You cannot make stuff like this up. New Jersey, in its attempt to diffuse a pension fund scandal that implicates Chris Christie (it roused him to respond in public), looks to have committed the classic crisis management blunder of a cover-up worse than the original crime.

International Business Times reporter David Sirota has been putting questionable relationships between state pension funds and Wall Street under the hot lights. One of the objects of his scrutiny has been the New Jersey pension fund, which is seriously underfunded. A recent tally puts it at number 43 out of 50 states in the level of its pension funding, with only 60% of its commitments funded. The New Jersey shortfall is the result of a series of classic blunders, starting with a decision to starve the pension system in the 1990s under governor Christine Todd Whitman.

New Jersey dug its hole even deeper during the crisis, by taking risky bets right before the markets unraveled, including investing in Lehman shortly before its collapse.

This bad situation was made worse under Christie. As we wrote in 2011:

A more accurate rendition would be that, at least in New Jersey, the state has been raiding the pension kitty for over 15 years. This is not news to anyone who has been paying attention, any more than underfunding of corporate pensions. In the Garden State’s case, Governor Chris Christie skipped the required $3.1 billion pension fund contribution last year. He claimed this move was to force reform, but what impact does another $3.1 billion failure to pay have on an unfunded liability that was already over $50 billion?

Fast forward to the Sirota investigation. Sirota showed how Christie shifted fund allocations to managers of “alternative assets” like hedge funds and private equity funds, which charge vastly more in the way of fees than simple stock and bond funds. It should be no surprise that hedge and private fund managers are heavyweight political donors. The result was more fees to the managers and underperformance for New Jersey. As Sirota wrote:

Gov. Chris Christie’s administration openly acknowledged that more New Jersey taxpayer dollars were going to land in the coffers of major financial institutions. It was 2010, and Christie had just installed a longtime private equity executive, Robert Grady, to manage the state’s pension money. Grady promoted a plan to put more of those funds into riskier investments managed by Wall Street firms. Though this would entail higher fees, Grady said the strategy would “maximize returns while appropriately managing risk.”

Four years later, New Jersey has secured only half the promised results. The state has sent more pension money to big-name Wall Street firms like Blackstone, Third Point, Omega Advisors, Elliott Associates and Grady’s old firm, The Carlyle Group. Additionally, the amount of fees the state pays financial managers has more than tripled since Christie assumed office. New Jersey is now one of America’s largest investors in hedge funds.

The “maximized returns” have yet to materialize… Had New Jersey’s pension system simply matched the median rate of return, the state would have reaped roughly $3.8 billion more than it did between fiscal years 2011 and 2014, says pension consultant Chris Tobe.

Unfortunately, it is all too common for pension fund systems to swing for the fences when they are in trouble and commit even more money to supposedly higher return investment approaches like private equity. In fact, due to too much money flooding into these strategies, returns for both hedge funds and private equity funds have generally lagged stock market returns in the post-crisis period.

On top of that, New Jersey’s authorized allocation to alternative investments is a full one third, a stunningly high level. Even CalPERS, a long-standing investor in alternatives, has less than half that level committed to these strategies.

But in New Jersey’s case, there’s even more reason than usual to doubt that the motivation for the shift to riskier investments was due to desperation to catch up, as opposed to rank corruption. After all, Christie’s professed strategy has been to worsen the crisis at the pension fund. What better way to achieve that result than to invest the money indifferently in high fee strategies, and get the side benefit of currying favor with extremely well-heeled donors?

Now, under heat for the suspicious-looking shift to Wall Street firms combined with embarrassing underperformance, New Jersey is suddenly reporting higher results as if no one would notice the change. On Friday, Sirota published a new scoop: New Jersey is now saying its pension fund returns for 2013 are a full 1% higher than previously announced. As Sirota writes:

Facing an ethics complaint after disclosures of the state’s below-market pension investment returns, Gov. Chris Christie’s top economic officials defended themselves by declaring that they delivered 16.9 percent returns in fiscal year 2014. Yet only weeks ago, the Christie administration reported the returns were 15.9 percent — lower by more than $700 million.

The discrepancy surfaces amid intensifying criticism of the Christie administration’s decision to triple the amount of pension money invested in high-fee private equity, venture capital, hedge fund, real estate and other “alternative investment” firms — many of whose employees have made financial contributions to Republican organizations backing Christie’s election campaigns.

In an op-ed published in the Newark Star-Ledger on Friday, the two top officials of New Jersey’s State Investment Council, Robert Grady and Thomas Byrne, criticized the investment strategy proposed by investors such as Warren Buffett, who say pension money should be primarily in stock index funds, not in alternative investments. Defending New Jersey’s $20 billion bet on alternatives, Grady and Byrne declared that “in the fiscal year ended June 30, 2014, the pension fund achieved a return of 16.9%.”

A return of 16.9 percent would still trail median public pension returns.

“The July 22 release says the fund produced returns of 15.9, according to preliminary data compiled as of June 30, 2014. Now final audited results showed the fund returned 16.9 percent,” Christopher Santarelli, from the New Jersey Department of Treasury, told International Business Times in response to a request for comment about the differing numbers.

This sort of revision is unheard of. Remember, even with New Jersey, over 2/3 of pension fund assets are invested in stocks and bonds. Those valuations are unambiguous. Similarly, hedge funds are required to provide valuations (so-called “net asset values”) monthly, with those figures verified by third party appraisal firms. The stock, bond, and hedge fund results come in shortly after month-end; there’s no basis for revision after the fact (put it another way: a change in valuation for any of these types of funds, even if favorable, would warrant withdrawing funds as soon as possible, because it would be proof of serious deficiencies in controls and accounting at the fund manager).

So the only types of investments where results are less clear-cut are in private equity, venture capital, and other illiquid strategies where the fund managers rather than third parties provide the valuations for their investments.

But even here, those managers have other investors in their funds besides New Jersey. They calculate the net asset value across the entire fund and then give valuations to investors based on their percent participation. So if New Jersey was getting revised valuations for such a large portion of its funds, you’d expect some other public pension funds to report significant upticks as well. But New Jersey seems to be suspiciously unique in this regard.

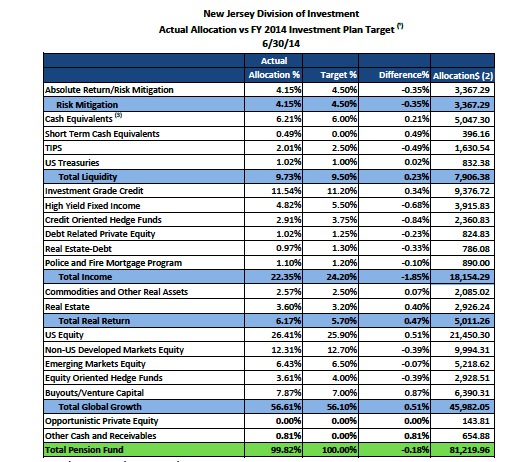

To understand how implausible this miraculous 1% performance improvement is, let’s look at New Jersey’s current asset allocation, as of June 30:

We will charitably include “Commodities and Other Real Assets,” “Real Estate Debt,” and “Real Estate” in the not-independently-valued funds for the purpose of this back-of-the-envelope calculation.

If you total Debt Related Private Equity, Real Estate Debt, Police and Fire Mortgage Program, Commodities and Other Real Assets, Real Estate, and Buyouts/Venture Capital, you get 17.13%. Remember, the total that is not independently valued is almost certainly lower.

The 1% miraculous improvement in performance is attributable to at most 17.13% of the portfolio. That is tantamount to that portion of the portfolio producing returns that were at least 5.8% higher than initially reported. That is simply not plausible.

We have to believe either that New Jersey is utterly incompetent at record-keeping,which would be a violation of its fiduciary duty, or something stinks to high heaven. It’s not hard to guess which is more likely.

The trouble with this is that CALPERS got a judge to essentially agree with their version of ‘reality.’ (That is how this layperson reads the events.) New Jersey can ostensibly claim to possess a more corrupt state governmental system than California. All Christy needs do is to spread around some Vig and problem solved. (What are the Feds going to do about it? Send in federal Marshals?)

Excellent background. Like here in Europe, there are those who feel others should not get a pension when austerity is the order of the day. Nearly every country resorted to slashing payouts. Create a man-made crises in order to swoop in to pick up the spoils. Blunders is not a word I would use.

It has been my experience that competency in [Fraudulent] mathematics, both in numerical manipulations and in understanding its conceptual foundations, enhances a person’s ability to handle the more ambiguous and qualitative relationships that dominate our day-to-day financial decision-making

Alan [its your own fault if you can’t keep up with our free market products] Greenspan

I’m really grateful for Sirota’s reporting and to Yves for highlighting it. I have brought this up with people in Rhode Island in response to the similar behavior of the former treasurer now gubernatorial candidate. It is surprising to see how some people react to the stories of her opaque management of the pension fund, and how even seemingly liberal people seem to blame retirees for pension problem, and not the managers of the fund. This topic is incredibly important and needs all the attention it can get. Please, everyone, share with any friends and relatives who ever complain about public pension systems.

‘The July 22 release says the fund produced returns of 15.9, according to preliminary data compiled as of June 30, 2014. Now final audited results showed the fund returned 16.9 percent.’

Shall we file an FOIA request for the breakdown of the July 22nd release … or has Sirota already done that?

Forensic accounting … let’s roll!

+ 1 to your post above, Mr.Haygood.

My limited knowledge and lack of expertise on the subject matter render me unable to make a detailed and informative reply, nor even to post an entertaining comment for the readers. Yet after having read this article, and previous reading so many others similar, I add myself to the list of the discontented.

It is surprising to see how some people react to the stories of her opaque management of the pension fund, and how even seemingly liberal people seem to blame retirees for pension problem, and not the managers of the fund.

Why shouldn’t those greedy public employees be as financially insecure as the rest of us?

Reminiscent of the one about D. Trump and two other people shipwrecked on a desert island with a food supply of only ten doughnuts.

i haven’t heard that one (about d. trump). could you please elaborate? i could use some humor right now.

Trump takes 9 donuts, says to one of the other guys while pointing at the 3rd, “He’s trying to take your donut.”

Hilarious! And a very good summary of the way that things really are. The guy who thinks his donut is being stolen will probably join the Tea Party.

I wish this joke actually happened:

Trump, a priest and a hippie are on an airplane going down there are only two parachutes. Trump declares he is too valuable to the world and grabs the hippie’s parachute and jumps. The hippie looks at the priest and says: Why did he take my back pack?

‘Why shouldn’t those greedy public employees be as financially insecure as the rest of us?’

Actually they’re already less secure than the rest of us, since state-sponsored pension plans are exempt from Erisa’s fiduciary requirements, and have no PBGC backing.

Theoretically this is to protect state sovereignty (a very selective concept in the U.S., as the fedgov takes over everything). But in a corrupt-to-the-core state like N.J., ‘state sovereignty’ is just a license for looting.

Too bad Erisa don’t give state employees standing to sue Christie, so they could march his fat ass into the dock and depose him under oath, the way Christie used to do when he was a fedgov prosecutor.

Whenever the scandal hits the fan over stg. Christie has done, I always think: Aha! Jeb Bush is chipping away at him. But here we learn Grady is in cahoots with Carlyle Group. The possibilities are amusing – Christie could be buying favor with the party puppetmasters, and when it looks like any serious digging will expose them, suddenly there is a 1% correction. And nobody would be any the wiser, because 1% sounds so insignificant, except for people who know what this 1% really indicates. That would be “person who knows” – Yves. In the meantime, it is a sure thing that no fiscal decisions will ever be made by governor Christie that would stimulate New Jersey’s economy so that more money would go naturally into the pension fund. Etc.

Jeb Bush, while governor of Florida, was one of the three trustees of Florida’s public employee pension fund. Bush’s campaign received lavish funding from Enron and Ken Lay, and the fund invested heavily in Enron stock and bonds, even (suspiciously) as news of Enron’s problems became widespread and as the stock was collapsing from $43 to 28 cents per share. As a result, Florida’s public employee pension fund lost more money ($325 million) on Enron stock than any other public pension fund. Bush and his many loyal supporters shrewdly kept this situation quiet and he somehow escaped any blame for the enormous fund losses even though he was one of only three board trustees. Enron had invested heavily in Florida Republican candidates, expecting they would facilitate Enron’s plans to deregulate Florida’s electricity market.

The hits just keep on coming. This surfaced 4 months ago when a guy was running for office in MA and David Sirota wrote via Pando http://pando.com/tag/christiebaker/

H/T to the folks who read that original information and performed a bit of due diligence! And yes, David Sirota has more to say: http://www.ibtimes.com/gov-chris-christie-economic-numbers-dont-add-1687188

Bottom line : Christie can make claims about ROI – it is below most others in the area: http://www.ibtimes.com/gov-chris-christie-economic-numbers-dont-add-1687188

Sounds like a 1% management fee rebate to take pressure off the PEU sector,

These guys never give money back (well, only if a regulator or a court is breathing down their neck….). And what did they do wrong? If you underperform, the remedy for an investor is to withdraw funds or for funds that are effectively lockups, like private equity funds, to not participate in their next fund.

And the rebate would have to be across the entire portfolio for that 1% to work. Institutional stock and bond funds usually charge less than 1% in management fees, particularly if they are index funds, which is what NJ ought to be in.

“”In New Jersey, the state has been raiding the pension kitty for over 15 years.”

The federal government has been raiding the Social Security trust fund kitty for over 30 years, using that money to pay for other federal expenses.

If N.J. puts back in Treasuries as collateral for the misuse, problem fixed, right?

Don Levit

The Feds have not been “raiding the kitty.” No report by anyone who is not a crank supports your characterization of the Treasury receipts in the Social Security fund.

I have no tolerance for readers who make stuff up.

The important thing is that the Republican Party got big campaign donations.

Who cares about New Jersey state finances, or retired government employees? Winning elections is what matters!

*defuse

sounds like the skimming harvest of a Ponzi scam

It’s unfortunate to see the political mess of my home state. As a die-hard Dem in my early 20’s, I eventually became disillusioned with corruption in the Corzine administration, and actually supported Christie in his first election. He seemed like he was going to get tough on corruption and whip the state back into fiscal shape. But I guess it was really naive to think anything would change. Sad.

If you followed everything that’s happened to pension plans from the mid 70s to present, you’d assume that there was an agreed upon elite strategy to eliminate the entire idea of a pension from the minds of us pathetic masses.

A systematic plan to erode the middle class, plunder their accumulated wealth, weaken the masses’ sense of security and affluence, reduce their savings options and drive them to wall street, make them reliant on corporate employment control, weaken unions, and delegitimize the role of government in the public mind?

Nah, must be a coinkedink.

Pension plans have always been a scam. The idea was never to create worker security, but rather to create the illusion of worker security while sending a flood of money to Wall Street, where it could be manipulated and scammed and skimmed. You can trace the post war stock boom directly to the “pension fund revolution”. Large corporations (beginning with GM in 1950) opted to divert a healthy slice of wages into these funds, which workers would become eligible to tap only by remaining on the job for long periods of time. Those who left early simply never ‘vested’. Of course, in those days the corporate problem was retaining workers, rather than pushing them out, because in order to sell stuff in the American market you had to make it here.

I always got a kick out of the so called Pension Reform Act, which was nothing but a regulatory ass kick to poor slobs trying to run an honest small business and provide something for themselves and key employees that would escape the maw of the tax collector. Over the years it became legally necessary to amend these small company plans over and over and over and over, to employ an army of consultants to manufacture obscenely complicated amendments and revisions and redesigns. Ninety-five percent of the amendments were utter nonsense, incomprehensible to anyone ignorant of bureaucratic gobbledygook. My own company’s plan expanded from the twenty pages I wrote myself to three hundred odd pages acquired at a cost of at least twenty thousand dollars over the eighteen years of our plan’s existence, which doesn’t sound like a lot until you realize that the total amount committed to the plan itself was eighty-two thousand dollars!

Fortunately, we didn’t have private equity investments. We had a portfolio of twelve stocks, all of them purchased in 1982 and sold in 2000. The total return was magnificent, but of course we were lucky.

Brilliant and standard strategy: Chase 1% difference into the tall weeds when the light of day reflects the heat of the real battle against forced buying the fat the Governeater is selling, while the steak has been committed away for the private party.