By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Originally posted at MacroBusiness

So say the South China Morning Post:

At least 40 central banks have invested in the yuan and several others are preparing to do so, putting the mainland currency on the path to reserve status even before full convertibility, Standard Chartered said.

Twenty-three countries have publicly declared their holdings in yuan, in either the onshore or offshore markets, yet the real number of participating central banks could be far more than that, said Jukka Pihlman, Standard Chartered’s Singapore-based global head of central banks and sovereign wealth funds.

Pihlman, who formerly worked at the International Monetary Fund advising central banks on asset-management issues, said at least 12 central banks had invested in yuan assets without declaring they had done so.

The US dollar is still the world’s most widely held reserve currency, accounting for nearly 33 per cent of global foreign exchange holdings at the end of last year, according to IMF data. That ratio has been declining since 2000, when 55 per cent of the world’s reserves were denominated in US dollars.

The IMF does not disclose the percentage of reserves held in yuan, but the emerging market countries’ share of reserves in “other currencies” has increased by almost 400 per cent since 2003, while that of developed nations grew 200 per cent, according to IMF data.

Pihlman said “a great number of central banks are in the process of adding [yuan] to their portfolios”.

“The [yuan] has effectively already become a de facto reserve currency because so many central banks have already invested in it,” he said.

There’s more than a little over-excitement here. The Chinese economy is the second largest in the world yet the central banks holding yuan don’t look much larger than those holding Australian dollars.

Besides, there is a quantum difference between central banks holding a few of your pennies and global markets pricing absolutely everything in relative terms off your currency. The US dollar still makes up one side of 90% of the world’s $700 trillion in over-the-counter forex, equity, commodity, interest rate and credit derivative transactions, making the yuan (and everything else) almost completely irrelevant.

A second point worth noting is that if you’re going to be a true reserve currency then you’re also going to have to run huge current account deficits, or there simply won’t be enough of your dough to go around. While the notion of 1.3 billion consumers going hog wild at the mall suggest such is possible in the future, with very low average incomes and entrenched savings habits, China has a long way to go before it’ll be chucking out enough yuan to satisfy that criteria.

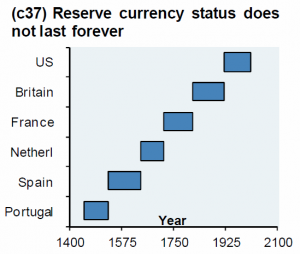

While the next chart from JP Morgan will no doubt one day come true, it probably won’t be in my lifetime:

“Many Taiwanese investors favor the yuan because they anticipate that it will depreciate further against the US dollar, the bank said.”

http://www.taipeitimes.com/News/biz/archives/2014/02/08/2003582981

“Chinese yuan-denominated deposits in Taiwan are expected to surpass 300 billion yuan (US$49.5 billion) by the end of this year, representing an annual increase of 64 percent, DBS Bank forecast…”

Agreed. The yuan won’t be a competitor to the dollar until China begins running persistent current account deficits.

Actually, becoming a reserve currency contributes to the account deficit, because the currency must flow abroad to other countries’ CBs in order for it to function as a reserve currency there. Known in economics circles as Triffen’s Paradox.

There is another way.

This other way can lead current account surpluses.

The Triffin Dilemma concerns the conflict between policies needed to maintain a reserve currency (running current account deficits) and national domestic policies required for full employment. It isn’t a chicken-or-egg proposition.

bloomberg, last week: Yuan Passes Euro as 2nd-Most Used Trade-Finance Currency

Agreed … Although the dollar is slipping there is a long way to go before its demise. The dollar will be the currency used by the “powers that be” to accomplish the end of growth and the management of de-growth in the coming years.

The current hoopla over the demise of the dollar is just a smokescreen to drive fear (and trading) and give cover to the ongoing looting of individuals and nations by the oligarchs and their favorite tool banksterism be it through the IMF or QE.

“give cover to the ongoing looting of individuals and nations by the oligarchs and their favorite tool banksterism be it through the IMF or QE.”

Should have added austerity …

“give cover to the ongoing looting of individuals and nations by the oligarchs and their favorite tool banksterism be it through AUSTERITY, the IMF or QE.

The US dollar is kinda like Microsoft Windows.

Everybody knows it sucks. But they use because everyone else does.

The dollar doesn’t suck as a reserve currency. Bankers want a stable value for a reserve currency. The Fed has basically always put constancy of value (low inflation) ahead of a healthy economy, except for the ’70s. The Bank of China has always put a healthy economy first. So the dollar beats the yuan until China is willing to tolerate a Great Recession to keep the yuan up (i.e. not soon).

The ECB has been even more dedicated to price stability than the Fed, but so much so that it raises questions about whether the Euro will survive long-term. So the dollar beats the Euro too. No other country has a sufficiently large economy behind it to serve as a reserve currency.

Basically the Fed is willing and able to destroy the US economy to keep the dollar stable. China won’t destroy its economy by choice, and the ECB may not be able to. So the dollar is the best choice for a bank’s reserves.

Instead of saying that a particular currency sucks as a reserve currency, perhaps it makes sense to say that a reserve currency sucks as a currency?

They aren’t willing to destroy the economy as that would create instability. They are however prepared to lower the quality of life for hundreds of millions, if they think it is needed to protect the power and prestige of the elite at the top.

One wonders whether the difference between trade related transactions and financial transactions may not be the essential delineation for the Chinese. The dollar could remain the dominant currency of the casinos where derivatives of all kinds are gamed while the yuan could see its use expanded and becoming dominant for settlement of goods. This would enable the Chinese to gain a strong position vis a vis raw materials in the short term while building out the necessary conditions for reserve status … such as rule of law … that the u.s. is busily degrading.

It does look like Sanctions are hastening non-dollar trade settlement. The US reacted swiftly when Iraq and Libya tried non-dollar settlement.

Buffy Ste. Marie was right: “My Country ’tis of thee Your People are Dying”.

I have concluded the death is well deserved. Reap what you sow.

China has its own economic problems … The Yuan could be a victim of these problems in short order …

Thank you Yves, this article has put me straight on a couple of things.

arby – Is this the kind of thing you are referring to :

http://www.zerohedge.com/news/2014-04-09/russia-and-china-about-sign-holy-grail-gas-deal

Yes. While a number of nations have reduced their dollar needs by opting for two way currency deals around a portion of their existing trade in goods (Australia-South Korea, for example), China has been most aggressive in this course of action i.e. not just China-GB or China-India but China-Albania?! They have also upped previously established currency swaps centered on trade in goods/natural resources.

China has recently entered into an agreement with Germany to become a RMB clearinghouse

see link: http://news.xinhuanet.com/english/china/2014-03/29/c_126330418.htm

The factor that none have brought up is the population difference between US and China and how that relates to balance of payment (account deficit) issues.

And I think the current “size” of the US economy is inflated by the financial sector but has been otherwise hollowed out in preparation for the great social leveling…..except for the plutocrats and family.

“Agreed. The yuan won’t be a competitor to the dollar until China begins running persistent current account deficits.” – Ben Johnson

I think that economics is really going to have to back off from making all of these unsubstantiated, fantastical claims and instead get down to the fundamentals of reexamining such improbable premises as aggregate demand and the “law” of diminishing marginal utility, etc. As long as 101 textbooks are littered with such blatantly fallacious and factually incorrect material, critically thinking people will never take anything such pseudoscientists say seriously.

Anyway, the system is too complex to offer up anything more than educated guesses about what will happen in the future. And economics education particularly is so full of fallacies and wishful thinking that anyone trained as an economist should not be taken seriously as a matter of course. Anyway, Jim Rickards believes that it’s at least plausible that the dollar will be backed by gold again sometime in the near future–which would make gold the new “reserve currency”; given how complex and unpredictable the financial system is, in reality no one can say if Rickards’ ideas are any more or less likely than anyone else’s. Although many do have varying ideological beliefs that can definitely influence what they think may happen and are not shy about sharing those ideological observations.

I am glad you are challenging Ben Johnson’s statement. I doubt that statement is always true, as well.

When you want to refute something, it usually helps to actually make an argument other than “everything is too hard and nothing can be known because aggregate demand is stupid”, which has absolutely no bearing on what is being discussed.

Sounds like a reasonable alternative to the bancor.

I liked Calgacus’ comment yesterday

‘It is easy to see that a JG anchors prices. Basically it makes a dollar equivalent to a certain quantity of “unskilled” labor time. A JG is a “labor standard”. Since human labor gets ever more productive, ever more valuable, a sane, not obscenely immoral monetary economy – that is one with a JG – will have the hardest money of all time. The dollar would be tied to an appreciating asset.’

Events don’t always happen in a smooth continuous manner.

I wouldn’t take a lot of comfort in backing $700 trillion of cotton candy.

I wonder if serfs are easier to control if JG disqualification is on the line.

@MyLessThanPrimeBeef: Yes, they are. Elite infliction of unemployment = JG disqualification = dishonoring the human right of a job in a monetary economy is a matchless tool of elite control.

Thanks, financial matters.

Interesting chart from JP Morgan. I wish some economic historian would summarize what caused each of those reserve currency transitions, or bring out some parallels among them, or elucidate it somewhat.

I wonder if those transitions (in the chart) each represent genuine shifts of power (among who was wielding power) or if the same banking establishment maintained control regardless of which country “fronted” for them as their hegemonic superpower/reserve currency?

Hegemony Theory work by political scientists and a few historians looked at this in a serious way back in the 1980s, but the unexpected collapse of the USSR and the Japanese economy within a span of only three years bought American hegemony a new lease on life and therefore it ceased being a hot topic and largely went into abeyance. The usual problem was a combination of relative or absolute shrinking of domestic production combined with debts incurred fighting to maintain hegemony. The collapse of the pound as the world reserve currency in 1931 was caused by a number of factors impacting simultaneously, but at heart it was a loss of confidence and an inability of the UK to provide the liquidity necessary to bail out the teetering world capitalist system. In 1907 the swift dispatch of gold to NY from London at the urging of Morgan was enough to halt the panic. By 1929 the NYSE was simply too massive and overvalued compared to Britain’s reserves for London to be able to act as a lender of last resort. This made keeping the pound as the world reserve currency problematic, and once the contagion had spread to Britain, it was sayonara for the pound.

Your absolutely right about what you’ve written! However, I believe, it was also the manufacturing production and export (Taken mostly by the USA) that facilitated the move of Reserve Currency to the USA as well

Tim,

Interesting that you brought up the JP Morgan chart on “reserve” currency. My limited understanding of economic history is that until about 1913, the global “reserve” currency was gold. So talking about Spain as the “reserve currency” in 1593 really means “Spanish gold”. Ibid the Netherlands, France, GB, (and even the US for a period). I doubt that Chinese silk traded to Spain was priced in Spanish doubloons in 1593 (in a fixed weight of gold or silver, yes).

Now if the JPM chart talked about global economic dominance, it’s more correct – at least from a West-centric perspective.

“A second point worth noting is that if you’re going to be a true reserve currency then you’re also going to have to run huge current account deficits, or there simply won’t be enough of your dough to go around.”

I saw a video of a conference the other day, in which the economist Dean Baker stated that the above view was demonstrably incorrect, and that anyone who expressed such a view simply didn’t know what they were talking about.

watch from 1:20:00 onwards:

http://economistsview.typepad.com/economistsview/2014/04/summers-lack-of-demand-creates-lack-of-supply.html

I don’t know what Dean Baker’s reasoning is, but I myself can think of a case where that statement about current account deficits is not correct.

Baker came off as woefully uninformed in that video. Apparently he is unaware the dollar was a fixed-convertible currency prior to Nixon’s closing of the gold window. The Bretton-Woods system under which the U.S. ran small surpluses while possessing the global reserve currency was stable for only twenty years before it began to collapse.

That’s the key, folks. It failed in record time. For a currency to remain a long-term reserve asset that country must have full control of it and be able to supply global demand for that asset.

Yesterday I listened to Paul Craig Roberts being interviewed on USAWatchDog state that Russia and China are going after the dollar, but the dollar isn’t in danger just yet. He stated that the US is using gold as a stability mechanism, and that Chinese gold purchases are a direct attack intended to run the Fed out of gold–if this is true, Germany is never getting its gold back!

I’m very suspicious of that “reserve currency” chart. Prior to the pound sterling’s ascent, the only currency I’ve ever seen mentioned as frequently used in major powers other than the one that minted it was the Florin, which isn’t even on that chart. And Portugal in the 1400’s? Portugal was of no economic significance until it took over the Indian Ocean trade around 1510.

The chart looks like it was made up by somebody with lots of preconceptions, little knowledge, and not even a couple hours for some googling.

ever heard of the Spanish Dollar?

http://en.wikipedia.org/wiki/Spanish_dollar

Yes, the Spanish dollar came closest, largely because for about two centuries the Hapsburgs ruled both Spain and Austria as well as much of the Americas and various other European countries. But even then England, France, and the Netherlands after rebellion ran their banks in their own currencies (not sure about places like Italy and non-Hapsburg Germany). The Spanish dollar was never anything like a “reserve” currency.

And France and the Netherlands never had anything like a world currency. Insofar as there was one, it was still the Spanish dollar as late as the American Revolution. That’s what they colonists used when they couldn’t get enough British currency.

Hence the “piece of eight”, the Spanish (silver) real. “Two bits” from the Mexican Real.

Chatting about currencies vis a vis the global economy is sort of like talking about weapons when speaking of the global balance of power. It’s what currencies and weapons represent that is most important.

As money is simply an abstraction of labor-value, as well as being the primary means of manipulating [stealing] it from those who produce, it really matters not exactly what clothes the theft happens to be wearing, only that the theft takes place.

There is one simple change we can make to not only stop the manipulation (stealing) but reverse the game, without the distraction of JG or basic income.

Of course, they don’t know to talk about that one simple, yet very powerful, change. We only have to view ourselves differently.

I would track how many countries in the world have China as first, second or third largest trade partner. The US likes to believe it has many allies and China none. The trade numbers are rather more telling and relevant to regime success of China’s counterparties. I believe reserves are a sideshow. Terms of trade are where China is and will be determining its own destiny.

US will be forced to re-denominate debt in RMB, but it likely it will only be obvious in hindsight.

As Krugman says, having the world reserve currency is usually BAD for the United States.

So let’s go for it. I hope the Chinese yuan becomes the world reserve currency.

The responders above are pretty smart! We (America) became a reserve currency probably because we became the worlds biggest and best industrial giants and exporter of goods to consumer and others from 1875 – 1968. Our “Middle class” was the international ideal. We began losing that in the late 1960’s

For reasons of distribution and cost our Industry diversified to other countries. Other strategies came forth. Technology and services and others. It has declined slowly in middle class efficiency since. Japan rose from devastation with industry as did S.Korea, then China. Russia depends mostly on raw resources in great abundance with export.

Without recovering and growing our native industry here at home. which Germany has, How do we employ middle class? Services haven’t worked well and I see no historical support for a Nation our size without exportable home made products! Therefore economically how can we remain a Reserve Currency?