Yves here. Ilargi is duly skeptical of the enthusiastic financial press response to an increase in home equity liquidation, um, borrowing using home equity lines of credit, or Helocs. While the party line is that this development reflects an rise in home equity and increased consumer confidence, Ilargi stresses that prices appreciation that the Fed has created, the Fed can also take away (of course, the way that investors appear to be betting is the Fed will be sorely lacking in nerve as far as tightening is concerned until the economy is clearly overheating, which is so far away that they can lend and otherwise party for a very long time).

But I have to wonder how many of these Heloc borrowers are doing so out of necessity or near-desperation. See this post by Wolf Richter on hunger in the US as evidence. As Business Insider pointed out last week, investors have forgotten what a normal recovery looks like. Muddling along with high levels of long-term unemployment does not qualify. How many people who are effectively liquidating home equity are doing so to deal with a medical emergency, or pay down credit card or student debt? None of that reflects optimism; it’s trying to keep the wolf at bay.

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth

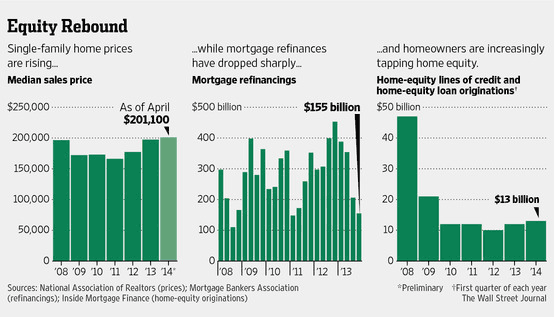

In a recent article, the Wall Street Journal uncovers a big problem in the US housing market, albeit, curiously, without necessarily identifying it as a problem. It would be nice if Americans could trust their once most trusted media to give them the best possible covering of a topic, but the Wall Street Journal apparently prefers to pick the side of, well, Wall Street. The problem not presented as one is the resurgence of American homes as ATMs, of borrowing against a property’s perceived value through home equity loans or home equity lines of credit (Helocs).

The article claims that lenders are being “conservative” since they’re merely handing out 85% LTV instead of the 100% ones they once did, but how conservative that is really depends on the future expectations of the values. And that’s one area where very little is conservative anymore. If lenders can only convince borrowers that the housing market has recovered, they can do their favorite business again: hook mortgagees into major debt increases. That shouldn’t be too much of an issue if only they can show their clients lines like this:

According to the Federal Reserve, net household equity stood at about $10 trillion in the fourth quarter of last year, up 26% from the prior year.

When I first read that, I had to check if they weren’t perhaps referring to the city of London, but sure enough, this is supposed to be about American housing. If it were anywhere near the truth, I don’t understand why Federal Reserve chief Janet Yellen was so cautious about housing prospects a few weeks ago, saying problems “could prove more protracted than currently expected.” If a 26% rise in equity in one year makes her express herself in such negative terms, you wonder what it would take to make her more optimistic. What also makes it hard(er) to believe are falling home sales and mortgage originations, price rises that exist only in the highest price ranges, plus a flood of other data that have come in recently. But there it is, printed in the Wall Street Journal , so why not take out that loan? Why not act as if the past decade, and the crisis it gave birth to, never happened? After all, people want loans, and bankers want commissions.

US Borrowers Tap Their Homes at a Hot Clip (WSJ)

A rebound in house prices and near-record-low interest rates are prompting homeowners to borrow against their properties, marking the return of a practice that was all the rage before the financial crisis. Home-equity lines of credit, or Helocs, and home-equity loans jumped 8% in the first quarter from a year earlier, industry newsletter Inside Mortgage Finance said Thursday. [..] … this year’s gains are the latest evidence that the tight credit conditions that have defined mortgage lending in recent years are starting to loosen. Some lenders are even reviving old loan products that haven’t been seen in years in an attempt to gain market share.

In 2013, lenders extended $59 billion of Helocs and home-equity loans. The last pre-boom year near that level was 2000, when lenders extended $53 billion, according to Inside Mortgage Finance. “We’re seeing much more aggressive marketing campaigns [for Helocs] by banks in locations where home prices have risen,” said Amy Crews Cutts, chief economist at Equifax Inc.[..] “We expect to see quite an uptick in Heloc activity” in the spring …

Some individual banks have seen their Heloc originations rise much faster than the national average. Bank of America, which has increased marketing for Helocs, said customers opened $1.98 billion in Helocs in the first quarter, up 77% from the first quarter of 2013. Matt Potere, who leads Bank of America’s home-equity business, said [..] “The driver is increased customer demand,” Mr. Potere said. “It’s an effect of higher consumer confidence and improving home values.”

Are we sure that “the driver is increased customer demand”, not “much more aggressive marketing campaigns [for Helocs] by banks”? Or is this just two elements coming together in a happy coincidence that will benefit everyone, a real win-win?

[..] During the housing boom, Helocs were a source that many consumers tapped to remodel their homes, buy new cars and boats, travel and send their children to college. Lenders often let them borrow up to 100% of their home’s value, in the expectation that prices would continue to rise. However, when prices fell and borrowers weren’t able to repay, banks faced steep losses.

This time, lenders seem to be offering Helocs only to borrowers with good credit in locations where home values have risen, said Keith Gumbinger, vice president of mortgage-information site HSH.com. During the boom, homeowners could borrow up to 100% of their home’s value, said Mr. Gumbinger. Now it is most common to see a maximum of 80% and sometimes 85%, he said. “Relative to where they were, lenders are still very conservative,” said Mr. Gumbinger. “Will the excesses of yesterday return? Only time will tell.”

Even if we would take that at face value, which we don’t, the question remains where home values are going. There can’t be too many people left who haven’t figured out that it’s the Fed’s hugely expensive QE programs that have lifted asset prices to where they are today, even if they don’t understand why extending QE ad infinitum would be very counter-productive, and is therefore of the table. If that were not so, then, unless the present generation of central bankers were absolute geniuses, it would be hard to explain why their pre-decessors didn’t do what they now do, decades ago. Whether that is clear or not, it would seem only logical to see what asset prices do when QE is gone, both for investors and for home owners. If we can agree that QE has distorted prices of all assets, then home prices must have been distorted too. And if the present record stock exchanges are any indication, it’s a safe bet that they are heavily overvalued. So loans against what some may see as the present ‘value’ of a home are entered into based on – probably greatly – distorted assessments. Lenders mind that less than owners should; and what does BofA care? They’re too big to fail anyway.

[..] “It’s really about the stabilization of the real-estate market and property values going up. It gives us more comfort as to the value of the homes – the equity is there and the client profiles look strong,” said Tom Wind, executive vice president of home lending at EverBank, based in Jacksonville, Fla. [..] Some lenders are even bringing back “piggyback” loans, which serve as a second mortgage and cover part or all of the traditional 20% down payment when purchasing a house. Piggybacks nearly vanished during the mortgage crisis.

Piggybacks bring back the 100% LTV loan. It may not be entirely subprime, but we’re well on the way there.

Banks have been emboldened to originate new Helocs in part because new regulatory requirements completed this year and last year make it less burdensome to do so. And in an era where interest rates are expected to rise in the future, some lenders say they prefer Helocs over some other home-equity products because interest rates on Helocs rise as interest rates rise, making the products potentially more profitable.

Oh well, there you are. Regulators have weakened regulations once again, always a good first step towards trouble. Lenders can now aim for those ‘potentially more profitable products’ again, that have already brought us so much joy in this new century. And got millions of American families unceremoniously thrown out of their homes. What’s not to like?

Ian Feldberg planned to open a $200,000 Heloc this week with Belmont Savings Bank to help pay his son’s college tuition. The medical-device scientist purchased his home in Sudbury, Mass. for a little over $1 million in 2004, and estimates that its value dipped as low as $800,000 during the financial crisis. However, after applying for the line of credit, he found that its value had completely recovered. “I’m very pleased about that.

A medical-device scientist with a million dollar home who can’t afford college tuition. If that isn’t a sign of the times, what is?

To summarize, if that’s still necessary, home prices, like prices for all assets, are way higher than they would have been without QE. And still 20% of mortgage holders can’t afford to even sell their homes, let alone upgrade. But already lenders are waving promises of cheap money in front of their faces again. Have we not learned anything at all from the depths of the crisis? The answer is a resounding No. We can still fool ourselves and each other into a form of mass psychosis, thinking we’re much richer than we are, and act accordingly. It’s enough to make one that much more despondent about the future of this failed experiment that was once the land of the free. If you know what’s good for you, ignore things like this WSJ article, and if you can’t be free, at least be debt-free. Because after the fake asset values of the illusionary economy fall back to earth, the debt will remain. And y’all will feel a lot less wealthy.

Phyl and I have been wondering why home sellers haven’t been dropping their prices when offers haven’t been up to asking prices. Oh, we obviously didn’t get the memo. When we have found good deals, the titles weren’t sound. Meanwhile, check out some of the mid and larger urban zones, especially Down South, on Zillow. Look at all of those blue icons; foreclosures, often outnumbering the red icons; for sale by owner. It’s getting messy out there.

In my area, people are dropping prices. And relatively quickly. I am seeing housing stock come on the market at very high prices, and routinely see price drops of $10k or more in two to three weeks. I live in a “desirable” suburb of Boston, so your results may vary. But people who need to sell seem to be acting realistically in terms of lowering their selling price expectations.

Dropping 10k is standard marketing for homes. Dropping 100k is not.

We have seen similar 10K price drops, but, curiously enough, generally for houses that are in foreclosure, or pre foreclosure. Stealth short sales? Our experience with that is the house price drops quickly, in steps, and either sells fast or suddenly is pulled off the market. (We had one place go through this sequence in six weeks.) As for the 10K vs. 100K price adjustment, the places we are looking at are below 100K. You can find nice places for under 150K and decent ones for under 100K here Down South. The caveat here is Location. If you are seeing a similar dynamic starting in the Northeast, then reality is starting to bite everyone.

I’ve been seeing this in the northeast for quite some time (greater Buffalo NY area). You can get slumlord quads and duplexes here for 40K all day long, and really decent smaller homes for ~70. They tend to drop in steps of 5, which takes a while to get going, but then when it does start going it tends to move fast. I don’t even pay attention to the pre-foreclosures, not something I’m interested in — I only look at “by owner” or realtor

Yes, well, Mission Accomplished. the Fed’s goal was always to reflate the Asset Economy.

The charitable interpretation of their actions is that they meant to stave off systemic collapse and buy our political class time to enact more fundamental reform. Another interpretation is that they are reactionary plutocrat poodles.

Since Congress whiffed on meaningful reform, and the Fed has obstinately staid with its reflation program long after the acute crisis stage passed, they are willy nilly reactionary plutocrat poodles.

And the realistic interpretation is that the Fed doesn’t give a rat’s ass about the real economy. Their job is to keep their member bankers flush with cash and keep the wealth-extraction “system” intact.

Oh well. Problem #1 of Housing Bust 1.0 was billed as “underwater mortgages”. After 5 years of the Fed blowing into a popped balloon using a bazooka tube, we’ve moved forward and arrived at Problem #1.

It’s as if after the 1929 margin call fiasco, our ancestors went back, after only a few years, to selling stocks on credit. Either we are a lot more stupid than people were back in the 1930s, or what we are seeing is, to use an unpopular term from the 19th century, a profound lack of will. The political class and the ideology-generating class that supports them have lost the will to resist anything the moneychangers want. Like characters in a parable, our elites seem to wake up every morning forgetting everything that has gone before. I’ll quote from Hughes, Culture of Complaint (p. 41):

In such conditions time itself breaks down into discreet parts….Continuum means nothing. Relationships mean nothing. The modern financier lives and dies by the transaction. Each day is wholly new, the wheel subject to endless reinvention. There is no need for coherence, because there is no advantage to coherence. Action is all….

And that was in 1993. Or, the epitaph for our sick civilization:

“They were careless people, Tom and Daisy- they smashed up things and creatures and then retreated back into their money or their vast carelessness or whatever it was that kept them together, and let other people clean up the mess they had made.”

What happens to us all when the money runs out?

The motivation may be to raise money for this month’s hamburgers, but taking out a second or third home equity loan is just good business. If you can’t sell your house, just lost your job, have to move to North Dakota and live in a tent to find a new one, and can leverage out some cash before sending the jingle mail letter to the bank, why not do it? And if the loan is large enough maybe you should consider moving to Ecuador and retiring–.

Reminds me of when I bought my first house in CA. The real estate agents used to tell new buyers that you want to put as little down as possible – because if “The Big One” earthquake hits, you can just walk away from it all.

The bank are reporting low frees for refinances and sales, thus they turn to high quality home equity loans for profits.

Q: When the pool of well qualified home equity borrowers is exhausted, then where do the banks turn?

A: Less qualified people, and so on.

When this scheme fails, “Who Could Have Known,” the few Banks remaining in the US are bailed out again by the Treasury & the Fed.

There will ALWAYS be plenty of people desperate or stupid enough to borrow their way to the poor house. ALWAYS. The question is can the banks get enough OPM (other people’s money) to make those loans. I think it would be worthwhile to see EXACTLY what kind of bonds are being bought in the QE program. Because I’m guessing that’s what’s driving HELOCs at this point.

What else can you call it besides organized, legalized stealing by the entire FIRE economy?

Doug Nolan of Prudent Bear also notes HELOCs among other symptoms of “this time it’s different” thinking now fashionable again on CNBS.

“My thesis is that the overwhelming

reaction to the collapse of the mortgage

Bubble – from the Fed, U.S. Treasury,

global central banks and governments –

unleashed even greater and far-reaching

financial and economic Bubbles. 2008

was not the “big one.” Rather, it was the

crisis response that was the biggest

ever, setting the stage, I fear, for the

really problematic crisis. And if our

policymakers had learned anything from

the terrible mortgage boom and bust

experience, they’d be especially careful

with these implicit market backstops

(and the distortions they promote).

…

“The “Granddaddy of All Bubbles” thesis

rests on the premise of a deeply

systemic Bubble throughout debt and

equities markets and asset prices more

generally, on a globalized basis. In

contrast to GSE market distortions that

impacted pricing most significantly in

mortgage Credit, today’s global central

bank distortions impact virtually all

asset prices. Market risk distortions now

basically permeate all markets – stocks,

bonds, Credit and any asset that

provides income/yield virtually

anywhere in the world. Assets include

collectible art, Manhattan apartments,

farm property and NBA franchises [and slum rentals]·”

Nolan’s analysis is a buzz-killer. Time will tell whether he and other voices in the wilderness like John Hussman’s sound like Chicken Little or the Prophet Elijah at year end. My bet is Elijah.

http://www.prudentbear.com/2014/05/hes-back.html?m=1#.U4zFwz9lDJu

http://www.hussmanfunds.com/wmc/wmc140602.htm

All problems can be solved by blowing the bubble bigger.

If people are still underwater, they should just hang on till the bubble arrives.

The illusory recovery tale being told by the financial press is such a whopper that it’s approaching the level of reality-denying propaganda. If there ever is a recovery in the US housing market it will be very short lived because the next generation of home buyers (people under 30) is so financially strapped by student loan debt.

Also, want to give a shout out to Wolf for the story about hunger in OECD countries AND for the piece he wrote two weeks ago on student debt that totally refuted David Leonhardt’s ridiculous piece in the Times last week on “Is College Worth It?” Leonhardt answers that “clearly” it is using data comparing incomes of college grads and people w. only “some college btw 1975 and 2013. As more than one commenter pointed out, this includes people 40 – 60 who went to school decades ago when college was a better value proposition. Wolf’s blog included a chart (from the WSJ) that refutes Leonhardt’s innumerate nonsense — the average student loan balance increased by 35% for those under 30, while their median earnings rose just 4% by 2007 and then dropped to -5% by 2011 and is still in negative territory.

See: http://www.testosteronepit.com/home/2014/5/19/this-chart-is-the-fate-of-housing-in-america-as-student-loan.html

“A medical-device scientist with a million dollar home who can’t afford college tuition. If that isn’t a sign of the times, what is?”

Are there tax advantages to doing it through a HELOC though? Is it really about affording?

I keep seeing this as a mole hill & not a mountain. After 2008 HELOC lending was squashed. The only way you could get a loan was having a having a huge FICO, lots of home equity, & signing away you soul in blood. The number have jumped from those low level but only the percent changes are large & that is because they are starting from depressed numbers. As listed in the article, HELOC’s are now at 2000 level & were were not in a housing bubble 2000.

Housing prices have recovered to at least 2004-5 levels in most places. While the Fed has helped, a lot of the reason why is that many foreclosed homes have been sold & very few new home have been build. Yes housing could stall, or slump, but there is not the overhand like in 2007 that will cause a collapse & loans since 2008 have been made using strict standards. While we have high levels of underwater or low equity housing, still 70% of home owners have 20%+ in equity & today’s interest rates are near historic lows.

Honestly, most people who can get a HELOC today are the survivors. The went through the crisis w/o trashing their equity or credit rating. They did not use their home like a piggy bank in 2007 & I doubt they are doing it today.

Many foreclosed homes have been sold????? Maybe some of the ones that have been fully foreclosed on, have sold. But in my home town in CT, there are a whole bunch that have been squatted in for years, with no-one paying the mortgage, but not getting “foreclosed” on, either. But now, just in the past few months, the banks have moved on a bunch of them. So all of a sudden, after there being almost no pre-foreclosure listings on Zillow, there are as many such listings as there are regular sale listings!!!!

Do you work in the real estate industry, Marc? If so, there’s a term that you might want to learn: “Shadow Inventory.” I think you are well aware of it, really.

Oh, and the builders are still building. Still a fair number of “new construction” listings; I guess the builders are using other people’s money. And I keep seeing “price reduced” next to every sort of listing. This is not a poor area; local schools are excellent. But there are no jobs.