Lambert here: Though I disagree with the thesis that taxes fund spending, I’ve always felt it would be a good thing to tax the rich heavily, for three reasons: 1) To prevent them from buying the political class and the government with their loose cash; 2) to prevent the formation of an aristocracy of inherited wealth; and 3) for the sake of the children of the rich, to whom great wealth often comes as a painful burden. To these reasons, the authors add a fourth:

Reducing the incentives for the most productive people in society to put effort into generating income leads to a reduction in labour hours provided by the top 1% earners on the order of about 30%.

We live in a financialized economy; hence — I would argue — the top 1% earners come from the FIRE sector. If this is true, then the work the top 1% earners do is parasitical and destructive.

If we had high paying private equity firms doing 30% less work looting firms, or highly paid banksters doing 30% less work fleecing customers, or HFT boutiques doing 30% less work gaming the markets, then I think the economy would be better off, not worse. Just because a tapeworm processes nutritive matter “productively” doesn’t mean tapeworms are productive for the body they inhabit. So I’m quite dubious about the authors’ claims for a “contraction of aggregate activity” if top earners are taxed at Eisenhower rates. In fact, aggregate activity might return to rude health.

By Fabian Kindermann, Postdoc, University of Bonn, and Dirk Krueger, Professor of Economics and Chair of the Economics Department, University of Pennsylvania; Research Fellow, CEPR. Originally published at VoxEU.

Recently, public and scientific attention has been drawn to the increasing share of labour earnings, income, and wealth accruing to the so-called ‘top 1%’. Robert B. Reich in his 2009 book Aftershock opines that: “Concentration of income and wealth at the top continues to be the crux of America’s economic predicament”. The book Capital in the Twenty-First Century by Thomas Piketty (2014) has renewed the scientific debate about the sources and consequences of the high and increasing concentration of wealth in the US and around the world.

But what is a proper public policy reaction to such a situation? Should the government address this inequality with its policy instruments at all, and if so, what are the consequences for the macroeconomy? The formidable literature on optimal taxation has provided important answers to the first question.1 Based on a static optimal tax analysis of labour income, Peter Diamond and Emmanuel Saez (2011) argue in favour of high marginal tax rates on the top 1% earners, aimed at maximising tax revenue from this group. Piketty (2014) advocates a wealth tax to reduce economy-wide wealth inequality.

Motivated by their analyses and recommendations, in our own research on optimal taxation at the top of the earnings distribution (Kindermann and Krueger 2014) we address the following substantial questions:

- What are the consequences of high marginal tax rates on the top 1% for macroeconomic performance?

- Is squeezing the maximum tax revenue out of the top 1% earners actually beneficial for society as a whole and if so, how large would the welfare gains be?

- Would a higher marginal tax rate on top earners only reduce earnings inequality, or would it also have a significant impact on the distribution of wealth, rendering a wealth tax obsolete or at least less pressing?

Modelling high labour earnings: A combination of luck and effort

Any analysis that wants to use models to reliably quantify the consequences of changing income taxes at the top 1%, and tax progressivity more generally, requires a quantitative theory that leads to earnings and wealth concentration in the economy consistent with the data. In our work we borrow the modelling strategy from Castaneda et al. (2003), who attribute large earnings realisations to a combination of luck and effort. Luck refers to an innate talent, a brilliant idea, amazing sports or entertainment skills or the like that carries the potential to generate a high income (economists call this ‘individual labour productivity’).2 Labour effort is needed since one still has to work hard in order for this potential income to materialise.

Attributing differences in labour earnings to differences in individual productivity is by no means novel to the work of Castaneda et al. (2003). What does make their work rather unique and very useful for our purposes is the way the structure of individual productivity over the life cycle is parameterised. This structure can be roughly summarised by two key elements:

- When starting working life at young ages, each individual rationally expects it to be possible, but not very likely, that she would end up as a top earner with very high individual productivity sometime during her working life.

- Having high individual productivity is a persistent but not a permanent state. While one might generate very high earnings for several years, there is a substantial risk of reverting to lower ‘normal’ individual productivity. Fully aware of this risk, individuals with high productivity understand that now is their time to generate most of their lifetime income, and choose their labour supply and savings accordingly.

We incorporate this structure of individual labour productivity into a life cycle model and compute the welfare-maximising marginal tax rate on the top 1% earners. We find that it is very high – on the order of 90%. We now explain why this is so, in two steps. We first argue that these high marginal rates are useful for generating substantial tax revenue. We then discuss why the welfare-maximising rate is lower, but not all that much lower.

High Marginal Tax Rates Can Boost Tax Revenues from Top Earners

When we search for the marginal tax rate on the top 1% earners that maximises tax revenue from this group, we find it to be very substantial.3 In fact, tax rates between 80% and 95% will do the job. The main reason for this is that earners in the top 1% income bracket react with only moderate changes in effort to changes in marginal tax rates. When one thinks about the structure of individual productivity over the life cycle outlined above, it is clear why this is the case. Even with high marginal tax rates, individuals at the very top of the labour productivity distribution can still generate a substantial amount of after-tax income, and they will do so to save and thereby insure against their uncertain and, in expectation, much lower future labour income.

Very High Marginal Tax Rates Don’t Necessarily Mean Very High Average Tax Rates

But what do high marginal tax rates on top earners mean from a practical perspective? Let’s take the example of a tax reform with a new marginal rate of 90% on the top earners. This certainly does not imply that a person earning $500,000 has to pay $450,000 in taxes. The highest marginal tax rates only apply to income above a certain threshold, in our 90% example (and in the context of our model) to any dollar earned above $300,000. For any income below this threshold, lower marginal tax rates apply.

In addition, increasing marginal tax rates for top earners boosts tax revenue from labour income quite substantially. This additional revenue can then be used to reduce marginal tax rates at the lower range of the income distribution. Consequently, in the tax system with high marginal tax rates on the top 1% earners, everyone whose income is below $200,000 a year would actually pay lower taxes than in the status quo tax system. And someone who makes half a million would still carry home more than $220,000, although admittedly her take-home pay is significantly less than under the status quo.

Consequences of the tax reform for the macroeconomy

Raising taxes on top income earners not only hurts the income of these people, but the macroeconomy as well. Reducing the incentives for the most productive people in society to put effort into generating income leads to a reduction in labour hours provided by the top 1% earners on the order of about 30%. This causes aggregate labour input and total wealth to contract by 4% and 14%, respectively, over the next three decades. The consequences for aggregate resources available for consumption are equally dire, and decline by 7%.

A proper criterion of optimality

Does this contraction of aggregate activity mean that increasing marginal tax rates at the top is a bad thing? Like most economists, we would argue that basing such a judgment on the macroeconomic consequences of the tax reform alone is misguided.4 In fact, just like reducing inequality or maximising tax revenue, boosting macroeconomic performance should not be considered a goal in and of itself. Consider a very simple example: The government could certainly reduce inequality in the economy to zero by confiscating all income and wealth and redistributing it equally among all households. In such a situation, people would likely stop working and saving as there are no individual incentives for doing so. The outcome would be a disastrous collapse of consumption for everyone. Few people would argue that such a situation is socially desirable, despite perfect equality.

In economics, life satisfaction is commonly measured as the flow of happiness generated by one’s own consumption and own leisure, often also termed ‘individual welfare’. This is fairly uncontroversial, at least among economists. What is controversial are the weights the government should give to the welfare of different individuals when it decides on optimal policy. There are young and old people, people alive in the future, poor people, and rich people. All these groups are differentially affected by a change in policy. But how should the differential effects on all these individuals be summarised in one measure of aggregate or social welfare? Our choice is to consider a government that compensates all people for a change in tax policy by giving them additional wealth (or confiscating wealth) to make each household as well off under the new tax system with high top marginal tax rates as they were in the status quo US tax system. After carrying out all these wealth compensations, would the government still have a surplus left over? And if so, how large is it? To maximise this surplus is the ultimate goal our benevolent government pursues.5

The Value of Social Insurance

When applying the above notion of social welfare we find, not surprisingly, that the welfare-optimal top marginal tax rate is lower than the revenue-maximising (from the top 1%) tax rate. Interestingly, it is not that much lower.

Why is it lower? Because the top 1% count in the social welfare function, and households currently not in the top 1% might actually get there in the future. Plus, future generations have a chance of getting there, too, and factor this in when calculating individual welfare.

Why is it not that much lower? Because the bottom 99% of the population gain along two dimensions:

- On average, due to the tax reform they face lower average tax rates and their consumption increases over their entire life cycle.

- Consumption inequality (measured as the variance of individual consumption across households) substantially declines as well, at least eventually.

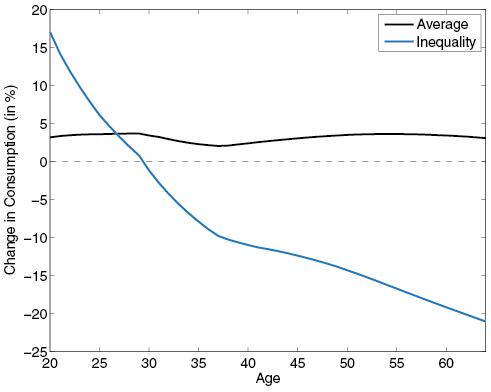

Figure 1 displays average consumption and the variance of consumption for the bottom 99% of the population over their life cycle, in deviations from their initial status quo values. It shows the benefits for this group from increasing marginal tax rates on the top 1%. While average consumption increases unanimously over the life cycle, inequality increases initially but then rapidly declines at older ages. Not knowing whether one would ever make it into the top 1% (not impossible, but very unlikely), households especially at younger ages would be eager to accept a life that is somewhat better most of the time and significantly worse in the rare case they climb to the top 1%. This type of social insurance via the tax system drives our optimality result.

Figure 1. Changes in average consumption and consumption inequality of the bottom 99% of the population from status quo US tax system to a system with high marginal tax rates on top 1% earners

Killing Two Birds with One Stone

We have seen that high marginal tax rates on top earners can increase both average consumption as well as reduce inequality for a large part of the population (the bottom 99%) despite the fact that it might lead to a macroeconomic downturn. But what will happen to the wealth distribution after such a tax reform? Will it still be so unequal that we might want to implement an additional wealth tax, as for example advocated by Piketty (2014)? Our results reveal that this is not the case. By taxing the source of high wealth concentration, namely extraordinarily high incomes, at a high rate, wealth inequality will significantly decline over time. Three decades after the reform has been implemented, the share of wealth accruing to the fifth quintile of the population (i.e. the wealthiest 20%) will have shrunken from currently about 84% to 67%. The Gini index (measuring overall inequality in wealth holdings) declines by a remarkable 15 points. Consequently, an additional wealth tax that aims at reducing additional wealth inequality might seem superfluous.6 Furthermore, relative to a wealth tax, a high marginal tax rate on top labour earnings has the advantage that labour (even at the top of the income distribution) tends to be much less internationally mobile than is wealth, thus leading to a lower extent of tax avoidance.

Conclusions and Limitations

Overall we find that increasing tax rates at the very top of the income distribution and thereby reducing tax burdens for the rest of the population is a suitable measure to increase social welfare. As a side effect, it reduces both income and wealth inequality within the US population.

Admittedly, our results apply with certain qualifications. First, taxing the top 1% more heavily will most certainly not work if these people can engage in heavy tax avoidance, make use of extensive tax loopholes, or just leave the country in response to a tax increase at the top. Second, and probably as importantly, our results rely on a certain notion of how the top 1% became such high earners. In our model, earnings ‘superstars’ are made from luck coupled with labour effort. However, if high income tax rates at the top would lead individuals not to pursue high-earning careers at all, then our results might change.7 Last but not least, our analysis focuses solely on the taxation of large labour earnings rather than capital income at the top 1%.

Despite these limitations, which might affect the exact number for the optimal marginal tax rate on the top 1%, many sensitivity analyses in our research suggest one very robust result – current top marginal tax rates in the US are lower than would be optimal, and pursuing a policy aimed at increasing them is likely to be beneficial for society as a whole.

References

Badel, A and M Huggett (2014), “Taxing Top Earners: A Human Capital Perspective”, Federal Reserve Bank of St Louis Working Paper 2014-017A.

Castaneda, A, J Diaz-Gimenez, and J-V Rios-Rull (2003), “Accounting for the U.S. Earnings and Wealth Inequality”, Journal of Political Economy 111(4): 818–857.

Diamond, P (1998), “Optimal Income Taxation: An Example with a U-Shaped Pattern of Optimal Marginal Tax Rates”, American Economic Review 88(1): 83–95.

Diamond, P and E Saez (2011), “The Case for a Progressive Tax: From Basic Research to Policy Recommendations”, Journal of Economic Perspectives 25(4): 165–190.

Fehr, H and F Kindermann (2014), “Taxing capital along the transition – Not a bad idea after all?”, Journal of Economic Dynamics and Control, forthcoming.

Kindermann, F and D Krueger (2014), “High Marginal Tax Rates on the Top 1%? Lessons from a Life Cycle Model with Idiosyncratic Income Risk”, NBER Working Paper 20601.

Mirrlees, J (1971), “An Exploration in the Theory of Optimal Taxation”, Review of Economic Studies 38(2): 175–208.

Piketty, T (2014), Capital in the Twenty-First Century, Cambridge, MA: Harvard University Press.

Piketty, T, E Saez, and S Stantcheva (2014), “Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities”, American Economic Journal: Economic Policy 6(1): 230–271.

Reich, R B (2011), Aftershock, New York: Random House.

Saez, E (2001), “Using Elasticities to Derive Optimal Income Tax Rates”, Review of Economic Studies 68(1): 205–229.

Footnotes

1 Mirrlees (1971), Diamond (1998), and Saez (2001) are fundamental contributions to this literature.

2 The words income and earnings are used synonymously here and both refer to income generated from labour (including bonuses, stock options, etc.).

3 This is in line with related research on this topic (see e.g. Diamond and Saez 2011 or Piketty et al. 2014).

4 In models without household heterogeneity and thus representative agents populating the economy, the connection between aggregate consumption and social welfare is of course much tighter than in models with substantial household heterogeneity like the one we employ.

5 This measure of social welfare turns out to be equivalent to maximising a weighted sum of individual lifetime welfares. Fehr and Kindermann (2014) show how different wealth transfer schemes translate into different weights in the aggregate social welfare function.

6 Admittedly wealth inequality is still substantial after the proposed reform.

7 Badel and Huggett (2014) offer some insight into how revenue-maximising top tax rates change when high productivity is mainly attained by human capital investment.

I don’t “buy” the premise that money or the love of money is a human incentive. The three reasons you list are sufficient for a high marginal tax. The only thing missing is the political will.

The fallacy of the rightwing point of view is not the belief that money is a motivator. It’s the idea that money is the only motivator. Of course in practice business, as opposed to GOP ideologues, understands this and deploys a more sophisticated understanding of psychology in its sales pitches. Therefore the essence of our modern capitalism is not Wall Street or its apologists but Madison Avenue. Behavioral manipulation is their bread and butter.

As for the wealthy, money for them equals power and power equals self preservation–the most basic of all human instincts. They defend their unjust lifestyles because they can imagine no other.

Marianne Cooper, a Stanford sociologist, and researcher for Cheryl Sandberg’s book Lean In has written her own book, Cut Adrift. She spends extensive time with several families across the income spectrum in the Bay/Silicon Valley area, and writes about how they all suffer from financial anxiety. They merely worry about different things. The poor may worry about paying rent or medical bills. The wealthy fret they haven’t saved enough for their children’s college education, as good parents among their socioeconomic peers should, or perhaps they did but then failed to save for retirement. Household incomes over $250K was her criteria for “wealthy” (? in CA). Because I have sisters, whom I know very well, as well as knowing others, who qualify, and qualifying myself once upon a time, as “wealthy”, I agree with Dr. Cooper. The more money you have, the more you spend and the more you need. No amount is enough. Admittedly she didn’t include (and I don’t know) a Bill Gates or David Koch, or other members of the super wealth echelon. Perhaps there is a point financial insecurity resolves, and is replaced by a need to enlarge the sphere of power and influence.

By the same token, I’ve found that ANY (up to a point) amount CAN be enough. There is actually a field of science that studies happiness and what leads to it. Income isn’t a particularly strong predictor. Instead its having a sense of purpose, one is making an important contribution that benefits others than themselves, and having a strong network of social connections. In the US, happiness peaks at an income around $60K, at which point basic necessities can be assured. Beyond that, happiness declines as income increases. I’d even argue that the $60K figure is a whole lot higher than one needs, at least for one or two people. My income is far less, and I’m able to have everything I need, and still enough to help others. I’m not always happy but it isn’t because of how much income I have, or don’t have. In fact, the years when I was “wealthy” were the most miserable, which is why I walked away from it.

It’s true. Money doesn’t buy happiness.

A few years back H’wood put out an interesting movie called The Joneses. The premise was that a marketing company would have a fake family (headed by David Duchovny, Demi Moore) move into an upper middle class community and show off various luxury goods such as flash cars and clothing to make their neighbors want to buy. I don’t think the film made very much money but it was a sharp take on Americans’ chronic “status anxiety.”

So yes money doesn’t buy you happiness but it is the job of our marketing saturated culture to convince you otherwise.

http://www.imdb.com/title/tt1285309/

money (a certain minimum amount for a reasonable standard of living) is necessary but not sufficient for happiness in modern times because the resources of survival have been monetized .

a serious student of this subject is more than likely to study the life of the buddha, who was born into riches. But he was exceptionally honest. and in his time money was not necessary to survive.

Consider the possibility that money is really not the issue. It’s been said semi-jokingly that money is just a way of keeping score – and I believe that that is mostly the truth.

Try on the idea that the pecking order is just as important in human society as it is in a flock of chickens.

Once the hue and cry about “social “Darwinism” dies down you can see any number of ways that pecking order determines any number of things in our society. Once you get past the idea that it determines who gets to peck on who, you can see that “pecking order”, even in chickens, is a subconscious force for stability. Once the hierarchy is determined, everyone fights to uphold the status quo.

Pecking order determines why everyone in a company goes after the whistle-blower even though they know that he is right. Certain parts of racism have more to do with pecking order than they have to do with hatred of another race. If you are close to being white trash, it’s absolutely necessary to overreact to the slightest incident that implies that you are outranked by a minority person. If you don’t overreact, the price is unbelievably high.

The need to fight you way to the top is equally necessary if you are part of the 0.01 percent. Maybe not necessary, but part of our DNA.

And we don’t notice it – in the same way that fish don’t notice water.

Perhaps chickens would pay no attention if the top rooster hoarded so much scratch that the survival of the flock was threatened. I doubt that gorillas are that stupid. The silverback would be unlikely to idiotically take so much food as to harm the community in the first place and would suffer a mass attack if he did. The deanthropomorphization of humans is valid only if we’re significantly less intelligent than the great apes.

I don’t believe that it has anything at all to do with intelligence. Farmers are familiar with “the boss hog” who keeps everyone else in the barnyard from eating, even after he has eaten his fill. He’s not part of a society, and it seems not to matter to the boss hog if all of the other animals starve.

The nature of the pecking order is that the chickens do not rebel – ever. The hierarchy changes when one of the birds dies, or when a new bird is introduced to the flock. As best I can tell, the boss chickens do not worry about what happens to the rest of the flock, chickens are natural born sociopaths.

Years ago, Robert B. Cialdini wrote a book called “Influence”. One of the more interesting ideas was “Reciprocity”. When someone gives you something, you feel a powerful impetus to give something back. Back in the 70s, the Krishnas used to work the airports, forcing a flower or a book on people who tried their damnedest to avoid them. But once the flower was forced on them, they felt obliged to give some small amount of money in return.

Reciprocity has a powerful effect on peoples behavior even while they deny that it has any effect at all. I believe that a whole collection of unconscious rules come out of pecking order behavior, including most of what we label as “greed”.

It’s not a matter of intelligence, it’s simply herd behavior that has been refined by a couple hundred thousand years of living in herds.

For a number of years I’ve been making notes for a book: “The Big Chicken Gets the Corn”. It may or may not ever get written. Of course if we actually understood how it worked, we would no longer have a society – we would probably have a Congress-critter hanging from every light pole in DC.

I think reciprocity is valid for most. Narcissists and sociopaths aren’t subject to its influence however. They think a different set of rules apply when it comes to them. Other people exist only to serve their needs. There has been a steep increase in the incidence of narcissism in our “me, me, me” society and its especially prevalent among those who have been highly successful.

A single-minded focus on self-interests, along with the amorality to serve those interests at the expense of others, have proven to be highly adaptive traits. Similarly, Bill Black talks about Gresham’s dynamic. In a nutshell, “the cheaters win”.

As a Human, I reserve the right to think before I act instinctually. I would never choose to be as thoughtless as a pig or a chicken. I also choose to believe other great apes are more worthy of emulation than swine, birds or reptiles for that matter. But perhaps the intermediate responder is thinking of the sub human ordinary people rather than the exalted classes, when he restricts motivation and behavior to that dictated by social instinct.

the barnyard and the chicken pen are a restricked that are not present like this in the wild

we likewise are citizens of a town or city, state and country

Income as a way to keep score is not a joke above a certain level. That is one reason why the estimate of a 30% reduction in working hours because of high marginal tax rates is absurd. If you reduce your work load past a certain point your score drops. (The relationship at the top between hours worked and effectiveness is not simple. Remember what J. P. Morgan said: “I can do one year’s work in nine months, but I can’t do nine months’ work in a year.”)

The post addresses one of two problems with the analysis of the highly paid:

1. That doing the job the highly paid do is good for the society. Less work done by some of the sociopaths at the top might actually be a good thing.

2. If the job is necessary, then it is implied that nobody else on the planet could cover for the reduced workload of the highly paid. There are such jobs but they are rarely extremely well-paid. Often the reason the highly paid don’t want to cut back on their workload is that if they did work less then someone else might take over all of their job. They do not want to risk losing their position.

& as soon as someone is paid money then that someone is more likely to claim that the money was earned. Taxing the highly paid gives the impression that the highly paid are doing charity for the rest while the true narrative is the opposite. The highly paid are taking more than they are worth and then pay a small portion as charity to the people who lost out due to the highly paid looting. Tax is useful for reducing income inequality but it has limitations.

Ties in nicely with the post below…

Pertaining to this part:

“and then pay a small portion as charity to the people who lost out due to the highly paid looting”

I will have 500k of earned income this year. My taxes:

12.4% of the first 117K goes to FICA

39% is my marginal tax rate

3.5% is my ACA device tax

8% is NYS tax

That comes to about 53% all in. How much higher than that do you want my tax burden? I’m at the point where more than half of what I earn goes out the door.

Go ahead and tax me at 90%. I’ll change my ways and not pay a dime in taxes. You think that is good economics? Your tax plan takes me out of the workforce and I contribute nothing.

If I make $500k and you tax me at 90% I take home $50k. That would be far less than someone making $200k in your example. You think that is a fair outcome? If so, please explain.

PS I also pay $50k in property taxes and another 8% on anything I buy. Net-net I’m the guy who is paying the government’s bills. And you want to stop me from being productive and a big tax contributor? Try that – You’ll hate the results.

Anyone claiming high income on a blog comment is usually earning just above minimum wage. Do you also drive a porsche and date supermodels? Given you don’t understand that a top marginal tax rate of 90% doesn’t mean you lose 90% of your income, I have my doubts.

BK’s bio on his blog states that ‘I worked on Wall Street for twenty five years.’

Since he was in trading rather than the mail room, it’s likely that he was pulling in better than minimum wage.

I don’t like to indulge in ad hominem, but BK does not seem to understand taxes or the word, “marginal”. It does not seem likely that he understands finance.

BK: “If I make $500k and you tax me at 90% I take home $50k.”

That’s not what a 90% marginal tax rate means. Case in point.

Never been a ‘car guy’. I have a 6 yr old Nissan. I also have a farm truck – a 15 year old Tundra – it’s beat to hell, but I still like it the best.

As for super-models – I wish. That stuff is for Derek Jeter, not me.

I also have kids and grand kids, I’d rather do something for them than chasing ‘lookers’ and hot cars.

It is interesting to me that you occasionally read Naked and make comments loyal to your income class. This one reminded me of Mitt’s ill-fated 47% comment. Mitt threw out the question, which got ignored, asking what can be done about this situation. The “rich” are already hammered by taxes and the poor are reduced to foodstamps. So, in your mind, what is the solution?

What’s the solution? I don’t have one. I see every developed country and (most notably) China facing a two-decade long road of aging population. In Japan, population is actually falling. In Europe it is about breakeven. The US is growing, but only from immigration.

These are incredibly powerful forces that will be with us for a generation. These are deflationary forces. It’s possible to push against this demographic wave on a short-term basis. Deficit spending and zero interest rates can make a difference. Keynesian economics “works”.

Japan is the poster boy for demographics. It’s now 20 years of marginal/negative growth. They’ve tried everything. They devalued the currency by 40%. Did 3Xs the amount of QE the Fed has done. They are spending themselves into oblivion (debt to GDP = 230%!)

And Japan just slid into another recession.

You can’t fight the demographics. 6% GDP and 4% CPI is not attainable in the US. But that is what most deep thinkers would like. Policies that try to achieve that will disappoint. If Plan is A is off, what is plan B? Plan B would be low growth, low inflation. Some years okay, the next so-so, every 8 a bad one. The struggle is to achieve 1% growth.

B is a very negative outlook for the world’s Central Banks, but the next 20 years will likely be a great time in history. Enjoy.

One thing I wouldn’t do is raise marginal tax rates on earned income to 90%. That would backfire – and it will never happen.

Japan has an extremely minimal welfare system and an aging population, leading to a severe sense of insecurity and a very strong incentive to save. The stimulus they did at the beginning of the crisis hasn’t been repeated, and the sales tax hike threw them into recession again. Japan’s debt reflects the strong propensity of the Japanese to save. No bank ever went under from too many deposits! And QE is just QE. Pushing on string, as they say. Regressive sales taxes just aren’t helpful when people are fearful for their future in an unstable world economy. What would probably help the most would be a strengthening of the social safety net, giving people enough confidence in the future to stop saving so much.

The keys to health and a long life: 1) low calorie consumption and 2) lift weights.

Sounds like you are keeping in shape with that farm truck and good for you.

For a nation, the keys become 1) Low consumption (save the planet as well) 2) make your own stuff, have a solid manufacturing base, and minimize imports.,,raw materials, only those you don’t have.

Your math is flawed. That 39% is only on the taxable portion greater than 250k. That’s why it’s called marginal.

Okay, 90% marginal is not 90% effective. But if I can say that, then please look at this through a different lens. I say you have to look at total effective taxes, not just marginal rates. I pay a lot of money to a lot of different government(s). SECA, Federal, State, City, Local, Property, Sales.

Lambert, (and most of the commentators) seem to hate the 1%. So who are these people that are so evil?

If one made 272k in 2013 they made it to the 1%. 1.5m people had earned income of this amount. Many Dr.s, most surgeons, most Congressfolks, most Wall Street types, all the CEO’s in the Fortune 500, virtually every pro-ball player in the country, all the folks you seen on the screen and TV, most talking heads, a few bloggers (Krugman), Kim Kardashian (what does she do?), many owners of their own business, well, I could go on. The fact is that 272K is not such a big number any longer, and people from all walks of life are in the 1%.

I hope that Lambert hits the 1% someday soon. Then he can hate himself.

The details on 2013 earned income in America – from Social Security Administration:

http://www.socialsecurity.gov/cgi-bin/netcomp.cgi?year=2013

‘I hope that Lambert hits the 1% someday soon. Then he can hate himself.’

LOL Bruce! With money, one can afford SHR (Self-Hate Reduction) therapy. And massages too!

Nobody’s really addressing your underlying point: the proposition that it’s acceptable for the hive to impose any arbitrary level of taxation desired, up to 100%, to pursue social goals such as income redistribution.

Collective theft is no more honorable than individual theft by free-lancers, which (by universal consensus) results in arrest and imprisonment. Why is it any different when the guy with a gun has a badge?

The underlying point that’s missed is that individuals cannot produce great wealth by hard work. A community is required to do the work that produces the wealth. [money represents wealth but is not itself wealth!] The 1% gather the wealth created by others in the community. To demand that they pay to support the community they parasitize is not redistribution. It’s fair payment for the produce of our labors that the masters take from us. It’s just retribution for the harm the rich do and the threat to survival they represent!

I believe in teamwork.

You need customers to get rich, or need counterparties.

In any case, if you can create wealth alone, let’s see you do it on Mars alone, and never come back to Earth.

I can’t answer for Lambert, but I can respond for myself. I don’t hate the 1%. It’s the 0.01% who infuriate me. Nobody has done anything to deserve to be a hectomillionaire or billionaire. We need a tax code that prevents the creation of such fortunes, and which claws back the ill-gotten gains from existing fortunes.

People at the lower end of the top 1% are usually only a problem when they advocate policies that benefit the 0.01%. Please don’t be a shill for the parasitic ultra-rich.

+googolplex.

The 0.01% like to hide behind the 1%.

They do. I personally peg it at the 0.1%, or as I prefer to call them, “the million dollar a year crowd”. (That’s roughly accurate.)

Okay – I got it it. You hate the .01%.

For the record, there were 6,058 people who were the .01% in 2013. To make it to this hateful status you had to earn $3m.

The average salary in the NBA is $5m. For baseball it’s $3m. There are plenty of football players getting that. Anyone you see on the screen is getting that, so are a lot of people who actually make movies. You hate that group?

Obama made $5.5, a few years ago. You hate him? How about all the talking heads on the nightly news? Judge Judy? Vana White?? Kelly Ripa? Scarlet Johansson?

Look up who made what. These are not people you should be hating.

I said that they infuriate me. I did not say that I hate them, although some of them probably deserve hatred. Nobody deserves to be paid millions of dollars for playing sports or for being a talking head on a vacuous TV show. Obama is especially infuriating, since so many of his campaign promises were lies.

But if you prefer, we can complain about the 0.001%.

Anyhow, back to the 0.01%. There are actually more than 6,058 people in the top 0.01%, so I’m going to let myself be diverted on a tangent which will probably produce little useful information. What was your source for 6,058 people? It seems peculiar.

There were about 310 million people in the U.S. in 2011, so the top 0.01% includes about 31,000 people. There’s a spreadsheet at the IRS web site showing the incomes for tax year 2011:

http://www.irs.gov/file_source/pub/irs-soi/11in04atr.xls

Maybe I could have chosen an easier source to use, but anyhow, there are 3 categories:

Returns with regular tax computation only.

Returns with Form 8615 tax computation.

Returns with Schedule D tax computation.

Returns with incomes of $10 million or more are 547 + 5 + 10,849 = 11,401.

Returns with incomes $5 million or more, but below $10 million are 1,378 + 36 + 17,710 = 19,124. Total adjusted gross incomes of $5 million or more on tax returns for 2011 come to 30,525.

There are a total of 108,423,790 individual returns for 2011. I’m sure a lot of them are joint returns. I don’t know how to compare the number of tax returns to the size of the population, because of joint returns and children, but the percentage of tax returns with adjusted gross incomes above $5 million is 30,525/108,423,790 = 0.028%. But if we divide that number of high income tax returns by the population 30,525/310,000,000, we get almost exactly 0.01%, but that’s probably misleading. Okay, I’ve just wasted half an hour. Have a nice evening!

Is the 1% income or wealth … answer very carefully …

Good point, JRS. Some people will be in a high income category only a small number of times in their lives; perhaps for only one year. But if a person is in the top 1% of wealth, he or she has probably had a high income for many years. If a person’s wealth is in the top 0.01% or top 0.001%, then that person really is sitting on a huge load of money and/or property.

Yes, I was thinking about surgeons as well. It doesn’t seem like that great of an idea to discourage the top brain surgeons to work less and free up more work for second tier surgeons.

So there’s a fixed quantity of brain surgeons? Seems odd.

Yes, there is. Nothing odd about it.

There are only ~200 training spots each year for neurosurgeons. But I guess that’s because evil organized medicine artificially restricts residency spots. So if we open neurosurgery training to all comers, you will have… ~300 neurosurgeons (that’s about how many apply each year). Even with the restricted slots of 200, only about 150 each year complete the 7-9 years of training. The rest drop out somewhere during the training process. So with a 25% dropout rate, even if every medical student who wishes to become a neurosurgeon was allowed the chance to do so, you would get ~225 neurosurgeons a year.

That’s about it. Unless you believe there is some supply of people who are a) skilled enough to become a neurosurgeon, b) interested enough to choose it over the myriad other careers available to such a skilled person, c) and yet not skilled enough to get into medical school, even with all the AMA-induced limits on med school spots…

This seems to be an absurdity. Higher marginal income taxes would somehow “discourage the top brain surgeons to work less” (assuming the double negative was inadvertent) or have brain surgeons working less? How is that supposed to work? Do you really want a brain surgeon operating on you who is only thinking about money?

I don’t know about any given brain surgeon but hasn’t money chasing including by actual healthcare practitioners just about ruined medicine as a profession? Wouldn’t WE ALL rather have doctors who make an ok living fine (they do in just about every industrial country even though it’s less) but who were in it to help people? Wouldn’t we all rather live in that world?

At a certain point noone will care because that brain surgeon won’t be covered by their increasingly lousy healthcare plans anyway.

I could be wrong, but I recall that ophthalmologists and radiologists are the highest paid physicians.

Actually, the 39% tax rate doesn’t kick until you make 390,000 in taxable income.

Your effective tax rate is ~25%, plus FICA and the rest (too lazy atm to calculate accurately). Let’s say a third of your income. Nowhere near close to 50% as you say.

And the 92% tax bracket suggested here worked just fine in the past (eg Eisenhower). And it only applied to any income above $400k, which, adjusted for inflation, would be $3,5 million. So it wouldn’t even apply to you.

PS: Everyone is paying sales tax/VAT. And for those with lower incomes, that is a far greater percentage of their income. Flat taxes are a greater burden on lower income earners.

‘The 92% tax bracket suggested here worked just fine in the past.’

It sho did. Those were the salad days of tax shelters. Film partnerships, cattle partnerships, oil drilling partnerships, and on and on.

Yep, tax code transparency is for the birds. Let’s go back to the good old days of gnarliness and opacity. Tax professionals need jobs too!

When we had high tax brackets, 92 percent under Eisenhower, lowered to 70 percent under Kennedy I think, I recall there were two deductions available that gave any high income person the option of paying no tax: an unlimited deduction for gifts to charity, and an unlimited deduction for business investment or depreciation. I don’t remember exactly how that worked. People could also defer income by buying whole life insurance with a lump sum, then borrow the money back. Anyway, tax sheltering created jobs with the money, and that was the intent. The money stayed here and didn’t fly away into overseas investments or go to consumption of imported luxuries. Tax shelters weren’t always bad. Sometimes the available money invested in new ventures started whole new industries. For example, the wine industry in the Pacific Northwest was begun as a tax shelter destination that quickly blossomed to profitability.

Actually, Jim, most of those funky partnerships did not exist until after Reagan rewrote the tax code in 1986, at which time the top marginal rates were drastically lowered. Top rates were in the 90% range until 1964, 70% or so until 1982 and 28% after the full implementation of the 1986 rewrite. Then George H. W. got savaged for raising the top rate by 3%. They moved up to 39.6% under Clinton.

I was licensed to sell those partnerships and they were all structured to take advantage of the loopholes in the Internal Revenue Code of 1986.

Paul – You are correct. Some of the tax shelters were structured as profit-making enterprises, with tax benefits secondary, and were successful. However, many were structured primarily around the tax benefits and failed miserably because there was no rational business purpose, only tax avoidance.

And most of the tax-benefit partnerships I saw had initial fees from 30-50% of the original investment which meant the underlying business had to double in value just to bring the investor back to breakeven.

So you are asserting that the tax code has been cleaned up and made significantly more transparent since the fifties? Are you sure you want to stick with that?

Here’s an idea: a 90+% top marginal rate *and* a simple code minus the accreted 10,000 pages of loopholes and associated corruption. Why the false choice framing?

Hopefully, they made better movies then.

Was ‘Attack of the 50 Foot Woman’ made with some tax-shelter partners?

The 1986 tax reform law specifically excluded oil and gas partnerships from the limitation on passive losses. So, yes, our tax code allows for oil and gas tax shelters.

Too funny! People who love their job will work no matter what the pay is. Maybe it’s time you cut your hours an hire someone who would love to work… then you can write it off as a business expense so you can pay less tax. LOL!

Exactly right. Do less, make less, pay less taxes. But what does that get You??

You see I just don’t understand why people hate paying taxes so much. This irrational hatred is what makes the system so corrupt and inefficient.

Instead of spending so much energy minimizing taxes, they could be exerting the same amount of energy making sure these collected taxes get put to good use.

No one objects to taxes that go to pay for basic public services. But financing public services doesn’t cost a fortune.

Progressive taxation is not intended to pay for public services; it’s tribute for the welfare-warfare state. Review the history: the first U.S. income tax was briefly introduced in 1863 to pay for Lincoln’s war. When it returned in 1913, it paid for Woody Wilson’s war. When Frank Roosevelt hiked top rates to astronomical levels, the heightened take paid for WW II, the Cold war, Truman’s war, and Johnson’s war.

Progressive taxes enable the welfare-warfare state to conquer distant lands full of strange, exotic people … so we can tax the shit out of them. Noble!

And yet taxes are a lot less progressive than they once were but the warfare state is still going great guns. Perhaps these two matters–tax rates and government behavior–are not so connected as you suggest. Indeed I’d say one defining characteristic of our current financial elite is an enthusiasm for war, an unwillingness to pay for it, personally or financially.

Elizabeth Warren has it right that taxes are a type of user fee. Those who benefit the most should pay the most. Our vast capacity for force projection is surely not to defend ordinary people but rather the financial interests of the elite. As for the welfare side–things like food stamps–that’s to keep them from being skewered by pitchforks.

Really good point Jim & Carolinian. Warfare-Welfare State. It’s hard to imagine that the top 1% fudging their taxes just because they are so loopholier than the rest of us have single-handedly skewed our economy to disenfranchise the bottom 80+% of us. Looking at the European countries since WW2 – they (an now Russia) have become peaceful nations and they have the money to do social programs that benefit their societies. Isn’t it interesting that the US maxed out its war budget and when it decided to go into the Middle East with guns blazing suddenly the EU fell into a depression? Gotta wonder.

‘And yet taxes are a lot less progressive than they once were but the warfare state is still going great guns.’

As Michael Hudson and Yanis Varoufakis and others have pointed out, it’s America’s ownership of the global reserve currency and seignorage on the dollar that’s really paying for the US military-industrial complex since the US went off the gold standard.)

http://en.wikipedia.org/wiki/Seigniorage

(And you can see why Russia and China wouldn’t be too happy about a global regime where they’re essentially underwriting their opponent’s military.)

My spouse and I had comparable childhoods. I studied in math, he in computer science. We started on an equal footing. In finance, at one point I was making 3X his income and I would say he had to tolerate an equal amount of stress at work.

While he attended pizza lunches, had to share hotel rooms with co-workers, I got to stay in 5 star hotels, flew business class, etc. He also got to enjoy pager beeps in the middle of the night. Was I working “harder”? Hardly. I just happened to be working in a sector of the economy that was directly benefiting from money printing.

@ Moneta

EXACTLY! +infinity

And FICA is not 12.4%. Social Security is 6.2% of the first $117,000 for 2014, ($118,500 for 2015) and Medicare is 1.45% (with no limit). I think Ben is correct. (As is greg and Th D).

It’s called SECA. The tax on the millions of Americans who are self employed pay the full 12.4% SS tax up to the cap. Look it up.

I did err however, the SECA tax for me is 15.3% for earned income up to the cap. I left out the HI portion above.

Yes, as a self-employed person you pay both the employer and employee portion of FICA/SECA. I am quite familiar with that. I’ve been a tax professional for 12 years. However, the employer portion is a deductible business expense and the 15.3% is applied to your net profit/earned income after that deduction. As is the income tax (after other adjustments). If you want to talk about how your personal earned income is taxed you can’t legitimately add back a business expense.

how can you pay 50K in property taxes?

I don’t even pay 50K in rent! Total.

why not get a cheap apartment and save the cash for 10 baggers. That’s what I do. unfortunately, I have succumbed rto all the doom & gloom I’ve read here over the years and though the market would crash. So I went short on several occassons. Had to cover at a loss each time. I also thought gold would go to 3000. Instead it went down 50%. In general, I haven’t gotten lucky.

Thankfully my rent is cheap. If I had to pay 50K in property taxes, that would be the end of my search for a 10 bagger. If I get the 10 bagger. I’ll probably keep renting, because I’d still rather throw 50K at a new 10 bagger than at the local tax collector. faaaaak.

You ought to move to Queens & rent a place in Astoria. It’s still pretty cheap. I do’n’t live there, yet, but it doesn’t look bad. Lots of good restaurants and a few boulevards to stroll down in style. There’s even a park by the river. Bellive me, llife could be worse than that. and no 50K in property taxes.

Anyone paying that amount of taxes with a check is guilty of destroying money…perhaps unpatriotic, when we are confronting deflationary pressures, at least in the oil sector.

The author explicitly cites the case of $500K income as an example. With a 90% tax rate at $300K, take home pay is $220K. Granted that doesn’t include state taxes, or sales taxes or gas/alcohol taxes, etc. Nor do those of your political persuasion include those taxes when referring to the 47% who pay no taxes.

The authors also assume a 30% reduction in productivity among top earners with higher taxes. You might be a leading contributor to that figure. But most I know in that bracket would reduce their hours, despite any protestations to the contrary. However, it would require ending tax loopholes and shelters, and the IRS beginning to provide real enforcement of the tax code. It’s estimated 30% owed is uncollected as it stands now.

Due to a vindictive ex, I’ve been audited 4x since 2004 (don’t ask me how) and my income falls under the median, and each time I was cleared. Yet a friend who just retired from the IRS says they won’t pursue the high-income evaders, as they find themselves outgunned by CPA’s and tax attorneys. He said if people only knew, nobody would pay taxes. After being rebuked by Congress 20 or 30 years ago, for harassing high earners, investigators (he had been one) adopted the attitude of “Fine. The hell with it. We won’t pursue them at all anymore.” I’m sure there was some exaggeration involved, but the point remains. The focus is on the small fry, who represent themselves and are seen as low-hanging fruit.

Typo above, critical to meaning. Should read:

But most I know in that bracket would not reduce their hours

So at 500k a year the only reason you work is money? Woah are you messed up. See a shrink.

90% is about right for *you*, bkrasting. By your self-description, you’re a worthless parasite, and if you decide to stop working, it means more jobs for unemployed people. I don’t believe you’d actually stop working at your parasitical job on Wall Street, but if you did, yay!

Every dollar you have is a government dollar, by the way. Look at what’s printed on it. You didn’t print that.

We live in a financialized economy; hence — I would argue — the top 1% earners come from the FIRE sector. If this is true, then the work the top 1% earners do is parasitical and destructive.

——

To get redistribution, the first thing that society must understand is

– the definition of a self-made man. No one can make it alone. Every single rich person needed the foundations of society, created by billions of individuals, to become rich.

-Most of the rich come from industries that benefited from printing. Millions of people work harder than the rich in sectors that do not get printing and only depend on trickle down .

– Free will is not what most think it is. Neuron-Science is starting to wake us up to this fact. When you start to accept how the brain works, you start to realize that most of our social structures are the equivalent of trying pigs in the middle ages. What we have today is not real choices but the tyranny of circumstances.

The problem today is that Americans really believe they deserve the income they earn. We’ve got to make it clear that the 1% are not middle class as they currently think they are.

My computer keeps on replacing neuroscience with neuron science… and I did not catch it!

Welfare-Warfare-Trickle down is a full plate. Aberrations. Lambert’s intro was better than the post. He addressed what so many hesitate to put too fine a point on – that there is such a thing as parasitic money. If taxes are imposed on industries that are extractive and have no social purpose we certainly will not harm an economy that is dedicated to a good society. But look at all the hysterics: even as far back as WW1 war skewed it all; and after the war came the roaring 20s wherein people were expected to go into debt to bail out the war debt which then gave us the great depression because in the end it became as fraudulent as obfuscated asset backed securities. No doubt that is where rampant rehypothecation got its start. So then we couldn’t really change the situation because FDR didn’t want to create inflation because a strong dollar was the way rich America gained a trading edge and the very rich were in control of it all; so the next best solution was WW2 – and we justified it by planning to kill 2 birds: Get rid of those pesky neo-imperialist Germans and Japanese And get rid of those pesky communists. And also too print money and impose austerity. Clearly nothing has changed in the bag of tricks. And blablablah. So fast forward to Reagan and supply side economics. Aka the equivalent of war without the war. Prevent inflation by eliminating demand from below – that’s the demand created by wages seeking goods and services and causing wage inflation. Instead we blithely chose to impose a new austerity by off-shoring labor altogether. Inflation solved. Productivity? To the moon. Instability? Duh.

We tried these tax rates in the usa and they produced a prosperous middle class. Piketty makes this more objective. A 15 minute summary of the book is at http://www.pikettyexplained.com

Relying on high marginal tax rates to fix income and wealth inequality after the fact is dumb because Federal taxation destroys money and thus the price of greater income equality may be a lower standard of living. An equally poor society is not preferable to an unequal rich one because SOME wealth and income equality is natural and results from differing talents, work ethics, individual priorities, etc. and benefits us all.

What we should aim for instead is to preclude UNJUST income and wealth disparity and to rectify previous unjust wealth and income disparity. That way, we should be able to have both a wealthy AND a largely equal society or at least as equal as it should be.

Excellent post.

Another reason to increase taxes on the 1% is to stop the rending of the social fabric that is a result of ever widening inequality. IMO, the place to start is by taxing interest and equity distributions / gains as ordinary income.

Also make sure these guys pay their taxes with coins so ‘taxation does not lead to money destruction.’

Omitted from the definition of “luck” here as possessing inherent skill or ability is birth-family race and socio-economic status, and also connections to empowered cronies (school, work, etc. connections) within the established rent-extraction structure. The rosy, meritocratic construction of luck plus effort leading to economic success fails to be usefully explanatory without considering these additional arbitrary factors, which are not a result of any meritorious effort. It coveniently omits the fact that different tribal memberships convey different types of “luck”.

I am sceptical of any model attempting to gauge so many interacting factors due to the large number of simplifications and assumptions that necessarily have to be made to get it to “work.” Such a model is more likely to reflect the philosophical predispositions of the researchers than anything in the real world. I don’t say this to be critical of some of the conclusions, which I am, but rather to say I’m wary of placing any reliance whatsoever on this model’s validity. Faux precision, however impressive seeming, is meaningless, worse, misleading.

I’m with bkrasting and Jim Haygood. Moneta says:

‘Too funny! People who love their job will work no matter what the pay is.’

What I think is too funny is that Progressives don’t think incentives matter. They do matter. Their idea that high earners will continue working when the ‘collective’ is taking 90% of their next dollar is ridiculous.

By the way, Moneta, I don’t mean to single you out. You’ve said brilliant things on other threads on NC with which I strongly agree. But the idea that you can tax high earners at a 90% rate and not affect their behavior is right up there with a belief in Santa Claus in my book. And I think there are very serious risks involved. Howard Hughes became the richest person in the world during the 90% marginal tax rate regime, and he did so by making everything in his life an expense. If you want to turn the rich into tax dodgers, raise the marginal tax rate to 90%.

We’re already risking turning low income people into tax dodgers as a result of the penalties in Obamacare. At some point the United States becomes Italy without the lasagna.

I’ve noticed that they (the upper class) seem to dodge taxes regardless of the rate – either the effective rate or the actual rate. Also, the greatest artists seem to continue their work regardless of compensation. Michelangelo was classified as skilled labor and paid as such in his day. Disclaimer: former Art major, a great way to learn from history.

I disagree. My father made most of his wealth during the high tax days of the 50’s, and without using extensive shelters. He always worked hard, because it was part of his nature, and he liked what he did. He was good at it and it gave him a source of meaning and success in life. Few are successful who don’t have these qualities. Oprah worked just as hard when she was anchoring news in Baltimore as when she was America’s richest woman. I’m disabled and unemployed. I do volunteer work. I’d rather work for free than not work at all. I’m not unusual. When I worked with the seriously mentally ill, on permanent disability and unable to make it past an interview, “did you find me a job yet?” was often the first question asked when I came to visit. Most people WANT to work.

If I had enough money I’d retire permanently at any age so if I was rich money would NOT be an incentive to keep working. Why would it?

And I’m not rich and still other incentives motivate me much more than money,

But if I didn’t know how I’d pay a rent and utilities then would money motivate me? You betcha. And that’s how this society actually works.

Incentives do matter… that’s why finance, which used to grease the economic wheel, has now become the wheel. Our system is now incentivising the wrong people and/or the wrong sectors.

I grew up in a family where the general idea was that if you are paying taxes it’s a good thing because you have a job and a social net. Noblesse oblige and its derivative.

Because of a generalized societal disgust towards paying taxes amid a desire for a social net, politicians are FORCED to lie to us.

The thing is that high incentives don’t necessarily attract the right people… they can attract those who hate what they are doing but will accept it only because of the big $$$. The ones who do it for the $$$ will typically promote short-termism while lower incentives could attract devoted workers who offer better long-term planning.

High earners facing an effective cap by a 1% marginal tax rate would have a huge incentive not to slack off below their value to their employer. Anyone who thinks there is a direct linear relationship between earnings and that earner’s value to society are more naive than I. If the majority of the 1% disappeared today, I doubt society would even notice.

I suggest seizing all individual assets exceeding, say, $10 million, enact global debt jubilee (wipe out ALL debt) restructure the dollar so it is not privately owned and managed and is not debt based, put the agents of the dollar @ the Fed/banks/gov etc to work washing public bathrooms or the like (growing veggies) for a decade or so, for minimum wage, end the drug war and weapons export, revoke and review every corporate charter, put the people to work rebuilding the infrastructure for long term sustainability, preservation of resources, embark on the healing of the land, air and waters. :)

The Great Helmsman would also provide enough barefoot doctors to address our health care crisis as well.

We just need many young, hippie Red Guards to get this off the ground.

No thanks, on the Helmsman part. (Funny too, how in this country, it’s the Repubs who are called red, lol.) As to healing the earth and restructuring the financial system, the former will take care of itself in time, the second will come as inevitably as night; and likely neither will be intentional on the human part.

I’m just throwing ideas out there, compared to the rest of this culture, which is more like, “we want the future to look EXACTLY like it does now, just better.” Like, “we want to the same financial system, we just need to reform it,” as if the system itself is not the root of the rot.

As for barefoot doctors, that’s what everybody gets for Health Care if we keep pretending the economy will just work itsef out, we can go on exploiting like we do forever and always. 12 billion like the UN says, 2100 – surely the earth will be an abundant garden!

The article seems quite myopic. Makes some presumptions that I question:

1) There are individuals worth much more than $500K to society (or more than some reasonable ratio)

2) That employers would consider it a wise business decision to give 90% of the wages they pay to the government

3) That, given the fiat money system, that taxes are of any benefit to society in reality.

( by this I mean, in reality, taxes are merely a gimmick used by governments that issue sovereign money to make it appear reasonable to the average person who can’t print his own money.)

This whole discussion is about angels dancing on the head of pin.

You have a nasty, unenlightened way of writing. You stand nothing to gain by employing the term “bankster” constantly or referring to entire industries as “parasitic and destructive”.

What is that you do to pay your bills? (surely it’s not blogging)

Name-calling is almost always ugly and alienating. Just imagine: if people actually listened to you there would be even fewer ethical people in the financial sector.

It’s not possible for there to be fewer ethical people in the financial sector.

Unless your moniker is a confession, can you help me discern why FIRE are referred to as “industries”?

This was meant for “Fool”.

OK, I stand corrected, “sectors of the economy”. Better?

I’ve been saying for *years* that we need to reinstate the 1986 tax reform, permanently. And probably do something about carried interest too. And transfer pricing, and… (fill in the blanks)…

Carried interest should be treated as ordinary income, and taxed at progressive rates.

I would like to suggest another reason as well. The immense amount of money held by the rich is effectively sequestered from circulation, effectively starving the real economy of working capital.

The question I never see asked these days is “why on earth should society’s wealth producers tolerate seeing 90% of their gains confiscated by a tiny number of capital owners who produce nothing at all?”

Investment could just as easily be made by us, collectively, in the form of government, and the rich can simply move to the Cayman Islands or Bermuda or wherever. They are not necessary to a functioning economy in any way whatsoever. To tolerate inequality is a choice, not a monetary, fiscal, or social necessity, and to allow the decline in investment in our children’s futures in the form of budget cuts because we just can’t bring ourselves to tax billionaires is irresponsible in the extreme.

And perusing the white-collar crime news, it appears that Balzac was on to something.

“In our model, earnings ‘superstars’ are made from luck coupled with labour effort.”

How naive can these people be? I think it has been shown that the people who consistently beat the investing market average returns and beat them by large margins do it by engaging in illegal behavior. Insider trading, cheating your customers and lying to them in violation the disclosure rules of the SEC, bribing ratings agencies, and myriad other dishonest ways of making more money than the average smart investor.

Crooks need to be caught and punished as an incentive for honest people to stay honest. A form of Gresham’s law is working to drive out the good financial people in favor of the crooks whenever we fail to enforce the laws. We need to punish people committing criminal acts, not the corporations in which they perpetrate control fraud over these corporations.

Yeah, it’s pretty clear that the vast majority of the obscenely rich (100-millionaires & billionaires) got there through fraud.

There are only two ways to get ridiculously rich:

(1) Luck (luck of birth or inheritance, luck gambling on the stock market or similar, etc)

(2) Fraud (theft from customers, employees, investors, etc.)

Talent and work can get you $200/hour — doing that 12 hours a day for a year still won’t get you a million dollars a year. To do that, you have to start stealing.

” aggregate activity might return to rude health.”

Only it wouldn’t, because we’re now up against resource limits.

Well, we can but try. I’d rather do a Pascal’s wager that we can have a non-sucky economy on renewals and recycling than continuing down a certain road to ruin, as we are.

NB: My income makes me a part of the 1%, so dismiss this as shilling for my class if you don’t wish to engage my arguments but here goes:

1) I fully supported the Occupy movement, but one of their mistakes was choosing the 1% as a cutoff. While it’s a nice rhetorical device, they should have chosen at least 0.1% if not 0.01%. Much of the 1% is comprised of professionals and successful small business owners, of the type that we as society generally wish to encourage. Interestingly, the “rich and famous” such as actors, athletes, etc. only make up the 0.1-0.01%. Even them, at worst we might feel are worthless, but I doubt people think they are actively contributing to the destruction of our society. Above 0.01% is almost all financial industry types, inherited wealth, and rent-seeking investment income. If your wish to is prevent that type of activity, you’re causing a lot of collateral damage by targeting the 1%.

2) Using the tax system to prevent destructive behavior is admitting defeat that we lack the political strength to directly ban the behavior we don’t want. It’s like building bigger jails instead of focusing on reducing the crime in the first place.

3) You can’t have it both ways. If the goal of a 90% tax rate is to reduce the “bad” activity, you have to accept that you’ll reduce “good” activity as well. You can’t assume that a surgeon will keep working his ass off for the love of medicine while assuming that a Wall St. exec won’t keep working his ass off for the love of the finance game. If a 90% tax rate suppresses activity, it will suppress *all* activity taking place at that marginal rate. Again, that’s a lot of collateral damage (in this case, productive work that society needs and benefits from).

4) While I never worked under the 90% tax regime, I have a lot of colleagues who did, and what they tell me backs up other commentators who’ve made the point that no one actually paid that 90% tax rate. There were tons of loopholes and tax shelters that brought your effective rate down tremendously. Indeed, part of Reagan’s compromise in lowering marginal rates was closing a ton of those loopholes, such that many high income individuals found themselves with a higher effective rate under Reagan than they did before. Yes, that’s anecdotal, but it’s instructive to note that the AMT (Alternate Minimum Tax) was started in 1969, during the era of high marginal tax rates, precisely because tax shelter abuse was so rampant.

So, to summarize, I would argue that the proposal is unlikely to be effective (tax evasion will increase), is likely to have significant collateral damage (in the form of discouraging work that is beneficial to society), and takes the focus off much more effective means to accomplish the same goals, namely changing the regulations to directly prohibit the activities we find destructive.

Yeah, the 0.1% or even the 0.01% is the correct cutoff.

Only those of us in the 1% are actually close enough to see this, though, because of the Richistan phenomenon, where the billionaires are hiding themselves away from the rest of the world. They are a bit easier to see if you’re in the 1%, and then you can see how crazy and isolated 0.1%ers are — the Versailles syndrome.

Obviously the author of this article failed to address the purpose(s) that Taxes should serve, as a general matter. If one believes Taxes should levied solely and exclusively for funding specific and clearly identifiable government services and that any additional use/purpose is likely theft per se, and therefore taxes should be allocated among taxpayers in proportion to the benefits each taxpayer receives from the taxes, most of the issues raised in the article become moot. I wish people writing on this subject would focus more on their views about the fundamental purpose(s) of taxes generally…