By Nick Cunningham, a Washington DC-based writer on energy and environmental issues. Originally published at Oil Price.

Major oil and gas companies are taking on an increasing share of debt in order to maintain drilling momentum, according to data from the U.S. Energy Information Administration.

Beginning around 2010, energy companies have been increasing their spending, particularly in the United States, as the tight oil revolution took off. Major firms snatched up acreage in oil-rich shale formations like the Bakken and the Eagle Ford and began drilling at a frenzied pace.

The significant outlays required to ramp up such an operation were offset by the rising price of oil, which allowed oil companies to expand their operations without having to take on substantial volumes of debt.

But after several years of increases, global oil prices began to plateau in mid-2011 and have stayed relatively steady since then. In fact, 2013 experienced the least oil price volatility since 2006.

And oil prices in 2014 have remained remarkably consistent, especially taking into account record levels of global demand and the abundance of geopolitical tension around the globe, from Ukraine to Iraq and Syria.

As a result of oil prices trading in a narrow band – roughly between $100 and $120 for Brent Crude and $90 and $105 for WTI – revenues for oil and gas companies flattened out even as their costs continued to rise.

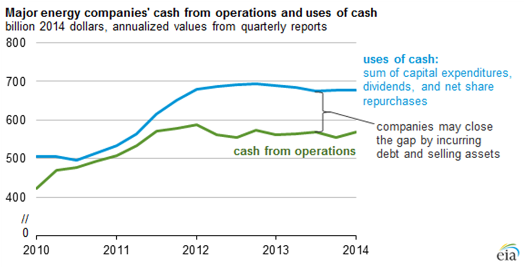

From 2012 through the beginning of 2014, average cash from drilling operations increased by $59 billion over the same average seen in 2010-2011. But spending rose at a faster clip: up more than $136 billion. The yawning gap that opened up between spending and revenues has largely been closed by the acquisition of more debt.

For shale drillers in particular, debt has doubled over the last four years while revenues grew at a meager 5.6 percent.

As the EIA points out, taking on debt is not necessarily a bad thing, especially if it is used to invest in new sources of production and growth.

But a new report from Taxpayers for Common Sense points to one other factor that may be contributing to the rise in spending long after earnings flat-line.

Under the U.S. tax code, oil and gas companies can defer billions of dollars in taxes by maintaining elevated levels of spending. That is partly by design. Drilling new oil and gas wells is capital intensive, and thanks to a provision in the 2009 stimulus bill, energy companies can use what is known as “bonus depreciation” to write off all depreciation in a single year, as opposed to spreading it out over future tax cycles.

The intended effect was to incentivize spending – to allow companies to earn immediate cash from producing wells and use that revenue to drill subsequent wells. Meanwhile, the country’s energy production receives a boost.

But Taxpayers for Common Sense sees something more nefarious. True, the companies theoretically have to eventually pay those tax bills, but in reality, the group argues, the tax incentives amount to a huge subsidy. By taking all the tax benefits upfront, energy companies don’t have to pay interest on billions of dollars in taxes that are pushed off to some point in the future.

“Often, in their financial statements, these companies tout how they finance their exploration and development investments with cash flow from operations. Yet, many have significant deferred tax liabilities. In effect, these companies are financing significant parts of their business with interest-free loans from U.S. taxpayers [emphasis in the original],” the report says.

Through the various peculiarities of the tax code, oil and gas companies already pay a much lower effective tax rate than the statutory 35 percent. ExxonMobil for example, paid a 19.3 percent effective tax rate between 2009 and 2013. But by deferring taxes, oil and gas companies can wind up paying even less than that.

But the heady days of drilling might be drawing to a close. The bonus depreciation allowance expired at the end of 2013 (although Congress is considering partially reinstating it). And although taxes can be deferred, energy companies will have to eventually pay their bill.

Also, much of the debt-fueled spending has been built on the back of low interest rates. With the economy improving, the Federal Reserve will soon end its program of extraordinary asset purchases, perhaps leading to a period of higher interest rates. This could dramatically raise the cost of drilling.

But more importantly, when oil and gas production stops rising, heavily indebted energy companies could face a day of reckoning.

Finally someone details exactly what fracking is: yet another perfect bankster Ponzi. Bankster finances the huge upfront costs and makes rosy projections about payout. Then bankster sells the debt on to the Muppetts and is long gone by Year Two when depletion rates rise steeply (up to 90% depleted by Year Two). It’s perfect: Muppett gets crushed, Mom and Pop get tapwater you can light with a match, and bankster gets a second private island.

The Fracking Revolution … Yet another of the lies to hide “peak oil”. Remember the “Hydrogen Economy” … Oh yes, Hydrogen was the new miracle fuel that would spare us from peak oil. Then it was the Nat-Gas transition fuel lie. Turns out hydrogen is not a fuel but just transfers energy. Turns out Nat Gas is in short supply which is why these billions are being spent and lost on fracking …

The Fracking phenomena is just another lie to prolong the belief in our cheap energy economy even though fracking is losing money hand over fist. The entire economy is based on more, as in more debt, to underwrite bankster profits. When the “secret” is out that the entire world will be doing with less and less the hope and dreams of billions will come crashing down and the results will be chaos, starvation, disease and war …

At The Automatic Earth, we’ve been detailing exactly that for years.

A remark: In my view, the part of the financing that happens through deferred taxes is more important than the article title suggests. Actually, first deferred, then not paid at all. The US taxpayer in this way finances a substantial part of the land speculation that fracking will soon be found out to be.

The non-payment to US taxpayers was my thought exactly. These companies will go bust when things go south, and dump their tax liabilities in bankruptcy. They will likely reorganize and replay the whole game all over again. The humble taxpayer will be left with poisoned water and less funding to clean up the mess left behind.

Small point but does high debt translate to high leveraged. We know that with high leverage, small perturbations in price level are disaster’s. So a 10% cut in oil energy usage, puts these companies in dangerous territory. 10% might be something possible with alternative energy, wind, solar, tides and use reduction in buildings. Reduced energy usage leaves utilities with stranded assets. Solar prices are coming down drastically ( Google Swansons law) and individuals in the south and north are gearing up rooftops. This is in part driven by extreme weather (Sandy, Katrina and tornado’s). California also remember the Enron electric market being manipulated, causing rolling brown outs. So, if investors see a diminishing profit, they might pull their money to cut losses. Now in bubble?????

One source, CSIMarket.com, provides debt/equity ratios by sector. Their figures indicate that the energy sector has the lowest debt/equity ratio of any sector, at 0.33. Whereas the financial sector, traditionally the most leveraged, tops the list at an eye-popping 2.73.

http://csimarket.com/screening/index.php?s=de&pageS=1&fis=

No doubt some shale drilling is debt-financed, particularly among cash-starved lower-tier players. But Big Oil is still a bastion of balance sheet strength compared to borrowing-addicted industries such as Utilities and Consumer Cyclical (which attracts plenty of PE money).

Fortunately, PE honchos don’t know jack about drilling and boiling oil. ;-)

I personally feel debt financing for long time will only create a vicious circle from which it is difficult to get out. The US economy has been doing debt financing for long and it has now ballooned by $7,060,259,674,497.51 (more than $7 trillion) since President Obama took office. I’m quoting from a report at CNSNews:

“When President Obama took office on Jan. 20, 2009, the total federal debt was $10,626,877,048,913.08. As of the close of business on July 30, 2014, it had risen to $17,618,599,653,160.19–up $6,991,722,604,247.11 from Obama’s first inauguration day.”

Source: http://www.cnsnews.com/news/article/terence-p-jeffrey/706025967449751-federal-debt-7t-under-obama

It seems debt financing is going on and will go on in the coming days. I generally not a proponent of Fiscal Management, just like Neo Liberals. But I do believe that Fiscal Deficit must not increase to such an extent which becomes impossible to manage.

Alissa: You say debt – I say savings since a very,very,very tiny amount of the Treasury debt is bonds I own in my retirement account. Similarly, the total debt represents asset allocation decisions made by individuals and institutions (incl. sovereigns) that does not have to be repaid in total any more than banks will ever repay (if they stay in business) all their depositors. Total public debt before the recession was flat whereas private debt (mostly mortgages) was exponential. Since then private debt has declined (foreclosures) and public debt has increased (SNAP, unemployment,continued military). The Obama administration had very little to do with either – bad timing to be elected in Nov 2008. Personally I don’t think the elected government has much control over events – the empire is in charge. If you want to worry, look at the increase in the Federal Reserve’s balance sheet. This is new, good money used to loan against old, poor bonds.