By Philip Pilkington, a writer and research assistant at Kingston University in London. You can follow him on Twitter @pilkingtonphil. Cross posted from Fixing the Economists

The other day I wrote a post that was about some awful load of nonsense that was coming from behavioural economics under the self-contradictory name of ‘libertarian paternalism’. Since then I’ve been looking into behavioural economics in some detail and what I’ve found, rather predictably, is no less awful.

You see, while behavioural economics has done the profession an enormous service in pointing out the obvious — i.e. that perfectly optimised utility functions are rubbish — it has nevertheless sought to maintain intact the utility calculus framework, albeit in a more experimental guise. Thus behavioural economics continues to chase the ends of rainbows for pots of gold of various kinds.

Given that measures of ‘objective happiness’ based on well-ordered, timeless preferences is obvious nonsense, it is nevertheless interesting to investigate in some detail how the behavioural economists go about constructing these. What you find when you look into it is all sorts of moral judgements slipped in under the radar. I take as my example Daniel Kahneman’s chapter ‘Objective Happiness’ in the book Well-Being: Foundations of Hedonic Psychology.

Okay, so here’s how the basic framework functions. The behavioural economist approaches an experimental subject in the process of undergoing a state of pleasure or pain. In the chapter Kahneman gives the example of a patient undergoing a colonoscopy.

Now, the researcher then gives the patient a scale of one to ten and tells them that they should register how painful (or pleasurable) their experience is. The researcher must also recognise that the intervals may not be homogenous. So, for example, the pain-interval from 1 – 2 may not quantify as much pain as the pain-interval from 8-9. This is remedied, somewhat vaguely, by a ‘knowledgeable observer’ who re-orders the intervals to capture this dynamic. Kahneman does not give precise details of how this is done rendering even his basic framework suspect.

It is not arbitrary that the venture should begin to look fragile and shaky even at this point. Let us imagine, for example, that a person can realistically convey the pain they are feeling using a scale of one to ten — I am somewhat skeptical of this, but let us nevertheless pretend as if it were the case. Now imagine that a person must calculate that, for example, one minute of pain at Level 7 is equivalent to two minutes of pain at Level 6.

I would say that anyone who finds this remotely convincing is fooling themselves because the whole things sounds appealingly neat and tidy. But regardless, let us ignore these scruples and continue along.

The next oddity that arises in the Kahneman framework is the slipping in of various moral judgements. Take his ‘principle of temporal integration’, for example. This, he writes, is “consistent with the intuition that it is imprudent to seek short and intense pleasures that are paid for by prolonged mild distress” (p6). Note even the language applied here: it is ‘imprudent’. This is Victorian morality at its purest, passing itself off as an abstract principle.

Of course, in reality people engage in such ‘imprudent’ activities all the time; when they drink too much alcohol, for example, or when they play hazardous sports. But the behavioural economic Moral Majority does not want to hear about any of this. These activities, after all, violate the sacred principle of temporal integration!

The entire utility calculus then falls prey to what we might call, to rename the ‘principle of temporal integration’ in a likewise pretentious fashion, the tyranny of the average. What we find is that Kahneman thinks that we need to homogenise human experience in order to properly understand the ‘utility’ that it leads to. Extremes of pleasure are avoided in favour of a sort of numbing ‘happiness’.

Again, we’re on moral terrain here. This sounds much like the old Victorian cant that we need to lead a moderate existence and to engage in temperance so forth. I must be clear: if some people wish to lead boring lives where decisions are made based on some sort of ‘smoothing’ of pleasures over time, that is their prerogative. But I would plead with these people: keep it to yourselves and don’t attempt to impose it on others wearing your lab coat as a priest wears his collar.

If humanity had engaged in such ‘moderation’, in such ‘temporal integration’ it is likely that we would not be where we are today. Would Copernicus and Galileo have decided to make the pronouncements they did — extreme pronouncements at the time — regarding the motion of the earth if they had adhered to the principle of temporal integration? Of course not. They would have undertaken a quick utility calculus and decided that they would gain more ‘utility’ by burning their work. The same could be said of the great explorers, like Columbus, or a whole host of others who took risks and went against the grain.

Real working psychologists know this too. You don’t advertise a product saying that it will provide you with a maximum of temporally integrated utility. No, you advertise it saying that it will whisk you off on some exciting adventure of some sort. What this shows us is that this is how human desire is actually structured. When faced with ‘smoothing utility across time’ and going on an adventure the majority of the population choose the adventure. What gives the likes of Kahneman the right to say that he is correct and the majority of the population are wrong? After all, this is an arbitrary judgement on his part and seems to me to stem from his particular preferences and opinions.

Behavioural economics is nothing but Victorian morality passed down, through figures like Edgeworth, to the modern age. What is laughed at in the works of the Victorian moralists is codified into foreboding and difficult to understand terminology in behavioural economics. But it is all the same thing. It is a program that seeks to domesticate mankind and destroy what the vast majority of people hold dear.

And what is the great irony of this program? Namely, that it will be rejected by the marketplace. Where the behaviourists’ ideas may find practitioners in the more authoritarian halls of government the marketplace will continue to sell dreams of breaking boundaries, pushing extremities and engaging in short-term pleasures. This will put the behaviourists in a somewhat awkward position because, believing as they do that markets are basically a good means to allocate resources, they will find themselves hard pushed to explain why people are engaged in all sorts of naughtiness therein. But perhaps that is when the mask will slip off and oxymoronic doublethink terms like ‘libertarian paternalism’ will creep in.

You’ve hit the nail on the head with this one Philip. And not just in the realm of behavioral economics. Our culture has largely been subsumed into a Victorian modality via the traps of modern life: credit scores and all that is based on them including housing, jobs, credit (and now apparently healthcare too. Yay Obamacare!) promote this very same way of behaving where taking risk or experiencing wild pleasures that may entice us away from the safe, proper path of “sound” behaviors is frowned upon if not entirely disastrous to our “careers” and “financial future”. The fascination with legality over morality, the harsh reaction to emotive expression (Very Serious People are moderate and measured in their speech and action no matter how monstrous or immoral are the events and arguments one is presented with)… we are trained all along, from schooling to academia through to every part of existence to never get angry, never be reactive. In fact, I think this is a major reason so many people are lying down for the monstrous eradication of our civil liberties and the serious lack of justice for powerful miscreants. It would be unseemly to NOT lie down. To NOT lie down suggests you have perhaps been damaged by this state of affairs, and one must never appear bruised or battered — its just so working class. This is especially the case among the sheep who pride themselves on being members of the middle/upper middle class. Joyce called them “the dead” for a reason. Victorian morality overwhelms us at every turn, and once you take away anger you take away motivation for change. Its a clever tactic, but one that will eventually fail, for anger is a very real part of human nature, and at some point all the rationales against it break down in the face of instinct and, ironically, rational self interest.

Or, as Thomas Carlyle tells us, in The French Revolution:

If the Gods of this lower world will sit on their glittering thrones, indolent as Epicurus’ gods, with the living Chaos of Ignorance and Hunger weltering uncared-for at their feet, and smooth Parasites preaching Peace, peace, when there is no peace’, then the dark Chaos, it would seem, will rise;- has risen, and O Heavens! has it not tanned their skins into breeches for itself?

That is one fabulous piece of prose!

and one must never appear bruised or battered — its just so working class.

I have noticed that sports related injuries are *always* an acceptable reason for being off work for many weeks. Skiing, while on holiday, is considered a sport too. They even send flower and chocolate while you sit and enjoy life in a haze of opiates, yes, you can (almost) freely indulge in the headier stuff; The purity of the Sports Injury sort-of resets all sins, and cancels any deviant behaviour at least while you are recuperating.

I can only recommend getting one: You get a few hours of excruciating pain, a few somewhat unpleasant medical procedures and then …. 6 entire weeks of drug-assisted pleasure and total freedom from work ;-)

This is in stark contrast with any work-related injury, which will bring the full power of Human Resources down upon the useless fool who brought this upon himself and shamed The Company – in public, even!

Does stress from playing, say, chess or go count as a sports-related injury? I’m guessing no.

As someone who was heavily injured while snowboarding I would have to disagree with your analysis. I received no sympathy for my injury and most people felt like I deserved to be hurt for partaking in such a dangerous sport. Same with crashing my bicycle, even if I didn’t cause the accident, the blame for my injury lay in the fact that I undertook a dangerous activity. Hell, try walking around a grocery store on crutches and see how people react. A callous disregard for our fellow human beings has permeated our society and sees no sign of letting up.

Wow Yankee Frank, you may have things exactly backward–what if the ethics of 1968 which boldly declared that” it is forbidden to forbid” contributed to the moral crisis we face today?

Isn’t the role of any culture to narrow our range of choices in some way however arbitrary such limitations may seem?

What if we live in a society today, where nothing is really sacred and less and less is forbidden?

Doesn’t your own political perspective presupposes some type of functioning morality?

Didn’t the decay of Victorian morality, in the early 1900s, lead people like Keynes to search for alternative methods of social control?

Didn’t Keynes start developing his projects of economic management when Victorian certainties were breaking down?

Didn’t it become true for Keynes that depressions were the consequences of the sin of not spending enough?

Wasn’t someone like Keynes attempting to remoralize capitalism?

And didn’t even Keynes finally admit, in a conversation with Virginia Wolf, that “Our generation yours and mine…owed a great deal to our fathers’ religion” He then went on to add:

“And the young who are brought up without it. will never get much out of life. They’re trivial: like dogs in their lusts.”

I confess I have never heard of behavioral economics, but I find the name amusing since it implies what I have long understood: that standard (i.e., non-behavioral) economics is unconcerned with human behavior or anything else grounded in reality.

What actually happens is that power crystalizes into institutions, and humans adjust their behavior as best they can. For example, this explains how medicine works. Insurance companies pay doctors $12.35 per hour and the doctors ‘work’ 70 hours per day by giving each patient 30 seconds and billing for 15 minutes. This is fine so long as the patient has nothing wrong with him. Otherwise…….’Ooops! Wish I had been more careful with that one.’

I would suggest that one of the moral judgments behavioral economists make is simply that people should be rational, as defined in neo-classical theory. The implicit judgment, if you ask me, of Dan Ariely e.g., is that people do not behave rationally, however the world would be better if they did. Also, a complicating fact that I’ve noticed about work in behavioral economics seems to be a failure to state explicitly whether people are not rational (fundamentally), or for some reason, say because of information processing problems, do not appear rational, or are not able to act rationally.

Since reading Steve Keen’s discussion in Debunking Economics on aggregating individual demand functions, I’ve also been somewhat astounded by the failure of behavioral economists to ask whether one would even want people to be perfectly rational. (I think the failure to ask this question also lends support to Pilkington’s point.)

So, thinking about the post on “libertarian paternalism,” even if some wise men could set up incentives just right to get people to behave rationally, neo-classical economic theory predicts that this will not guarantee a coherent outcome.

Even though I find some of the behavioral economics stuff entertaining, I think Pilkington is correct that it tends to come along with moral judgments, especially the following: either deviation from rationality and/or inability or unwillingness to process information in a certain way is a moral failing. Behavioral economics that I have so far come across implies that individuals ought to be isolated rational actors, and that deviations from this ideal are problems that should be fixed.

I’d love it if someone would point to work in the field that doesn’t see deviation from isolated rational individuality as a problem. I’d be interested in looking at it.

I would suggest that one of the moral judgments behavioral economists make is simply that people should be rational, as defined in neo-classical theory.

That’s the heart of the matter. Neo-classicals insist individual actors are rational and all have the same preferences and desires, while behavioral economists insist actors should be rational and have the same preferences. Both just assume they know the optimal forms these must take and are therefore both paternalistic.

This wasn’t behavioral economics as I learned it in the 1990s; it was a strictly empirical, non-normative subject. Apparently it’s been completely bastardized.

I’ve also been somewhat astounded by the failure of behavioral economists to ask whether one would even want people to be perfectly rational. (I think the failure to ask this question also lends support to Pilkington’s point.)

Oh, do some more hunting. This question is all over behavioral economics. I’m not at my desk so I won’t do your homework for you, but it’s (a) considered, and (b) the science is focused on the economics.

Rationality is useful for some things. I suspect psychologists know that most decision making is emotional, with rationalizations cobbled together after the fact in order to appear to make sense.

Above L’ilD responded, “The question is all over behavioral economics,” about whether people should be rational and, “rationality is useful for some things.” My question, however, is specifically about the problem of aggregating demand functions of individual rational actors as handled by neo-classical theory. So, I suspect L’ilD is not addressing my question and claim.

As I understand it (from Keen’s book Debunking Economics), as early as the 1950’s Gorman had shown that individual demand curves do not necessarily “add up” to a downward sloping demand curve, in fact the resulting shape of the demand curve can be any polynomial, for instance one that rises as supply increases.

Later the same result was called, or rediscovered, as the Sonneschein-Mantel-Debreu theorem. Even if individuals all behave rationally, their aggregated demand function can be any polynomial function of supply. (This isn’t a problem of people buying luxury items, or of irrationality of some kind, it is directly a result of the assumptions of how a rational actor is defined.)

So, to continue with the homework metaphor: if someone could help with the homework, please suggest some reading where behavioral economists address this question in particular.

I repeat: I think the failure to deal with the SMD theorem suggests that Pilkington is correct.

It is a means by which to control. I discovered the term a few years ago and it scares the pants off of me.

I think that behavioural economics is more than just lessons in morality.

Within the work of Kanemann and Twersky, especially the early work, there is a lot of good research into how people actually make complicated decisions and how easily manipulated those decisions are, how flawed the decision making logic really is, e.t.c.

They at least give a framework for understanding how the scummy, high-pressure, salespeople and televangelists operate (the flip side is that this research also give “them” a better procedure for selling useless real-estate to “suckers” – and we are all suckers).

The problem is that they extend their research much too far and try to make it all-encompassing (which contradicts the early work in a way because there it is shown that human decisions are based on “look-up procedures” specific to the situation, not the task at hand). Then it becomes silly. The professionals in that area, organised religion, spends many lifespans to hone their ideas into “all-ecompassing-ness” and then they argue about what that exactly means for more centuries. But, I guess there is a temptation to keep working with “what worked”, especially if one makes a career based on it.

A book in a similar vein that I think people should read is: Martin Lindström’s, “Buyology” (http://www.martinlindstrom.com).

He is selling something, marketing and branding, it is good to know what the opposition is up to before we go out and buy ourselves another Obama!

I agree. I used Kahnemann and Tversky’s work extensively in my bachelor’s econ thesis on why Cost-Benefit Analysis is bull—-. They provided hard evidence that people are not rational utility-maximizers, and that this fact has important consequences for economic outcomes and behavior. BE should have led to a complete re-working of the mainstream theory, but instead it just got added as another sub-discipline and economists, for the most part, continued on…impervious to cognitive dissonance.

Unfortunately, BE has given birth to the whole “nudge” school of social policy design, which attempts to coerce people into making “rational” decisions by using the framing and bias issues that BE has documented so well to encourage citizens/consumers to make the desired choice or act in the desired way (Cass Sunstein, of course, is the exemplar of this mode of thought).

Desired by who? Sunstein and his ilk never consider the question. What framing and biases may have gone into creating the technocrat’s ideas of what is desirable for everyone else to do remain forever unexamined. The experts are assumed to know what is best, while the masses must be lead by the nose to follow their own self-interest, being too stupid to figure it out on their own. If it sounds like Bolshevism, it is…just the capitalist version.

“BE should have led to a complete re-working of the mainstream theory, but instead it just got added as another sub-discipline and economists, for the most part, continued on…impervious to cognitive dissonance.”

Aha. So that’s what went wrong. Behavioral economics was very promising in the 1990s when I studied it — very experimental. Apparently the cultists who run economics schools wouldn’t allow proper behavioral economics to continue being studied.

Don’t tar all the Victorians with the same brush. The period may have given us a lot of uptight Gradgrindish utilitarians and temperance scolds, but it also produced the likes of Algernon Charles Swinburne. If you want the full low down, I’d suggest Peter Gay’s massive five volume ‘The Bourgeois Experience from Victoria to Freud’.

The Victorians also gave us our archetypes of modern cool like Wilde, Crowley and George Sand, so..mixed bag.

What’s also interesting is how the behavioral economists’ ideas of “averaging” of pleasure and pain lead to the uniformity of individual preferences, which, as Keen and other critics of neo-classical economics, point out, is necessary to make the whole intellectual edifice of neo-classical economics stand up. If economic theorists allowed for people to choose a moment of intense pleasure for an hour of pain, or vice versa, then the uniformity of preference would break down and the neat theories of supply and demand are rendered nonsense.

The problem is that behavioral economists are still trapped by the concept of an objective utility (or pleasure) maximization “law” that governs all human behavior, akin to some sort of “principle of least action”. Of course, anyone remotely familiar with literature will see that that’s nonsense: What would the Iliad be if Achilles had chosen a long life of pleasure over his moment of glory and then death? In fact, how can this “principle of temperance” explain Wall Street’s casino mentality?

Nope. Just more for the pile of intellectual manure that is modern economics.

Just more

This is a foolishly broad brush dismissal of an entire, diverse field of economic research based on some criticisms of some of the theories of a single individual. Much of behavioral economics consists in people doing very useful research on the actual economic behavior of individuals, and it has been an important corrective to the absurd, idealized models of the neo-classicists.

The only general criticism I made in the piece of behavioral economics was that it sought to keep the basic utility-maximising framework intact. Do you deny this to be true, Dan?

The only criticism? really? Here is one criticism you made of the field:

Behavioural economics is nothing but Victorian morality passed down, through figures like Edgeworth, to the modern age. What is laughed at in the works of the Victorian moralists is codified into foreboding and difficult to understand terminology in behavioural economics. But it is all the same thing. It is a program that seeks to domesticate mankind and destroy what the vast majority of people hold dear.

I would say that that amounts to a blanket condemnation.

Yes, and I’m clearly equating the system of utility maximisation as a form of Victorian moralising passed down from Edgeworth.

Do you not think that this is true?

I am curious what branch of political economy does not seek to domesticate mankind? Or perhaps said differently, what is it you wish to maximize instead of utility?

To organize society requires compromise somewhere along the way, some means of defining and then enforcing social norms that can scale beyond face to face human interaction.

Maximising income is fine with me.

That sounds like the same approach – a semantic debate over whether to term the concept ‘utility’ or ‘income’.

I guess I’m not familiar enough with academia. I don’t really follow what has gotten under your skin about behavioral econ/finance.

Maybe a future post can explore the fundamental dissent MMT has from this approach?

Wouldn’t be prudent.

Philip, I don’t know about Dan but I *do* deny it.

The entire point of behavioral economics, as I learned about in the 1990s, was to throw out the “utility-maximizing” nonsense in favor of actual evidence about how people actually behave.

Apparently some bastardized neoclassical garbage is being peddled under the name of “behavioral economics” these days, but that doesn’t change what behavioral economics was supposed to be about when it was started.

Philip, I suggest learning some real behavioral economics, not this misbranded garbage. There are some references to real behavioral economics in some of the other comments.

And of course a certain segment of the population actually enjoys colonoscopies…

What’s not to like?

The bill.

The issue here is that we are seeing an attempt to quantify things that cannot be quantified. It is true you could quantify something like pain or pleasure if you trained people to view those feelings in a quantitative way but otherwise it is absurd to those of us that live beyond the world of spreadsheets. All economics, as currently defined, is political. Quantifying human beings, turning us into numbers is a method of control. If we pursue policy A we will get this number so let’s turn that spigot on, that spigot off and let that over there trickle a bit and see what happens. This lends itself to social engineering, central controls and so on.

There is such a thing as moral philosophy which number crunchers ignore and fear like vampires fear the cross. One of the great issues of the past century or so is the attempt to fit people into ledger books and now spreadsheets–this lay at the heart of both Stalin/Hitler/Mao and the collective efforts of the U.S. based commecial empires–put a woman next to beer and you will get X amount of new customers–use fear of communism, “crime”, “terrorism” and so on and watch military budgets bloom. Yes, manipulation “works” but mainly for those in power the rest of us just become treadmill runners and are thankful for the opportunity to live increasingly stunted lives.

I urge all of us to live expanded lives. Rediscover the depths of human potential for love, compassion and community that we seem to be moving away from in the mindless pursuit of narcissism. I like spreadsheets, numbers, robotics, AI and all that and they have a role to play in serving us–why are we serving those things instead? Money, in the end, is the highest and ultimate arbiter of all moral value–do we actually understand that? It is a fact for most people. Money is a number on a spreadsheet and we worship that? Let’s move on. Beauty (which can only come from love), truth is all we need to know.

Banger said:

“Beauty (which can only come from love), truth is all we need to know.”

Banger you sound like an eastern philosopher. Many times I have used the word truth in my travels (in a ultimate truth sense) I get “strange” looks from people. Our civilization is doing less and less right brain thinking as time goes on. That is why as you have observed so confused.

But we forget that left brain always executes on what the right brain believes/pictures as truth and the proper goal. Three things are required to execute on the “goal” as decided upon by the right brain. These three things are left brain directed:

1) Rationality (in the narrow non-philosophical sense)

2) Categorization/taxonomy (things in the natural world have to be categorized so they can be managed — things to be measured)

3) Measurement (as in spreadsheets as you discussed)

Therefore there is nothing wrong with the behavior/desire to classify/categorize and measure everything and increase efficiency in order to reach the right brain decided goal.

I explain this idea to my friends and co-worker this way:

We should create a highly efficient and automated economy but “gift” its output to the people!

In order to “break out” of the current paradigm (worldview or way of thinking) we must depend on the right brain and ask “big picture” why questions and think in terms of beauty, balance, grace peace, tranquility, justice and truth.

Mansoor H. Khan

Agree that Khaneman’s work is on occasion beleaguered by assumptions and some math one may consider odd. It is set in a particular cultural framework, which is unavoidable, of course, but yes, in the direction of “victorian type mind set” -well that is what ppl hold! – and classical economics. He got the Nobel prize for a lot respected work on these issues, that chapter is just one thing, see other posters. Well Obama and Kissinger also etc.

People aren’t rational in the sense of following reasoning or learnt schemes, which are outcomes, resumés, of bodies of knowledge like math, logic, economics, physics, built up over time by humans.

Except when in a professional role in these fields, or when using ‘learnt tools’ such as with a calculator in hand figuring out how much a mortgage will cost. The buy decision rests of course on many other factors.

Partly this is because these fields themselves are evolving, ongoing; Psychology is supposedly busy figuring out how ppl actually behave as they do; not much is known about ‘intuitive understanding’, ‘decision making’, ‘pragmatic schemes’ and the like. How ppl use their math and logic (normally built up thru cognitive development in some society, also partly acquired through schooling..) is particularly puzzling. Much of the time, it may not be in their interests to be ‘rational.’

The other side of the coin is that seeing ppl as somehow at heart ‘risk takers’, or going for ‘immediate rewards’, being subject to ‘short-term thinking/planning’, guided by a ‘pleasure principle’, going for individualistic and hedonistic ‘gains’, winning over a ‘competitor’ is also an image of man that is dubious and epoch, society, culture, bound. The reverse side of a sort of black ‘n white reasoning – neither is subtle, nuanced or humble enough.

For light yet related relief, here a tale of a young man who used math and computing power to find the perfect girl friend. He succeeded but she picked him on his looks ;)

http://tinyurl.com/qbbphku

Many thanks for that story. It makes me glad to be no longer young. Before computer match making I somehow found four wives on a total of fifteen dates. I would have married four or five of the others but they rejected me. Two of the wives were terrific; two proved to be nightmares. My advice: stay single. Of course, nobody ever takes it.

Did the 2 nightmares change after you married them, or did you have some intuition of it ahead of time?

My advice: stay single.

So says the Bible, if one can, but without the usual cheating engaged in by non-believers such as sex outside marriage.

However, there is such a thing as love at first and nearly every other sight, I know from first hand experience. It’s only happened once so far but so far that is all that’s necessary.

Life as a Christian (assuming I prove to be one) has been hard at times, very hard on an occasion or two, but otoh, it’s been real, very real where it counts.

I’m a little confused. Of course advocating market-based economics is fundamentally a subjective moral claim. What would be bizarre is claiming that an alternative means of allocating resources is not.

Political economy isn’t a hard science like physics or something. There are no mathematical formulas that dictate how things work; we merely have our collective opinions as human beings about how things ought to work. Even deciding how to value those opinions is subjective.

To that end, while I acknowledge it’s been a few years since I was in school, I thought behavioral economics/finance was particularly interested in how people actually act in the real world.

The more I think about this, the more I think this piece is fundamentally flawed:

“Real working psychologists know this too. You don’t advertise a product saying that it will provide you with a maximum of temporally integrated utility. No, you advertise it saying that it will whisk you off on some exciting adventure of some sort. What this shows us is that this is how human desire is actually structured. When faced with ‘smoothing utility across time’ and going on an adventure the majority of the population choose the adventure.”

First, this is demonstrating exactly what is being complained about – asserting things as true without evidence.

More substantively, this is exactly backwards. The reason this kind of advertising exists is that the demand has to be created. People do have a sense of obligation and responsibility to the future; our ability to think beyond now is one of the defining characteristics of human thought. The lack of hope about the future is one of the most horrific trends in urban youth in the US trapped in cycles of poverty and incarceration thanks to the drug war and wage stagnation and other public policies.

Advertising has to trick people, to persuade them to override their caution and instead act rashly. This kind of selling – the illusion of choice instead of actual choice – dominates much consumer and political activity. This is why Obama was the brand of the year.

“The next oddity that arises in the Kahneman framework is the slipping in of various moral judgements. Take his ‘principle of temporal integration’, for example. This, he writes, is “consistent with the intuition that it is imprudent to seek short and intense pleasures that are paid for by prolonged mild distress” (p6). Note even the language applied here: it is ‘imprudent’. This is Victorian morality at its purest, passing itself off as an abstract principle.”

The lack of understanding this demonstrates of human behavior, from personal finance to substance abuse to healthy eating and exercise, is mind boggling. There is vast demand from people for practical help on how to be more responsible – more prudent – with their financial, physical, mental, and even spiritual health. I find this language critique of the word prudent comical.

One of the primary critiques of the excesses of Western culture today is that we could use a bit more prudence from our Fearless Leaders.

You think that the emotions that advertising appeals to were created by advertisers?

I suppose Homer must have had access to a time machine when he wrote the Illiad then…

Eh, sorry I wrote so much. Maybe a future series of posts will help explain where MMT dissents from behavioral econ/finance for those of us that aren’t steeped in the nuance of the academic disputes.

I thought MMTers and Nudgers (?) agreed that human beings are not rational and strictly self-interesed, and thus do not fit the models designed by textbook economics.

I’m not defending Cass Sunstein’s policy positions; I’m pointing out that his approach is favored by the very political leadership which MMTers would use to implement a JG.

Except the current political leadership would never approve of a JG; they have too much to lose.

If there is meaningful work to do that isn’t already being done it is because income is ill-distributed.

Hint to the ethically ignorant: Victims should not have to work for their restitution.

Can behavioral economists explain Junkies with a privilege jones, i.e., rentiers?

Perhaps, if they are multidisciplinary enough to invoke social identity theory or system justification theory.

You forgot “Collective narcissism”. Nonetheless it seems like a lot of “theories”, all from the psychological disciplines, for a simple question. The point I was trying to make is that, if behavioral economists purport to study behavior that affects “the economy”, isn’t it suspect that they would ignore behavior as pernicious and damaging as that of rentiers?

Behavioral Economics is predicated upon the assumption that we are just complicated robots that can be controlled predictably with just a little more fine tuning. This is by no means proven and despite the obvious observable fact that the meat puppet can be manipulated by other minds than that of its ostensible owner, it remains an open question wether human behavior can be subject to total central control by technological means. This notion of social “science” is just an epistemological cartoon.

Oh, we are complicated robots which can be controlled with a little fine tuning. The thing is, no two of us are alike. :-) So we don’t all behave the same and we aren’t all subject to the same control mechanisms.

“This sounds much like the old Victorian cant that we need to lead a moderate existence and to engage in temperance so forth. ”

Quite a bit older. Aristotle at least.

All things in moderation, I always say, including moderation. ‘Tis better to be moderately extreme than extremely moderate.

It’s true: I proved it mathematically and everything….

I must be clear: if some people wish to lead boring lives where decisions are made based on some sort of ‘smoothing’ of pleasures over time, that is their prerogative. Philip P

It’s ironic that our money system with it’s boom-bust cycles is exactly the opposite.

But I would plead with these people: keep it to yourselves and don’t attempt to impose it on others wearing your lab coat as a priest wears his collar. Philip P

Indeed! And who is one man to tell another how to lead his life so long as it is ethical?

The utility calculus comes from Jeremy Bentham. It’s philosophy, and Bentham is considered a third-rate thinker at best. Aristotle dispensed with hedonism millennia ago in Book I of Nichomachean Ethics as an ethic account equating pleasure or material satisfaction with happiness. As Aristotle observes, pleasure or material satisfaction may contribute to temporary happiness, as do fame, fortune, and power, but these are accidental factors that are neither necessary nor sufficient for abiding happiness. Moreover, as Phil observes “satisfaction” is subjective and qualitative rather than objective and quantitative, and attempts to quantify it are arbitrary rather than natural and contingent on disposition and circumstance rather than necessities of nature. Trying to make a science of this is as much a fool’s errand as trying to make a science of so-called rationality. Conventional economics is ill-conceived at that foundational level. The foundation turns out to be sand on inspection.

As Aristotle observes, pleasure or material satisfaction may contribute to temporary happiness, as do fame, fortune, and power, but these are accidental factors that are neither necessary nor sufficient for abiding happiness. Moreover, as Phil observes “satisfaction” is subjective and qualitative rather than objective and quantitative, and attempts to quantify it are arbitrary rather than natural and contingent on disposition and circumstance rather than necessities of nature.

My beef with behavioral economics is that simply doesn’t add much as a distinct line of inquiry. Trying to understand why people do things is the realm of psychology and neuroscience where all of these things are and have been asked for a long time, so what do we need economists for in this regard?

Perhaps it’s that economists felt the need to start dealing in pseudo-science instead of pseudo-religion.

Ben: behavioral economics was started when it was realized that psychologists weren’t bothering to study how people behaved in relation to MONEY.

So they started doing psych experiments with real money to figure out how people behaved in relation to money.

It was a good field. Apparently actual behavioral economics may have died? I haven’t heard about new research for at least 5 years, maybe 10.

Yeah I spent about a year developing a utility function that could tell me what to do under any circumstance. It differential equations with 950 lines of code and thought I’d consult it every hour. I could maximize my utility by not thinking or feeling. The function would tell me what to do all the time, or most of the time, as long as I wasn’t sleeping.

I finally finished it and the first day I used it, by about lunchtime, I realized it was a complete disaster. It told me I wanted a tuna sandwich but on an impulse I ducked into Chipotle and got a pork carnitas salad bowl with extra hot sauce.

I don’t know why. it’s like that a lot, actually. things happen, then you explain to yourself why. Sometimes it takes years to know. Then you realize.

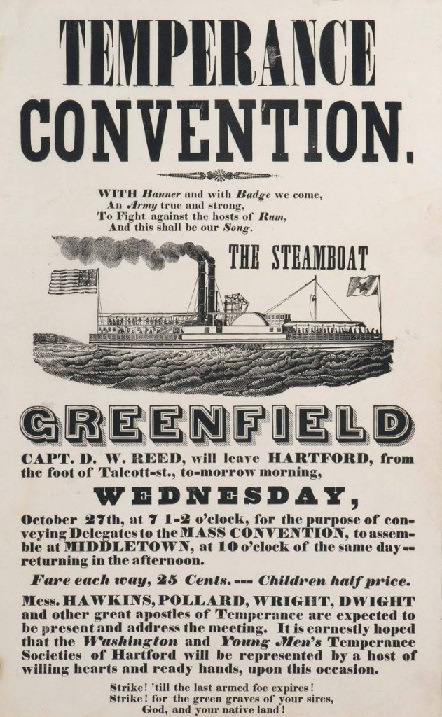

That’s a hilarious poster. Can you imagine going on a temperance cruise? I wonder if you can get beers. Probly not.

Economics is a mental disorder.

I have read somewhere that Galileo sat on contracting evidence to his Copernican beliefs.

These observations were incorrect but he did not have that scientific information at hand at that time.

He was trying to make Parallax measurements of stars based on the apparent diameter of their Airy disc ( which shrinks the larger the size of your telescopic aperture)

Thinking that stars had the same diameter as the sun he made certain assumptions.

This evidence along with these assumptions seemed to indicate Ptolemy was correct.

But he kept stum.

Things back then were not quite as clear cut as we imagine them with todays eyes.

I agree with you that some people don’t seem to get that other people can be a bit mad and enjoy it as it makes them feel alive.

This music always strikes a cord in me for some funny reason.

http://www.youtube.com/watch?v=Dk2u25v53FQ

Actually, both the Copernican AND Ptolemaic views are correct; the Sun does orbit the Earth from an Earth-centered coordinate system. I built a crude (but accurate as far as it went) C++ Solar System Simulator and saw for myself the Sun orbiting the Earth (and epicycles too) when an Earth-centered coordinate system is used.

Ah yes , a fellow amateur astronomer.

Things however get a bit more difficult when observing the retrograde motion of Mars in the heavens.

http://www.alpo-astronomy.org/jbeish/2014_MARS.htm

Is it possible to combine rationality with human existence at all?

Best of all for mortal beings is never to have been born at all

Nor ever to have set eyes on the bright light of the sun

But, since he is born, a man should make utmost haste through the gates of Death

And then repose, the earth piled into a mound round himself.

A truly rational computer would simply turn itself off. We don’t, because we’re evolutionarily programmed not to, but that’s not rational.

See also The Wheel of Existence.

Aristotle developed the theory of the Golden Mean — the right course of action was midway between extremes, for example, generosity is good, but too much is wasteful — too little is mean and stingy, etc. But his Nicomachean ethics were adopted during the Middle Ages into a Platonic (or Neo-Platonic) Christian framework. since Christianity and Judaism are religions of extreme of holiness, extreme love, and extreme evil. One sees this organization in Dante, where Nicomachean ethics are prescribed for earthly, secular matters, (in hell and purgatory) but heavenly matters are Neoplatonic/Christian (Paradiso). The heavens encircle everything on earth in Dante’s cosmology.

I had thought it was common knowledge that Kahneman is a psychologist, and has had little to no formal training in economics.