By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Two weeks ago, when I wrote about the Shanghai Containerized Freight Index (SCFI), the index had fallen so far so fast that it seemed to be a statistical fluke, something that would instantly bounce back. The SCFI tracks the spot rates from Shanghai to various destinations around the world. At the time, the SCFI component for Northern Europe had plunged 14% from the prior week to $399 per twenty-foot container equivalent unit (TEU), down 67% from a year ago. An all-time low.

There was a lot of handwringing because, even with the lower bunker fuel costs, the break-even rates for these routes were $800 per TEU, according to a report by Drewry Maritime Research. Over twice the spot shipping rates!

The question was how much lower could rates drop?

A lot lower. Over the two weeks since, the SCFI for Northern Europe plunged another 14% to $343, setting a new all-time low. A terrific 68% collapse from the same week a year ago. Something big is going on in the China-Europe trade.

Carriers have tried to impose big rate increases, with UASC pushing for an increase of $1,300 per TEU, and a gaggle of others going for an increase of $1,000 per TEU, according to the Journal of Commerce. None of them were able to make them stick.

The swooning rates came as bunker fuel costs have been rising off their January lows. Higher input costs are hitting container carriers just as revenues are collapsing. A toxic mix.

Now the hope is that planned rate increases for June are going to stick….

On some other routes, carriers have succeed in raising rates, and so not all routes from China suffered the same relentlessly brutal fate. Rates ticked up recently to the Mediterranean, South America, and the US West Coast.

But that doesn’t say much. On the routes from Shanghai to the US West Coast, carriers tried to impose rate increases effective April 1. But after rising by nearly $300 to $1,932 per forty-foot container equivalent unit (FEU) in the first week, the spot rate plunged to $1,623 in the second week, and to $1,596 in the third week. In the week just ended, the index jumped to $1,783. It’s still down 8% from early April, and about back where it was a year ago.

Rates lost ground on other routes, such as to Australia/New Zealand and the US East Coast (those rates had been inflated by the labor dispute at West Coast ports that had caused shippers to bypass them). And so the composite SCFI for all routes rose to 761, from 702 which had been the lowest level in years! The index is down 34% from a year ago and far below the multi-year range between 900 and 1,200.

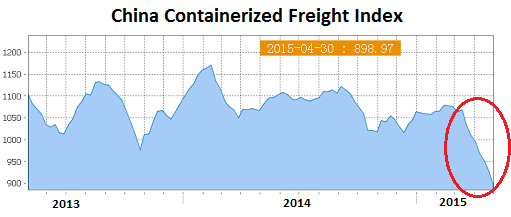

The much broader China Containerized Freight Index (CCFI), which is sponsored by the Chinese Ministry of Communications, paints a similar picture.

While the SCFI tracks spot rates from Shanghai to global markets and can be very volatile, the CCFI tracks spot and contractual rates for all Chinese container ports, is much less jumpy, doesn’t react as quickly to changes in spot rates, and is “more comprehensive and macroeconomic,” as the Shanghai Shipping Exchange, which operates it, explains. It’s considered “the second world freight index” after the Baltic Dry Index.

And it has skidded 16% since mid-February to a multi-year low of 899. This is what the 2-month plunge looks like:

Another index, the Worldwide Container Index for routes from Asia to the Americas and Europe, which Drewry cites, has plummeted 41% since January to below $1,300 per FEU (ugly chart). Clearly, something is going on in the east-west container business – and beyond – to create this sort of gloom.

On top of the list of reasons is weak demand for imports in Europe, particularly the Eurozone, whose currency has been purposefully massacred by the ECB to achieve just that sort of effect: reducing imports and goosing exports as part of the currency war. Imports measured in euros may actually rise, since the same imports are now more expensive. But the number of containers would drop, since the same amount of euros now buys a lot less in China, whose currency is pegged to the dollar.

In the US, there has been a monstrous buildup of business inventories. Inventories tie up cash. Eventually businesses try to bring them back in line by cutting orders. And that comes on top of a really crummy first quarter.

On the Chinese side, the impact has already shown up, however foggy the figures may be. China’s “official” manufacturing PMI, which was released on Friday, came in at 50.1, barely in expansion mode, and the worst reading for an April since 2005. But it captures the state-owned giants that are less engaged in manufacturing for exports.

The HSBC manufacturing PMI, released today, fell to 48.9 in April, solidly in contraction mode, the worst level since April last year. The new-orders sub-index, which points at what the near future might look like, dropped to 48.7. The March PMI had also been in contraction mode. It’s the HSBC PMI that captures the private-sector companies that are heavily export-oriented. These companies are struggling with very lackluster global demand for their products.

In terms of shipping, on the supply side, carriers have been adding new and ever larger ships, now that money is nearly free. Decision makers had been bamboozled into thinking that QE and interest rate repression would stimulate actual demand! And they’d expanded their fleets to meet this illusory demand.

Cheaply borrowed money gets plowed into creating overcapacity: Investors desperately chase yield, and companies become over-optimistic believers in the fallacy that central-bank asset-price inflation can create actual demand for everyday goods needed or wanted by real people. This happened in the global resource sector, in the US oil-and-gas sector, in the global shipping business…. These are among the places where money now goes to die.

There are other places where money goes to die as investors who’d bought into the hype get crushed. Read… Stocks in This Totally Hyped Sector Are Crashing

=

We need Moar Austerity. It is just the thing to bring round the economy.

One the one end, the producers, on the other the consumers and in between, finance doing the trick. Yep that was certainly set to last….

Interesting. There has been a lot of talk the past few years of companies in Europe repatriating work due to rising costs in China and the disadvantages of long supply chains – I’ve heard various stories of major European companies investing in capacity in low cost East European countries for precisely this reason. I wonder if the drop in value of the euro has created a sort of tipping point whereby China is no longer a viable country for off-shoring – work either been done in Europe, or in cheaper Asian countries such as India. Just speculation of course.

Low cost Eastern European countries.

Like more Lebensraum in Ukraine, the new South Korea, facing a menacing eastern neighbor, an aggressor to be deterred with a few tripwire legions.

‘where money goes to die’ I think that’s a very apt description of money that is used for asset appreciation rather than used to build a good employment base.

“Cheaply borrowed money gets plowed into creating overcapacity: Investors desperately chase yield, and companies become over-optimistic believers in the fallacy that central-bank asset-price inflation can create actual demand for everyday goods needed or wanted by real people. This happened in the global resource sector, in the US oil-and-gas sector, in the global shipping business…. These are among the places where money now goes to die.”

Bill Gross (with his usual dose of narcissism and purple prose) riffs of the same themes, and the ones Grantham discussed (rather more eloquently) in yesterday’s links.

The graveyard. Bill Gross was one of the first insiders to use the term New Normal in 2008. His latest love letter to his clients talks about the bitter end. But he has always used poetry to speak the truth, so you can read his latest lament as a plea for patience. He mentions 5 years from now, if he is lucky enough to be alive, things will be functioning again. I assume he means functioning logically. I think 5 years is long enough for everybody hoping to create a future out of the ashes to come clean, do some contrition, and learn to be grateful. Because I can’t imagine in my wildest dreams that 5 years is long enough to create some new, fabulous economy.

Bill Gross has been so wrong for so many years. The boy who cried wolf…

Bill always mistook his government investment biz as a sign of savvy-ness that arrangement afforded him…

Skippy… his doom speak is a lament reflex after the arrangement changed…. rosebud thingy…

And thus we see the absolute stupidity of the political “science” call economics. A purely descriptive endeavor that then applies political/social predisposition to selective data to make the case for a particular economist. No, I’m not ragging on the author or the piece, but the closing that indicates clear as day the utter hopeless decrepitude of economics: interest rates to create or kill demand.

People need some things, always, so there is inherent demand for those things irrespective of economic philosophy. If people have excess money/wealth AFTER serving basic needs that is the ONLY source of additional demand. Simple. Interest rates are largely irrelevant. People having money available is the only thing that creates new demand. The answer, as always has been the case, is PAY WORKING PEOPLE BETTER, THE RICH LESS. The wealthy are a zero source of real demand, they are entirely lost in background noise…truly useless eaters. The vast majority of the populace who WORK for a living is the only place to go for more demand. You MUST pay them (much) more for actual demand to increase. Period. The end. Anything else is doomed to fail. Game playing by idiot elites with interest rates or currency valuation shit is a bandaid, a dirty, wet, all but useless bandaid.

This is the truth, well put.

So, all those rich people buying Tesla Model S’ are useless? Those who WORK for a living have their disposal income tied up in mortgages and outrageous taxes. Their “disposable income” are credit cards and HELOCs.

What’s the percent market share of Teslas–0.001%? Go pick up your oligarch check from the Libertarian think tank, Chris.

Doesn’t most of the Junk that China sends to the US come from southern China not Shanghi?

I note the crash in rates to Europe is vastly worse than to the US, where it’s close to year ago levels rather than down by 2/3. So it’s probably mostly the collapse in the Euro. Chinese manufacturers typically have narrow margins and are hard pressed to deal with unfavorable currency swings.

Basically Europe is exporting its depression to the rest of the world via the Euro rate. Sadly, Europe has a lot of depression to export.

What is shocking in today’s news is the increase in the US trade deficit to ~$50/B per month. This is shocking because over the last 15 years much of the deficit was caused by energy imports. Given the glut of oil and natural gas in the US, this high a deficit is a mystery.

Remember that what drove and is driving financial crisis in the developed world are trade imbalances internally ( Eurozone ) and externally ( US ). I haven’t read a coherent explanation of why the US trade balance should be so high given the fracking revolution.

Also recall that a US that ran a balanced trade account would have 1.5-2 million more jobs, higher internal growth , higher tax revenue, more working/middle class leverage employment … a no brainer.

I thought it was because of the growing strength of the dollar that is making exports weaker, no?

So wouldn’t that imply that shipping rates would go up too? This is a telling disconnect. Also, probably related, is that the yuan is appreciating, which is something we have been pushing for for a decade.

Is the New Silk Road railway to Europe, but not North America, operational?

Worth a look: New Deal Democrat takes a look at a little longer perspective in the Chinese stats, and effectively discounts the accuracy of this post.

In today’s Links section, one can find an AP article about China factory index showing the fastest deterioration in a year.

Just one piece in this puzzle.

Usage of electricity is another piece of the puzzle :

http://oilprice.com/Latest-Energy-News/World-News/China-Is-Cooking-The-Books-On-GDP-Growth-Figures.html

“….China’s premier, Li Keqiang, has said China’s GDP figures are “for reference only.” Bloomberg reported that in a declassified U.S. diplomatic cable from 2007 then-U.S. ambassador Clark Randt related a dinner conversation with Li, secretary general of Liaoning Province at the time, in which Li revealed his preferred indicators of Chinese economic activity: rail cargo volume, loan disbursements and–wait for it–electricity consumption. China’s leaders don’t believe their own government growth numbers……”

So , two of Li’s preferred indicators are looking pretty dismal. The third one – loan disbursements – can only save the day if debt doesn’t matter , a dubious premise. Another debt-fueled expansion will just make the crash worse when it comes , as it will , inevitably.

I think a soft landing for China is out of the picture given the current trajectory. The question now is hard landing , or worse ?