Yves here. We’ve said that fraud is the fastest growing business in the US, but the US is far from having a lock on that market. One of the proofs is the way our Richard Smith has turned chasing international scammers into a full-time activity.

Scamming has strong links to money laundering. That seems to have exploded as more and more of the global rich seek to move cash across borders in ways not readily tracked by tax men and border officials. The New York Times, for instance, did a major expose on high end real estate as a money laundering vehicle, focusing on one building, the Time Warner Center in Manhattan.

John Helmer looks at another nexus, that of art and very high end collectables, through the lens of auction house Bonhams. However, there are intriguing extra wrinkles with Bonhams which puts it closer to the Graham Greene world of shadowy dealing than is the norm for the art world. And since Bonhams is a major dealer in Russian art, the collateral damage extends to the Russian art market, as well as Bonham’s efforts to sell itself.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

Works of art are only reliable investment assets if the trade in them is tested and transparent enough to prove they aren’t stolen goods, forgeries, or what is known in Russian as falshak (фальшак), a term originally applied to counterfeit coins.

Naturally, as the art trade generates higher and higher prices for individual works, the lure of expensive objects becomes irresistible for those with cash on the run. That is, if it can be laundered, er exchanged, through international auction houses like Christie’s, Sotheby’s, and Bonhams – institutions less regulated, and apparently more reputable than banks. Just as these house names claim to be setting records for auction prices for their goods, the margin of profit to be gained from fraud and forgery attracts almost as many well-heeled crooks for sellers as for buyers.

The relatively short time in which Russian art has been traded in international markets has meant that the swiftly earned riches of the Russian oligarchs have been bidding up auction house prices for objects with dim histories, uneducated demand, and short or non-existent records of ownership. For a London auction house like Bonhams, the record-setting value of Russian art it has been able to find for sale has turned into an opportunity for exchanging the auction house itself for cash. If the privately-owned Bonhams, whose turnover is a tenth of the two bigger houses, were to trade at the price to earnings ratio (P/E) of Sotheby’s, it might fetch over £530 million. But prices like that don’t fetch if there is slightest suspicion of falshak.

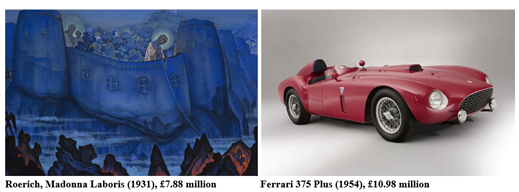

Bonhams has been selling itself, according to the Financial Times, for its success at taking a corner on two markets – vintage cars and Russian paintings. It has set the market record for “the most expensive Russian painting sold at auction: the ‘Madonna Laboris’, by Nikolai Konstantinovich Roerich, fetched £7.9m.” At the time – June 2013 – Bonhams claimed the Roerich work was “the most valuable Russian picture ever to be sold in a Russian art auction.” Last November, Christie’s beat the Bonhams record with the sale of Valentin Serov’s Portrait of Maria Zetlin for £9.2 million; for that story, and the Russian record table, click here.

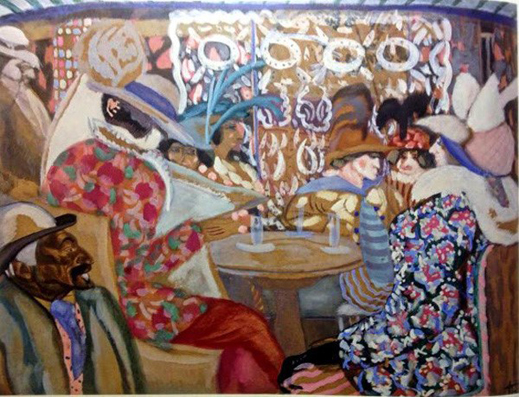

Bonhams’ cars have turned out to be pricier than its Russian paintings, and there’s the rub. One of the priciest, a Ferrari 375 Plus, turns out to be stolen goods. That’s according to at least five, maybe six claimants now in court in the US and in London. As for Russian painting, Bonhams was lucky to “rediscover” the Roerich Madonna; since then it has been unable to sell Russian paintings for anything like a record, either for lot or for batch.

Worse, there is still controversy among Russian experts over an attempt Bonhams made in 2008 to sell a work by Alexandra Exter, an artist of the Russian Avant-Garde of the 1920s. That painting (lead image), ‘Study for Venice’ of 1924, was withdrawn from sale in circumstances the experts and auctioneers aren’t willing to discuss on the record.

A Russian art expert, Yevgeny Zyablov (right), chairman of the board of Art Consulting, concludes that “the reliability of Christie’s

A Russian art expert, Yevgeny Zyablov (right), chairman of the board of Art Consulting, concludes that “the reliability of Christie’s

and Sotheby’s is higher. More controversial things, or things without attribution or elaboration, you can meet at Bonhams.”

So what has become of the Financial Times attempt to promote the sale of Bonhams itself? According to the newspaper’s report of July 2014, “people close to the group said they were hoping to complete a sale by the autumn.” The newspaper claimed Poly Culture of China was one of four bidders – the others were Bain Capital, CVC Capital and Bridgepoint. CVC is a shareholder in Formula 1; neither it, nor Bain and Bridgepoint had taken an equity stake in a business like Bonhams; their names may have been planted. A few weeks after the Financial Times reported, Bain, CVC and Bridgepoint were reported to have dropped out, leaving Poly Culture, the only one of the four to operate within the fine arts, with a price offer for Bonhams reported to be “several hundred million pounds”.

Poly Culture was listed on the Hong Kong Stock Exchange in March 2013, initially valued at HK$33 per share. It then jumped to $45, but steadily slipped over the past two years. Its current share price of HK$24 gives Poly Culture a market capitalization equivalent to £512 million. It is trading on a price-earnings ratio of 11.5. So based on Bonhams’ reported financials for 2013, the Chinese ratio should give Bonhams a valuation of about £300 million. If Bonhams were valued on Sotheby’s P/E of 20.5, it might be worth £533 million.

The Poly group says it originated as a joint venture in the 1980s between the People’s Liberation Army and CITIC, a giant state-owned conglomerate, best known in China for its CITIC Bank. Poly Group’s current lines of business include military technology, real estate, and popular entertainment, as well as art auctions. The company hasn’t said a word about its reported interest in Bonhams; it refused this week to answer questions about its reported bid.

Bonhams is jointly owned by two businessmen: Robert Brooks (below, left) and Evert Louwman (right), a Dutchman. Both were racing car drivers; both traders of new and used cars. Brooks was also an auctioneer for Christie’s, and the owner of the London premiseswhich Bonhams rents out.

By mid-September Poly Culture was reported in London to have dropped out of the Bonhams bidding – and there was noone left. A source claims Bonhams was asking for £350 million, whilst the source claims the Chinese were only willing to offer between £250 million and £275 million. Independently, Reuters reported bank sources as claiming they had put together a loan of about £200 million to back the bidding. By then, Bonhams had acknowledged an outright sale to a single investor was the only chance it had to generate an equity profit, all earlier attempts to find underwriters for a stock exchange listing having failed.

Financial reports filed by Bonhams reveal that in 2013 it valued its assets at £112.9 million. Revenue was £127.1 million; earnings (Ebitda) £26 million; profit £15.7 million. These numbers were all up healthily over 2012.

Between the start of the bidding for Bonhams and the drop-outs, a group of claimants to a Ferrari Bonhams had sold went to the High Court. The lead claimant, Leslie Wexner (right), an American underwear merchant, demanded that Bonhams return of more than £12 million – that covered the purchase price of the car which Bonhams had auctioned on June 27, 2014, plus legal costs. This story hit the newspapers in November of 2014.

Between the start of the bidding for Bonhams and the drop-outs, a group of claimants to a Ferrari Bonhams had sold went to the High Court. The lead claimant, Leslie Wexner (right), an American underwear merchant, demanded that Bonhams return of more than £12 million – that covered the purchase price of the car which Bonhams had auctioned on June 27, 2014, plus legal costs. This story hit the newspapers in November of 2014.

The disclosure of Bonhams’ financials for 2014 is running late compared to last year. Because of the litigation over the Ferrari, the provision for liability of just over £1 million in the 2013 financial report is likely to rise to the court claim figure, plus legal costs. At about £12 million that may be enough to push Bonhams into loss.

This isn’t the first legal fracas Bonhams has faced for mis-selling Ferraris. In May of 2013, Bonhams had auctioned a 1959 Ferrari, subtitled Ferrari 410 SuperAmerica Series III Coupe, for which a London antiques dealer Thierry Morin paid Bonhams £480,000, following a fiercely contested auction. Bonhams had claimed in sale advertising the car had done “a mere 16,626 km”. Court action followed when Morin discovered the car had almost certainly done more than 200,000 kms.

Had Bonhams been tampering with the odometer — was it lying to defraud? Morin went to the High Court in London for the contract to be cancelled, and his payment, plus costs, returned. The High Court ruled against him, on the jurisdictional ground that it was a Bonhams subsidiary in Monaco which had done the deal, not the London parent. “M. Morin does not have a reasonably arguable case against B&B London that they owed him a duty of care, ” wrote the judge, Jonathan Hirst. but he rule that if Morin sued in Monaco against the Bonhams compay there, “[he] certainly has an arguable cause of action against B&B Monaco in Monesgaque law if he can establish a misrepresentation as I am satisfied he can.”

“If it is right,” Hirst decided against Bonhams, “that the Ferrari had actually done over 200,000 kms, it is a matter of real concern how an international auction house could have stated that it had done “a mere 16,626 kms” when (if Mr Grist’s evidence is accepted) a short road test would have revealed the true position….For this latter reason, I would also conclude that M Morin had a reasonable prospect of showing that B&B Monaco was in breach of any duty of care.”

This year’s Ferrari problem for Bonhams is the evidence that the car had been stolen in 1989 and that Bonhams knew there was an ongoing dispute among several claimants when it told Wexner otherwise. According to court papers available last week, Wexner’s lawyers argue, “Bonhams knew that if it honestly revealed the true position regarding the challenges to title to the car, no-one would even consider buying it. This is apparent on the face of Bonhams’ own evidence… Bonhams knew that to auction the car successfully it had to present it on the basis that the long-running dispute around it had been resolved and that there was no challenge to the sellers/consignors’ title. When it realised that that would not be possible, it could have done the honest thing and pulled the car. But it knew that the financial consequences of doing so would be disastrous. So, instead, Bonhams pushed ahead with the auction and told the world and the Buyers what it knew was not true: that, in short, a purchaser would take the car free of any known risk of challenge to title.”

At this point there are six claimants to the car, including Wexner. No trial is likely before April of 2016. For the time being, according to the court documents, Bonhams is refusing to put in writing what it intended to mean by the pre-auction representations it issued on the Ferrari. One of the claimant buyers has asked the court to order a forensic inspection of the chassis, brake drums, and take metal shavings to determine whether the metal is as old as Bonhams claims the car to be.

In court last week Justice Julian Flaux said: “This case requires momentum and robust case management. The idea that it should maunder on does not seem appropriate.” Evidently frustrated by the competing claims, he demanded that by the date of the next hearing, May 5, Wexner and the others, including Bonhams, should agree on a list of issues to be decided. The judge also suggested that mediation might be a better option, because the longer the litigation goes on, the faster the asset will depreciate. The reputational and financial risks to Bonhams also grow as the case drags on.

Bonhams has issued a press statement: “we are satisfied that any claim is wholly without merit and will be strongly contested.” In court papers Bonhams claims that before the sale to Wexner it had brought the parties together; that the ownership dispute had been resolved; that “all relevant litigation had been settled”; and that Bonhams knew of “no reason why . . . the buyer should not be able to register title in . . . the USA.” Wexner and the other claimants are saying Bonhams is lying. According to its defence, “the idea that Bonhams would have participated in the fraudulent activity alleged against it is absurd”.

Bonhams has issued a press statement: “we are satisfied that any claim is wholly without merit and will be strongly contested.” In court papers Bonhams claims that before the sale to Wexner it had brought the parties together; that the ownership dispute had been resolved; that “all relevant litigation had been settled”; and that Bonhams knew of “no reason why . . . the buyer should not be able to register title in . . . the USA.” Wexner and the other claimants are saying Bonhams is lying. According to its defence, “the idea that Bonhams would have participated in the fraudulent activity alleged against it is absurd”.

The impeachment of Bonhams’ credibility and the failure of its sale to investors cast a shadow over the Russian art market, not only because the mystery discovery of Roerich’s Madonna and the record price it fetched aren’t likely to be repeated. Misrepresentation, fraud and forgery aren’t unique to Russian art, according to Simon Hewitt, international editor of Russian Art + Culture. “Russian Art has attracted forgers in specific, lucrative areas, particularly the late 19th century (Shishkin, Aivazovsky) and the early 20th century Avant-Garde. In my opinion, there is as much forgery of Flemish old masters as there is of late 19th century Russian paintings.”

“The Avant-Garde is a case apart,” Hewitt adds, “because the KGB set up something of a forging industry in the field as a way of accessing gullible foreign cash. They had access to materials dating from the 1920s which enabled many of their fakes to pass chemical testing with flying colours. When researching a piece for ART + AUCTION a few years ago I was informed by one high-profile source that the post-KGB forging industry continues, with practitioners based in ships off the Israeli coast (as well as Germany).”

It has been much easier also to get away with forgery in Russian art, at least in the 1990s. “Spurious authenticity certificates could be had from chronically underpaid and easily corruptible Russian museum officials for a pittance until quite recently, but this is less and less the case.”

Pyot Aven (below, right) of the Alfa Bank group, and one of the largest collectors of Russian art, has called in experts to authenticate the paintings in his own collection. In 2011, he called a press conference to report that a criminal gang based in France and Switzerland was flooding the market with fake watercolours by Natalia Gonacharova (left). “[She] never did watercolour versions of her oil paintings”, Aven said.

Aven’s collection is reported to hold 400 paintings, with a value estimated last November by Forbes at $500 million. They are works of the late 19th century and early 20th century. Vyacheslav Kantor, owner of the Acron fertiliser group, has an equal sized collection; he specializes in Russian Jewish artists of the early 20th century, whose collection value is also estimated by Forbes at $500 million.

In Forbes these are advertisements for asset value, resale profit, collateral credit. The loopholes in the Forbes calculation are authenticity and dealer fraud. In November the publication claimed Dmitry Rybolovlev’s (below, left) collection was worth $700 million. This month fraud indictments in Monaco, France and Switzerland, initiated by Rybolovlev against his art dealer Yves Bouvier (right), reveal that the paintings were over-valued and Rybolovlev over-charged.

Just how little an oligarch’s collection may turn out to be was revealed when liquidators of Boris Berezovsky’s estate discovered he had laundered his money too quickly, and carelessly, into works that turn out, on examination now, to be forgeries. Works that Forbes would put up to £50 million turn out to be a fraction.

For litigation by another fertilizer specialist, Andrei Melnichenko of Eurochem, to prove he had been defrauded by a New York art dealer, click here; Melnichenko didn’t win. For Victor Vekselberg, who did win in a London court over Christie’s in the case of a fake Kustodiev painting, read this.

Right now, a St. Petersburg court is hearing criminal charges of conspiracy to commit fraud by Elena Basner in the certification, then sale, of the 1913 painting, “In the Restaurant” attributed to Boris Grigoriev (below). Bringing the charges is the collector, Andrei Vasiliev. The Russian press coverage of all sides in the affair, which Basner has called a frame-up, is voluminous.

The Russian expertise on which museums rely are the Art Research and Restoration Centre named after Academician Igor Grabar (GRC) and the State Tretyakov Gallery. They say they do not make public comments.

Yekaterina Kartseva, co-owner and founder of Privatecollections.ru, says that Russian art forgery is exposed regularly, particularly of 20th century and contemporary works. “Less high-profile cases occur quite regularly; many of my friends who bought a painting at auction cannot obtain confirmation of authenticity at the Tretyakov Gallery. Major Russian auction houses are trying to keep track of their reputation, but many are bombarded with lawsuits. Most problems arise with online auctions, since there it is more difficult to keep track. Major Western auctions rarely bring cases to court. At Sotheby’s, as far as I remember, the buyer has three months in which to return the work. If the work is brought to us, we will examine it, make contact with the experts at Sotheby’s, and if the experts do not agree, there is three months for the buyer to make a decision.”

Kartseva suspects there may be forgeries in well-known collections, such as the collection of cellist Mstislav Rostropovich, which was bought by Alisher Usmanov at Sotheby’s in 2007. Usmanov (right) paid £25 million ahead of the auction, and then presented the works to the state. Paintings by Grigoriev and Roerich led the Sotheby’s estimates, which were roughly five times the prices Rostropovich had paid.

Kartseva suspects there may be forgeries in well-known collections, such as the collection of cellist Mstislav Rostropovich, which was bought by Alisher Usmanov at Sotheby’s in 2007. Usmanov (right) paid £25 million ahead of the auction, and then presented the works to the state. Paintings by Grigoriev and Roerich led the Sotheby’s estimates, which were roughly five times the prices Rostropovich had paid.

Suspicion doesn’t always result in an unambiguous certificate, Karsteva concedes. “Authentication may end up with a statement like, ‘the work does not conflict with the brush of a certain author’…the opinion of some experts do not necessarily reflect the opinion of others. The art market is certainly more prone to fraud, which is stimulated by the very high price of some of the works, when it isn’t clear whether the collector’s motive is to buy the painting itself or to demonstrate for all to see the cash equivalent. If you bought an image, is it important for you for the object to be the original or a copy?”

Zyablov of Art Consulting explains that as the economic stringencies being felt by buyers get worse, demand is restricting price, and the circulation of forgery is contracting. “Our company was created in order to protect investors — we have a very tough procedure. For this reason the British market takes our expertise for insurance of private collections. During the growth of the market, investors (buyers) had high hopes for this market. They bought a lot of things that were attributed by some experts without evidence, and sometimes without provenance. Now all these things are out of the market. You can appreciate too that when the market itself has fallen in volume, the number who want to make fakes and sell them is greatly reduced. Market expertise in Russia has also developed strongly to stop counterfeiting.”

A Moscow art market source explains that just as the incentive to forge is bound to grow as art prices grow, so does the expertise to detect it. When prices were in the low thousands of pounds, he said, the gallery or auction house commission would be roughly equal to the cost of high-quality chemical and other testing to authenticate a work. Russian buyers started out naïve, and if prices were low, they didn’t need to be careful. Once prices reached the millions of pounds,though, the demand for expertise intensified, and the cost was affordable for the auction houses.

About the Rostropovich collection, Zyablov says: “of course, things can turn out to be fake, and this might be found in many different collections. For example, Pyotr Aven commissioned us to examine and evaluate his collection for insurance purposes. From a few hundred things we found two things which were wrongly attributed. Pyotr Olegovich was grateful to us, and talked about it at a press conference. So, such cases happen.”

Auction houses like Christie’s, Sotheby’s, and Bonhams maintain their own experts, Zyablov adds. “Experts with the same specialization compete for credibility. Those who stand on the side of the market, and are more lenient in their assessments, get promoted by the market. In this way, there’s better business for experts who are less tough. This is a paradox. The trend of expertise to protect the buyer goes against the trend of the market, which favours higher priced sales.”

How in hell do you even drive a Ferrari for 140,000 miles and who would do it?

So this thing has been toodling around Europe or UK since 1959 or on somebody’s

daily “commute” and no one knew?

“For litigation by another fertilizer specialist, Andrei Melnichenko”

Makes me think he is a true bull shit artist. :-)

So I do some minor auction purchases online and resell via ebay to help pay off my student loans. There are several American, English, French, and German sites now that allow the people on the internet to participate in more and less reputable auction houses. Some of these places are really just sales fronts and not genuine auction houses, others are vintage / antique emporiums that sell the goods of multiple sellers, including items that the auctioneers own. I regularly find mislabeled items, fakes, item reselling (evidence of shill bidding), damaged pieces, etc in many of these ‘auction’ houses. In all honesty it is safer to purchase something via ebay due to the reputation issues and ebay is itself not devoid of shill bidding. Auction houses regularly absolve themselves with statements limiting their liability and there is little to no recourse unless you can catch them in the fraud itself. In several cases I have corrected auctioneer statements regarding pieces via email. In the positive cases they will correct their errors, which can have a significant impact on pricing. But, often this will not happen. I am really quite surprised that it hasn’t been investigated thoroughly. Bonhams is really just the tip of the iceberg. The auction service sites that facilitate these processes really don’t have policies or programs in place to prevent shill bidding or punish auctioneers for providing misleading information. In discussing the matter with someone more familiar with the antiques business, the fraudulent behavior listed above is generally thought to be endemic.

Maybe if they admitted it, they could auction the forgeries for so much they could make a huge legal profit!

They could become a style of their own, with masters and masterpieces. Maybe even better than the originals!

What difference does it make if you can’t tell the difference?

I’ve seen attributions that at least 50% of art auctioned are forgeries.

What difference does it make if you can’t tell the difference

Much (most?) is bought as a store of value not for aesthetics, it’s a currency. If aesthetics was the driver maybe it wouldn’t matter as much, but it would also be reflected in the value.

If fine art/collectables are bought and sold as a currency/store of value, originality is ALL that matters, the same as a briefcase of forged vs authentic $500.00 bills.

The sticky bit is when auction houses using “experts” that are sympathetic to a sale occurring rather than authenticity. –Case in point Coys which has a slippery reputation:

http://www.ferrarichat.com/forum/other-italian/442477-does-coys-really-sell-iso-grifo-no-001-%96-%93-very-important-rare-car%94.html

http://www.telegraph.co.uk/motoring/10770006/Rare-sports-car-is-a-fake-say-German-authorities.html

Relative to someone buying a 1959 Ferrari GT car with higher mileage that as advertised, that’s what inspections are for. This was a road car, ~2,500mi/yr average is hardly out of line. Misrepresenting to a gullible buyer is.

That’s why w/ collectibles, high value vintage cars for example, an unbroken history of ownership (provenance) imparts “value”, this can potentially be a huge component of value in fact.

Some are so desirable that even if an honest assessment is established on a car that is an amalgamation, the values are still astronomical these days.

http://www.rmauctions.com/lots/lot.cfm?lot_id=1072788

1955 Jaguar D-Type

To be auctioned on Saturday, March 14, 2015

Sold for $3,675,000

These cars are so rare and valuable that there is a healthy market for “toolroom” reproductions that trade in six figure values.

http://www.classicdriver.com/en/car/jaguar/d-type/2010/162884

I guess it’s not the Chinese who make fakes.

I read once about a collector in China with a Yuan blue and white for each year of Zhizheng reign (1333 – 1370) – each, if genuine, is worth several times more that that 1955 Jaguar D-type – including ones when the Mongol longer ruled (thus no such reigning marks). Simple 3rd grade math should have alerted our billionaire collector to that inconvenient truth (Mathematically impossible! as some would say).

Should be ‘not only.’

Even the greatest museums are full of fakes. See for instance this movie:

http://en.wikipedia.org/wiki/The_Moderns

or this one:

http://en.wikipedia.org/wiki/American_Hustle

If a fake is really good, it doesnt matter one bit. If we had incontrovertible proof that Flaubert had not written “Mme Bovary”, that it was some obscure writer who didn’t write anything else of value, should we stop reading “Mme Bovary”?

Good topical movie

http://en.wikipedia.org/wiki/F_for_Fake

Orson Welles: Ladies and gentleman, by way of introduction, this is a film about trickery, fraud, about lies. Tell it by the fireside or in a marketplace or in a movie, almost any story is almost certainly some kind of lie. But not this time. This is a promise. For the next hour, everything you hear from us is really true and based on solid fact.

…Orson Welles’ free-form documentary about fakery focusses on the notorious art forger Elmyr de Hory and Elmyr’s biographer, Clifford Irving, who also wrote the celebrated fraudulent Howard Hughes autobiography, then touches on the reclusive Hughes and Welles’ own career (which started with a faked resume and a phony Martian invasion). On the way, Welles plays a few tricks of his own on the audience. Written by Anonymous …

I have at least one fake pre-Columbian, still a way to go to catch up with them famous museums.

Luckily, I don’t have any Mark Landis fakes or any of that false ‘Provenance’ stuff. Too expensive for me to be a victim of.

The rest of us should worry about these Rich Sh_ts and their “stores of value?” When the “value” being “stored” is amazingly spendable Funny Munny, or rent extractions, or that huge bump of avoided “externalities” that the rest of us are forced to eat or to “make good on” because THEY can “lawfully,” or with impure impunity, collect on either side of bets THEY make with leveraged Real Wealth that us ordinary mopes are expected to create, and re-create, and re-re-re-re-create every time these self-indulgent barstids and their “people” over-inflate yet another bubble that explodes in OUR faces, not theirs?

For the Libertarians, and neo-libs and all, one just has to ask how well the magically self-adjusting market, and the power of reputation gained or lost, has performed in establishing a level playing field and all that jazz. Gee, will there be recourse to “government” to resolve these little tiffs? Honestly, of course, it would seem that a significant part of the real deal behind the smokescreen of Lib-neolib puffing is creating and maintaining the opportunities to pull stuff like this. Caveat Emptor? Non — “Sauve qui peut!”

Forgive me if I don’t feel the urge to shuck my own life jacket so some Better in the Gilded Barge can have a little more padding under his or her pampered posterior.

I don’t think the thrust of the article is about eliciting sympathy, more about revealing fraud and international money laundering. OTOH, there is an entire backroom ecosystem to these auction houses that feed regular people.

Yes, and Goldman Sachs employs secretaries and janitors. I get it! It’s one of those JOBS programs! Can’t take it down — think of the poor children! Or does Blankfein contract those services out? Maybe the interns could build hours by polishing his brass.

Good to know the “successful people” have their own tapeworms and crab lice and cancers to contend with. Comforting, in a way, to know that moral hazard is an endemic pandemic. And up and down the timeline too.

It may sound crazy, craazy, but no one really can tell the difference.

This past weekend, I watched an auction with a Daokuang blue and white – the mark at the bottom seemed iffy to this amateur (so, don’t trust me on this) It was, I believe, purchased from Christies previously, but found no bidder this time. Perhaps, the Chinese bidders were all busy watching the Shanghai stock market soar ever higher and higher and had no time for such a genuine bargain.

http://www.sothebys.com/en/auctions/ecatalogue/2013/fine-chinese-ceramics-works-of-art-l13211/lot.16.html

you can store rice moonshine in here

Too bad they erased the 6-character seal (script?) mark on the outside bottom of that Qianlong flask.

The best blue and white pieces were made during the Yongzheng (his father) and Kangxi (his grandfather) periods. The blue of this is not quite as deep as those of Ming Xuande pieces, painted with imported cobalt.

The five claws of the dragon indicate the picece was from the Imperial Kiln, made for the imperial use.

Interesting hobby. Chinese porcelain was truly the advanced engineered material of its day

No Malevich, no Larionov, no Lissitsky in the top 10? At least there’s a Goncharova. A woman painter beat all her male counterparts.

I followed the Ferrari auction last summer . I was at that sale with a mate of mine in Hampshire. The buyer of that Ferrari, Les Wexner owner of Victoria’s Secret, bought the car without any examination or even a test drive. First saw the car 1 hour before bidding, walked around the car once and said ” It is what it is”. I was standing there. Guy gave us the impression it was like ordering a chippy, no big deal. He paid 10,000,000 pounds without crawling under it or starting the motor. It’s called parking money. Seems Wexner has 50 of these Ferrari cars with a major Picasso hanging over each of them, and still 4 billion pounds to spare. That’s one lucky old man ! Underwear models , art and Ferraris and more money than anyone can spend.

The 1954 Ferrari 375 Plus was bought by a resident of Cincinnati Ohio in 1958. For no good reason he dismantled it, sold off the engine, and dispersed other components. In 1989, thieves stole the bulk of what remained — consisting of the front 2/3rds of the tube frame, the front fenders, and the hood — from its resting place in a wooded lot. These parts were shipped to Belgium, where Belgium law will issue a title to a stolen vehicle. The new owner converted these parts to the car as it stands today, including reuniting the frame and fenders with the original engine. The heir of the Ohio owner filed a countersuit in Ohio, seeking ownership of the restored car. She is joined in this claim by a pair of treasure hunters. On the other side is the heir of the Belgian owner. In March 2013 these four reached a settlement agreement, which provided that Bonhams would sell the car at its annual Goodwood auction in September 2013, with the Belgian party to receive 50% and the Americans to receive 50%. The agreement provided that all future disputes would be resolved by the London High Court. The September 2013 auction did not happen. The Belgian and one of the Americans agreed to go forward with a Bonhams sale at its June 2014 Goodwood auction. The other two Americans went back and forth on that proposal, and currently contend that Bonhams’ agency expired in September 2013. The Victoria’s Secret billionaire, by his agent, a New York collector car dealer, won the June 2014 auction, paid the money and took possession. By coincidence, Mr. V.S. is also a resident of Cincinnati. The dispute over Bonhams’ agency, post-September 2013, has put a cloud on an Ohio certificate of title to the car. Mr. V.S. is suing for Bonhams to unwind the deal, and the four litigants are suing in London for a determination of Bonhams’ agency. Bonhams filed an action simply asking the London Court what to do with the money. The suggestion in the article above that Bonhams should carry on its books a liability in the amount of this money is silly. It’s not Bonhams’ money, it’s being held in trust. Bonhams’ exposure is the return of its commission and attorney fees. It also has a thin exposure to punitive damages, if it is found to have engaged in outrageous fraud.