Yves here. The carnage in natural gas drillers that Wolf called early has arrived.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

The Fed speaks, the dollar crashes. The dollar was ripe. The entire world had been bullish on it. Down nearly 3% against the euro, before recovering some. The biggest drop since March 2009. Everything else jumped. Stocks, Treasuries, gold, even oil.

West Texas Intermediate had been experiencing its biggest weekly plunge since January, trading at just above $42 a barrel, a new low in the current oil bust. When the Fed released its magic words, WTI soared to $45.34 a barrel before re-sagging some. Even natural gas rose 1.8%. Energy related bonds had been drowning in red ink; they too rose when oil roared higher. It was one heck of a party.

But it was too late for some players mired in the oil and gas bust where the series of Chapter 11 bankruptcy filings continues. Next in line was Quicksilver Resources.

It had focused on producing natural gas. Natural gas was where the fracking boom got started. Fracking has a special characteristic. After a well is fracked, it produces a terrific surge of hydrocarbons during first few months, and particularly on the first day. Many drillers used the first-day production numbers, which some of them enhanced in various ways, in their investor materials. Investors drooled and threw more money at these companies that then drilled this money into the ground.

But the impressive initial production soon declines sharply. Two years later, only a fraction is coming out of the ground. So these companies had to drill more just to cover up the decline rates, and in order to drill more, they needed to borrow more money, and it triggered a junk-rated energy boom on Wall Street.

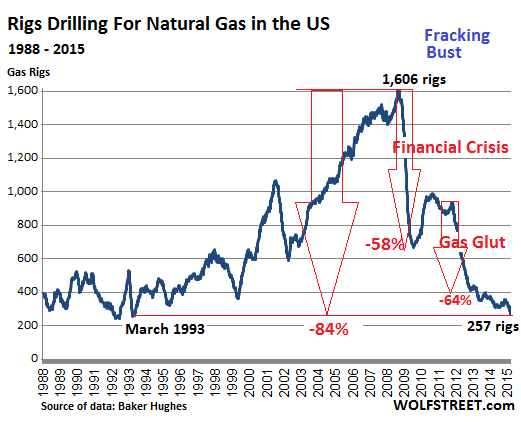

At the time, the price of natural gas was soaring. It hit $13 per million Btu at the Henry Hub in June 2008. About 1,600 rigs were drilling for gas. It was the game in town. And Wall Street firms were greasing it with other people’s money. Production soared. And the US became the largest gas producer in the world.

But then the price began to plunge. It recovered a little after the Financial Crisis but re-plunged during the gas “glut.” By April 2012, natural gas had crashed 85% from June 2008, to $1.92/mmBtu. With the exception of a few short periods, it has remained below $4/mmBtu – trading at $2.91/mmBtu today.

Throughout, gas drillers had to go back to Wall Street to borrow more money to feed the fracking orgy. They were cash-flow negative. They lost money on wells that produced mostly dry gas. Yet they kept up the charade. They aced investor presentations with fancy charts. They raved about new technologies that were performing miracles and bringing down costs. The theme was that they would make their investors rich at these gas prices.

The saving grace was that oil and natural-gas liquids, which were selling for much higher prices, also occur in many shale plays along with dry gas. So drillers began to emphasize that they were drilling for liquids, not dry gas, and they tried to switch production to liquids-rich plays. In that vein, Quicksilver ventured into the oil-rich Permian Basin in Texas. But it was too little, too late for the amount of borrowed money it had already burned through over the years by fracking for gas below cost.

During the terrible years of 2011 and 2012, drillers began reclassifying gas rigs as rigs drilling for oil. It was a judgement call, since most wells produce both. The gas rig count plummeted further, and the oil rig count skyrocketed by about the same amount. But gas production has continued to rise since, even as the gas rig count has continued to drop. On Friday, the rig count was down to 257 gas rigs, the lowest since March 1993, down 84% from its peak in 2008.

Quicksilver’s bankruptcy is a consequence of this fracking environment. It listed $2.35 billion in debts. That’s what is left from its borrowing binge that covered its negative cash flows. It listed only $1.21 billion in assets. The rest has gone up in smoke.

Its shares are worthless. Stockholders got wiped out. Creditors get to fight over the scraps.

Its leveraged loan was holding up better: the $625 million covenant-lite second-lien term loan traded at 56 cents on the dollar this morning, according to S&P Capital IQ LCD. But its junk bonds have gotten eviscerated over time. Its 9.125% senior notes due 2019 traded at 17.6 cents on the dollar; its 7.125% subordinated notes due 2016 traded at around 2 cents on the dollar.

Among its creditors, according to the Star Telegram: the Wilmington Trust National Association ($361.6 million), Delaware Trust Co. ($332.6 million), US Bank National Association ($312.7 million), and several pipeline companies, including Oasis Pipeline and Energy Transfer Fuel.

Last year, it hired restructuring advisors. On February 17, it announced that it would not make a $13.6 million interest payment on its senior notes and invoked the possibility of filing for Chapter 11. It said it would use its 30-day grace period to haggle with its creditors over the “company’s options.”

Now, those 30 days are up. But there were no other “viable options,” the company said in the statement. Its Canadian subsidiary was not included in the bankruptcy filing; it reached a forbearance agreement with its first lien secured lenders and has some breathing room until June 16.

Quicksilver isn’t alone in its travails. Samson Resources and other natural gas drillers are stuck neck-deep in the same frack mud.

A group of private equity firms, led by KKR, had acquired Samson in 2011 for $7.2 billion. Since then, Samson has lost $3 billion. It too hired restructuring advisors to deal with its $3.75 billion in debt. On March 2, Moody’s downgraded Samson to Caa3, pointing at “chronically low natural gas prices,” “suddenly weaker crude oil prices,” the “stressed liquidity position,” and delays in asset sales. It invoked the possibility of “a debt restructuring” and “a high risk of default.”

But maybe not just yet. The New York Post reported today that, according to sources, a JPMorgan-led group, which holds a $1 billion revolving line of credit, is granting Samson a waiver for an expected covenant breach. This would avert default for the moment. Under the deal, the group will reduce the size of the revolver. Last year, the same JPMorgan-led group already reduced the credit line from $1.8 billion to $1 billion and waived a covenant breach.

By curtailing access to funding, they’re driving Samson deeper into what S&P Capital IQ called the “liquidity death spiral.” According to the New York Post’s sources, in August the company has to make an interest payment to its more junior creditors, “and may run out of money later this year.”

Industry soothsayers claimed vociferously over the years that natural gas drillers can make money at these prices due to new technologies and efficiencies. They said this to attract more money. But Quicksilver along with Samson Resources and others are proof that these drillers had been drilling below the cost of production for years. And they’d been bleeding every step along the way. A business model that lasts only as long as new investors are willing to bail out old investors.

But it was the crash in the price of “liquids” that made investors finally squeamish, and they began to look beyond the hype. In doing so, they’re triggering the very bloodletting amongst each other that ever more new money had delayed for years. Only now, it’s a lot more expensive for them than it would have been three years ago. While the companies will get through it in restructured form, investors get crushed.

And as these investors are pulling back to protect themselves, a special phenomenon occurs. Read… Junk-Rated Oil & Gas Companies in a “Liquidity Death Spiral”

But Quicksilver along with Samson Resources and others are proof that these drillers had been drilling below the cost of production for years. And they’d been bleeding every step along the way. A business model that lasts only as long as new investors are willing to bail out old investors is a ponzi scheme.

The best way to rob an oil drilling company is to manage one. The CEOs made $millions, personally, while fronting a scam. Just like the banksters.

‘The best way to rob an oil drilling company is to manage one.’

Bush h8ters just won’t let go, will they? /sarc

When the system is set up so that the few take from the many, I am reminded of Catch 22.

From the wikipedia link –

. . . wanted to sell the Texas Rangers baseball franchise along with the new sports dome; built on land acquired under eminent domain law and built under funding financed through taxpayers’ funds backed by a bond issued for its debt. The new home of the Texas Rangers is still being contested in court by the original landowner who has not received payment for the land. The sports dome has not yet been paid off with the tax increase enacted to pay off the bond. The selling of the baseball team included the new stadium, which accounts for the huge profits the investors received.

. . .

.Many in Arlington protested that the stadium was paid for with public funds, and when the stadium title was given to the Texas Rangers Organization, it effectively allowed Bush to cash out public funds.

A successful looting operation, for the winners in Texas.

Actually, the lawsuits have been finished.

The people that held out the longest was the family of the late Curtis Mathis. They owned land that the Rangers incorrectly used eminent domain to steal in order to build a parking lot.

The case lasted over 10 years and finally, the family was victorius in court. They put out a press release saying that although they spent over $10 million on legal fees and only won $10 million dollars, it was well worth it.

The agreement between the city of Arlington and the Rangers included the provision that the tax payers of Arlington pay any eminent domain judgements, so the taxpayers were on the hook for payment.

Fast forward to 2005, my mothers friend (in her early 70’s) who lived down the street was forced into an eminent domain case with the city attempting to take her two houses to build a new football stadium for billionaire Jerry Jones. Although her houses were accross the street from a new Walmart, the city offered her less money than Walmart had paid years earlier. The city brought up the Curtis Mathis case and told her, yes you could sue for more money and probably win, but you will be long dead before you see any of it. To show they were serious, they lined up bulldozers on the edge of her property and gunned the engines at 7am one morning.

At the same time, the city attempted to take a gas station owned by Quick Trip a regional convience chain. They found out the Cowboys were planning on leasing out the same corner spot to a bigger national convenience chain for a gas station. They promptly sued the city of Arlington and said they had no problem with a 10 year lawsuit, so the city relented and they kept their property.

Surprisingly, during the Cowboys eminment domain issues, Gov Perry passed a law making it much more difficult for cities to take land for sports stadiums (with an exception for Jerry Jones of course :-) ).

“investors get crushed” Investors got what they deserve!

Reaching for yield at the expense of safety of principal always ends the same way. This business is set up at every stage “to lose” for the unwary outsiders. Price volatility is a small part of the exposure.

The people who didn’t understand the risks in the early 80’s in Texas were Dentists and Doctors who with high marginal tax rates took on drilling exposure with little equity but big leveraged Letters of Credit (90/10-full Recourse) all of which was deductible against earned income at that time. It ended with the Medical Industry going down in flames with massive personal bankruptcies as banks foreclosed on the LC’s.

When you add in the horrific toll that ‘weekend warrior’ Cessna piloting took on dentists, it’s a wonder that Texans had any teef left at all. ;-)

I wonder about the liquidation value of these companies. If the marginal value of an oil rig is effectively zero or negative due to the effects of production on oil price, the reported liquidation values may be all wet. Leases and such have real value, but rig value is likely very low.

“A business model that lasts only as long as new investors are willing to bail out old investors.”

Classic Ponzi

Thurfe

The only question I’m interested in is when will I, a taxpayer, have my savings confiscated (current and future) to bail out these astute businessmen suffering from the unjust effects of capitalism red in tooth and claw?

Other than that, if the human psyche didn’t predispose us to fall for this hype over and over again, Charles Ponzi would merely be a name on a long-forgotten tombstone somewhere rather than perhaps the most brilliant economic psychologist in history.