By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Mortgages are hard to get, and inventories of homes for sale are low: Those have been the dominant reasons cited by the industry to rationalize the crummy home sales that have disappointed pundits for over a year. But now those memes have been debunked by homebuyers themselves.

Each real-estate data-gathering entity has its own methods, so results vary. But the direction has been consistent. Today, real-estate broker Redfin released the November data for the 41 or so major metro markets it serves across the US. The terrible numbers came with a conundrum:

With gas prices low and consumer confidence at the highest reported level in seven years, there was a lot to be cheery about heading into the holiday home-buying season. However, positive consumer sentiment did not translate into more real estate transactions last month as the number of homes sold plunged 21% in November versus October and was down 5% from this time last year.

Yet the median sale price rose by 6.2% year over year. It’s not jumping in the double-digits anymore, as in the two prior years, but it’s still rising, though sales are falling.

The National Association of Realtors, when it reported similar but not quite as dismal results before the holidays, offered its own conundrum: “Fewer people bought homes last month despite interest rates being at their lowest levels of the year.” It also blamed “stock market swings in October.” Which makes you wonder what’s going to happen to housing when an actual correction sets in, or a bear market or worse? And finally with a nod to reality, it admitted that “rising home values are causing more investors to retreat from the market.”

The NAR, a lobbying group, has been on the forefront of pushing Washington to bamboozle taxpayers ever deeper into subsidizing mortgage lending, and thus mortgage lenders, based on the premise that if nearly free money, guaranteed by the taxpayer, is made available, few questions asked, for mortgages that require nearly no down-payment, it would inflate home prices further and thus make agents more money, which would be good for homebuyers, and for the nation overall, or something.

So Fannie Mae and Freddie Mac caved. Earlier in December they unveiled mortgage programs with down-payments as low as 3%. It would put homeowners with nearly no skin in the game underwater at the slightest market downturn. It piles much more risk on lenders, and ultimately taxpayers, via the same sorts of shenanigans that contributed to the Financial Crisis.

The lobbying group was ecstatic. In its statement, it said, “NAR applauds Fannie and Freddie’s commitment to homeownership….”

It’s all part of “healing” the housing market by inflating home prices beyond the crazy levels of the prior bubble-peak, while putting the taxpayer on the hook again. It has worked so well that the market is now running into the same problem it had smacked into so catastrophically at the end of the prior housing bubble: despite super-low mortgage rates and increasingly loosey-goosey underwriting, home sales are tanking.

All year, we’ve been guessing that this was happening because people couldn’t afford the prices anymore or refused to pay them, and we’ve lined up data points and anecdotal evidence, and we’ve theorized about it. But now we heard it from the horse’s mouth: from homebuyers.

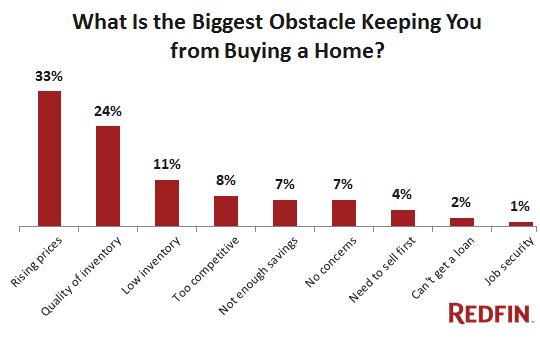

In Redfin’s Real-Time Buyer Survey of homebuyers, the biggest obstacle to buying a home wasn’t that a mortgage was hard to get or that there wasn’t enough inventory to choose from or that the stock market had a hiccup or whatever – but rising prices.

One-third (33%) of the respondents said that “affordability in the area I want to buy” was the biggest obstacle for them to buy a home.

And 24% griped about the quality – not the quantity – of inventory, which is another outgrowth of inflated prices. In the price range that a specific homebuyer can afford, there are suddenly only those homes that last year used to be in a much lower price range. Just to make a lateral move in financial terms, a homebuyer would have to step down a lot in terms of quality. But folks aren’t eager to step down and drastically lower their quality of life just because their incomes have stagnated while home prices have soared.

Those two categories combined accounted for 57% of what homebuyers considered the biggest obstacles to buying a home:

Low inventory – “not enough homes for sale,” – which the industry has held up as excuse all year, was seen as an obstacle by just 11% of the respondents. And here is the answer to Fannie Mae and Freddie Mac, and the army of lobbyists around them: only 2% – almost no one – complained that they couldn’t get a mortgage.

Redfin cites one of its brokers, who pointed at the same conundrum:

“If you can’t afford any of the homes for sale, it doesn’t matter how many homes are on the market,” said Leslie White, a Redfin agent in Washington, DC. “Despite the low interest rates, prices in DC are so high right now, many homebuyers feel priced out of the market. They’re being forced to decide between putting their home search on hold and renting another year, buying a significantly smaller home, or looking in neighborhoods farther away from the city.”

And if those hapless souls wait “another year,” and the housing market in DC continues to “heal,” they will be even further behind.

This rampant home-price inflation is the result of the Fed’s “bold actions.” The Fed has long prided itself in “healing” the housing market, along with inflating all manner of other assets, with its zero-interest-rate policy and by dousing Wall Street with newly created money. There is no limit anchored in reality how far stocks can be inflated. Irrational heights only encourage further buying, at least for a while. But housing is still subject to reality: inflating prices beyond the reach of homebuyers kills sales.

Sales in DC dropped 3.9% year over year, while the median sale price still edged up 2.6% to $360,000. Now imagine what a homebuyer faces in San Francisco where the median price, according to CoreLogic DataQuick, soared 27% year over year to hit an all-time record of $1,072,500. That might buy a 2-bedroom no-view apartment in a so-so area. Yet sales over the same period plunged 20%.

That was the moment when the prior bubble broke: exhausted buyers walked away while sellers continued to jack up their prices. And the whole kit and caboodle fell apart. Read… Housing Bubble 2: California November Home Sales Plunge to Multiyear Lows, Prices Soar

I would of thought job security would be a bigger worry.

You are spot on about job security, though perhaps that doesn’t pop up in a survey as people would rather not think about it.

I know in my area many of the other issues that the Redfin surveys capture hold. Particularly inventory and quality. I bought a home this year and was happy with what I found for the price. I still watch the market and see plenty of homes that I consider overpriced and in need of substantial work. Aside from that, others are holding out for high prices. My brother-in-law has had his home listed for a year and a half, hoping that the giant thing sells for an inflated price. He is actually trying to downsize a bit. But hardly anyone is coming to see the house. So I see people being priced out, and more carefully evaluating the homes that are available on the market.

You bought a home when no one has fixed the corruption in the land records? OMFG

As a former Realtor who is telling everyone I know to NOT buy until the land records have been rectified, good luck with that.

Curious also if after reading NC, you signed a mortgage (or deed of trust) that included MERS?

Well, this being historic New England, the chain of title is quite clear. We can trace the homes history and owners back to it’s original builder in 1819. That includes a move West and slightly north in the 1840s. So I’m not too concerned about chain of title or other such issues.

MERS was not included in the signing of papers.

Though I must say, I was not all that excited to hear that Ocwen acquired my mortgage shortly after closing. They have already tried to force mandatory homeowners insurance purchase onto me when I already have insurance and documented proof thereof. In today’s consumer friendly society, I received a letter stating that I must demonstrate proof of insurance or be subject to Ocwen’s unknown cost of insurance purchase for me. No call. No email. Just a letter. What if I had been away on work or on an extended vacation when said letter arrived in my mailbox with a two week deadline? Egads. I got it sorted, but the shennaningans involved in what is my largest asset by far, is not encouraging. I can only imagine what less sophiscated buyers go through.

I’ve been wondering for awhile why any bank still offers 30 year mortgages, because few people, in this day in age, have the certainty of being continuously employed for that period of time.

Has securitization—the ability to essentially shift the risk to someone else and essentially take a “not our problem” attitude—had anything to do with it?

Perhaps there is a thought that if the mortgage can be paid with one income in a dual income household the likelihood of both people being unemployed at the same time is acceptable. Of course that requires dual income and a cheap mortgage.

Perhaps one reason is that banks are only in it for the fees, since they never hang onto the paper. If it makes the loan more affordable and they can sell the loan, what do they care whether it is 5,10,30 – whatever – years?

The average duration of a mortgage has been 5 years, due to refis, moving, death, divorce, and (drumroll) job loss induced sales.

With interest rates so low, if the Fed ever increases them, the average duration will increase a ton, making the job risk even more important.

I am not a fan of the Fed’s policies, but it seems quite likely that higher interest rates are going to severely punish homeowners once again. They will be locked into their homes due to the inability to reclaim equity or they will not be able to afford their homes when the monthly payments rise too high.

Career employment with a decent wage is what allows you to buy a home.

Since that is severely lacking in the US, it is no wonder home sales remain anemic.

Housing prices simply don’t match income levels.

Hopefully buyers are getting smart with their money and not falling for the all-time low rates shenanigans. Sure, home prices in the high end sell, but if The Federal Reserve’s Consumer Survey is accurate, 90% of the populace is being economically exterminated. The only relevant factor is at the speed of ones own destruction based on income levels, again, if the survey is accurate.

In my home state, real median incomes have been going down for 12 years while prices, under the old formula of income/minus debt, it would automatically disqualify buyers (not enough income, carrying too much debt). It’s simple mathematics in a market being perversed by propaganda from all sides. Throw in deeply indebted college graduates, a lower ROI on college educations, technology advancements, and a tighter job market, it can only be cognitive dissonance or political confirmation bias usurping reality for the overwhelming majority of us.

Mortgage interest rates have been manipulated down to near record lows. This shows the Fed is making another run at feeding a housing bubble. Two things from the Fed prove this. First, they are pushing for lower standards to obtain a mortgage, and second, they have manipulated mortgage interest rate down to the 3.0% range. While they talk about lending standards, behind closed doors they are pushing hard for lower down payments, larger loans, and less credit worthy borrowers being qualified. The lesson is clear, sub-prime was the Feds preferred policy.

The original boom was driven by the effect of drastically lowered home mortgage payment driven by a steep drop in interest rates. As interest rates dropped, so did monthly mortgage payments. This increased demand, which drove up prices. People thinking the prices would rise forever took out risky loans, or refinanced to pull out money.

This time, the memory of all those foreclosed homes is fresh in everyone’s mind. Therefore, we’re not going to see very many people overstating their incomes to take advantage of the booming home prices – and the folks inclined to take out second mortgages probably did so before the 2008 crash.

Thus, we’re seeing the inevitable: the median home price in a given area cannot sustainably rise above the amount that folks earning the median income for that area can afford. Absent inflation, or a rise in the median income, home prices have apparently peaked.

ok, people can’t afford homes but can they afford apartments? apartment rents have gone up quite a bit.

Apartment rental has somewhat more elasticity in prices than home sales because many see themselves renting only short term until they find the job/house they want at the right salary/price. Thinking it is only for another year or two, they will be a little more willing to pay higher prices relative to income. The stretch is not unlimited, however, and some people don’t fit that pattern at all so at a certain point you’re absolutely right, people will change location, live with parents, etc.

Housing prices have gone up to the point where many people can’t afford the down payment–buying is only cheaper when you can either afford a down payment on a mortgage, or pay in full–so they’re left with no choice but to rent. It’s been (and presumably remains) a seller’s market, and all-cash sales have become a lot more common: if you can’t pay the full price in cash, you’re SOL.

Also if you don’t have job security or are self employed and have erratic income, you may not earn enough in some years to make good use of the interest tax shield.

Anyone buying real estate now, before any remedy to right the wrongs in the land records has been deployed, is a fool.

We walked away from a very good deal in Alabama over MERS. What got us was that the Clerk of Courts office for that county told us straight faced that the state recognized MERS as a perfectly safe and legal method of transfer of title. The fix is in on all levels. Now we take nothing for granted.

You should have quoted the Washington Supreme Court case Bain v. Metropolitan Mortgage which declared that MERS is an unlawful beneficiary.

Yet, even in WA State, the corrupt Attorney General (Google “Bob Ferguson”) knows that the banks continue to write deeds of trust that list MERS as the beneficiary. I just shake my head and again tell all my colleagues NOT to buy property at this time.

You are not only right, but “dead” right in a manner of speaking (inescapable). People have to live somewhere so the pressure builds. Also, it remains that surprisingly few people are aware (or willing to be aware) of just how crooked the system has become. Others assume (with good argument) that it isn’t going to be fixed anyway -any more for instance than the recent Dodd-Frank legislation managed to survive – until the whole political/financial/industrial/military system collapses or is radically changed; neither of which is likely to happen soon. So with little alternative and “family on the way” or other legitimate motivators, some buy, blissfully ignorant or with uneasy acquiescence.

I’m selling my condo, planning to downsize, but now i’m having second thoughts about buying again.

I tell people who absolutely must buy:

1) Find a bank who provides “portfolio loans” which means they RETAIN the promissory notes.

2) Buy BORROWER title insurance. (the title insurance you buy is for the BANK not for yourself!)

3) Do NOT sign any mortgage/deed of trust that includes MERS anywhere on the documentation.

Also, when selling your condo, you must amend the escrow instructions to include that YOU GET THE CANCELLED PROMISSORY NOTE BACK AT CLOSING! This is a MUST!

thanks, it’s a cash sale, thank goodness, and i dont have a mortgage to pay off

I just went over a friend’s final “Reconveyance” she received after paying off her mortgage in full.

The document was signed by “Kevin Grier” from PRLAP, Inc. (a notorious robo-signer). The “Trustee” (you know the entity that is supposed to be a neutral third party) is PRLAP, Inc., a fully owned subsidiary of Bank of America (the purported beneficiary who got all their money). I told her that I wouldn’t trust that to prove she owed nothing to Bank of America.

So, we tried calling Bank of America to obtain the cancelled promissory note. *Laugh* I was hung up on.

So, my friend intends on going to “her banker” from Bank of America to “get to the bottom of this.” I laughed even harder. “Get to the bottom of this” has taken me FIVE years and $35,000 of legal fees. I can tell her what she’ll find: Bank of America cannot/will not provide her the cancelled promissory note. Because more than likely they are still negotiating it on the open market.

“Because more than likely they are still negotiating it on the open market.”

I’m not sure what you mean by this statement. My assumption would be that BoA cannot even find the promissory note to cancel it. It’s lost in a file box somewhere.

That would be my guess – the concept of keeping actual paper copies of things doesn’t really sink in these days. Folks just don’t realize that a photocopy of a promissory note has about the same value as a photocopy of a bank note (such as a $1 bill). The only difference is that trying to spend a photocopy of a $1 bank note is considered forgery, while storing photocopies of a promissory note seems to be standard procedure these days. (I never was able to get the originals of the promissory notes for my student loans… they just said they were “lost.”)

Possible double post – slightly different

Slightly off topic but how high an income do you have to have in the USA now to have a decent place to live, a car that runs, be able to pay the usual, everyone has them bills, eat decent and have enough time to get away once in a while from whatever would drive you insane – $30,000 net? More less?

A single person living in a low-cost part of the country would be fine with 30k. Living in any of the more expensive areas 30k would be a hard slog, certainly not sufficient to enjoy nice vacations or any other indulgences.

$30K, imo, will barely get you by, even in lower cost areas bc even there, rents are higher than usual (some exceptions but that’s what I’m hearing; anecdotal). If you happen to be young – and more importantly – not owing much or anything, then $30k can you get by in a smaller city or town, but even then you may need to share housing. Purchasing a house or condo would almost be impossible on this salary, unless your parents or someone gave you enough for a hefty down-payment or to buy outright.

I’m finding groceries to be quite expensive anymore, and I coupon shop like mad, plus use the farmers markets when available. Of course, right now, gas at the pump is low but for how much longer will that last? I surely don’t count on it. And if you live somewhere that gets cold in winter and very hot in summer, then utility bills will start to eat into your budget. I get away with low bills bc I can tough out the cold (where I live isn’t so bad in winter) and I don’t mind the heat so rarely use air con.

If you owe for your tertiary education costs, then $30k won’t go as far due to loan payments. It’s tough out there.

I think 30k AFTER tax could get you by if you don’t have huge healthcare costs, not so much 30k before tax though.

Purchasing a house or condo here isn’t going to happen unless the salary is well into 6 figures, so I wouldn’t even bother thinking about that when I think about what is needed to “get by”.

In the market for over a year now and fitting the profile: paying more in rent than we’re willing to pay for a mortgage, resistant to being priced out of our current neighborhood and refusing to pay $275/ft for a crappy house with a 55 walk score. NC has made me all too aware of the macro-risk incurred by MERS title shifting. But I have assumed that my mortgage and title would be fine as long as I made payments on time, regardless of whatever shenanigans the derivatives market plays with my financing. Can someone explain (or link to) the risks that mortgage holders in good standing face from MERS.

Because the only people at risk with MERS is people in default??? OMFG.

Do you ever want to sell your property? If you do, then you believe anything that MERS does (reconveyance, appointment of successor trustee) is legitimate? It isn’t.

MERS is a shell game. MERS hides the true nature of who owns the mortgage.

I am in good standing with my (supposed) Wells Fargo loan, but the original lender is gone. HOW CAN MERS (OR ANYONE) TRANSFER TITLE? Please tell me how. I don’t know what to do regarding this…..most likely I will be in court……again.

I am very unknowledgeable about any of this, despite my best efforts to understand what I read here. Is there no way to de-MERSify a title that has been MERSed-up?

Is there not a legal process called “Quiet Title” or something like that?

I believe it’s purpose is to rectify a cloudy title with a legal ruling that will not be overturned. Ever. Unless, of course, the person seeking to quiet the title committed some kind of fraud, I would think…

If you read: http://www.ritholtz.com/blog/2013/04/states-fight-back-against-mers-mortgage-fraud/ , you will never deal with MERS! Run as fast as you can away from them!

I commented on this on the Ritholz site back then and still hold that property rights and the rule of law have been completely abrogated by the establishment of MERS. Title for as long as we have been a republic has been recorded with the local county clerk as a matter of course – this is now gone and may never be able to be reconstructed as a result of this mess called MERS.

Bottom line – some one or an entity has to ‘HOLD’ title to the property and MERS does not qualify as either a person or an entity.

Sticking to my guns on this one!!!

Despite theBecause of low interest rates, prices in DC are so high right now, many homebuyers feel priced out of the market.I consider the last honest central banker to be John Crow, the Governor of the Central Bank of Canada, from 1987 – 94. The politicians at the time couldn’t wait to get rid of him, and while governor, told them to pound sand every day. Mr Crow maintained that the inflation rate should be zero, and interest rates were high. At the time, 12% mortgages were normal, and there was no housing bubble except for Toronto and Vancouver, where the driver was cash buyers setting up an escape route from Hong Kong in the run up to the 1997 hand over to China.

I agree with GuyFawkesLives. I thought the housing market would grind to a halt in th US due to title issues. Home buyers are surprisingly trusting of a corrupted system.

But … we saved the banks, so ‘s all good. — Bernanke, Dudley & Yellen, LLC

It looks as though we will have to save them again. How are the PTB going to sell it to us this time? What will be the main propaganda line pushed by virtually every newspaper (online and print) as well as every broadcast outlet? How do they think they can get away with it so soon after the last heist?

1) They don’t really care (some even derive amusement out of excuses so lame they are insultingly obvious)

2) La la la la la; eat cake. We live in the best of worlds at the best of times – what could tax payers object to?

I refinanced my mortgage a year ago. Out of five banks, only one admitted to even knowing what MERS was, never mind whether or not they used it. Granted, I was only speaking to the first individual one meets at a given bank about the possibility of a loan – usually not very high up in the chain of command. But not even knowing what MERS was????

You think it’s odd that the banks didn’t know what MERS was…..I got the shock of my life when I called my Senator to talk about the mortgage crisis…..I was transferred to their “housing specialist” who had no clue what MERS was. Jesus Christ. If our own legislators have no clue, how the hell do we get this fixed????

If the recent past is any guide, based on this info we should be coming into a window of home affordability fairly soon. We started looking for a home in late 2005-2006 when prices were high. most decent moderately sized (1500 sqft or so) homes were $250K + and rising yet if you looked at job listings the majority were in the $10-$15/hr range. The situation was exactly as this article states – the only homes that were ‘affordable’ were either sheds or falling down Then despite our real estates agent’s claims to the contrary, we noticed prices start falling. Pretty quickly. We bought in 2007. We all know what happened shortly after that. Prices dropped even more for a little while until the PTB decided to run the whole scam all over again. This merry go round we’re on really isn’t all that amusing …

Stock market inflation – nice…it will trickle down. That’s the way it works.

Housing price inflation – nice too…it will trickle down and spill over. That’s the way the world spins.

Profit inflation – even nicer. It’s key to our survival; otherwise we (the rich) can only afford to boss over fewer serfs.

Wage inflation – Highest defcon alert!!! All hands on deck. Those sneaky b***ards attacking in the middle of the night.

I think this covers modern econ 101.

That’s about it exactly, Beef.

We can shut down the Chicago and Harvard economics departments now. Seriously.

Yep! You’ve nailed it.

Trickle down economics was only when there was a Republican in the White House. Now it’s not even recognized as such.

Not only econ 101, but also any MSM reporting on the economy.

I am a retired builder of affordable housing. One of the major geniuses behind the last bubble was Lambert’s favorite Democratic banker, Bob Rubin, who helped build on the idea that everyone In America should own a home regardless of income. Forget rental, let’s make everyone an owner. The realtors, home builders and Fannie and Freddie promoted this concept along with rubin’s organization, LISC. Not surprising new construction was overbuilt in many areas and prices spiked so most of the new Rubin buyers couldn’t afford to buy unless they got one of the no verification mortgages. One could see the resulting storm coming in terms of housing.

In terms of Red Fins survey, my speculation is that the majority of the responders did not even get to the question of whether they could get a mortgage. The price structure in their area put them with the feeling that prices were too high and they would be left holding the crapified bag if they bought now. There were enough stories about buyers being in over their heads from the last bubble to make most buyers cautious. This is not surprising to me. Having been there myself, there is almost nothing that builders and realtors won’t buy into about a rosy housing market that is just around the next corner despite any evidence to the contrary.

I assume you are being ironic with your reference to Rubin. Lambert and even more so yours truly point out regularly how Rubin is a huge moving force behind the Vichy Left’s embrace of neoliberalism and bank deregulation.

Yves kudos for the use of the term “Vichy Left”, at least the history majors will get it. Question is: who will be our DeGaulle with his Free French Forces? When does the revolt start? What will be our Dakar, Gibraltar, Damascus? We need to fight the battle for the heart and soul of the “Left” before it’s too late, if we wait until they install business-as-usual corporo-fascist Hilary with her backer Rupert Murdoch we’re (even more) screwed.

Weird, I read this differently. I assumed he was being Ironic in citing Bob Rubin as Lambert’s favorite banker. Maybe I should get my vision checked.

‘It’s all part of “healing” the housing market by inflating home prices beyond the crazy levels of the prior bubble-peak, while putting the taxpayer on the hook again.’

It ain’t pretty, but sequential bubbles are the only economic model we’ve got.

J-Yel’s working on her autobio … How I Learned to Stop Worrying and Love the Bubble.

Houses are part of the capital economy, which enjoys a tax advantage that inexorably attracts all money until the market literally breaks. Thus, we have bubble after bubble after bubble after bubble in the housing market. Equalize taxation of earnings from capital and labor and many many problems will disappear.

And with housing of course it has advantages even as far as capital is concerned. So capital gains on stocks have a 15% tax rate. Capital gains on a personal residence can be tax free.

It is the job of government to enforce majority rule on the minority, which is incredibly stupid if you think about it. That’s like encouraging your children to vote on whether they are going to have candy for breakfast before you drop them off at head start. Congress fairly represents the majority, whether anyone likes to think so or not. Labor carries all that gravity up the hill to drop it, to raise the next generation.

My wife nearly doubled the food and dramatically increased its quality, for food bank recipients. When two people quit before Thanksgiving, she did her job and theirs. The remaining two managers buckled under the weight. And the executive board ordered them to replace her, with a kid that can’t stay off pot long enough to pass a drug test without someone else’s piss, to drive on ice in the mountains, and she was surprised, by her mother’s participation. Crack me up.

Management’s job, regardless of corporation, is to prove that labor is replaceable, with real estate inflation. If you step forward, the system collapses automatically. A woman can no more do a man’s job than a juvenile male, or a man can have a baby. The only way you are going to move that weight under equal rights is to replace that man with three juveniles at 1/3 the pay, or a machine, which is what you are observing, and most are complaining about, while they participate.

The critters will consume everything in their environment and kill each other fighting over the remaining scraps, which is why a moron like Edison is in the textbooks, Tesla Motors is building batteries, and the critters are all carrying I-phones, to eliminate privacy and impose the errant will of peer pressure on the individual, in an increasingly closed monetary system. Endangered species wearing t-shirts in ostensible support of other endangered species doesn’t get you very far.

Maglev is already two generations behind the curve, and programming high VIAC is not something you want to leave to majority vote, or its juvenile with a joy stick in a cubicle, playing games, but do what you want. Obama isn’t bemused by accident, playing golf, while the living standards of blacks, along with most everyone else, continues to fall, but keep counting that money and hoarding those commodities expecting a different result.

The critters always think that they have you cornered on their turf, which they stole and know nothing about. The empire is a snake digesting a rat, and those demanding equal outcomes are welcome to it. Funny thing, about small towns and big city politics, in a positive feedback loop…

Sit on those resources just as long as you like, watching first responders chase their own derivatives on Empire TV, expecting the planet to have no response, and wonder why labor has no response, because it responded decades ago. Not everyone chooses to accept the misdirection at birth, or with the increasing weight.

Don’t expect mercy from labor.

How do you generate high VIAC with incremental oscillation of an elevator, and brake its fall with no mechanical devices?

Where I live, the housing market is bifurcated; starter homes–properties of a quarter acre or so, with one or maybe one and a half baths, perhaps 3 bedrooms, don’t sell for awhile; their prices continue to fall and ultimately close below asking. That’s because even so, they’re ultimately selling between $270k and $350k, which is out of reach for most wannabe first time buyers who would want a ‘starter’ house. And most of these houses need work, which further reduces affordability; hard to afford a roof, or non-leaky windows, or other basics much less real upgrades when everything went to do the purchase.

At the higher end of the market–nicer homes, larger lots, beach rights and the like, housing prices continue rise. And that will likely stay, because a lot of that money is NYC money looking for a summer home. Locals aren’t making most of those purchases. Even those who purchase to retire here and thus become locals got their money elsewhere.

Good heavens! You have just explained “Snow Crop” immigrants to me. Here Down South, $270K to $350K will get you a nice big place on the golf course or 3000 square feet plus ten acres!

“It’s all part of “healing” the housing market by inflating home prices beyond the crazy levels of the prior bubble-peak, while putting the taxpayer on the hook again.”

Say twenty times before going to bed each night, “taxes do not pay for anything, they only destroy money in the private sector.” Government transfers of funds into the private sector are done everyday and are what keep our economy moving. The statement should read maybe ” . . . while a potential transfer of billions into the business segment of the private sector will be done later if the bubble bursts.” The businesses likely to be rescued will be those attached to the banking and mortgage industry.

Either way it’s more money going to the 1% while everyone else gets poorer.

Unfortunately, that survey is flawed from the start since only homebuying customers from Redfin were asked. If 100 people would like to buy a home but 90 decide to never shop around due to lack of income, ineligibility for a mortgage etc. they will not show up in the survey. Then asking the remaining 10 that are registered customers what their reason is for not buying a home will give you a completely different picture.

I don’t know that that is unfair. You aren’t a customer if you aren’t shopping. You need to look at actual houses to determine if you can afford what you deem to be acceptable. If you aren’t looking, you have already concluded you can’t buy, and that means you don’t have the income and/or downpayment, or are down on buying for some other reason. Not everyone is homeonwer wannabe.

I don’t buy this buyer’s sentiment survey. If I were asked on a survey what is the biggest obstacle keeping me from owning a yacht, I would look for the answer closest to “I can’t afford a yacht.” That’s something like answers #1, and #2 if you also broaden the answer to include “I can’t afford a decent yacht.” There’s only one cross-section of data presented, so I have no idea what I should expect the numbers to look like in “normal” times when the market isn’t “strangled.”

*Sigh*

1. Redfin does these surveys on a regular basis. Affordability never ranks so high.

2. Did you miss that these people are actually LOOKING FOR HOUSES??? If they can’t afford a house at all, they would not be looking for one. And the “decent” tradeoff is versus how much they’d have to stretch v. what they’d get, relative to how they fare if they continue to rent. There’s a real baseline here, renting in the same market. By contrast, no one has to buy a yacht.