By Chris Becker, a proprietary trader and investing strategist. Originally posted at MacroBusiness

You don’t have to be Einstein or Charlie Munger to work out that since March 2009, central banks have led the recovery (and then some) in global stock market prices (I won’t say value, because they are not the same, just like mistaking volatility for risk).

But it turns out it’s not just money printing and lower (or negative) interest rates that are doing the cooking!

An interesting report to be published this week by the OMFIF claims that because of record low interest rates, central banks have “lost” around $200-250 billion in foregone revenue in interest income on their reserves, with the shortfall being made up by directly investing into the world’s stock markets – from the FT:

The report, seen by the Financial Times, identifies $29.1tn in market investments, including gold, held by 400 public sector institutions in 162 countries.

China’s State Administration of Foreign Exchange has become “the world’s largest public sector holder of equities”, according to officials quoted by Omfif. “In a new development, it appears that PBoC itself has been directly buying minority equity stakes in important European companies,” Omfif adds.

In Europe, the Swiss and Danish central banks are among those investing in equities. The Swiss National Bank has an equity quota of about 15 per cent. Omfif quotes Thomas Jordan, SNB’s chairman, as saying: “We are now invested in large, mid- and small-cap stocks in developed markets worldwide.” The Danish central bank’s equity portfolio was worth about $500m at the end of last year.

Overall, the Omfif report says “global public investors” have increased investments in publicly quoted equities “by at least $1tn in recent years” – without saying from what level, or how the figure is split between central banks and other public sector investors such as sovereign wealth funds and pension funds.

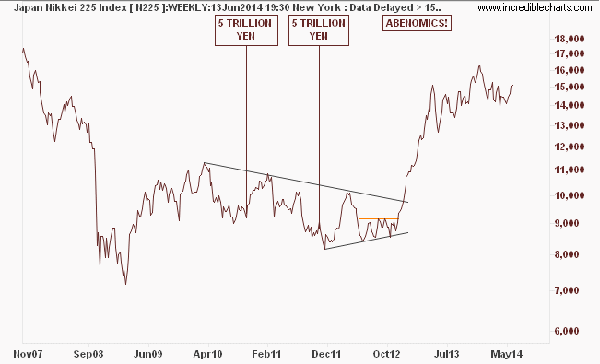

The Bank of Japan (BOJ) has publicly led the way with its announcement in April this year, jumping straight into buying 60-70 trillion yen of stocks and ETFs each year, trying to incite inflation and a general recovery:

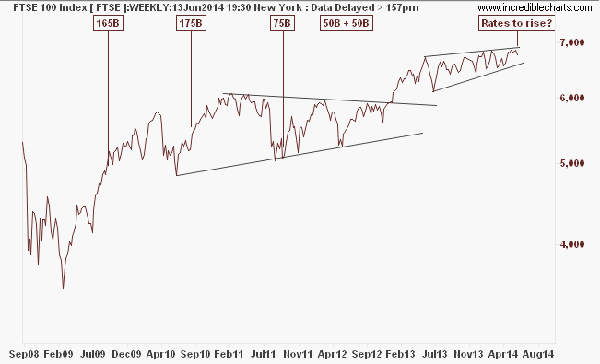

The Bank of England (BOE) has stated it has not bought direct equities among its nearly 400 million GBP QE, although a small quantity maybe some private unlisted stock, the effect has been the same as in the US:

Of course, there are well founded fears that such intervention, including massive growth in reserves, has led to such a benign period of volatility and the expectation of continued price appreciation is cooking “the goose” that laid the golden egg.

In Europe, two years of stimulus from the ECB has pushed the various bourses to record valuations, as measured by the price-to-earnings ratio, which is also pushing the boundaries of delusion when it comes to chasing yield. From Bloomberg:

Gains have pushed the Stoxx Europe 600 Index to 17.5 times annual earnings, the highest since 2002, data compiled by Bloomberg show.

While corporate dividends are higher than bond yields after two years of stimulus by European Central Bank President Mario Draghi, they’re luring investors to companies with unjustified valuations, according to Graham Bishop, an equity strategist at Exane BNP Paribas inLondon. Payouts that exceed the interest on German bunds by more than 2 percentage points will be little comfort as earnings growth falters and the economic recovery sputters, he said.

The advance in the Stoxx 600 since June 2012 has pushed the gauge up 48 percent and sent its price-earnings ratio 26 percent above its decade average relative to reported earnings, according to Bloomberg data.

Of course, one can’t keep one’s own stimulus down as this liquidity has spilled over into record bids for European bonds – yields now below that of US Treasuries – and indirectly into US shares:

Draghi’s policies have encouraged investors to bid up European assets from bonds to stocks and avoid cash. They’ve added $43 billion to European mutual and exchange-traded funds traded in the U.S. this year, according to EPFR Global data tracked by Bank of America Corp. Meanwhile, they poured $3.3 billion into American equities funds.

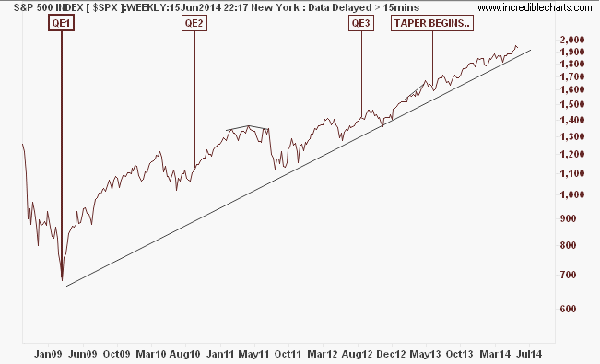

And the US is guilty as charged when it comes to the general goose and turkey feasts for stock traders, where “good” forecasts are seen as bad for stock prices, and a “dovish” economy good for stock prices, all because of the perception of less or more intervention from the Fed that follows such views, respectively.

Theres no better way to explain the moves of stock markets with intervention than this chart of the S&P500:

Which brings us to QE3 or “QEforever”, where the Fed buys $40 billion worth of bonds each and every month for an “undisclosed” period of time. There has been some “tapering” since mid-June last year as the Fed firms its forecast of a recovery in the economy.

Last month’s statement was a little cagey on the “bad news is good for stocks” meme, but this week’s FOMC meeting (tomorrow morning, Australian time) could see a tapering statement that sets a fire to the fragile stock markets around the world. From CNBC:

The Federal Reserve is widely expected to announce another $10 billion monthly reduction in quantitative easing in Wednesday’s FOMC statement. But the focus will be on the Fed’s economic assessment, which could end up dramatically realigning investor expectations about when the Fed will hike rates.

The economic outlook certainly seems to have improved since …. The last two employment reports showed monthly nonfarm payrolls growth of 282,000 and 217,000. And after a severely weak first quarter, several economists are looking forward to Q2 GDP growth around 4 percent.

… the Fed acknowledges that the American economy may be entering into a period of above-trend growth, that could distort expectations about the future target of the federal funds rate, the highly influential rate at which banks lend to each other.

This is a time to be cautious. If central banks start pulling the rug out in the form of stopping, or even slowing down stimulus – heaven forfend they raise rates – it could be a rocky ride for the rest of the year for stocks.

The NC comment section sometimes (too often?) resembles the anti-neo-liberalism-inquisition-Klan that sees neoliberal conspiracies pretty much everywhere. Anything that is bad in our lives has its root cause in something neoliberal, somewhere, whether real or imagined. This kind of mono-tracked-minds unfortunately obscurs the real criticism of society and economy that is warranted, whether it is because of neoliberalism or because of something else.

Having said this, there is no doubt in my mind that the central banks plus the commercial banks plus their friends in supervisory authorities and government over the past years through a myriad of micro décisions, plus some macro decisions, have moved things, step by step, in a direction where owners of capital and people in leadership positions in the Financial institutions have benefitted fantastically from the Financial crisis that they themselves created. There is however no single cinspiracy or smokefilled room that runs this. It is simply how the economic eco system in its current shape functions. Had there been such a smokfilled room, Occupy Wall Street would have blown it up long ago. But alas. Too many people have too much to win from a status quo.

In Europe we are waiting for ECB to continue printing…………..

Nonsense. Occupy couldn’t blow anything up: they were too busy being arrested and convicted for the unspeakable crime of messing up a park. The people they were protesting, by contrast, were earning ever higher bonuses for blowing up the world economy. Occupy 254 convictions, Wall St 0.

You don’t need a “mono-track mind” to see the blatant inequity of this. You’re right, there is not one “smoke-filled room”, there are just a few main ones that get the job done. In the Justice Department. In the White House. In the Marriner Eccles Building. JPM headquarters. SEC headquarters. There, I named five…and between them they got the job done, no problem. Conspiracy? Why no…I’d call it a philosophy.

LIBOR is an exclusive club of bank friendly banks that sit outside of public view which collude

conspirewith one another to jack up rates for practically anyone that has ever received credit.Just because you don’t see something does not mean it does not exist.

“There is however no single cinspiracy or smokefilled room”

I Beg to differ. The rooms where the Irish, Spanish, or Greek governments decided to nationalize bank debt and to increase taxes to that debt were definitelly smokefilled. These single decissions were conspiratory. Conspiratory decissions are taken everyday, As you say miriads of micro-decissions and not so many macro decissions. Many of them are conspiratory. This does not mean that each decission is a necessary step in a Grand Conspiratory Plan designed by some kind of Neoliberal God as you suggest the commentariat here is prone to think. It is just that most small or big (linked or unlinked) conspiracies end taking taxpayer money to serve some other interest. Public finances end like a Gruyere cheese.

We are not in disagreement as far as I can tell.

Neoliberalism is the prevailing ideology in western governments today. What, do you think NC readers should blame communism?

Today, the smoke-filled rooms may well smell sweetly of pine and have views of Davos or Jackson Hole, but that doesn’t matter. What does matter, whether or not one central bank is buying stocks because the others are doing it or to pursue an independent agenda, is the breathtaking moral hazard involved as the scope of this activity has grown large. Central banks have long had a function of providing liquidity through open market operations as a means of keeping markets from stalling out, but that was trivial. They are not supposed to print money to amass colossal portfolios of stocks and effectively guarantee a market’s return on investment. What that does is let the central bank pick winners and losers, the winners being invested in stocks in the markets so favored and the losers being not invested. Then there is a twist. The central bank is also lending money at zero interest to the so-called winners, who then use the borrowed money to invest and grow even more while the losers can’t get credit from the central bank. I don’t think economics can be more corrupted in practice than it is now. Whether or not this represents neo-this or neo-that, we need to uncover what is going on and keep asking the questions.

Yves brought up a book to me a few months ago called Agnotology: the making and unmaking of ignorance by Robert Proctor and Londa Schiebinger (2008). Inside the book you will find how little we really know in comparison to what we do know. A few examples from the book include: tobacco industry tactics, and the classic case of well-funded propaganda around climate change. If one extrapolates to other industries — pharmaceutical, fracking/energy exploration, reality television/fantasy entertainment and the privatization education. It is a much more profitable business plan to poison, drug, distract and dis-inform a population that to create a citizenery that is healthy, bright, and financially secure.

No there certainly is not “one” conspiracy but many. I also think the proponents of neoliberalism are no longer that ideological and merely corrupt. However, from a systems point of view, these competing conspiracies or, as I prefer to think of them, criminal gangs, act as if they were a single conspiracy.

If by “smoke-filled-room” you mean a hegemonic, global economic and social ideology then yes, in fact, there is a very large smoke filled room and we are in it too at the kiddie table very far away from the “grown-ups” conversation. Ideology is more powerful than any camaraderie of global elites in the basements of enlightenment era mansions. Every monumental political, economic, and social event in history was driven by ideology. It becomes even more interesting when there are conspiracies within the ideology, which we would be foolish to believe do not happen. History is the story of the powerful and their beliefs. Unfortunately most of us are just along for the ride…unless…

Too many people have too little power to change your beloved status quo, Swedish Neoliberal.

But as you might live long enough to learn, political markets are also subject to their own little corrections.

“Had there been such a smokfilled room, Occupy Wall Street would have blown it up long ago.”

Why do you say this? By what mechanism would Occupy “blow up” any conspiracy? And conspiracy does not require a smoke-filled room. As Noam Chomsky says in today’s Truthdig:

“Today’s elite schools and universities inculcate into their students the worldview endorsed by the power elite. They train students to be deferential to authority. Chomsky calls education at most of these schools, including Harvard, a few blocks away from MIT, “a deep indoctrination system.”

“There is the understanding that there are certain things you do not say and do not think,” Chomsky said. “This is very broad among the educated classes. It is why they overwhelmingly support state power and state violence, with some qualifications. Obama is regarded as a critic of the invasion of Iraq. Why? Because he thought it was a strategic blunder. That puts him on the same moral level as a Nazi general who thought the second front was a strategic blunder. That’s what we call criticism.”

What I meant to say that had it been sufficient to neutralise – one way or the other – the Louis XVI of world finance, it would already have happened.

But, as you point out, we are more dealing with a potent virus here.

Yes, but in basic physics, it is still a feedback loop creating just that much bigger of a bubble. That there is no one central planning process to this means these people are not really in control. They are just riding an enormous wave. One which is powered by a collective desire for possessing money, as much or more than the intentions of those holding large amounts of it.

What is a positive on the local level, is a negative on the global level. Go forth and multiply hits the edge of the petri dish.

Exactly.

I think it will surprise exactly no one that the Fed as well as the ECB have been ‘goosing’ all sorts of markets for quite some time. But what I would be interested in hearing is Mr. Becker’s read on why Belgium has suddenly gone on a UST bond buying binge of something like $41B per month. Could it be that the Fed isn’t tapering at all, but is hiding its bond purchases by way of a 3rd party? Quelle Suprise!

I can’t find it to link it now, but I remember reading a Japanese magazine article saying the Chinese were doing it. They are supposed to have half of their surplus foreign exchange funds in U.S. treasuries, or $2 Trillion, but only $1.27 T shows up in the Fed custodial account. The unaccounted-for remainder supposedly equals the Belgium purchases. Possible motive behind using Belgium is the expectation that the funds could be frozen if the U.S. ever applies sanctions against China, so it makes sense to move the bonds somewhere else. That makes it worth a comment, because unless the Chinese actually expect to do something that would legally trigger U.S. sanctions, using Belgium would otherwise make no sense. There is some fancy skulduggery going on here, but it is as yet unexplained.

I had not heard that….. Very interesting. Also interesting that you found that tidbit in a Japanese article. Heaven forbid the MSM report on it. It does make a lot of sense that it could be Chinese money.

I’m incredibly angry that we’re reduced to reading tea leaves to try to figure out what is actually going on in our own government and markets.

Thank you for advising us on how to think about these things, Swedish Lex.

I’m sure everyone is very appreciative of your great insight.

The situation discussed above suggests that things are irreversible and that the market clearing mechanism is kaput. My question is this: If asset prices are going to be perennially inflated, then the gains from those artificial prices will go increasingly to the class of people who benefit from the purchase of those assets. Correct?

So the 1 percenters will take the money they’ve acquired from these gains, recycle it into stocks and bonds and thereby increase their rents on the real economy assuring more economic stagnation, greater inequality, and less social cohesion.

Am I right about this or am I missing something? I don’t claim to be an expert.

That’s about right. If an investor expects prices to go up, she buys.

Exactly.

But since things that cannot go on forever eventually will stop, so will this. At the level of the individual, therefore, one has to milk as much out of the system as possible for as long as it is possible. As a collective, the picture is not pretty.

Seven years into the crisis, and this is the best that we have come up with as a “solution”.

Once one accepts the doctrine of central planning — the absurd proposition that a group of wise lifeforms with advanced educations can add value by ‘steering’ the economy — it’s too late to complain that they’ve exceeded their mandate. Globally, the three largest asset classes are bonds, equities and property. Central bankers now explicitly manipulate all three.

How desperately deranged have their feckless interventions become? During the past 12 months — the fifth year of an economic recovery which has seen U.S. stock valuations reach into the top decile — the Federal Reserve expanded its balance sheet by 27%. If I just posted crazy sh*t like this without a link, people would think I was on drugs. So here it is; proof:

http://www.federalreserve.gov/releases/h41/current/

Enjoy Bubble III while ye can, because when it blows, things are gonna suck worse that one could ever imagine. And hypodentilated* Boomers may not live to see Bubble IV.

*PC euphemism for ‘t**thless’

How desperately deranged have their feckless interventions become?

Monumental, gargantuan, massive, …

Imagine that 27% increase in Fed balance sheet going directly, in equal shares, into the accounts (at the Fed) of Little People, as in Money Creation via the Little People Spending it Into Existence, instead of the government.

No trickle down.

No money for meddling in Ukraine, but money for the Little People to buy milk and pay for their children’s health care.

Profit, without production = stock market today.

With an average holding time measured in seconds, and long term time horizon in minutes, it must be comforting to know the dumbest money on the planet has your back. Of course the central banks really don’t have to sweat for their next dollar, or euro or yuan. Just push enter on a keyboard and voila, money galore.

The buying of equities by the central bank is bound to violate equal protection under the law but what’s new since gross inequity in a country can only have resulted from the violation of equal protection under the law?

yes, the central banks influence markets, buy gold, etc. but “OMFIF” is just another think-tank. Think-tank studies are all over the map when it comes to accuracy of stats/assumptions, etc.

as my teachers told me in grade school, show me your work.

“A time to be cautions”. That’s not very helpful. Even I can think that one up! I thought it up last year too and that movie didn’t end very profitably for me.

A time to be cautious. Oy vey. Is this something out of Nostradamus or what?

We want to know the day and the hour. The day and the hour to toss caution to the wind and get rich quick with some waaaay out of the money puts or long-triple-leveraged VIX gambles. That’s the point is, isn’t it? How can you figure this out if not by channeling? Maybe it will be July 31, 2014. That’s what I’m thinking. Or maybe June 27 or August 8. It gets confusing.

Since Dr. Draghi rang the bell a couple of weeks ago with his negative interest rates, even seasoned pros recognized — the scales dropping from their rheumy old eyes in a flash of blinding insight — that we’ve got ourselves a hell of a Bubble going here.

‘Most likely over the course of the next 12 to 24 months we will enter the speculative phase of this market. But, the best profits of a bull market often come in the speculative phase,’ says Scott Minerd of Guggenheim.

http://tinyurl.com/ljqnso5

This is like a modern-day John Paul Jones [the naval captain, not the Led Zep bass player] proclaiming that ‘I have not yet begun to speculate.’

Into the great wide open

Under them skies of blue

Out in the great wide open

Banksters without a clue

faaak. If I go through another year without making lots of money in the stock market, I really will go crazy. It’s long past time to get rich quick and lay around doing nothing of any social value. At least I won’t be bothering anybody. That’s a net plus for society!

So our Fed seems to have limited itself to US treasuries and some MBS which they will just let “run off.” But it would be easy to believe that this is just a cover (the MBS designation) for investing in all sorts of stuff like buying stocks directly and putting them in some Fed fund. To keep the market from crashing. But since the system isn’t working, the more they buy the more they have to buy. Our Fed is not a central bank that invests for a sovereign fund. Sovereign funds don’t eat their own tail. Aren’t we talking two different sorts of central banking institutions here? That is where it gets dangerous because at some point we’re probably looking at socializing the banking system and folding the private Fed into the Treasury. And free-marketeers everywhere are going to panic – unless that has already happened and what we are in is just a mopping up. Nevermind.

The “Fed” is driving the bus in the movie Speed (Keanu Reeves, Sandra Bullock) that’s rigged to blow if it ever drops below a trigger speed. With hundreds of trillions in leveraged derivatives depending on non-stop growth, the global bus will blow if assets ever drop more than five percent. They can’t ever let up on the pedal.

So yet another conspiracy theory proves to be fact. Central banks are printing money to buy stocks. It’s a creative way to run a “free” market.

Must be time for everyone to jump into the stock market now that the “Fed” has made an implicit guarantee. What could go wrong?

What these people have lost sight of is their method of control is this very monetary system that they are turning to mush. When it blows up, they people they gave all the guns to are not going to need the bankers, if the money is no good. Back in the old days, those people would be sent off to war and be fairly gutted, as well. This time, the Eurasian countries are going to start using other currencies and ship all those surplus dollars back home rather suddenly. A lot of those overseas troops will likely find themselves no longer as welcome either. The question will be who ends up in control here.

The long-standing power of resource allocation/credit creation invested in largely private central banks has become increasingly problematic as financialization advances and investment in the real economy declines, contributing to inequality, instability, and constricting democracy. This fresh proof of further power in an already rigged market (ie central banks hugely intervening in ‘free’ markets) suggests to me that we are operating in a command economy that deliberately disadvantages the many for the benefit of a powerful few. I’m with Michael Parenti on this one. It’s not an either/or. We’re talking Class Power AND Conspiracy. Because otherwise they’d fix it tomorrow, no?

http://www.youtube.com/watch?v=31iwRoyhoX4