By Philip Pilkington, a London-based economist and member of the Political Economy Research Group at Kingston University. Originally published at his website, Fixing the Economists

The question asked in the title of this post is actually somewhat of a trick. It is a trick because it all depends upon how you define ‘science’. Often when people say that economics is a science what they are doing is defining ‘science’ in such a way that economics fits the bill. They can do this because there is no real, firm definition of ‘science’ that is widely held among philosophers of science, scientists or, most certainly, among economists (who are the most anti-intellectual of the three groups by far).

If we look at Wikipedia, for example, it gives a definition of science that is Popperian — despite the fact that Popper’s falsifiability criterion have been called into question since the 1960s.

Science (from Latin scientia, meaning “knowledge”) is a systematic enterprise that builds and organizes knowledge in the form of testable explanations and predictions about the universe.

By this criterion economics is probably not a science because it cannot undertake repeatable experiments. Even in a weaker form most marginalist proclamations can be tested and falsified in the sense that they can be shown to not hold given the data we hold yet they remain powerful arguments within the discipline and are taught to students.

Let me then give a different definition of science. I am not saying that this is the correct one but it appears to me to be the one that modern economics as a discipline tried to follow when it was being born in the 19th and 20th century. My definition is as such: science is the search for timeless laws.

Here the obvious reference is Newton and his physics. Now, while we know that Newton’s system was imperfect and was completely overturned in the early 20th century the spirit of what he was doing was, I think, what gave rise to the scientific impulse during the Enlightenment out of which economics was born. When you look at a supply and demand graph you are looking at a representation that is trying to copy Newton by giving us timeless laws. This is also how such constructions are taught to students (any concerns are whisked away using the mysterious ‘ceteris paribus‘ clause).

By this criterion I do not believe that economics is science either. Before undertaking such a discussion I will first lay out my underlying criticism which will be long familiar to readers of this blog: economics deals with historical time which is non-homogenous and thus cannot generate timeless laws. Anything that remotely resembles a functional timeless law in economics is in fact an identity and is true only by its tautological construction.

Let us turn to the precursor to classical economics to give a sense of what I am saying. I am speaking, of course, of mercantilism. In this regard it is worth noting a now somewhat obscure work by the Soviet Marxist economist I.I. Rubin entitled A History of Economic Thought. It has been recently made available online and it is well worth a read.

What is so interesting about the work is that it places the older economic theories in their historical contexts. Rubin discusses each theory with respect to the specific circumstances of the historical situation out of which it emerged. What Rubin tried to show was that mercantilist theory and policy was not a simple ‘mistake’ as the later classical economists tried to portray them. Rather the mercantilist period was a phase of development of the young capitalist states that would go on to conquer the world. He writes:

The basic feature of mercantilist policy is that the state actively uses its powers to help implant and develop a young capitalist trade and industry and, through the use of protectionist measures, diligently defends it from foreign competition. (p26)

When economies had finished with this stage of development and had developed sufficient industrial capacity they were then ready to open up to the world and dominate its markets. It was at this stage that the classical economists arrived on the scene with their doctrines of free trade. This accounts for why the free trade dogma was accepted at different times in different countries. The Americans and the Germans rejected it until the late-19th and early-20th century simply because if they had adhered to it in the early and mid-19th century they would have been dominated by British industry.

Seen in this light it becomes clear that it is fruitless to ask whether an economic doctrine is ‘true’ in some timeless sense. That would be like asking whether, say, feudal law is ‘true’. Feudal law is neither true nor false. Rather it is the formalisation of a code by which a certain type of society organised itself. For that particular type of social organisation it was functional. If we tried to transplant it into a modern capitalist democracy it would probably prove dysfunctional.

Thus economics, and with it economists, fall into two categories. On the one hand we have what I opt to call ‘dogmatic economics’. Dogmatic economists are basically ideologues. They think that they have access to timeless truths and are scientists in the Newtonian mold. These economists are probably apt to get most things wrong most of the time. They also likely change their basic discourse over and over again. In the face of an ever-changing history they roll with the times, all the while maintaining the pretense that they have access to timeless truths. Basically the interpret and reinterpret their dogmas in light of new facts. The purpose of the dogmas is not illumination, rather it is to lend what they say authority. Dogmatic economists make up the majority of academic economists and also some very high up policy economists in government and economic institutions.

The other category of economics is what I opt to call ‘reflective economics’. Reflective economists understand that what they do is provide interpretations of a given historical constellation. They understand that there are better and worse interpretations — just like a judge can recognise a better or a worse interpretation of a law — but they do not hold to the idea that there are timeless, Newtonian laws in economics. Much of the sort of theory that they promote might be said to be very loose-fitting in that the tools needed for such interpretation tend to be less precise than those exacting constructions put together by the dogmatists. Reflective economists make up the minority of economists in academia. But the vast majority of serious working economists are in practice reflective economists.

What is the relationship between dogmatic and reflective economists in our society? Here there is no firm answer. The dogmatic economists react to the reflective economists in two ways: condescension and deep suspicion/fear. Working economists who do not partake in theoretical debate can be safely condescended to by the dogmatic economists. But the reflective economist who actually tries to engage in theoretical debate will provoke confusion and frustration in the dogmatic economist who is not used to having his or her authority challenged. The main device utilised here is to simply ignore these reflective economists and try to push them out of the debate through social isolation.

The reflective economists also react in two ways to the dogmatic economists. Some build a relationship of what psychotherapists call ‘transference‘ to the dogmatic economists. They assume that the dogmatic economists do in fact have access to timeless truths and that they, the poor working economist, did not make the cut to gain access to these truths. This reinforces the dogmatic economists’ power and social prestige. The other reaction is one of overt hostility. These reflective economists know that the dogmatic economists are Emperors that do not wear any clothes and they make no bones about saying it in public. This makes them quite unpopular with the dogmatic economists who then try to avoid such awkward discussions by isolating the critical reflective economists.

A clear and concise elucidation of an important point. Who are we to believe, and why. Thank you Brother Philip!

Yeah Phil is working his way to an honorary GED degree from U. Magonia, although there’s still a risk he’ll be sucked in to the black hole of economic “thought” – (air quotes!! hahaa). He’s orbiting it now in concentric circles but tthere a high probability he’ll hit the thrustters and shoot free like a rock out of a sling.

Money = property like wave = particle, so if there’s a purely Newtonian concept of money – as particles with velocity that you collect like baseballs — it msses the most essential wave-like properties. Money can disappear in an instant, for example when a currency collapses, which is a strange property to ascribe to a Newtonian object. Money can also appear in an instant, created ex-nihilo seemingly, butt not really. It’s only created ex-nihilo because a larger structure of social cooperation exists for the money wave TO BE ABLE to collapse and be recognized as property. This social structure is based on ideas of order & forms of cooperation that exist ex-ante to issuance of money. Moreover There’s an odd inverse symmetry between physics and economics, since iin the physical world thiings go from newtoian to quantum as you go from big to small, but I economics things go from Newtonian to quantum as you go from small to big. one person can collect money like a pile of baseballs and be rich, but society cannot to that as an entirety. Also The entire pile of baseballs can appear & disappear instantly in direct relation to the FORM of the wave structures that organize the perception of property throughout socieety. If those wave forms become disordered, the ability for the wave to be observed as property ccollapses. Imagine the energy relieased and eliminate ifthat was all Newtonian. It would be like atomic bombs going off allover the place.

The wave reality of money is indisputable ad needs no logical proof. it’s like proving the sun exists. how would that be done? You’d have to specify conditions in which the sun doesn’t exist and then prove current conditions are incompatible with those conditiions. What a waste of time! it’s easier just to look up and see it. but if you stare at it you’ll go blind. Better just to observe what it illuminates with a clarity of thinking and a judicious use of metaphor, knowig what you’re getting yourself into

Oooooh!!! Quantum Economics! The Second Coming of Keynes is at hand! (I’m sort of curious to find out if Keynes used his economic theories to guide his personal trading career, or if it was the other way around. [There’s a Doctoral Dissertation subject for you!])

What’s curious about your comment craazyman is that I think I understand what you’re saying. My regards to Professor Tremens.

Interesting metaphors…or maybe more precisely analogies…from ‘gooey’ to ‘prickly’ then back to ‘gooey’ ad infinitum.

“In the physical world things go from Newtonian to Quantum as you go from big to small… but in economix things go from Newtonian to Quantum as you go from small to big.” Timeless. Maybe this is the famous Craazy equation: Money equals matter times the speed of light squared. Meltdown indeed.

:)

A simple way to look at is there a way to build scientific consensus on any economic “theory?” There seems to be general agreement on a number of them. What we need is a run down analysis to see how much of a consensus there actually is on various dogma/reflex economics. Do they actually work?

If it can’t be measured then there can be no basis for a science argument.

Consensus means nothing in science, it’s what you can prove or replicate.

There has been plenty of consensus in science that was proved to be flat out wrong – flat earth, the phlogiston theory, the ether wind, the sun rotating around the earth – to name a few.

I’d say the difference between a science and a religion is the treatment of real-world facts. It’s a science if you discard theories that are contradicted by real-world facts – it’s a religion if your reaction is to deny the real world facts and attack those pointing out the problem. (If you don’t compare your ideas to reality, it’s a philosophy.)

Note that under this definition, it is the attitude of each individual that determines whether something is a science or a religion. Far too many economists treat their field of study as a religion, saying things such as “that can’t be correct because it contradicts my existing beliefs.”

For example, it would also be nice to see economists deal with the contradiction between economic models postulating endless growth and the Law of Conservation of Mass/Energy. Instead, most economists think this too dismal a limitation for even the Dismal Science.

Sociology and economics are similar in that both describe a social, constructed order. Both studies describe what we do collectively and how that issues from collective beliefs. We construct a society and with it an economy by means of shared understandings and practices.

So neither sociology nor economics can do a good job of predicting, although they try.

The other implication of this view of science and society implies that once we change our collective understandings and practices, so do our society and economy. Our sociology and economics thereby also change so as to describe a new order.

I would quibble that sociology attempts to seek, who we were, what we are and what forces shaped the transitions … where as modern economics – dictates – what we should do and be… as a market participant.

Good post. The distinction you make between these types is captured in other contexts as ‘prescriptive’ vs ‘descriptive’. I would take exception with this, however:

I don’t think it’s accepted that Newton’s physics was either ‘imperfect’ or ‘overturned’ — after all it’s still perfectly valid on the macro scale. Force is still mass times acceleration, etc. Einstein extended physics into other realms, he didn’t invalidate Newton.

Academic economics is not science- it is religious dogma carefully designed on the basis of fatuous assumptions to buttress a social system founded on accumulated private property. There have been a handful of critical thinkers who elucidated the economic consequences of such a system, notably Marx, Veblen, Keynes and Henry George. None of these was actually an economist. If he had been, his work would have been as worthless as the rest of economics clearly is.

Haven’t had our morning coffee yet, have we, just bill?

If Economics is a science, it’s pretty soft, despite the math. Hell, parapsychology is more rigorous.

If you’re going to question whether Economics is a science (FWIW I don’t think it is) then is it admissible to use a concept from another questionable science (you said psychotherapy but taken ultimately from pyschoanalysis) to make a general point about the first, especially when (acc. to Wikipedia) you’re not even using the concept properly? The Wiki entry mentions childhood emotions in almost every quotation (with the qualification ‘especially’). I’m not sure how using a questionable analogy here helps the overall point you’re making.

I think you’re characterisation of Newton is tendentious as well. Classical mechanics has not been overturned in the way you imply.

Am I being too picky here? Can’t writers just write about what they know about? Isn’t there too much clutter in this article?

Economics is to the economy as alchemy is to chemistry.

Economics could be a real science, even with the difficulty in performing replicated experiments (cosmology anyone?). It’s just that right now most of it is, plain and simple, propaganda.

Imaging someone with a PhD in meteorology whose job depends on telling you that it is sunny, and who tells you that it is sunny even when it is raining. This does not mean that meteorology itself is not science.

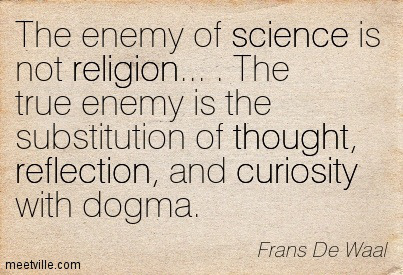

The enemy of science is dogma? Well, yes. But I would say that more often than not, it is the lust for money that is the enemy of the truth…

http://globuspallidusxi.blogspot.com/2014/05/economics-is-to-economy-as-alchemy-is.html

I’m sorry, but alchemy produced a path to disciplined study and research. Wonders such as modern concrete were produced. Yes, they were often mistaken and pursued whacky ideas, and to compare alchemy to economics which no discernible positive effects for society or understanding is ludicrous.

Carter Glass the driver of the Federal Reserve Act and Glass-Steagall was a newspaper editor, not an economist, known for his anti-Southern Democrat and anti-Republican editorials. He is a far cry from Janet Yellin, Ben Bernanke, and Alan Greenspan.

I think the best comparison is the priest caste in society where the religious figures demand tribute to yammer about faith based promises of prosperity and in turn protect the looting class.

After much contemplation, I have concluded that BOTH economics and climatology are a combination of historical data (and not very good data, on the whole) and attempts to predict future results from it by the use of “black box” models.

This is more in the line of fortune-telling than science. If one can crack open the “black box” model, and check its underlying premises against the current reality, then one can determine if it is a valid prediction machine for the present circumstances. When one tries to apply a model under conditions not conformable to its interior assumptions, one gets the Garbage Out Effect (not strictly Garbage In, Garbage Out; it’s more like stuff random foodstuffs into an untested recipe and get inedible compost instead of dinner).

“Newton’s system was imperfect and was completely overturned in the early 20th century”

So f=ma is not true anymore? Of course it is.

I think this could have expressed this in a better way. I see this error repeated often.

Engineers still use the stuff that was “overturned” designing and building many of the things people use today.

Newton’s ideas work well in the middle scale – between the cosmological and the microscopic – but fail at the “edges.” At the edges is where general relativity and quantum mechanics enter.

This kinda resembles psychology and sociology where different ideas apply at different levels of analysis – from the individual to pairs of people to groups to organizations etc.

This makes you wonder if unification of concepts is possible even within one discipline. Look at the conflict between general relativity and quantum mechanics – Einstein tried and failed to unite them.

Newtonian physics applies in all cases except for those involving very small (sub-atomic) particles or at speeds approaching the speed of light…in other words in the vast majority of cases where we solve real-world problems. I wouldn’t call that the “middle scale” but lets not quibble over semantics.

My objection is in the way the idea was presented by the author…it borders on misinformation, the very thing we are criticizing economists for doing (and rightly so). We should be more careful.

Sorry, you are still wrong here. Newtonian Physics has been completely overturned by General Relativity. That means that the theory is wrong at all scales. The difference being is that nor “non-relativist” velocities (which is where we mortal beings spend most of our time in), the error is so small as to be irrelevant for most situations.

But not for all situations. GPS systems have to compensate for space time distortion. Space time distortions become relevant for long range space missions to the outer planets. A mission to Jupiter failed when transmitter frequencies failed to take into account space-time dilation. In these cases – small errors lead to catastrophic results. Heck, even the clocks on the International Space Station run at a slightly different time because of general relativity.

These factors are easy for us to ignore because we can’t see them. But computers and radio-frequencies do have to deal with this.

With that said, you are wrong in another even more crucial way which has to do with why Newtonian Physics was overturned. It’s because his model of space time was simply wrong.

Newton assumed space and time were ridged and constant. Albert Einstein has shown that space/time are dynamic and directly tied to each other. This insight explains how light and the force of gravity works and how they are related. General relativity gives explanatory power which explains these phenomena where Newtonian Physics can not.

What science doesn’t tolerate are inconsistencies. It doesn’t allow for Newtonian Physics in these areas and General Relativity for all of those areas. Every thing all falls under the same theory of General Relativity. Indeed, the reason why Newtonian Physics was called into question in the first place was that it didn’t explain the observed properties of light.

This is a far cry from Economics – even for MMT, which tolerates a multitude of separate theories which are applied for given situations – because they doesn’t seem to be relevant for all situations. Rather than try and ferret out the mistakes in the theory and why they remain inconsistent, they compartmentalize each separate theory where they “appear” to work best. Then act all astonished when things don’t go according to plan.

No. Economists have separate schools for a reason. They are modern seminaries nothing more at least American ones. If John Maynard Keyes was in school today, he would be listed as a liberal arts, mixed studies, or inter disciplinary, not an economics major.

The work of Frederick Soddy demonstrates the possibilities when a real scientist tackles economics. Imagine how far chemistry would have progressed without a basic definition of the objects with which it deals. That’s what the current ‘values free’ economics is attempting with its pretensions to being the science of wealth – without ever defining wealth. This is from Soddy’s “Wealth, Virtual Wealth and Debt”, 2nd edition, p. 108:

Excellent. A true NOBLE laureate. Marginalized for having the mind, heart and credentials of a real scientist that challenged the “divine order” of ‘leechdom’, with real science.

I’m guessing that I am preaching to the choir, i.e. that you have already discovered & read Soddy. If that includes “Wealth, Virtual Wealth & Debt” (WVW&D), was it the 2nd edition – which has lots of good stuff not in the 1926 edition including a “FOREWORD TO THE AMERICAN NATION”? Did you have any trouble locating and obtaining Soddy’s work? (I am hoping to be able to contact the copyright holder of the 2nd edition of WVW&D and obtain permission to produce an E-book version.)

The positive confirmation I have received that Soddy was on the right track from the work of people like Dr. Michael Hudson together with just simple observation have almost made me a ‘dogmatist’. I would appreciate any references to good criticisms of Soddy’s work on money and economics.

Is this a scientific statement in either sense of Pilkington’s meanings?

It states a fitness condition, much like fitness to the environment in evolutionary biology, which generally is considered a science.

And if they are formalists, they are logicians and mathematicians but not involved in science. Logicians and mathematicians for a while made the same dogmatic mistake; some still do. The social consequences however tend to be less catastrophic than the dogmatic mistake of economists.

To dogmatic economists, reflective economists appear to be “rude mechanicks”, tinkerers who have sufficient practical knowledge to make buildings stand up, machinery work, and trains move without knowing the fundamental principles of statics, dynamics, and thermodynamics. Physicists used to have that sort of arrogance about engineers; some still do.

But to my mind, the real issue with economics is not its pretense as a science but the sleight of hand that it does with respect to the notion of value and values. It first abstracts from values and purpose (teleology) as being a science that is purely descriptive. And then when it becomes prescriptive, when it makes policy, it reduces values to fairly restricted economic concepts–cost, profit, incentive for some classes of people–that have the fact of biasing policy in ways that are useful to the people paying the economist’s salary. And then uses its standing as an “objective science” to defend that sleight of hand.

That is not a philosophical misunderstanding between dogmatic and reflective economists. That is a failure to admit data that might lead to different conclusions than what people holding money are willing to consider. It is in fact what ensures that theoretical economics becomes dogmatic and scholastic – the Keynesian school, the Hayekian school, the post-Keynesian school. But Thomas Kuhn pointed out the scholastic nature of the sociology that drives science fifty years ago. In the face of the demonstrable worldwide failure of the neoliberal Washington policy consensus, economics after a decade has not moved on to something that rebuilds the human economy. It is not philosophy of science that has economists stuck.

Exactly – “the real issue with economics is not its pretense as a science but the sleight of hand”. The problem with “Economics” and economists is that they are lackeys of the 1% and their goal is to build a rational for why the new feudalism of the billionaire’s is how scientific laws have predetermined that world order is destined to exist.

Probably one of the best books that have come out recently to address that issue is from Australia:

“Sack the Economists… and disband their departments” from http://sacktheeconomists.com/

Interesting. Similar to Ha-Joon Chang’s views? Morality is not an emergent property of an economic philosophy but something you put in first. Thus the different schools, which are all prescriptive in spite of what they may say?

We need an economix that completes itself with each revolution. Even the energy cycle of the earth, based on energy from the sun, does not return energy to the sun. Well, not for another billion or so years. So Economix is by necessity an art form. Kinda like nature.

mmm… I’m not sure what I just said…

Well, I’m not sure my comment was any clearer. But half-formed thoughts are allowed according to Yves.

When the large scale nation states developed in Europe, the only study of humanity as a whole was history. But the past did not mean as much to the present day decision making needs of growing industrial empires. What to do about the restless amount of people undergoing social changes from moving from rural farming communities to urban factories? The social relationships between ruler and ruled, went by the wayside with a growing system of payment for work, to anyone who would work from anyone who would pay for work. MMT proposes the introduction of money in the form of a national currency as the unit of account for economic production as driven by state’s ability to compel tax payments in that currency alone. Additionally, the rise of the market as a governing mechanism to determine who does what, where, when and how, replaced traditional norms of behaviors and learned expectations and more than gladly welcomed a uniform currency because it enable labor to be formed into relationship based upon money over the entire national territory by the same force that compelled its usage for taxes. Hence the state and the market are united in their authority based upon the universal currency. As traditions faded into memory or history books, a new social relation could begin and end with the simple hiring or firing, and all of the good or bad that came with.

But now, with a historically new social order emerging, how does a ruler rule? What kind of advice can he or she take to maintain the social order. Enter the new emerging science of man, based on the science of nature from Newton, deemed necessary by a brand new world of fixed borders under the Westphalian system of nation states self determination and a new changing social world within these states due to growing capitalism. Change as opposed to tradition became the regular and common experience of the ruler and the ruled how can all of this be managed before it could get out of control? The big 3 social sciences of sociology, for the understanding of civil society, economics for the study of productive business activity and political science for management of the state all came into being to serve the larger social order and legitimate decisions made, laws passed, the terms of various social relationships in the eyes of population of subjected to the rapid changes around them.

Traditions that lasted for centuries, blessed by the knowledge that god willed it by a divine plan came crashing down, defying the will of god. Now, the 10 commandments had to be replaced by the laws of nature, immutable, and unseen until precise methodologies of a uniform practice could reveal universal laws, science. As strong and unchanging as the will god almighty chiseled into stone, handed down from the misted mountain top and delivered by the priestly tribal leader to the people, the scientist labors in the laboratory unseen until he emerges with the discovery of yet another scientific truth. And the laws of society passed by newly formed legislative bodies used reason and rational lines of argumentation based upon the newly mined knowledge of science. Royal academies of science and Philosophical Societies were formed to gather the notable people of any nation into of a union of valid understanding and knowledgeable writings and discussions to control the development of the social order in the direction suitable to the interests those empowered by title and tradition and the newer monied elites. The policies pursued had to have a basis acceptable to the old and the newly forming powerful. It had to have a basis that could be imposed on the large population without terrible opposition. The use of the science, appealing to the mind, with its capacity for reason and logic, built upon measurable and comprehensible information could be transmitted widely in the place of the sermons of the ministers and delivered with a compelling force other than blind faith.

Transference was important in taking the faith of religion as a tool of governing and moving it towards belief in the material progress spilling out of scientific discoveries. Once the connection between the bounty of industrialization was connected with the research of science as a method to discover truth, there was no need for faith or trust, the social change and improvements in agriculture, work and life in general were plain to see and did not have to be argued. The policies recommendations of the economist, governing the material production of the social order become the most important of the social sciences because it produced the food on the table, the clothes on our backs and roofs over our heads. And that, you could take to the bank. But today, the food is GMO dyed and preservative salt laden with no taste, the clothes wear out in a season and the roofs over heads are in foreclosure. Economists are failures, as plain as can be. There needs to be a political purge to replace these general of the economy with some new leaders that can start winning battles again, before we all start starving to death in the cold and in the dark.

Success of the real economy does not depend on the understanding of economists. Likewise, the success of economists does not depend on their understanding of the real economy.

Science is the search for timeless laws.

AND science can only give you the current best explanation versions of those ‘timeless laws.’

So, science offers an approximation (with an unknown error).

Now, economics is not science but pretends to be one, but that introduces another approximation…it matters not whether it’s dogmatic or reflective, if one insists on applying an understanding that is approximation^2 on people or on nature.

Now, if one only limits oneself to just understanding Nature, rather than going further by taking the next step to intervene, to alter Nature, then, here, perhaps, one can make a distinction between dogmatic and reflective economists, if one is careful not to apply any ‘theory’ to people. But, alas, the money is in applying one’s approximation^2 understanding to Nature and people, by scientists and by econmists, with disastrous results.

There is another problem.

Every thing is unique.

But if in your world, the monetary total of, say 15 chickens, equals 1 pig, you would tend to think 15 chickens = 1 pig.

But really, every of those chickens will tell you, first of all, every chicken is unique and, secondly, no way in h*ll that 15 chickens = 1 pig.

And so, with money, we CASUALLY equate beings that are not equatable.

And we do that to everything we can think of, million times in day.

I could go on with another problem, which I mentioned before, and, that is, reducing infinity to something finite. Maybe I will save it for another day.

+100

You seem to be advocating knowledge for knowledge’s sake: “…if one is careful not to apply any ‘theory’ to people.” And money as a medium of exchange in a civilization characterized by increasing specialization and division of labor is probably a fact of life whether we like it or not. The problem here seems to be not allowing those ‘timeless laws’ of economists to push society so far out on the limb of a particular technology or form of economic organization there is no retreat when existential flaws are discovered in those ‘timeless laws.’

I think I would start with ‘knowledge for knowledge’s sake’ and negotiate from there.

We need to re-orient our Weltanschauung…deciding what/who is revolving around what/whom.

So, yes, the first step is to examine the ethics of applying what we only know partially (with no idea of how big the application-input-error is, and mind you, in an asymptotic curve, even a small delta-input can result in googolplex sized delta-damage-output).

I think I am catching your drift here – something along the lines of ‘what you don’t know (and it is ALWAYS something) most likely will eventually kill you.’ That’s probably true regardless of your perspective (Weltanschauung?) You don’t strike me as a believer in at least the discover-ability of Absolute Truth.

As for the rest, I think one of the reasons the science (sic) of establishment economics has such appeal is that it is a lot easier to put a price on something than to figure out what it is really worth. That goes double for people and discovering the meaning of their own lives.

And neither does Science – as it offers only the ‘current best explanation.’

Speaking of the division of labor of early humans, I believe the concept of barter was the basis for that.

‘You go gather some squirrels and berries.’

‘OK, and what do I get in return?’

‘You get a baby sitter and a cook.’

‘Is that a deal for life?’

‘Yes, we Neanderthals don’t believe in divorce.’

‘You troglodyte, you!’

“…money as a medium of exchange in a civilization characterized by increasing specialization and division of labor is probably a fact of life whether we like it or not…”

Steven, that’s why the Fortress of Economics is such a house of cards.

As soon as you don’t like it and don’t accept it, equating the un-equatable, it collapses.

Here, we look at the universe differently, similar to stationing our perspective on the Sun, instead of on Earth, and we see another world.

Nevertheless, we must consider the following: the introduction of the “free trade”, i.e. of the free individual economy hundred and more years ago was based on the misunderstandings to which the 18th century had fallen victim. At that time it controlled the minds the apprenticeship of Isaac Newton of the run of the stars, by attraction and repulsion to itself in the everlasting one Balance held and in miraculous harmony pulled her roads. One transferred these thoughts on the human society and connected them with the metaphysical image from prästabilierten harmony, after which it also for the human society, precisely like for the starry sky, one of God sedate order would give, with unchecked prevailing the maximum of luck and well-being for single like for the totality would arise.

However, this “natural order” existed after the view one, mighty party, behind them prospective customers of the ambitious capitalistic system stood, in the free activity of the single economic subjects, by attraction and repulsion just like the heavenly bodies the “harmony of the spheres”, thus them the “harmony of the interests” on earth would cause.

That such, to the least, strange idea on which till then an age had never fallen, even for a while and also only in limited extent could be realised, therefore had some historic conditions be fulfilled.

Strange, not to say adventurous is the idea, that everything must turn to the best, if one give the single management the freedom to act and to let what they wanted.

Werner Sombart, The future of Capitalism, 1937, S.10

Wir müssen doch folgendes bedenken: eigentlich beruhte ja die Einführung des “Freihandels” im weiteren Sinne, d. h. der unbehinderten Individualwirtschaft vor hundert und mehr Jahren auf einem

Mißverständnisse, dem das 18. Jahrhundert zum Opfer gefallen war. Damals beherrschte die Geister die Lehre Isaac Newtons von dem Lauf der Gestirne, die durch Anziehung und Abstoßung sich im ewigen Gleichgewicht hielten und in wunderbarer Harmonie ihre Bahnen zogen. Diese Gedanken übertrug man auf die menschliche Gesellschaft und verband sie mit der metaphysischen Vorstellung von der prästabilierten Harmonie, wonach es auch für die menschliche Gesellschaft, just wie für den gestirnten Himmel, eine von Gott gesetzte Ordnung gäbe, bei deren ungehindertem Walten das Höchstmaß von Glück und Wohlbefinden für die einzelnen wie für die Gesamtheit sich ergeben würde.

Diese “natürliche Ordnung” bestand aber nach der Ansicht der einen, mächtigen Partei, hinter der die Interessenten des aufstrebenden kapitalistischen Wirtschaftssystems standen, in der freien Betätigung der einzelnen Wirtschaftssubjekte, die durch Anziehung und Abstoßung gerade wie die Himmelskörper die “Harmonie der Sphären”, so sie die “Harmonie der Interessen” auf Erden herbeiführen würden.

Daß eine solche, zum mindesten absonderliche Idee, auf die bis dahin noch nie ein Zeitalter verfallen war, auch nur eine Zeitlang und auch nur in beschränktem Umfang hat verwirklicht werden können, dafür mußten ganz bestimmte, historisch bedingte Voraussetzungen erfüllt sein. Denn absonderlich, um nicht zu sagen abenteuerlich ist doch wohl die Vorstellung, daß sich alles zum Besten kehren müsse, wenn man den Einzelwirtschaften anheim gäbe, zu tun und zu lassen, was sie wollten.

Werner Sombart, Die Zukunft des Kapitalismus, 1937, S.10

And in order to breathe life into that foolish optimism the Nazis juiced up their industries and charged off to war. Sounds like a model I’m familiar with.

Textbooks, Teachers & Demographic Variability

We have once again reached that point in the empire cycle where/when (spacetime) the majority is completely adrift, lost in the minutia of its own derivatives, chasing its own tail. Nothing is learned from a textbook, drafted by committee, for the purpose of maintaining extortion toll booths. Giving the critters technology is like showing them where to fish; their population grows until it collapses, when the fish move.

The vast majority on this planet can do three things: operate an arbitrary diagnostic device to confirm the status quo, identify probabilities from the resulting distribution in an attempt to bypass proprietary systems, and simply accept the stupidity. The moneychangers are just parasites taking advantage of the latest technology, feeding and harvesting the demographic booms and busts of technology with self-fulfilling prophesies. Government, always the derivative of the majority, is always the last and worst choice for educating your children.

Why would you allow critters who have never successfully raised their own children to raise yours, based upon something they heard from somebody who read a textbook, written by somebody who observed parents who could not raise their children to become productive, even if you knew nothing about raising children?

The only reason you send your children to school is to see why the majority’s economy is always fubared, so they don’t need to see what the critters hiding in a building, in a cubicle, behind a computer, are doing, from five thousand miles away, to discount the behavior appropriately.

The accelerator and brake in your car are now electronic circuits, arbitrary overlays in a closed extortion system, subject to environmental variables. If you lose your electronic choke, what do you suppose happens when you apply both the brake and accelerator to get going without warming up the car? You now have an electronic timing circuit. What do you suppose happens if you take your car to a mechanic without a proprietary computer to set the timing? What effect do you suppose that has on pricing?

Why would you allow some moron medical scientist hurling baseballs at chimps strapped into a seat decide whether or not, how or when, you are going to have children? The critters always have children when others have children, and stop when others stop. And they always find themselves trapped in smaller cubicles in each round accordingly.

What equality under the law, of ignorance, jealousy and greed, means is that you must allow the government of the majority to disable you to the extent you accept your assigned position in the FILO bankruptcy queue, based upon a compliance feedback process regurgitated in school, like everyone else.

What I am telling you is that your best approach is to spend 10% of your time doing just that, because gravity has its uses, so you don’t have to bother with their cops and military, in a closed system that can only blow up, and that by letting them steal the second derivative of your development, your children can do the same at least cost in time, but you have to learn for yourself, because the planet is not quite so stupid as you may have been led to believe.

Regardless of what you want to do, find someone who has done something similar, to learn, at whatever cost is demanded, and in the meantime, pick up the building block skills, in your travels. Don’t expect the old-timer, with the necessary assets to discount on your behalf to take you seriously otherwise. Labor is not going to wait for you to wake the f* up.

$100 for an oil change; what does that tell you?

The only way it makes sense to have that garage work on your car is if you know what the problem is, you make more per hour than you are going to be charged and you can trust the mechanic, or you want to support the garage, the probability of which is very small.

Why do you suppose California is protecting its education system at all cost?

Philip Pilkington continues to fashion and circulate criticisms of mainstream (dogmatic) economics that was renewed and spearheaded since the onset of the Great Recession by Yves Smith among others.

In this posting Pilkington adds a dimension by highlighting responses of opponents to dogmatic economists, those labeled reflexive economists; there are those who still harbor suspicions that dogmatic economics has something to it. The transference he points to has a Stockholm Syndrome-like quality. Other reflexive economists are outright opponents of dogmatic economics (with heterodox economists in small middle-ground arenas).

Taking dogmatic economics as an ideology and a mode of dominating public discourse and what passes as public policy discourse, will the illumination of defects within it change the practices and ensuing public discourses? It’s a question of interest given, as Philip Mirowski (Never Let a Serious Crisis Go To Waste) notes, that the ideology-policy prescriptions coming from a part of the pantheon of dogmatic economics (e.g., the late Milton Friedman and successors) doesn’t promote or advise per universal laws and masterful Newton-like knowledge. Instead, in the information age knowledge is viewed by such promoters as superfluous, trumped by the religious-like omniscience “the market” that is humanly unknowable “market.” For most: “whatever will be, will be.” It’s a world in which opportunistic agents and agencies thrive, what Naomi Klein popularly labeled “disaster capitalism.” The promoters and beneficiaries of disastrous episodes do not have distributive justice as a primary concern nor, as is often pointed out on this site, aim for a broader productive-consumption world associated with an earlier epoch of industrialism. Yves Smith’s writing changing management modes and related postings are among items illustrating this.

In the fairy tale land of intellectual disputes maybe the critiques and criticisms will result in a Council of Nicaea-like settlement on economic thought and practice, unless of course the bishops of dogmatic economics and their subordinates have, with the aid of other establishment interests, settled the matter. Meanwhile, for those of us as citizens or in the choir of the convinced that dogmatic economic thought and discourse is deadly, looking for other tools and opportunities of resistance to the dogmatic economists and those for whom they apologize, these prophets of misery and their handworks are challenges.

Additional tactics seem warranted. In my everyday encounters the facile, unreflective use of mainstream economic terms and oversimplified portrayals constitute routine challenges. Suggestions to others of problems with such discourse is challenging, especially in a world where opportunities for engagements are in minutes, not leisurely hours, days or years.

However, even in everyday short encounters it’s of interest that there’s a bit more reflexivity than in dealing with the few academic intelligentsia whom I encounter. Often among the latter agnosy is as firm as that of flat-earth adherents. If not that, willful ignorance is offered as an excuse or brush-off: “I don’t understand such stuff.” Or polite indifference is signaled prompted by “other things to do” or a stylized model of “repressive tolerance” (Marcuse) that becomes a stylized presentation of self. Or simply one is attended to as little more than an ornament to be trashed.

Maybe casting nets into deeper water such as Kenneth Burke’s highlighting of “perspective by incongruity” and other such tactics may be emerging. Naked Capitalism provides materials for such projects. And as a forum for dissenters it provides hope.

I’m not very interested in what is and is not “science.” I think the quest for certainty that is part of the scientific project is, at this point in history, counterproductive. I believe in human-centered inquiry based on the idea that we live in a fundamentally mysterious universe that cannot be known fully or even for the most part. When you stop and think about life, as opposed to what we have been taught to believe is life, it seems very confusing, contradictory and paradoxical. Indeed–pursue everyone’s favorite “hard” science, physics, and you eventually come to paradox.

Economics is really just politics by another name. There is no such thing as a “free” market and can there can never be such a thing. All markets are governed by political forces, end of story. In our own system we are governed by all kinds of regulations and incentives most of them, in my view, perverse if you believe in creating a convivial society which the vast majority seems to oppose. Economics appears to be, as many have commented here at NC, an ideological system to justify oligarchy. Certain economic calculations have validity, don’t get me wrong, just as certain weapons are effective in combat but to what purpose are we using them? That is the question we need to focus on. We should be less concerned with gov’t spending or tax-breaks and more concerned with what sort of society to we want? Do we wish society to be a field of combat where the strong survive and the weak perish? Do we wish society to exist in order to simply please ourselves and keep our rivals weak?

Is economics a science, or not? As a lawyer, I can confidently give the answer, “it depends.”

But what does it depend on? Not some definition offered by a philosopher of science.

No, it depends upon on legal precedent and upon whether the expert opinion testimony proffered by the economist in question serves or disserves my client’s interest in the case at hand; when I call an economist as an expert witness to help my client’s case, then that kind of economics passes all the tests of rigorous scientific admissibility, and I will argue for admission based on all the authorities supporting it. But when opposing counsel calls an economist to proffer the contrary opinion, then that kind of economics is contemptible junk science and rank charlatanism, and I will argue against admission from the precedents for opposing it. And which side is right will be decided by the judge when the testimony is allowed, or otherwise not.

I once heard a pulibic utility regulatory lawyer argue that the cost accounting allocations of joint and common costs are based on rigorous science. I didn’t think so, but what could I know? I have never been a scientist. But I once was an accountant.

I take your point, but science works because it is reproducible and testable. It was some empirical basis in reality.

Although in honesty, if it were in my interests to do so, I’d also glibly mangle words and promote false beliefs; I’m fairly poor, desirous of material wealth, and have no particular desire or inclination to see Truth prevail or this society thrive in any way. I’d even write eloquent odes to Obama and spread glowing praise for His regime to all and sundry if I were properly motivated. So by all means, let there be “scientific” economists, and “contemptible” economists.

Economists give policy advice to policy-making elites who act on that advice and thereby disrupt the lives and fortunes of millions of people. Now, those people are not inclined to accept arbitrary interventions in their lives or their business, but they can be persuaded to accept even burden intervention that appears to be governed by principle. So, to sell the intervention, economists and their clients invoke the name of “science” to supply the needed principle. Because “science” can claims to be objective (unlike ethics or religion or other unverifiable authorities that are generally agreed to be subjective and dismissed as matters of opinion), “science” can be used to supply a principle to justify even totalitarian interventions. It’s the only weapon like that left in the arsenal of modern propaganda.

In short, economists need to claim their discipline is science because there would be no demand for their services if their advice and justifications were truthfully characterized as the mere matters of opinion that they actually are.

Economics exists to give academic justification to whatever the elites want or don’t want to do. Whatever intellectual-sounding gobbledegook can be shoehorned into the predetermined outcome, will be. There is no other purpose to economics. Economics does not even need to have internal logical consistency, which it doesn’t, in order to fulfill its role. Therefore to say economics as a science would be equivalent to saying that astrology or tarot reading is a science.

“Economics exists to give academic justification to whatever the elites want or don’t want to do.” That about sums it up. Some economists have said that economics exists for two purposes: the first is to explain, and the second is to justify, the workings of the economic system. The problem with that thesis is that the object of explanation and justification, the “economic system,” is not an observable phenomenon. It’s not something concrete; it’s inferred and reified. No one can apply the scientific method to an object that cannot yield to it.

Humm, lots of words about science but none on a straight forward definition of “science”. So here’s mine.

Science is knowledge gained from an interaction between a living being and a non-living being. Not “scientific” knowledge is knowledge gained from an interaction between two living beings. So the key concept is who is involved. All knowledge is based on human understanding, so one living being must always be a human. When the other half of the interaction is non-living, the properties of this interaction can be fairly stated: the interaction can be reproduced, its outcome can be predicted with high accuracy, it is not dependent on its time or environment, if these factors are held constant. And we can correctly state if the interaction is proven or not.

Now, if the other half is a living being, either another human, or an animal, then the interaction properties can not be fairly stated. Why the interaction properties change is probably due to the nature of the interaction between a human and the other living being. That interaction is a non-linear one. Non-linear interactions are not accurately predictable, are highly dependent on their start points and environments, and so reproduction of the interaction is not possible. And so we should not state if the interaction is proven or not.

None of this definition and distinction about science says that non-science knowledge is not valid. Of course it is! Religion is knowledge, it is real, it is valid, it is important. But it is not “science”. I can prove 2 + 2 = 4, but I believe God exists.

I have tried to understand economics. I have taken a class, I have read many books, including Paul Krugman’s 940-page textbook, and it just does not make sense to me. Max Tegmark is from Denmark, and like many of us he made a stab at picking a career when he graduated from high school. Here is what he wrote (emphasis added):

Tegmark decided to become a physicist and is author or coauthor of more than two hundred technical papers, twelve of which have been cited more than five hundred times. He holds a Ph.D. from the University of California, Berkeley, and is a physics professor at MIT. He recently published Our Mathematical Universe: My Quest for the Ultimate Nature of Reality. I applaud Tegmark’s wish to make “our planet a better place,” and I agree with his description of economics as being “a form of intellectual prostitution.” I wish I had thought of it.

Another scientist, more famous than Tegmark, was Albert Einstein. He shared Tegmark’s wish to make the world a better place, and he believed that the economic scourge of capitalism produced more evil than good. He was inclined toward socialism which is a dirty word in America today, but based on my reading of his views, I think he was more inclined toward any system that obeyed the will of the people. In any case he wondered if the field of economics would be useful in designing a government of the future. In the May 1949 issue of Monthly Review he wrote:

So, for anyone out there who thinks economics is a science, I will be happy to debate it with you. However, your quarrel is not with me—you really should take it up with Max Tegmark or Albert Einstein.

“My definition is as such: science is the search for timeless laws.”

Do not get me wrong here. I hold Pilkington in very high regards and greatly respect his work. But when he said this, I face-palmed do hard that even Picard had to flinch.

The scientists I work with are mostly in unison in defining science as “the understanding of the natural universe.” But perhaps focusing on definitions is not the best approach here.

Science is best described as a process. The process starts with observations made out in the field. These observations are used to generate hypotheses to which a fundamental quality must be falsifiable. That is that we must have a way to test such a hypotheses of being true and of being false. Those hypotheses that survive testing are then integrated into a larger body of knowledge called a theory. Into which all indoctrinated hypotheses must be consistent with. If this is not the case, than it is called into question which leads to new research in retesting older ideas to see if they remain true. In science, evidence is king – it even overrules logical inferences.

On occasion, new observations will overturn existing theories. This happened when Einstein overturned Newtonian Physics with General Relativity which explained some qualities of light which were vexing scientists of the day.

Academic Economics stands in contrast. It uses a far older method of inquiry which predates science – namely logical induction, better used in philosophy. Here, evidence is more of a curiosity. Evidence which supports inductive reasoning is naturally held up as support for the idea. But disconfirming evidence is easily dismissed as being irrelevant, or worse its manipulated until it conforms with existing “theory.”

Pilkington’s argument that this is between “dogmatic” and “reflective” economics is simply wrong. Science is not reflective – it is based on evidence. And so should economics.

Very little of science is concerned with ‘the search for timeless laws’. Such a definition would exclude most of biology and geology for a start, including the historical aspects of evolution and earth history. And many things labelled ‘laws’ are pretty marginal to science, often amounting merely to useful rules of thumb.

Science consists of many aspects, such as collecting observational data and classifying things, as well as a social and institutional organisation to support all these activities. But what I’d say is fundamental to all science is theory, which is a search for explanation, something that Popper almost but not quite hit on.

By explanation, I mean accounting for domains of knowledge (typically but not necessarily observations) in terms of other domains of knowledge that are (in the absence of any theory) unrelated to the former. For example, observed chemical changes are accounted for by properties of atoms and molecules, the current state of the earth’s surface and the life on it are accounted for by geological and biological evolution, and so on.