Lambert here: Bezzle, bezzle, who’s got the bezzle…

By Steve Horn, a Madison, WI-based Research Fellow for DeSmogBlog and a freelance investigative journalist. He previously was a reporter and researcher at the Center for Media and Democracy. Originally published at DeSmog Blog.

A new report published by the Post Carbon Institute concludes that Texas’ Eagle Ford Shale basin, the most prolific shale oil basin in the U.S., has peaked and reached terminal decline status. The Post Carbon report dropped just as Congress is on the verge of lifting the oil export ban for U.S.-produced crude oil, which will only further incentivize drilling and fracking.

Titled “Eagle Ford Reality Check: The Nation’s Top Tight Oil Play After More Than a Year of Low Oil Prices,” the report is the latest in a series of long reports on the overhyped future of oil obtained via hydraulic fracturing (“fracking”) in the U.S. by Post Carbon Institute Fellow David Hughes. Hughes formerly worked for 32 years with the Geological Survey of Canada as a scientist and research manager before coming to Post Carbon.

It also comes just two months after Post Carbon’s October release of a similarly titled report on North Dakota’s Bakken Shale basin, the second biggest shale oil field in the U.S. behind the Eagle Ford.

“In Eagle Ford Reality Check, David Hughes…looks at how production in the Eagle Ford has changed after a year of low oil prices,” a summary of the report explains. “Oil production in the Eagle Ford is now falling after more than a year of low oil prices. The glory days of the Eagle Ford are behind it, at the ripe old age of six years.”

Many of the same themes and concepts, for those familiar with Post Carbon’s previous “shale bubble” updates, reappear in this report. Those include the drilling treadmill, drilling sweet spots, and U.S. government and industry drilling productivity assessments (the seeds and intelligence upon which energy policymaking is made) vs. independent drilling productivity assessments.

The skinny on the report is that the Eagle Ford is certainly productive and resilient, even despite a year of low global oil prices, but its future as a super-major type field is certainly in question based upon the numbers crunched by Hughes.

Eagle Ford Oil Production Numbers and Figures

Post Carbon’s report cites an array of numbers and figures throughout the report, some of which are jaw-dropping.

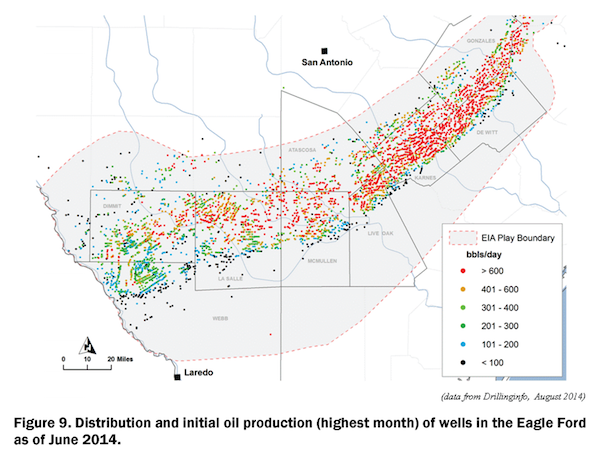

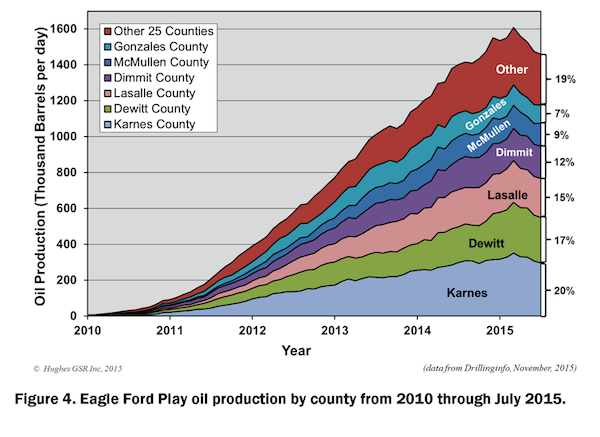

For example, the vast majority of the drilling — read sweet spots for fracking — occurs in six counties within the Eagle Ford. And productivity of that oil in some counties, yes even in the most productive counties, is in decline.

“In July 2015, 52% of production came from Karnes, Dewitt and Lasalle counties, and 81% came from the top six counties,” the report details.

“Oil production peaked in all counties between June 2014 and May 2015. Karnes County, the top producer, has experienced the largest decline at 54.4 thousand barrels per day or a 15.5% reduction from peak. Dimmit County, with the fourth highest production, has declined the least.”

Image Credit: Post Carbon Institute

As a result, the drilling treadmill — seeking out new locales to frack in order to keep productivity rates flat — continues apace. The problem, Hughes points out, is that there isn’t anywhere left to turn.

“This is somewhat counterintuitive as conventional wisdom suggests that companies are focusing drilling efforts on their best acreage, which is in top counties such as Karnes, and withdrawing from more marginal parts of the play in order to maximize economics in a low oil price environment,” he writes. “The reason for the steeper decline in Karnes County is likely that it is the most heavily drilled and high quality locations are running out.”

These drilling trends are also mapped out for readers to see what the drilling treadmill and sweet spots looks like in action.

Image Credit: Post Carbon Institute

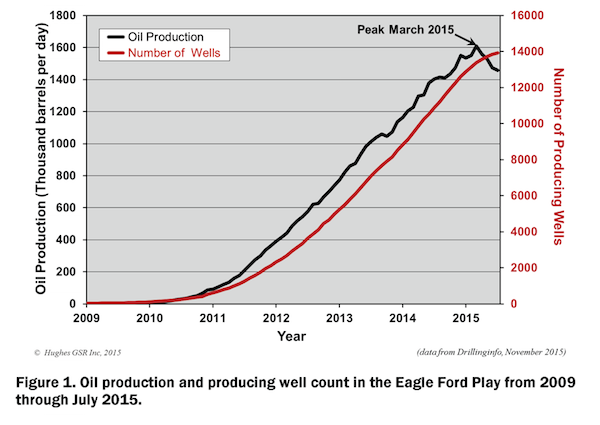

Peak production and the downward productivity trend in the Eagle Ford is also explained and shown visually by Post Carbon in the report. As more and more wells are drilled, productivity has reached a downward spiral as of March 2015 and hasn’t turned back since.

Image Credit: Post Carbon Institute

“Figure 1 illustrates Eagle Ford production through July 2015,” Hughes explained. “Production peaked in March 2015, at 1.61 million barrels per day (mbd) and has fallen 149,000 barrels per day, or 9.1%, since then. As of July there were 13,930 producing wells in the play, compared to 13,384 in March 2015 at peak production.”

Bleak Future for Eagle Ford Fracking?

Couple the fact that new policy is in place that will open up the spigot to U.S.-produced oil in places like the Eagle Ford with the fact that even in the best counties, productivity rates in the Eagle Ford are in terminal decline, and you have a perfect storm.

Not to mention the myriad local community impacts, air impacts, groundwater impacts and climate change impacts that accompany the controversial fracking and drilling processes.

“The observation that new well quality is declining in top counties, despite every incentive to maximize individual well production, is key,” Hughes wrote in the conclusion. “Thus even to maintain the peak rate of 1.6 mbd, the drilling rate would have to increase from the 2,900 wells per year currently required (needing $23 billion per year of capital input exclusive of leasing and other ancillary costs).”

Hughes closes the report by suggesting that U.S. energy policy (and thus global energy policy) is dictated by a drilling technique that has already eclipsed peak production mode just over a half decade after its birth.

“The hype surrounding tight oil as a means to bolster global oil production over the long term is not justified. Geological fundamentals clearly show that high decline rates, limited sweet spots, and finite numbers of drilling locations will limit long term contributions to production,” wrote Hughes.

“The optimistic tight oil forecasts of the EIA, and even more optimistic forecasts of some industry watchers, are unhelpful abstractions in developing energy policy for a more sustainable future.”

This is pretty much exactly as the geologist Arthur Berman (and others) predicted quite a few years ago. Extrapolations from the outputs existing shale oil wells ignored the fact that experienced drillers don’t drill randomly – they know what they are doing and usually are very good at hitting the sweet spots. Add in the strong incentive drillers have to exaggerate their success rate and you have a recipe for over optimistic predictions and over investment. The nature of tight oil is such that a decline is likely to be very rapid after the peak is hit as established techniques for drawing out the life of a conventional well (such as fracking around an oil bearing void or pumping in seawater/CO2) can’t be used.

Which is going to be interesting for places like Texas which is importing millennials vis-à-vis Apple [over flow] et al w/ beanies to front load their low or zip corporate – back fill tax consumer marginal tax over burden.

Skippy…. all whilst booming RE construction to flesh out the supply of new dog boxes and irregular water demands from developers et al…. what could go wrong….

What could go wrong?

Texas could go wrong. I’ve been reading of the Cartels moving slowly into the lower states. As best I can see, poverty and extreme wealth inequality spawned the Latin American constant revolution merry-go-round. Inculcate a similar social ‘disease’ in any American region and the vultures will come flocking to the feast.

Hay some Cato apparatchik told me that marginal tax was GST with an IQ of 80 as some milquetoast shite happens make a nice sandwich shtick.

http://taxfoundation.org/article/texas-margin-tax-failed-experiment

Skippy… so much for market fundamentalism…..

Can we dare hope that they (Texas) will secede?

If Texas does secede, it will likely take New Mexico, Arizona, Nevada, and Southern California with it. (I don’t know about Oklahoma. That’s still a mainly Native State I’ve been told.)

If the cartels are moving into Southern states it is because the Money Laundering/ GoverDustrial Complex wants them to do so. One reason would be for them to harvest even more money to launder.

“Legal marijuana” will not be an answer to the Cartels. If marijuana becomes totally legal, the Cartels would simply assassinate legal growers and legal stores until the surviving growers sold at or below cost to the Cartels so the Cartels could sell at Shkreli-multiples to the legal storeowners . . . who would be assassinated until they agreed to buy from the Cartels only.

The answer to the Cartels in America is the same as the answer Colonel Lang at Sic Semper Tyrannis suggested for the Cartels in Mexico. Send JSOC in there with orders to exterminate them all. Each and every one.

Do you have any idea of how many DEA agents you would have to kill too? Not to mention all the Mexican Rurales, Federales, and Mexican Military? Might as well send Pershing back down.

The “DEA agents problem” could be solved by total legalization of currently illegal drugs. No drug laws would mean no need for a DEA which would mean no more DEA agents. They would have to find other work.

Your point about the Mexican Federales , etc. is well taken. Yes, those Federales and etc. who are Cartel frontscum would have to be killed as well under such a scenario. If the Cartels will keep their violence out of this country, then the issue need not arise. But if the Cartels bring their violence here along with the rest of their operations, then the issue of whether to accept the violence or whether to stop the violence will have to be faced. And if the decision is made that the violence will have to be stopped, then we will have to exterminate the arrangers of that violence. The Cartelers can prevent that issue from coming up by agreeing to traditional Mafia codes of conduct and behavior while operating in our country. No violence against non-cartel members. No violence against law enforcement. And quiet acceptance of the loss of their cannabis markets in this country if we legalize cannabis in this country.

But given the Cartelers’ expansion into area after area after area in Mexico, something tells me that they will not go quietly into that good night even if all illegal drugs are legalized.

Different & Clueless,

The Americans already tried your solution in Iraq. Shock & Awe sure worked wonders there.

Illegal drug cartels are a business operation, in many ways not unlike the legal drug business in the US. Granted their business methods are somewhat different, the Cartels preferring gang warfare for market share and Big Pharma choosing monopoly control of drugs and pricing through legalistic and political means. The end result is the same— thousands of innocent lives lost and huge profits generated.

The solution to the Cartel problem is a business one. Simply make it unprofitable by making all drugs legal, and drive the stake through their hearts by totally undercutting the market with free supplies initially until the Cartel operations collapse. Free crack & heroin— not a pretty thought. Phase it out and a decade later my bet is that addiction rates would be lower than they are today.

Why not just build a fence?

The Texas economy is very diversified. My friends in Austin won’t stop $I#$#ing about the influx of Californians working in the tech industry over there.

And that’ll never go under, right?

Right?

Agreed. I am doubtful of secondary and tertiary recovery processes as used in conventional oil fields being effective in tight oil bearing formations. These plays and their ability to make the US an energy independent nation have been over sold to the American public. Now, allowing for these finite resources to be exported is foolish and will prove to be the height of political folly. If we are to move forward with it, we should remove all Federal subsidies and tax breaks to the industry. Let the industry sink or swim on its own dime. If it isn’t a strategic resource for this country, as a country, we have no imperative to support it more than any other commodity or enterprise.

Your comment highlights one of the ‘hidden’ developments of the modern political economic landscape: Internationalism, or Globalization.

Properly speaking, those who ‘manage’ the resources have become ‘equal partners’ with the National governments. Something very akin to the old Robber Barons has arisen; a new Oligopoly. I hesitate to say that the old version of the film “Rolerball” was prescient, but, there it is. Rather than teams sponsored by and representing Industries we have stadia doing that job. Would that I live long enough to see the Army Navy game played in the “Military Industrial Complex Stadium!”

Hail Hydra! Let’s do the Strut.

Likely accurate and therefore devastating. I still don’t know how the fracking industry is surviving, as every barrel they pump is a loss–under no model I have ever seen is fracking economical at $40 a barrel and dropping. And the dropping is hiding in plain sight the significant (massive?) contraction of the global economy. Growing economies do not use fewer inputs of energy and raw materials. This is so obvious it’s amazing that it goes unreported (are people blind to the big picture, swallowed up in the minutiae, or just whistling past the graveyard?).

As with the banks, the government is setting things up for the Oligarchs to make One Last Killing on fossil fuels. The aftermath is not going to be pretty.

James if I might be so bold as to suggest the issue is erroneously viewed from a traditional economic stand point, cash flows dictate, it did so from the start of this activity and is the driving force in this environment, come hell or high water. One could argue till the cows come home, tho at the end of the day, its the impetuous of the currant market fundamentals, its the way individuals make money, in the short term.

This post sent me looking for the origins of a famous quote, which may first have been uttered by Native American Alanis Obomsawin, “an Abenaki from the Odanak reserve, seventy odd miles northeast of Montreal.”

“Canada, the most affluent of countries, operates on a depletion economy which leaves destruction in its wake. Your people are driven by a terrible sense of deficiency. When the last tree is cut, the last fish is caught, and the last river is polluted; when to breathe the air is sickening, you will realize, too late, that wealth is not in bank accounts and that you can’t eat money.”

http://quoteinvestigator.com/2011/10/20/last-tree-cut/

The sentence “Your people are driven by a terrible sense of deficiency” just nails it, does it not?

Words of wisdom crying in a sea of delusion.

Carla–

Thanks for this.

The shape of the future–long predictable and in fact predicted–is becoming visible.

The survivors will relearn the old ways.

But that is just a tautology.

–Gaianne

I remember reading that a Pacific Northwest Nations person is supposed to have said something similar.

” When the last salmon has been fished from the last river, then the White Man will learn that he can’t eat money.”

One could update it this way: “When the last can of cat food is gone from the last shelf in the last WalMart, then the White Man will learn that he can’t eat money.”

My understanding is that they can keep going partly because the marginal cost of keeping existing wells going is very low (i.e. if you pretend there wasn’t a heavy upfront investment) and that many operators were heavily hedged (showing that their investors aren’t complete fools). Of course, that raises the question of who is making the hedging losses.

But as Wolf has pointed out, the hedges will likely run out early 2016, at which point the naked swimmers will be all too visible.

Please indulge me here because this is just beyond me: if I borrow a billion dollars to make computer chips, and I have to sell them at $80 a unit to make money, but the going price for computer chips is $40 a unit, how is it that I am not bankrupt before the first unit leaves the factory? Who will continue to lend me money when I’m losing a fortune on every unit I produce, when I have no chance of making back my initial investment, no less turn a profit?

I’m a naval historian. This makes me something of a crass materialist. If I have no oil for my ships’ bunkers, no propellant for my ships’ guns, I can’t fight a naval battle, forget about win one. These are just facts. From where I sit, if I sell goods at below the price of production, I’m going broke. How can this possibly not be the case?

My take on it is that it’s a case of fraud. I believe Mr Black from the Kansas City Fed calls it “Control Fraud.” Like a Ponzi scheme. As long as the “Cons” behind the game get their cut up front… Many corporations are run this way now. The object seems to be to line the pockets of the “insiders,” and the Devil take the hindmost. Remember Zaharoff and Vickers Arms in WW1?

Sell stock. Refinance. sell bonds. reissue bonds. Run the bond prices up. Take advantage of changed interest rates to get loans on the goods in hand and real estate and anticipated future market value.

Speculation and fiat money don’t require marking concrete assets to market as long as the dance can be kept alive.

binky–

Very good, but you did leave out the final step:

CASH OUT!

While the regulators stumble around saying, “who couldda node?”

–Gaianne

James – partly it comes down to a different investment model in commodities and base products. It is always assumed if you invest in those that there will be periods where the market price is well below what is profitable. You lose when oil prices are low, you gain when they peak. So investors are conditioned to gritting their teeth when prices are low. What is important to the producers is that the price can cover running costs – which is why sometimes oil supply increases when prices are low – existing wells raise production to keep a cash flow going. Quite simply, investments on this scale are made on 20-25 year timescales, they will assume (or hope for) sufficient super-profitable peaks to tide over the low periods. And of course wiser investors will have hedged anyway so they may not be feeling the pain as much as you might think.

Of course, there is also the ‘sunk cost fallacy’ at work – having put billions into oil, many investors feel they have no choice but to keep the operators going in the hope that somehow a war somewhere will lead to a spike that will rescue them. Hence there is a bit of a ‘too big to fail’ mentality at work, nobody wants to start a panic by being the first one to move to wind up loss making operators, its easier to make sub contractors suffer by cutting costs to the bone, up production in existing wells to keep some cash flowing, and hope for the best.

If you borrow that billion dollars in the form of re-sellable loan instruments, and then you sell those interest-bearing instruments to some greater fool before you have begun spending down the billion, then you do not worry about going bankrupt. Some Greater Fool gets to worry about going bankrupt.

You get to skim off just enough money from that billion dollars so that when the rest of it is gone, the factory shuts down and you declare “bankruptcy”. But you haven’t lost anything. The people you sold the debt-repayment-instruments to are the people who lose everything. You walk away with whatever survival-money you quietly skimmed off the billion while operating your factory at a visible loss with the rest of the billion till the rest of the billion is gone.

Nice synopsis of the Private Equity model as practiced successfully by vampires like Mitt Romney.

Federal subisidies to frackers with incentives to conserve the resource and protect the environment; negative exports. Why? So as to wage financial warfare v. the supporters of the Califate.

Why didn’t you note that the number of drilling rigs in the Eagle Ford has gone from about 250 in late 2015 to 47? Perhaps that had something to do with the decline rate? The Eagle Ford has considerably more potential than you suggest and your graph would look considerably different if 247 rigs were still active there – as will happen when oil prices rebound back in the next year or two.

Eliminating the Oil Export Tax on oil is long overdue. It will close the gap between Brent and WTI – so that at least US oil producers aren’t having to sell oil produced in the US for less than oil produced by OPEC. It will also eliminate the economic wastage of U.S. produced light oil being sold to U.S. refineries who buy it so cheaply that they substitute it for medium grade oil in their refinery processes. Keeping my fingers crossed that this law gets eliminated next week.

Multiply known depletion rates of individual wells by lower productivity per new well as the sweet spots are all tapped and the mathematics are so simple that even a Texan should be able to understand them. 247 rigs or 2,000 rigs drilling holes with production rates that fail to recover their capital costs won’t do much for reversing oil field senility.

But I’m sure changing the tax policy is the solution. Perhaps having the Government just pay for all drilling costs would do the trick— at least long enough to create a few more Koch dynasties.

Vaporizing Russia with nuclear bombs would solve the problem of low cost competition. Nuclear Winter would increase demand for heating oil and shut up the whining Global Warming cone heads. A Texas politician’s win-win dream scenario.

Or militant Islam in the ‘stans.

CH – your are raining on the “Shale Miracle”. For it to work, we must all believe, believe with all our hearts. It’s like Tinkerbell. All it needs to succeed is unquestioning belief and $100/bbl oil.

You left out the other requirement: Zero interest rates and unlimited credit creation so capital expenditure costs can be infinitely rolled over.

“Why didn’t you note that the number of drilling rigs in the Eagle Ford has gone from about 250 in late 2015 to 47?”

I could entertain this idea. Figure 1 would be more informative if it had a rig count as well as an active well count. It’s clear to see that the leveling off of the active well count takes place at or just after the peak production. If the rig count dropped off at the same time I think the phenomenon it actually illustrates is just how drastic the depletion rate is for fracked wells especially at this point in the development of this field. I would take that as reinforcing the study’s point, not opposing it.