Yves here. There’s a lot of important information here on student loans, such as default rates at different borrowing levels and the impact of having student loans on a prospective borrower’s ability to get other credit. One important and surprising finding: the default rate is highest on low loan balances. As Lambert says, you can drown in six inches of water.

By run 75441. Originally published at Angry Bear

For Profit Goes on Probation

The University of Phoenix has been placed on probation by the Department of Defense preventing the university from recruiting on military bases. The probation comes after the Federal Trade Commission and the California Attorney General’s investigation into the University of Phoenix recruiting methods, its high costs, and the resulting poor student performance.

This is not the first time Phoenix-U has been in trouble. In 2013 the University of Phoenix was threatened with probation by the accreditation board for a lack of “‘autonomy’ from its corporate parent -– a development that prevented the university from achieving its ‘mission and successful operation.’” In other words, the for-profit university #1 priority by its owners was to turn a profit at the expense of teaching, retaining, and graduating its students. This is precisely what I had alluded to previously on higher rates of defaults.

Student Loan Defaults

An interesting analysis by the NY Fed suggests students with lower amounts of student loan debt are more likely to default than those students with higher amounts. This is a new take on student loan debt and associated default as it was always thought the higher the debt the greater risk of default. Student Loan Debt has increased as more attend college, costs to attain an undergraduate degree have increased, even higher costs are sustained for Masters and Doctorate degrees, and students have been staying in school longer. Coming out of college the study finds amongst students loan debt is distributed rather evenly over time with one third being held by those in the 20s, one third held by those in the thirties, and one third held by those forty years of age and older. A large percentage of those borrowers or ~39% of them have loans of less than $10,000 and it is the holders of debt who have been defaulting at a higher percentage. The study goes on to break it down as to why they might be defaulting more frequently than tose with higher amounts of debt.

Using Equifax credit data, the NY Fed broke down the data into loan origination cohorts of student loan borrowers and using the same Equifax data, developed default rates for each cohort. Taking the origination date information for each academic year, the Fed was able to assign borrowers to loan-origination-completion-cohorts. The analysis did not reveal dropout or graduation information; however by using loan origination data, the methodology used does approximate whether students left school finished their education or just left school.

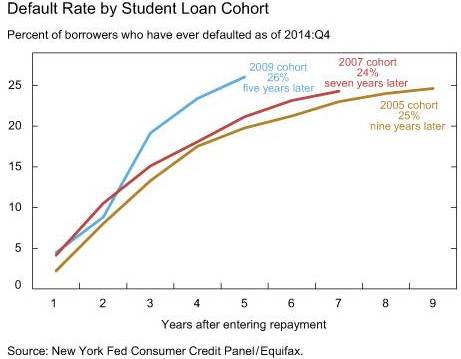

As shown on the graph and nine years out for the 2005 and the 2007 cohorts 24% of the students and greater had defaulted on their student loans by the 4th quarter of 2014. While the data for the 2009 cohort is incomplete and depicts five years as opposed to nine years, the data depicts a worsening default rate at 5 years then what can be found with the 2005 and 2007 cohorts at 9 years. Typically what we read and hear about is a 3-year window as reported by the Department of Education and is discussed by the news media. The 3-year window default rate is much less for each of the cohorts with the 2005 cohort being ~1/2 or 13% of what it is in 2014 as shown by the Fed study.

As shown on the graph and nine years out for the 2005 and the 2007 cohorts 24% of the students and greater had defaulted on their student loans by the 4th quarter of 2014. While the data for the 2009 cohort is incomplete and depicts five years as opposed to nine years, the data depicts a worsening default rate at 5 years then what can be found with the 2005 and 2007 cohorts at 9 years. Typically what we read and hear about is a 3-year window as reported by the Department of Education and is discussed by the news media. The 3-year window default rate is much less for each of the cohorts with the 2005 cohort being ~1/2 or 13% of what it is in 2014 as shown by the Fed study.

As I mentioned above, a large percentage of those who defaulted had student loan debt of less than $10,000. 34% of those borrowers in that group who defaulted on their student loans had balances of less than $5,000. 21% of the 2009 cohort were in this category of < $5,000 in student loans five years out which depicts a worsening trend when compared. A closer examination of the 34% also reveals this group to be made up of students who attended community college, did not finish, perhaps discovered this is not what they wanted to do, or the curriculum did not fit their needs.

What the NY Fed concludes is the default rate worsens when a much longer period of time is taken into consideration as opposed to the 3 year window the Department of Education looks at and which the public hears about in the news. The longer the period, the higher the default and it continues through years 4 through nine for the first two cohorts. As shown the default rate for the 2009 cohort is already higher. Those who had lower amounts of student debt in the end may have defaulted due to a worsening economy or potentially did not get the payback expected from a two year degree at a community college or for-profit school. The study also revealed those who are current today with their student loans did experience stress in making payments and 63% of those student loan borrowers appear to have avoided delinquency and default over the last decade. On the other side of the coin, student loan borrowers with $100,000 of debt had a default rate of 18% which has been attributed to their being higher earners after graduation.

Economic Impact of Student Loan Debt

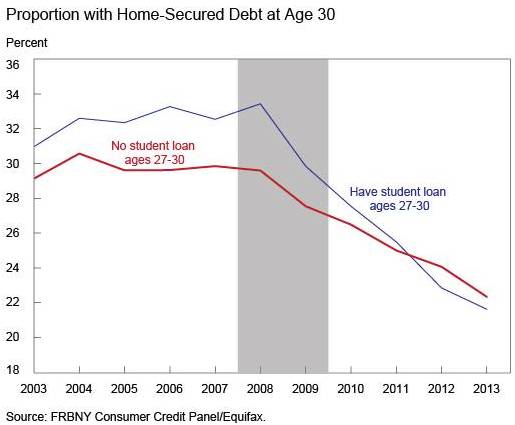

One aspect of the fall-out resulting from increased student loan debt as suggested by the Fed study is decreased home ownership. From 2008 onward the study depicts a steady decrease in the numbers of graduates burdened by student loans investing in homes. Dropping from a high of ~34% in 2008, the percentage of homeowners and having student loan debt has declined to ~23% in 2014. What has occurred, those 27-30 year old having no student loan debt have surpassed those with student loan debt in home ownership. While both groups experienced a decrease in home ownership during bad economic times, the decrease for those having student loans was far more severe. The decrease in home ownership still continues for both groups with those having less debt owning homes at a higher level.

One aspect of the fall-out resulting from increased student loan debt as suggested by the Fed study is decreased home ownership. From 2008 onward the study depicts a steady decrease in the numbers of graduates burdened by student loans investing in homes. Dropping from a high of ~34% in 2008, the percentage of homeowners and having student loan debt has declined to ~23% in 2014. What has occurred, those 27-30 year old having no student loan debt have surpassed those with student loan debt in home ownership. While both groups experienced a decrease in home ownership during bad economic times, the decrease for those having student loans was far more severe. The decrease in home ownership still continues for both groups with those having less debt owning homes at a higher level.

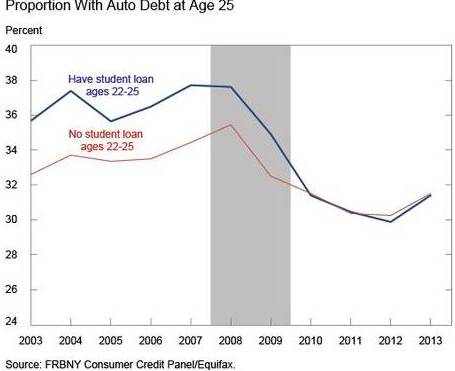

A similar situation holds true for new auto ownership. The numbers of 25-year old college graduates purchasing automobiles and with student loan debt retreated from the market place at a faster pace than those without student loan debt. It is only recently have increased numbers of both groups returned to the market place to buy automobiles. While the purchase of automobiles has increased for all 25 year old people, the numbers of college grads with student loan debt no longer surpass those without student loan debt and at best are at the same level as those without student loan debt. Student loan debt is a burden and more of a burden in harsher economic times.

A similar situation holds true for new auto ownership. The numbers of 25-year old college graduates purchasing automobiles and with student loan debt retreated from the market place at a faster pace than those without student loan debt. It is only recently have increased numbers of both groups returned to the market place to buy automobiles. While the purchase of automobiles has increased for all 25 year old people, the numbers of college grads with student loan debt no longer surpass those without student loan debt and at best are at the same level as those without student loan debt. Student loan debt is a burden and more of a burden in harsher economic times.

Much of the retreat from the market place is due to large loan and higher interest rates on undergraduate student loans, even higher interest rates and balances on graduate and doctorate student loans, higher balances due to the increased costs of colleges across the board, and longevity in paying back student loans. There are no controls on colleges and universities to rein in costs and it is the only cost to increase at a faster rate than healthcare. The higher costs play out in student loan debt as states do not subsidize colleges to the same ratio as they did 20 years ago, Pell Grants have not kept up with the costs of colleges, and parents can not afford the increased cost out of pocket either.

For the purchases of homes, cars, appliances; the bank assesses your ability to repay the loan as these loans can be discharged in bankruptcy unlike student loans which can not be discharged. Many college graduate households today consist of two married adults both of which are burdened with having student loans to pay off making the situation even more precarious. The result is increased risk.

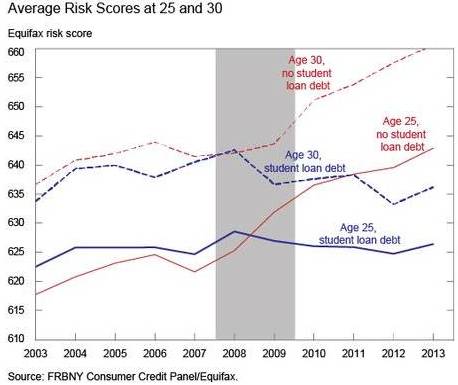

The difference in the ability to buy in the market place between younger people with student loans and those without student loans has flip-flopped. While both groups have retreated from major purchases during bad economic times, those with student loan debt retreated at a quicker pace than those without student loan debt and have not regained the prominence they had with banks in the purchase of homes and other items previously. Other than the inability to purchase during bad economic times, a rise in student loan debt by these households may have triggered higher risk levels by banks when looking at credit history. Banks and other loan originators may be more reluctant to loan to those with student loan debt which has changed over the years as new grads were once favored by banks due to higher earning potential. Using the same data, the NY Fed reviewed the risk rates of 25 and 30 year olds with and without student loan debt. As can be expected, those households with student loan debt were deemed a higher risk due to student loan balances and higher interest rates and a decrease of potential income over time. Those students would be less likely to obtain a loan or a loan with lower interest rates. Ahigher interest rate adds to an already high financial burden.

The difference in the ability to buy in the market place between younger people with student loans and those without student loans has flip-flopped. While both groups have retreated from major purchases during bad economic times, those with student loan debt retreated at a quicker pace than those without student loan debt and have not regained the prominence they had with banks in the purchase of homes and other items previously. Other than the inability to purchase during bad economic times, a rise in student loan debt by these households may have triggered higher risk levels by banks when looking at credit history. Banks and other loan originators may be more reluctant to loan to those with student loan debt which has changed over the years as new grads were once favored by banks due to higher earning potential. Using the same data, the NY Fed reviewed the risk rates of 25 and 30 year olds with and without student loan debt. As can be expected, those households with student loan debt were deemed a higher risk due to student loan balances and higher interest rates and a decrease of potential income over time. Those students would be less likely to obtain a loan or a loan with lower interest rates. Ahigher interest rate adds to an already high financial burden.

There are probably many other reasons why young households may have retreated from the market place; cultural changes in how younger households view home ownership, automobiles, and other purchases; higher costs of financing; lowered expectations of future earnings; unwillingness to take on more debt, etc. The fact of the matter is, not only does the market place view them as a higher risk; but, these college-educated young buyers are not buying homes, autos, etc. or making large investments at the same level that once existed and it does not bode well for the economy.

It also never ceases to amaze me the number of anti-educational opinions which flare up when the discussion of student loan default arises. There are always those who will prophesize there is no need to attain a higher level of education as anyone could be something else and be successful and not require a higher level of education. Or they come forth with the explanation on how young 18 year-olds and those already struggling should be able to ascertain the risk of higher debt when the cards are already stacked against them legally. In any case during a poor economy, those with more education appear to be employed at a higher rate than those with less education. The issue for those pursuing an education is the ever increasing burden and danger of student loans and associated interest rates which prevent younger people from moving into the economy successfully after graduation, the failure of the government to support higher education and protect students from for-profit fraud, the increased risk of default and becoming indentured to the government, and the increased cost of an education which has surpassed healthcare in rising costs.

There does not appear to be much movement on the part of Congress to reconcile the issues in favor of students as opposed to the non-profit and for profit institutes.

See original post for references

“There does not appear to be much movement on the part of Congress to reconcile the issues in favor of students as opposed to the non-profit and for profit institutes.”

Forget the children, think of the securities that could suffer…the horror…the horror!

First they came for the assets that backed my security and I said nothing…

Then they came for the derivatives written on the bundle my assets were part of and I said nothing . . .

then they came for the equations that valued the derivatives written on the bundle of assets that backed my securities . . . and I said . . . drum roll please . . .. .

“It’s too late baby now it’s too late, ‘though you really did, try to make it, something in side has died and you can’t hide it you just can’t fake it, ohhhh nooooo!” hahahahah fuckkin AAAAA.

I’m not Carole King either. I just quoted her when they came for the equations

“She swallowed the spider to swallow the fly, but I don’t know why she swallowed the fly….”

Be good in this life, you will be rewarded in the hereafter!!!

How do you know this?

Never had any complaints.

That seems like a pretty direct call out there :-)

It is not anti-education to point out that our system of higher education is fundamentally flawed. It is a systemic problem, and to whitewash that problem is to ignore reality itself. The system is predatory, designed to reward connected insiders with out-sized compensation packages, from tenured professors to football coaches to administrators. while reinforcing class boundaries. That is the reason there is so much student loan debt. That money doesn’t vanish; it represents the wages paid to the employees of the institutions, wages far exceeding the median wage.

The reality is that the American system of higher education as it exists today is a credentialing machine. That it happens to promote a little bit of actual learning as an ancillary benefit does not invalidate the core observation, and attempts to shrug off this reality as if it’s some kind of anti-education diatribe does not speak well of those who advocate moar college as the answer to our social challenges.

And once you get that certificate, it’s deflating to be ‘educated’ that, in life, it’s who you know that matters.

“They didn’t teach me that in college!!!”

Well, machine parts don’t need to know that.

I remember my stats professor joking years ago that those who know why things are done will always be telling those who know how to do it what to do.

I am anti-education as the solution to our economic woes. We need jobs or a guaranteed income. And we need to stop outsourcing the jobs that exist. And we need a much higher minimum wage. And maybe we need work sharing. I am also against using screwdrivers to pound in a nail. But why are you so anti screwdriver anyway?

And I see calls for more and more education used to make it seem ok to pay people without much education less than a living wage. Because they deserve it for being whatever drop outs. And it’s not ok.

I don’t actually have anything against the professors (except their overall political cowardice in times demanding radicalism!). Now the administrators, yea I can see the bloat and the waste there. But mostly, I have issues with more and more education being preached as the answer to a jobs and wages crisis.

We all should be against Big Educational-Complex and its certificates-producing factory education that does not put the student’s health and happiness up there with co-existing peacefully with Nature.

“You must be lazy – you’re not educated.”

“Sorry, you are too stupid for our elite university to admit, just as your brother was too poor for our rich club to let in.”

“I am going to kill you intellectually. I will annihilate you intellectually. My idea will destroy you and I don’t have to feel sorry at all.”

Yeah, I find it fascinating when people make the argument that jobs require college degrees or we need more higher education to be competitive. It’s completely backwards; if employers actually needed more college graduates, they would pay for it. The point is merely to justify inequality after the fact. It is like saying that aristocratic titles reflect the merits of the nobility. In practice, virtually all workplaces train new hires to do what they want because they have a specific process to which employees must adhere. Onboarding is such basic HR it’s hilarious when people speak authoritatively about jobs without seeming to understand how organizations function.

I do have more direct hostility for professors. I’m not talking about adjuncts or people making $60k a year teaching a heavy course load or the ones trying to change things within their profession (like a law professor organizing a pro bono legal defense group for low-income defendants). I’m talking about the ones making six figures (or more) who lend their name to that justification of inequality, working the soft corruption of careerism for cushy conference travel and pet research projects and corporate consultancies and politically convenient conclusions.

Also, aside from that, there is an air of arrogance and condescension that permeates a lot of academia. There is a difference between a fact and an opinion, but some of our more comfortable intellectuals like to assert that their personal opinions are facts which the unwashed masses are unworthy to challenge. One does not say such things in polite company out of professional courtesy, so the end result over time is an intellectual bubble in which the people at the top simply have little experience being challenged.

It’s like the Eddy Izzard joke about flags. Do you have a doctorate?

“economic elites tend to prefer lower levels of government spending on practically everything, while business groups and specific industries frequently lobby for spending in areas from which they stand to gain”

Gilens and Page ‘Testing Theories of American Politics’

http://www.princeton.edu/~mgilens/Gilens%20homepage%20materials/Gilens%20and%20Page/Gilens%20and%20Page%202014-Testing%20Theories%203-7-14.pdf

Low loan amounts sounds like students who drop out or forced out…meaning useless loss of time if no real prospect of finishing…also what type of scools had loans at losses…beauty school ?? Computer networking courses for jobs that existed 15 yrs ago ? Did the folks default due to lack of familial support ? How many defaulted never even finished 64 credits ?…ftc lets post graduate schools slide…how many industries can lie to you and sell you a useless product…the ftc went after a real estate guy who sold folks the best info on using tax sales to get a bargain…i was personally upset (borderline livid) at how he was creating a wave of competition with so much info so cheap…but most of the buyers wanted it for free and didnt want to do the hard work that is required and well he got toasted by the ftc (note…i use the tax sale lists to find abandoned properties to be able to find owners who walked away and buy their abandoned interest…not to buy certificate, call inspectional services to harass them and bleed them & then throw them out…which happens more often than you would imagine…professional tax buyers using inspectors to disrupt the lives of property owners)…meanwhile…post secondary “non profit” institutions rape and pillage peoples futures…and nothing but the sound of crickets…the ftc is 100 yrs old…but it has become the fox news network for actual protection…all noise and low hanging fruit for press release purposes…

Remember DINKs? Dual Income No Kids.

Dual Debt Bad Job No House No Kids doesn’t work well for acronyms. Better for an abbreviated hash tag?

Too indebted to survive [the] unusual punishment. TITS UP for short.

It’s easy to explain, really. According to the Department of Education (https://studentaid.ed.gov/sa/repay-loans/understand/plans) you’re going to be paying off that loan at minimum payments for 25 years. Assuming your average bachelor’s degree is about $30k if you go all-loans (http://collegecost.ed.gov/catc/) and the average student loan interest rate is a generous 5% (http://www.direct.ed.gov/calc.html), you’re going to be paying $175 a month for a sizable chunk of your adult life.

If you’re merely hitting the median income of a bachelor’s degree after graduation, $55k (http://nces.ed.gov/fastfacts/display.asp?id=77), and good luck with that in this economy, you’re still paying ~31.5% of that in taxes (http://www.oecd.org/ctp/tax-policy/taxing-wages-20725124.htm) you’re left with $35.5k before any other costs. Out of that, you’re going to have to come up with the down payment to buy a house and a car after spending more money than you have left (http://www.bls.gov/cex/csxann13.pdf).

The last paragraph sums it up perfectly, especially the predictable counterarguments. Accurately assessing what job in demand several years down the road is very difficult, if not impossible.

Majoring in IT or Computer Science would have a been a great move in the late 1990’s; however, if you graduated around 2000, you likely would have found yourself facing a tough job market.. Likewise, majoring in petroleum engineering or petroleum geology would have seemed like a good move a couple of years ago; however, now that oil prices are crashing, it’s presumably a much tougher job market.

Do we blame the computer science majors graduating in 2000 or the graduates struggling to break into the energy industry, now that oil prices have dropped, for majoring in “useless” degrees? It’s much easier to create a strawman about useless degrees that accept the fact that there is a element of chance in terms of what the job market will look like upon graduation.

The cost of higher education is absurd and there simply aren’t enough good jobs to go around—there are people out there who majored in the “right” fields and have found themselves underemployed or unemployed—so I’m not unsympathetic to the plight of many people in my generation.

At the same time, I do believe in personal responsibility—I’m wary of creating a moral hazard if people can discharge loans in bankruptcy. I’ve been paying off my student loans (grad school) for a couple of years—I kept the level debt below any realistic starting salary—and will eventually have the loans paid off, though it may be a few more years.

I am really conflicted between believing in personal responsibility but also seeing how this generation has gotten screwed. I really don’t know what the right answer is.

To confuse going to college with vocational education is to commit a major category error. I think bright, ambitious high school graduates– who are looking for upward social mobility– would be far better served by a plumbing or carpentry apprenticeship program. A good plumber can earn enough money to send his or her children to Yale to study Dante, Boccaccio, and Chaucer.

A bright working class kid who goes off to New Haven, to study medieval lit, will need tremendous luck to overcome the enormous class prejudice she will face in trying to establish herself as a tenure-track academic. If she really loves medieval literature for its own sake, then to study it deeply will be “worth it” even if she finds herself working as a barista or store-clerk.

None of this, of course, excuses the outrageously high tuition charges, administrative salaries, etc. at the “top schools.” They are indeed institutions that reinforce class boundaries. My point is that strictly career education is best begun at a less expensive community college. After working in the IT field, for example, a talented associate’s degree-holder might well find that her employer will subsidize study at an elite school with an excellent computer science program.

My utopian dream would be a society where all sorts of studies are open to everyone– for free. Everyone would have a basic Job or Income guarantee and could study as little, or as much, as they like!

Finland agrees with your utopian dream. This was in Links a couple of days ago:

http://inhabitat.com/finland-prepares-universal-basic-income-experiment/

Now, since I’ll be moderated for including a second link, try searching for “Study in Finland” and “tuition fees.”

Currently, no tuition is charged in Finland for baccalaureate, masters and Ph.D. programs. However, there is a plan to charge modest tuition fees to students who are not Finnish or from an EU country, starting in 2017.

So there you have it: Utopia on earth. Right now, today!

Completely agree. I think you lifted my biography.

You are worried about moral hazard, yet you’re ok with the people making these loans not having to do due diligence? I have to say that there is a very real incentive for crooked bankers to extend loans at usurious interest rates to literally everyone with a heartbeat, up to and including homeless vagrants and the mentally ill, and having a plausible sounding legal reason for why they did it (no bankruptcy possible?) is a great way for them to avoid prison time for doing that.

If someone can’t pay a debt, no matter what it is, it should be quick and easy to clear it. That’s the only morally defensible standpoint a functional society can have. Any other sort of position/attitude will cause a society to murder itself in short order, such as ours is doing now.

jgordon wrote:

.

I’m not necessarily opposed to allowing people who were defrauded by say University of Phoenix or one of the other for-profit scams to have relief of some kind. However, you don’t want to create a universal get of jail free card–nobody is going to lend if there isn’t a reasonable expectation of being paid back. The trade-off of having virtually guaranteed access to loans through government backed institutions is that you can’t get rid of loans in bankruptcy.

I’m not saying everyone in trouble with student loans is scamming the government–quite the contrary, many people have fallen on hard times. However, the rule against discharging debt in bankruptcy was put in place for a reason; there were enough people that were engaging in bankruptcy scams–they could pay but made it look like they couldn’t–that it was a problem.

I don’t how this rule is any different that the rules that generally prohibit you from discharging anything you owe the government in bankruptcy.

“…nobody is going to lend if there isn’t a reasonable expectation of being paid back.”

Options for paying for a college educated society:

1. debt = ‘x’

2. charity = ‘y’

3. taxation = ‘z’

Ax + By + Cz = D

Could you cite for me specifically where the numbers showed people gaming the student loan bankruptcy as being the reason for changing the law? “They could pay but wouldn’t” sounds kind of hmmm….I know if I loaned a substantial sum to a teenager I would be amazed to be repaid. There is some risk to the lender and college in many cases is not worth the cost as others have pointed out.

tegnost:

The numbers going into bankruptcy when they could in the seventies was extremely low. The thought as stated by Louis is incorrect and banning students from the same protection as TBTF had is just nonsense.

thanks

Yes, it was a classic example of a vested interest lobbying Congress to “solve” a problem that didn’t exist.

Louis:

There never was a history of many students going into bankruptcy.

“It’s important to note that when student loans were treated the same as all other loans in bankruptcy court, far less than 1% were discharged that way. There was never a bankruptcy crisis for student loans. In the words of a Congressman in office at the time, it was a “crisis only in the imagination”.

Today, there are various Income based repayment programs that offer far more attractive options for newly minted graduates than bankruptcy, so the banker’s fear mongering rhetoric just doesn’t wash.

If John Boehner has an ounce of guilt about the big-government monstrosity that his work helped create, and wishes to ride off into the sunset with a clear conscience, he would fight to return the free-market mechanisms that he helped to dismantle.” Alan Collinge; Student Loan Justice Org.

http://angrybearblog.com/2015/10/john-boehners-student-loan-legacy.html#comments

“Affordability” and other self-fulfilling myths, successfully peddled and propagated by neoliberalism…

The creed deeply embedded into the ethos of the neoliberal: “Given enough time, unregulated and untaxed, we can racketeerize anything and everything…

…not just war but payment system, education, housing, food, water, health, construction, taxis, spare rooms etc.etc.etc…and remember that any shortcomings will be taken care of by “charity” and “philanthropy”…so please support the tpp, ttip, tisa etc. , so we can globalize the racketeering in a “bloodless” and orderly fashion…”

“Inequality” is not the “defining issue of our time” but discerning between the legitimate taxman and the corporate banksters’ bagmen masquerading as taxmen.

Thanks for this informative post. It reflects the privatize profits-publicize losses economic reality of the USA, because I know from personal experience that student loans I had paid in full were NEVER considered in my credit rating scores!

I had paid off all of my student loan debt for my undergrad and master’s degree many years ago, and got NO credit score benefit for it at all. Now, as a middle aged doctoral student in humanities (my undergrad was in physics and i have a research methods cognate), I am playing at the high stakes table of very large govt student loan debt. Because I haven’t graduated yet, but have also been working on building up a credit rating after many years absent from US economy, I now have a pretty decent score, even though I have an enormous debt burden on the horizon and cannot earn as an employee while preoccupied with full time dissertation work.

I do have a question I wish NC readers (or writers) could help with: The student loan servicing company (which abides in Wisconsin Koch Bros land) always advises debtors to start paying interest on loans before they go into repayment, but also automatically allocates payments made within months of new loan disbursements toward the principle. Yet, since it is the interest that snowballs, to my intuitive mind, I should try to pay the interest first regardless of the size of the principle.

POO:

Undergrad is a different beast in comparison to getting a Masters or Doctorate . You are left to the free market to soak you with higher interest rates so I can see why they might advise you to pay interest. One could buy a car or do a roof at a lower interest rate. I do not believe the Gov. makes subsidizes loans to Masters or Doctorate students either. The Beth Akers, Matt Chinagos, and Jason Delisles of the educational world believe you should pay higher interest rates as you can afford it and will be more successful with it. I always felt we should be encouraging more people to seek higher degrees so as to compete globally. It is not necessarily all about the money as some technical professions are not high wage and yet require a higher degree.

Alan Collinge of Student Loan Justice Org would tell you student laons make more money in default than when they are paid back.

Thanks for that!

The question is how I am mistaken that my intuition to pay on interest will be more helpful than reducing principle negligibly. Especially given the risks, that I may be so impoverished after graduation (with or without well-paying employment), such that I may never be able to get another loan again for a long time, even with the high rate ~8% for grad loans, i feel like I should take whatever I am eligible for now rather and if i manage to live on less, should pay back on the interest before the principle.

As for the mathematics, the principle has a ceiling cap by time and amount, so that monkey is going to retire. But the interest compounds over time, perhaps for the rest of my life that I will be paying. So even though the total is higher with a higher principle, since I can’t say how long I will live, I always feel it more prudent to pay any extra possible before graduation on interest.

One way US gov could help would be by offering student loan debtors an option to emigrate and forfeit student loan payment in exchange for forfeiting social security claimant rights.

Finally, one key dynamic that is always left out of student loan and education cost discussions is how the GFC killed off many university endowment funds, which is a major factor in them now cannibalizing the students. Fed had ~$4trillion for bank bail outs, of course!

As a middle-aged doctoral student in the humanities you should not even be thinking much about your loans. Write the most brilliant thesis that you can, get a book or some decent articles published from it– and swim carefully in the shark-infested waters of academia until you reach the beautiful island of tenured full-professorship.

If that island turns out to be an ever-receding mirage, sell your soul to our corporate overlords and pay back your loans! Alternatively, tune in, drop out, and use your finely tuned research and rhetorical skills to help us overthrow the kleptocratic regime that oppresses us all!!

…except (in my experience) the corporate overlords want young meat.

I have 2 masters degrees 2 undergraduate degrees and a host of random diplomas – but at 45, I am variously too old, too qualified, or lacking sufficient recent corporate experience in the field to get hired…

Trying to get enough cash to get a contractor licence seems my best chance at anything other than random day work.

Genuine education should provide one with profound contentment, grateful for the journey taken, and a deep appreciation of life.

Instead many of us are left confused – confusing career training (redundant and excessive, as it turned out, unfortunate for the student, though not necessarily bad for those on the supply side, one must begrudgingly admit – oops, there goes one’s serenity) with enlightenment.

“I would spend another 12 soul-nourishing years pursuing those non-profit degrees’ vs ‘I can’t feed my family with those paper certificates.’

This is the sad truth! Our corporate overlords prefer making the means for survival scarce, rather than plentiful. The older, “over-qualified” people I have known to successfully re-enter the corporate rat-race have used their proven research skills as their strongest suit. The filthy rich people who dominate in our current system are mostly lazy. They are always keen to exploit someone else to spend long hours digging out opportunities for wealth extraction!

Yes, I was in a clinical program with one such person; she got her master’s from Harvard by having a private secretary write all of her papers-she didn’t even know how to operate a computer program! She ran into trouble when she couldn’t comply with HIPPA regulations because she had an unauthorized person typing her case studies! But being an elite, the institution just let it slide. I spoke up for the subjects of the case studies (who happened to be undocumented people), but the supervisor closed ranks with the elite woman and they all gave me the cold shoulder for the remainder of that program…that is how contrarianism works; one has to be energized by the hostility!

What evidence do you have that employers are hiring young workers? It’s old workers who have actually been finding employment in the economy over the past few years, relatively speaking. The over 55 crowd has more jobs today than a decade ago while the 25-54 group is basically flat despite years of population growth.

Not enough new hiring for decent jobs is going on in any age group. I suspect the imbalance you are pointing to, in the past decade, reflects the fact that older workers can no longer afford to retire early, and are now routinely clinging to jobs well into their seventies. These older workers are in some cases supporting forty-something children– who can’t find a decent job after spending a lot of money and years obtaining new, improved, advanced degrees!

Agreed. Note that’s a very different take than saying the overlords want young meat. (I mean, they do want young meat, but that is a literal social problem of the contemporary global slave trade…I’m assuming subgenius was talking metaphorically about workers in the formal economy)

One of the most interesting (and potentially impactful long-term) inter-generational changes in the labor force is that the gap between both the household incomes and net worth of younger and older Americans has been growing over the past three plus decades. It’s not just that older workers are hanging onto their jobs longer before passing them on. It’s that the jobs being passed on are being degraded in the process of that transition. Xers and Millennials, quite simply, are on life-long paths of crappier jobs and less financial wealth relative to Boomers. The social consequences of that are unstable yet also unpredictable.

I can tell you that, in law, no firm will hire you if you’re over 40 unless you have a book of business of such size that one can honestly wonder why you want to join a firm. Firms control access to any in-house position worth having. Government is what it always has been: You can get in if you know someone, otherwise fuggedaboutit.

I would pose the same question. What evidence do you have that this disproportionately affects older workers? Our society is awash in highly educated young people who are also seeking gainful employment.

The problem is an enormous oversupply of JDs (and every other degree), not discrimination against older workers.

Nice response, Ulysses! Thanks!

POO:

Undergrad is a different beast in comparison to getting a Masters or Doctorate . You are left to the free market to soak you with higher interest rates so I can see why they might advise you to pay interest. One could buy a car or do a roof at a lower interest rate. I do not believe the Gov. makes subsidizes loans to Masters or Doctorate students either. The Beth Akers, Matt Chinagos, and Jason Delisles of the educational world believe you should pay higher interest rates as you can afford it and will be more successful with it. I always felt we should be encouraging more people to seek higher degrees so as to compete globally. It is not necessarily all about the money as some technical professions are not high wage and yet require a higher degree.

Alan Collinge of Student Loan Justice Org would tell you student loans make more money in default than when they are paid back.

Delete this one as it is a duplicate. Not sure what happened.

I have a simple solution. Not one I like.

Join the Military. Do your term, pay off the loans.

I suggest the Air Force. Least likely to be in harms way.

The End, no loans, justifies the Means.

I graduated law school with $100k+ in debt inclusive of undergrad. I’ve never missed a loan payment and my credit score is 830. my income has never reached $100k. my payments started out at over $1000 a month and through aggressive payment and refinancing, I’ve managed to reduce the payments to $500 a month. I come from a lower middle class background and my parents offered what I call ‘negative help’ throughout college.

my fortunate situation is unique and I wouldn’t wish my debt on anyone. it’s basically indentured servitude. it’s awful, it’s affects my life and health in ways no one should have to live, I have all sorts of stress related illnesses. I’m basically 2 months away from default of everything. my savings is negligible and my net worth is still negative 10 years after graduating.

student loans, combined with a rigged system, turned me into a closeted socialist. I am smart, hard working and resourceful. if I can’t make it in this world, heck, then who can? few, because the system is rigged!

I have no problems at all taking all the wealth of the oligarchs and redistributing it. people look at me like I’m crazy. confiscate it all I say, and reset the system from scratch. let them try to make their billions in a system where things are fair and not rigged

My story is very similar to yours, although I haven’t had as much success whittling down my loan balances. But yes, it’s made me a socialist as well; makes me wonder how many of us, i.e. ppl radicalized by student loans, are out there. Perhaps the elites’ grand plan to make us all debt slaves will eventually backfire in more ways than via the obvious economic issues?

It’s usually peoples first real capitalist job that makes them socialists :). Sure pushed me in that direction, all horrible soul deadening BS and powerlessness all the time. Abolish wage labor. And then regardless of it all or how much you give to the soul deadness machine, unemployment in every single recession.

But I do think the further impoverishment of the young will add to it.

debitor serf:

You were scaring me for a bit. I thought I was going to be talking to someone who walked to and from school up-hill each way. You are correct though, the system is rigged.

For what it’s worth, I’ve come out of the socialist closet, I am maintaining healthier relationships with friends and family.

I started work in a corporation in 1986, not a year has gone by when working conditions improved (relatively, within my own pay grade).

If TPP goes through I might even be looking at red brigade membership.

“economic elites tend to prefer lower levels of government spending on practically everything, while business groups and specific industries frequently lobby for spending in areas from which they stand to gain”

Gilens and Page ‘Testing Theories of American Politics’

http://www.princeton.edu/~mgilens/Gilens%20homepage%20materials/Gilens%20and%20Page/Gilens%20and%20Page%202014-Testing%20Theories%203-7-14.pdf