Yves here. This article is an important sanity check on the impact of the current oil price war on Russia. We’ve seen similarly skewed conventional wisdom on the Saudis: “No, they can’t make it on a fiscal budget basis at below $90 a barrel,” completely ignoring the fact that the Saudis clearly believe it is in their long-term interest to suffer some costs to inflict pain on some of their enemies, and render some (a lot) of shale oil and alternative energy development uneconomical, which increases their ability to extract more in the long term from their oil asset.

By Colin Chilcoat, a writer at OilPrice. Originally published at OilPrice

After a frosty reception at the G20 summit in Australia this week, Russian President Vladimir Putin required some much needed rest, at least according to the official explanation given for his conspicuously early departure from the proceedings. All things considered it could have been a lot worse. Russia finds itself in familiar territory after a controversial half-year, highlighted by the bloody and still unresolved situation in Ukraine. Nonetheless, the prospect of further sanctions looms low and Russia’s stores of oil and gas remain high.

Shortsighted? Maybe, but Russia has proven before – the 2008 financial crisis for example– that it can ride its resource rents through a prolonged economic slump. Higher oil price volatility and sanctions separate the current downturn from that of 2008, but Russia’s economic fundamentals remain the same – bolstered by low government debt and a large amount of foreign reserves. Moreover, Western involvement in Russian oil and gas plays is more pronounced than ever.

Economic diversification has not come easy for Russia, arguably for a simple, but effective reason; oil and gas are a source of tremendous wealth for the country. However, the dire straits of the 2008 global crisis illustrated the importance of financial diversification. Since then, Russian state-owned oil and gas giants Rosneft and Gazprom have increasingly allowed Western majors like BP, Eni, Exxon, Shell, Statoil, and Total access to some of Russia’s underdeveloped, but prized projects. Western companies have an estimated $35 billion tied up in Russian oil with hundreds of billions more planned and service providers Halliburton and Schlumberger each derive approximately five percent of their global sales from the Russian market.

The Western majors remain committed to their extra-national ventures and these powerful relationships ultimately limit the sanctions’ scope. Still, with their cooperation put on hold, Russia has been forced to look elsewhere, and increasingly within. Rosneft is set to announce new Arctic partners by the end of the year, a role formerly dominated by Exxon. China appears a likely suitor as the two countries have already embarked on a promising oil partnership in Russia’s Far East in addition to the highly publicized long-term gas deals. Domestically, Rosneft and Gazprom have strengthened their alliance and Putin has approved the creation of a state-owned oil services company.

The learning curve will likely be steep, but early successes have bred high hopes and oil production is not projected to contract. Gazprom Neft just completed its third delivery from their Prirazlomnoye project, the world’s first stationary Arctic platform. Shipments from the promising field have now exceeded 1,400,000 barrels on the year. Onshore, homegrown technology and execution has already yielded huge results in East Siberia, which looks to overtake West Siberia as Russia’s primary producing region in the near future.

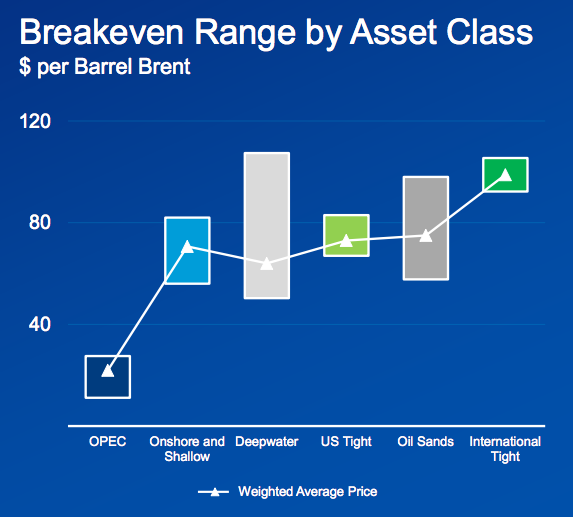

The picture is incomplete without a discussion of price, and oil’s sinking value – a combination of low demand and increasing supply, US shale included – spells trouble for a number of major players, Russia among them. The breakeven price, or the production cost per barrel, is the central figure here however, and in an international game of ‘how low can you go’, OPEC is in the driver’s seat.

Source: Chevron, 2014

Still, the lower prices – Brent crude has averaged $81 per barrel thus far in November – are in no party’s best interest and OPEC will do their best to keep prices high while defending their market share. The cartel’s upcoming meeting in Vienna on the 27th will go a long way in determining the future trajectory of oil prices. The global supply glut will be the focus, but theories surrounding both US and Saudi collusion and conflict give doubt to any plan for unified production cuts.

Business as usual in Vienna would be a welcome sight for Russia, who would see a decline in the United States’ ability to define geopolitical events in the Eastern Hemisphere. The truth is, the US can’t win any volume or price-based game of brinkmanship with the traditional producing states, Russia included. Shale plays in both Russia and the US will soon be priced out with continued slippage. Unlike the States however, a majority of Russia’s production comes from cheaper, though declining, fields in West Siberia. The International Energy Agency already predicts a 10 percent decline in US shale investment in 2015.

Whether or not that’s enough to stunt global supply remains to be seen. Shaky situations in Iraq and Libya could just as easily remedy pricing woes overnight. What doesn’t kill you doesn’t always make you stronger, but Russia can survive a price war.

The question isn’t whether Russia can survive an oil price war, but whether Putin can survive one.

I suspect that Putin and the other Russian oligarchs will survive quite nicely. The average Russian, on the other hand, may not do so well.

The situation may develop in a fashion similar to the U.S. “recovery” from the Great Financial Collapse. Recall the celebrated Tcherneva chart, which shows that people in the top 10% of the U.S. economy have experienced about 120% of the growth since the Collapse.

Putin’s approval ratings are at record highs. Even the intelligensia in Moscow, who had been highly critical, are now supporting him in the face of Western attacks on Russia. And Russia was in far worse conditions in the years immediately after the USSR dissolved, so memories of vastly worse times are fresh.

This seems to me a good time as any to restart a process of reindustrializing Russia – sanctions could actually be useful for this very purpose. The Russians at minimum should be able to handle most oil & gas extraction/dev with homegrown technology and manufacturing and the successes mentioning seem to confirm the potential. I’m not too sure if Putin’s gov is heading in this direction for most basic manufacturing – I think they’re still to wedded to the current neo-liberal “free-markets” fluff.

They probably have to import knowledge… and at a crucial time in their economic development, they are being infected with an oversupply of neoliberal fallacies and business people whose only goal is to exploit them.

“They probably have to import knowledge”

Seems to me I read recently that Russia had committed to reverse the “brain drain”, and in fact it had already reversed and is ramping up the other way…a “brain draw”.

From my uninformed POV, it seems to me that Russians are far more able to weather bad economic times than other countries. They know how to suffer.

“The question isn’t whether Russia can survive an oil price war, but whether Putin can survive one.”

Easily.

1) The Russian gvt’s foreign-currency-denominated debt is trivial, and all her bills are in Rubles. So the floating Ruble counterbalances the oil price decline nicely. Fewer $/barrel, but more Rubles/Dollar.

2) The declining Ruble makes an import substitution strategy more effective.

3) Russians remember the last time Western-oriented ‘FreeMarketDemocraticReformers’ were in charge. ‘FreeMarketDemocraticReforms’ had put ~60% of Russia’s GNP in the hands of seven bankers, who considered paying taxes & wages a decidedly lower priority than stripping assets from the businesses they had acquired by payoffs to the Yeltsin ‘Family’, and offshoring the proceeds. The Russian government was bankrupt. Debt payments to Western banks & intl. institutions was about 50% or the Russian government’s total revenue. There were cases of death by starvation in remote Russian army posts. Overall, deaths in Russia were exceeding births by a million/year.

And all the Anglosphere Foreign Policy Elite & Punditocracy (AFPE&P) would say about the situation was

“Moar Reforms!!! Faster!!!”

By contrast, in 2013, births exceeded deaths in the Russian Federation for the first time since 1991.

And the AFPE&P are permanently outraged at Putin, and have been ever since Putin took down their Golden Boy Khodorkovsky in 2003. The AFPE&P care not how, or even whether, Russians live, only that the Russian government submit, which Yeltsin did, and Putin does not.

And Russians know this.

So, yes. Putin will survive this easily.

I think you’re right. And I hope you’re right.

Yeouch-if that graphic is accurate, how can TransCanada and BP continue to keep plowing capital into these sinkholes?

Don’t know about Schlumberger, but Halliburton absolutely does not get ‘5 percent’ of its global revenues from the Russian market. more like 2.5 percent. and the profit margins are much lower than in other markets because of higher costs of doing business. moreover, since the sanctions virtually all of their client base is off limits. Halliburton will probably leave Russia altogether, as was alluded in a recent moscow times piece – http://www.themoscowtimes.com/business/article/sanctions-squeeze-western-oil-service-companies-out-of-russia/507136.html

if the halliburton-baker hughes merger goes through, that means that 2 of the 3 major players will be gone, and i wouldn’t be surprised to see schlumberger follow suit. without modern drilling technology available, russia will be hard-pressed to fully exploit its energy reserves.

This is what I don’t understand. US, canada, australia oil industry will die first long before Russia. US:expensive shale oil, Canada expensive sand oil, Australia expensive deep water gas. None of them can survive $60-70/barrel oil. Russia can. Painful, but not lethal.

If Oil touches $60/barrel, the entire US shale oil industry, including the mos competitive texas one will fold. The next question: what will happen to trade deficit? Borrow money from china to buy middle east oil?

This on top of ever unstable middle east situation.

so, you tell me who will survive the oil war.

The US doesn’t “borrow” money from China or anyone for that matter as it is the sovereign issuer of its own currency via keystrokes. The US offers those in possession of dollar assets, which earn no interest, the option of exchanging them for US Treasury Securities that do pay interest, also in dollars, via the same keystrokes.

https://ir.citi.com/rBWYa6YM4Scr4LsmpuQB8DZubx61JU8NqGw5jsCxMMfxMRxBp4u4gwbWrQgfNlfhzMSpx1Jv3qA%3D

Energy2020 out of america

Of course Russia will survive, so will us scale oil production. The graph is overly pessemistic on breakeven for developed production. More like $40/bbl. Saudi Arabia will run out of bullets first

There are two arguments that get conflated, and IMHO this article might have focused on the wrong one. There is the production break-even, and the fiscal break-even, which is the price of oil a state needs to maintain its government finances. The Saudi fiscal break even has been pegged at $90 a barrel. However, the Saudis have plenty of borrowing capacity, so they can play the predatory pricing game for some time.

The Saudis have the best petroleum engineers in the world. They are also widely cited as having the lowest production costs. No matter how glossy the presentation (and I note a lot of undue bullishness re shale oil here), I’m skeptical of a single analyst’s report so out of line with what is reported virtually everywhere else.

It will remain to be seen if the saudi arabian reserve capacity over time is sufficient to replace shale oil production below all of it’s players breakeven. Im guessing no. As for russia, their state controlled production will soldier on, gasprom will begrudginly assist rosneft. It will be interesting to see what SA idle reserve production capacity turns out to be recalclated as

The only thing not being addressed that’s crucial to all this is the peak oil question. I guess oil must abiotic ally replenish somehow if the Saudis can just endlessly kick out the jams whenever they feel like crushing the competition? They’ve been doing this since the early 70s

I hear what your saying..

All mere speculation, but the US shale oil industry is not an amorphous interest so although it may in aggregate have an average breakeven price of $**/bbl, it is composed on discrete players. Presumably the expensive ones may go upside down and idle, but there are lower breakeven plays that will muddle on. Personally I don’t think Saudi Arabia has the idle capacity to pull the stops out on that will supplant the lower breakeven shale oil. SA has traditionally been VERY opaque on real reserves and idle capacity. the latter would have to be bigger than I think it is. In any case, it’s not a long term play that I think will work to kill the shale oil industry, bloody its nose, of course.

As far as Stadia Arabia having the best petroleum engineers (and petroleum geologists?), that may or may not be the case, never thought about it. If they do I’m guessing most are American and European contractors, not Saudis. It’s a good question, I’ll probably be having beers w/ a couple frmly w/ UOP & Amoco this weekend that would be at the top of the list in those professions, I’ll ask them that. Surely I’ll solicit an unbiased opinion HAHAHA

.

I am not sure that to idle is possible as shale oil companies are major issues on debt on junk market. They need to service those loans. And with typical life of the a shale well of less then three years, they need to drill and drill to stay solvent. Now they can’t get new financing. So my take on this that they might go bankrupt.

You are right that Russia will be severely hit by sanctions. They are already suffering. But

one interesting issue is the ability of Russian to compensate for Western technology from Chinese or other sources. They have huge experience in this particular area as during Soviet times they were under sanctions all the postwar period.

I think they also might realize that they actually do not need to rush as their foreign debt is not that large. They can use accumulated foreign currency reserves for some time leaving some oil in the ground for now as oil is now the most powerful convertible currency. So they can join OPEC and cut output as the matter of common policy. That will be huge surprise for the US policy makers.

I feel that outside few “indispensable” companies those major Western companies that left Russian market has little chances to return. Some are intentionally pushed out (Coca-Cola). In any case for US food producers the market share will shrink. Also looks what is happening with German auto and industrial exports right now. German suppliers are now treated like “also run” and simply avoided in new contracts, if such a possibility exists. That policy also effect “easy money”: all US major accounting/auditing companies might now be shown the door.

Does not not diminish the damage for Russia. I just want to say that sanctions are two way street and Russians might have a few tricks in their sleeves as the US elite is stretched between containing Russia and containing China.

There is problem here — short terming of the US foreign policy. I am slightly skeptical about the abilities of the current ruling oligarchy in the USA to calculate the position three or four moves ahead in this chess party.

Many important technologies are in some form are now available elsewhere, so the key question is whether the US can persuade other countries to join the sanctions game. So far they managed to coerce/persuade Europe (not without Merkel help, NSA probably has something on her ;-).

And if Hillary can become the next President, then all bets are off. She has a unique ability to spoil everything, in foreign policy. Probably only Senator McCain can compete with her in this particular ability. Such chickenhawks as her might be a huge liability for the USA as a country.

All this talk of the price of oil… Oh, the tears of crocodiles. Cry me a river.

Russia survived world war 2 despite the loss of 20million lives she survived the 1950’s-1989 despite the shortages of everything that resulted from the command economy. Russia survived the collapse of the USSR despite the collapse of the economy it had left after 72 years on the communist road to nowhere.

anyone who thinks that these absurd sanctions are going to accomplish what the nazis, economic collapse and the loss of empire did not accomplish is brain dead.

if the russian people know how to do anything, it is how to survive anything.

I just had a thought: maybe they’re tired of surviving hard times.

So did I: And so they should become a subsidiary of USA Inc?

They should do what Americans should do: get some leaders who aren’t members of the 0.001% and aren’t beholden to the oligarchic class. Of course, people in neither country are likely to do that, mostly because it’s very difficult, but also because naive people in both countries support their predatory leaders.

Crop failures due to command economy needs a bit of granularity.

“A form of Lamarckism was revived in the Soviet Union of the 1930s when Trofim Lysenko promoted Lysenkoism which suited the ideological opposition of Joseph Stalin to genetics. This ideologically driven research influenced Soviet agricultural policy which in turn was later blamed for crop failures.”

Skippy… Spencer Hubert’s posse strikes again!

The bit about (in comments) the elasticity of oil producer states and their currency was interesting. Makes more sense of the ‘petrodollar’ than before. Demand rules. I’m still puzzling over a reported comment by Merkel that Putin is “delusional” in his foreign policy. Does his delusion run toward the US or against us?

More oil . . . more carbon skydumping, more ocean acidation, more climate dechaos decay.

Well! isn’t that special.

I found this last night, but don’t know if it reflects Russian or Putin’s views, or whistling past the graveyard.

http://fortruss.blogspot.com/2014/11/grandmaster-putins-golden-trap.html