Yves here. This post will not doubt give readers some grist to chew on in the ongoing debate as to whether the Fed is a very very clever bank stooge or not all that smart (and therefore a bumbling bank stooge, by virtue of cognitive capture). This discussion of the Fed’s blindness on disinflation, when commodities prices have fallen, oil is continuing its downward slide, and Europe has tipped into deflation, strongly suggests that the Fed is so desperately in need of believing in its own virtue that it will ignore any contrary evidence. That refusal to look at reality and to learn, particularly after how the central bank’s past ideologically-driven policies helped drive the global economy into the ditch, is a form of stupidity that seems to be drummed into orthodox economists.

By Chris Becker, a proprietary trader and investment strategist. Originally published at MacroDigest

The US Federal Reserve released its minutes from the December FOMC meeting just a few hours ago AEDST time (available here). The reaction on the markets has been mixed, whereas the pundits are chewing at the bit for signs of where the Fed shall strike next, with any rate rises put off until at least April.

Adam Button at ForexLive has the sceptical take on inflation:

The FOMC minutes show a total disregard for the signals markets are sending about disinflation. Five year breakeven rates are plunging, implying that 1.09% average inflation over that period.

The Fed discussed this problem of signaling rate hikes while the market signals disinflation in the Dec 16-17 FOMC minutes and had this to say.

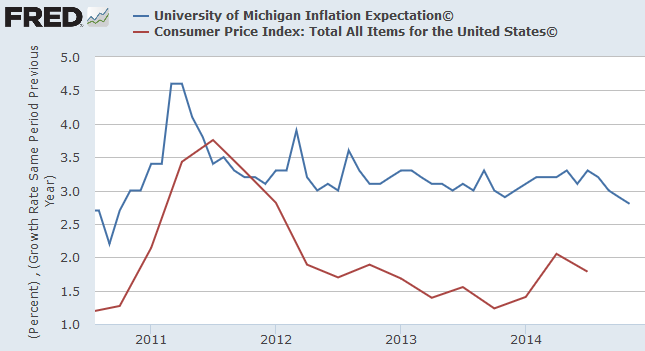

Instead of listening to the market. The Fed decided to listen to its models — the same kinds of models that assumed house price declines wouldn’t happen or be limited. On top of that, Yellen specifically mentioned the University of Michigan survey on inflation expectations, which has overestimated inflation by 200 basis points for the past three years.

This hearing disorder probably has grown out of an optimism condition, with most members dismissing any external risks, e.g deflation in Europe or fallout from the oil price collapse, with most betting on the ECB and others “doing something”, although some saw downside risks if “foreign policy responses were insufficient”.

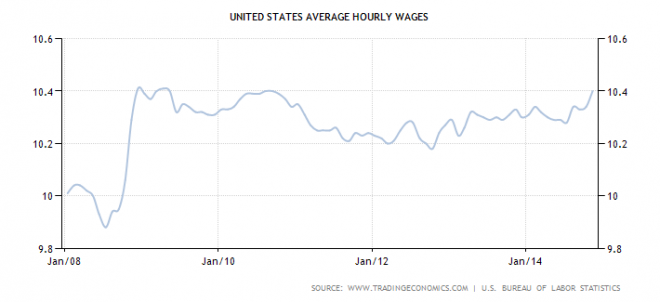

The question of rate rises by the Fed is being pushed out further and further, with the key point raised but not yet widely analysed is the lack of any acceleration in wages, although the huge relief from oil halving is sure to have an impact on disposable income. Wages have finally recovered from the GFC low:

Whether this filters through to inflation is hard to gauge, which is stubbornly staying at or below 2% with core inflation slipping.

I would suggest unless this changes – and forward looking breakevens and the yield curve indicate no such change for a long time – rate rises will be off the table for a long, long time.

Looks like some have slid back into “opportunistic disinflation” mode, thinking of acting to halt inflation before it becomes a problem as though we’re in a conventional cyclical recovery.

Ah, but this is Code Name D’s 2nd rule of economics: The economic is always in recovery.

Tools, fools and con artists. The markets have become a travesty of a mockery of a sham, and the Fed is the conductor of this runaway freight train. When the music does finally stop, this is going to be very tragic indeed. These clowns are afraid to let the S&P drop even 10% for fear that the “recovery” meme might be exposed for what it is…a continuing transfer of wealth to the entitled, sociopathic crooks at the top.

A serious discussion of economic “indicators” and whether the Fed is somehow connected to the reality of what their policies mean? Puh-leeze. The Fed wants one thing and one thing only: to preserve the debt money banking system as it exists today, *everything* else must be sacrificed on the altar of making sure bank insolvency is outlawed. So we get a Potemkin economy, run by Potemkin politicians, and manned by Potemkin stooges who just stand by and watch their real wealth decline. The system does not work for 90% of people, whose net worth has declined in the last 30 years…the question is, do we wait until that number is 95%? 99%? 99.99%? I’m afraid I know the answer.

The Fed is shootin’ for the whole ball of wax. The Fed is also targeting Russia, Venezuela and every other US adversary. Seems Putin is starting his own “SWIFT System” and free trade zone. At this point I see the Fed holding the US up based on the reserve status of the dollar until the rest of the world collapses.

After the collapse oil usage will be far below what it is today hiding the fact that peak oil production is in. From a new lower production base they can resurrect the petrodollar scam maybe two more go-rounds while they siphon the wealth of world into their own pockets.

What you must consider is that dollars are created with debt. Without cheap energy for future growth the chances of that debt being repaid sink rapidly causing a collapse. Debts are future promises that won’t be kept should the economy stall or contract. They control the contraction to loot wealth for pennies on the dollar.

Dollars are not created with debt. Bank IOUs denominated in dollars are created via credit.

Ben … dollar account balances are created when credit is granted and the “proceeds” of the loan are made available to the borrower. Given the fractional-reserve nature of our banking system, over 80% of new loans are unsupported by reserves and banks often have to borrow, after the fact, from the Fed to bring reserves up to statutory minimums (thus granting loans out of credit-worthiness created by borrowing … and from whom?). Sally refinances her house with a loan from, say, Citibank, and pays her 2014 Income Tax and you’re saying the proceeds aren’t “dollars.” Quibble? Or a misunderstanding of what Legal Tender actually is these days.

We do not have a fractional reserve banking system. Your basic premise is wrong.

Whhaaaat?

Yves, thought I had all that sorted out … I’d love to understand your point. It’s a bit briefly stated.

Fractional reserve model = banks receive reserves and then make loans

In reality, banks make loans, and then find reserves after the fact if they must.

So its all about causation. In the fractional reserve banking model, the Fed is in control because its the monopoly supplier of reserves. In reality, the Fed is a reactionary, always providing the number of reserves that is consistent with its target Federal Funds interest rate.

It should probably also be mentioned that the Fed is supposed to be a regulatory body and therefore not totally reactionary.

I meant reactionary only wrt reserve supply, not regulation.

The Fed cannot use the supply of reserves to discipline bank lending because it would lose control of its interest rate target as banks continually bid up the price of a short supply of reserves. Which could also cause settlement issues if banks couldn’t get the reserves to settle transactions, chaos would ensue.

But changing interest rates are supposed to be a pro-active policy. How often do were hear that they are being raised or lowered to “head off” inflation. It’s fairly open secret that the Fed’s “regulatory” department consists of little more than interns, a great big “APROVVED” rubber stamp, and a ready supply of green ink. I don’t even think they have a declined stamp. And if they did, I am sure no one has seen it in years.

Wouldn’t this rip the head off of MMT? At its foundation is the argument that it’s the government that creates the money supply.

I keep coming back to this question: Do the banks create money. There doesn’t seem to be a conscience on this. I am becoming convinced that it’s because there isn’t a viable definition regarding what money is. Without a proper definition, than there is simply no way to answer these sorts of questions.

Banks create their own IOUs denominated in dollars, while the government creates dollar IOUs when it spends. Bank IOUs are temporary, expanding the money supply with loans and contracting it as the loans are paid back. Bank IOUs do not increase the net financial wealth of the non-government sector because each IOU is both a liability and an asset, summing to zero.

Government IOUs (dollars) do increase the non-government sector’s net financial wealth, because the liabilities remain with the government sector. So the total non-government net savings is equal to the total quantity of dollars the government has spent and not taxed back (the national debt). If government didn’t spend the private sector couldn’t save.

Yes. I am aware this is what MMT says. But is it true? Prof Steve Keen has produced compelling evidence that bank lending does indeed expand the money supply – significantly. https://www.youtube.com/user/ProfSteveKeen/videos Auburn Parks makes the same observation that we do not have a Fractional Reserve System.

It appears that banks do create money, expanding the money supply through lending, while governments can not and are compelled to barrow through the banks. The so called “debt crises.” Keen even goes as far as to say that the debt created by these systems is the driver of the economic crises – and is completely ignored by the neo-classical.

The MMT and Steve Keen had a long talk in person about a year and a half ago.

I don’t have time to go into details, but basically they agree, the apparent row was over nomenclature and referring to different time frames.

No one can control private credit. A bar tab is a form of private credit. Anyone can create it.

Keen’s main argument is that increases and decreases in credit need to be added to aggregate demand.

YS,

The differences overlap on public and private solutions as well, correct?

Yes, bank lending expands money supply when the loan is made and contracts as the loan is repaid. If there were no money hoarding or losses to trade this would be a fine state of affairs, but capitalist economies incentivize hoarding for all of us, so we need the government sector to net spend enough offsetting the hoarded assets.

they love splitting hairs here, and confusing the technical details of the banking system with fundamental issues of the economy.

basically they will convert a real economic problem (eg, unemployment) into an accounting problem, and because accounting only applies as a technicality to the sovereign – they claim the solution to the problem is so straightforward. “The government can buy anything in its own currency” is presented here with a smugness as if a result of quantum mechanics has been discovered.

This confusion between the nominal and real is a perennial problem in economics.

After all, you want to follow the money. And the money is at the Fed.

Because the Fed really has no checks and balances except for the rubber stamping Banking committee hearings, the response of the Fed to any problem has been to double down on its losing bet, each and every time. In the process the “friends of the Fed” have become very, very rich indeed. In fact most of the super noveau riche are financiers. Given how much trouble finance has caused, you would assume they would be compensated a bit less, but looks like this whole architecture is flawed, and on any crack, the Fed will double down. That is why no one dare criticize the Fed.

private bank deposits are IOUs of the private banks

US Currency, by law, can only be IOUs of the Govt.

The mainstream position is that only IOUs of the Fed are US Currency (Monetary Base), and IOUs of the TSY are not (securities). But this position is is seriously confused given that Term savings deposits at private banks (CD’s) are included prominently in the mainstream’s concept of the money supply in the M2 aggregate. Yet they dont consider the exact same thing (term savings deposits) at the Govt bank as part of any monetary aggregate.

Such is the confusion of mainstream economics.

I think one of today’s links ties in well with this.

Risks lurk in failure to simplify finance Satyajit Das, Financial Times.

“”The three Cs of financial product regulation have been capital, central counterparty (CCP) and collateral.””

The way I see this is that the ‘capital’ is the money the Fed is creating that is going into asset appreciation such as real estate and equities.

And ‘collateral’ is the pile of bailout money if these assets eventually fall as they will as they are not supported by fundamentals (business investment, wage growth).

CCP is how one gets to the other. “”New exposure arise from only some but not all products being cleared, the need to channel deals through a small group of clearing members and the clash between national CCPs and cross border trades.”” (Mainly JP Morgan and Bank of New York)

“”Collateral places excessive reliance on government bonds whose quality is falling.”” Government bonds in the end are a measure of these fundamentals which are not being supported.

In essence we are using our financial tools to support asset appreciation in a shaky manner rather than using them for socially productive purposes.

How is the Fed creating money? Its simply exchanging one type of Govt IOU for another type of Govt IOU, its not adding anything to the private sector.

The only possible effect QE can have is by reducing the total number of potential investment opportunities by removing $2+ trillion in savings deposits at the Fed. Which means that that $2 trillion will now get saved in some other form, which are equities, Non-TSY securities, foreign markets etc causing the prices\values of those asset classes to increase (given a constant supply of them, which of course there never is).

Das brings up this mechanism. If you are an owner of these assets you can sell them for more cash. At least as long as buyers are available.

“”A prolonged period of ultra-low interest rates and abundant liquidity has artificially boosted bond, equity and property markets.””

The FFR is always necessarily a policy choice as the Fed is the reserve monopolist. Which makes terms like “Fair rates” “Artificial rates” etc meaningless.

If the Fed chooses a 5% FFR, I could just as equally say that house prices are too low because of the Fed’s artificially high interest rate policy. There is no objective natural rate except zero. Which is the natural rate of interest in a pure fiat monetary system if the Govt doesnt artificially raise the FFR via T-securities issuance (draining excess reserves) or paying interest on reserves directly..

But this seems premised on the Fed only dealing in cash and T-securities. They have also provided liquidity for more unconventional uses.

The latest 10-K from the CME proves the grotesque fact that CBs are now heavy buyers of equities and equity futures. Denmark, Japan and many others do it openly, the Fed doing it surreptitiously is the worst-kept secret on Wall St. So we have the laughable state where we are supposed to be market participants against a player at the poker table who can print his chips at will in unlimited quantities. Try betting against the ocean sometime and see how you do. This means the entire debate about CBs, their roles, and their effects on the markets and economies is based on false premises from bygone eras when gold left profligate nations and CBs took punch bowls away. With credit creation as the transmission channel for money creation on the ropes, equity flows have become the transmission channel. 85% of stock market gains go to 5% of the population…and we’re surprised at the outcomes?

‘Five year breakeven rates are plunging, implying that 1.09% average inflation over that period.’

Becker is referring to the breakeven rate on TIPS. Take the yield on the 5-year T-note (1.49% this morning), subtract the yield on 5-year TIPS (0.23 percent this morning), and the breakeven inflation rate for nominal and TIPS investors to come out the same is 1.26%.

This breakeven rate usually understates expected inflation, because TIPS are a lot less liquid than plain-vanilla T-notes, and thus carry a yield premium to compensate for their liquidity risk. Inflation swaps provide more accurate readings of pure inflation, but current rates aren’t readily accessible without a Bloomberg terminal.

FRED publishes a breakeven rate for the period that starts five years from now and goes out to ten years from now. It is also derived from nominal T-notes and TIPS, of 5 and 10-year maturities. As of Jan. 6th, the ‘5-year, 5-year forward expected inflation rate’ was 1.96%.

http://research.stlouisfed.org/fred2/series/T5YIFR

Why does expected inflation around 2% cause such fear and trauma in the U.S.? Economists believe that the money illusion of 2% nominal raises (which actually provide no increase in purchasing power when inflation is 2% also) act as a social lubricant. In plain words, outright deflation might make the peeps revolt. Therefore stability depends upon buying them off with money illusion.

Well, deflation would drive bankruptcies as debtors have to pay back loans in nominal dollars and with fewer may not be able to pay them, which would cause problems for debtors as debts they expected to have paid back are not paid back creating a positive feedback loop of bankruptcy and demand destruction and more deflation.

Exactly, with inflation, the only people who lose are the creditors and thats only a real loss, they still get the nominal value back. With deflation everybody loses like you said, both the debtors who default and creditors who lose their income and asset.

“(H)uge relief from oil halving is sure to have an impact on disposable income,” but a negligible one. After the Fed’s QE programs provided cheap funding for commodity speculation in food and energy, fueling that spike seen in the CPI despite the lack of any real demand or real shortages, this essentially mopped up any disposable income remaining in the middle class. If those few households that do realize disposable income use it in any meaningful way, it will go towards deleveraging household debt. Thus, consumer spending remains “off the table for a long, long time.”

Yellen, pull those binoculars away from your face, and quit expecting to find inflation on the horizon.

Does the fed not treat stock market disinflation and real estate disinflation with aggressive dispatch?

The perfect storm for ending the age of consumerism. Not only are the boomers aging and dying off globally, but the planet is dying. The confection that has become our human economy can’t do much about it. In order to keep a minimum economy functioning to the max to provide things we all need, we have central banks and treasuries tweaking everything. It is simply mindboggling to hear people optimistically predict when interest rates will rise. It’s a lost cause. Like the defeated southern confederates. Who consciously maintained an impossible hope when they bravely told each other, The South will rise again!

Good Deflation

In a vacuum, nothing appears. That’s how you initiate the fulcrum. You are building a motor, which appears to be many motors, which are not, with inverted stacks on either side, creating a stack in a double-sided mirror. A capacitor is just an inverted inductor, and the resistor is going along for the ride, as a switch.

Empire mathematicians define themselves, with derivatives and integrals on either side, as a derivative tool. Any replicant can do the math, once all the work is done. It’s like having a baby. No man can do it, but a woman’s body does it naturally, if she doesn’t allow all those empire LRC apparitions create unintended capacity for the path of least resistance. Given a choice between my wife, their current boss, same as the old boss and the new boss, and me, the vast majority will choose their current boss, take advantage of my wife, and hunt me down.

The empire is nothing more than a collector of habits, in its own time. Making that gate, to complete the circuit is a matter of timing between the gears, waves. The empire is just a stupid machine, a reference voltage, run by people who chose stupid, which they have every right granted by G to do. The Bank controls currency, making all derivative markets extortion based, surprise.

The empire maximizes rent to wages. If you increase the minimum wage, what do you expect to happen to rent, for property owners represented by Republicans and Democrats? If you look for a job based upon credit-based income, what do you expect to happen to rent? If you follow the herd and increase commodity volatility with Bank supplied margin leverage, what do you expect to happen to rent? If you have a G guarantee, what do you expect to happen to rent? If you have a G guaranteed inside track on an IPO that will have a G guarantee on downstream IPOs, what do you expect to happen to rent? Blah, blah, blah.

The empire is a game of last-man-standing, in a game of last-herd-standing, in which automation replaces human beings, by majority vote, its behavior, to hunt down the 1%, which is only 1% inside the empire, because it’s being hunted down. If bankers were the 1%, or any other easily identifiable group, they would already be in jail.

The majority votes for fascism, the path of least resistance, natural resource boom and bust, every time, first in spirit, and then in intellect and then in body, politic, but think whatever you like. Nutrition, which depends upon the individual, creates and eliminates the noise. You want the empire to se you 10% of the time, and create time with the other 90%. What is the cost of nutrition to the people you want having babies?

Set wage to rent accordingly.

The Fed is only powerful in its own mind, the mind of its gatekeepers, and in the mind of its followers, the global majority, as expressed by demand for UST printing, in master-slave relationships. Program the electricity itself, heat PVT potential, implicitly.

Right now, you would be better off picking up someone off the street than taking that applicant or placing an ad, if you actually want to do some work, not that I’m suggesting you do so. Small town bias isn’t any better than Big City bias, with deferred unintended consequences, the chicken or the egg. Time is the illusion. Make of it what you want it to be; work in Zero Time.

The farmer will give my wife a side of beef, but otherwise will send it across the planet to an executive board, an executive director and an operations manager, managing economic slaves, to maximize make-work price. Life is always and everywhere a test of intent. Efficiently increasing speed to nowhere only gets you an A at Empire University.

Inside the empire, I happen to like elevators, for obvious reasons, but my janitors, who happen to like being janitors, fix my elevators far more often than I do, in their daily activity. Many other mechanics like to make a contact error filling a buffer out to be rocket science, so they can pull out their computer and stylus, pretending to be rocket scientists, and call an adjuster, who orders a mod, when the arbitrary system can no longer reinitiate. You get what you pay for, with wages to rent. The majority prefers make-work, rent to wages.

So who’s lying?…

a.) The USG reporting 5% GDP growth,

b.) Commodity markets, the Baltic Dry Index, and the bond market with long-term Treasury bond yields at historic lows,

c.) Nobody.

d.) Everybody