The Greek government appears to have decided to resolve the inherent contradiction of its political promises. The ruling coalition has creditors’ demands that Greece adhere to the terms of an exiting bailout deal, in particular “structural reforms” like cutting pensions, “reforming” labor markets, raising VAT, and continuing with privatizations, while paying its debts and staying in the Eurozone. After a flurry of weekend negotiations, trying to get some movement from the Troika and Eurogroup before a Eurogroup meeting today at which no resolution was expected, Greece has started, late in the game, to threaten to default.

Remember the state of play: Greece is still in the Troika’s sweatbox, and is clearly, desperately short of cash. The body language of the Greek government is a bit too obvious that it really, really needs the €7.2 billion in so-called “bailout” funds in order to make a €750 million payment due to the IMF on Tuesday, May 12, as part of a repayment plan set in 2010. Greece no longer has a primary budget surplus, so the longer the negotiations (or more accurately, impasse) continues, the more dire the Greek government position becomes. It has already stiffed, um, delayed payments to vendors to the government in order to make IMF payments in April and May. And as has been widely reported, the government has also ordered local governments and universities to turn over spare cash for the government to “borrow” to make payments. Many officials in these institutions have objected loudly and some are withholding funds.

Unlike past negotiating inflection points, the reports from various media sources are generally consistent. The creditors have not budged. German Finance minister Wolfgang Schauble warned of the danger of an unintended default over the weekend, then walked it back a hair by saying that Germany would do everything it could to keep Greece in the Eurozone “under justifiable conditions. It must not fail because of us.” The German press also reported that Merkel and Tsipras spoke multiple times over the weekend.

Remember that Eurogroup head Jeoren Djisselbloem said at the last meeting at Riga on April 24 that there would be no deal at this meeting, so expectations were low. And even if there were a miraculous breakthrough, it would still take time to finalize language and get parliamentary approvals. The session is expected to be short, perhaps to keep the discussion civil. If you are at loggerheads, trying prolonging a conversation is unlikely to be productive. The Greek representatives will be Deputy Premier Giannis Dragasakis, Finance Minister Yanis Varoufakis and Deputy Foreign Minister Euclid Tsakalotos.

Neither side is backing down on its demands. From Ambrose Evans-Pritchard:

The only concession so far from the EU creditors is to reduce the target for Greece’s primary surplus from 4.5pc to 2pc of GDP next year…

The Greek newspaper Kathemirini reported that the Eurogroup is drawing up a Plan B that will be presented to Syriza as an “ultimatum”, offering nothing from its side to break the impasse.

To be clear, the “concession” of the lower primary surplus is symbolic, given that economists and policy-makers regarded the 4.5% target for next year to be insane.

The ruling Greek coalition appears to have finally woken up to the fact that it it cornered. As we indicated, the longer the creditors keep Greece in the sweatbox, the more its popularity is destined to decline.

While the latest polls still show Syriza as the most popular party, its support is now at 36%, a round trip from a huge surge after the government took office to back to where it stood when it was voted into office. Approval ratings of the government’s strategy have dropped precipitously from the very high levels reached shortly after the new government took office. As e pointed out early on, the best strategy for the creditors was simply to remain non-negotiable. Either Syriza would capitulate to their demands, or the government would lose support, paving the way for the return of a more complaint coalition. Syriza appears to realize that following the inertial path of trying to extend its negotiating runway does not work in its favor. Even if Greece were to pull a rabbit out of the hat and make the €750 million IMF payment, it has a total of €1.5 billion coming due to the IMF in June, which it almost certainly can’t satisfy if it fails to unlock the bailout funds.

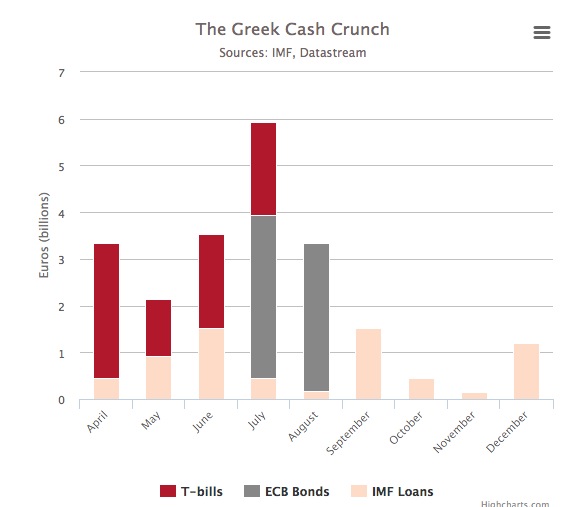

This chart from the Telegraph shows the payments Greece has coming due over the next few months:

Greece if anything is upping the ante. The latest reports are that the Greek government plans to take a more strident position on Monday. They come from Ambrose Evans-Pritchard, who is close to Greek government sources, and Greek Reporter. The overview from Greek Reporter:

After an eight-hour cabinet meeting led by Prime Minister Alexis Tsipras regarding Monday’s crucial Eurogroup, there was no official statement other that the reiteration that the Greek government will not sign an agreement with creditors unless it is within the framework of the people’s mandate.

Greece is also, very late in the game, taking steps to limit bank withdrawals. The UK’s Times on May 5 said that the government was seeking ECB approval for a plan to tax cashpoint withdrawals and certain financial transactions, which they projected would raise as much as €180 million.

The situation is more fluid than it appears. The odds are high that blame game political calculations will win over sound policy. We’re already seeing jockeying starting to take place. Notice Schauble’s “justifiable conditions” caveat. He’s made clear repeatedly that he’d just as soon see Greece leave the Eurozone, but no one, particularly Merkel, wants to be seen to have pushed Greece out. Thus if Greece plays its cards so it can be depicted to have brought the default (and if it comes to that, an exit), that works to the advantage of the hardliners who see Greece as disposable and believe a default/possible exit can be made painful enough for the Greek people so as to make any other country that might contemplate leaving the Eurozone to see that alternative as too costly.

Despite the continued impasse, and virtual certainty of a default on Tuesday, the creditors have quite a lot of choices and options. For instance, despite the IMF’s tough talk about not giving Greece any grace period on a default, an IMF default is not as fine a trigger event at a private sector bond default. As the Financial Times explains:

But that hard line masks a little wiggle room created by the IMF’s own procedures. Under the official timeline plan, it is not until a month after a missed payment that the managing director formally notifies the board and not until three months afterwards that a formal statement to the outside world is expected to be made.

However, the IMF is also in disaster preparation mode, with the agency working with national banking regulators in states where Greek banks have operations to develop contingency plans for a Greek default. Keep in mind that board members of the ECB have stated repeatedly that while they’d prefer to see Greece remain in the Eurozone and an exit would be disruptive, they believe they have the tools to manage any fallout. Nevertheless, a German language report (hat tip Yannis Koutsomitis via Lambert) says the EU Council might have a special session to bypass the Eurogroup impasse. However, given that the IMF has been refusing to budge on structural reforms, and is now seeking to assign blame for the failure of its program in Greece to EU member states failing to write down debt as promised, it’s not clear than any such meeting could achieve a breakthrough.

Similarly, various sources, most recently Greek Reporter, have stated that Greece is hoping to get the Eurogroup to issue a general statement after the meeting that the two sides are making progress. There is a belief in some quarters that that sort of fig lead would help in preventing the ECB from executing on a threat that would almost certainly push the Greek banking system over the brink and force a disorderly Grexit, that of increasing collateral requirements at Greek banks in light of deterioration of the Greek economy.

Thus the creditor officialdom has the ability to keep Greece in play, um, in the sweatbox a while longer, particularly by making reassuring noises if Greece defaults on Tuesday. However, as we pointed out above, continuing discussions (assuming no willingness of the creditors to make new concessions) is of no help to Greece. It merely continues the squeeze on the government and the Eurocrats no doubt hope it will help in assigning blame to Greece.

Greece may have made a significant tactical error. Finance Minister Yanis Varoufakis stated last week that Greece would make the IMF payment due this week. If Greece were to default or make only a partial payment, that would mean the creditors could depict Greece as choosing not to meet its obligations, as opposed to failing out of necessity. Greece is, needless to say, trying to frame the issue as creditor rigidity rather than Greek intransigence, but given that the creditors have had the advantage in access to European media, the odds don’t favor them winning the blame game. From ekathimerini:

Greek officials have expressed the government’s intention to pay the IMF but according to sources some are in favor of not paying if the outcome of Monday’s Eurogroup is not satisfactory. Such a move would lead to Greece being declared bankrupt within a month with capital controls likely to be imposed on Greek banks much sooner than that to avert a bank run.

Mind you, if Greece defaults this week, we suspect it’s out of political rather than fiscal necessity. The government makes salary and pension payments at month end. So far, the new coalition has met those obligations. But paying the IMF and coming up short on pension or wage payments would dent support for Syriza, as would making payment in a scrip like Rob Parenteau’s TANs.

The Greek public is still deeply opposed to a Grexit.

#Greece poll [Marc/@EFSYNTAKTON] — Pro #Euro zone membership: 76.9%, Rupture with Eurozone & return to drachma: 19.2%

— Yannis Koutsomitis (@YanniKouts) May 11, 2015

Reader JTMcPhee cited the science fiction classic Dune in comments on an earlier Greece post. In the novel, the planetary ecologist, Liet Kynes, has been dumped in the desert with no protective gear, a sure death sentence. In a hallucination due to dehydration, his brilliant, control freak father lectures him. The quote: “Then, as his planet killed him, it occurred to Kynes that his father and all the other scientists were wrong, that the most persistent principles of the universe were accident and error.”

We’re likely to see those principles dominating the Greek drama over the coming weeks. Stay tuned.

Absolutely wrong and ignorant of the situation in Greece. As long as the creditors try to corner the government and block payment of €7.2 billion so-called “bailout” funds, the Greek government’s popularity is increasing. At the present moment more than 70% of the people support the government in every step is taking, Be sure about it, Greece will not step back. Greece is again writing HISTORY and in fact it is Greece that has giving a hard time to new world order neo-liberals. Wait and see. You will not believe your eyes, The Greeks will choose to default instead of being cornered. You just cannot understand the situation. Have you ever spoken with a Greek or been to Greece to know how people think?

Please provide links supporting your assertion. Poll data from Greece across multiple polls show the approval ratings for the government’s strategy, and Syriza all falling sharply. Your personal opinion and that of your circle is anecdote, not data.

For instance, from Yannis Koutsomitis on April 21:

Popular support for #Greece govt’s negotiating strategy cracking. @skaigr poll: 45.5% agree (February 72%), 39.5% say it’s wrong (prev 28%)

A nearly 30% fall in approval ratings is dramatic. Similarly, Guardian, which is left-leaning and therefore sympathetic to Greece, stated on May 9 that “Syriza’s popularity has dropped precipitously.” It did rise sharply after the election, but as stated in the post, its approval rating in now 36%. That is back to where it was at the time of the January election.

UPDATE: There is a new poll result from Greek Reporter this morning, It shows that the approval of the government’s strategy has fallen dramatically since February:

The poll was conducted by MARC and also shows that the trust of Greeks in the way the government handles negotiations is waning, with 54.2 saying that the SYRIZA government follows the right strategy when the percentage in February was 81.5. Also, 43.3 percent believe that the negotiation strategy is wrong.

So the MARC poll, which looks to be different than the one Koutsomitis cited (February approval of 72% versus 81.5% in MARC) and likely had more Syriza-friendly wording to get a nearly 10 point higher approval rating in February (poll results are highly sensitive to the phrasing and sequencing of questions), shows a similar large point decline in approval of the government negotiating strategy then to now.

So Yves, what happens?

The Greeks do not have the money for the debt payment. Without the debt payment the Troika will not give Greece the money to pay its state employees and pension payments. Then Greece cannot pay its people. Who wish to remain in the EMU and wish to be paid their wages and pensions, in Euros.

It is an impossible circle?

Yes, it is an impossible circle. Short answers…

The upcoming disaster, however, no matter how much the EuroGroup would like to blame Greece and isolate the damage, will be a terrible blow to EU stability. Think 50% unemployment, old people starving, massive capital flight (if there is any left already), a possibility for insane inflation once the Drachma is in full swing. Hard to look like a “union” when your people go hungry.

And although I am idealistic, and would like to imagine the immediate response to be one of worldwide condemnation of Troikism, in reality it’ll probably be more like extreme Schadenfreude. Not to be too anecdotal (v.s.), but all of my German friends are “excited”… yes, “excited” to see Greece out of the EU. Giddy like a nun with a ruler. Prepare for sadness.

Greece is only 9 million people out of an EU population of something like 340 million.

I agree that the Eurozone is in long term trouble because Germany is pursuing utterly contradictory policies, of wanting to keep large trade surpluses but not finance its trade partners, nor move to a stronger federal structure that would provide fiscal transfers (as in the US, where states like New York and California effectively support states like Mississippi). But the Eurocrats have become masters of extend and pretend. If they can make whatever happens to Greece very painful (and it is already plenty painful), they might delay the political fracture for a few more years, which is all most politicians care about.

The Eurocrats have managed, again and again, to be able to do the bare minimum it takes to keep the Eurozone together at the 11th hour. At some point, their luck will fail. But the Greece problem has been telegraphed well enough in advance that the IMF and ECB have had plenty of time to engage in contingency planning, even as they officially deny that. So while anything is possible, the odds don’t favor a quick unraveling.

Yes, agreed, my thinking was that the Eurozone will chug along just fine, but Greece will suffer desperately. And the thing I think that sickens me the most is that the suffering is deliberate, and from what I can tell based on fundamental misconceptions of what role Greece actually played in the meltdown of aught 8.

Unless there has been a huge upsurge in emigration since, the last census put the Greek population at 10.8 million.

It’s very hard to say when an EMU collapse will happen. On the current course, EMU collapse is inevitable, but as with most things monetary, *when* it happens depends on psychology. It could be right after Grexit, or it could be many years from now.

The only “real” change from a Grexit is that the ECB loans to Greece are obviously bad and thus provide a certain amount of money the ECB can’t pull back, committing it to a certain amount of monetary expansion. The actual amount is certainly too small to exceed the ECB’s ability to compensate. You’d need a Spexit or Italexit for that to come into question.

Agreed, and that is why the more bloody-minded authorities have persuaded themselves if they inflict enough pain on Greece for its intransigence, Spanish and Italian politicians and voters won’t dare cross them.

Thomas Kuhn’s concept of the paradigm and Foucault’s of ruptured discourse come into play here. The situation is one of a worldview (paradigm, discourse, habitus, and so on) no longer solving problems, or every “solution” leading to unintended or further problems. We humans believe we can identify and resolve problems rationally ahead of time. This presupposes we are defining the problems rationally and empirically accurately and that our worldview provides viable answers. I believe that neoliberal TINA is approaching its endgame and its adherents cannot see, a la Kuhn, any alternative. In addition, they are corrupted because the current system “works” for them as long as they keep on exploiting/cannibalizing more and more of the 99%. When we consider the nitty-gritty outcomes of TINA at its endgame, it means the Greeks are getting -literally- a heavy dose of Thanatos, and that still too many of them, the Greeks, prefer the known suffering -which they hope can be ended within the dominate paradigm- over the unknown.

Yannis Koutsomitis twitter posts, which I have been observing, have a tendency to show neoliberal (maybe socioliberal) sources and have a well known bias against Syriza. I would not use his links without further confirmation from less biased sources (scarce these days).

Michael Mixalis is 100% correct. What he says is a sum of many articles and from discussion with people. If you want sources, I add some here that mention what people expect from the government. They are in Greek, but you can use a translator to get the gist of it. Most recent polls show an extremely high acceptance of recent government moves and a 20-24% lead for the government coalition.

http://www.newsbomb.gr/politikh/news/story/585008/nea-dimoskopisi-dinei-provadisma-15-2-ston-syriza

http://www.newsbomb.gr/politikh/news/story/585043/nea-dimoskopisi-deixnei-ton-syriza-mprosta-me-24-monades

Polls are far more accurate than conversations with members of your social group who are likely to have similar views. Articles are similarly not reliable as a guide to popular views. What you read in the media is a reflection of the leanings of the editors of specific publications, not mass opinion.

The polls have been consistent in showing a large fall in Syriza’s popularity since its peak in February. This is indirectly confirmed by the vote of no confidence of the continued bank run.

I have to disagree with this. Polls are designed to tell people what to think; not to tell people what other people actually think. This is done by asking questions in a certain manner, cherry picking the results; sometimes inferring the opinion of people in a manner not reflected by the questions asked. This is why you will have wildly different poll results depending on the company performing the polling and interpreting the results.

No, I have been involved in survey research. Polls are useless to those requisitioning them (marketing people and politicians) if they don’t give a pretty accurate reading of what is happening. You can’t run a messaging or product campaign of any kind with bad data. In the US, the subset of polls that are PR oriented (Rasmussen is one) are a decided minority and their biases are well known to most people in politics and the media.

You are correct in that the those requisitioning them want accurate information, but that does not mean that they want the “accurate” or most relevant results to get published. I did a stint inside a major party affiliated polling firm and saw this first hand.

I generally agree with this in theory but lets just look at the latest UK polling as a counterexample. Those people should be out of business running such garbage polling, but I highly doubt a single head will roll.

The other problem with the Greek polling is that just posing the question can make a respondents head explode. The real answer is that they dont want any of these things. Maybe the Greek survey respondents are pulling a Germany : ” It wont be me who is responsible for Greece leaving the Euro!”

What if someone polls me with two choices : do you want Jeb or HIllary? Well, I will say Hillary, even when I know that I really want Colonel Sanders. What would that poll show?

All that said, you work with the polls you have, and then decide how much to discount them. I would put a somewhat high uncertainty and suspicion rating on these. But in the end, they are the ones that get reported, so they are the results that influence the discourse.

First, no one in the UK was trying to get the polls wrong, which was the argument made above.

Second, the UK results are a big outlier. While they were a huge black eye, they also are seldom so wrong. Nate Silver thinks the big mistake was not having high enough margins of error. And that results from having it be harder to come up with representative samples. That in turn results (at least in the US from more people, particularly the young, not having land lines.

My dim recollection is that there was no polling ouch in the January elections in Greece.

That’s assuming the poll is meant to obtain usable data and not a push poll designed to gin up the story written about it. Which is one reason I never, ever write about poll results unless I can check the methodology and verify that the questions are neutral and randomly ordered. (I once had to fix a medical survey which found that almost 75% of respondents—American college students—felt that oral sex wasn’t sex. I still get a chuckle out of that one.)

And never assume pollsters have any more integrity than, say, Standard & Poor’s, Moody’s and Fitch. We all know how well that worked out.

Be skeptical and verify first.

The polls predict ..

Are those the same polls that predicted the collapse of conservatism in Britain?

Polls are nearly useless when what most Greeks want (an end to the depression while staying in the EMU) is patently impossible. Where they end up when reality dawns can’t be predicted from a poll because the Greeks can’t tell you their own response to learning the truth until after they learn it. How the Grexit happens will have a lot to do with reaction, as do the possibilities available to them (e.g. if the conventional parties’ solution to the Grexit is a return to the EMU with yet more austerity, Syriza may well win by default).

The WIN/Gallup 2014 End of Year Poll found 52% of Greeks favored dropping the Euro in favor of returning to the drachma. How good is that poll? An outlier? I’ve one big issue with it. Conducted by Alternative Research Solutions in Greece, it was an online survey which should send up a red flag for anybody. Still, it was sanctioned by Gallup, and they know how to poll.

The word I’m getting from Greeks are that the polls we’re seeing reported are garbage. Push polls. In light of this, my fallback position has become that the only worthwhile poll in Greece took place on 25 Jan. There’s no getting around that one.

Generally speaking, I’m impressed with just about everything I read on NC, with the sole exception of pretty much everything I’ve read here on Greece. NC isn’t alone here however. The reporting on Greece is uniformly awful. I take everything I see on Greece with a big dose of salt and I’m very careful about making any assertions at all. I don’t think anybody knows what’s really going on in Greece by now.

If that poll were accurate as of now. please tell me why Syriza found it necessary to campaign as a pro-Eurozone party in January to get the votes that it got. It had to tone down its message substantially and play up its pro-Eurozone bona fides.

All accounts say that Syriza picked up old Pasok voters, who are also middle of the road but lost faith in the party and were willing to give Syriza a shot Moreover, 2/3 of Syriza MPs THEMSELVES are moderates and pro-Eurozone. And Varoufakis himself hails from on of the biggest, if not the biggest districts, and thus got more votes than any other MP.

Because it was only 52% & anyone in their right mind won’t base their decisions on one online poll. This doesn’t preclude the possibility that the rest of the polling isn’t garbage either.

Google translate, but you’ll get the gist https://translate.google.com/translate?sl=el&tl=en&js=y&prev=_t&hl=en&ie=UTF-8&u=http%3A%2F%2Fwww.thepressproject.gr%2Farticle%2F76656%2FFoul-tou-euro-se-mpompes-me-xarakiri&edit-text=

There are three things nobody can trust the US & European press to get right: Greece, Venezuela & Honduras. I get tons of it (here at http://papicek.t28.net) & it’s 99.9% propaganda.

I remember the first time I really noticed this disconnect was during the 15M “indignados” events in Madrid. I was there, day after day and night after night, and I was watching news and reading newspapers telling outright lies or hiding what happened. Since then I have learned a lot in terms of media mistrust. Now I look to metainformation much more than to information.

Now I tend to think that if the media wants me to see it one way, it is quite possibly the opposite…

For me it’s sources. A lot of what is passed off as “news” is on behalf of some lobbyist or think tank with an agenda. Always check the authors. Sometimes news articles are actually written by someone whose full-time job is lobbyist.

I would love to have better sourcing on European events at street level. Suggestions?

I have not found many good sources about Greece in English. Looking for twitter links used to work, but lately it delivers mostly trash. What I do is to search google news and compare several reportings, to try to trace sources and manipulations. A lot of work with little benefit, I only am able to do it because I’m unemployed… ;)

BTW, today I found this very manipulative (but telling) tweet by no less than BBCWorld that tells me that the PTB are preparing us for an agreement in Greece. If you look into the news, is it more or less normal reporting, but the headline and the graph is like: “you see, the Greeks started paying and now we can be good with them”… which is outright false but drives us towards the tension release of an staged agreement.

About Spain in Spanish there are plenty of good sources, in English not so many. The very best information about election polling I have found about Spain is the wikipedia… in English. Pure aggregated “pills”, no opinion. :) Very useful to track trends of the same pollsters over time.

With all due respect, you have yet to convince me why the English language reporting worse than the Greek reporting. You consistently become testy in comments when I criticize Syriza for play what I have alway depicted as a weak hand badly. I’ve had serious leftists in Europe write me privately in frustration and despair at what a hash Syriza has made of its situation. This from an economist who has been a consistent public critic of Eurozone austerity policies:

It is a mess – and it is difficult indeed to not get angry with the way the Greek government has been negotiating with its Eurozone “partners”. Let me first stress that these negotiations were never going to be easy and that – indeed – major opposition to a “Greek deal” is coming from the Baltic States and also Spain and Portugal. It is not just Germany or the ECB – Greece may have overestimated the degree of sympathy which other “crisis countries” have for the Greek cause. But in addition to this, Greece has been alienating almost every actor in this bargaining process by errors of omission or commission and has been losing not only “goodwill” (to the extent there was any) but also precious time and the “initiative”. The Syriza government is constantly running after the facts, in a prolonged state of “emergency” which cannot last politically nor socially (at some point all the cash has been used up …..).

So it seems, at least based on your comments, that you view friendliness to the ruling coalition as a significant proxy for you as to whether the news outlet is any good. If so, I don’t agree that that is a good criterion.

The major English reports have done a decent enough job to allow me to call the state of negotiations FAR more accurately than the Greek sources. I care about accuracy of information. I’ve been reading past spin for years (have you missed that this site regularly does close reading of articles to demonstrate to readers where and how the story was skewed?). Both the Telegraph and the Guardian have run live blogs at critical junctures in the negotiations, and those include having reporters reporting live on official statements and news conferences. Are you seriously telling me that the Greek press has outdone them in terms of accuracy and detail?

Moreover, pro-Greek government sources like Ambrose Evans-Pritchard and Greek Reporter incorrectly stated that Greece was going to take a hard line with the Eurogroup as a result of an 8-9 hour “war room” meeting. In fact, Greece did no such thing and just authorized payment to the IMF after a 1 hour meeting, which basically means pretty much nothing of substance was discussed. This is not the first time I’ve given readers misleading information by virtue of relying on Greece-friendly sources. So my experience, in closely covering this topic, is there is vastly more risk of error and misreporting in believing what Greek government-aligned sources say.

It seems pretty clear that the Greek press is heavily propagandized too (yes, more by the neoliberals but the government no doubt has its pet outlets too, and it ought to have an advantage in access to TV). It’s not hard to read through the English MSM to see what the matters of substance are if you take the time to inspect carefully.

Syriza has no advantage whatsoever in access to TV channels since these are 100% oligarch owned and rabidly anti-SYRIZA. NERIT, the so-called replacement to ERT (national broadcaster) was an incomplete project. Greek Reporter, by the way, is not pro-Syriza. Anything but.

I agree that the live blogs of Guardian/Telegraph were good but these are one-off events without deep analysis, and transient. I agree with Santi that the English language press has been shockingly consistent: maybe not so remarkable given they are controlled by 9? owners with more or less the same ideological bias (& variations of) or / and connected in online international groups (such as NYT, Kathimerini, Ha’aretz, WaPo, etc). Responsible English language analysis has mostly been confined to individual financial, economic, political and historically-oriented blogs (naked capitalism was one) and academic press mostly.

As for your quote from an anonymous Leftist, this reaction is par for the course, entirely predictable, endemic and part and parcel of the Left’s longtime negative pathology.

The ideologically committed, Divided Left in Europe and America has had a lot of difficulty with SYRIZA because the party is trying to move the Left beyond sclerotic divisions, Trotskyites, Leninists, Maoists etc. etc. and the millions of red lines that each of these parties hew to which has kept them divided for decades, refusing to act together and thus self marginalized politically. The debate between Callinicos and Kouvelakis that you posted two days ago perfectly illustrates this point.

http://isj.org.uk/syriza-and-socialist-strategy/

Callinicos, though Greek, has been mostly outside Greece during the crisis: he views events through an historical and sympathetic but predictable ‘red line’ lens. Kouvelakis, living in Greece throughout, articulates the experience of the crisis and the learning process the majority Greek Left were able to make in that extreme circumstance.

In Greece ANTARSYA and KKE refused to join forces with Syriza because of ideological red lines, and lost up to half of their own voters to Syriza from frustration.

Worse! – Syriza is “impure”: you don’t have to subscribe to a party & ideology to be part of the movement. Kouvelakis explains this well: referencing Bensaid and Poulantzas – two respected but not northern political philosophers – he describes the radicalization of society in the social compressor of extreme crisis and how spontaneous social mobilization in the case of Greece occurred from so many directions and multiple ways – from unions & political parties to old & new charities, feeding groups, homeless aid networks, the churches, from demonstrations (as different as pensioners and cheated bondholders), anarchists, general strikes, children’s aid and homes, work cooperatives, migrant aid, person-to-person aid privately, education initiatives, medical clinics, families forced to move back in together with 4 generations under one roof but surviving. As small as food bags found hanging daily from street doorknobs, ditto spare clothes, old shoes. The collection & re-distribution of unused medicines. As seemingly unconnected (but psychologically connected) as the sudden huge rise of animal adoptions, animal rights protection. Greek society (across the political spectrum) survived through massive solidarity and myriad imaginative private initiatives and mobilizations that spread nationally. It regained its spirit after a painful, prolonged period of depression, introspection & fear over 5-6 years exactly through its ability to survive in spite of, and in the face of abusive government. This process was faster, different, totally impure, generally non-ideological, deeply moral and upset the traditional Left political prescriptions of process. Yet it has been genuine and transforming.

It also sheds light on the Syriza / ANEL coalition. Ideologically they might be miles apart but ANEL is representative of the same mobilization with the same overriding goal.

Here you go.

Few make the distinction between “remaining in the EU” and preferring a national currency over the euro. Greeks are fully aware of the distinction.

Here’s the poll http://www.google.gr/url?sa=t&rct=j&q=&esrc=s&source=web&cd=3&cad=rja&uact=8&ved=0CC0QFjAC&url=http%3A%2F%2Fwww.orb-international.com%2Fperch%2Fresources%2Feuropeanattitudesresults.pdf&ei=JBxRVYiiPOG1sQS7kYDwAQ&usg=AFQjCNGHSU2VzdfddK83pafcVlgbzFsrQQ&bvm=bv.92885102,d.cWc

Table 2: 77% want to stay in the European Union

Table 4: 32% want to maintain the Euro, 52% want to return to the drachma

Syriza campaigned on a stay-in-Europe platform not because Greeks love the euro but because Greeks realize whatever is going to happen should be as safe for Greece as possible, especially in light of humanitarian crisis. An emotion driven break with the eurozone would yield nothing for Greece despite popular anger. Damaging the Eurozone by uncontrolled Grexit will not make creditors more cooperative or willing to come to a civilized agreement post-Grexit re debt. Considering the asymmetrical treatment of Greece thus far, and the twisted narrative propaganda, Greeks fear the further punishment a rightfully vengeful Europe/Eurozone would dish out when there really IS a reason to punish Greeks further. The hope was that the Eurozone would collapse by way of a big country and Greece could exit with the others quietly in the background, with the same deal as the others. So the popular and the political logic was that Grexit is a process to be handled with extremely conservativism. Thus “pro-Eurozone”.

Greece has asked for a few modest changes of policy (win-win too) in light of the internationally acknowledged disaster of austerity as it pertained to Greece and in light of its democratic mandate. This is extremely reasonable. Greece has stuck to its repayments and demonstrated good faith throughout, while sticking to its modest, reasonable red line. Greece is only 2% of Europe’s economy (down from 3% in 2010) and quietly undergone the world’s biggest fiscal adjustment outside of war: it should be no threat to the Eurozone, and much to its credit, to adjust its failed policy towards Greece in light of what should be an embarrassment to the Eurozone’s economic credibility (and self-damage wrought) and Europe’s political credibility: i.e. policy failure, an unnecessarily destroyed member country economy (on false grounds), the resulting poverty and humanitarian crisis.

This was Syriza’s strategy and it was and still is a good one. The only failure so far has not been on Greece’s side but on the part of the Eurozone in its response and especially the ECB. Meanwhile it is clear that the IMF wants to salvage its own damaged credibility, (such as it is), to put distance between itself and the Eurozone problem, even exit altogether. Thus, IMF ‘deep state’ accommodation on repayment via discovered reserve funds.

It turns out the early reporting on the IMF payment was incorrect. Greece has discretion to make use of the SDR account it tapped. It did not need IMF approval. Thus even if Greece claims it “asked” the IMF, the IMF could not legally say no, and would be falling into a political trap if it tried to (as in Greece would be able to claim that the IMF was trying to overreach).

Gallup is probably the least capable of the major pollers in the US (they have the worst errors, worse even than Rasmussen’s polls-as-propaganda), and in this case probably had little to do with this. Online polls are usually garbage (they were a significant part of the UK fiasco; telephone polls showed a substantial Tory lead) and I’m betting this is an inexperienced outfit too.

The Guardian greek reports are by Helena Smith, an anti-SYRIZA journalist briefed by Venizelos’ personal press agent. Ditto Reuters and Peter Spiegel FT briefed by same. 99% of reportage from those sources are anti-SYRIZA fact twisting. Kathimerini, The TOC, Greek Reporter, Greek Analyst, Check box Check box, Greek Crisis, To Vima, Ta Nea, Ethnos, Proto Thema are oligarch-owned SYRIZA-hating propaganda papers and websites, some invented since SYRIZA came to power. These are non-reliable sources.

On Saturday H Efemerida Ton Syntakton ran with a scoop. Stournaras, governor of the Bank of Greece has been caught briefing a prominent tv journalist on how to present the first 100 days of SYRIZA in a negative light. The document is indisputable. Denied of course. The issue has moved underground.

The need to brief negatively against the government is much stronger inside Greece than outside and 90% of Greek media is oligarch owned. The external systemic press (EU, US) has its own agenda too.

There are only a handful of reliable sources – mostly non-systemic and academic; but the real action is not Greece but 100% to do with the ECB, European economic instability, failed QE, bond flight, creditor country exposures (to each other + Greece) and tottering banks. I see no discussion of that here.

For readers of Greek (sorry, can’t find an English translation), a bit more on the story mentioned by Tsigantes:

http://www.tovima.gr/finance/article/?aid=703260

Basically, an email has recently emerged, sent apparently from the BoG by a close associate of the Governor, which provided a detailed outline of the “FIrst 100 Days” of the new government, in terms of the increasing financial stresses on the banking system/ government reserves. It’s really hard to say what’s going on (I’m out of Greece at the moment for a short stay in another austerity-wracked state, i.e. Illinois), but it looks as if the Gov of the BoG has been, well, not to put too fine a point on it, feeding information to … Reuters.

It is true that the Gov of the BoG is a political appointee; this particular Gov was appointed in June 2014 by the Samaras government (so he is a ND appointment), and had served as the Min of Fin for the Samaras government from 2012-2014. However, it is also true that traditionally, the Gov of the BoG upon assuming the position moves “beyond politics”, somewhat analogous to the President of the Hellenic Republic, who though elected by Parliament sheds his party affiliation upon assuming the Presidency. That a Gov of the BoG might have acted to politically undermine a sitting government is, actually, unheard-of in recent Greek history.

It is also the case that this Gov sits – simultaneously – on the BoG of the IMF, which imho looks like a prima facie conflict of interest under current circumstances. I find it … well, never mind.

The fourth estate is almost entirely anti-government. During the first few weeks of the new government, I was joking with friends that watching SKAI was better than watching German news. I’m constantly begging people back in Greece for reliable sources of news – at the moment, there aren’t any, period. You really just need to be there at the moment. I survey a range of twitter feeds and read the lead stories in a couple of newspapers, but what I’m looking for is mostly what Parliament’s doing – contrary to what’s being reported in the Greek and Anglophone press, Parliament’s been pretty busy, as have a number of Ministries. For those who are interested, here’s an EU report on the state of the Greek media today:

http://www.mediadb.eu/en/european-media-database/greece.html

If anybody’s interested, I’d be happy to provide updates on Parliamentary debates/ legislation/ committee formation during this period.

http://www.electograph.com/search/label/Greece

In all polls ignoring undecided Syriza grows and a lot, in those including the undecided, Syriza barely falls.

Yes gardener1, it’s an impossible circle.

Actually, it’s the arch-famous ‘Greek Impossible Triangle’ that every Greek and his sister talk endlessly about.

A worthwhile, to-the-point source is http://www.iiprc.org/europe-s-trapdoor-slams-shut.html..

Hey guys, please stop squabbling for a minute about poll results, poll interpretation, poll validity, poll quality, and the rest of the bickering.

Let’s just state the obvious that we would all agree with: Greeks just want to have their cake and it too.

So, it’s a “Greek Impossible Triangle“, i.e. Greeks don’t want to pay taxes as they should, nor do they want austerity… or leaving the euro… while simultaneously opposing a referendum to decide the matter.

…kinda like Americans who think they want Peace while exporting War across the planet?

Oh yes Bruno, your most valid point comes through loud and clear as our beloved Nobel-Prize-Awardee President ‘Yes-We-Can‘ (remember ?) Obama has currently at least half a dozen wars under his belt.

So while the Greeks may cheat here and there on softies we have never wasted time just grabbing soft and hard stuff ASAP for ourselves as if the world’s were ours (ain’t it ?).

‘American exceptionalism’ we call it.

Back on track, Greece should just cut off links with the EZ even though its fat cats may not like it. Greece should have never being part of the EZ, but the BB axis needed such members and Greeks entertained the fancy idea. They’d be better off pulling a Grexit than what they are facing now despite the initial hardships they’d go through.

The euro can’t last that long either, so…

You know, the Ottoman Empire thought their own markets were safe & stable from the Europeans because they had erected walls around them:

(Bold mine.)

So “have their cake and eat it too” is empty-headed claptrap. The problem of the periphery (whose dynamic was the point in what I quoted above) was well known as the monetary union was being debated and in the euphoria of the fall of the Soviet Union, these inevitable problems in the Maastricht Treaty were glossed over. Greeks should have known they’d be Europe’s poor child (Italy’s province Brescia has a bigger GDP than Greece) from the start and that’s on them. What’s on the rest of the EU, is that when push came to shove, they decided to conveniently forget the popular terms under which the Maastricht Treaty was adopted back in 1991. The result is that the EU today is less a union than a banking cartel intent on looting Cypriot bank accounts, tossing Greek retirees out onto the streets and putting people out of work.

They call that “structural reform” and golly, aren’t they being kind to themselves. Bunch of predators.

papicek, your equation should include the Greek fat cats as part of the BB-axis predators.

At any rate :

First, political union.

Then, fiscal union (at the very least, sorta).

After that (if minimally consolidated) a banking union would follow.

Fourth, monetary union (cross your fingers for this one)

So Euroland put the cart before the horses, so no hope now for the (über fiat) Euro.

Let’s not beat around the bush, they blew it.

And war (in any of its modern forms) is now far closer rather than impossible which, mind you, was the original intent way back then. H.Kohl and F. Mitterand might spin their way out of their coffins if they even get word of what’s going on now.

So SYRIZA was basically planning this all along and all those on the left who questioned their negotiation strategy were talking through their… Why am I not surprised? It was obvious from day one that SYRIZA had to be seen to be playing the game because that was the platform they were elected on. Once it became clear to the electorate that the refusal was on the part of the EU and not of SYRIZA then the government could start playing hardball. All of this was pretty obvious but a bunch of geniuses thought that they had identified a blindspot in Varoufakis’ mind. Yet it was clear that SYRIZA have not given an inch since they got into power.

P.S. Poll results falling after an election is completely normal. Governments always get a ‘grace period’ with the electorate. You really cannot tell how much of this was down to their ‘failed’ negotiation strategy.

A fall from 70-80% approval ratings when the strategy was unveiled in February by over 25 points in a mere two and a half months is a HUGE drop. There is no prettying that up.

And there are plenty of examples of Syriza giving ground, despite its “red lines” PR. It reversed itself on the Pireaus privatization and has signaled it is willing to concede more ground on that issue in general, and has also made concessions on VAT. Varoufakis saying that Greece would always run a primary surplus means he has committed the government to continued austerity. All the new coalition is arguing over is whether they can get it to be austerity lite as opposed to the old industrial strength version. Syriza has also engaged in tactics that it criticized the old coalition for using with the creditors, most important taking funds from local governments! See here for a longer-form recap:

http://www.truth-out.org/opinion/item/30575-syriza-lies-broken-promises-and-prolonged-austerity#

I wouldn’t be surprised if Syriza’s plan all along was to get to a default (probably not exit from the EMU though) but they’ve done a bad job preparing if that was their goal. Tapping out liquidity sources *prior* to default/Grexit/whatever was a big mistake, as was infuriating and frightening pensioners and local governments.

All my Greek contacts (a fair number, typically spending short stages in Spain right now or in the last times) still show strong support for Syriza. As all of us, a solution that does not imply losing dignity in the numbers would be preferred, but barred that they all prefer defaulting than capitulating. Because they now that capitulating leads to ruin, albeit more slowly, and they prefer a fast trip down there… :)

I hate to tell you, but you have fallen prey to sample bias.

I might, but selecting a few polls from dubious agencies pushed into the neoliberal media doesn’t look like a very safe sample either. I’d rather stick to facts. What is getting me sick is that Varoufakis and Tsipras repeat the same words once and again since months ago and the media construct very dramatic stories of catastrophic failure all the time. I’m still waiting to see some real signal of “be compromised”. I guess that there will be reforms, but not your proverbial wage repression, unemployment and money for brother-in-laws reforms that we are tired to see in Spain…

As an example, this news about how Greek Public Television reopened today has been skipped by most if not all international press (I found it via eldiario.es in Spanish) It is highly symbolic, as the public TV was closed and privatized in the middle of mistaken austerity measures.

Huh? Tsipras and Varoufakis have regularly contradicted themselves. Early on, Varoufakis made a number of statements to the international media, then said things that were significantly different in local interviews. Both Varoufakis and Tsipras have had a habit (Tsipras more so than Varoufakis) of making conciliatory statements after meetings with European leaders, then significantly or entirely walking them back as soon as they return to Greece. This happens with such regularity that I have no idea whether this is raw cynicism, or trying to run significantly different stories to two different audiences when the media is too open to allow for that, or that Tsirpas gets beaten up by the radical wing of Syriza when he gets back home and has to make at least a partial retreat to keep them from breaking up the coalition.

How can you keep coming here and make such abject misrepresentations? As much as I sympathize with Syriza’s aims, even as I deplore their ineptitude, I’m not about to have someone run a disinformation campaign in the NC comments section. It increasingly looks like that is what you are doing.

Yves, I cannot understand in what way you believe Santi is making misrepresentations.

Yes, Santi, ERT is re-opened and the staff of the barely functioning NERIT (ex-ERT technicians) will be folded back into it. This is very important because it means we will finally have one non-right-wing, non-Oligarch channel that has a constitutional obligation to present the news from all sides, give equal time to political parties during elections, that provides straight newscasts and also high quality cultural programs. A total staff of 2000 from presenters to orchestra, archivists, internal and external technicians provide 2 tv channels and 4-5 radio channels, paid for entirely (since forever) by 3-4 euros added to everyone’s telephone bill 6 times a year, max total 24 euros/annum. A bargain.

It was a political decision to shut ERT 5 months before the European/regional/mayorial elections. It didn’t change the catastrophic result for the previous government.

In addition, the unarmed Athens police, the school guards and Finance ministry cleaning ladies have all been rehired.

This week’s Marc Gallup poll.

The support for SYRIZA today is the same 36,2% that voted them into office. Plus ANEL 4,1% = 41,3% total.

The opposition is ND 21% + Potami 6,7% + 3,1% PASOK = 30,8% total, less than at the election. However these parties supported SYRIZA’s humanitarian measures bill (unanimous).

KKE (5%) and Golden Dawn (5,4% a drop of almost 3% points) are two outlier anti-memorandum parties that have so far supported SYRIZA bills and will not support the opposition.

51.7% of the 82,5% total parliamentary vote are anti-memorandum parties, 30.8% are pro-austerity (opposition). SYRIZA/ANEL commands 41,3% of the 82,5% parliamentary votes.

For the rest:

5% are for parties not represented in parliament.

12.9% are undecided but this category includes the total 5.5% dropouts from GD, Potami and PASOK.

It also includes elderly who are not obliged to vote after 75 (half do), and emigrants still on the voting lists.

600,000 new 18 year old voters were (illegally) disqualified by the previous ND/PASOK gov’t from voting in the Jan. election and will vote in the next election with this years’ new 18 year olds.

Those supporting SYRIZA’s eurozone battle from all parties is 54%.

Those supporting Tsipras as PM are 65,9%.

This does not look like failure to me.

The Greek government appears to have decided … late in the game …

This word choice conveys the impression that Greece is uncertain in their strategy. But they “decided” on their strategy months ago. What we are seeing now appears to be the culmination of that strategy (which necessarily entails a confusing mix of agreeableness and noncompliance – see Making Sense of Greece). The big concern, I thought, was that Greece might capitulate (in a TINA! sellout) rather than adhere to their stated strategy. It seems to me that by threatening default (finally) they show that they are in fact executing on their strategy.

=

I think I read somewhere that Greece would have a 30-day window to cure a default (non-payment) to the IMF. Can anyone confirm this? I expect that there are other payments within that 30-day window that Greece could default on. Thus, Greece can make a partial IMF payment (a great way to signal their distress and put EG on notice), then pay their public sector workers and then default on a payment to the EG (who refuses to release the bailout funds!).

=

7.2 billion of bailout money is being withheld. If Greece defaults, it will say that it is because this money was not provided. Greece would say that they did everything they could to maintain payments. At the same time the Troika/Institutions know that providing these bailout funds is just throwing good money after bad.

=

=

H O P

PS I realize that Greece has said or done some things that may show a willingness to extend/deepen austerity. This has created much angst and I too have been critical of Syriza. But this is a game of chicken where it is not clear who ‘wins’ until the end. What seem most important at this point is that they are talking about a default rather than announcing a grand bargain.

How can a party have a strategy when it is internally contradictory (staying in the Eurozone, making all payments to the creditors, maintain primary surpluses, which is austerity and (supposedly) ending austerity? And Syriza itself is divided, with its hard left 1’/3 favoring a Grexit and the moderates not.

This “strategy” shows a certain disdain for nearly everyone involved. If it is a strategy at all, it is only one of obfuscation, in that they have a specific thing in mind, but they won’t say quite what it is, and in the end, will just say anything at any time and hope that they can somewhere along the way get a break and have an out. I would say that this might work sometimes, but given that it was Schauble and co that was on the other side of the table, it reeks of the Greeks having absolutely no clue as to what they are doing. They had one viable strategy up front, standing hard with the nuclear threat, then took their only card off the table. Amateur hour, barring some very crazy convoluted strategy of which everything we’ve seen so far is a piece, including the YV sidelining. Doubtful.

It is contradictory. Syriza can be criticizized for not chosing a more straightforward strategy (and I have been critical of that).

Syriza’s stragegy is to force Troika/Institutions to recognized the need for a restructuring. this requires that Greece pay lip service to the need for austerity and debt payment schedule but that is less important than their noncooperativeness, which makes it impossible to reach an agreement. IMO, any agreement before the 11th hour would very likely be a sell out.

=

Frankly, I think it quite possible that Euro Security Services foment/incite a coup rather than see Greece default and Syriza succeed. The inability for Syriza to explain a strategy that is on-its-face irresponsible and involves negotiating in bad faith is an inherent weakness. We see this weakness being used against them as they are attacked in the media as incompetent and their intransigence is portrayed as a danger to European security via warnings about immigration and the Gazprom pipeline. Such concerns could be used as a reason for a coup.

Right on Yves, but you forgot to add the most important goal for Syriza (or any political party anytime, anywhere) namely “staying in power”.

Please do check out the “Greek Impossible Triangle” at

http://www.iiprc.org/europe-s-trapdoor-slams-shut.html.

Maybe we should wait and see if those poll numbers go up. Though, I don’t see how any poll can be accurate these days when so many folk either don’t have land lines or carefully screen incoming calls. An enormous mistrust has been generated by the ptb’s untrustworthy actions, so I don’t believe in poll data any longer, now that we have it partially revealed how much manipulation across the board is simply ‘the new normal’.

It seems to me Syriza has had to be very crafty – people get their countries invaded and bombs dropped on them for taking an unambiguous stand before they have all their ducks in a row. Time is not on the side of this nefarious system, so playing for time is totally worth the effort – and I don’t see that as in anyway resembling what Obama did when he shafted the electorate. In fact, it’s just the opposite.

Oh, I agree completely but I get enough hectoring from the Syria loyalists without accusing them of having their strategy driven at least in part by survival considerations.

SYRIZA is a party made up of several parties and also non-SYRIZA SYRIZA-sympathetic members. Its strength in the greek political reality is that it has open debates. These have been the only public debates throughout the 6 years of the crisis. It is no secret that within SYRIZA 30% favour Grexit, another % would also like to exit the EU and NATO. This is similar to the range of opinion within the UK’s old Tory and Labour parties, and perhaps also the US parties (consider Saunders, Warren, Clinton, Obama – rather contradictory too, if that is the best way to characterise it). Despite differences of opinion on certain issues the party works together on a series of stepped goals; also Lafazanis, head of Left Platform, (unlike Lapavitsas, a lone wolf) consults Tsipras for all his moves and statements.

As for the Pireaus deal, it is worth remembering that this is with Chinese, who also showed good faith by buying 200 million of T bills the same week, and even so this is not a complete sell off but the Greek government retains some shares.

I’ve been predicting for some time that the powers that be will never permit a Greek default and I’m standing by that now. What I see, first of all, is that nothing will be resolved until the absolute last minute required and that minute can be extended and pretended for some time yet. There have already been so many “deadlines” the media has now dropped the term altogether.

What I see is that Greece will ultimately get its loan, but under some sort of fig leaf that will enable the troika to save face and make it look other than what it really is. Not that anyone will be fooled. But no one has been fooled by these people for some time now and it doesn’t seem to matter. The problem is that Greece does not need yet another loan. So the “final resolution” of this crisis will quickly lead to another crisis.

I agree, docg. The Eurogroup will not allow a Grexit. Whether it can prevent a default is another matter.

Under review now is the last tranche of the MOU, whose re-payment previous governments have already committed Greek taxpayers, after which Greece exits (i.e. finishes) the programme. However Germany does not want Greece to escape control and therefore insists on imposing a 3rd loan package/memorandum, lent and overseen by the Germans. Greece certainly does not need nor want a third loan, a position agreed to by all parties. Most likely the issue of the 3rd loan is being piggybacked onto the release of this last tranche.

The EU will not allow Greece to default. It’s not just the euro it’s also the fact that it would push Greece into the arms of Eurasia (i.e. Russia and China) and would leave the Trans Atlantic Pipeline dream in tatters. That’s not saying the TAP is going to happen (especially as Eurasia can offer Greece far more than the EU) but Greece is trying to extract the maximum benefits given it’s strategic position within Europe.

Greece can default without leaving the Eurozone. We’ve discussed this in previous posts.

Also consider:

Put it another way: if the EU saw things your way, we’d have seen negotiating progress over the weekend. The media reports are in agreement that there was none.

The creditors’ winning strategy is to keep Greece in a sweatbox and keep in the Eurozone. They might be able to downplay a default enough to keep Mr. Market from getting too rattled (as in stressing that the IMF has latitude on what steps it takes when after a default, and also pretending that since negotiations are ongoing, there still could be a deal. So we will learn a lot about each side’s resolve in the next 36 hours.

If the ECB reallyreallyreally wants to avoid a default, they can arrange a shell game to avoid it, legal technicalities be ******. Who’s gonna sue? On a guess they’ll do it if a deal is reached to deal with the deadlines but not otherwise. That’s mindreading of course, with very low confidence.

Agreed, but this process is really public, and the ECB seems to want cover for its moves. It clearly does not like keeping Greece on the ELA drip-feed, but will keep doing so until things change.

Usually a lurker but a regular reader.

Is this site under a weird pro-Syriza invasion? I see a bunch of comments from people that are new (save Santi, I don’t recall Armchair Revolutionary posting on Greece, but I could have missed it) all hitting the same message “Oh the polls are no good and you have Greek opinion all wrong.” It seems weird than anyone in Greece should care that much to do thought policing at NC, particularly the line Yves taking is hardly new (and not the main thrust of the post either). Still, this influx trips my “something is wrong with this picture” register.

Like you, I am primarily a reader. I have been a regular reader here since Yves posted on the Monty Hall Let’s Make a Deal health care rescission issue something like 6 years ago. I am chiming in now, because I think Yves is placing too much weight on these polls. I cannot say that these polls are inaccurate, but I can also say that I have worked inside a polling firm. I have seen questions constructed in manner to yield results for publication that do not reflect the real opinion of those being polled. The goal in constructing questions in this manner is to influence those reading the published results; not to give them better information.

Huh? Please look at the the post again.

The poll issue is the LAST point and takes all of one paragraph in a 24 paragraph post. I don’t know why readers have gone batshit over a single observation, which does have factual support and is clearly documented. Honestly, this reaction looks to be displaced resentment over laying out how bad things look for Syriza. I don’t mean to personalize this, since other readers are also fixating on the polls, but I’ve seen this behavior repeatedly in Greece posts,: Syriza defenders will sometimes take issue, often vehemently, with secondary points where the post’s position is entirely defensible. It seems as if they are overly eager to impugn any Syriza critic.

In your comments above, you have used the polls to back your positions quite a bit. I am just saying that I am not so confident in those numbers. Polls are relatively cheap to perform, especially when compared with the amount of money in play here. I could easily see these manufactured for the primary purpose of influencing opinion.

With that said, I tend to agree with your overall pessimistic position on Syriza. Early on, I gave you 60% chance of being right and having been seeing this number creep up consistently. The game is not over, but it is looking close.

I kind of agree with your description of polling firms. Where I live polling has become big business the last 15 years. Coming up with different results is really the core business. How else to get attention and customers if you try to challenge the “old market leaders? We used to have only two and today they are so many you could hardly count them. I would call their strategy market-differentiation but when it comes to big issues they all want to take part and I am sure many of them have hidden biases in their polls using samling-methods which could be difficult to evaluate.

I am not criticizing the greek polls in this matter.

Domestically Syriza continues to fan the flames of the blame game and seek outside scapegoats. Since the end of April a 50 second short featuring footage from the Nazi occupation is being shown in 35 Athens subway stations. The film starts with images of German planes flying over the Parthenon and the words “World War II, resistance, we do not forget.”

SWAP from the FT blog site noted that:

A few months ago Greece had regained access to capital markets.

3-5 year bond issues below 5% yield, massive oversubscription

Access to ECB money was unquestioned

Access to ECB QE had been OKed

A third bailout was in the cards

And now? Once Syriza gained power, all the funding is gone. Greece is now truly bankrupt because Greeks chose to elect a party that no one would lend to.

All those Greek state employees-subsidees who voted for Syriza looking for the eternal handout must be feeling rather foolish. They backed the only party that won’t be able to pay them (in a real currency that is; fake payments will soon happen; in a fake currency).”

On Friday the PM in Parliament noted that the current issue is an issue of political will and an issue of whether Europe will tolerate not a leftist government but democracy.

IMO, The Troika is trying to change the structural system in Greece that is archaic and financially defunct. To a great extent the current issues surrounding Greece relate to power. Regardless of which party is in power in Greece…it relies on jobs, patronage, corruption and gaming the rules. Syriza doesn’t want to lose power and needs a referendum to gain political protection for not upholding their “red lines”. Internal strife within Syriza will play a part but most of these issues are really secondary.

Can the existing system economically balance their books? No.

Are the Greek political parties willing to make needed structural changes. Not really.

What reform initiatives demanded by the Troika have actually been implemented?

Who pays for the needed moneys to fill the funding gap?

The needed reforms have been lost in a battle of defending political power and propaganda.

First, Greece is still a sovereign nation and, thus, can elect anyone they choose. Second, and a follow-on from the first, is that NO banker, country, or corporation(s) gets to dictate what or who is “acceptable” for governance of ANY country. They have one option: suck it.

I believe truly that if Syriza really wanted to win, they could but it requires going truly bold…and threatening expulsion of NATO/US troops and leaving NATO as real possibilities along with leaving the EU high and dry without a single dime of any payment whatsoever. If you see ruin no matter what you do, you may as well make it REALLY hurt those who sit pretty outside who think they get to run roughshod all over you without harming themselves. I am a true believer in various forms of MAD strategy…and following through if your bluff is called.

I hate to tell you, but the agreements for the EU and Eurozone have extensive language on how the members states are giving up significant aspects of national sovereignity. Moreover, the Troika exercises even more de facto power through the ECB’s ability to destroy the Greek banking system by withdrawing the ELA. As we’ve said, there are effectively curbs on the ECB’s power, since its governors are very mindful of the risk of an unelected body acting without political cover. But do not underestimate their power as the Troika’s fist.

Greece is a sovereign nation and can elect who they choose. If the Troika lends Greece money based on certain conditions, they become a party to an agreement as does Greece. If Greece does not want to abide by the agreement, I have no problem with that. Lending more money to someone who has decided not to honor a prior agreement does not make sense. Syriza proposed leaving NATO in their 40 point program after election. They have back-tracked on that. They also proposed terminating government payment for the clergy and a separation of church and state; they have back-tracked on that. Syriza is propagandizing the situation with appeals to Greek pride, nationalism and dignity…attacking Germany and the evil Troika. At the same time Syriza shows nepotism and robs the coffers of municipalities and state ventures. Syriza re-installs cleaning ladies but doesn’t pay their bills for a wide swath of third party and independent contractor jobs/supplies. As the Parliament votes to reinstate up to 13,000 laid off workers, hospitals are running out of supplies. Personally I don’t care if Greece pays the Troika. I would prefer that they don’t and fend for themselves. The reality of the matter is that Greece is responsible to themselves. Until Greece cleans up their system of patronage, cartelism, bribery, tax evasion, etc. it will be a declining economy and the well off/elite/politicians within Greece will reap undue rewards. Greece needs a major restructuring but your MAD strategy still leaves Greece with a huge problem…a political party that will house clean. Whether it be the New Democracy, PASOK or Syriza… they all parcel out patronage and protection to get elected. Once elected they don’t have the funds to pay off all the IOUs to their constituency and still run the country in a competent manner. Greek political parties talk a great game but don’t perform. Syriza as a “reform” party has done what in 100 days in office???

No, that is just not accurate. Greece does not control its central bank, for instance. It is part of the Eurogroup system. Only the governor is a political appointee. Based on a quick look at the governance structure, the Fed looks to be more accountable to the public than the Hellenic Central Bank is. Greece also cannot legally exit the EU uniaterally; it must ask permission, enter into negotiations, and if those don’t reach resolution, the exit does become automatic…24 months later. Most important, the Eurozone treaties discuss at length how the EU is a unique arrangement and member states submit to its jurisdiction, and rescind their rights to have disputes adjudicated in any courts except courts authorized under EU treaties and following EU laws.

Tell that to the Constitutional Court of Germany, who defined itself explicitly as the ultimate arbiter of treaties in Germany ! I quote from here

“If, for example, European institutions or governmental entities were to implement or to develop the Maastricht Treaty in a manner no longer covered by the Treaty in the form of it upon which the German Act of Consent is based, any legal instrument arising from such activity would not be binding within German territory. German State institutions would be prevented by reasons of constitutional law from applying such legal instruments in Germany. ”

Lisbon didn’t change that.

This being said, let me remind you now what is the ECB mandate, which is, as what is reminded above, the SOLE source of its authority :

“The ESCB shall act in accordance with the principle of an open market economy with free competition, favouring an efficient allocation of resources, and in compliance with the principles set out in Article 119 of the Treaty on the Functioning of the European Union.”

with the Article 119 containing, inter alia :

“3. These activities of the Member States and the Union shall entail compliance with the following guiding principles: stable prices, sound public finances and monetary conditions and a sustainable balance of payments.”

Letting balance of payments going haywire through Target2 imbalances (especially for Germany) was dereliction of duties from the ECB, and it would be the same for an abrupt ELA cut or disruption of the settlement system (how could this be compatible with “efficient allocation of resources” ?)

When Greece will effectively default (because we all know it is not an “if”), it will have many legal grounds under EU Law to take conservatory measures, including firing the whole Board of the BOG, printing banknotes or entering into currency swaps with external counterparties (with generous overcollateralization of the newly created “BOG-euros”). The Eurozone countries will not agree ? Then they will have no choice than to sue in punctilious EU Courts ! It will take a very long time to actually prove that a euro printed by the BOG under such circumstances is not a euro, but actually a drachma, and it could open peoples’ eyes that the euro is indeed a very fragile construction…

The needed “reforms” are a 30% cut on pensions and a 20% cut on salaries. This reduces the minimum wage from 530 EUR / m to 416 EUR/ m before taxes. The new minimum wage will be 40% (below half) of what the EU defines as poverty level whereas the present wage is half. Taxes are paid on the first euro earned, there is no poverty cut off point. Any remaining union protections, pitiful as they are, (American workers are better protected) must be stripped. All of these “reforms” break EU laws and also the EU Conventions on Human Rights, Labour Rights, and Social Protection. They also break Greece’s constitution.

But it is clear that in your view all these European conventions and social protections were undesirable anyway and must be broken: obviously you are in the same neo-liberal, corporate protective camp as Scheuble and Djeislebloem.

As for the Greeks whose character and reality you claim to know so well, they are so beneath contempt and deserving of their situation, I am surprised that you bother discussing them.

Anybody who read Varoufakis book (and followed his blog) understands well (between the lines) that there are only two options: (1) With the EU if there is reform. (2) Without the EU if there is no reform. As a minister he is obliged to talk different and play the attrition game.

Huh? Varoufakis has repeatedly and consistently said in his blog posts that exiting the Eurozone would be a disaster for Greece, in no small measure because it would be a disaster for the Eurozone too.

Not true.

I suggest you rewatch the, now infamous, “finger lecture” , especially 42:30 to 44:30.

his stated goal is to have an euro with inter country transfers, or destroy the euro altogether, preferably while keeping the EU.

I hope that thanks to German AND Greek locking horns (appropriate for minotaurs no ?) , the latter outcome will happen. I admit my bias, but I believe it is what it takes to avoid extremist parties taking over big countries in the Eurozone. The crazy euro construction is the main piece of resentment that fuels the takeoff of these parties.

This article says the opposite of what was just on TV news this morning, which showed a public demonstration in Greece. The announcer said that the current Greek government has promised to continue the austerity programs. I thought that Syriza had been voted in because the Greeks did not want the austerity programs to continue….

The fact of demonstrations in isolation does not say anything. You need to have a decent estimate of crowd size to reach conclusions. As Lambert will tell you from his intense observation of Ferguson and other protests, the media are masters of taking narrow shots of protestors to make the demonstrations look bigger than they are. So you can’t go on video images unless it’s a shot at really high elevation (from a helicopter or tall building) so you can see the overall mass of people.

Helicopter, building, or consumer-grade drone (heavily used in the Bangkok protests last year, to great effect).

SYRIZA has NOT ‘promised to continue the austerity programs’ and it could be that the demos you watched were about the education issue, something separate. These are large demonstrations.

There is a ‘big picture’ context to all this that if introduced might permit more economy in the discussion of Greece, TPP and TPIP and bunches of other issues that surface on this blog. It boils down to the abuse of money – from the global level of the US abusing (to put it mildly) its “exorbitant privilege” of the world’s principal reserve currency to the TBTF banks, hedge fund operators and their like employing what Varoufakis calls “private money” created ex nihilo and passed off on the public as ‘wealth’.

Perhaps one of the reasons Wall Street people like Minsky so well is his ability to cut to the quick with observations like “Any unit (i.e. anyone who can get credit – me) can create money. The problem is getting it accepted.” The peaceful way to secure that acceptance is finding the next ‘greater fool’ in the financial markets during periods of “irrational exuberance”. (That’s the real job description for a Wall Street financial engineer.) When the money so created is actually used to further the creation of wealth this little fraud on the money-holding public, euphemized in the world of finance as “efficiency of capital” may not be such a bad thing.

But this “private money” creation – mostly by or for people who already have more money than they could spend in several lifetimes – has been carried to such an extreme under the reign of finance capitalism it threatens to destroy the utility of this little fraud on the money-holding public. When there are no ‘greater fools’ to be found because the big fish have eaten all the little fish, those who play money games just to wrack up a bigger score must rely on the coercive power of the state.