By Lambert Strether of Corrente.

The front-running scheme for “retirement security” — backed by billionaire John Arnold — looks an awful lot like it’s “on the table” because it guarantees that middlemen collect fees for “managing” what we used to call your “nest egg.” Will Hillary Clinton’s campaign platform support it?

Hillary Clinton Has Ruled Out Expanding Social Security

This was the line in Talking Points Memo, back in April:

Hillary Clinton is not taking a position just yet on Social Security expansion, an issue with growing support in the Democratic Party that several of her prospective presidential primary rivals have endorsed.

The Clinton campaign told TPM on Thursday, in response to a query, that the Democratic frontrunner “will have a lot to say” about the issue and emphasized her opposition to privatizing Social Security.

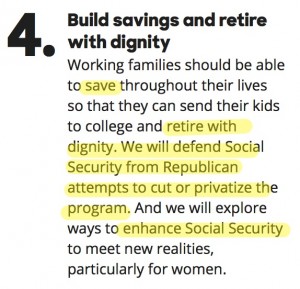

But here’ s Clinton’s platform today:

“Explore ways to enhance” most definitely does not mean “expand,” especially when Clinton plans to include “saving” in any plan to allow working people — since “working families” doesn’t include those who aren’t married — to “retire with dignity.”

And that’s rather a shame. Robert Kuttner:

The average national pension benefit in 34 OECD countries is about 60 percent of median worker earnings. In the U.S., our national pension system, Social Security, provides just 40 percent. And due to previously legislated cuts, that will gradually fall to just 32 percent.

So presumably Clinton’s “lot to say” will combine savings and Social Security to bring the United States closer, at least to world standards. Is there a plan like that out there in the Democratic nomenklatura? Why yes. Yes there is.

Clinton May Be Leaning Toward “Guaranteed Retirement Accounts” (GRAs)

Check out this beat sweetener for potential charismatic technical spokesperson, Teresa Ghilarducci, in the National Journal (hat tip AH), where we see the Clinton code of omerta fully operative:

[Ghilarducci] will not talk about how many times—or when, or where—she has met with Clinton … Though Clinton has begun her campaign on a decidedly liberal note, it’s anything but clear how far she’ll go in adopting the kind of agenda that Ghilarducci advocates. Clinton gave “retirement security” a shout-out in her campaign launch speech on Roosevelt Island, but there were no specifics. [That’s putting it mildly. –lambert] “The retirement issue will come a little bit later in the campaign, when more people are paying attention,” Ghilarducci says.

Good to know; Ghilarducci seems pretty clued in, for an “informal economic advisor.” Here’s the “retirement security” policy that Ghilarducci is pushing: GRAs.

Ghilarducci’s big idea is to create government-run, guaranteed retirement accounts (“GRAs,” for short). Taxpayers would be required to put 5 percent of their annual income into savings, with the money managed by the Social Security Administration. They could only opt out if their employer offered a traditional pension, and they wouldn’t be able to withdraw the money as readily and early as with a 401(k). The government would invest the money and guarantee a rate of return, adjusted to inflation

I’ll have a bit more to say about GRAs below. Interestingly, although the National Journal doesn’t mention this, Ghilarducci’s GRA concept is being road-tested in California.

GRAs in the Democratic Stronghold of California, and John Arnold’s Role

Yes, the California GRAs are Ghilarducci’s GRAs. From the New School blog (where we may remember Hillary gave a speech on economics earlier this month), in 2012:

When economist Teresa Ghilarducci looks back over 2012, it’s a pretty good view. Last fall, California governor Jerry Brown signed into law legislation that would provide a retirement savings plan for millions of the state’s private sector workers. Passage of this proposed plan was an impressive achievement for Ghilarducci, chair of the economics department at The New School for Social Research. As the author of Guaranteed Retirement Accounts, her policy proposal served as a model for the California legislation. ….

[T]he plan would ease people’s reliance on Social Security—which offers on average only $1,181 per month—by providing a guaranteed minimal [sic!] return rate for contributions made by employees from their payroll checks.

Notice the similarities to Clinton’s platform: GRAs are parallel to Social Security, and expanding Social Security isn’t “on the table.” And many label the California plan — it has the eerily focus-grouped moniker “California Secure Choice Retirement Savings Program” (“Secure Choice,” for short) — a “national model.” Here’s detail on how “Secure Choice” would work, and the logic behind it:

The California program aims to create an effortless savings vehicle for an underserved population. Three-quarters of eligible workers make less than $46,420 per year, putting them into a demographic that relies heavily on Social Security in retirement. The new law won’t end reliance on Social Security, but it could provide workers with additional financial security.

The contributions would be saved in individual, IRA-type accounts, but the accounts would be managed collectively as an estimated $6.6 billion fund. To protect workers against stock-market crashes, no more than 50 percent would be invested in equities. …

Enrollment won’t begin until 2015, at the earliest.

Large, pooled funds are cheaper to manage than hundreds of individual accounts—and that lowers fees that account-holders have to pay.

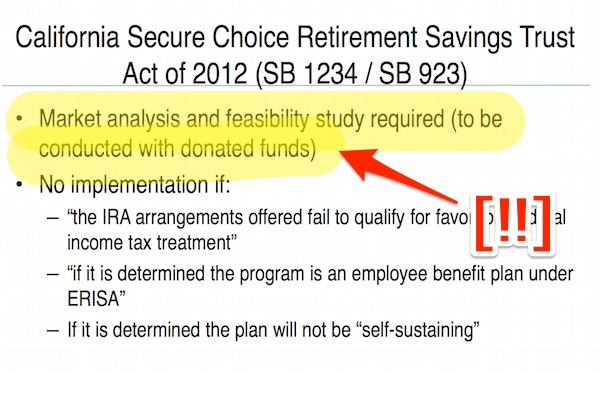

So, if Secure Choice was passed in 2012, why hasn’t it been implemented yet, three years later? Well, because of legislative requirements like the following, from a presentation by California State Treasurer John Chiang, at the CalPERS Board of Administration and Executive Offsite, July 2015, slide 5:

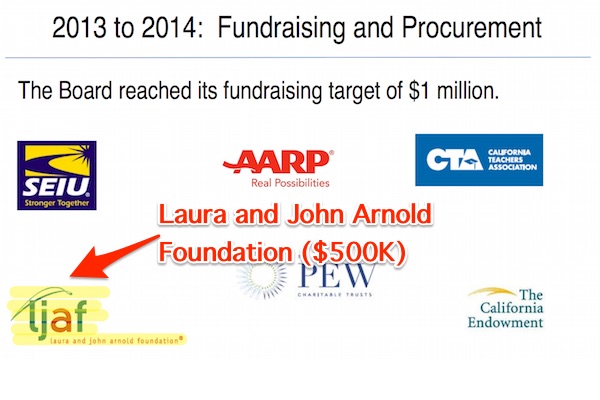

The bullet points under the highlight: Obama has directed his Secretary of Labor to work on the first two; the third will be the result of a forthcoming study. Amazingly, however, the Secure Choice board, set up in 2012, had to spend two years going hat in hand to private funders to pay for its own studies on a topic of vital importance to its own citizens. Oh-k-a-a-a-y. And who [drumroll please] were those funders? Slide 7:

We notice various “progressive” or at least putatively liberal organizations, like the SEIU and the AARP, chipping in. However, half of the funding ($500,000) came from the Laura and John Arnold Foundation. So who is John Arnold? Suffice to say that, despite or perhaps because he’s a major Democratic contributor, he’s not your friend, nor would you wish him to be. Arnold “has become the dominant figure funding pension reform efforts in recent years.” And he’s been subject to the tender ministrations of both Sirota and Taibbi, but I’ll pick Taibbi. Remember corrupt Democratic Rhode Island pol — sorry for the redundancy — Gina Raimondo?

Gina Raimondo, the dynamic young Rhodes scholar [,] was allowing her state to be used as a test case for the rest of the country, at the behest of powerful out-of-state financiers with dreams of pushing pension reform down the throats of taxpayers and public workers from coast to coast. One of her key supporters was billionaire former Enron executive John Arnold – a dickishly ubiquitous young right-wing kingmaker with clear designs on becoming the next generation’s Koch brothers, and who for years had been funding a nationwide campaign to slash benefits for public workers.

Nor did anyone know that part of Raimondo’s strategy for saving money involved handing more than $1 billion – 14 percent of the state fund – to hedge funds, including a trio of well-known New York-based funds: Dan Loeb’s Third Point Capital was given $66 million, Ken Garschina’s Mason Capital got $64 million and $70 million went to Paul Singer’s Elliott Management. The funds now stood collectively to be paid tens of millions in fees every single year by the already overburdened taxpayers of her ostensibly flat-broke state. Felicitously, Loeb, Garschina and Singer serve on the board of the Manhattan Institute, a prominent conservative think tank with a history of supporting benefit-slashing reforms. The institute named Raimondo its 2011 “Urban Innovator” of the year.

So — hold onto your hats, here, folks — it was all about the fee fees, wasn’t it? (That’s what the financiers wanted, that’s how Raimondo serviced them, and that’s what John Arnold funded.[1]) But before I answer that question — and while the suspense builds — let me put on my tinfoil hat and show why the push for GRA seems eerily similar to the push for ObamaCare.

Sidebar: Why GRA and ObamaCare Look Like They Use the Same Playbook

| ObamaCare | GRAs | |

| Conservative Foundation | Heritage | Laura and John Arnold |

| Neoliberal “Because Markets” Policy Laundered By | “Progressives” | “Progressives” |

| Technical Spokesperson | John Gruber | Teresa Ghilarducci (?) |

| Test State | Massachusetts | California |

| Proven Public Policy Pre-empted | Single Payer | Expanded Social Security |

| FIRE Sector1 Entrenched | Health Insurance2 | Money Managers3 |

Notes to Table

1 By which I meant “grotesquely bloated, parasitical FIRE sector,” but that might have thrown the formatting off. Sorry.

2 Ka-ching.

3 Ka-ching.

Why GRAs and not Social Security?

So, why GRAs? The fees, right? That might seem like a cynical, even a radical view, but fortunately it’s confirmed by Ghilarducci herself. From the National Journal profile, Ghilarducci appears on the same platform as supply side charlatans Stephen Moore and Arthur Laffer:

I expected verbal fireworks. Instead, it went down more like a cordial afternoon tea. Moore and Laffer extolled the virtues of low taxes, less regulation, and overhauling Social Security, Medicare, and Medicaid. The audience of money managers nodded along, but Ghilarducci reined herself in. She rested her chin on her hand. She gripped a bottle of water. At one point, her face registered bemusement, but only a little. When her turn came to talk, Ghilarducci argued politely for the importance of the government’s role in moving along the economy. She made the case for older folks having more money in retirement. And, sounding nothing like a fire-breathing populist, she appealed to her audience’s self-interest: getting to handle people’s extra retirement cash.

“Getting to handle people’s extra retirement cash.”

All about the fee fees, just like I said. (But wait! you say. It’s a government-run program. But as the sausage to pass the bill gets passed, I’d bet that the managing the funds will be outsourced[2]; allocating streams of rent is, after all, the function of the market state.)

So, once you understand what the GRA is really for — entrenching money managers in the retirement system, hopefully forever, just as ObamaCare did with the health insurance system — the defects of the program fall right into place. Let me list just a few, since I’m sure we’ll return to this topic again:

1) GRAs reinforce the finance sector, because they get to manage the money; lots of lovely loot, if California’s GRA in fact becomes the national model. But the finance sector kills growth. So how do we as a society square the circle of lower growth and bringing our retirement system up to world standards?

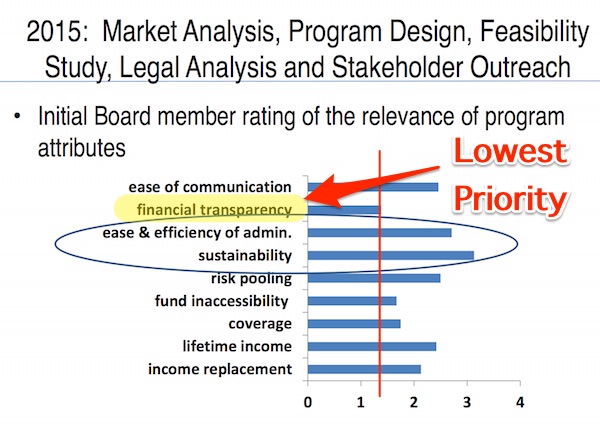

2) There is little reason to believe that GRA fees will not be abused, if California is any guide. One more slide from Chiang’s presentation:

Can we really trust money managers in a system that lacks transparency? All our experience from 2008 argues that we cannot.

3) The GRA’s are said to be guaranteed, but there are no guarantees. If — and by “if,” I mean “when” — we have another ginormous crash, or if a state with a GRA goes bankrupt, the only real guarantee is a Federal bailout, using the power of fiat that comes with being the currency issuer. (In other words, “Secure Choice” is a particularly subtle and pernicious oxymoron.) But if it’s the power of fiat that makes the GRA work….

4) Why not simply expand Social Security? There is no reason to hand the money managers any fees to manage retirement money, any more than there’s a reason for the health insurance industry to exist (except as, just possibly, a luxury product). Of the many reasons that the 410(k) program was a disaster, one stands out, as Ghilarducci herself explains: “The fees add up, that if you pay these fees and these retail products, you’re going to erode your retirement savings by 20 to 30 percent.” But that means that any fee greater than Social Security’s fee isn’t justified, either. (To which the riposte might be that the money managers earn their fee by achieving the 3% rate of return. Not if it’s guaranteed and backed by fiat, they don’t!)

So, it would be great if the Clinton campaign figured out that improving a proven and popular program like Social Security would be an electoral winner, besides being the right thing to do. Then again, they’ll get a cut of the fee fees, called “campaign contributions,” or possibly “donations to the Clinton Foundation.” “I’m thinking it over”…

NOTES

[1] On the website for Arnold’s foundation, the “Principles of Philanthropy” — apparently for all times and all places — are listed. Among them:

Philanthropy should use proactive and innovative approaches that have a measurable impact on specific communities and individuals with the greatest needs.

Clearly, at least in Raimondo’s Rhode Island, the individuals with the “greatest need” were hedgies. Funny, life.

[2] Here’s what Ghilarducci writes in a concrete proposal in 2012:

The board of trustees would contract out the fund’s investment and management to the state pension fund(s). States, through their employee pension plans, sponsor excellent financial institutions that, on a not-for-profit basis, get the highest returns for the least cost. In short, because they pool longevity risk, can offer a well-diversified portfolio with longer-term investments, and are professionally managed, public pension funds deliver the same level of benefits as DC plans at only 46 percent of the cost. Any funds invested with the state pension fund would be kept in a separate investment pool from public sector funds.

First, Arnold’s goal is to weaken public pension systems generally. It seems unlikely to me that he’s going to want to strengthen them by contracting investment and management to them. If a CRA program is attempted at the national level, and the sausage to pass the bill is made, Arnold will push either for private management, or for the Federal government to outsource to private management.

Second, Yves has done extensive reporting on how CALPERS has been captured by the FIRE sector, and private equity specifically. There is little reason to believe that the same process will not occur with CRAs.

NOTE

I should say that I actually have some sympathy for Ghilarducci, because her decision point in campaign 2008 was the same as mine. From the National Journal profile:

I voted for Clinton when it was Clinton versus Obama,” she says, partly because she was “more progressive around investment issues”—defending Social Security benefits, for example, when Obama was flirting with raising the retirement age.

I remember this incident vividly (though I don’t want to plow through my archives right now). In the Iowa caucuses, the press was yammering for Obama to distinguish himself from Clinton in some way on policy, and he did so, on TV, by doing something the political class always loves: Putting Social Security in play. This — as Atrios pointed out at the time — after Democrats and progressives had beaten back Bush’s attempt to privatize it! Of course, 2008 is a very, very long time ago for me.