By Nicholas Shaxson, the author of Treasure Islands, an award-winning book about tax havens. Originally published at Tax Justice Network

This post examines another excellent in-depth investigation by Reuters into global financial stability issues, and the role of tax havens in this giant game of pain and plunder. The investigation uncovers, among other things, a whole lot of offshore shenanigans, complementing what we (and relatively few others) have been saying for some years now, and it goes right to the heart of what capitalism is — or at least what it has become.

Before reading this, though, see the box “What is a tax haven?” There’s a lot of misunderstanding out there.

What is a tax haven?

The term ‘tax haven’ is a bit of a misnomer: they aren’t just about tax. We will mostly use the term ‘offshore’ here instead of ‘tax haven’ – what we are talking about is the same basic phenomenon: jurisdictions offering escape routes to financial players elsewhere, helping them avoid taxes or disclosure or financial regulation or whatever other ‘burdens’ of society they don’t like.

In financial stability terms the world of offshore — a world that includes places like Ireland, Luxembourg, Cayman and the City of London (see box) – has been where financial services players have been able to escape regulatory barriers at home, taking the cream from risky activities while shifting the risks onto taxpayers via bailouts and other nasties. Offshore was very significantly at the root of the global financial crisis that erupted in 2008 — and on all evidence it will be at or near the epicentre of the next one too. We have written about this many times, and we have fingered London as being especially dangerous for global financial stability. And this comes in the context of the UK just having announced that they will be rowing back on money laundering checks and so on, in the name of ‘cutting red tape.’ (Read it and weep.) As was reported in the Financial Times not so long ago:

“Carolyn Maloney, a Democratic representative from New York, said there was a “disturbing pattern in the last few years of London literally becoming the centre of financial trading disasters””

Whatever one might think of Congresswoman Maloney, that statement is spot on.

This article looks at two Reuters stories in particular:

- How Wall Street captured Washington’s effort to rein in banks; and

- U.S. banks moved billions of dollars in trades beyond Washington’s reach.

The first story notes:

“[The] FASB, the private group that sets accounting standards for public companies, came under political pressure to tighten rules blamed for exacerbating the financial crisis. Critics said FASB had made it too easy for banks to stash mountains of securitized loans in off-balance-sheet vehicles based in the Cayman Islands, hiding their exposure to risks that eventually swamped them and the global economy.

Here, too, banks pushed back hard. And here, too, their protests reached sympathetic ears. Ultimately, FASB’s rules barely dented the size of banks’ off-book holdings”

. . . as the Reuters graphic here suggests. The banks, Reuters reports, hold nearly $3.3 trillion of securitized loans in off-balance-sheet entities. And that’s just Cayman and six U.S. banks.

“It isn’t just the banks. As hedge funds and private equity funds have ramped up high-risk lending in recent years, their use of off-balance-sheet vehicles has ballooned.”

There are two guilty parties here, geographically speaking: first, the United States, which shouldn’t allow this to happen; and second, “offshore” (which some think of as a single seamlessly interconnected place) where, as a general rule, the big players are allowed to do whatever they damn well like. As a former top Cayman official once put it:

“The responsibility of the Cayman government was managed by avoiding the concept of prudential regulation.”

Once again, ‘offshore’ jurisdictions and players get the cream from all the trading churn, while the ordinary taxpayer ultimately foots the bill. As Gary Gensler, former chairman of the Commodity Futures Trading Commission in the U.S. put it in the case of the AIG disaster, which was ultimately about risky trading activity in London:

AIG had been hit by its financial products unit in London while Citigroup had been harmed by special purpose investment vehicles set up in the UK capital. “So often it comes right back here, crashing to our shores … if the American taxpayer bails out JPMorgan, they’d be bailing out that London entity as well,” he told the House financial services committee.

Back to Reuters. The story trawls through a lot of colourful detail, including the work of an activist JP Morgan Vice President known as “Loophole Leslie” Seidman, as well as a number of regulatory changes after the Dodd-Frank financial reform bill which were “all in the direction of watering it down,” according to Marcus Stanley of Americans for Financial Reform. This Reuters investigation is a reminder of how much important stuff has been going on behind the scenes. They are relying on the fact that nearly everyone is tired of this stuff now.

Then Reuters moves on to this:

Which, again, is offshore: our terrain.

This article begins by looking at the apparent sudden vanishing of hundreds of billions of dollars of trades by some of the largest U.S. banks — including Goldman Sachs, JP Morgan Chase, Citigroup, Bank of America, and Morgan Stanley — to get around U.S. derivatives rules. (Tax havens and wild-west derivatives trades seem to go together like Bonnie and Clyde.) Reuters summarises:

“The trades hadn’t really disappeared. Instead, the major banks had tweaked a few key words in swaps contracts and shifted some other trades to affiliates in London, where regulations are far more lenient. Those affiliates remain largely outside the jurisdiction of U.S. regulators, thanks to a loophole in swaps rules that banks successfully won from the Commodity Futures Trading Commission in 2013. . .The products affected by that loophole include some of the most widely traded financial derivatives in the world.”

We wrote at length about this too: Reuters summarises it like this:

“The lobbying blitz helped win a ruling from the CFTC that left U.S. banks’ overseas operations largely outside the jurisdiction of U.S. regulators.

. . .

Once the banks got that loophole, then a lot of that predatory behavior migrated overseas to wherever there was less regulation.”

. . .

While many swaps trades are now booked abroad, some people in the markets believe the risk remains firmly on U.S. shores. They say the big American banks are still on the hook for swaps they’re parking offshore with subsidiaries.”

(We’d only dispute the word “believe” in that second-last sentence: it should be “know.”)

In case anyone were crazy enough to think that this stuff has stopped, the indefatigable Americans for Financial Reform a few days ago came out with news of this latest godawful exemption.

And now, as an aside, here’s a little snippet that Reuters unearthed, which we hadn’t seen before, about a big pre-GFC crisis:

“Gensler often told people how, at the Treasury, he was stuck with the task of briefing then-Treasury Secretary Robert Rubin about Long-Term Capital Management in 1998. The Connecticut hedge fund collapsed under $1.2 trillion in swaps booked to a post office box in the Cayman Islands.”

Cayman again. LTCM was a biggy – causing global market carnage at the time. However, the only book today’s blogger has read about it – Roger Lowenstein’s otherwise excellent When Genius Failed — does not mention Cayman once in the footnotes. You will hardly find it mentioned here or in other detailed analyses. This wasn’t on anyone’s radar screens at all. And far too few people are paying attention to the financial stability threats that lie offshore, hidden and unknown until crisis hits.

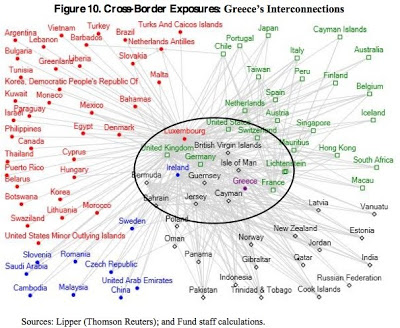

Now this isn’t to say that the next crisis won’t be triggered and significantly caused by an economic collapse in China, or an asteroid strike, or something. But the last big crisis showed — if you look carefully — how tightly connected all this stuff is, and how offshore is so often at the heart of it. This IMF graph from 2010 is one of the only bits of research that really points the finger offshore. (Even then, though, they pussyfoot around using such emotive words such as ‘tax haven’ or ‘offshore.’) But just look at that rogues gallery in the cross hairs: BVI, UK, Luxembourg, Ireland, Bermuda, Cayman, Jersey, Isle of Man, Switzerland, Liechtenstein. And of course the United States.

As mentioned, this stuff goes to the heart of what capitalism has become. All this regulatory arbitrage, like tax cheating and so much other stuff that is going on, is a form of what academics call rent-seeking, and we prefer to call ‘wealth extraction.’ In this case, it’s ultimately about extracting wealth by gambling with other people’s money: taking risks and getting others to pay when the balloon goes up.

The more risks build up, out of sight and offshore, the more likely they are ultimately to create mayhem. Hence the headline of this post.

The world’s leaders and international financial institutions need to wake up to what offshore is, and where it is. The place to start looking is London.

How do they get around Reg W with these amounts?

reputation laundering by Robert Herz in the Reuters article…must have been his evil twin laughing at congress when he said “his” investors were not going to put up with more regulations…hmmm…maybe someone can look up the magical FASB interpretations that allowed John Paulson to make all those billions on the back of a multi trillion dollar loss of equity to amercian homeowners…

some old copies of a trade publication…mortgage servicing news might bring his memory back to life…suspect Paul Muolo might remember things a bit differently, especially about the FM Watch crowd that got that legislation passed a few days before the fake margin calls on derivatives against Fannie and Freddie allowed them to be shut down…

in a short span(conveniently for harvey pitt and that mystery letter he sent in 2007 to the ISDA before the organization he claimed to represent even existed as a Delaware entity) the FASB changed interpretation of a number of items, including FAS 115, 133, 140 and 157…basically saying servicers were “Not” allowed to do loan modifications in complete dereliction of duty and in conflict with Fannie Mae, Freddie Mac, and Ginnie Mae regulations…fiduciary theatre…

Herz and Pitt argued that since Paulson and his fellow privateering crew had made bets on derivatives, servicers were no longer allowed to modify loans as it would turn Paulson and his buddies into losers on the derivative bets…period end of story…and then Herz and the FASB ruled that QSPE’s were no longer an acceptable vehicle…causing a freeze up and crash…he must have paid his publicist a large bag of greenbacks to get Reuters to not do any research on what he did during the Sept 2006-October 2008 period…

he weellee weellee wanted to do oder wise…but having only 75% of the votes on the FASB made it hard to fight off the evil bank people…oh wait…75% is a majority…hmmm…..

great story though in general…except maybe the LTCM po box thingee…me thinks every entity in the Caymans uses a po box since there is no delivery of mail by the postal service down there…you have to go to the box to get your mail…

oh well…back to baseball…go rays…

The author incorrectly says this is “what capitalism has become.” No, this is what capitalism has always been, and will always be.

Capitalism is an immoral economic system. It’s also not very good at economics.

It should be replaced by participatory economics (which is a technical term — you can google it).

Hay Nicholas…

Linked your post to another financial site and received this drive-by in response.

”

88888

September 4, 2015 at 6:04 pm

How dramatic

The Caymans is a conduit. Bad trades have nothing to do with domicile. They are bad trades.

Trades (or funds like LTCM) get set up offshore for many reasons but the ‘results’ still need to be repatriated.”

“I can assure you that when the Australian Banks blow up – it is going to have nothing to do with tax havens and everything to do with unsophisticated greedy investors, systemic risk and hopeless regulators. All egged on by useless politicians and Central Bankers.”

To whit….. Skippy… if the best you can do is arbitrarily hand wave with the missive of “Bad Trades” your either ignorant or blowing smoke, so which is it 8~

Crazy 8s misses the point. Yes, it all comes out in the wash (duh). But using the Caymens and other tax havens is done solely to keep the regulators from adding the requisite amount of detergent.

This is the common tax haven defence: point the finger elsewhere. It’s a bit like the driver of the getaway car saying “that bank robbery had nothing to do with me.” well, perhaps, but only up to a point.

“The term ‘tax haven’ is a bit of a misnomer: they aren’t just about tax. We will mostly use the term ‘offshore’ here instead of ‘tax haven’ – what we are talking about is the same basic phenomenon: jurisdictions offering escape routes to financial players elsewhere, helping them avoid taxes or disclosure or financial regulation or whatever other ‘burdens’ of society they don’t like.”

By avoiding these ‘burdens of society’ this is taking many countries down the road of being failed states.

I think they are directly linked to 5 of the 13 measures of a failed state. Uneven economic development and inequality, sudden economic downturn, corruption, criminalization of the state, and deterioration of public services.

The ability to tax comes from the power of the state and is what gives value to a given currency. The ability to regulate is what creates a fair playing field. By using tax and regulatory arbitrage both of these functions are undermined.

Insomuch as these entities are transnational, they are taking us down the road of being a failed planet. “Gaias’ Shakeout” is going to be a lose lose proposition.

I’m just sitting back and waiting to see if China invades Singapore to repatriate all the Chinese expat money.

Depending on how the story gets spun here, maybe we’ll have the US Navy do something useful for a change and invade Grand Caymen for being accomplices in tax fraud.

If we’re not so lucky, we’ll invade Ukraine and Syria because Putin has a very large Swiss numbered bank account – and that’s just wrong.

As a Brit I’m begging you – please come and slay The City and liberate ordinary British people.

You can clearly see from that diagram they are at the heart of it. Raise rates and then **finish them**.

first step is voting Corbyn or the Greens v. Conservatives, Lib Dem or a Blairite.

“we shall carry on the struggle till in God’s own good time the New World, with all its power and might, comes forth to the rescue and liberation of the Old.”

Winston Churchill 1940

Maybe we can get some agency in Brussels to label The City a terrorist organization and take appropriate action, like make a call to the Force de Frappe.

Otherwise, it must devolve upon the Duchy of Cockaigne to intervene.

Fraud is not merely systemic. It is the nature of finance. Moses knew that. A mere 3500 years later and almost no one has caught on.

City of London: I say we nuke the site from orbit, it’s the only way to be sure.

See my comment above. The French would be more than happy to accede to our wishes in this matter.

Seems like the fourth largest banking center in the world is off the radar of this article. Those with a historical bent will recall that one of the few “successful” US military operations since WW2 was the invasion of Panama. Former CIA asset Noriega got uppity and demanded too large a percentage of the profits from arms running and drug money laundering, so the Marines were called in to burn a few residential neighborhoods and liberate the country so it could achieve future greatness.

That future was to become the western hemisphere’s Switzerland, where billions of dollars funneled from private equity skimming and drug profits could go to become legitimate US dollars, secure behind blind trusts and shell corporations. That modern skyline of office towers (several with the Trump name attached) didn’t emerge from the stinking jungle to serve the needs of the Panama Canal pilots.

I’ve been to Grand Cayman and marveled at how giant international corporations could be successful managed from the confines of a single post office box, LOL — but that operation is a backwater compared to Panama City.

Fer sure. When you google for pics of Panama it’s really hard to believe it’s in Central America, of all places.

yes, Panama does need serious attention. Not only is it big, but it is one of the most recalcitrant in terms of responding to global pressures to rein in some of the worst excesses of secrecy.

Not sure if Singapore is considered a “tax haven” nowadays. But can’t wait for their comeuppance as a haven for corruption money from neighboring countries.

For some reason I see Sean Connery in the very moment of recognition of the magnificent strategic opportunity proclaiming: “And he who holds Cayman, has all of America in his hands.”

I can easily see the City of London choking on too big a gamble because it believes ultimately the US Fed will have its back playing the same old ‘Too big to fail’ canard. I saw that term elsewhere recently put in the question ‘Is the stock market now ‘too big to fail’ and I think we have the answer, i.e., the Fed will not willingly allow much of a correction. Whether it can decide that for itself is another question.

Those Financial Secrecy Index links (from the Tax Justice Network) for several countries are absolutely awesome. They are beautifully written–exceptionally good reading.

For example, the one on Ireland was harrowing, eye-popping, and well documented, naming names of key actors–some still active–in shaping tax, regulatory and civil service policy. It provides historical background, including relatively recent events that for some strange reason (ahem) haven’t been discussed in Ireland during all these “post-crisis” years and analyses. Its observation of how the entire civil service was gradually systematically “captured”/trained to not question government policy matches reality on the ground.

Thanks. I co-wrote most of those. There’s a whole series of updates to those, and a new financial secrecy index, coming out on Nov 2. And I agree re Ireland: I found that one particularly fascinating.

The Royal Family has purview and complete autonomy over the Privy Council. It is through this entity that the Commonwealths such as the BVI’s, Caymans, Bahamas, Isles of Man, Jersey, Guernsey, Barbados, etc etc are managed. They derive mineral royalties for the Crown Corporation from many other jurisdictions like Alberta (oil sands), BC (gold), Austraila’s Western Territories… If you were to extinguish the City, you would likely need to extinguish the monarchies as well.

The Royal Family of the UK has purview and complete autonomy over the Privy Council. It is through this entity that the Commonwealths such as the BVI’s, Caymans, Bahamas, Isles of Man, Jersey, Guernsey, Barbados, etc etc are managed. These political “sovereignties” pay mineral royalties for the Crown Corporation and from many other jurisdictions like Alberta (oil sands), BC (gold), Austraila’s Western Territories…etc. If you were to extinguish the City of London, you would likely need to extinguish the sub-states as well. The map above shows the connections with many other monarchies as well…The Netherlansa, Oman, Morocco, Bahrain, Monaco, Kuwait, Saudi Arabia, Jordan…. I wonder why Monarchies are among the prefered governmental entities for tax-haven activity… But I also wonder why the US taxing authorities have given our “dual-passport weilding” citizens and corporations a pass on much of their evasion through gimmickry…. ie., favorable transfer pricing treatment of intangible assets like copyrights, patents, trademarks, ship “flag” domiciles, synthetic leases… etc.