what you wish for; “..let the motherf$%^ers try to put us all in jail.” The self deluding nature of authoritarian elites everywhere and everywhen almost guarantees that “they” will try and do exactly that.

Well, what’s that saying about nothing left to lose?

Dude, I am sick of the sunbelt bias in America. “RE” is dirt cheap where I live. you can buy a decent house for 50,000 and a high end one for 150,000.

Leave your problems down south and west(some northeast).

“The reactions I’ve gotten from people who were seriously interested in buying a home is “OMG, I had better jump on this before the rates go even higher.” So I’d hazard you see a cross-current between people who have decided to accelerate their buying timetable (to the extent they can), which will have the effect of pulling forward some demand, and people suffering from rate shock, who are adjusting to the decline in their purchasing power and rethinking their plans.”

That’s what you call a ‘cogent observation.’ And I think it’s probably correct. The bottom line to me is that REAL inflation (my Blue Shield just went from $900 every three months to $1260 every three months, and I just bought an outboard engine for my boat that cost more than the pickup truck I bought new in 1991) is actually running at about 8%. So if you borrow at a fixed rate of 4%, the government is actually PAYING YOU 4% to borrow money to buy an appreciating asset. And you can still easily buy houses for less than they cost to build, and have monthly payments way below what the house would rent out for. This has been the game in America since the end of WW2. When my parents bought their first house back when Milton Berle was big, their payments were an incredibly burdensome $140 per month. But it was a thrity year fixed loan, and in 10 years, due to inflation, that $140 was more like a pizza dinner & Disney movie for the whole fam. And in five more years it was a joke to be laughed about during backyard barbecues. That’s why you must have a govenrment agency back these 30 year fixed loans if they are to be available at all. What private individual or corporation would ever loan out money on these terms? (Unless, that is, they already had the loans pre-sold to your pension fund.)What I think MAY happen is that as this “game” is put into overdrive JUST ONE MORE TIME the result will be that the average Joe will no longer be able to afford a house at all. You’ll either own property, or you won’t (like Germany or Mexico). And if you don’t, you never will, because you won’t be able to save up enough depreciating currency to buy one or even put up the down payment. That’s the way most of the rest of the world is.

Hermann:

And you can still easily buy houses for less than they cost to build, and have monthly payments way below what the house would rent out for.

Three thoughts:

1) Where are these purchases “way below” rental costs of which you speak? Small town mid-west? Rural south? Distant exurbs of major metropolitan areas?

2) Much like stocks, Real Estate winners are publicized and losers go down the memory hole. NOBODY owned Atari or Worldcom, let alone Pets.com, right? Just like EVERYBODY has a long term gain on their primary residence, because NOBODY bought in Flint or Buffalo or Dayton — only in Palo Alto and Camarillo, eh?

3) Past performance is NO guarantee of future results.

It’s more than the cost of building.

As a homebuyer, you have to calculate how much energy and resources it will take to maintain the house over 10-20 years, even if you only plan to stay there for 5-7 years because chances are in 5-7 years the buyers will assessing those.

You also have to assess how the house affects the cost of your lifestyle (i.e. the opportunity costs)… does it force you to buy an extra car? will it be a money pit because of the chosen building materials, and does it limit your employment opportunities?

Herman, I think you nailed it. My Dad bought his Levitt built house in 1948: nothing down, $226 per month, thirty year fixed mortgage. He said the decision was ‘like buying a bottle of catsup’. He bought the house on a Sunday, the first day 150 houses were offered for sale on Long Island’s north shore. By Sunday night, all of the houses were sold!

He created a fabulous backyard garden, the envy of the entire neighborhood, and sold the house in 1962 at a profit of $6,000, before deducting the broker’s commission. All this happened during America’s most prosperous decade in one of New York’s most desirable commuting communities, with the second or third best school system in the State!

The house had a 100 x 100 foot lot. The property was for sale recently at $1.2 million, and subsequent owners had ‘improved’ it into a first class dump, judging from the pictures.

With a lawn instead of a garden, no doubt.

Actually, with asphalt, mostly.

Ouch. After all, why process the hydrocarbons through plants when you can just lay it right down on the soil, nice and thick….

Hi I am just testing a new feature.

lol, interest have barely budged in “real” terms. Please stop posting on this subject, it is ruining this board.

this will engender more foreclosure starts when banks are in the denouement of their mortgage settlement kabuki.

no it won’t

ping

ok, let’s do a little filtering for the filter…so, we are talking about the old atomic age…

The Stup- Zone

The reason we are going through all this remedial bul-sh- is because the last two generations, subject to the manufactured oil embargo crisis that ran finance through the Middle East stup- zone, have never seen a real elastic economy operate. The empire majority is now in the wrong place, doing the wrong thing, at the wrong time due to the convoluted feedback, and you can’t change habitual behavior replicated from birth in real time.

where is the unacceptable speech?

Those with jobs in the empire economy obviously can’t solve the problem, even with the benefit of $30T in ‘free’ money, because they are paid to ‘think’ that retiring jets right off the end of the assembly line, to build more, is normal, and assume that government can guarantee their retirements for faithful service with entitlement spending that will not inflate away the resulting income, despite evidence all around them to the contrary. They exploit labor in every possible way and then cry crocodile tears for labor on the Internet, which they assume is stable, all the while demanding more of the same, empire jobs.

Demand for the disposable oil economy falls off the cliff and the price skyrockets, causing speculation in alternatives to skyrocket, which, for anyone with any perspective, tells you that yet another centrally controlled, socialist scale ponzi economy, ran by a bunch of passive aggressive Napoleons, in a long line of failures, is about to fail, again. And the participating majority is going to say it never saw the collapse coming, while it sings the mantra of “never again,” again, pleading for more free money, time, to make the make-work work.

in here somewhere…

placeholder…

The empire majority can’t add 2 and 2 without being given the answer, because if they mark 4 they are going to be corrected,

and they are trusting MBAs that can’t do rudimentary linear regression without a computer program,

you gotta be freakin kidding me:

who had to be given the

answers

to pass

stats,

the dum-est of all pseudo-sciences, which conveniently skips over the assumption of division by 0, inverting causation and association, who, in turn, trust Bank to report inflation without self-bias, because “you can’t fight the Fed.”

If you are an elevator mechanic ‘making’ $1/4M/yr, to reboot by changing a bit, or replace because the programmers were too stupid to give you access, and are too lazy to figure out a way to wire around the stupidity, and the empire majority is dumb enough to guarantee you a closed market, because it is too lazy to learn anything about physics, (or a pot farmer in Mendo with a storefront downtown to launder the money, which puts out no product, but results in driving BMWs, living in a McMansion and tripping to Hawaii) you are not going to be in a big hurry to see change come down the assembly line.

The empire majority has made dam- sure labor can’t go to work, except to wash its dishes. Good luck with that. Those of you left standing are going to get paid, with penalties and interest, if you provide for your children and grandchildren. In an elastic economy, you hire and fire people with your participation price point.

It doesn’t do you any good to get $10 an apple to send it across the ocean, even if you call it organic, because the price of energy goes up more. Capital’s job is conservation. There is nothing evil about it. It’s just gravity, to do with as you see fit.

Nothing, N-O-T-H-I-N-G, gets done without intelligent labor, capable of balancing the system. The American Empire is just another crock of sh-, primordial soup, but go ahead and prove me wrong.

Did the nuclear bomb exist before WWII?

This is sad when it is mainstream opinion that the best way to improve this economy is to subsidy leveraged speculation in housing

Right, but I don’t see much leverage at this time.

The problem is getting real rates low enough that the market can clear. The exact “opposite” problem of the 70’s issues that began with BW(which Nixon could have saved, but didn’t for political reasons).

“This is sad when it is mainstream opinion that the best way to improve this economy is to subsidize leveraged speculation in housing.”

Hey blowing bubbles is all Neo-Liberals know and the Banksters consider it work!

In my neck of the woods, I noticed that many houses built in the 50s still have their original windows. Houses built in the 70s mostly got their windows changed in the 90s and 00s. Interestingly, McMansions built in the mid-90s are starting to change everything… as are houses built 5-10 years ago. These are 300-700K houses!

There is so much focus on interest rates and monthly payments that homeowners are not accounting for the money pit factor. Houses and lifestyles have gotten too big to maintain properly and most individuals are too focused on short-termism for things to work out over the long-term. I am convinced that both will shrink over the next couple of decades and the number of slumlords will soar.

Turn off the bubble machine!

I make close to a 100 grand a year working for a MNC in flyover land. I have 4 degrees, 1 in physics, two in engineering and an MBA. I sold my last house in 2004. I will never ever ever buy a house in America ever again until I am cashing my SS checks and sticking it to my Doctor who resents me because I am a Medicare patient. I sometimes wonder how dense the elites in Washington are to think we are so stupid. They have removed every vestige of job security in every form and they want the middle class to put down roots and buy a home? When I moved from my last job a year back, the entire group was dissolved and I watched the lead engineer, a poor uninformed idiot desperately trying to sell his house. He is a Ph.D by the way and was forced to take another position in the same company 500 miles away. In the last 10 years I have seen fewer and fewer Product Managers and shorter and shorter product development cycles. Our Leviathan MNCs are running on treadmills commanded by idiot CEOs. It does not matter how qualified you are and what you know, CEOs in MNCs are no longer bothered about innovation or about a bunch of smaller companies innovating and kicking them in their teeth. They have all become Lords of such vast fiefdoms that they scratch the left side of their fat behinds and send a corporate legal buyout team to go buy any company that even whispers ‘new idea!’. If that does not work then they sue their asses off till kingdom come and make sure the little beggars are snowed under with patent infringement suits. When I hear people talk about ‘the housing market and home buyers’ I know they are referring to the same kind of crowd that populated Madoff’s merry party – complete rubes who think, ‘well, I’ve now got a job, that’s swell, now lets find a house to buy’. Complete idiot. We have all now become migrant farm workers – we need to be ready to move at a moment’s notice.

It’s like being in a factory that management is going to close. Run the old machines at the red line, and don’t fix them when they break down. Extract every smidge of value, shutter the place, and move on.