Truth be told, I had really wanted to ignore Andrew Ross Sorkin’s artfully packaged Timothy Geithner puff piece in the Sunday New York Times magazine. It’s is a major element in the pre-publication public relations push for Monday’s release of Geithner’s rewriting of history book, Stress Test.

I’ve described the Geithner’s repeated claim that the TARP made money as three card monte, since looking at the TARP in isolation from the hidden tax on savers of ZIRP and QE was misleading. ZIRP alone is estimated to have cost US savers over $300 billion a year, more than 10x in a single year of the total “profit” attributed to TARP. And as we’ll discuss shortly, even that claim does not stand up to scrutiny.

Lambert astutely pointed out that this technique wasn’t just a device used relative to TARP, but applied more broadly to Sorkin’s and Geithner’s messaging. And upon inspecting the Sorkin article, Lambert is even more on target than he realized. Separately, I think it’s important to identify this propaganda technique, since it is distinct from other types of dishonest communication or rhetorical tricks, such as cherry picking.

It’s critical to remember that three card monte is a three person con. The roles are the dealer, who throws the cards in a way so as to mislead, a mark, who is the intended victim, and a shill who helps instill overconfidence in the mark’s level of insight to encourage him to play the game.

So what distinguishes three card monte as a narrative trick is deception and misdirection. As indicated above, it is different than cherry picking, in that it is not merely expunging unflattering elements so as to present an unduly rosy picture, but engaging in deliberate deception. But it is also distinct from the Big Lie, where something that is clearly untrue is stated repeated with the understanding that dint of repetition will sway quite a few people.

Here’s a classic three card monte example from the article:

This criticism that he was too close to Wall Street was also fueled by the fact that Geithner, with his English spread-collar shirts and his perfectly coifed hair, just looks like a banker. He often tells a story about how Emanuel’s wife, Amy Rule, once told him at a dinner party, “You must be looking forward to going back to that nice spot you have waiting for you at Goldman.” During an April 2009 hearing about the financial-bailout program, Damon A. Silvers, a panel member, seemed almost incredulous that Geithner had never worked on Wall Street.

“You have been in banking — ” Silvers said.

“I have never actually been in banking,” Geithner interrupted. “I have only been in public service.”

“Well, a long time ago. A long time — “

“Actually, never.”

“Investment banking, I meant — “

“Never investment banking.”

“Well, all right,” Silvers conceded. “Very well then.”

Did you catch it? Geithner was the president of the New York Fed. The Fed is a bank. The fact that it is a central bank, as in a banker’s bank and also happens to have an awkward public-private status does not make it any less a bank. Let us turn to the authoritative Palgrave Dictionary of Money and Finance (no online version), in an entry written by Richard Sylla:

The Federal Reserve System, or “Fed” in common parlance, is the central bank of the USA. It was founded explicitly as a central bank in 1913. In this respect the Fed differed from the central banks of the leading European nations of the last [19th] century. These central banks evolved gradually over decades into bankers’ banks, holders of the nation’s ultimate monetary and banking reserves, lenders of the last resort, sole issuers of banknote currency, and supervisors and regulators of ordinary banks. This was after earlier phases in which they had served primarily as agents of government finance and, in most cases, as as ordinary banks of discount, deposit, and note issue. From its inception, the Fed took on all these functions save one. It never carried on an ordinary commercial banking business; it was an exclusively a bankers’ bank.

In addition, the New York Fed, the most powerful of the Fed’s member banks, has interest rate and currency trading desks, which are important activities to large banks. He was considered to be sufficiently experienced as a banker to be asked in 2007 by Sandy Weill to become CEO of Citigroup.

But see the misdirection? Even Damon Silvers, who is widely considered to be very sharp, fell for it. Americans are so deeply acculturated to see banks as private, profit-making entities that the “public servant” palaver threw him off track. And Andrew Ross Sorkin uncritically parrots Geithner’s ruse.

That isn’t to say that all of the three card monte in this article originated with Geithner. The entire edifice of the piece is a sleight of hand. Sorkin starts out depicting Geithner as having to defend his record, showing Geithner fieldinh questions from not-terribly-friendly economics undergraduates in Larry Summers’ economics class:

On this morning, as was the case many times before, his responses generally coalesced around the plan that defined his tenure: the wildly unpopular authorization of $700 billion in taxpayer money, known as the Troubled Asset Relief Program, to bail out Wall Street’s biggest banks. “To oversimplify it, and I think this was Jon Stewart’s framing,” Geithner told the students, “why would you give a dollar to a bank when you can give it to an American? Why not give them a dollar to help them pay their mortgage?”

Sorkin uses this device to make the story of Geithner’s (by implication) unfairly hostile reception as due to his association with the unpopular TARP. Huh? The TARP was designed by Hank Paulson’s Treasury and depended on Obama, as leading Presidential candidate, whipping for it aggressively in Congress after its initial defeat to secure its passage. It was most decidedly not Geithner’s baby.

The focus on TARP (and to a lesser degree, Lehman) allows Sorkin to omit mention of actions that were clearly Geithner’s doing, including: his fighting Sheila Bair tooth and nail on resolving the clearly insolvent Citigroup; his decision to pay AIG credit default swaps counterparties 100 cents on the dollar; his defense of the failure to haircut AIG employees’ pay; Treasury’s acceptance of intransigence by AIG’s CEO, Robert Benmosche; his refusal to use $75 billion in TARP that Paulson’s Treasury had courteously left aside for homeowner relief; the clearly too permissive “stress tests,”; Geithner’s Treasury allowing banks to repay TARP funds early rather than rebuild their balance sheets (get this: because they were eager to escape very limited restrictions on executive pay); Treasury letting banks repay TARP warrants at an unduly cheap price until Elizabeth Warren’s Congressional Oversight Panel caught them out; his cynical policy of “foaming the runway,” as in using what were billed as homeowner relief programs merely to attenuate foreclosures and thus spread out bank losses, which had the secondary effect of wringing more money out of already stressed borrowers before they were turfed out of their homes. And this is far from a complete list of Geithner’s actions that favored banks over the public at large.

Sorkin instead tries to use the TARP to epitomize that Geithner has been treated unfairly. After all, the TARP was a success! The first paragraph is from Geithner’s Harvard talk; after the ellipsis is Sorkin, much later in the article:

“People think we gave the banks this free gift of hundreds and hundreds of billions of dollars, using the taxpayers’ money that we would never see again,” he said. “People thought we would lose $2 trillion on our financial rescues.”….

Geithner is confident that the empirical data has already vindicated his decision. And while there is some debate over how to calculate the proceeds from the various bailouts — TARP, the auto companies, the F.D.I.C. programs and Fannie and Freddie, among others — the evidence is persuasive. ProPublica, the nonprofit investigative organization, which keeps a tally of the bailout, puts the current profit at $32 billion. The White House Office of Management and Budget estimates that Fannie and Freddie will turn a profit of $179 billion over the next decade. (Critics might contend that these figures don’t include the costs of the stimulus or the Federal Reserve’s quantitative-easing programs.)

Notice how we’ve shifted terrain again, another three card monte trick. If we are going to make Geithner responsible for the TARP, then Sorkin should follow through with that framing. Paulson, and not Geithner, was responsible for putting Fannie and Freddie into conservatorship, as Sorkin knows full well, having written up that decision in detail in his book Too Big to Fail. Geithner has no business taking credit for that. Nor does he get points for the various alphabet-soup lending programs, which are widely credited to Bernanke (not that I think they deserve praise, mind you. They violated the Bagehot rule of “lend freely, against good collateral, at a penalty rate” and thus created a terrible precedent. And their “success” depended in large measure on ZIRP, which goosed collateral values, particularly of weak credits).

Moreover, the Geithner claim of “$2 trillion in losses” was a straw man, as Sorkin knew full well. Neil Barofsky sent me his e-mail to Sorkin in response to some questions:

[Sorkin] You have been critical of TARP. Should the public, in determining a view about TARP, measure the proceeds returned to taxpayers? You suggested in your book – I think– that the government could lose money. Do you think that stands? To the extent that I’ve seen estimates of profits, are those real? Or do you think govt is playing games?

[Barofsky] I believe that TARP should and will be measured, historically, by the moral hazard it created and what that means when the next financial crisis hits, as well as the millions of people that it could have helped (and were supposed to help) but did not. As to costs, I defer to CBO, which recently indicated a loss. It is of course good news that the losses will be far less than originally anticipated.

I can only hope, Andrew, that you do not repeat the rather stark misrepresentation that you did last time, which is to attribute a quote in my book about potential losses in the PPIP program on page 136 (regarding potentially catastrophic losses which did not occur after the programs were trimmed significantly based on our recommendations) to AIG or the program as a whole. It was unfair then, and it would be even more so now.

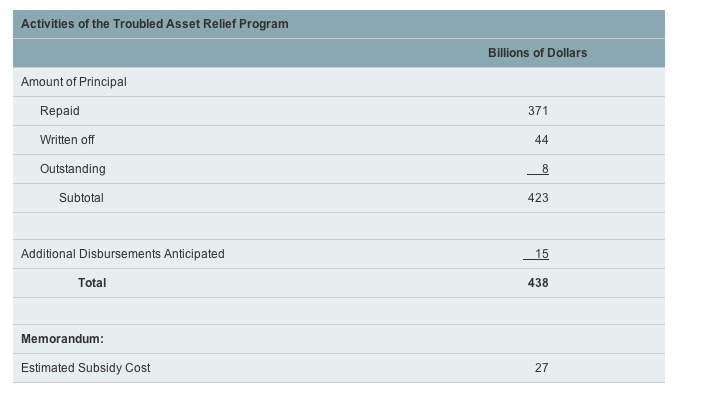

In fact, Barofsky is correct on the CBO’s tally on the TARP as of April 2014:

Amusingly, Tim Cavanaugh in the National Review, which really does not want to like Barofsky, since he’s a “liberal,” can barely contain his antipathy for Geithner:

But Barofsky (who became SIGTARP shortly before Obama’s inauguration and left in 2011) was notably if not uniquely honest in the Obama brain trust. He correctly pointed out in 2010 that the design of federal housing efforts was to re-inflate the housing bubble — not exactly a Newtonian discovery, but something few people in government were willing to say outright. He consistently threw water on bogus claims that the TARP was on the verge of turning a profit. Despite or because of his soft spot for bad mortgage borrowers, he was unusually willing to admit [pdf] that the whole federal apparatus of trial loan modifications was a form of cruelty, dragging out the pain and false hope for people who would have been better off just getting foreclosed and moving on with their lives. He made an earnest effort to perform an essentially impossible task: safeguarding the taxpayers’ interest in a program that was designed to rip off the taxpayers…

Barofsky’s commitment to getting at the truth is in fact the source of the hatred between the two men.

Some other examples of three card monte in the story: Sorkin offers a weak defense of Geither’s “Turbo Timmie” tax problems as being due to fact that he was a modestly paid public servant and couldn’t afford big ticket tax advice. Please try that excuse with the IRS the next time you have a tax problem and tell me how well it goes. Similarly, Sorkin plays the modesty card again” “Last month, Geithner officially began a new job as president of a modestly sized private-equity firm, Warburg Pincus.” He does concede that Geithner is “likely to make millions if not tens of millions of dollars over the next decade if he stays in the business.” Is this the Andrew Ross Sorkin who is a finance maven? Top players in PE have pay packages that make bank CEOs look like pikers. And Warburg Pincus “modestly sized”? It’s the fifth largest player.

These are far from the only misdirections by Geithner and his loyal water-carrier Sorkin, although many of them are more conventional rhetorical devices, such as straw manning or false dichotomies. For instance, Geithner repeatedly presents the alternative as bailing out the banks versus letting the system collapse, as opposed to preventing a meltdown and making sure that bankers and bank investors shared in the pain along with ordinary citizens. The idea of restructuring (as opposed to collapse) appears to be utter anathema to Geithner. Similarly, Geithner uses the straw man of half-hearted British measures to direct more credit to the real economy as proof that other approaches would have failed. And par for the course, Geithner deems ending “too big to fail” as ” not just quixotic, it’s misguided.”

The one bit of good news here is that for three card monte to succeed, it takes a gullible mark. But Geithner is too well known to the American public for his efforts at record-burnishing to have much effect. The comments in the New York Times section were overwhelmingly critical of Geithner and often Sorkin, and the defenses were far shorter and less articulate, generally of the “if he hadn’t done what he did, you wouldn’t have been able to get cash from your ATM.” Honestly, even that as a worst case scenario is overdone.

Americans would have accepted a week long bank holiday if they knew the system was being restructured. And the bigger point, which is not lost on the public, was there were plenty of other options for saving the system. The one chosen, that left the banks largely unreformed and no one of any consequence punished, was clearly just about the worst of the available options, unless, of course, you are, like Geithner, a banker.

How are the comments running on Sorkin’s piece of crap?

I trust you [Yves & Lambert] have made a contribution?

Sheesh, the NYT, what a tool!

I didn’t count, but I’d say (on the “reader favorites” or whatever they call it subset, which was about 2/3 of total comments) somewhere between 6:1 to 8:1 versus Geithner and Sorkin. And the positive comments looked to be cherry-picked to reduce the imbalance. One person was made a large percentage of the supporting remarks, and several of his that were rated as faves got as few as three thumbs up.

And I saw several NC regulars among the critics!

Brilliant pounding, Yves!

I used to take the Times into the clinic where I work for patients to read. Between its disinformation on the recession, Palestine/Israel, Venezuela, Afghanistan, and now, to mention the currently most gag-inducing, the Ukraine, I just give it to the cat.

I find myself thinking how desperate it is when a society cannot even be based on a consensual shared view of what happened, and is happening. “Everybody is entitled to their own opinion but we have to share the same facts”. This is completely out the window. The plane fell out of the sky and crashed on the ground: this is the only kind of thing we (mostly) can agree on, everything else is fair game for debate and deceit. “He voted for that bill”, um well, no, he didn’t. “He was never a banker”, um, well, yes, in fact he ran the most important bank in New York. Where the hell do we go from here? Yelling lies, the bigger the better, will always work better than anything the “realty-based community” can counter with.

Looking at the CBO how with those numbers is the “estimated subsidy cost ” 27 billion?

It appears they do not count the “written off ” part. Regardless of accounting rule “allowability” why that shouldn’t be counted as a genuine or actual cost I have no idea…

but I get a cost in the 60s of biliions from the above which is significantly different from the CBO

I would also be interested to know what counts as repayment- did the banks pony up cash or did they simply transfer toxic assets that current accounting rules allows them to value at cost? I suspect some of the latter

I didn’t want to get that deeply into the weeds, but here we go:

Sorkin (and one has to assume the Administration) is now trying a new angle on “the TARP made money” canard by arguing that the way to look at the investment is by treating the Fed/Treasury “investment” jointly, as opposed to looking at the TARP (Treasury program) in isolation. That is just another exercise in three card monte. If you are going to include Fed actions, you need to look at them in aggregate, and not cherry pick the ones that suit your case. The Fed’s apparent recouping of its “investment” in garbage barges like Maiden Lane 2 and 3 results from its extraordinary interventions to goose the prices of financial assets, including the alphabet soup of special facilities during the crisis, ZIRP, and QE and QE2. These represent a considerable transfer of wealth away from savers to financial institutions, by design. The most colorful account of how this worked comes from Steve Waldman:

In the Sorkin article, the article revolves around a MEGO (My Eyes Glaze Over) inducing argument of which share price for AIG is the right one to use for determining whether the government got the dough it put at risk in TARP back (never mind the point that Waldman, your truly, and numerous others have made: that merely paying the money back is also a big gimmie, given that the banks wrecked the global economy and no private party would have given them funds at anything other than extremely tough terms when the financiers were on death’s door). Barofsky contends that the price is over $43 a share (above the Treasury’s latest sales price of $32.50) while Sorkin repeats Treasury’s claim that the price (by throwing in the Fed’s three card monte “profits”) is really $28.73.

But buried in the article, Sorkin concedes Barofsky’s position: “Mr. Barofsky is technically correct that if you isolate the original cost to TARP for its investment in A.I.G., $43.53 a share is the break-even number.”

And Sorkin has a convenient episode of amnesia, that his own previous work proves that the Treasury number he flogs in this article is also too low.

In a February article, “Bending the Tax Code, and Lifting A.I.G.’s Profit,” Sorkin described how AIG was allowed to retain $26.2 billion of net operating losses that should have been wiped out as a part of the rescue of the company as well as an additional $9 billion of “unrealized loss on investments.” That increased AIG’s fourth quarter and hence fiscal year earnings by a remarkable $17.7 billion, which dwarfs the mere $1.6 billion its operations produced that quarter. And the article includes this juicy bit:

So get this: the government break even figure, which it has calculated down to the penny per share, excludes $35 billion of what Sorkin in February called “a tax benefit, er, gift, from the United States government” that goosed the stock price by at least $5. Reverse that out and even using the government’s remarkably aggressive view of the matter, the AIG bailout was and remains a turkey.

http://www.nakedcapitalism.com/2012/09/andrew-ross-sorkins-bad-math-on-aig.html

When does Goldman quit being a bank and go back to being an investment firm?

Good question. MS too.

I don’t like this business of referring to low interest rates as a “tax” on savers. The same language sometime emerges in connection with interest on reserves. Before the banks started paying interest on reserves, banks sometimes whined that reserve requirements were a “tax”, since reserve accounts paid no interest. But not giving people free money is not the same thing as taking their money.

Now if interest rates are intentionally suppressed below the rate of inflation, that does result in savers losing money in real terms. But any response to the financial crisis was going to have to result in creditors taking a hit so that debtors could get some relief. Negative real rates are part of that. But they were never as much of a factor as they could have been.

It seems to me that there is some tension between the Bagehot line and the Barofsky line. Either the government should act as lender of last resort in a financial crisis or it shouldn’t. If it does, then there will be a moral hazard problem. If it does not, then moral hazard might be avoided, but at the cost of a deeper recession and liquidationist phase. Choose your benefits and choose your costs.

The most important issues about the Geithner-Obama economic reign, to my mind, revolve around the fact that the 2008 crisis was not used as a springboard to a restructuring of the financial sector. The government might have seized control of more financial institutions; rebuilt some of them as public companies; broken the largest private ones into pieces; asserted more direct public management of the central bank; outlawed shadow banking; outlawed hedge funds and other forms of capital exclusivity; taxed financial fortunes and expanded the public role in employment, economic strategy and capital development; and imposed vigorous executive compensation requirements throughout the system – including the non-financial system, since high compensation throughout the corporate sector is part of a kickback racket for delivering delivering high returns to capital on the back of labor.

I don’t care about TARP. I’m much more concerned about what the government didn’t do, rather than what it did. We should have moved further in the direction of the socialization of finance. Instead we have done nothing significant about the deeply unbalances and exploitative nature of American capitalism. The Paultardian caterwauling about TARP has always been a red herring as far as I’m concerned.

Understood, but to use some corny terms from back in the 1960s there is a System and there is an Establishment, and they weren’t going to do any of the things you correctly suggest would have been of value to the vast majority of Americans and to America’s long-term benefit. It is debatable, but some of us believe that the System is now so sclerotic, so self-referential and self-serving, that it cannot make the kinds of compromises with reality and the so-called 99% (I still think the 93%, but that’s my calculation of who counts and who does not) that you suggest. I may be wrong. Under enough stress, the System may redistribute wealth, allow for effective collective bargaining and the expansion of unionization, and end both offshoring and the visa binge that undercuts intellectual labor. Perhaps the System can still buy and coopt its way out of trouble, as it did in the 1930s, but I doubt it. Only time will tell.

I wrote: “Before the banks started paying interest on reserves, banks sometimes whined that …”

but meant:

“Before the Fed started paying interest on reserves, banks sometimes whined that …”

It is very disappointing to realize that our government has no intention whatsoever of doing any of these obvious things. Instead they will continue to support a system that is unbalanced for no apparent reason. Even trying to give them the excuse that we are in an undeclared war in the middle east over control of oil so now is not the time to bring the banksters down, begs the real questions. The system can never be made to work as it is. If it could, they would have done it.

“It is very disappointing to realize that our government has no intention whatsoever of doing any of these obvious things.”

Why be disappointed and not recognize that currently as laws and rules allow we have a sub-species recognizable as politicians and bankers and they are in the “looting” business!

I’m an investor … saver. I did not have any exposure to the crisis and I was not saved. In fact I’ve been robbed of an opportunity to buy assets at their economic value because those that were saved (bailed out at my expense) and who would have been bankrupt … here’s looking at you Warren Buffet.

And you never, once, competed for an asset bought by Bain or Koch?

When are you going to grow up and out of retail politics?

No … I don’t compete with Bain et al for deals. Different business model. I pay cash, they borrow (rehypothecate to the moon, baby). I have cash flow from earnings and employees, they leave debt ridden shells.

Retail politics. Nah … tired of insolvency being played as illiquidity.

Buffet was the single largest recipient of TARP funds. He would personally be bankrupt now were it not for being bailed out.

Wow. Seriously? I didn’t realize that.

How come nobody talks about it?

I’m re-reading Goldsworthy’s excellent book “How Rome Fell” and I am reminded of something I tell my students about military history but fail to apply more generally–military forces only exist in relation to other military forces. They have no absolute standard of excellence. A mediocre army beats a bad one nine times out of ten. It doesn’t have to be great, or even very good, to win. It just has to be better than the other guy. Rome held on so long not because it was great, or even healthy as a society or economy, but because it was more populace, wealthier, and better organized than anything else around it. Despite decline it had massive resources at its disposal, and could absorb mistakes, even disasters.

The American FIRE sector, the American government, the American political economy, is in lousy shape, deeply corrupt, in denial about everything and lying endlessly to itself about the true state of affairs. But it endures and will continue to endure so long as it has the resource base that it enjoys, and nobody else has a bigger one so they can come along and topple it from the outside. The Geithners of this world, and their enablers in the press, will prosper because they serve what is still a rich and powerful system that can reward them and punish those who would do differently. A bleak picture, I know, and one that mismanagement, peak oil, and climate change are very likely in time sweep away, but that’s how things are from my perspective.

One might urge that the only possible counterforce to America is inside America itself; the larger states would be high in the league tables were they nations.

Here’s some interesting reactions to the possibility you just brought up:

http://www.reddit.com/r/AskReddit/comments/1i4fi2/if_civil_war_broke_out_in_america_within_the_next/

An interesting question highly dependent on the economic and technological conditions of the moment. If we’re in steep climate change, with peak oil having fully manifested itself and globalization screeching into reverse, then my money would be on New England and the swath of territory on the southern border of the Great Lakes centered on Chicago. Those would be the places to be, no question, because they have water resources and lots of arable land. The LA-Vegas-Phoenix corridor would be shit out of luck. The area north of LA to Seattle would be in very good shape. Florida and the old cotton belt would face perhaps insurmountable problems and would experience rapid devolution to its primitive pre-WWII conditions. Much of the military would simply dissert as there would be no money to pay most of them. My guess is that the equipment would fall into the hands of the successor states. The biggest question would be, who gets Montana and North Dakota’s nukes? The ballistic missile submarine fleet would be tough to keep serviceable, but the ICBM silos could remain operational for several years without a ton of maintenance. War between the states would be over key areas at the margins. The organizational and logistical apparatus for sustained operations or deep penetrations and conquest would not likely be there. America in 1861 was a rising power with a solid infrastructure (for that time) and vast natural resources. A collapsing American state in say, 2025, would have much more trouble fighting a “modern” civil war than America did in the 1860s. The logistical and maintenance needs of contemporary military forces are staggering. If the power grid collapses in six months we’d likely be back to marching infantry and horse-drawn artillery supported by an occasional aircraft or helicopter sortie.

“Power is contextual.” YES, THIS. But don’t even try to tell a

veal rancheridentity politico that. That power is absolutely vested is one of identity politics’ most important Big Lies; without it, there are no identities to politick against, and one is forced to start talking about power and own culpability, and that just won’t do. Hmm, I wonder if there is a Three Card Monte angle to be found in identity politics in general….@James Levy,

I also hope you direct your class to read Paul Kennedy’s “Rise and Fall of the Great Powers.”

It was essential reading when I read History and Politics in the late 80’s – I remember when a course was offered on Francis Fukuyama’s “End of History” dribble, it was to critique the book and the authors views – I was reading Law by that time, but can eagerly recommend most of the works of Paul Kennedy.

I have! Cheers.

Had the Obama administration used a lot more money for homeowner relief it is very likely that Naked Capitalism would be full of rants about how much corruption resulted from it. I mean how hard is it to predict that market value declines getting covered (partially or wholly) by public money based mostly on how leveraged the owner chose to be would be hated by millions who only lost their own money? How hard is it to predict that second lien holders wouldn’t get wiped out when public money was pipelined via owners to firsts? How hard is it predict that, say, Pelosi’s district would end up with an incredibly high amount of funds from whatever got implemented? Does anyone think that most parts of the nation wouldn’t notice that the federal government had just made a huge investment in upgrading housing in a few select markets and that those markets were selected on the basis mostly of just how imprudent their lenders and borrowers were? Had Geithner taken $75B and just divvied it up even among the 330M or so residents, vicious controversy probably would have been avoided, but in no case would it been avoided under the schemes of principle reduction discussed nonstop back in 2009 to 2011.

“Had the Obama administration used a lot more money for homeowner relief it is very likely that Naked Capitalism would be full of rants about how much corruption resulted from it.”

Hey why involve government in divvying up government created money. Why not a constraint that if house prices deflate so do mortgage repayments. That might not have Banksters looking to see if they were ever given a moral compass but it make them expend some energy thinking about the virtues of house price bubble blowing!

I still don’t understand how Turbo was allowed to get away with it. Is it just that the system is really that captured? That the simplest answer, as unpalatable as it is, is the correct one? Tim did the job he was assigned to do. The truth or doing the right thing based on it was never an option with the Administration.

Why is Sorkin so willing to help this weasel? I thought that, back in the day, exposing malfeasance was the highest calling of journalism. Not so much anymore, I guess.

I’m with Dan on what they didn’t do. In a way it stretches further in that our worlds went backwards from 1970 and the stealing amounts to what the rich have plus what we have not achieved.

The use of gambling-thieving metaphor is well made. I’m now convinced by Dan Sperber that we have little clue what best argument is, other than how to avoid it with easy and false ones. In maths, which I’ve only practised as a lubber-scientist, we start with a notion we can’t do the full logical argument and use intuition and ingenuity. The activity of intuition involves spontaneous judgements that are not the results of conscious trains of reasoning. Ingenuity aids the intuition by arranging propositions, maybe some drawings or geometry, in order to make it unlikely the intuitive steps needed in an argument cannot be seriously doubted. Of course, we keep at the boring logic to get to proof.

When we argue against the Establishment, as Yves does here, they always force us to a far higher standard of proof than science-maths would accept for going consideration. One can imagine the ‘quirky, fringe, opportunist Ms Webber’ stuff from the opposition reading Yves here. How dare she allude to a three card scam! I know these prats aren’t in our argument here, but they use this kind of denunciation in appeal to a wider audience assumed in their rhetoric. Yves argument here is systems theory – we know about the three card system – does it apply usefully to this public bulldung stuff? I obviously think it does, but I also think, as a scientist, that we use metaphors like this all the time. Pick them out of ‘looking at the microbiology of the cell as a co-evolutionary arms’ race between the cell and viruses’.

And in further ingenuity, we might lay out various bankster tricks like front running (found in some biological predators), PPI (insurance issued with no intent to pay out), interest-rate swaps (insuring the lender at the borrower’s risk), PE fees (trait group fraud) and various land and property grabs that require a moustachioed bankster and a damsel in distress. This and more gets us close enough to it being ‘unlikely the intuitive steps needed in an argument cannot be seriously doubted’.

I’m past arguing on their terms. Their claims amount to no more than crooks in denial.

Thanks a million for exposing that “public servant” trick. Other predatory agencies use that too. Like the Massachusetts Estate Recovery Unit, which expropriates the assets of all the people beggared by the great recession or by ZIRP to exact payment for single-payer health care. ERU hammers on the lofty public interest of their state employee status, Because we’re state employees this, because we’re state employees that.

Bullshit. They’re a unit of the dominant health care provider in Massachusetts. Think they give a rat’s ass about the creditors they dun for their giant hospital boss? ERU attaches assets without the muss and fuss of court-supervised receivership. They decide whether your surviving dependents can stay in your house or buy food with your IRA. They impose the real death tax.

The Massachusetts health exchange is not single payer health care.

Who do you think that shill’s working for? Clearly the Democratic elite has every reason to spray anonymous denunciations of single-payer all around right about now.

I took it that the poster was referring to Medicaid which is of course the single, one, and only, healthcare available on the exchanges for those below a certain income.

Not merely available. Below 133% of Federal Poverty level you are forced into Medicaid, and if, after having been forced into it, you incur expenses, Medicaid claws them back from your estate under MERP. Outright brutal discrimination against poor, sick, elders. Tell me it’s not a great country.

Likely the Honorable Prying Corpse Teeth made an honest mistake. If you get sick enough to lose your job, or just get born lucky, your income will qualify you for Medicaid, and then you have no choice. In Minnesota, I was just making inquiries about options on the MNsure site (O-care for Norwegians) and while I was unable to find out if my doctor would be on this or that plan – we are relatively well off with broader networks than most places, at least in the Twin CIties – the site automatically enrolled my 22 year-old son in Minnesota MA. I am still getting bills for him, and not paying them, being re-assured by human beings (cause the program is still all upgefuken) that his credit will not be ruined while he is in Indonesia or Singapore or wherever he is now (with international health insurance, but they didn’t ask, so eager to get him into the best federal to state reimbursement they were!). Then I realized what Minnesota’s Estate Recovery does for my patients* whose health declines and lands them in penury. It may as well be single payer because, once your fortunes have sunk that low, you have no choice. More likely at age 55 than at age 22. The point is, my son, not even in the USA now, was forced into MA. Try that at age 55, after paying off a mortgage, and falling really ill.

* I am one of those saps who spends too much time with patients and flunked the ethics tests for continuing in corporate medicine.

So, who is that “dominant health care provider?” The same place that gave us Summers, Shleifer, Mankowitz et al in econ?

While I commend your efforts to shred the NYT piece, this is hardly surprising. They gave Timmy a blowjob so he could sell a few books. Can you envision a scenario in which a single person from the 2008/2009 crew came out and issued a genuine Mea Culpa? I can’t. You can file this next to Blankfein’s “Doing the lord’s work” and other gaffes.

By capturing history, Timmy and his friends can normalize their theft. It’s not enough to steal, you have to steal and get away with it.

And by capturing the past, you’ve captured the future. If it was a mere technical process then it’s a technique that’s available any time you want. The principle of the thing, taxpayer money to keep banker oligarchs from being bankrupt, fired, and prosecuted, goes unquestioned.

The TINA narrative is the kleptocrat’s best friend. Maggie Thatcher used it to stonewall objections to her austerity campaign and to dismiss the carnage it left behind. The EU is currently using it in Southern Europe and the Teabaggers are using it here in the US. You’ve got to get rid of the stonewall before you can get to the alternatives.

What is it about Geithner’s forthcoming memoir that calls to mind the Nixon-era buzz phrase “Don’t Buy Books By Crooks.”

How about an amalgam of Abbie Hoffman and Pol Pot:

“Steal This Book and Burn It”.

Puff piece on NPR this evening. Robert Segal did the hagiography interview, asked all the soft questions, and let Timmy expound on his not being a banker, saving the world, and all that. The interview was preceded by misdirection that Wall Street thought of Geitner as a socialist. (OK, fascist is what we’re really into now, at least in my “industry” where we industrially make sick people into chronic sick people) Segal’s one real question positing that “the people who took the risks managed to get the laws changed” [paraphrase] was simply ignored by the poor Tim, who described himself as not so good at PR. The good Mr. Segal gave TG two (!) chances to reframe the looting. Tim turns to the un-named Minsky. Because human beings and tulips and stuff. Minsky was right: The GFC and current Lesser Depression was caused by a long period of confidence. Naturally, biologically, (allcoppedout should give us an intuitive mathematical analogy for the evolutionary pathway) these H sap critters get increased testoterone levels, leading to infinite rehypothecations with other people’s money on the CDS rear end. Oh hell, Freud was right after all!

“the people who took the risks managed to get the laws changed” So, the risk must have been they couldn’t get the laws changed? I wonder what they could possibly have done to make that happen…. [pounds head on desk]

Over the years there has been little public discussion of what would have occurred if the government had

tried to reorganize the Wall Street banks. I believe the government would have made a hash of it,

after years of underfunding of regulatory agencies, and government capture by the perps.

Where the FBI had less than 1/10 the personnel to examine even one large Wall St bank, could the FDIC have handled taking on the biggest banking behemoths, with worldwide presence? Oh, just fire the officers and boards and promote from within? Don’t we think the chicanery went deeper into the ranks? Would not there have been administrative chaos? I don’t know. Certainly it would have taken months for new administrators to come up to speed.

Another great, detailed, and thorough take down. Thank you for investing your time and energy to write this rebuttal. Who could be better marks for this piece than Obamabots reading the Sunday NYT?

Thanks Yves for this takedown. As you know, you are my go-to source for analysis of this mess. I tried to read Sorkin’s slop, and then did skim it, and then just went to comments where as you pointed out, nobody is going for this b.s., except some guy named David Underwood, and he seems to be working the “how many angels can dance on the head of a pin” angle by adhering to the absolute specific circumstances of the crisis, i.e. that it was the CDO’s that brought down the system, with their multiple leveraging, not the subprime mortgages themselves. It’s an odd angle to take re: Foamy Geithner, and parrots the “It would have been so much worse to let the system collapse.” I filed Chapter 11 two weeks before Lehman collapsed, and let me tell you, there was real fear among the banks. They were so busy saving their asses they hardly knew I existed for a few months. Geitner had them by the balls, and instead of twisting them, and fixing them, he stroked them and then gave a slobbery b.j. to boot. Disgusting Quisling of a man.

Shame on Sorkin. I was one of the commentators who actually got through the maze. But 50 percent of my comments on capitalist tools Protess and Sorkin are usually tossed by NYT – I would say 80 percent of my comments on Protess’ article. Which leads me to believe the reporters must have some say in what comments get through.

Sorkin knew going in he was shilling for Geithmer. Pro Forma. They just did an actual review of the book, so I will tiptoe towards that. It’s just that I so personally revile Mr. Geithner that I have trouble giving him one more second of my evfer-shorter life.

In another time, he would have been identified as the Quisling he is, and hanged just like his namesake. He is a parasitic, sociopathic liar. Glad he couldn’t sell his house too. What a stupid man.

The surname Sulzberger may as well be the new Quisling. Didn’t the NYT’s publisher promise, shortly after the Pentagon Papers brouhaha, to never hold the USG to account without its advice and consent?

The operative principle is that insiders don’t criticize other insiders, and the NYT is so very obviously inside I’d be surprised anyone but those Buying-In-Isn’t-Selling-Out believe a single word of it.

Yves, what you and Lambert have unpacked here is the essence of what I used to call “CIA writing.” It artfully dodges the very point it claims, and you come to the end of the article and wonder why you even read it. 3-Card Monte is a great metaphor. Many thanks.

The FT (Edward Luce) has an article about Geithner’s book.

Apparently he takes credit for the following:

The bank CEOs were not fired;

The banks were not nationalised;

Bankers pay continued unconstrained;

Bonuses were not clawed back.

What can one say?

Three-card monte — the cartoon version:

http://tinyurl.com/kfa5kxs

‘I’m telling you, the man and the dog are definitely working together.’

more importantly than all of this is WHY Geitner needs his image rehabilitated. sounds to me like he wants another whack at the public’s piñata. Paulson retreated to his banking empire with never a look behind him. whenever they start pulling out one of these vampires and dusting the grave soot off them, get ready for another reaming.

The other possibility is what happens in another crisis. The bottom 85% are definitely worse off than they were, and the next 14.5%+ are pawns to be sacrificed in a sadistic game of chutes and ladders.

If a Democrat wants to be President, all he has to do is promise to put the effort the GOP put into Clinton’s sex life investigations into banking. It might win 48 states. The first to do this in New Hampshire and Iowa will be the next President. Demonizing Geithner and company will make someone President much like Obama’s lack of an iraq war vote. If Geithner is reasonably intelligent, he might be trying to just avoid backlash after the various victory laps he took.

If a Democrat wants the support of the national Democratic Party, that candidate will have to stay far away from attacking banks. Otherwise campaign funds will unaccountably dry up.

No Democrat will run on that platform for they will be investigated, ridiculed, pilloried, starved of funds, Muskied and Howard Deaned to death. They will not survive such a process to be nominated. McGovern was the last man even remotely likely to take such a risk, and the Party remembers what happened to him. And despite our hopes, what the electorate did to McGovern doesn’t say much for the electorate.

Geithner probably wants Hilary to make him Fed Chair when its safe to jettison Yellen. Rather than just plain guilty, this book will make Geithner “controversial”, which in Washington should generate enough smoke to cover his ass. Besides, the more viable he is now the more money he can make waiting for his shot at the Big Chair. And yes, I think it’s all that cynical and calculated.

Naw, it’s not for Tim himself. Why give him prime print or radio time? It’s for the professional class or top 7-15%. I hear it while navigating traffic on my way home, too tired to think, so it seeps into pre-conscious information flows, bypassing most critical facilities. I just started to wonder why I was feeling nausea, so noticed that propaganda was happening. Oh my, kinda like financial crises have been happening.

On Fresh Air tonight a couple of genuine whistleblowers (Kirk Wiebe and Bill Binney of NSA fame) got decent air time, following the interview with Frontline director Michael Kirk. I am confused though. Before 9-11, Binney was working on a program called Thin Thread to collect I-net and telephony traffic but leave it encrypted unless one could show probable cause.

I had thought that the broader surveillance which supposedly started after 9-11 had actually been underway (without Binney’s safeguards or “two degrees of association” maximum) before 9-11. The story that emerges from the interviews implies that mass data collection had not started until after 9-11. Am I wrong about this? Or is the revelatory Frontline – to air Tuesday night, May 13 – another layer of obfuscation? It does validate the basic MSM line on 911.

I have no doubt that many NSA employees thought that they were acting within the law, and were shocked by 9-11. I have to wonder about what gets dismissed as incompetence at higher levels (given physical anomalies of the WTC collapse and clear lies by Condy RIce, Cheney et al; and the pre-written PATRIOT Act’s scripted rapid enactment)

My guess is the frontline piece will edit out the actual meaning of what bill binney has to say,and just use his association with actual whistleblowers to make it seem like they are doing an actual reporting piece.After all, binney has been on too many reputable programs like bill moyer’s and democracy now, enumerating the laws broken and treaties violated by the NSA.

AND so far all the sound bites from the frontline piece presume a sort of legitimacy.Even though the players can’t even say it was legal.They only say that david addington, who had no authority to do so, wrote a document claiming legality, or at least justification, and then go on to say, that that document was kept hidden so no one could see it. Though the rumor of its existence supposedly is enough to let people who BELIEVE the executive branch has greater powers than the other “co-equal” branches of gov’t.. despite this view being contradictory to what is clearly stated in the constitution.

My other take is the using of “operational code names”.These codenames become a working title which refers to a specific time period. The trick is involved by using a code name, which automatically means a certain frame in time, say after 9-11, but the reality is these programs were really getting extra-legal back when Clinton was in office under the fbi name carnivore and especially the cia name “eschelon”.Back then they had other names too. But every time news broke out about the laws being violated, the name was changed…. which by way of legalese deflection, meant that no longer was a whistleblower actually talking about the program(s) currently being exploited.

It is a trick of semantics only.

If it was reality,everyone who believes the executive branch is above the law and constitution, would be thrown out of gov’t and charged with a crime if their actions went directly against the written laws that everyone else can read.In the case of the bush administration, many would be hung for treason and/or imprisoned for “high crimes”.

Just like the reformation, was when people could read the bible for themselves and realized that what the clergy was doing was not justified by the bible.

But what we get is the whole bizarre-universe where all the different “sides” are really just a part of the whole.

Like Christianity.:which is a whole concept that has no merit.The whole thing is a lie based on false myths.

In the beginning, the romans and local politicians kill the “lefty”” socialist”,troublemaker who overturned the tables of the moneychangers….and dissed religious orthodoxy….So the powers that be kill a fanatic….. and crucify him with other thieves…. end of story? not quite…

a few hundred years later, the story is morphed into one of myth…. which is then taken by a roman emporer, who sees a use in a new “roman religion”.. and figures this will help him kill people and rule over them… which for the next thousand plus years lets the crumbling vestige of their long gone empire,survive into the new times…..all the while perverting everything they made up to teach to others…. until you get to the reformation…. wherein you get other groups of people who take the original lie(jesus was divine), and excuse every reality… and try to go against the catholic church which begets protestants and the anti protestsants,the Jesuits.

These groups are supposedly at odds with each other ,yet their whole theory, is based on the original lie.And then hundreds of years later we get Mormons(who were just looking to marry more than one woman) and Satanists.. who again are using the original lies created by their roman forebearers to justify what they pretend to be reality…..

and now we have it… a whole spectrum of people:catholics,protestants,mormons,satanists,etc… ALL beholden to the same set of false myths, all used to pretend they are real….. but the reality is NONE OF THEM ARE.

Like the scam of pretending to be “exposing” the crimes of the NSA, while really just making the world feel that everything is fine…. nothing to look at here… just keep moving folks…..

It’s an election year. It’s part of the broader effort to defend the Obama administration’s record.

Very simply, Yves, one of your most outstanding posts this year.

Offering his “unique view” of the crisis. Coming this fall.

http://wnpr.org/post/former-us-treasury-secretary-geithner-speak-yale

Yves – yes, thank you for this article. The shame of it is that you, instead of Sorkin, wrote it. Where are the investigative journalists? Why is the uncovering of lies left up to Naked Capitalism, The Automatic Earth, The Burning Platform, et al? I’m glad they’re there, but they shouldn’t have to be. Found this on Sorkin’s Wiki page:

“On the PRISM (surveillance program) and Edward Snowden situation, Sorkin said “I would arrest him and now I’d almost arrest Glenn Greenwald, the journalist who seems to be out there, he wants to help him get to Ecuador.” The statement prompted Glenn Greenwald to tweet, “Should the NYT editors & reporters who published classified information about false Iraq WMD claims be arrested?” at Sorkin.”

Matt Taibbi calls it like it is:

“Reviewing his record after his anti-Greenwald outburst, Matt Taibbi described Sorkin as “a shameless, ball-gargling prostitute for Wall Street”.

Thank you, Yves.

Gee, do you think Sorkin went easy on the unnamed sources for his book?

Sorkin would be well advised to remember Rule #1 about journalism: All sources are selective and self serving in their recitation of prior events.

His exculpation of Hank Paulson’s shutdown of Lehman, below, is extreme even by Sorkin’s standards:

http://dealbook.nytimes.com/2013/09/09/what-might-have-been-and-the-fall-of-lehman/?_php=true&_type=blogs&_r=0

This article (“Financial Terrorism”) by Mike Whitney nicely describes what happened before and after the financial crisis:

“The deal fell apart because Paulson torpedoed it, that’s why. Just like the deal with Bank of America (and Lehman) fell apart. In fact, BoA CEO Ken Lewis wouldn’t even answer (Lehman CEO) Dick Fuld’s phone calls on the weekend of the bankruptcy. Why? Because the fix was already in, that’s why. Paulson wanted his own 9-11, and he got it.

Paulson has defended his decision to let Lehman fail saying that neither he nor Bernanke had the legal authority to save Lehman even though they had bailed out Bear Stearns just months earlier under similar conditions. Even though they bailed out AIG the NEXT DAY under similar conditions (under trumped up emergency powers) . […]

This is where it gets interesting. The day before Lehman collapsed, that is, Sunday, September 14, the International Swaps and Derivatives Association (ISDA) offered an exceptional trading session to allow market participants to offset positions in various derivatives on the condition of a Lehman bankruptcy later that day.” (Wikipedia)

Pretty convenient, eh? So a lot of the banks who would have suffered catastrophic losses by counterparty deals gone south, were able to hedge their bets the day before the volcano blew. Doesn’t sound like the people in charge had already decided how the deal was going to go down?”

http://www.counterpunch.org/2013/09/17/financial-terrorism/

“if he hadn’t done what he did, you wouldn’t have been able to get cash from your ATM.”

And that’s entirely bogus and indicates without any fear of contradiction that the banks are legal embezzlers.

The monetary sovereign ITSELF should provide a risk-free storage and transaction service for what is, after all, its FIAT to the entire population as a free public good. To leave that to the private sector is gross dereliction of duty. Government deposit insurance is as gross a kludge as was ever invented.

Btw, great point about ZIRP cheating pensioners. And who should care if the monetary sovereign made a profit off of TARP? What good does that do for the general population whose purchasing power was diluted by what was almost surely new money creation? Shall it be used as a further excuse to cut taxes on the rich whose arses were saved by it? Those “profits” should be distributed to the victims of the banks, not to those who benefit from them..

Hey, Sorkin, read this (“The Greatest Propaganda Coup of our Time?”):

“By September 2008, Bernanke and Paulson knew the game was over. The crisis had been raging for more than a year and the nation’s biggest banks were broke. (Bernanke even admitted as much in testimony before the Financial Crisis Inquiry Commission in 2011 when he said “only one ….out of maybe the 13 of the most important financial institutions in the United States…was not at serious risk of failure within a period of a week or two.” He knew the banks were busted, and so did Paulson.) Their only chance to save their buddies was a Hail Mary pass in the form of Lehman Brothers. In other words, they had to create a “Financial 9-11″, a big enough crisis to blackmail congress into $700 no-strings-attached bailout called the TARP. And it worked too. They pushed Lehman to its death, scared the bejesus out of congress, and walked away with 700 billion smackers for their shifty gangster friends on Wall Street. Chalk up one for Hank and Bennie.

The only good thing to emerge from the Fed’s transcripts is that it proves that the people who’ve been saying all along that Lehman was deliberately snuffed-out in order to swindle money out of congress were right. […]

“Bernanke deliberately misled Congress to help pass the Troubled Asset Relief Program (TARP). He told them that the commercial paper market was shutting down, raising the prospect that most of corporate America would be unable to get the short-term credit needed to meet its payroll and pay other bills. Bernanke neglected to mention that he could singlehandedly keep the commercial paper market operating by setting up a special Fed lending facility for this purpose. He announced the establishment of a lending facility to buy commercial paper the weekend after Congress approved TARP.” (“Ben Bernanke; Wall Street’s Servant”, Dean Baker, Guardian)”

http://www.counterpunch.org/2014/02/27/the-greatest-propaganda-coup-of-our-time/

Thank you for that link to a truly amazing article. He makes it all so clear. . . I had always wondered about Lehman, now it makes sense.

Karl Denninger – September, 2008 – fax sent to all Congressmen and Senators

“Note that there has been an intentional drain of “slosh”, or liquidity, from the banking system. $125 billion in the last four days drained?

Ben wouldn’t be trying to intentionally cause a bank failure or two to bolster your call for the $700 billion “bailout” plan, or perhaps intentionally lock the short-term credit markets, would he?

If the market has a liquidity crisis, as he has maintained in hearings the last two days, why would he be intentionally draining reserves from the banking system and further constricting liquidity?

Don’t you think he ought to explain that to Congress – and the American people?

If the market (stock or credit) blows up as a consequence of The Fed trying to force you into passing his bill, what will you fine folks in Congress do about it?”

http://www.denninger.net/letters/bernanke-drain.pdf

“I have never actually been in banking,” Geithner interrupted. “I have only been in public service.”

Let me fix that for ya:

“I have never actually been in banking,” Geithner interrupted. “I have only been in F*CKING the public service.”

Extremely disappointing that Damon A. Silvers, a panel member, didn’t have the background or brains to ask:

If the FED isn’t a bank, what is it (much hilarity would have ensued….)

If your not working to make Wall street richer, and by that I mean the US unemployment rate increases, and the medium income decreases, and the stock market INCREASES – well, seems like quite a coincidence that everybody in the 99% is worse off, and everybody in the 0.01% is much, much better off. Almost like the best way for the super wealthy to make money is to have a financial crisis….but thats SHEER coincidence…eh, Mr. Geithner???

If he had been an actual banker, he probably would have been less naive about what banksters are all about.

“Oh, Look at the Worm!”:

“Let’s leave aside the “after” part of the 08 blowup and focus on what he either knew or should have known. Like, for example, the documented fact that Citibank knew Lehman was insolvent well before it blew up because they refused a repo transaction due to the firm not having any collateral that they judged to have value. Since both were regulated entities that traded with the NY Fed, and a tri-party repo involves the NY Fed directly, it is inconceivable that the NY Fed did not know directly and factually that Lehman was insolvent weeks before it blew up.

Yet there was no regulatory action taken, no clampdown, and, quite-clearly, no monitoring of the firm’s capital and leverage prior to it detonating.

Geithner was in charge of the NY Fed at the time.

The same situation existed with Bear Stearns.

I need go no further. Self-declared Supermen are not amusing nor worth your money when they write self-congratulatory “memoirs” that are full of delusional crap from top to bottom. What such persons should face is prison time, and lots of it.

You are, of course, free to believe whatever you’d like and to waste your money in any fashion you choose. But I, for one, will not be reading Geithner’s spooge, as even if it was available for a penny it would be overpriced.”

http://market-ticker.org/akcs-www?post=229004

Judging from the comments on the NYT website, poor Timmy’s going to have an extremely uncomfortable (and hopefullly short lived) book tour. Sorkin may be the one buying a copy.

The other astonishing thing at the NYT site is the disdain shown by the NYT readers for Sorkin’s reporting.

We need John Oliver to do to Sorkin what he did to climate change deniers.

http://www.huffingtonpost.com/2014/05/12/john-oliver-climate-change-debate_n_5308822.html?ncid=edlinkushpmg00000022&ir=Politics

Re. Geithner’s autohagiography, I am uninterested in what unindicted criminals such as Timmah Gee and Hank Paulson have to say as long as it’s not written from behind prison cell bars.

No, the Mass Health Exchange is not single payer, but Medicaid is. The ERU is exacting its death tax from the people who they don’t think will fight back. If the ERU kills Medicaid by financing it on the backs of its indigent users, that’s gravy for the Democratic Party. The Democratic death tax is real. It’s just not for people with million-dollar estates, it’s for every family with a member who gets forced onto Medicaid.

Actually, I believe that estate taxes should be steeply progressive to prevent the development of an aristocracy of inherited wealth. Therefore, I reject the reactionary framing “death tax,” which rules out that policy option.

I never get tired of this quote referring to Geithner:

“The audacity of that p—k in front of the American people announcing he was deciding whether or not a firm of this stature and this whatever was good enough to get a loan,” he said. “Like he was the determining factor, and it’s like a flea on his back, floating down underneath the Golden Gate Bridge, getting a h–d-on, saying, ‘Raise the bridge.’ This guy thinks he’s got a big d–k. He’s got nothing, except maybe a boyfriend. I’m not a good enemy. I’m a very bad enemy. But certain things really—that bothered me plenty. It’s just that for some clerk to make a decision based on what, your own personal feeling about whether or not they’re a good credit? Who the f–k asked you? You’re not an elected officer. You’re a clerk. Believe me, you’re a clerk. I want to open up on this f—-r, that’s all I can tell you.” [http://cloudtransit.wordpress.com/?s=cayne]

At the link for the quote, who is the guy in the picture?

“Gentlemen start your lying”!

http://www.newsmax.com/Newsfront/geithner-lie-romney-tax/2014/05/11/id/570713/?utm_hp_ref=mostpopular

Yves, I’m grateful for this post and your pointing out how the 3-Card Monty us something almost systemic, and how it looks in different contexts.

I’m evaluating certain “opportunities” in a new light. . .