The post-crisis era is rife with band-aid-over-gunshot-wound approaches to deep-seated weakness in the financial system. Perversely, because the authorities were able to keep the system from falling apart, albeit via a raft of overt and covert subsidies to the perps, they’ve reacted as if all that needs to be done is a series of fixes rather than more fundamental interventions. One glaring example is a critically important funding mechanism, repo, for firms that hold large inventories of securities and/or enter into derivative positions, such as major capital markets firms like Goldman, Deutsche Bank, and Barclays, as well as hedge funds. Here, the authorities have been giving way to industry demands that will assure that repo, which was bailed out in the crisis, will be bailed out again.

As we’ll discuss, a series of recent articles about “fails” in the repo market have the smell of an industry public relations push to get measures implemented that will serve them at the expense of the broader public.

Brief Background on Systemic Risks of Repo

Repo is a form of short-term lending, using securities as collateral for the loan. Repo is short for “securities sold with an agreement to repurchase.” The difference between the sales price and higher repurchase price is tantamount to interest to the lender. The lender has ownership of the securities during the period in which the borrower has the cash, which can be as short as overnight.* Large lenders like this arrangement because they have cash they need to park for short-term periods of time that are well in excess of deposit guarantee limits. From their perspective, repo serves the same function as a deposit but is more secure. The big lenders in the repo market are money market funds and major dealers.

Historically, repo was not a risky or controversial practice because repo collateral was limited to the most pristine securities, US Treasuries. As we wrote in ECONNED:

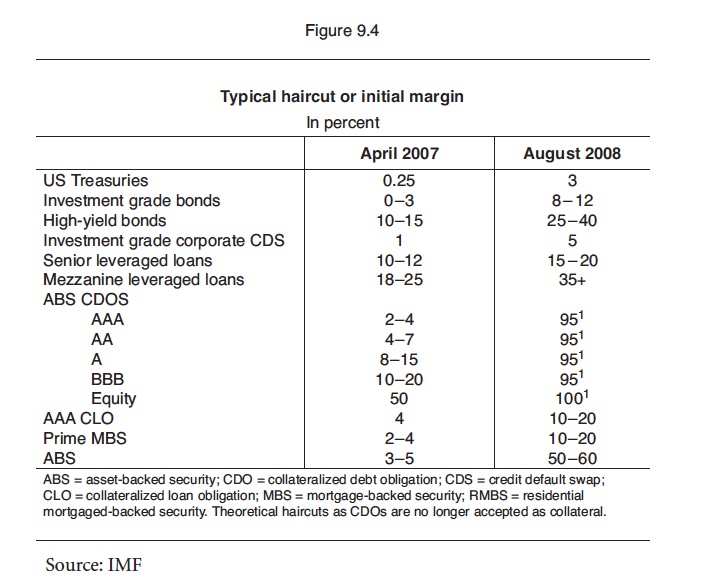

Borrowers and securities for repo are not treated equally. A lender may require a “haircut” or margin, say lending only $95 against $100 of current market value. That is, he may not lend the full market value of the instrument sold to secure the loan, based on his view of the risk of the borrower and of the odds of unfavorable price changes in the instrument repoed. A small haircut implies that the repo borrower will have correspondingly greater leverage…

Repos only began to become dangerous when, in response to increased demand for paper that could be repoed, more and more dodgy paper became widely accepted as collateral for repos.

Some have argued that the parabolic increase in demand for repos was due in large measure to borrowing by hedge funds. Indeed, Alan Greenspan reportedly used repos as a proxy for the leverage used by hedge funds. Others believe that the greater need for repos resulted from the growth in derivatives. But since hedge funds are also significant derivatives counterparties, the two uses are related.

Brokers and traders often need to post collateral for derivatives as a way of assuring performance on derivatives contracts. Hedge funds must typically put up an amount equal to the current market value of the contract, while large dealers generally have to post collateral only above a threshold level…Cash is the most important form of collateral. Repos can be used to raise cash. Many counterparties also allow securities eligible for repo to serve as collateral.

Due to the strength of this demand, as early as 2001, there was evidence of a shortage of collateral. The Bank for International Settlements warned that the scarcity was likely to result in “appreciable substitution into collateral having relatively higher issuer and liquidity risk.”

That is code for “dealers will probably start accepting lower-quality collateral for repos.” And they did, with collateral including complex securitized products that banks were obligingly creating.

We’ll skip over intervening chapters, but money market funds and dealers were accepting AAA trances of residential mortgage backed bonds and CDOs as repo collateral. This chart shows what happened during the crisis:

Note that this was August 2008. A 95% haircut means a security is deemed to be worthless. In September, there were points where dealers were so concerned about counterparty risk that it was impossible to repo Treasuries. Shortly after Lehman failed, a money market fund, Reserve, admitted it “broke the buck” as in it was unable to honor its promise to customers of a $1 net asset value, meaning they would lose money. Investors started pulling out of money market funds in a panic. It was not only a run on money market funds, but on the highly interconnected repo system. The authorities slapped in place a guarantee of money market fund assets up to $250,000 an account, staunching the bleeding. That move also led them to increase the guarantee on bank deposits to $250,000, lest they precipitate a massive shift out of bank deposits (then with only a $100,000 guarantee) to the newly-safer money market funds.

The Repo Reform Headfake

Repo is an obvious source of systemic risk. Regulators recognize that it would look pretty poor if they were to have to rescue money market funds again if markets swoon. They’ve tried convincing the financial services industry and the public of their seriousness. But their half-measures don’t amount to adequate remedies.

Former SEC Chairman Mary Schapiro was unable to get her fellow commissioners to agree on a straightforward remedy: fund would either have to hold higher cash reserves or abandon their $1 net asset value promise. Mind you, Paul Volcker has railed for decades against the money market pretense that they are as safe as bank deposits, which is what the $1 NAV amounts to. Had senior officials from the Fed or Treasury weighted in on this issue, it would have considerably strengthened Schapiro’s hand (for instance, see Bernanke’s noncommittal comments here). Instead, under Mary Jo White, the SEC adopted new rules that instead remove the $1 NAV exemption from institutional money market funds, which from a systemic risk perspective is beside the point (they didn’t benefit much from the $250,000 guarantee and some institutional funds showed meaningful losses in the crisis, putting those investors on notice). On the retail side, the SEC imposed more “gatekeeping” in the form of letting money market fund operators limit or even halt withdrawals, as well as allowing them to impose liquidity fees if liquidity drops below a stipulated level.

Those changes may sound better than nothing, but they have the potential to generation slow -motion runs, similar to what happened in the asset backed commercial paper market in August-September 2007, which was the first acute phase of the financial crisis. “Asset backed commercial paper” was a major source of funding of for so-called structured investment vehicles, which often held subprime exposures. Money market funds are major investors in commercial paper. When they wised up, in part due to investors pulling out of money market funds with subprime exposures, it produced a failed Treasury effort to shepherd a private-sector solution and the liquidation of many SIVs. In some cases, the bank was on the hook to step in and fund the SIV if it could not “roll” its commercial paper, meaning the bank would be on the hook for losses.

As for repo, there’s been an outbreak of articles on the problem of “fails” in the repo market, and rashes like that are often signs of an industry campaign. We wrote last week about an article in the Wall Street Journal which gave the impression that regulators were behaving inconsistently as far as repo was concerned. It pointed out that banks were pulling back from repo as a result of new capital rules. It also mentioned that rising fails were a problem, and the Fed was acting as the counterparty for a lot of repo (lending all those Treasuries it bought in its various QEs) but some comments indicated it wasn’t exactly happy with the large role it was playing.

I had chosen to ignore the whining at the top of the article, but given that an overlapping story appeared in the Financial Times the next day, it’s time to do a sanity check on industry messaging:

A critical part of the plumbing that keeps money flowing through the financial system is experiencing turmoil as new regulations prompt banks to step back from the multitrillion-dollar “repo” market…

But there have been increasing signs of trouble. Big banks, which act as middlemen between borrowers and lenders, have been pulling back. In recent weeks, senior bankers have said they are reluctant to participate in the market because of regulatory requirements that make repo trading more expensive.

Turmoil? Really? With the Fed as a big participant?

And the idea that banks pulling back is a big deal is treating a feature as a bug. The authorities want banks engaging in less maturity mismatches, which means using repo less for financing and relying on longer-term sources of funding more.

But just because repo activity at banks is shrinking does not mean it is necessarily shrinking in a desirable manner. What one would really like to see go away is the use of repo to fund risky derivatives positions and dodgy products. But instead, the regulatory changes, which consist largely of higher capital charges, are instead leading banks to abandon the least risky business, which is where the Fed is taking up the slack. As NC contributor Michael Crimmins wrote:

Plain vanilla Treasury repo activity unrelated to bank derivatives/securities lending books is now too low margin for the banks, so they don’t mind to ceding that activity to the Fed.

The remaining repo activity on banks books now carries a higher capital charge, so the non-Treasury repo business is probably still profitable, and theoretically less systemically risky if the capital charges are sufficient.

Repo markets are being impacted by scarcity of collateral driven by derivative collateralization requirements. That keeps the level of fails at an elevated level, which is problematic in a crisis and needs be addressed more agressively.

Yves here. So so far, not so bad. But Crimmins highlighted a Financial Times article earlier in the week that described how Pimco and Blackrock were stepping into the riskier parts of the business that the banks were unwilling or unable to serve in size under the new rules. He observed:

The regulators may feel confident they’ve made the appropriate changes to the institutions in their remit, but the FICC [fixed income, currencies and commodities] business is migrating elsewhere.

While the industry is trying to raise alarm about possible future volatility, the only current issue is an elevated level of fails. The Financial Times, in a story Friday on repo, again played up the issue of the fails, with the headline “Leaky repo deals present new concerns.” Unlike the Journal article, it focused narrowly on the issue of fails, contending that they are troubling given how the markets are not under stress now, and that some of the causes are due to how the Fed has meddled (it owns Treasuries maturing in 2016 or later, when shorter-term Treasuries are preferred for repo, so by implication, even its willing to lend Treasuries isn’t an ideal solution).

But the story is really a long warm-up for what amounts to a bailout facility:

A solution may involve the US Treasury creating a lending facility where it could loan out securities to help reduce fails – a matter that was the subject of a 2006 discussion paper. Regulators have already introduced a penalty charge for failed trades.

Most of the formal emergency interventions were under the rubric of lending facilities, which were made on terms that amounted to large subsidies.

And this remedy is completely unnecessary. There’s a simple way to end repo fails. Impose onerous penalties. Make it costly enough and it will stop. And make sure the sanctions extend to major non-bank players like Pimco and Blackrock.

As Crimmins noted, “Banks will continue to play chicken with the regulators. Time the regulators call their bluff.” But the current crop probably won’t, not even due to the usual suspected reasons of regulatory capture or outright corruption, although those could as always be operative. It’s also due to an inability to think the chess game through enough moves out. Recall the Fed’s apparent surprise at how it has become such as substantial player in the repo market. How could they have failed to foresee that, given bank economics and incentives?

A former senior staffer at the New York Fed said,

Policy – monetary and financial stability – is just one long Robins Williams style improv. To look for logic or consistency over time is a mistake.

While that is consistent with the central bank’s pre-crisis abject misses, it means the public can expect yet another wild and costly ride the next time the Market Gods demand a ritual sacrifice. But that was predictable when virtually no one in leadership positions in the public or private sector lost their perch as a result of their lousy stewardship. Rewarding incompetence is guaranteed to perpetuate it.

____

* This is simplified, particularly in a world of tri-party repo, but is meant for laypeople.

IIRC, at one stage, Italian gov’t bonds were suffering from massivel repo fails. I believe Italian CB pushed a very strong penalties for the fails, and it stopped it for a while – but then they reappeared at some time – basically, even the strong penalties were not strong enough under some conditions and it just pent the problem (as in the jump was massive, and people didn’t think there would be a jump).

sorry to be an ED pest, but what’s a “repo fail” and why should anybody care? Even the FT article is nebulous. It says people borrow Treasuries then don’t give them back, that’s the “fail’, but if Treasuries are collateral you’d think what’s being borrowed is cash, not Treasuries, and you could just keep the cash. In fact, this post says repos are “short term lending using securities as collateral for the loan’. That’s confusing. Is it cash or Treasuries that people want and why?

“Something’s happening here and what it is ain’t exactly clear.”

that may be a question for the Financial Circus Classroom and not the responsibility of a blogger or journalist to rescue naïve readers from their own ignorance, but it sounds complicated

Where’s Andrew Dittmer? he could explain this but he’s long gone someplace doing math. And nobody has arisen who can fill his shoes. In fact, maybe nobody really understands any of this but they don’t want to admit it. So when the bailout comes they can make up reasons why it’s needed and nobody will know any better and they’ll all be telling the truth

Did the Song Dynasty have the same problems with getting folks to trade in old paper for a 3% service fee every 3 years.

skippy… that ended bad…

Bank A lends the money to B against collateral (now we’re not talking tri-party). Given the short time-frames (say overnight), you need to deliver more or less simultaneously (what’s the point in T+3 delivery when the maturity is T+1?)

If A delivers cash, but B fails to deliver collateral (which is the fail), A all of sudden has unsecured as opposed to secured exposure. Oh, and if A was counting on the collateral to do some of their own stuff, they now have a shortage and have to go out and get it from somewheer (or do a fail of their own, which may not always be possible).

If there’s a slew of fails on a certain run of collaterals (say a certain series of UST), that collateral gets a bigger haircut, which then drives the price of the collateral – which in past has been a reson for fails (see naked short elsewhere).

A “repo” is a repurchase agreement. So it should be called “Repu” for “REPUrchase agreement” or “Repa” for “REPurchase Agreement”, but, for some reason, it’s “repo”, even though there’s no “O” in the full words.

Many words contain latent meanings that are hidden in plain sight.

In this case repo is undoubtedly short for “repossession”. The very name predicts the essential problem. Like a repo man getting a leased car back. But when the shooting starts only the feckless public gets sprayed with lead, while the borrower and lender share the bounty.

This whole ship’s going down. :). If you look at the tri-party repo between Lehman, Reserve Fund and JP Morgan it was bad MBS that broke the buck. This could happen with any of the opaque derivatives now out there. The Fed was blinded by the headlights and bailed out financialization but left the real economy hanging.

Support fiscal change. https://www.indiegogo.com/projects/real-fiscal-responsibility-today-radio-and-tv-show

I can state what the original intent of repo was as a systemic reason. The Fed wants banks with excess reserves to lend short term to banks that come up short meeting reserve requirements. This was to keep the Fed out of the loop whenever a bank needed to borrow to meet Fed requirements.

This concept could be obsolete now with fancy computer systems, I really don’t know.

Then the Fed also does a small amount repo transactions continuously, same as they do FOMC trading with T-Bills. They have some reason for it, but I don’t know what.

The only other reason I can think to do it is someone wants money to do whatever and someone wants to make some interest on money they have, but they repo a treasury instead – because it’s the thought that really counts.

Weird that transactions would “fail” with a repo clearing house. I would assume that this is like a “escrow” account which doesn’t deliver until both sides have put up the goodies. But if we have to move too fast, I guess then the system would have another useless Rube Goldberg Machine deducting pennies from useless transaction churning.

Not to say it isn’t is an easy way to get rich.

“Something’s happening here and what it is ain’t exactly clear.”

Dylan from time to dime. Did you take that quote from him when he was at the White House getting his

bloodbravery saturated medal of freedom fromgodgood ‘ol pal Barrraaack or from him as a singer in the 60’s?Buffalo Springfield, not Dylan.

How old are you? :)

More than old enough to know better, :( Getting old enough to forget that I just pulled my foot out of my mouth from the last gaff.

For what it’s worth, that’s not Dylan.

Dusty Springfield

Got the proof here – Live!

http://myhomecloud.yzi.me/Demos/osmplayer/60sRock.html

woops, Buffalo Springfield. Old enough for memory gaffs.

The Simpsons live in Springfield.

Yeah. Is this repo “fail” thing basically the same as “stealing”, or “cheating”, but we’re in polite company, or what? What’s that mean, fail to deliver? On it’s face it sounds as if I sent down a dollar from my apartment balcony to Moe or Larry for a fresh cod from off of their cart and they passed me back up a very smelly one.

This will all end very badly… for the common man in the street. I imagine the Elites will all come out of this in some immunized fashion.

Yeah it ends when everyone goes bankrupt and the elites buy pennies on the dollar the remaining 10% of all assets that they don’t currently own. Then money velocity literally hits zero and there is no remaining need to employ anyone other than for slave purposes, since there is no longer any profit incentive to hire people. Gawd knows what will happen then, with all the weapons laying around in the public’s hands. I’m thinking more and more stealth military domestic occupation. We have much to learn from the middle-east peoples who rise up against their occupiers.

Have a nice day!

https://twitter.com/BlueDuPage/status/501075399796088833

Yves , Thank you for clearing that up! I would and did need a dictionary for that one but it was very succint, getting the message across . I get out of it that we are as you very calmly and gentilemen like understate the far reaching affects of a “wild and costly ride” on other sectors of the very fragile system due to( lets call it what it is) CORRUPTION!, a cause for half of the US to go into a deep depression . Do you think lending money to europe and the other marks of the world will be available when this sunami comes a knocking . There seems to be a rebellion in the ranks due to austerity and sanctions of late , maybe the EU might pull away and leave us stranded in step to a larger global distancing from the greenback as time goes on ! I read somewhere that china offer’s better bri ah -hum incentives . If we can’t fix our own house what of the world? can we regulate out the fraud and halucinatory fix;s of the FED in time enough? I was just wonderin!

It seems like this is unwinding collateral chains which doesn’t seem like a bad thing. It’s hard not to bail out money market funds but investors in PIMCO or Black Rock should have a better understanding of risk.

http://davidstockmanscontracorner.com/financial-stress-alert-repo-market-anomolies-fails-and-collateral-strains/

“”The recent state of repo is becoming more widely scrutinized as outlier events have become more noticeable. In this case, repo fails spiked to a level not seen since those dark days of panic. The pressure of UST issuance (lower) and QE silo mismatch has left the window-dressing state of rehypothecation with fewer options. There is only so much SOMA inventory that will satisfy what the market actually demands at any given moment (contrary to the theory that led to the reverse repo program).””

Over my head. I was interested in reading about a new clever head fake because being head-faked is now everybody’s default assumption. It brings to mind Liz and Janet talking about doing something about the TBTFs, or rather not doing anything about them. And Janet invoking the highly complex living wills as if they prevent any resolution. (Ten thousand pages explaining why finance is now so interconnected it cannot be resolved.) Or at least delay it. Since liquidity is the only game in town and we have no underlying economy, it seems that repo is essential. Even bad securities. Why not? After the free-for-all known as fraudulent securitization? And we go through all this because the last thing we want to do is socialize our financial system. Public finance would resolve this nonsense. (But would the market crash?) So it’s curious that the Fed has just gotten tough by threatening to close the repo window if the TBTFs don’t make their absurd living wills practicable. In the first place, they probably can’t make them practicable, and then if the Fed follows through with its threat, liquidity will evaporate because the only thing keeping money circulating is the repo mechanism. I’m totally confused.

Doesn’t a shortage of “good” collateral plus re-hypothecation of collateral account for the rise in fails? (IIRc before the crisis about $1 tr in collateral supported 4 times as many repos through re-hypothecation).

Nah. That’s gotta be illegal. :)

So I was right in making the 3 Stooges as fish mongers short subject analogy? It’s basically a con that’s bound to eventually fall apart, but not before the principals hope to make their money and beat it. Only these guys are so smooth and sophisticated that they manage to keep up the illusion that they’re honest traders, not conmen, even after the whole thing has disintegrated, keeping all their loot, including some paid by the government to make sure they’re “whole”. Then a few years later (now), do it all again.

Being as I have read this analysis, and others, and I still can’t understand what’s going on, and I understand a lot better than ANYONE I know, mostly, I figure they’re in pretty good shape. All they have to really contend with are bribeable, intimidateable, sometimes overworked and overwhelmed, probably, regulators and politicians. The public remains almost completely ignorant. The occasional Spitzer can probably be set up.

However it comes out eventually, Yves and Lambert still will go down in history for having done yeoman’s work. Maybe we can give them a medal ceremony someday.

Golly, we need to organize.