I do not have an answer for you on how it is possible to steal so much money from a small country.

Pirkka Tapiola, EU ambassador to Moldova, New York Times, June 4, 2015

By Richard Smith and Ian Fraser (www.ianfraser.org; @Ian_Fraser)

We can offer a little assistance to the bemused Mr Tapiola, by way of Kroll Investigations’ 84-page confidential report on the $1Bn bank fraud in Moldova that is the subject of the New York Times’ piece. The Kroll report, leaked in May 2015 by the speaker of the Moldovan parliament, Andrian Candu, and available at his blog, describes the wildly elaborate machinery of the scam. It ran from August 2012 to November 2014, and ended with three crippled banks under the control of the central bank of Moldova. $1Bn had gone missing. That is one-eighth of poor, tiny Moldova’s annual GDP.

According to the report, a whole fleet of British shell companies played major roles in the fraud. By our count, no fewer than 48 distinct British entities get name checks, masking the fraudsters’ activities in one way or another: acting as opaque repositories for looted assets, or as conduits for stolen cash; either way, concealing controlling minds.

Some of the usual UK limited company abuses show up in the report: for instance, Trimms Green Limited leads us to Andrew Moray Stuart, prolific stooge director, and to the Hitchin-based UK arm of shell company provider Mossack Fonseca. At Jet-Tech Industries, we find Angelique Elizabeth Lilley, of Nelson, New Zealand, a professional stooge of the notorious GT Group; her name crops up in previous Moldovan scam action that NC covered here, and in another asset-grabbing wheeze in neighbouring Ukraine, here.

Mossack Fonseca and GT Group are merely bit-part players this time, though. For that matter, the much-abused UK Limited Company entity plays a smaller role in the bank scam than UK Limited Liability Partnerships (LLPs). There’s also a novelty, UK Limited Partnerships (LPs), especially Scottish ones. It happens that many of the Scottish locations, at which these LPs have their registered places of business, showed up last year, in a story about a 20Bn moneylaundering ring, also operating through Moldova. The recent bank scam is itself a part of a bigger story.

Anyhow, this is the essence of our tip for Mr Tapiola: UK LPs and LLPs are particularly attractive to crooks. Here’s the hinterland of the British corporate apparatus that helped $1Bn to go for a walk in Moldova:

- UK Limited Liability Partnerships (LLPs)

- UK Limited Partnerships (LPs), especially Scottish ones

- Slapdash UK Limited Partnership registration, a dearth of structured online information about Limited Partnerships, and consequences

- Miscellaneous business service providers, UK and international.

We’ll tackle all of that in this post, providing indications that the thirty-five LPs and LLPs mentioned in the Kroll report are merely a tiny part of something much, much bigger: a network of 20,000-plus opaque UK LLPs and LPs.

There are only 90,000 active LPs and LLPs in the UK, all told. In other words: pick a currently active UK LP or LLP at random, and you have nearly a one-in-four chance of lighting on an entity perfectly configured for financial crime. If you narrow your choice to Scottish LPs alone, it’s much worse again: you have a better-than-even chance of hitting a dodgy one.

Here’s part of the explanation for that phenomenon.

UK Limited Liability Partnerships (LLPs)

In 2013, Richard Brooks and Andrew Bousfield, of the UK satirical & investigative weekly, Private Eye, broke the story of the large-scale abuse of British Limited Liability Partnerships (LLPs) for money laundering, in a special report entitled “Where there’s muck, there’s brass plates: How UK ghost companies made Britain the capital of global corporate crime“:

“Limited liability partnerships”… joined the lexicon of British corporate law only in 2000 as a result of heavy lobbying from Britain’s big accountancy partnerships, which wanted to limit their liability for carrying out dodgy audits without becoming limited companies and so incurring extra taxes. The new corporate vehicle allowed them to have it both ways by stipulating that an LLP would have limited liability but would not be a taxable entity itself…

The new hybrid had great appeal: not just to respectable accountants, but also to those who were up to no good.

The Hermitage fraud, in which $230Mn in tax receivables were pinched, in Russia, gets its obligatory mention. Sergei Magnitsky, said to be working with Hermitage boss Bill Browder to investigate the fraud, found himself a suspect in it. Magnitsky was later beaten to death, or died of neglect (there are conflicting accounts) in a Russian prison.

Whoever it was that was laundering the Hermitage fraud proceeds, British LLPs were involved:

…proceeds were also laundered through a couple of the limited liability partnerships that were by now becoming increasingly popular among launderers (partly because the Companies Act 2006 required companies to have at least one “natural person” as a director, whereas LLPs could continue with entirely shell company directors).

The underlying money laundering network turned out to be enormous, containing thousands of British entities, but was ultimately the creation of just two minds:

The LLPs in this case, Armut Services LLP and Dexterson LLP, filed either no accounts or figures way out of line with their multi-million pound activities….their ultimate ownership would be impossible to trace – but a look at their background hinted at the scale of the LLP money-laundering scam running through London. Armut was owned by a couple of Belize based companies, Advance Developments Ltd and Corporate Solutions Ltd… These Belize companies were or had been members of more than 500 LLPs each – all, so far as a sample survey can establish, with no genuine business. Trade Invest Ltd, for its part, had been involved in another 245. Remarkably, however, this was nowhere near the full output rolling off the great British production line of dodgy LLPs. Dexterson’s “members”, companies called Milltown Corporate Services Ltd and Ireland & Overseas Acquisitions Ltd, were used even more prolifically as the components in the great LLP contraption. Companies House records show that these two companies were joint-members of more than 1,600 LLPs formed in Britain since 2005. This vast network was the creation of a company formation business called International Overseas Services (IOS), which investigators led by Graham Stack had tracked to a couple of Irish businessmen, Philip Burwell and Desmond Kearney.

There’s more on the pedigree of IOS and the ever-shifting pattern of dodgy incorporations:

By the late 1990s, IOS had incorporated Irish companies linked to arms sanctions-breaching deals with such reputable partners as, er, Burundi, North Korea and Saddam Hussein’s Iraq, before the Irishmen identified the UK as a more attractive corporate launching point. IOS had used companies called Milltown Corporate Services Ltd and Ireland & Overseas Acquisitions Ltd in Dublin since 1996; but by 2002 the companies carrying these names, which were to become members in thousands of LLPs, were in the British Virgin Islands. More recently the companies “moved” to Belize, before relinquishing their roles to a new series of companies created by the men even further off the beaten path in the Seychelles and the Marshall Islands. At this point location becomes almost irrelevant: no authorities, anywhere, are going to see the full picture and even if they look at one offshore money-laundering edifice, it can be swiftly knocked down and reconstructed by any number of willing bagmen and stooge directors.

As well as IOS, the Eye finds an onshore player, Company Formations Ltd, based in Cardiff, incorporator of Cliffberg LLP, Highways Investment Processing LLP, and Trentmile LLP, all associated with a variety of dodgy deals that look much more like fraud and money laundering than genuine business. That’s just three LLPs, less than the tip of the iceberg. By the Eye’s rough estimate, the number of dodgy UK LLPs is “likely to be well into five figures”.

We have an update for that estimate, based on April’s monthly Companies House data extract of active companies. The boom in LLP registration may have tapered off since the Eye’s 2013 survey. The results of our own incomplete analysis of LLPs hint that the Eye’s 2013 estimated total of dodgy LLPs, “well into five figures”, has dwindled a little in the mean time. Nevertheless, there are still upwards of 9,000 dodgy LLPs, out of 60,000 in total. The criteria we have used are broadly the same as the Eye’s: LLPs based at a serviced address, with partners that are corporations registered in secrecy jurisdictions such as the Seychelles, Marshall Islands or Belize.

Thus, two years after the Eye’s survey, just shy of one in 6 UK LLPs can still easily be shown to be an opacity vehicle suitable for money laundering. And lo, in May 2015, the leaked Kroll report asserts that a whole bunch of UK LLPs played money laundering roles in the Moldovan bank fraud.

Here they all are. Where we have provided hyperlinks for the partners in the table below, click through to see how many dozens or hundreds of partnerships they have in total. You will get the idea.

| LLP | Postcode of UK registered address | Partners |

| Ardooks LLP | WC1 3BQ | The corporate partners are Delait Secretaries Limited and Tucpain Limited. These two are registered in Belize, where “At registration, no information whatsoever is filed on public record on the company beneficial owners, directors and shareholders”. |

| Dastinger LLP | WC1 3BQ | Once again, prolific partners Delait Secretaries Limited and Tucpain Limited are registered in Belize. |

| Drensler LLP | WD6 3EW | Dissolved in September 2014. Prolific partners Intrahold A.G. and Monohold A.G. are both registered in the Seychelles, where the Registrar of Companies “does not require any data whatsoever on who is the beneficial owner of the company”. |

| Fairmac LLP | WC1N 3ES | Dissolved in March 2014. Prolific partners Quadro Management Ltd of the Seychelles, Hightech Agency Ltd, of Belize; also Chambers Directors Limited and Chambers Secretaries Limited, which, in the UK register, have addresses in Belize, the Seychelles, and perhaps the BVI, too, where, if you didn’t guess “details of the company beneficial owners, directors and shareholders are NOT part of public record”. |

| Formisold LLP | WC1B 3BQ | Once again, prolific partners Delait Secretaries Limited and Tucpain Limited are registered in Belize. |

| Harwood United LLP | EH6 8HH | Prolific partners Carberry Investments Limited and Winton Associates Limited are registered in, of all places, the Seychelles. |

| Hostas Level LLP | WC2E 9HA | Once again, prolific partners Delait Secretaries Limited and Tucpain Limited are registered in Belize. |

| La Costa Trade LLP | WC1N 3ES | Prolific partner Eurodata Limited is registered in the Seychelles. Prolific LLP partner Union Benefit Limited is registered in Belize. |

| Manos Alliance LLP | B3 3QR | Prolific partners Pintox Systems Limited and Syten Group Limited are registered, just for a change, in the Marshall Islands. One thing hasn’t changed, though: “Marshall Islands company offer anonymity as shareholder and director registers are not publicly available”. See also a whole run of defunct New Zealand shell companies where the same Syten Group Limited is a shareholder. This network is global. |

| Pondmarsh LLP | SE1 2TU | The partners are the mysterious multi-location Chambers Directors Limited and Chambers Secretaries Limited, again. |

| Roseau Alliance LLP | B3 3QR | The prolific partners this time are A&P Henderson Ltd and Consult Cyprus Services Ltd. Despite the latter’s name, both are registered in the Marshall Islands. |

| Spectra Ventures LLP | BT7 1JJ | This and the next company are Northern Irish LLPs, but that makes no big difference to the setup. The prolific LLP partners front operations this time are Laverton Consulting Ltd and Project Services Group Ltd, registered in the Marshall Islands. |

| Vercell Solutions LLP | BT7 1JJ | LLP partners this time are Alliance Management Team Ltd and Neptune Overseas Ltd, both registered in the Marshall Islands. |

It’s the Eye’s 2013 network all over again, of course. Even the Burwell/IOS master vehicles mentioned by the Eye put in appearances: Milltown Corporate Services Ltd and Ireland & Overseas Acquisitions Ltd, former members of Drensler LLP.

UK Limited Partnerships (LPs), especially Scottish ones

Here’s a table of LPs derived from the April 2015 Companies House extract.

| Type | Number of active LPs |

| Scottish |

18,818 |

| Northern Ireland |

141 |

| English |

13,818 |

| Total |

32,777 |

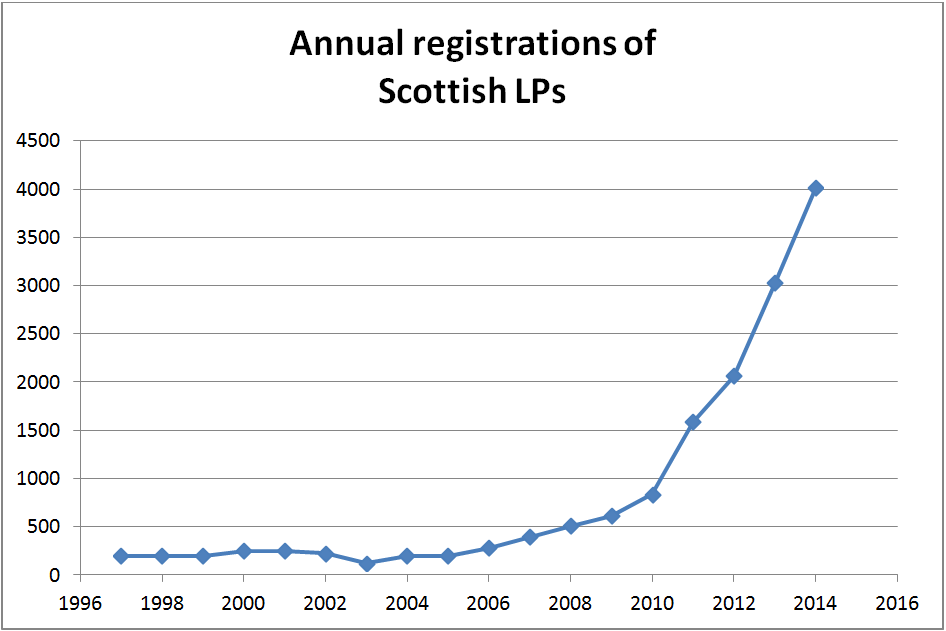

Note the eyepopping number of Scottish Limited Partnerships in the table, grossly out of proportion to the Scottish share of UK population or GDP and heavily outnumbering even the English LPs. That can’t be right. Let’s home in on the action, in graphical form.

Very obviously, something pretty unusual has been happening with Scottish LPs since, what, 2008 at the latest. Nosing around in the 14,000 or so new registrations since the start of 2008, one can roughly identify three sorts of player.

First, there are financial services types, mostly clustered at the EH3 postcodes around Edinburgh’s financial and legal district. The hyperactive Burness Paull, a well-known law firm that has registered north of 1,600 Scottish LPs since 2008, is by far the most conspicuous. This particular component of the surge of incorporations is evidently some new smart finance lawyer wheeze. The entities they are registering have identifiable people in control, though, not faceless offshore corporations. Burness Paull and their lesser competitors aren’t the players we are looking for.

Second, there is the usual sort of background activity of LP formation that there always has been, since 1907.

Together, these two sources, old and new, only account for just under 19% of the new LP registrations since the beginning of 2008.

Third, though, we find what we suspected all along. Like LLPs, LPs are allowed to have partners that are corporations, and this concession can be abused. Astonishingly, a sampling of another 11,000-odd LPs, every single one of which has a registered place of business at a small number of accommodation addresses anywhere from Ayr to Aberdeen, implies that they are all opacity vehicles of exactly the same style as the LLPs that were the subject of the 2013 Eye piece.

Once again, the partners of our suspect LPs are generally corporations registered in secrecy jurisdictions such as Belize, the Seychelles, the Marshall Islands. In just a few cases, the old-fashioned stooge system is still at work: the partners are occasionally UK corporations whose directors are foreign nationals and resident overseas.

Once again, the Kroll report into the Moldovan bank fraud mentions a whole bunch of UK LPs with money laundering roles. All but one of these LPs has a registered place of business in Scotland. There are no hyperlinks this time, since OpenCorporates doesn’t yet have the info online, and much of it isn’t instantly available at Companies House, either. For the moment, it has to be scratched together from document images, where available:

| LP | Postcode of UK registered address | Partners |

| Avenilla Commercial LP | EH7 5JA | The general partner, Lausanne Group, S.A., and limited partner, Sion Holding S.A., defied our attempts to trace their countries of registration. The presenter gives an address in Milton Keynes. |

| Danley Impex LP | EH6 7BD | General partner: Voxpoint Inc, limited partner: Goldstein AG, both registered in Dominica, where, if you hadn’t guessed, “companies are not required to disclose the names of directors and beneficial owners to the registration authorities”. Both these corporations are currently directors of a UK limited company, Exford Transit Ltd, whose other director, Youngsam Kim, has the same name name as the director of 457 companies in the UK, New Zealand, India and Utah, and seems to be a favourite stooge of International Overseas Services. |

| Expovision Logistics LP | EH1 1DD | Both partners, Laverton Consulting Ltd and Project Services Group Ltd, are registered in the Marshall Islands |

| Fortuna United LP | EH5 1LB | Both partners, Brixton Ventures Limited and Trafford United Limited, are registered in the Seychelles |

| Genyral Trade LP | G2 1QX | Once again, prolific partners Delait Secretaries Limited and Tucpain Limited are registered in Belize. |

| Hansa Investment LP | IV3 8SW | Both partners, Intercorporate Group Ltd. and Financium Limited, are registered in Belize. |

| Harrogate Consulting LP | EH6 8HH | General partner Winton Associates Ltd is also a member of a few LLPs, as is the limited partner, Carberry Investments Ltd. Both appear to be registered in the Seychelles, though Carberry also crops up with Panamanian coordinates (hardly an improvement). |

| Intratex Sales LP | EH7 5JA | General partner Eurointer AG is also found at hundreds of Panamanian companies and UK LLPs, as is limited partner Bridgepoint AG. Both are registered in the Marshall Islands. |

| Investos Buenos LP | G2 1QX | Once again, prolific partners Delait Secretaries Limited and Tucpain Limited are registered in Belize. |

| Jasterport LP | BT34 2BX | Northern Irish entity. Once again, prolific partners Delait Secretaries Limited and Tucpain Limited are registered in Belize. |

| Metalforum LP | EH7 5JA | General partner Eurointer AG of the Marshall Islands. Documents were presented by “Trinity Services Inc., Panama”, who give an address in, I kid you not, Dublin. |

| Nord LP | IV3 8SW | We failed to identify the general partner. The limited partner, Capital Consortium Ltd, appears to be a dormant UK company directed by Pawel Treczynski, of Warsaw. |

| Rosslyn Trade LP | EH6 8HH | General partner Winton Associates Ltd is also a member of a few LLPs, as is the limited partner, Carberry Investments Ltd, again. Both are registered in the Seychelles. |

| Sunrise Cotton LP | EH6 7BD | General partner Montbar Ltd and limited partner Arta Consulting Ltd are both registered in the Marshall Islands. |

| Swedtron Alliance LP | EH7 5JA | General partner Eurointer AG is also found at hundreds of Panamanian companies and UK LLPs, as is limited partner Bridgepoint AG. Both are registered in the Marshall Islands. |

| Tennant Shipping LP | EH1 1DD | General partner Headway Invest Ltd is a member of many LLPs, alongside limited partner Loyalty Services Ltd, both registered in the Marshall Islands. |

| Trademarket Networks LP | EH7 5JA | Partners: Eurointer AG and Bridgepoint AG, again. |

| United Technologies LP | IV3 8SW | Both partners, Intercorporate Group Ltd. and Financium Limited, are registered in Belize. |

| Welentas LP | G2 1QX | Once again, prolific partners Delait Secretaries Limited and Tucpain Limited are registered in Belize. |

| Westland Alliance LP | IV3 8SW | Both partners, Intercorporate Group Ltd. and Financium Limited, are registered in Belize. |

| Winefarm Alliance LP | EH6 7BD | The lead author ran out of research budget and briefly lost the will to live… |

| Zenit Management LP | IV3 8SW | …but rallied once last time for this one, where we failed to identify the GP. The limited partner, Capital Consortium Ltd, appears to be a dormant UK company directed by Pawel Treczynski, of Warsaw. |

As you can see, despite all the varied locations and types of entity, a select group of partners appears in both the LP table and the LLP table in connection with the fraud entities:

- Winton Associates Ltd and Carberry Investments Ltd of the Seychelles

- Delait Secretaries Limited and Tucpain Limited of Belize

- Laverton Consulting Ltd and Project Services Group Ltd of the Marshall Islands

In other words, we have a strong hint that a lot of the LLPs and LPs in this table, or even, all of them, are all one network. And the same must be true for the whole 20,000 entities, of which these 35 LPs and LLPs are merely a sample. They are united by a single shared quirk: a taste for corporate partners, based in jurisdictions that don’t disclose the identity of company directors.

if you didn’t drill down into every link we’ve provided, consider just this one representative one. Opencorporates identifies Arta Consulting Ltd, General Partner of Sunrise Cotton LP, as an officer of 146 UK LLPs and 8 Cyprus companies, usually alongside Sunrise Cotton LP’s other partner, Montbar Ltd. A sample of those 146 UK LLPs shows that many, perhaps all of them, are registered at Cornwall Buildings, 45-51 Newhall Street, Birmingham B3 3QR, an address heavily used by dodgy LLPs, that crops up in the Eye’s 2013 report. By way of the Cyprus directorships of Arta and Montbar, we suddenly have a bonus connection to Cyprus, too.

Putting it all together, we have a strong indication that the UK onshore footprint of the giant opacity network detected by Private Eye is in fact twice as big as anyone realised, still very active, and particularly big in Scotland. With 11,000+ Limited Partnerships, the Scottish leg of the network represents more than 80% of Scottish LP registration since 2008, and 60% of all active Scottish LPs.

Oops. How did that happen without anyone noticing?

Slapdash UK Limited Partnership registration, a dearth of structured online information about Limited Partnerships, and consequences

It turns out that, just like Scottish LPs themselves before 2008, the Limited Partnership segment of the Companies House on-line register is a bit of a backwater. Only in April 2014 did Companies House start putting the incorporation data online. Before then, it was difficult indeed for anyone to spot the proliferation of corporate LP members in secrecy jurisdictions. Even now, citizen journalists who want to nail down the the ownership and control of the 6,000+ dubious Scottish LPs registered between 2008 and April 2014 have to reach in their pockets, to the tune of £6,000+, to obtain scanned copies of the documents, and then transcribe the content into their own database.

Journalist on a budget may prefer to skip that, and rely on sampling instead. There are still around 5,000 recently created dodgy Scottish LPs that have their details online, a decent sample. Even there, though, there’s a disappointment: the new Companies House API keeps changing, and none of its iterations so far has included the General Partner and Limited Partner as separate fields that could be routinely identified and extracted by third party information suppliers, such as the very excellent OpenCorporates. So, the Partner details aren’t yet available online anywhere in any kind of readily machine-assimilable form. One must do one’s best, by hand.

None of this technological backwardness helps with scrutiny, which, one imagines, is precisely why offshore incorporators suddenly got interested in LPs in the first place.

Not that anyone’s been showing any great inclination to scrutinise, for a long time: further indications of neglect turn up in the Limited Partnership data items themselves. Around 5,000 English LPs have no address details whatsoever. Elsewhere there are other strange sightings, such as dozens of Scottish LPs that have their registered place of business in the Channel Islands, or in New York, neither of which is generally considered to be part of Scotland.

If “Scottish” doesn’t mean much any more, in the context of Scottish LPs, neither, lately, does “place of business”. For instance, there’s no genuine sense in which the roughly 3,600 LPs and LLPs registered at EH7 5JA, the Edinburgh postcode of Messrs John Hein and James Stuart McMeekin, of company agent Cosun Formations Limited, are doing any business there at all. The Kroll report names a number of LPs registered at EH7 5JA. That doesn’t imply that Hein or McMeekin has done anything wrong, though.

They’re just doing their jobs, sometimes in a quirky style. For instance, McMeekin has his own unique way of demonstrating to himself and the world that Companies House isn’t paying much attention to his registrations. A decade ago Cosun formed, and McMeekin currently directs, two limited companies, Hugh Janus Limited and York Hunt Limited. This pair of old jokes evidently isn’t so obvious to Companies House, who are supposed to keep an eye out for such japery.

Consider next 45, Rosehaugh Road, Inverness, IV3 8SW. Despite the occasional stabbing incident on the run down estate in which it is situated, this address is a veritable magnet for new businesses. It is one of the throbbing hearts of Scottish regional commerce, in fact. The Companies House extract shows that 585 LPs now have their registered place of business at 45 Rosehaugh Road, and 20 new businesses set up there in April 2015 alone. Such is the registration frenzy that the street address appears in the data extract with post codes IV3 8SW and IV2 8SW, which can’t both be right.

Let us see what is really attracting new LPs to Scotland in general, and Inverness in particular, in such numbers. Here is the incorporation documentation of Hansa Investment LP, of 45 Rosehaugh Road:

blREX-GJ0130-235332_8-12336324

blREX+GJ0130-235332_8-12336324

Hansa Investment LP is just one of 28 Scottish corporations (and other UK outfits, including LLPs from the same network of suppliers) that, Kroll thinks, functioned as moneylaundering and asset-holding shells in the giant $1Bn Moldovan bank fraud described in the NYT.

Both the General Partner, Intercorporate Group, and the Limited Partner, Financium Limited, are apparently registered in Belize, but we’ve had to make that reasonable inference via a whole lot of digging. The registration form does not require disclosure of corporate partners’ country of incorporation, which is absurd: at best, locating an offshore corporate Scottish LP member from public data sources becomes a time intensive exercise in sleuthing. At worst, a suitably generic partner name can turn up in multiple jurisdictions. Which, then, is the real Slim Shady?

Equally ridiculous: the acceptance, for UK partnership registration purposes, of secrecy jurisdictions, where the names of directors of companies are not public information. See, for instance, this UK ‘privacy’ peddler crying up that very point, in connection with a whole run of offshore locations. Companies House’s operating assumption, good faith registration, is particularly heroic when control is “offshore”, and secret, and unverifiable. How does one even verify the company seals adorning some of the registrations, or the illegible signatures adorning Hansa Investment LP’s registration document, if one isn’t allowed to know who put them there?

Finally, the complete absence of a presenter signature and address means that no investigator can trace who presented Hansa Investment LP’s incorporation documents either. The registration was accepted, nevertheless.

So there you have it: a partnership formed by persons unknown, at an improbable location, and with untraceable ownership and control. We don’t know who formed Hansa Investment LP, but, even without the activity documented in the Kroll report (pp. 55-60), we can easily guess why they did. Latvian banks aren’t quite so savvy, to put it excessively politely. Hansa Investment LP managed to convince the easily-convinced Privatbank of Latvia that it was entirely on the level. PrivatBank duly opened a bank account for Hansa Investment LP that was duly used as a channel for loan proceeds from one of the doomed Moldovan banks.

Miscellaneous business service providers, UK and international

Scottish LPs and UK LLPs are heavily marketed by dozens of offshore incorporators as a vehicle of choice for Eastern European businessmen. See here, here and here for a sample, with the blurb from the last one pitching the privacy angle:

Company House will hold on public records only names of the Members, which are commonly offshore entities.

Unsurprisingly, International Overseas Services, stars of the Eye investigation, turn up among the pedlars. At IOS, Scottish LPs and UK LLPs cost a reasonably representative EUR1,490 to incorporate and EUR1,120 per annum to run.

Add the 9,000 dodgy LLPs to the 11,500 dodgy LPs, and you can see that providing these corporate shells is a big business all by itself. Here’s a snapshot for the year to the end of April 2015.

| Activity | Revenue |

| 3,500 or so dodgy Scottish LP registrations in the last 12 months | EUR5.2Mn |

| 8,000 older dodgy LPs | EUR9.0Mn |

| 1,500 dodgy UK LLP registrations in the last 12 months | EUR2.2Mn |

| 7,500 older UK LLPs | EUR8.4Mn |

That’s an industry that has around EUR25Mn in annual revenues, and what should be a pretty modest cost base. Anonymity may be pricy, but it’s highly valued, and lucrative for the providers, who don’t have to work terribly hard: the annual reporting requirements, remember, are modest to non-existent. The business is a gravy train.

Conclusion

Overall, it’s pretty safe to say that the use of Scottish LPs has drifted quite some way from what the original framers of the law had in mind, in 1907, and is overdue for reform. The same goes for the much more recent LLP law. By means of judicious structuring, a UK LP or LLP can be made as opaque as anything you might find in a tax haven, and used for large scale financial crime. That is the real reason why these spurious businesses are flocking to the UK in general, and Scotland in particular.

The first-cut legislative fix would be to prohibit registration of LPs and LLPs that have corporate partners in jurisdictions that do not identify the directors. Someone would have to identify the jurisdictions, of course, and keep it up to date, and apply it: not necessarily terribly challenging, but extra work for Companies House, for sure.

It would also be sensible to pre-empt the natural response of less-than-scrupulous company agents and their clients, who would be likely to appoint individual offshore ‘stooges’ as partnership members. That pre-emption needs some thought, early on.

There’s another snag, too: “legit” finance likes very similar offshore structures, via LLPs with directors in Delaware, for instance. Tweak the ban, then: exempt FCA-regulated entities and their subsidiaries from it. It would be worth finding out how complicated that exemption would be to implement. It might not be too bad. It’s worth at least a look, given the stakes.

Obviously, there is more to the story of how British LPs and LLPs are now so heavily involved in Eastern European frauds. NC will be tackling some of it, in more or less detail, in forthcoming posts:

- European banks in jurisdictions that have especially poor money laundering controls, backed up by feeble sanctions: Latvia, and maybe Cyprus, too.

- Big-time criminals in countries with bent or broken civil institutions, such as Moldova.

- Former UK Business Minister, Dr Vince Cable, and his legacy, the 2015 Small Business, Enterprise and Employment Act.

We emphasize again that we are not claiming that any of the business service providers who register companies or partnerships at the addresses we have found are doing anything illegal. However, very recently, Her Majesty’s Revenue and Customs and the Federation against Copyright Theft (FACT) do seem to have spotted something fishy going on at a few of the post codes on our list. Two weeks ago they announced a raid in Scotland:

Five properties in The Lothians and Fife, the registered addresses for around 1,500 companies, were searched yesterday morning by officers from HM Revenue and Customs (HMRC). The searches are part of an investigation linked to suspected Money Laundering Regulations breaches and illegal film distribution.

HRMC, along with Police Scotland and the Federation Against Copyright Theft (FACT), seized computer and business records from five business and residential properties in the Edinburgh and Fife areas. The addresses searched are believed to be the registered offices of around 1,500 legal entities, including Limited Partnerships (LPs), Limited Liability Partnerships (LLPs), and Limited Companies, which are being investigated by HMRC.

…

Kieron Sharp, Director General, FACT, said:

“The illegal distribution of film content causes significant harm to the UK economy, and often those involved are linked to financial crime and other forms of serious crime. FACT is committed to working alongside HMRC and Law Enforcement Agencies to identify and bring those individuals to account.”

1,500 legal entities: it’s a start. Mind you, finding a couple of people dumb enough to leave traces of their activities onshore, if that’s what the investigation turns up, might be a fluke.

Back in Moldova, news of the bank fraud led to mass street protests in the capital, and indirectly to the resignation of the Prime Minister. Reportedly “pro-Europe” and “pro-Russia” sentiment has been evenly balanced in the ensuing election (but see the update below). Fraud was also rife for many years in neighbouring Ukraine, which also had its pro-Europe and pro-Russia factions. There, too, the fraud was often facilitated by British shell corporations. Eventually, there was a war.

It might be a good idea if the UK’s LP/LLP registration gravy train was brought to a halt, as soon as possible.

UPDATED 18-Jun-2015: omissions from the LLP and LP tables rectified (thanks again!) and much richer data added to both tables. Added a link to the Private Eye special.

UPDATED 02-Feb-2016: Characterizing the political split in Moldova as ‘pro-Europe’ vs ‘pro-Russia’ looks more and more like an oversimplification. See, among other sightings, Politico.eu, or, for a rather different take, this.

UPDATED 02-Feb-2019: The Magnitsky story gets ever more cloudy.

I’m thinking that maybe this whole idea of legalizing white collar crime and letting the gentlemen keep all the money they steal was not such a good idea after all.

Never in the history of mankind have so many trillions been printed so fast without any true supervision. We can only imagine the number of frauds and bad bets that will become visible over the next few years.

The writing is on the wall and moral hazard is written all over it.

I agree with you about the likelihood of ongoing pervasive criminal activity, Moneta. However, like predatory lending, securities and control frauds, and the recently acknowledged currency and interest rate price fixing at large transnational banks, I expect corporate media coverage of much of the criminal activity will be suppressed or receive very light and limited coverage.

The media will quickly move on to the usual topics on the 6 o’clock evening newscasts: “Murder, Mayhem, Traffic, Weather and Sports”. Elevating the visibility of white collar crime in the public discourse would implicitly raise questions about key constituencies within the existing framework.

Thank you for another very enlightening and well researched piece, Richard Smith and Ian Fraser. I had no idea.

I expect some big doozies that can’t be swept under a carpet. Furthermore, I’ve seen enough Bond movies to know that the elite love to stab each other in the back when they can… and Lehman is just one real life example.

Does the transatlantic trade treaty then allow all of these shell corporations into the USA “unsupervised”?

As a long time Private Eye reader this article unfortunately does not shock me. It does depress me quite a lot though. The UK legal and financial systems seem geared towards underhand activity these days, and no-one in Government is paying even the slightest attention.

Oh, I’d say they were looking away quite studiously!

Am I right to understand Ukraine in the new light on all this fraud? It was a looting war between the Russians and the West, all going after Ukraine’s resources, and eventually “there was war.” This info makes George Soros look virtuous.

Is Greece all caught up in this crap too?

Yes, and with the right to bring claims against the US in an investor-state dispute (ISD) tribunal. Because most ISD treaties and panels consider shell companies to be “citizens” of whatever country they are nominally incorporated in, an offshore shell company can considered an aggrieved foreign investor even if it is wholly owned by a US citizen, only has assets in the US, only does business in the US, and brings an unsuccessful suit in American federal, state, or local courts against Americans.(*)

The ISD panel, when considering the case, may, but is not required to, take into account the domestic laws of the jurisdiction where the case took place or the decisions of other ISD tribunals. Many ISD panel members see their role as “global citizens” deciding the case as according to “global values” without regard to the legal idiosyncrasies of individual nation-states. Increasingly, this difference in perspectives – i.e., globalist versus legal – leads to ISD panels awarding significant damages to investors “harmed” when a country’s courts and government agencies fairly and accurately enforce their own laws in accordance with local legal norms. Why, panel members ask, should an investor be harmed by some unenlightened judges applying local laws the panelists see as “harming the investment climate?”

* (For ISD purposes, governments are considered essentially unitary with national government being responsible for the actions of national and sub-national officials, agencies, and courts. If a foreign investor is unhappy with the outcome of litigation against another business, some ISD agreements (e.g., NAFTA’s per the Loewen Group decision) allow the investor to bypass the appellate process, bring a claim in the ISD tribunal, and then demand that the national government either reverse the decision by executive fiat or pay damages for harming the investor’s economic interests. https://www.citizen.org/documents/Loewen-Case-Brief-FINAL.pdf

While Loewen Group was later reversed after the named claimant suddenly underwent a bankruptcy reorganization that converted it from a Canadian-based to an American-based firm – destroying the required “diversity of nationalities” – the precedent still stands. Worse, one of the lawyers who sat on the Loewen Group panel, L. Yves Fortier, has used subsequent ISD decisions he co-authored to ensure that the Canada-based shell company Loewen set up during the reorganization would, under current precedent, likely have been enough to protect its “foreign” status.)

My post was intended as a reply to DJG’s 9:44 a.m. post on June 16, 2015.

This kind of activity is alive and well in the Scottish Borders!