By Sara Hsu, an assistant professor of economics at the State University of New York at New Paltz. Cross posted from Triple Crisis

In China, things are not looking pretty. Debt is high among corporations and local, provincial, and state governments—up to more than 25 trillion RMB among governments in 2012 and 60 trillion RMB among corporations in 2012. Some say debt is also high among households, but let’s face it: households still have a hell of a time borrowing from banks. Their debt load comprised close to 10 trillion RMB in 2012, and most of their income is put into savings as a cushion against adverse conditions.

Much of the debt that has gone to governments and corporations has been extended through loans, “entrusted loans,” or “trust loans.” Entrusted loans are loans from one party to another that use a bank as an intermediary, while trust loans are loans from trusts to one or multiple parties. Both of these types of loans can be securitized and sold off to bank customers, which they have been, in spades, as wealth management products.

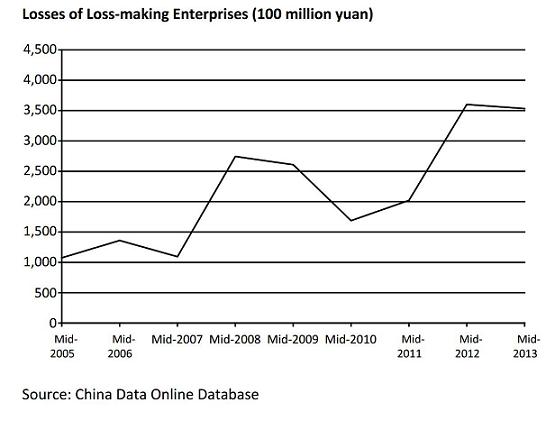

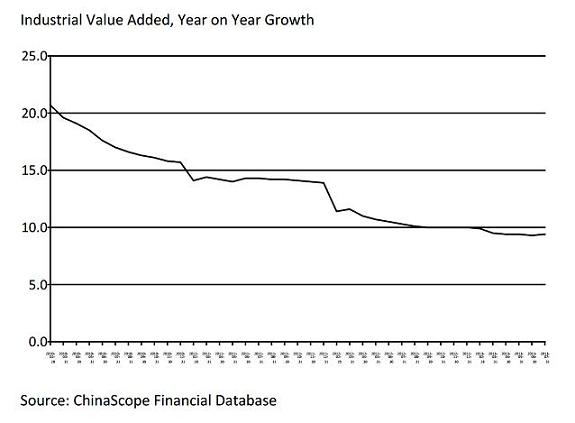

The biggest reason that corporate and government debt is high is that income from real production has been down. Local governments wanted to look like they were producing and boosted creation of assets (often infrastructure or real estate) by borrowing through local government financing vehicles. Corporations have faced smaller income flows and have therefore borrowed to augment industrial capacity. But signs on the real economy are turning unmistakably negative despite all of this propping up of GDP, signaling a potential credit crisis in the works. Signs that the economy is turning downward include an increase in losses of loss-making enterprises and declines in industrial value added.

Very little of the news on China’s economy lately has been good news. Increasingly, we fear our fear is justified. A credit crisis may arise when banks and trusts stop lending because economic conditions indicate higher levels of risk.

Who will suffer from the debt crisis? Those who stand to lose include unpaid government workers, residents without infrastructure, corporate bondholders, and wealth management product customers, ordinary households that just want higher returns on their savings. Non-performing loans from corporations and local government financing vehicles would likely be taken off banks’ books (especially if the bank is of medium to large size) and be transferred to new or existing asset management companies. Ultimately unrecouped losses may the responsibility of the central government.

Does this game sound familiar? Although China’s financial economy is not as sophisticated as that in the US, during the credit crisis of 2008, it was the American people who lost their jobs while financial corporations were bailed out by the government. The latter were “too big to fail.” The corollary to that is that ordinary citizens were “too small to save.” Somehow, a similar situation has been created in China, and certainly not by accident. Financial institutions have insulated themselves against a potential downturn, while China’s citizens still struggle to lead decent lives. If and when a credit crisis appears, it will be ordinary Chinese people who lose their jobs and their savings over corporate and government mistakes.

The Chinese government’s first step in approaching a credit crunch is to prevent this type of crisis from happening in the first place, or to bring about a controlled deleveraging, as witnessed by the engineered credit crunch in June of this year. The second step should be to protect those who deserve to be protected—individuals who may lose their livelihoods as a crisis unfolds. This is also in the government’s best interest, since a sudden rise in poverty rates tends to catalyze social unrest. The third step should be to protect institutions that are systemically important, but to sanction and shrink them thereafter. Corporate managers and government officials who made the erroneous decisions that could result in a crisis should take financial responsibility for their actions, as should the lenders who provided them with the funds in the first place. The alternative is a lasting bitterness among the citizenry similar to what is now experienced in the United States.

Looks like the loan sharks got to China too. The mafia must be so jealous.

Debt slavery has been the primary weapon of the financiers against companies, governments, and whole populations for centuries. They’re very good at it, and their victims never learn, no matter how painful and repeated the lessons.

Banking must be regulated to the point where it functions as a low-overhead utility, or con artists will escalate it into a high-stakes casino where everybody loses except the banksters. Loan sharking must be broadly defined an treated as the crime it is.

In the meantime stay away from financial predators. The more you feed them, the more famished they become.

After paragraph 8 all additional paragraphs within this article appear to be repeats from earlier in the article.

The graphs seem informative.

The whole article like hundreds of other articles, all variations on the central theme of predatory lending, economic bubbles, and rent extraction by banksters.

If you’ve seen a few dozen countries fall prey to loan sharks you’ve pretty much seen them all. The world is at the mercy of bloodthirsty pirates, and governments aren’t fighting back because they’ve been captured by the pirates. I’ve predicted food riots, old people dying in the streets, and genocidal repression for years, and if you throw in a massive ecological crisis and a couple of global wars you have the makings of a perfectly nasty and probably permanent dystopia, assuming a few million survivors to populate the ruins, which really isn’t such a great assumption.

Ugly, shortly followed by weird ugly, as I’ve said.

I boggles my mind when I look at how fragile our complex economy and society have become. And even more when I look at the people in charge and how insulated they are from reality. Then I look at the BP Gulf catastrophe and the ongoing Fukushima catastrophe. Imagine these if socoiety has shattered. Think of how many nuclear plants there are and the level of effort it takes to shut one down safely and keep it safe. How many overloaded nuclear fuel pools there are in the world that must be continually cooled or there will be …. Or how many mile plus deep oil wells in the off shore area there will be in a few more years. and I think of the clowns and gangsters that are in charge these days, the military and security complexes run amok… the financial predators… It’s hard to be optimistic.

Aargh, I hate WordPress. Something went kerfluie when I added the graphs. Fixed, sorry.

Amen!

Doesn’t China blow up every few decades and a few tens of millions of people die violently?

It seems like it’s just a matter of time.

You get born and think things are brand new, and then you realize you’re just going around and around in a washing machine.

I bet it was like this in 3000 BC. At least according to David Graeber’s book DEBT that’s what I gathered. He talks about these Chinese philosophers of economics in 3000 BC who wrote stuff down and when I read what they wrote I thought to myself “That could have been last week!” It’s like the cave paintings. You look at them and you think “Well, if they were doing that 25,000 years ago, I guess they weren’t as stupid as we thought.”

It’s funny how you think that. That people from several thousand years ago were dumb and inferior. Then you realize that it’s the same all the time for everybody and then you think “whoa, that’s a deep thought”

It’s just like Li Po himself. You’d think he was alive just last week but it’s shocking how long ago it was. But the wine and the moon are the same. And you’re the same as he was in almost every way except he was quiet good at writing things down. That’s about the only difference

“… and then you realize you’re just going around and around in a washing machine.”

“Circling the drain” could also be an apt metaphor.

A presoak or rinse cycle reference might be amusing if you happen to have one.

If Professor Hsu can tell us when the shit will hit the fan I’ll be impressed.

Otherwise, this is the same old yada yada we’ve been hearing about China for, oh, 150 years or so.

Even a broken clock is right as long as the hands aren’t moving. But if the clock is broken so the hands jump around, and go backwards, then it’s wrong all the time.

It was just like this during Kung Fu when Kaine was in the Shaolin temple and went to the spring festival with Master Po and saw the Emperor’s nephew throw a spear through Master Po’s chest because he was blocking the carriage. Then Kaine killed the nephew and that’s why he had to go to America, as a fugitive always on the run with a bounty on his head. This was in the 1870s. So things haven’t changed much. Even then the beggars were everywhere and life was cruel beyond any contemplation. The money comes and goes but the reality doesn’t change.

sorry I totally botched that. The nephew I believe shot Master Po and Cain threw a spear through the Emperor’s chest.

sometimes if you don’t get the detail right people don’t trust your command of the Big Picture.

Anyway, it’s on Youtube if anyone wants to see for themselves. If they do, they’ll certainly see there was lots of poverty and injustice even then. After all, why would they go work on the railroads? It’s hard to imagine doing something like that. If I can’t order food delivery I consider it a hardship.

They have ghost cities in China now. Maybe that’s where all Mao’s victims hang out now? Maybe you could get your big break as a paranormal investigator and get a job working for the Chinese government. Seems like they need someone to figure out how the predatory lenders sold all the houses to dead people, then stuck the government with the loans?

Then, while you’re there, you should check out if they had any Bigfeet sightings in China. That would be interesting.

Everywhere blows up every few generations. When China blows up, millions perish in China.

When the Modern Secular Rational Humanist Special Snowflake Occident blows up (twice during the past century), millions perish all over the world.

Whew! Craazyman’s back. Thank goodness. It seemed he’d gone all earnest and literal there for awhile.

FYI: the text in this article is repeated twice–or at least on my computer…probably a cut and paste issue. E.g. the second sentence “Debt is high among corporations…” and everything after is later repeated below.

http://www.youtube.com/watch?v=aa4oVHz32i4 John Garnaut explains in this video about how the klepto system in China works

Humph, and I thought the Rubin-Obama cabal fancied themselves Singaporean-style dictator wannabees, but look what it gets you!

If millions are not starving on the streets, then it is nowhere near as things 150 years ago,cycling every few generations into famine through crop failures or misguided policies.

Maybe with the familial peity will the poor in China will fare better than USA’s 45million (19 million children) in poverty.

Perhaps the truth is that we’ve always danced precariously close to the precipice and yes we occasionally fall but those moments are few and far between.

The US is in trouble!!! China is close to collapse!! The Euro is breaking apart!! Honestly speaking, it’s getting old. I have a funny feeling that everyone of these countries is playing “pass the hot potato” i.e. it’s not going to be MY COUNTRY that will cause the next crisis, so they all print money, etc. Honestly speaking, it’s probably cheaper in the long run just to engineer a Credit Anstaldt in some 3rd world country.

a monoculture crop is the agricultural metaphor for China. Momentarily spectacular with no depth of diversity. Impressive til its fatal fragility is revealed. It will fail in spectacular fashion.

China is systemically unable to organically (internally) innovate and scale will eventually not overcome eroding margin. Peak Labor will sew the seeds of their socioeconomic unraveling..

China’s central bank MMT style has been rolling over or funding subsidiary banks’ non-performing loan portfolios for decades. It’s the secret of China’s high GDP growth rate;-

“The portfolio of non-performing loans …. far from being an albatross around the neck of the system, is instead its primary motor force.”

Page 85 “The Predator State.” James K. Galbraith.

“Does this game sound familiar? Although China’s financial economy is not as sophisticated as that in the US, during the credit crisis of 2008, it was the American people who lost their jobs while financial corporations were bailed out by the government. The latter were “too big to fail.” The corollary to that is that ordinary citizens were “too small to save.” Somehow, a similar situation has been created in China, and certainly not by accident. Financial institutions have insulated themselves against a potential downturn, while China’s citizens still struggle to lead decent lives. If and when a credit crisis appears, it will be ordinary Chinese people who lose their jobs and their savings over corporate and government mistakes.”

So very well put. I would like to see this repeated often. It describes what the Randites, Reaganites, Rubinites, Clintonites, and Obamabots did to us to a T.

A link for those who like to see the data on how well we were robbed.

http://advisorperspectives.com/dshort/guest/Shedlock-130923-Illusion-of-Prosperity.php