Yves here. The housing market is looking wobbly now that big money investors are pulling back. But anyone who was paying attention should not be surprised.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Ballooning home prices have made it tough for investors to work out their equations. These investors were everyone from the couple living down the street to giant private equity funds and REITs that, stuffed to gills with unlimited funds from Wall Street, have been buying vacant single-family homes by the thousands. They’ve been chasing their luck in the now teetering buy-to-rent scheme.

Part of that scheme – encouraged by the Fed – was a concerted effort by these players to push up prices by waves of purchases that would ripple through the larger housing market via the multiplier effect. It would reward them with near-instant paper gains. And they’ve succeeded so well in pushing up home prices over the course of two short years that their own business model no longer works.

Another class of investors has also been hit. Flippers, who buy homes in the hopes that with some trimming, painting, and rehabbing, they can resell them for a profit a few months later, must buy low – below market prices! – and sell at least at market rates for their equation to work. But buying low has been getting tough, and now price increases have slowed – and flippers have been curtailing their buying as well [Home-Flipping Collapses in San Francisco, Losses Spread].

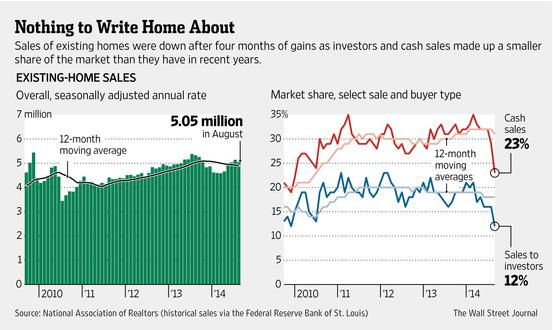

The National Association of Realtors (NAR) keeps confirming these trends on a monthly basis, as both “cash sales” – many of which by investors – and “sales to investors” have been dropping, or rather plunging since late 2013.

Every month since late last year, existing home sales have been below their year-ago levels. The culprit, among others, are the same folks who drove up sales starting in late 2011 through mid-2013, and who have now walked away: investors.

The share of sales to investors has plunged to 12%, down from over 20%, and as high as 23%, during the investor spree in 2012 and early 2013. By the looks of it, it’s not over.

The chart on the left shows the declining home sales since late 2013 (green bars). Note the dropping 12-month moving average (black line). The chart on the right shows the recent plunge in sales to cash buyers (red line) and investors (blue line).

But prices are still rising, as sellers are clinging to their hopes of instant riches. And regular folks are increasingly priced out of the market. Now the market is in a quagmire of dropping sales, still rising prices, and ballooning inventories; existing homes are now at 5.5 months’ supply, and new homes at 6 months’ supply [Drowning in Unsold New Homes?].

That’s the toxic mix with which housing downturns always start. And something has to give. Not that the NAR, which represents realtors, ever gives up hope for yet still higher prices and more volume:

“I do believe there is sizable pent-up demand – it’s just a matter of when it will get released,” explained NAR chief economist Lawrence Yun, as his organization is desperately hoping – because that’s all it can do – that these renters will come out of the woodwork somehow and buy homes and pay hefty commissions on inflated prices to NAR’s clients, namely realtors – along with points, interest, insurance, fees, and other expenses to everyone else who is making money off homeowners.

So what about this American Dream? Turns out, it’s not for millennials. Read…. California Home Sales Dive, Prices Hit Wall, Millennials Blamed <

Sort-of related, FT Alphaville covered the festering sore that is private label MBS last night (http://ftalphaville.ft.com/2014/09/23/1980722/fix-housing-finance-fix-the-economy/) and managed to get more wrong than they did right, in my humble opinion. But their feature did contain some interesting data and charting.

Japan didn’t (still doesn’t to a slightly lesser degree) learn that you can’t sustain an economy which is in hoc to construction. Here is the UK, the lesson has been taught at least 4 times now in my living memory and we still don’t get it that you can’t sustain an economy which is in hoc to residential real estate. Et tu, Uncle Sam ?I’d be interested in US readers’ views about why such differing nations can keep making the same basic mistake over and over again.

Few economists seem to understand you can’t sustain rising home prices without rising wages. Those now speculating in houses will be wiped out except to the extent they are bailed out. More money has been lost chasing yield than at the point of a gun.

Housing in the U.S. is more and more resembling a cargo cult. Somehow these economists just don’t get it – rising home prices are a symptom of economic strength, not a cause. Building butt-loads of slap-trap McMansions may create a facsimile of a healthy economy, but it isn’t sustainable without wage growth and a healthy middle class.

Even with decent wages you risk being wiped out due to the insecurity workers now face. Years ago it was feasible to take on 20-30 years worth of debt but back then a worker could expect he/she would be working for the same company and retire there. Nowadays workers are disposable and if you lose your job there is no guarantee that you won’t have to adjust downward rather than upward. With this in mind why would a smart millennial put themselves in a position where they lose their mobility and then have to spend months worrying that they’ll lose their homes?

This suggests also that family formation isn’t a particularly sensible idea. Perhaps the entire country is on the road to becoming a Seinfeld episode, but without the jokes. I experienced this in the Seventies in NYC.]

Houses are depreciating durable goods, a wise person just buys what they need.

If you have aesthetic inclinations they shouldn’t be considered to be an “investment”. When taking on home debt make sure you can pay the note for whatever period of time you expect you may need to find a replacement position in your field.

Otherwise seemingly intelligent people get strung out on more long term debt than is prudent. Homeownership, (which is a bit of a misnomer you’re are never free and clear) is not appropriate for everyone, unfortunately some people victimize themselves by not understanding the amount of debt they can reasonably tolerate.

The only difference between permanent employees and temps is that the permanent employees don’t understand that they are also temps.

Real-estate, like everything else, is a zero-sum game: rising prices benefit those already in the market but negatively impact–if not lock out–would be first time buyers. Likewise, declining prices make it easier to buy for the first time but negatively impact those already in the market.

Perhaps the larger takeaway is that home prices alone—whether rising or declining—are a useless metric.

“rising prices benefit those already in the market”

And cratering prices damage people that owe money on stranded assets.

This is true of all asset purchases leveraged on credit. Nobody is forced to buy a house.

However, help will surely be on the way!

The rationale of the recent SCOTUS decision on O-care (that the government can tax you for failing to buy something) can be re-purposed virtually without limitation. If people can be forced to buy health insurance under penalty of tax, what can they NOT be forced to buy under penalty of tax?

The basic principle is that if it’s a “good thing” in the eyes of progressive government, then that government can stiffly penalize you for not having exactly the right kind and amount of it (as determined by all-wise and ever-caring politicians).

So…all that’s really needed now is a tax which must be paid if you don’t buy a house. Problem solved!

Like O-care, it wouldn’t matter if you cannot afford the monthly payments and upkeep. The house will steadily decline in value owing to neglect, of course, and you’ll end up in bankruptcy. No matter. The “social safety net” will then kick in to maintain you (at pubic expense) in marginal poverty for the rest of your life. The bank will take back the house and discount it to clear the market and the lawyers will get their usual slice.

What’s not to like?

Now, how about that college education you really gotta have to live out the “American Dream”? Your best friend, the government, can solve this problem, too, by applying the same simple formula: if you don’t obtain a degree (preferably one suiting you only for government work) by the time you are 25, you get taxed until you’ve got that piece of paper firmly in hand. Once again, problem solved!

We have state and federal taxes on liquor sales. Why not have taxes for NOT buying liquor?

Virtually any problem, real or imagined, can be “solved” by politicians using this method. Indeed, there’s an infinite list of good things progressives can doubtless think up that haven’t yet been properly taxed into compliance to assure “the greater good”.

Rinse, wash, repeat.

We already have this. It’s called the deductibility of mortgage interest. Not to mention the capital gains exemption for houses. Both serve to promote home ownership (actually, debtorship) vs. renting.

No, that’s a reduction of taxes on property owners as a reward for buying.

But that’s entirely different to what the SCOTUS has recently enshrined into law: a tax penalty on non-property owners for NOT buying.

Should have phrased that as “no constitutional bar to levy a tax penalty for not buying a house (or anything else)”. As in O-care.

The USA stands out as a beacon of inequality to the world. It is a place where many believe market principles is the rule. Of course, most us know better. Most of what we see is a rigged system that favors the rich and connected. Concentrated power becomes the defacto market. Rich corporations ensure loads of people are homeless yet keep them out of unoccupied homes.

65% of those who can own a home already do. Millions just went through foreclosure. The other 30% are most likely sub primers from the bottom of the barrel already up to their arse in debt or unemployed and struggling to get by. Our Government wants to pin their hopes on a housing recovery and return to a 2004 like building boom. Fat chance of that when the shadow inventory of folks who want to sell is huge. With wages stagnant for the last 25 years for the lunch box types it would be reasonable to think that we might need to go back to early 1990 prices which means we need to shave off about 45% off the top of home prices. But what the hell! More fools are born every day.

JLB

I see examples of this national trend in my suburban enclave outside of Boston. I see homes listed at quite high prices, followed by significant discounting. If I see discounting I assume the family really needs to sell. When I see houses go off the market after hanging for a while, I interpret it as people holding out hope that the right buyer will come along eventually. And it’s possible. There are wide swings in prices within my town of ~35,000 people. We have both mansions and modest and worn out homes. The end towards the mansions is doing better than the cheaper inventory.

Premium assets can generally find willing premium buyers in any market.

Living next to the University of Michigan, I have seen a property boom since…2009. People want to move to Ann Arbor and live here, and they have the means to do it. We get a lot of Children of the Elite, or at least, the Solvent, or perhaps the quasi-investors: buy a condo for the kid while attending college, rent it after, maybe retire to it in the end…or sell at a hefty capital gain.

Available housing stock within city limits (and services) is tiny, and much of it is either horribly expensive ($500k and up) or horribly dilapidated (cheap construction, built prior to 1980, or both).

So the Greater Fool theory still applies here. But how many communities can make that claim? Michigan is STILL in a Depression (creative accounting drops the unemployment numbers, as does moving out of state), and the demand isn’t pent up, it’s broke ($ and otherwise). Our local children are out of luck, unless their parents can provide.

It’s hard to resist the narrative that the Fed’s battle was to save the banks; the middle class was, regrettably, collateral damage.

It’s so simple, yet it seems to explain things so well.

It is cloudy what the Fed might have done for housing, apart from much more rigorous bank supervision prior to the bubble forming. After it formed a lot of the steps often advocated were not in areas of Fed authority. Bankruptcy mortgage cramdown – as an example – requires legislation. Principal reductions aren’t in the Feds toolbox either. What should the Fed have done in your view?

One thing that should have happened was to *not* bail out the banks and investor class in 2009. Preserving them ensured that they remain to exert a disproportionate, distorting force everywhere they go. In this case they prevented the obvious correction in prices that was needed for housing to track the income of home buyers. The Fed played a large part in this via its backdoor bailouts.

I think the Fed should have advised Treasury that the banks were insolvent, and that they should be nationalized to stop the panic. Then, I believe the Fed should have worked to break them up.

Eric377 – how about Greenspan lowering interest rates to 1% for way too long in order to GET a bubble going in the first place? What does the Fed do wrong? Just about everything! It engineers and manufacturers bubbles for the benefit of the banks, then bails them out.

Mike Davis has a wonderful chapter in his book City of Quartz called The Infinite Game. The men (and maybe a couple of women) who were calling the shots and making the decisions in 2008-9 were unshakably convinced that if they saved the banks, the banks would then find productive and profitable avenues for lending and they would restart the economy all by themselves if they were solvent and had access to enough capital (TARP and ZIRP). Thus, the grand game of accumulation would recommence. This was the dogma. This was the intellectual equivalent of the World of God. Governments must and will misallocate resources, but private banks and financial institutions working though the Miracle of the Free Market will get it right. Save the financial sector and you save civilization itself. This was the one and only thought in Paulson, Geithner, Summers, Bernanke, et al.’s heads.

They had their chance, and they blew it. They got everything they wanted and it still turned out a goat you-know-what. Yet miraculously the dogma stands. In the face of all evidence, all experience, all logic, it stands. Chalk it up to the egomania of the Economists, the mendacity of the Politicians, and the entrenched interests of the Investor Class.

Just for my edification, are you implying that the governments wouldn’t have blown the money on useless crap/cronies had it been their hands instead? Regardless all this “money” crap is pure bs. The elites of the empire rule because they’ll put you in prison, or shoot you, or regime change you if you don’t listen to them. All these endless red herring arguments regarding various money theories and economic stuff is just obfuscation of that fact.

Don’t dance around the topic, jgordon: tell us how you really feel. /yes snark

Possibly several decades ago, the Govt would have handled the “money” better in terms of doling it out and not giving payola to cronies. We can look to FDR and the various fed programs that resulted in buildings and other infrastructure projects, etc. But that was then, and this is now.

It’s clear that, while the populace voted for Obama as a “change” to do something for the 99s, that sure as heck didn’t work out. Obama may have come into office with some sort of ideals (hard to say, really), and he did do the GM bail out (against the wishes of the rightwing). We can argue all day whether that was a good idea or not, but it did save some jobs for the 99s (not just at GM but at all the related businesses).

Since then, though? Yeah, whatever… Seems like we’re captured & penned in by the rich and powerful, and there’s not a whole lot to be done about it, near as I can tell. Yet I do feel that discussing what is really going on – here and elsewhere – has some value. Perhaps reality will trickle down on a hapless and dumbed down populace. Will that make things better? I have no idea. I guess I still subscribe to the Old School thinking that Knowledge is Power. Right now, the US populace is illiterate, lacking in knowledge, and very definitely powerless.

Can we change that paradigm? One hopes so.

Yesterday’s Golem piece, which I read last night, thus too late to make any comment, talked about privatizing education, pension and welfare.

What is left for government to do after that?

Oh, yeah, security and surveillance.

That would be a good time to shrink the size of government, I guess, if it only does imperial adventures and monitory citizens.

With droit du seigneur, the lord must first be happy before the serfs could even dream of not starving or getting married…or having some money.

Yes — as I’ve said before, the Fed has a model of how the economy works, and they’re going to stick with that model and *prove* it works, if they have to blow up the entire world to do it!

MikeNY – the Fed doesn’t have a model of how the “economy works”. They use models in order to make YOU believe they’re actually trying to solve something. When these models fail (as the Fed knows all along they will), everybody and his brother thinks that the Fed are “mistaken, confused, stupid”. They’re not.

They are owned by the banks, so therefore they are beholden to the banks. They don’t give a care about you or the economy. Their intentions are always to benefit the banks. Under the GUISE of trying to help the economy, employment, homeowners, they set about to help the banks.

Citizens are duped into believing that the Fed is actually trying to help. Nothing could be further from the truth. They are not ignorant or stupid. They are very intentional in their policies.

I wish people would finally get that they are NOT WORKING FOR YOU!!!!!

It’s the old debate about stoopid or evil. (OK, they’re not mutually exclusive.)

James and I are on the side of stoopid… or as I more politely say, “ideologues”.

MikeNY – if you are on the side of stoopid, then you are a big part of the problem and the reason that nothing ever changes. You must be happy with the status quo.

And it isn’t just a choice between stoopid or evil; there are other adjectives in between, like say “self-interested, egocentric, narcissistic”. But to just dismiss them as “stoopid” is simple-minded.

Ad hom comment. Conversation over.

Stenciled deep in the marrow of all of the banksters best friends is a simple notion:

`What’s good for Goldman is good for America’

With this level of complete intellectual, psychological, and emotional capture they don’t even need to be corrupt.

The departure of flippers, gamblers, and money-launderers from the housing casino is welcome for would-be buyers if prices eventually fall (yes deflation has its benefits for non-homedebtors). That seems to be supported by the right-hand chart, but the sales chart doesn’t support the breathless thesis in the least. The tiniest little down-tick, seen only with the aid of an arrow and zoom-in, does not mean diddly. Perhaps the “investor” exodus will show up in declining sales soon, but these bubble implosion predictions are losing credibility. What am I missing here?

I think you are missing the literally millions (3-5 depending on who you read) of homes being kept off the market by banks to artificially maintain housing prices so that they can “mark to market” these assets at the inflated prices. Banks have also switched to a “don’t foreclose unless absolutely necessary” default setting, so many more homes are now one year or more in arrears mortgage-wise but the banks don’t want to foreclose for fear of putting even greater downward pressure on the market. The entire market is gamed.

Hedge funds and the like have unquestionably distorted, and in turn, broken the housing markets; however, the fundamental question is whether the housing market can be “unbroken.” You can’t legislate your way out of the problem–legislating how long people have to hold their homes, or impose price controls, isn’t going to hold up to legal or constitutional scrutiny/

Even if many of these people get wiped out and don’t succeed in lobbying congress for a

handoutrelief, it still doesn’t automatically solve the problem of investors competing against homeowners. Something truly catastrophic has to happen in order for investors and speculators to never consider betting on the housing and rental markets again and subsequently get out.The days when homeownership is in reach of those who want a place to live, may be over for most people who aren’t in the upper-income brackets. As much as the housing evangelists may malign (often unfairly) renters as scumbags–rental will likely become the new normal for economic reasons.

Is homeownership to renting what employee-ownership is to slaving away as a wage earner?

If you desire workers to own businesses or co-operatives, you would, I think, prefer resource-owning (houses, in this case) by the little people.

Even if renting is cheaper…by that ideal.

Otherwise, 0.01% end up owning every plot, every building in the land.

Louis – banks are holding homes off the market, FASB allowed banks to hold homes on their books at full price, artificially depressing interest rates. The whole market is gamed.

Interest rates are about to start rising, which means house prices will come back down, return to the mean. The day when investors can make bucket loads of money are gone. Perhaps they’ll soon be renting.

It’s all just another symptom of chronic short-termism at the government level, just as it has been for decades at the corporate level.

It will help a politician’s career for the economy to “recover” this year, even if it inflates housing prices artificially so that in 3-5 years the average buyer can’t afford their mortgage and can’t sell due to a potential loss, or even if it means that inflated stock prices means that future retirees have less buying power in their 401(k)s and IRAs and have fewer shares tomorrow when they retire and also suffer a market crash as the unnatural support leaves the system.

I was reminded the other day that my “dream job” as a 15 year old would have been to be a starship captain a la Jean Luc Picard. I always knew that would never happen in my life time, and I was OK with that. However the other day I realized that what appealed to me was not the actual spaceship or the alien planets and lifeforms, but the reasoned, deliberative decision-making and the ethics and values-based judgements, as well as the long-termism. I loved their style.

In theory this should be good news because that style could be applied to a business or the government. Unfortunately, since the 80s, it hasn’t been. We actively force out anyone that thinks about anything other than immediate gain, in every aspect of our society.

Yes, ST:TNG really was resonant of its time. Did you notice like I did that as the franchise went on, it lost some of that indefinable magic which was present until, say, the mid 2000’s ? ST:VOY was the last to consistently capture what was present before. I think art really does imitate life. It was as though the producers lost confidence — perhaps with good reason — that the audience would appreciate all that utopianism. The more scams, grifting and trickery we have to deal with in our every-day lives, the harder it is to lose yourself in the possibility that there might be something better possible.

Now we have Game of Thrones, which is much more an accurate reflection of how my life is today. And you’d hardly wish to be any of those characters. Even the “good guys” are trapped in the basically nasty dynamic, with limited upside potential.

Yes, indeed, Game of Thrones, Shades of Grey, Reckless, Empire (reportedly O’s fav), House of Cards, Reckless, and Dallas 2.0 seem to herald a devolution of culture. It’s quite sad. I wonder whether it’s the twilight before a dark age, Armageddon and tribulation, or just a predawn nightmare. Here’s hoping for a glorious awakening, a flowering of united consciousness and creativity. It can happen.

Dallas (who shot JR gripped a nation), Miami Vice, M.A.S.H., China Beach, Roots, the original V (the visitors were welcomed for a reason), Happy Days, All in the Family, the first season of Good Times, Network, Miami Vice, Dukes of Hazzard, the Waltons (they blew up the town), In the Heat of the Night, Beauty and the Beast, and Alf beg to differ. I think the Wonder Years was all in the 90’s, but they didn’t hide behind a false nostalgia.

Yes, the censors and demands for 26 episodes made shows feel that they have a certain innocence, but I just don’t see Modern Family having a rape or an abortion episode. I’ve seen part of an episode.

The change in television is more about cable and the decline of the film industry (movies are made for translation; humor and subtlety aren’t quickly translated) than anything else. The Dick Van Dyke show only shared the stage name of its featured performer because Van Dyke didn’t want to explain a childish joke to adults. The Simpsons was largely an indictment of existing American cultural norms, and the series premiered in 1989.

Are you kidding? Voyager was a nightmare of banality and creatures of the week. There is a reason all the good TNG writers quit or refused to sign up. Voyager killed the one interesting character and let Neelix live. Also no one said a word about the duplicate Harry Kim?

Please rewatch Deep Space Nine. Or Season 4 of Enterprise. The penultimate episode is nothing short of fantastic. Deep Space Nine had the feeling of TOS which was the Federation wasn’t a dream agreed to by magic but an ideal that always has to be built.

The conflicts on DS9 had way more thought and push to be better and achieve that utopian ideal without the false pretense of it being easy. Aliens and broken people made up the cast. Did you even see the episode where Riker bangs the androgynous being who wants to be a woman? The resolution amounted to, “oh well, it’s another notch in Riker’s belt. Let’s go to the planet Malcor, so he can teach Lilith the Kama Sutra.”

Oh, I knew I’d end up starting something with this !

Everyone has their favourite, if they like the ideal of the show to begin with. Yes, I did like DS9 too. Not quite my own personal first choice though, but I wouldn’t decry anyone making it theirs. And there were some really lame TNG and VOY episodes, I wouldn’t make even the real Timothy Geithner sit through the one where the TNG crew got stranded, by a plot device, on a “primitive” planet populated by hot and horny aliens with the god-like overseeing artificial intelligence satellite thingy (alas one of Roddenberry’s most frequently reached-for concepts).

Roddenberry wasn’t firing on all cylinders by the time they got around to TNG which explains Wesley who wasn’t awful in the pilot. He had a point beyond wish fulfillment. Patrick Stewart’s casting took a revolt, but Voyager is just bad except for Robert Picardo and maybe B’Lanna and Kes. This is far beyond preference. Voyager is high budget version of the third season of TOS. Minus the Wesley episodes, the first season of TNG at least had promise and was interesting. The dialogue was probably worse, but Voyager…seriously did you watch it? It’s just not good, and they completely gave up on the most interesting premises.

Rather than quality lets perhaps consider tone. The tone of TNG was that the human race and its culture could improve. We could master our demons and reach out to others and live like, well, human beings. I thought that DS9 became a militaristic amoral downer, which was finally and perfectly manifested in the remake of Battlestar Galactica, where everyone was an amoral homicidal manic. They call this tone “dark”, and imagine it profound. I think Beethoven and others showed that joy and exuberance and optimism can be as profound as death and despair, but that’s me.

Wouldn’t the pent up demand come out at lower prices, Larry?

You cant panic chase prices up when you cant afford them, so maybe he is waiting for credit to get easier or PE to raise rents to the point that buying is attractive or something.

Btw was referencing Lawrence Yun, not the previous commenter Larry which I just saw.

When you consider incomes, does the cost of ownership equal any price for a home? Is there a lower price? Contractors, they want to rent. Part time workers might want mobility. Even if could afford a mortgage, can you afford the upkeep?

Except for teenagers, pregnancy rates are down. Singles and childless couples need a room. Given the experience of the sub prime market, younger people won’t move the market at the rate necessary to create a recovery.

I think that there is pent up demand – not big, but some demand – at the lower end of the housing market. That said, my anecdotal observations of Sacramento & San Diego CA (where I spend time) is that there have been feeding frenzies at the lower end of the market since the crash. The frenzies abate somewhat and then re-ignite.

Some RE people I know talk about shenanigans with foreclosures on the courthouse steps. In Sacramento, BlackRock managed to scoop up a whole lot of low end properties and I believe they are still rentals (with not insignificant rents, I might add). San Diego is somewhat similar but many of the low-end prices are seen in really BAD neighborhoods with really BAD houses. Anything half-way decent (location & condition) tend to still be fairly pricey and beyond the means many.

IOW, low-end pricing is still somewhat difficult to find – whether you are in bidding wars with many others (which raises the price) or the place just isn’t worth it.

Sacramento recently got overheated but not quite to the level of 2007. Like someone above mentioned (in terms of another market), many of the prices were pretty high, but those who were really “motivated” (iow, really need to sell for one reason or another) had to drop their prices somewhat significantly. Still wasn’t low enough for me to consider buying something at this point. Still think a lot of the prices are too high, plus the stupid idiotic bought off county council has approved a number of rather large home construction projects, so I think that prices may go lower yet with more inventory coming onto the market.

It’s all kind of a mug’s game really. I co-own a property in San Diego with a friend, which seems to be one way to go, if you happen to be single but want to diversify investments. Our property has gone up in value since we purchased it at the rock bottom of the market. I figured San Diego was a better investment op than Sacramento (where I live more ft and work). I am currently renting in Sacramento and enjoy pretty low rent for a very nice town-house style of rental unit. Right now, renting is probably a better deal for many, but I guess it depends on where you live.

The logical trajectory of housing is rentals. Half of the population is busted and will never even want to own a home, especially one they could actually afford. The jobs of the near future will set the standard. The Tiny House movement, however charming, isn’t all that practical. But multi-family projects are practical. They can be built green and rent controlled. So if the old housing market is going to lose 50+% of its former market, what’s left? Just the upper 20% maybe. That’s not going to do anything to revitalize housing. Most entry level housing will have to be torn down, recycled and the land used, or not used, for other purposes. The REIT attempt to rescue housing didn’t work because nobody is buying. The big question in my mind was why didn’t the Administration, Treasury, and the Fed think through the possibilities early on? Forget Congress – but if by chance Congress ever managed to rub two thoughts together – they should have been able to predict this very outcome. Without jobs we have nothing for housing.

Every time affordable housing developments are proposed, the overprivileged NIMBY crowd comes crawling out the woodwork, throwing a hissy fit about how they don’t want to live near “those people” and how the proposed development will threaten property values.

Let’s not forget that the implosion of the housing market drove millions out of crappy mortgages and into the rental market. At the same time housing prices crashed, rental prices skyrocketed. In Chicago, modest one-bedrooms that could be found for $600 ten years ago now go for $1,000 and up.

They get you coming and going.