This is Naked Capitalism fundraising week. 901 donors have already invested in our efforts to shed light on the dark and seamy corners of finance. Please join us and participate via our Tip Jar, which shows how to give via credit card, debit card, PayPal, or check. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our current target.

Yves here, as John Helmer explains in this post, one of the many focuses of economic warfare between the US and Russia is production of iron ore, in which Russia is a large player. Helmer describes how Urkaine is pushing to produce iron ore at the minehead, which means in Africa. Not only would Russia suffer, but Australia and Brazil would take collateral damage.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

The Ukrainian civil war, and its aftermath, economic warfare between the US, the European Union, and Russia, are transforming the global flows of the minerals from which steel is made. Starting with iron-ore, the future for steelmaking will start at the minehead, not in Australia, nor Brazil, but in West Africa. That is if Gennady Bogolyubov, the Ukrainian miner, can help to produce high-grade iron-ore at a cash cost of $20 per tonne. At that price, Bogolyubov and China’s iron-ore traders and bankers calculate, they will be able to break free of the global price-fixing for the mineral which has been dominated, until now, by BHP Billiton and Rio Tinto in the US camp, and Vale of Brazil.

Ending commodity price-fixing by just three corporations whose governments are tied to the US and the NATO alliance is also a strategic objective of Russia, which has sizeable reserves of iron-ore to export to Europe and to China. But for the Kremlin, and for its favoured iron-ore exporter, Alisher Usmanov, controlling shareholder of Metalloinvest, there is difficulty in reaching the $20 threshold – and finding Chinese investment financing to open new, big-volume, low-cost, high-grade mines.

Bogolyubov has been identified in the pre-war Ukrainian rich-lists among the five wealthiest figures in the country. Unlike his peers – Rinat Akhmetov, Igor Kolomoisky, Victor Pinchuk , Konstantin Zhevago, and Dmitry Firtash – Bogolyubov has remained personally outside the conflict, concentrating his assets in manganese mining in Australia and Ghana, iron-ore in Australia. Frequently mistaken for his one-time partner Kolomoisky, Bogolyubov has been the target of UK High Court claims by Pinchuk, which can be followed here. Bogolyubov is responding independently of Kolomoisky.

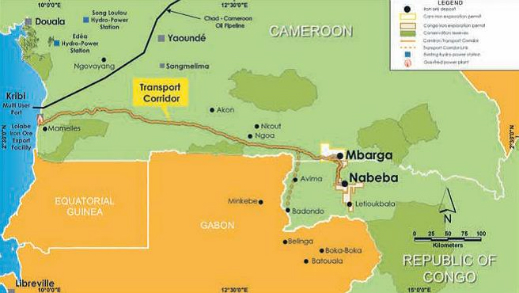

On September 3, Bogolyubov announced that he is financing Sundance Resources with the option to convert into an 18% shareholding, priced at A$40 million (US$35 million). The Australian Stock Exchange (ASX)-listed company said that on approval by regulators and other shareholders, Bogolyubov would take a seat on the 8-seat board. The proceeds would be spent, the company said, on preliminaries for the Mbalam-Nabeba iron-ore project in Cameroon and the Republic of Congo.

The design for this African project calls for two mine sites, a rail line to the sea, and a new port. With a resource estimate of 4.5 billion tonnes, according to the feasibility studies, and estimated output of 35 million tonnes per annum, the project would challenge Vale’s Brazilian mines and Rio Tinto’s Australian ones, as among the world’s largest.

Source: http://www.sundanceresources.com.au

Strategically, the Sundance project would be the largest independent source of iron-ore in the world, uncontrolled by either Vale, Rio Tinto, BHP, or Glencore, which is also starting an iron-ore mine at the Congo. For Bogolyubov’s strategy to succeed, a revolution in iron-ore pricing must convince the Chinese banks that the major producers can be knocked off their benchmarks, and the volatile spot-market pricing currently dominated by small, high-cost producers replaced by more direct Chinese control.

Bogolyubov’s entry would make him the single largest investor in Sundance. He replaces the Sichuan Hanlong group, whose owner, Liu Han, attempted a $1.2 billion takeover of Sundance between 2011 and 2013. The Hanlong bid collapsed when Liu and his brother were arrested on corruption, murder, and other charges. In March of this year the brothers were convicted and sentenced to death.Their fate suspended negotiations for Chinese bank financing for the project. These negotiations now resume with Bogolyubov and the Noble Group, the Singapore–based trader, which signed an agreement with Sundance in March to ship and sell mine production.

The financing requirement is estimated at $3.5 billion for the rail, port, power and other infrastructure costs, plus $1.1 billion for the mine itself.

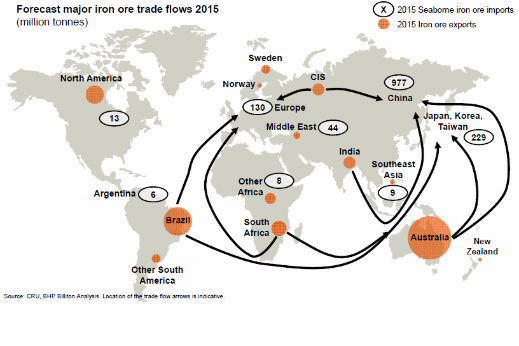

On the map of global iron-ore movements forecast for next year, Australia and Brazil dominate as the global sources of iron-ore; China is the dominant consumer. Russia’s significance as supplier to Europe in the west, China in the east, is relatively small on the map. West Africa is still a blank.

Source: http://businessmining.files.wordpress.com

Until now, Liberia and Guinea have been active targets of Russian mining investment – until the Russian oligarchs ran up larger debts to the state banks than they can afford to repay. Alexei Mordashov, the steel oligarch, has abandoned the Putu iron-ore project in Liberia, but cannot find a buyer. Oleg Deripaska is the dominant Russian in Guinea, but he can’t afford his obligations to open new bauxite mines and alumina refineries. Rio Tinto, Vale, and others dominate the future Guinean iron-ore fields, but they are in no hurry to invest as the price of iron-ore plummets at much the same speed as the re-election chances of the local despot, Guinean President Alpha Conde. For more on his Russian relationships, start here.

Kremlin directives also put an end to the attempt by Victor Rashnikov’s Magnitogorsk Metallurgical Combine (MMK) to invest heavily in Australian iron-ore through Flinders Mines in 2013. The domestic alternative is MMK’s Prioskol project, in western Russia, with reserves of about 2 billion tonnes. The largest undeveloped Russian iron-ore project is Timir, in the fareastern Sakha republic, with 3.5 billion tonnes. It is still on the drawing-boards of a joint venture between state diamond miner Alrosa and Roman Abramovich’s Evraz.

The oligarchs have proved unwilling to invest the multi-billion dollar sums over the long terms required to exploit Russia’s new iron-ore projects. They are not allowed by the Kremlin or the state banks to invest in iron-ore projects outside Russia. Instead, smaller volumes of Russian investment are going into higher-value iron products, such as pellets and briquettes, whose iron (Fe) mineralization is concentrated at a higher level than the ore at the minehead, with lesser impurities. That makes steel smelting more cost-efficient, with less pollution.

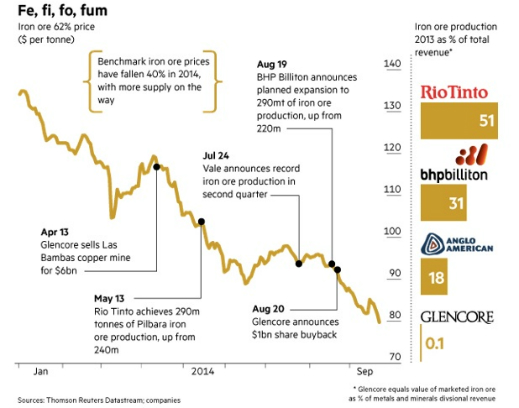

Without the mega-volume, mini-cost advantage of the Australian and Brazilian miners, Russian iron-ore producers are trailing in the competition for a future share of the Chinese import market. A study of the global market by Goldman Sachs, released on September 10, is uncertain what the Chinese strategy will be. The report claims that as mine supplies grow faster than steel demand, and iron-ore prices fall towards, or even below $80 per tonne, small Chinese iron-ore producers will be squeezed out of the market altogether. In their place, Goldman Sachs guesses that “in principle, the displacement of marginal producers should eventually lead to a balanced market with a high level of concentration among the top 4 miners.”

The Financial Times speculates that Beijing will have no choice but to let the foreign majors deliver more and more supply to Chinese ports and stocks, and let the falling price put Chinese mines out of business. “Demand in China for steel is not what it was. The ‘Li Keqiang’ index of (relatively) trustworthy economic indicators hit a post-financial crisis low last month. Yet it has coincided with big international producers opting to increase, not cut, supplies of iron ore. This is a classic attritional strategy. Iron ore for delivery in January to the Chinese port of Dalian dropped below $80 a tonne on Monday. Thus miners who extract ore for $85 or $90 a tonne in west Africa or China itself are straddling economic life and death. In theory, they should stop digging.”

Source: http://www.ft.com

Oleg Sheiko, the strategist directing Bogolyubov’s mining ventures, believes the supply and price projections won’t lead to acquiescence on the part of the Chinese. “If there is a cost and supply-driven contest between the majors and the Chinese, it is possible that it would result in the closure of too many mines, and make it difficult to restart them again. So what will Beijing decide to do? It will invest in long-term project equity and offtake security, preserving today’s cost and price advantage of the big projects. But this is not an advantage the major suppliers will be able to exploit in future, when the supply-demand balance tightens again. The Chinese want independence of them. This is what makes the Cameroon-Congo project even more attractive. To forestall the Big-Four [Rio Tinto, BHP, Vale, Anglo-American], Sundance is a unique opportunity for China to grab more pricing power.”

So what are the costs of iron-ore supplies, and who can compete now?

The latest report from Vale indicates that in the first quarter of 2014, the cash cost of its iron-ore production was $21.59 per tonne; the previous quarter cash cost was slightly lower at $20.84. Rio Tinto claims that at the end of 2013 its cash cost stood at $20.80. On other measures of cash cost, BHP Billiton is about $10 per tonne higher than Rio Tinto’s.

It is difficult for Russian iron-ore producers to compete, although the falling rouble and shorter transportation distances help to compensate. Chinese financing in Russian iron-ore mines has so far been restricted to the small Hong Kong-listed, UK-owned producer, IRC. But at its current, unreported cash cost of production, IRC is loss-making.

In Russia Novolipetsk Metallurgical Combine’s Stoilensky mine claims to be the lowest in cost at an estimated $18 per tonne; that was in 2010. In 2011 Severstal estimated its own cash cost and those of its Russian peers at slightly higher numbers, pushed up in part by adding the cost of producing pellets:

Source: http://www.severstal.com

Severstal’s latest cash cost (concentrate) estimates for the first half of this year are $43 for its Karelsky Okatysh mine, and $42 for its Olkon mine.

Metalloinvest, whose Mikhailovsky and Lebedinsky mines are the largest currently in operation in Russia with almost 15 billion tonnes of reserves, has published cash costs for pellets and hot-briquetted iron (HRI), but not for iron-ore: in 2013 Credit Suisse estimated that Metalloinvest’s cash cost at the minehead was around $30. This year, Metalloinvest told Moscow bank analysts that cash cost of iron-ore concentrate at the Lebedinsky mine is “around $30”; pellets, $40. The cash cost at Mikhailovsky is $5 to $7 more. That was before devaluation of the rouble began to lower the dollar estimates.

Roman Kunilovsky, the spokesman for Metalloinvest, said this week in response to a question about Fe grade that the magnetite ore at the Mikhailovsky and Lebedinsky mines has “an average iron content of 34% to 39%.” Because of the differences in Fe grade or percentage, the cash cost numbers aren’t exactly comparable. For the steelmaker, the optimum grade of iron-ore is Direct Shipping Ore (DSO) – that means ore of more than 60% Fe content, rich enough to go more or less straight from minehead to smelter. The Australian ore is DSO; the Russian is not. Concentrating the ore into pellets or briquettes adds cost, reduces competitiveness.

For transporting iron-ore to China, Russian rail costs erode the production cost advantage, and allow West African shipment, even over much longer seaborne distances, to become more competitive.

According to Sundance chief executive, Giulio Casello (left centre), “what the iron-ore price is today is almost irrelevant to this project.”

That’s because he is calculating a minehead cost of $25, and shipping cost of less than $25 per tonne. In five years’ time, Sundance believes its cash cost and shipping costs will be the equal or less than the Australian and Brazilian sources.

This week BHP announced a new plan of its own, increasing the volume of its Australian shipments by 29% to 290 million tonnes per annum; allowing the sales price to continue falling but preserving its profit margin by cutting the cost by 25% below the current level to “less than US$20 per tonne.” The iron content is estimated at about 61%. According to a BHP presentation issued on October 6, “we aim to be the lowest cost supplier to China.”

A source close to BHP comments: “there is no doubt that the expansions currently happening will further marginalise and cause high-cost [Chinese] producers to disappear as their production becomes uncommercial and their losses grow to the point of leading to their extinction. There is no doubt that fewer players in the market, even in a free market, can exercise greater leverage in terms of price outcomes by virtue of their ability to withhold supply.”

“This is a situation when independence of pricing in the new African iron-ore fields will be Sundance’s market advantage,” Sheiko notes. “Independence plus high grade – these are the two drivers of future global iron-ore shipments. The Cameroon-Congo iron-ore field we are developing with Sundance assures the main iron-consuming markets, particularly China, that it can have long-term security of supply at low cost and high grade. Chinese iron-ore consumption will continue to grow for the next decade, while the current iron-ore price makes domestic Chinese supply uneconomic. The Mbalam-Nabeba iron-ore project is the most advanced project in the region, and is a keystone for further developments of the iron-ore corridor in central Africa. While iron-ore prices are at a five-year low, the demand is expected to exceed existing operating capacity in five years’ time.”

A Russian steel industry source interprets BHP’s move as “a declaration of war against the rest of the iron-ore producers, especially the Chinese. If BHP is hoping thereby to dominate the future global price, it is going to be surprised by the reaction. The Chinese understand the risk of concentration very well – this is that the Australians, or the Americans behind them, will try to dictate terms to China’s steelmakers.”

While I have little doubt that WA production costs will be super-low, I’d say that the main drawback would be volatility of delivery. When you buy Australian (or even Russian) ore, you’re pretty much guaranteed to get it (short of ships sinking or similar). In WA you have gov’ts, civil wars, ebola and the likes that all can significantly affect the ability of the mines to operate and deliver. Just ask the oil majors in relatively stable Nigeria…

Yes, but just one quibble. Western Australia (major source of iron ore) is usually abbreviated as WA. The results of confusion between Western Australia and West Africa could be hilarious.

Superb post, I am quite grateful and will think carefully about this now.

However it plays out, it’s unlikely that the Congolese people will see much benefit from it. See for example:

http://www.thinkafricapress.com/drc/corruption-congo-how-china-learnt-west