Yves here. As we’ve written, austerity in Europe and Chinese efforts to rein in construction-related lending have delivered enough of a hit to global growth so as to start denting oil prices, which were holding up in large measure due to tensions in the Middle East. This post suggests that more oil price weakness is in the offing. This is a big negative for the fracking boom, needless to say, and may give environmentalists more time to stymie further development.

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Originally posted at MacroBusiness

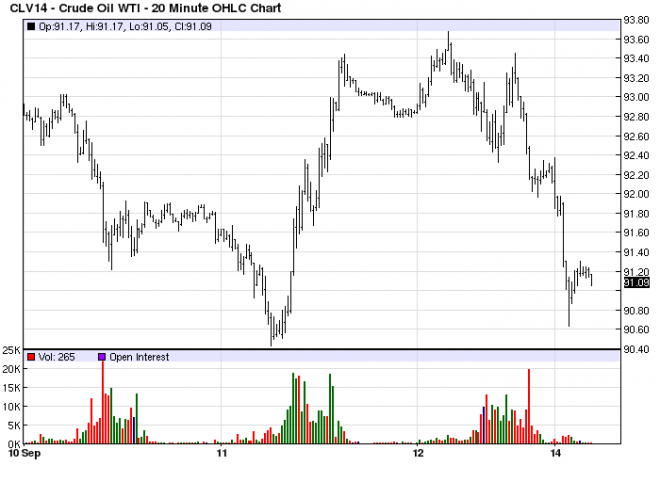

The oil price is taking a shellacking today on the terrible Chinese data, down north of 1%:

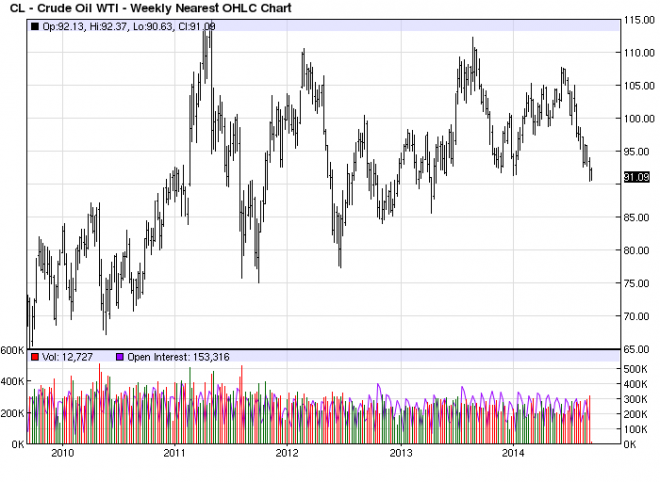

The weekly chart is already through key support and targeting $85:

I was one that thought we would see consistent geo-political premium in prices as Iraq deteriorates. However BofAML has an intersting opposite take today:

Islamic State could force a rethink of Saudi oil output policy

We recently showed how active management of Saudi oil output has helped keep oil prices above $100/bbl for almost 4 years. Yet recent advances by the Islamic State (IS) have disrupted Middle East politics and shifted incentives for key regional and global players. After all, self-proclaimed caliph al-Baghdhadi, leader of the IS, rejects political divisions established by Western powers at the end of World War I. As such, IS presents a direct threat to Middle East governments at a time of growing social discontent. What could Arab countries offer the West to help contain this threat? Lower oil prices.

Lower oil would hurt IS, Iran and Russia, but help the West

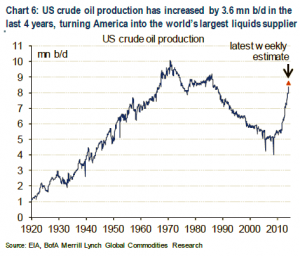

Western leaders should welcome the help. Lower oil prices could weaken Russia’s hand by significantly curtailing revenue streams, just as they did the mid 1980s and again in the late 1990s. Then there is the upcoming November US midterm election. History does rhyme here too. Since 1990 Brent prices have been, on average, 2% lower in the month preceding a US election and 4% lower in the election month itself. Lastly a dip in prices could benefit Saudi Arabia by simultaneously slowing down US shale oil investments and weakening Iran and IS financially. A delay in energy independence would keep the US engaged in the Middle East for longer.

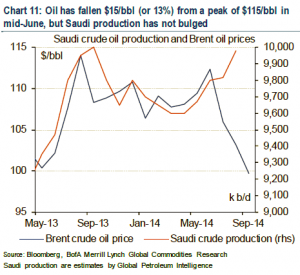

So far, Saudi has increased oil output despite a drop in prices

Are there any signs that Saudi may want lower oil? Discounts in Aramco’s official oil selling prices (OSPs) tend to lag the crude oil curve shape and say little about Saudi production intentions. Yet our analysis suggests a 10% drop in oil prices has historically led to an average 1.5% reduction in Saudi production 3 months later. The recent drop would imply a supply cut of 150-200 k b/d. Instead Saudi has increased production by 200 k b/d since June, allowing Brent to move lower. How much money can Saudi forgo? A significant amount, as the government budget break-even is $85/bbl. True, a lower oil price carries risks. But the Islamic State may now pose a larger immediate threat.

I’m not sure I buy the argument. Saudi could just as easily see IS as a stalking horse for Sunni interests to destabilise an Iraq that is dominated by Shia Iran. As well, the best way to pacify the Arab Street is surely to make as much dough as possible and bribe the it like mad.

Still, whether it’s geo-politics or a market share battle or falling Chinese growth prospects, the oil price looks like it’s going lower. That knocks another leg from under the Australian dollar as oil-indexed LNG prices fall right along with crude.

What is emerging is a sustained, destabilized Middle East that shows no signs of abating — even with all that American heavy metal from above. Beating ‘them’ into submission is not going to happen in our lifetime.

We also need to look at rest of the world. Sustainable development will continue unabated because people want to live better. Destitute poverty is decreasing. What key commodity has propelled the steady rise in the standards of living? Fossil fuels. In spite of a lull in prices the high demand for fossil fuels will most certainly continue.

Fossil fuels are on their way out as America goes green along with the rest of the world

We are hoping this will stop fracking in California, as we have very little ground water left and if that gets contaminated we are doomed.

The bits re ISIS are way, way off.

Can you say more about this?

Yves, near the end you say, “As well, the best way to pacify the Arab Street is surely to make as much dough as possible and bribe the it like mad.”

Who/what are you suggesting the Arab Street might bribe? (typo or missed word)

I think so too Fiver. ISIS didn’t just reach a threshold of jihadists willing to go to war from all over Europe and the Middle East. ISIS (in my paranoid old opinion) was tailor made to be our beloved enemy for decades to come. So we could chase them wildly around the Middle East, rescuing all the oil fields, and controlling them with out benevolent expertise. Putting the price up or down, whichever is needed at the moment. And, as if on commend, there the villain is – disguised in black, hood and all, holding a butcher knife, and he proceeds to behead an innocent Westerner. That is how jaded we have all become. “Oh, they beheaded another one; it still looks like a movie set to me.” The shock and revulsion of Daniel Perle wore off pretty quickly. But the possibility that ISIS really is the enemy is analogous to an atheist’s doubt. What if god really exists?; I better at least do a small contrite prayer to let god know how difficult it is to be a human.

Sorry. I didn’t mean to be quite this offensive. The whole thing is so disgusting I can’t deal with it.

To watch beheading videos you have to be jaded. But somebody has to do it. And then, yes, you discover they are fake.

Just a little peak behind the curtain of the hologram.

Being fake gives no comfort. Somebody was killed so that the fake video could be made.

Machiavelli as political naif. (Post) modern times.

–Gaianne

What we are seeing is Central Bank intervention to slow the world’s economy to mask peak oil. They are very successful with the bonus of lining the pockets of the already corporations wealthy through cheap credit, stock support and QE.

Oil and other commodity spikes are a dagger in the heart of fractional reserve banking that must have growth at all costs. Central banks have preempted these shortages through measures deliberately designed to slow and stop growth such as austerity.

Central banks and the oligarchy will, with this “degrowth”, loot public and private resources for pennies on the dollar while printing money for their own use to capitalize on these fire sales. Pulling investment from Russian oil fields through sanctions can only mean the next financial crisis will be very deep indeed.

I don’t think that Saudi are constrained by their break-even on oil prices. They have high reserves that they can tap (about 740$ billions). Russia has significant reserves too (470$ billions), but has corporations which cannot roll their loans because of sanctions. Of course, Russia can fund itself with China, but this is assuming that China can actually lend that money. If the US threatens a BNP on the Chinese financial institutions, including the central Bank, China may discover that the 4 trillion that it sees on the statement is just a number.

An orchestrated lowering of the oil prices is not a viable strategy, financial sanctions are not a viable strategy, but both together could be more effective. If this is the thinking in the higher spheres, we are in for a rough ride…

This will result is a drop off in US production, which will result in lower supplies, which will also increase the demand which will raise prices, which will……………you get the picture. It is a continual dance.

Wow. If this is the type of analysis BofA / ML takes, it’s no wonder they went bankrupt (absent gobs of Govt cash).

IMHO, they’ve gotten nearly everything wrong.

1) The Saudis haven’t increased production, they cut it in August. OPEC has been lowering their estimates for oil consumption for the rest of 2014 and 2015 due to the slowing economy and growth of non-OPEC suppliers which means there is likely to be further cuts to OPEC output soon, or at the least stable quotas, but certainly not increases.

2) The general target has always been $100/bbl and there’s no sign either officially or unofficially that the Saudis want to reset that to a lower price. While the breakeven price for Saudi budgets may be $85, the rest of OPEC needs higher prices and they’re not about to sacrifice their own budget stability to “help” the U.S.

3) About that help: I’m not sure why Saudi Arabia would want to do that anyway. Saudi Arabia is the biggest source of funds for Sunni-led rebels throughout the Middle East. While the KSA presents a moderate, Western-allied image on the foreign front, domestically, its corrupt royal family maintains support among its increasingly radicalized population by spending enormous sums supporting fundamentalist Sunni organizations both within the country itself and throughout the world. While to the external world, they’re offering to be allies against ISIS, I’m not sure whether internally that’s the case as well.

4) The primary means that middle eastern countries have used to maintain support for their current leaders in the wake of possible revolutions like the Arab Spring has been to throw money at their citizens in the form of massively expanding the welfare state. If ISIS gains support among its citizens, I suspect this is what Saudi Arabia will do again to prevent any rebellion against the royal family’s rule. To do this will require additional funds, which means I highly doubt Saudi Arabia wishes oil prices to remain low in the short- to medium- term.

5) The biggest reason for the decrease in prices has nothing to do with Saudi Arabia (which has cut output to support prices) and everything to do with economic slowdowns in Europe and China, as the article correctly points out in the beginning. Why would BofA try to deflect attention away from that fact by coming up with some asinine theory about Saudi Arabia? Could it be because they’re primarily an investment banking firm whose profits would nosedive if its customers realized the world economy was slowing down and about to take stocks, commodities, and housing with it? No, of course not. There are firewalls in place to prevent that sort of conflict-of-interest-riddled analysis, after all…

‘The primary means that middle eastern countries have used to maintain support for their current leaders in the wake of possible revolutions like the Arab Spring has been to throw money at their citizens in the form of massively expanding the welfare state.’

Say it again! A vast, underemployed peasantry in KSA is bought off not to revolt against several hundred privileged princes who rake off a large cut of oil revenues to live like billionaires. Sustainable? I reckon not.

Meanwhile, closer to home, one of the first weak links that’s gonna break if crude oil plunges is Venezuela. Ricardo Hausmann at Harvard has pointed out that it needs to pony up $5 billion in debt service in October, while already having defaulted on billions due to airlines, importers, PDVSA vendors and the like. What to do, what to do?

I also think Saudi Arabia is bound to blow up.

Politics over there is such a complicated, twisted, mendacious tangle that the only other thing I’m sure of is that, when things blow up, the US is will find itself with a face full of shrapnel.

I’ve been wondering when Venezuela would blow up. Ever since Romney recommended war in “South America” I’ve been expecting this. I wonder who is next? Ever diminishing returns.

+100 on BAML.

For the second day, your program tells me I have duplicated a previous comment and swallows the comment I hadn’t entered. What’s wrong?

I have also had a problem with disappearing comments. Try this: After clicking Post Comment if it doesn’t appear, wait a 2-3 minutes and reload the page. This has worked for me with the 6 or 7 comments that I thought had been lost in the ozone.

Last Thursday, I also had a comment disappear after appearing on the website. It initially appeared with an “awaiting moderation” note preceding my comment, but disappeared shortly after that. I was surprised about that note, because it was a fairly tame comment. I checked back several times later that day, but it never showed up. It did finally show up later that evening.

For the past several days I’ve posted comments and they have disappeared–reloading de-caching makes no difference they completely disappear–might be some nasty script floating on the server or our browsers.

Yea comments are behaving funky on several PCs, of course that may just be my comments :D

I had one of my comments deleted, I believe I know the reason for that though. This could be an alternate explanation, as it was in no way justified or explained to me.

I had one of my comments deleted or didn’t get through, I believe I know the reason for that though. This could be an alternate explanation, as it was in no way justified or explained to me.

You can try any other advice posted here. But whether or not it works, you still need to be patient with the platform NC uses, which is WordPress. It is not quite Star Trek in the IT world, yet. I find that half of what I post disappears, goes into moderation or just goes somewhere I know not. I wait. Later in the day it usually shows up no matter how much I curse or disagree with the Glimmer Twins. Further proof this is an amazing site, it’s tolerance of me and a few others I could mention, but it should be obvious who they are. Unless it’s not and I’m just revealing myself. Whatever.

Be patient. Try written yr novella on a file you set aside on your desktop just for NC and cut and paste it as a post. I try to actually think about my longer pieces, which is most of the stuff that winds up on here. So, it takes time. I have left it for hours to simmer while I was simmering something on the stove. I correct some spelling and punctuation and try to make some space between paragraphs. That takes time and I think that messes with WordPress. Or maybe it doesn’t, which leads back to be patient and write on another file and then post. You know, this is turning into real work. What have I done to myself?

Just rephrase it and resubmit. It’s a good idea to take a few notes so you know what you wrote.

To Curb Global Poverty Every https://en.mwikipedia.org/wiki/Third_World Currency Should Be Pegged To OPEC Oil For 4 Years Till https://en.m.wikipedia.org/wiki/Triffin_dilemma Is Resolved.

This just doesn’t make a lot of sense to me. How is the IS deriving strength from high oil prices? And how will a drop hurt them?

If the rise in commodity prices are indeed due to much increased speculation then these are good dominoes to fall. If money market funds are being diverted away from the the tri-party repo market this should help dry up this speculation.

This would be a good thing as it would decrease inflation in important areas like food and fuel.

sanctions on russia are designed to push oil prices higher. not sure i buy this theory. if the contest is the fracking lobby, which wants higher prices, vs common sense, i’d put my money on the fracking lobby winning every time.

Connecting Dots

The rivers are vanishing because the civil servants are sucking them dry with irrational developments in the State grant cycle, to create excess demand over supply, to fuel inflation in a deflationary cycle. Juveniles collecting toys by impoverishing their children have no business telling parents how to raise their children. A community doesn’t raise a child. You do, or it doesn’t get done.

Building economies is like building homes. You build the home, hand over the keys to the new owners, and build another, until you retire. What sense does it make to build empty houses for the State, just so you and your children can live in the street, because that’s what derivative morons did before you, based upon State imperatives?

Have you noticed that the political networks have nothing to offer the Scots, but threats, based upon fear? Does London Have the natural resources to feed its population?What is the inflation rate of London Square? America is quite capable of providing its own energy, so why is it so worried about Saudi oil subject to rapidly falling demand?Why are New Yorkers and Londoners controlling land in California? Why is Jerry Brown trying to make money out of pot?

Of course the short term thinkers graduating from public education, to maintain the status quo with busy work, cannot see the new economy in transition. If you have developments in the can, you might want to begin inserting them, and if you don’t, you might want to get busy. Only morons go to the voting booth to demand equal rights, expecting change.

Whether the Scots split is not going to be determined at the voting booth, any more than Londoners are going to determine whether the Scots are good land stewards. The Scots have more oil than they can ever use. And what has any navy on this planet done since 2007, except suck the coffers dry with their irrational international trading schemes? Do you see highly intelligent labor showing up to any of their wars?

California has had one of the worst performing education systems over the last 50 years, built on standardized testing, and yet it continues to print toilet paper in exchange with other morons doing the same, wiping out purchasing power with a revolving immigration door. Why do you suppose that is? Why are all these empty units being bid up in a global city circle jerk, and what do you suppose is going to happen?

Don’t wait for the fascists to knock on the door.

My grandma didn’t think twice about taking a switch to my a*, and my father didn’t think twice about giving me a belt, because I was taking heavy equipment for joy rides when I was 5, but no teacher ever threatened me while they were around. The teachers did threaten the kids watching TV, learning to conform, who are now the passive aggressives operating drones, who like to think that they are a threat, to something other than busy work.

International trade among juveniles, the toilet paper they print, and the wars they wage, against each other, is not the foundation of civilization. You are, if you choose to be, a human being, instead of a derivative.

Who do you suppose presided over the California Master Plan for Higher Education? “When he was 12 and selling Liberty Bonds on street corners, he would end his spiel with, ‘Give me liberty, or give me death.’ ”

Lower oil prices do not hurt “The West”, as in the US economy?

How quickly people forget their history. The US economy was in the doldrums until the fracking boom happened. Economists, environmentalist and pundits may talk all day about this-that-and-the-other but the fracking boom has saved the US economy from a worse depression.

There is nothing wrong with higher energy prices. $150 barrel oil would be a welcomed conservation event here in the US. It could give people the opportunity to realize what they are doing with all that energy.