One of the major fallacies skillfully employed by the lending industry since the foreclosure crisis is that the meddling defense attorneys and pro se litigants were clogging the courts with their dilatory motions and challenges, unnecessarily prolonging the foreclosure process, creating neighborhood blight and costing homeowners billions in property values by preventing “market clearing.” This was presented to state lawmakers as a rationale to tighten the rules on foreclosure challenges and eliminate consumer protections, ensuring that lenders could bulldoze their way through the courts.

It never appeared to be true, however, given that plaintiff’s attorneys routinely allowed cases to rot, filed motions to delay, withdrew cases at the last minute and so on. Some of this was due to problems with documents and procedure, some of it was inscrutable, some of it maybe even based on squeezing more money from investors. But the main investor in mortgages, the GSEs, continue to play along, whether wittingly or not.

Last week, Fannie Mae and Freddie Mac, in successive days, extended their foreclosure timelines in a majority of the states where they own mortgages. The timeline is a guidance for how long a foreclosure is supposed to take, from the initial delinquency to the foreclosure sale. This includes the timeline for an uncontested foreclosure proceeding.

In theory, if servicers go beyond the timeframe they get fined a “compensatory fee,” which they pass on to the foreclosure mill law firms to get them to hurry up. But servicers can provide “reasonable explanations” to waive the fee, like bankruptcy, probate or an active trial modification. There’s also a compensatory fee moratorium for Washington D.C., Massachusetts, New York and New Jersey, which presumably is related to their more stringent foreclosure laws.

Here’s a look at the Fannie Mae timelines (the Freddie timelines are seemingly identical), and you can read the compensatory fee allowances on the second page. As you can see the timelines are incredibly long, from a low of 300 days in the District of Columbia to a high of 1,080 days – nearly three calendar years – in Hawaii and Oregon. The timelines don’t correspond to the usual assumption that judicial foreclosure states take longer, by the way – Oregon, Washington, Rhode Island, Nevada and Maryland are examples of non-judicial states with timelines over 720 days.

But the focus for this post will be Maine, because Tom Cox, the lawyer who did the Jeffrey Stephan deposition that led to the robo-signing scandal exposure, is apoplectic about that state’s timeline increasing another 300 days, to 990, one of the highest in the country. Cox thinks the timeline was already too long, and I’ll get to why he considers that a problem in a moment.

But first, let’s look at Cox’ calculations. According to statistics provided by the Maine Judicial Branch to the legislature’s Joint Judiciary Committee, the average time in court for a foreclosure with no delaying motions from either side was 317 days. If you add to that:

• 120 days from the last paid installment of the mortgage to the commencement of foreclosure, a required period under new CFPB regulations;

• 90 days from final judgment to the end of the redemption period, where the borrower can still get their home back after foreclosure by paying off the loan and fees;

• 30 days from the end of the redemption period to the date of sale.

You still come up with 240+317=557 days, tip to tail. But the allowable timeline for GSE loans – and the GSEs are big enough that they’re really the industry standard – was increased from 570 to 690 days starting in November 2014, and is now 990.

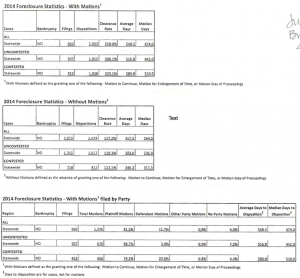

Why are these foreclosures taking so long, even in uncontested cases? Delaying motions, says Cox, whether motions for continuance, stays or to extend statutory time limits. A motion increases the time in court from 317 to 548 days on average, pushing well past the November 2014-era timeline. And who’s filing the motions? The plaintiffs, 81.5% of the time. In uncontested cases that increases to 88.1%. I’ve put the chart below (click to embiggen).

Cox doesn’t think this is a problem limited to Maine, and given my experience with cases around the country I don’t either. It’s true that Maine is somewhat unique because of the Greenleaf case, where Bank of America couldn’t prove ownership of the mortgage because MERS didn’t have the authority to convey the right to enforce the lien. But lawyers were not quick to restart their cases because of the Greenleaf decision, in some cases holding them for over a year, deliberately extending the timelines.

This is duplicated in cases that get dismissed. A report for the Joint Judiciary Committee in Maine based on a random sample from Pine Tree Legal Assistance, the nonprofit where Cox volunteers, shows that foreclosure mills take 343 days on average to take action on inactive cases. I’ve definitely seen this in other states too. Hopefully some defense attorneys can chime in, either in the comments or offline.

Cox cites delays at the referral stage, from the time when a law firm gets the case to the time to file. He thinks that should take no longer than 30 days, but the random audit showed this taking a whopping 377 days on average. He also claims that local banks’ counsel file cases more expeditiously, while attorneys for the large servicers sit around waiting for the court to schedule a trial. This relieves them from doing any work to prepare a summary judgment, increasing the payment-per-man-hour on the case. There are also delays in setting up foreclosure sales and suspicious postponements of foreclosure sales. And when the homeowner does contest a case, usually to get a court-ordered mediation to work out a mod, the national servicers fail to bargain in good faith, and are repeatedly sanctioned by the court for this behavior. This also extends the timeline.

Aside from chuckling with glee knowing that banks are complaining about a situation their own lawyers are causing, it raises several unanswered questions. First of all, why is this a problem? Cox makes several good points. Fannie and Freddie are getting ripped off, and given that their profits all go to the Treasury that means taxpayers, when their servicers get an extra year to foreclose. They pay for maintenance and upkeep if the home is abandoned, they have to pay taxes and insurance in many cases, and they don’t recoup their investment in a timely manner. In areas with a lot of blighted properties, that problem lingers; even if the homeowner remains in the home, they have no incentive to make repairs on a home they might lose.

And despite the image of freeloading homeowners living without rent, they aren’t helped by delays either, Cox said. “The family remains unsettled, under tension, and having it drag on doesn’t help. It also leaves them with a delayed beginning point for credit repair.” If they’re seeking a loan mod while the timeline extends, they get continued arrearage on their mortgages, increasing the chances of the mod being denied or the forbearance being excessive.

Worst of all, the financial industry uses these elongated timelines to get lawmakers to roll back consumer protections, so they act as a faux demonstration project for why homeowner due process should be eliminated. It’s telling that local banks file their cases much more quickly than the nationals; they’re the ones who benefit the most from a legislature doing their bidding and greasing the foreclosure skids.

That could be one reason why this is happening. Another is that it’s potentially a way for lawyers to collect extra on the case by keeping it alive longer, though frequently they get paid on a per-case basis. Certainly servicers profit from extending foreclosure timelines, because they can add on fees that could get paid off at the expense of investors (whether on property inspection or processing or whatever), as well as for deficiency judgments, going after the homeowner post-foreclosure. Cox suspects that “between lawyers reporting to servicers, and servicers reporting to Fannie and Freddie, somebody’s hiding the ball.”

I actually contacted Fannie Mae about this, but while their spokesman asked me to call he never called me back. I can’t say why the GSEs are allowing these timelines to be so ridiculously long without imposing compensatory fees. Nobody wants to see any foreclosures, but stretching them out, especially in uncontested cases, has little redeeming value. It’s just servicers and law firms making a buck off the taxpayer, with everybody else taking the hit. Are the GSEs colluding with the big banks to force state legislatures to smooth foreclosures and take away due process? We’ve certainly seen troubling signs of that before.

Hopefully we’ll see some real investigation of this. It’s another example of a broken industry with conflicted players.

with all due respects, the “servicers” are not doing anything…this process is still controlled by the largest (and dominant) title company in america, Fidelity, in Jacksonville. The servicers are not running this show. LPS was and is the “default” servicer. Nothing has changed…Fannie and Freddie got ripped off when FM Policy Focus was able to toast them with the creation of the FHFA. Hank “which direction” Paulson either did it on purpose or somehow has gotten away with not being blamed for the biggest blunder in american economic history. Fannie and Freddie were shut down under the notion they “might” have a loss and from counter party collateral calls that were curiously priced.

There is no attorney client relationship between the servicers and the law firms moving on these cases…

but I really do not see a problem with the lengthening of time…in many parts of the country, the market is not great, but closer to 85-95 of the top of the market. There are solutions to abandoned property issues…it should not lead to hurry up and throw agnes and her kids out of her home…

it would be nice if foreclosure defense attorneys took a real primer on loan pools…two trustees, three servicers, depositor, sponsor and something called the Trust Indenture Act…ask the right questions in discovery and you might get some victories that will stick…

shouldn’t be happening in the first place and Fidelity is hand and hand in the white collar crime that is so pervasive. And yes, the bank executives know all about this RICO. WELLS FARGO STOLE !! WITH HELP FROM FANNIE MAE

This is a story on how a bank could steal a dead person’s identity, steal a living persons identity and with the help of manual designed to fabricate fraud steal a home. I am not alone Wells Fargo loves dead people, and seniors are their targets along, with widows and people with health problems. NOT to mention the VETS And the government, allows this ! I had my legal home (in trust) stolen by manipulation of public records, a fake address (that the Post office would not address thru Matt Cartwright’s office), I can show a fake flood cert provided by Wells Fargo, for forced placed insurance for a fake property that is not even in a flood zone at all. In fact, the property on the still missing wet blue ink note never filed in the deed office of Northampton County was a corn field property owned by a farmer whose family has owned that tract for 300 years. What Wells Fargo did, with PHS, Art Jenkins, the combined government of Fannie Mae and the OCC and CFPB the US post office and PA state Police was march me out of my legal home with paperwork that was created to look factual when it was not. The TBTF Banksters are doing this all across this nation, the deeds are dirty and clouded. No one will ever be able to know if the paperwork in the county records office is truthful. This is a travesty of record keeping used for insurance and taxes that has run amok.

Remember, with out homeowners’ identities, social security numbers, credit history and signatures the TBTF banksters would not be able to package them up in CDO’s and sell them overseas in a whale of deal.

We, the people are the residential mortgage back securities – stop the grand theft of people’s homes ! NOW

JoAnn Kennedy

What’s hilarious about that:

I’ve heard several bank attorneys say in oral arguments that assignments of deeds of trust don’t matter. So, in essence, the banks are now claiming that title and title insurance are irrelevant.

The banks tried to eliminate real estate agents a few years ago. Now, it seems, they are trying to eliminate title insurance.

And of course, I hope everyone knows that the original documents do not come into play anymore at escrow. Years ago, escrow accepted the original promissory note before releasing any funds to any bank. Now, they accept an indemnity agreement and a lost note affidavit.

To counteract what the banks are doing at closing EACH AND EVERY ONE OF US needs to amend the escrow instructions and demand that the closing happen at escrow ONLY with the original promissory note and NO indemnity agreement. That will straighten out these fuckwads.

Alex, pardon my ignorance,but this post seems very unclear. Why is Fidelity in control? What is LPS? What is FM Policy Focus?

“There is no attorney client relationship between the servicers and the law firms” ??? How could that be, and how is it important?

And what questions in discovery would lead to victories? This seems tantalizingly close to a real contribution.

lender processing services (LPS)…the company that gave us robo signing was spun off just before the crash into its own SEC public vehicle by Fidelity in Jacksonville, yet was still in the same building using the same computer servers…LPS handles the payment information on about 50% of all home loan payments that are funneled through securitized loan pool partnerships…when you send your payment to a po box, that is usually handled by a third party in a lock box scenario, and inputted into the database of fidelity/LPS…not your banks computer server…

in a loan pool scenario, skimming is the key issue…in the old days, you got a loan from a bank and it serviced its paper…it might be able to convert that loan into cash by underwriting it to fannie and freddie standards, who would then loop it back via a certificate for the loan which was as good as cash, and would thus lower the capital requirements for servicing and holding the note…

in a loan pool you have a multitude of parties as each “task” is now a skimming opportunity… two trustees…one who holds the corpus, or the actual note, and another that handles the money side…DB is an example of the money side, so whenever you see a DB as trustee foreclosure, they are not the holder of the note, they are the “indenture trustee” required by the Trust Indenture Act…

in most loan pool scenarios, the actual corpus holder (note holder) is either Northern Trust(Chicago) or Wilmington Trust(Delaware, now owned by M&T)…a securitized trust will have three servicers…the main one is the one handling the cash with the investors(Trust Indenture Act servicer)…the one most people interact with is the second one, the one most people “think” is their bank…they usually use RR Donnelley or some other “mail out” provider who get their instructions from the computers at Fidelity/LPS…(skimming)…

so your neighbor loses their job, or has a gambling problem, a medical problem, or just decides to one day not pay…and the Fidelity/LPS computers then burp out a notice sent by RR Donn in the name of the one you perceive as your “banker”…

after a few months…the Fidelity/LPS computer then sends out a notice of “award” to one of their in network attorneys, to begin the “foreclosure” process…most of these network attorneys get a small portion of the money that Fidelity/LPS books against the “foreclosing” entity…and monitors the work of the attorneys…when you look at a foreclosure case, you will notice some number that recurs on many documents either on the lower left or right side of the pleadings…that is the LPS file number…when calling law firms with your foreclosure case information, often their system will not be able to find your case without that LPS number…

so in a practical sense, it is Fidelity/LPS which is “hiring” the law firm…and any communication is done through Fidelity/LPS in its “in network” communication system…

to get extra fees, many of the larger law firm foreclosure groups have created side entities where they have their own “title” company(meaning really title agent) and take additional fees by “reviewing” the documents, even though they can not move or respond outside LPS approved written responses as prescribed for each state…

and so LPS is the “third” servicer, the default servicer, but will again, skim some revenue back to a “sub-servicer” who will usually be some other party brought in to eat a chunk of the over payment americans make on mortgages(in asia, you can get a home loan from Citi for less than 2% fixed…would that not be nice for americans too, whose FDIC insurance “covers” those asian low interest loans)

as to FM Watch/ FM Policy Focus…JC Watts was the one who put the stake through americans and their lost 5 trillion in home equity…FM Watch was designed to try to force americans to pay higher interest rates by removing the dominant system of home finance, Freddie and Fannie…it would also crush the capital position of community bankers who had much of their capital tied to Fannie and Freddie…kill fannie and freddie…kill off local banker competition…raise interest rates to americans…

Mr. Henry F. Potter would be pleased(L. Barrymore)

the FHFA came into being from the work of FM Watch, a group of financial firms whose sole purpose was to shut down fannie and freddie, which they did with the help of Hank Paulson…who was running Goldman when the other paulson created the “short america” syn-CDO deals with that same Goldman Sachs(just a ko-inkidink)…

John Paulson had Harvey Pitt send a “fiduciary theater” letter to the ISDA to counter the Bear Stearns argument that loan pools could modified. The ISDA must have known the letter was coming, since the organization Harvey Pitt claimed to “represent” had not yet bothered filing its corporate documents in the State of Delaware…just a big show really…

hmmm…this is getting too long…

as to the discovery issues…it is not fair to ask attorneys who are getting usually paid minor change by homeowners to run up the ladder on foreclosure defense cases without being compensated for the extra time and energies needed to fight against the well oiled LPS foreclosure mill system…that having been said…

UCC-1 rules on business lending has well established case law which is hardly ever used. Basically, if you fumble with the use of the wrong spacing with the wrong character in a UCC filing, you may find yourself with no security at all…yet no one challenges the captioned entity…DB as trustee for xyz zoom zoom trust 2007-CD2a…the caption almost never matches any real entity…it is just a mirage…moving to dismiss as the plaintiff being a nullity or a motion for more definite statement is the start…any document that has a notary stamp on it is open for aggressive discovery…is the notary from a state that requires a notary log be kept ? if yes, then the log is usually a public document subject to foia and must be handed off…do not make the mistake of letting the notary ask you “which” date or document..ask for their entire set of log books…this will usually get the other side to cry…but do it directly as a foia and not as a discovery question as then they might design a piece of evidence to conform to the previous filing with the court…depositions can be expensive, but using a “written” deposition will get answers and save funds…most lawyers don’t like written depos, but it saves money and time, as the other side will almost always object to any meaningful regular discovery…requests for admission will usually nail down the other side (although they will often attempt to object to answering as it being impractical or not on point)…the zinger is to ask that any documents presented in the court file (note, assignments, allonges) be analyzed by local law enforcement against the Secret Service electronic database of inks…

subpoena duces tecum for documents from LPS and RR Donnolley…

and please, use a lawyer…do not try this yourself…the real world is not judge judy…

wow…this got long…

merry christmas mister potter…

Thank you very much Alex for the very informative explanation. And thank you David D for keeping this beat alive. If I don’t get some shelter…I’m going to fade away….

Thank you. A gold mine. I didn’t realize I was asking you to work quite that hard.

In the last few decades, how many new courts have been built vs. the growth in population or housing?

There are bottlenecks everywhere in the system since it was built to maximize profits by minimizing costs. Courts are externalities just like the environment.

You will find at least 40 years of underinvestment in every aspect that would deal with something going wrong. And when we elect politicians whose goal is to prove that government is useless, we are sure to see things going wrong.

Bubbles always lead to a misallocation of resources and many lining their pockets. The bubble in foreclosures is following this rule.

I strongly suspect that this is another plank in the the government’s plan to smooth over the ongoing structural depression that will worsen.

There’s a zombie foreclosure just a few doors away from my parents’ house. No one is living there — the house has been empty for close to two years.

I don’t know who holds the mortgage, but the township is well aware of the status of the property. They’re trying to get the bank (Wells Fargo) to take responsibility, but so far, nothing is happening.

I might add that this house was built by the richest man in the neighborhood. He and his wife sold it to another family, and that was the family that walked away from this place.

Back in the day, it was a very nice house. We neighbors considered ourselves very lucky to be invited over. But now, it’s just sitting there, decaying.

why would not you and your fellow owners on that street pay a few dollars to track down the former owner (who may still have the actual rights of ownership) and obtain a lease option for a nominal amount (100 per year) and then be in a position to keep the property in decent shape from the visual corridor aspects and then also be in an equitable position to force the lender/servicer to negotiate a conclusion and move the property forward. Why would you wait for whatever “local town official” deemed themselves capable if they have shown an inability to deal with a vacant home ?

You mean, why don’t the neighbors pay to maintain a bank-owned property? Hmmm…..sounds dubious. Maybe if maintenance conferred some type of ownership right, which it doesn’t. But you just seem to be suggesting that the locals put equity into Wells Fargo’s property. What am I missing?

My parents and their neighbors aren’t interested in paying one red cent to maintain this property. Why should they? It isn’t their responsibility. It’s the bank’s.

What are they interested in? Well, they’re interested in the fact that this empty house is being vandalized. They’re worried about the un-fenced swimming pool, which can easily be seen from the adjacent elementary school property. Think of curious kids and what could happen next.

Meanwhile, I’m across the country, hearing what my mother has to say about this situation. And let’s just call her language the kind that can’t be repeated on NC.

we can agree to disagree…I believe in living a pro active nor re active life. just because a house is empty does not mean the foreclosure process has moved forward or been completed…waiting for someone else to “do something” is not my style…to each his own…this is why our democracy falters imho…it is not my concern does not cut it with me…for less than a hundred dollars one could figure out what the facts are by getting a title company to have someone do a tract search…probably closer to 50 bux…another 25 bux helps to maybe track down the missing owner…or for another 100 bux one can access a database with a few hundred thousand direct banker contact points…go to the property and see if there is a sticker on any of the windows with an 800 number on it…and if the mailbox is removed…if not, then the servicer probably has not gone forward with a case…the former owner may be in bankruptcy or they may not have a loan at all and may have died…how do you “know” the property is in foreclosure…25% of the properties in america have no loan or loans at less than 35% of value…

Foreclosed and vacant properties reduce the value of all the homes in the ‘hood by at least 10%. It’s in your interest to maintain that property.

Not really in his interest to maintain. First, the “hood” isn’t being sold. Second, lower valuations mean lower taxes. Great! Fourth, someone would have to admit that all those foreclosures performed by HOAs claiming to be needed to “preserve value” could not possibly operate to preserve value….at least not for the homeowners.

Huh? Studies have repeatedly found that foreclosed and abandoned or abandoned-looking properties reduce the value of other houses in the neighborhood. So not having the home in decent shape hurts the writer’s net worth and will hurt him more tangibly if he were to choose or need to sell the house.

But dream if he can get his city or town to lower his appraised value for tax purposes.

You’d be surprised what can get done when people in the community work together. And it does not even have to cost that much.

This is the perfect circumstance to create community… if you actually want it.

The real estate bubble, built on excess, optimism, fraud, corruption led to a bubble in foreclosures. The system to deal with foreclosures was not built to sustain such a large amount of them so we see the same excess, fraud and corruption going on there.

The system is stuck in bubble mode because there is no agency to help get it out of there. If you want to break the pattern, people in communities will have to rise up to the occasion.

who loses when the house down the street is slowly melting away…the people who live there, or the person at 2b2f international…?

Yes, option to purchase with the lease means equity…ownership…there are two issues in play with the destabilizing effect of the derivative contracts stealing money from pensions and then the lender/servicer double dip by not mentioning to the courts it is getting paid by a third party guarantor…

the first problem is in working class neighborhoods where home values fell below $100 grand. 100 grand (or maybe now 125) was the magic number for there being a mainstream financing vehicle, meaning, if you lived in an area where homes were cheap enough, you were not very valuable to the servicing industry. So, by allowing those homes in working class neighborhoods to slide down a slippery slope, the 2b2f or too big to care institutions can push those communities back into the junk pile…creating long term instability in the general area, and allowing economic discrimination to flourish (and make boss hogg happy along with his rent to own and check cashing palace/payday loan buddies)…

In the more affluent communities, the destabilization factor has to do with the lines of credit that existed on homes and which many small business owners used for their day to day short term capital needs. The OCC demanded at the beginning of the crisis that funding sources continue to provide the lines of credit, but they were ignored. Hundreds of billions of dollars in fairly unbundled capital slipped away from the market, causing headaches for business growth and stability.

Paint and cutting grass costs very little money short term, but has a strong effect on stability in valuations. Ignore the problem down the street and it will not effect the folks taking a meeting in the tall buildings downtown…it will effect you on your own street…

And yes you can make money at it…had a pair of rehabs I was doing in Newark, NJ when there was a property across the street that had been fire damaged and was sitting in limbo. The owner did not want it and the bank did not think beyond needing to demolish it…got the owner to hand off a deed…secured the property, and eventually after some gnawing of teeth and threats to file suit for “tortious interference” the servicer finally relented and a deal was cut and after rehab, a few bucks were made…

Why don’t you change the locks and rent the place?

As someone who worked at a large housing non-profit, where I assisted homeowners in their foreclosure dealings with their lenders, I really appreciate the fact that Naked Capitalism continues to report on the ongoing corruption in the industry. I would hear stories from homeowners that seemed too incredible to be true; and then weeks or months later, read an almost identical story in the news either here or elsewhere on the internet.

WELLS FARGO STOLE !! WITH HELP FROM FANNIE MAE

This is a story on how a bank could steal a dead person’s identity, steal a living persons identity and with the help of manual designed to fabricate fraud steal a home. I am not alone Wells Fargo loves dead people, and seniors are their targets along, with widows and people with health problems. NOT to mention the VETS And the government, allows this !

I had my legal home (in trust) stolen by manipulation of public records, a fake address (that the Post office would not address thru Matt Cartwright’s office), I can show a fake flood cert provided by Wells Fargo, for forced placed insurance for a property that is not even in a flood zone at all.

What Wells Fargo did, with PHS, Art Jenkins, the combined government of Fannie Mae and the OCC and CFPB the US post office and PA state Police was march me out of my legal home with paperwork that was created to look factual when it was not. The TBTF Banksters are doing this all across this nation, the deeds are dirty and clouded. No one will ever be able to know if the paperwork in the county records office is truthful. This is a travesty of record keeping used for insurance and taxes that has run amok.

Remember, with out homeowners’ identities, social security numbers, credit history and signatures the TBTF banksters would not be able to package them up in CDO’s and sell them overseas in a whale of deal.

We, the people are the residential mortgage back securities – stop the grand theft of people’s homes ! NOW

JoAnn Kennedy

Alex, Thank you for two very important pieces of information.

The whole process stinks, top to bottom. This post isn’t about the core point in the article (UNcontested foreclosures) but addresses another aspect that happens a lot, it seems. What I don’t get is why aren’t foreclosures shut down entirely when it is found that who owns the title to the property is in question? Why should a homeowner pay a bank or mortgage company ANYTHING if they cannot show they have title? That’s basically the homeowner giving free money to a bank/entity that doesn’t have any legal basis to take the payments, ie, a title. No title, no mortgage, no mortgage payment necessary.

If VALID title cannot be clarified within some reasonable time frame, then the title should automatically go to the homeowner, free and clear at that point. Too bad the banksters/servicers fucked up and lost the paperwork. Too bad they chopped up the mortgage into a bazillion pieces and packed them into some stupid derivative such that the title is hopelessly diffused and lost. Title should go to the homeowner/former mortgage payer. That would eliminate a lot of the stupid and sloppy games played by these clowns in order to extract as much money as possible from the mortgager. Hell, let’s put a cherry on top: if title cannot be found in same reasonable amount of time, the lawyers get NADA. No pay. You lose, you don’t get paid.

Thank you, David; any morsels of info on foreclosure is appreciated. Alex, where have you been all my life? Joking aside, after 8 years of running in the foreclosure hamster wheel, I’m kinda tired and grumpy. As I try to write 2 persuasive appellant’s briefs that will just take the Appellate division by storm, when the fraud is ummm….obvious? apparent? right in front of your face? have to keep my eye on the prize and my emotions at bay as I attempt to write my statements of facts (8 pages…yikes!), when all I want to do is SCREAM. Ok, better now.