By Branko Milanovic, Visiting Presidential Professor, Graduate Center, University of New York. Originally published at VoxEU

The Kuznets curve was widely used to describe the relationship between growth and inequality over the second half of the 20th century, but it has fallen out of favour in recent decades. This column suggests that the current upswing in inequality can be viewed as a second Kuznets curve. It is driven, like the first, by technological progress, inter-sectoral reallocation of labour, globalisation, and policy. The author argues that the US has still not reached the peak of inequality in this second Kuznets wave of the modern era.

In 1955 when Simon Kuznets wrote about the movement of inequality in rich countries (and a couple of poor ones), the US and the UK were in the midst of the most significant decrease of income inequality ever registered in history, coupled with fast growth. It thus seemed eminently reasonable to look at the factors behind the decrease of inequality, and Kuznets famously found them in expanded education, lower inter-sectoral productivity differences (thus the rent component of wages would be equalised), lower return to capital, and political pressure for greater social transfers. He then looked at (or rather imagined) the evolution of inequality during the previous century and thought that, driven by the transfer of labour from agriculture to manufacturing, inequality rose and reached its peak in the rich world sometime around the turn of the 20th century. Thus, he created the famous Kuznets curve.

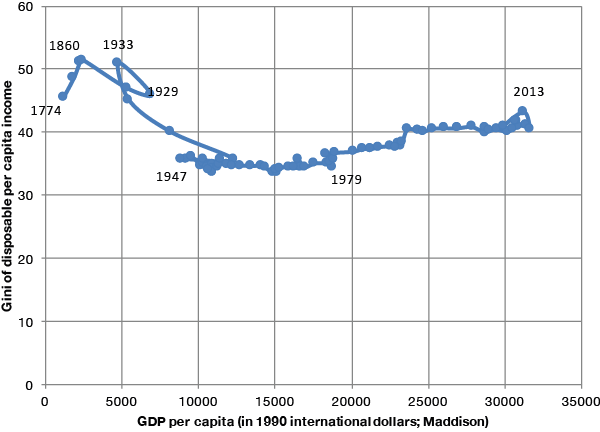

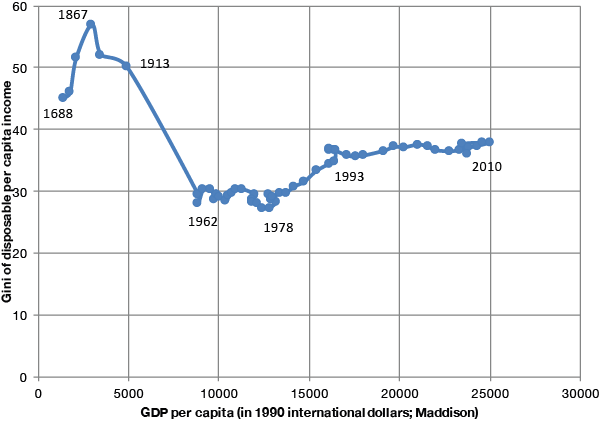

The Kuznets curve was the main tool used by inequality economists when thinking about the relationship between development or growth and inequality over the past half century. But the Kuznets curve gradually fell out of favour because its prediction of low inequality in very rich societies could not be squared with the sustained increase in income inequality that started in the late 1970s in practically all developed nations (see the long-run graphs for the US and the UK). Many people thus rejected it.

The Upswing in Current Inequality as a Second Kuznets Curve

In a new book (Milanovic 2016), I argue however that we should see the current upswing in inequality as the second Kuznets curve in the modern times, being driven, like the first, mostly by a technological revolution and the transfer of labour from more homogenous manufacturing into skill-heterogeneous services (and thus producing a decline in the ability of workers to organise), but also (again like the first) by globalisation, which has both led to the famous hollowing out of the middle classes in the west and to a pressure to reduce high tax rates on mobile capital and high-skilled labour. The elements listed here are not new. But putting them together (especially viewing technological progress and globalisation as practically indissoluble, even if conceptually different) and viewing this as part of regular Kuznets waves is new. It has obvious implications for the future, not the least that this bout of inequality growth will peak like the previous one and eventually go down.

But before I address that part, let us consider recent important work done by economic historians such as van Zayden (1995),Nogal and Prados (2013), Alfani (2014) and Ryckbosch (2014), who have documented periods of waxing and waning inequality in pre-modern Europe. The interesting part is that Kuznets cycles in pre-modern societies basically replicate the Malthusian cycles because they take place in conditions of quasi-stationary mean income. The pre-modern Kuznets cycles are not driven by economic factors but by epidemics and wars. Both lead to a decrease in population, an increase in mean income, higher wages (because of labour scarcity) and thus lower inequality, that is, until population growth in a Malthusian fashion reverses all these gains.

Thus, we can observe Kuznets waves over some six or seven centuries of European history. In pre-modern times, they are observable against time because mean income is more or less constant (it is just one point on the x-axis). After the Industrial Revolution, however, we see the waves responding to economic factors (e.g. technological change, transfer of labour), and can plot them as Kuznets thought against mean income. This is shown here in the graphs for the US and the UK (Figure 1 and 2). In addition, I show in my book long-term inequality cycles for Spain, Italy, the Netherlands, Germany, Japan, Brazil, Chile, and over a shorter period for China.

Figure 1. The Kuznets relationship for the US, 1774-2013

Source: Ginis: 1774, 1850, 1860 and 1870 from social tables created by Lindert and Williamson (2013); 1929. Radner and Hinricks (1974); 1931 and 1933: Smolensky and Plotnick (1992). From 1935 to 1950 from Goldsmith et al (1954); After 1950, from US Census Bureau, Income, poverty and health insurance coverage in the United States (various issues); gross income data adjusted to reflect disposable income. GDP per capita from Maddison project 2014 version.

Figure 2. The Kuznets relationship for the United Kingdom/England, 1688-2010

Source: Ginis: for 1688, 1759, 1801, and 1867 from social tables for England/UK (as reported in Milanovic, Lindert and Williamson, 2011); for 1880 and 1913, from Lindert and Williamson (1983, Table 2); from 1961 to 2010, official UK data (disposable income per capita) kindly calculated and provided by Jonathan Cribb, Institute for Fiscal Studies. GDP per capita from Maddison project 2014 version.

While Kuznets’ explanation was focused almost entirely on economic and thus ‘benign’ forces, he was wrong to overlook the impact of ‘malign’ forces (especially wars) that are powerful engines of income equalisation. I find this somewhat puzzling because Kuznets himself, having worked during World War II in the US Bureau of Planning and Statistics, must have noticed how the war led to the compression of income through higher taxation, financial repression, rationing, price controls, and even sheer destruction of physical assets (as in Europe and Japan).

Inequality may not be overturned soon

Which leads us to the present. How long will the current upswing of the Kuznets wave continue in the rich world, and when and how will it stop? I am sceptical that it will be overturned soon, at least not in the US where I see four powerful forces that keep on pushing inequality up. I will just list them here (they are, of course, discussed in the book):

• Rising share of capital income which is in all rich countries extremely concentrated among the rich (with a Gini in excess of 90);

• Growing association of high incomes from both capital and labour in the hands of the same people (Atkinson and Lakner 2014);

• Homogamy (the educated and the rich marrying each other); and

• Growing importance of money in politics which allows the rich to write rules favourable to them and thus to maintain the inequality momentum (Gilens 2012).

The peak of inequality in the second Kuznets wave should be lower than in the first (when in the UK, it was equal to the inequality level of today’s South Africa) because the rich societies have in the meantime acquired a number of ‘inequality stabilisers’, from unemployment benefits to state pensions.

The pro-inequality trends will be very hard to overturn during the next generation, but eventually they may be – through a combination of political change, pro-unskilled labour technological innovations (which will become more profitable as skilled labour’s price increases), dissipation of rents acquired during the current bout of technological efflorescence, and possibly greater attempts to equalise ownership of assets (through forms of ‘people’s capitalism’ and workers’ shareholding).

Now, these are of course the benign factors that, I think, will ultimately set inequality in rich countries on its downward path. But history teaches us too that there are malign factors, notably wars, in turn caused by domestic maldistribution of income and power of the elites (as was the case in the World War I), that can also do the job of income levelling. But they do it at the cost of millions of human lives. One can hope that we have learned something from history and would avoid this destructive path to equality in poverty and death.

See original post for references

Oligarchy, like a glutton, unwittingly commits suicide unless it can be convinced to act against its own immediate interests.

It seems to me like a malignant tumor which keeps feeding on its host until the host dies, thereby killing it, barring either tactics to starve it or nuke it with radiation. Can it be convinced that the greater good is beneficial to it? If it really is not a parasite, I guess this is possible. Then again, billionaires do spread their money around, and the result is social engineering which results in death of those deemed unworthy by the oligarchs, and slavery of the rest who get with their program. They will kill the Earth, that is certain, if they are not stopped.

This makes no mention of the limits of the planet. neither Kuznets nor his predecessors analyzed the dynamics of environmental destruction or the permanent problems caused by overpopulation which turns their labor supply explanation into so much nonsense. This synopsis openly states the attitude toward war in pre-manufacturing societies and until the early 20th c. as a way to cull the population, thus culling labor and bringing up wages within a range acceptable to capital. Not anymore. Human population equality is beyond the capacity of

Capital. So making factories run full time to stimulate demand to sop up surpluses is pointless because in no time we’ll be back in the same surpluses. FDR understood this and chose to go to war to defend our empire and guarantee a wider market (Asia) essentially. Which didn’t didn’t bring lasting equality either. I get the feeling that in our modern era Malthus informed Minsky more than anyone.

1989 is a peak for Median Household Income : Population.

2014 was 78% of that peak.

This post doesn’t actually support that assertion, though. No matter how much academics desire to blame abstract forces, that doesn’t change the reality that public policy choices are what actually cause inequality.

That’s why we have such differing amounts of inequality from one country to the next. If it was due to factors like technology and globalization, then the US should possess less inequality than a country like Germany, not more.

I am also puzzled by the graph, with GDP per capita on the x-axis.

what has GDP per capita to do with his gini curve if inequality is driven by technological progress, inter-sectional-sectoral reallocation of labor, etc.?

Are they positively correlated to GDP per capita? Is inter-sectional-sectoral reallocation of labor positively correlated to GDP per capita?

Yeah, the more I look at this, the more curious it becomes. The author appears to be using an aggregate metric (per capita GDP from the Maddison project) to discuss distribution thereof. Nevermind the qualities of GDP itself, that usage makes no sense. The size of the pie has no bearing on how the individual pieces are sliced.

And to the extent the aggregate does matter, it further undermines the logic of the author. Saying that globalization hollowed out the middle class is not consistent with also saying that aggregate wealth has increased within the United States. If you are going to argue that our wealth was shipped overseas, then the data better show that our wealth decreased rather than increased(!).

That makes the author’s use of the neoliberal boogeyman skill appear even more absurd, as well. Skill doesn’t explain the difference in wages between an econ professor and a school cook or any other number of publicly funded jobs that have a wide variety of wages, benefits, and working conditions. Those wages, benefits, and working conditions are set by public policy, not private labor markets.

Or a different way of looking at it, using the same Census Bureau relied upon by the author, is to analyze two similar jobs that have vastly different wages. If technology, globalization, and labor transfer are the explanatory variables for inequality as the author claims, then such a wage differential should not exist.

For example, the annualized mean wage of the roughly 9,500 post-secondary social work teachers employed by US colleges, universities, and professional schools is about $68,500. That’s a good wage, significantly higher than the overall mean of $47,200 (which itself is higher than the overall median, which the Social Security Administration pegs at $28,900). But what is interesting is that it is not nearly as good as the 11,400 post-secondary economics teachers employed by those same colleges, universities, and professional schools who are paid an annual mean wage of about $108,200.

Even if one claims that technology, globalization, and labor transfer explain why university professors make more money than most workers, that still leaves a difference of roughly $30K a year that is completely unexplained.

whereyby $30k, I mean $40k…illustrating the importance of peer review and constructive criticism

:)

Due to budget cutbacks, we now only offer self-service (do it yourself) peer reviews.

Homogamy seems a sorry excuse for inequality. The rich have been marrying each other since the middle ages; but the introduction of inheritance laws can swing the balance away from accumulated wealth, as evidenced by the decline in private ownership of the hereditary great estates of Britain. Insofar as education is concerned, if marriage were a perpetual tryst, we women would all be dating Greek waiters and men would only be dating the kind of women that appeal to Donald Trump. Anyone preparing to commit to sharing decades with another human being is rightly going to look beyond exterior packaging. In the absence of a true system of meritocracy, it seems to me that the establishment of useful personal networks is more important than the amount of education or inherited wealth in determining someone’s circle of power. Fawning for access seems far more dangerous to societal equality than marrying someone with a similar educational background.

I suggest some reading of Roman and Greek history on marriage between families, especially the Julia family – around 40 BC.

It may be the Chinese also have interesting history which goes back further.

Milanovic states: “I see four powerful forces that keep on pushing inequality up”.

What is new here? The first two reasons are circular, the third and fourth are no different than in the past. Why doesn’t the list point to the real reason – the rise of neoliberalism among the .01% ruling elite starting in the 1970s, including the collusion of the Hybrid-Keynesian and Retro-Classical economists, which drove policies that led to corruption, fraud, bailouts, QE and ZIRP – all designed to support the wealth transfer to the 1%. Instead Milanovic tries to explain it as some “natural phenomena” he calls a Kuznets wave. So I will repeat what I said the last time Milanovic wrote about Kuznets, where I’ve added “(wave)” where Milanovic previously he used “cycle”:

What is it with economists and their “cycles” (waves) – in this case the Kuznets cycle (wave) – as if saying is a cycle (wave) explains anything. Clearly the Kuznets curve was a simplistic idea that was no more enlightening then Anne Elk’s theory of the Brontosaurus https://www.youtube.com/watch?v=771E0aOFS4Q. The Kuznets hypothesis was clearly wrong. Inequality is rising – therefore the hypothesis was wrong and it explained nothing. So now in an attempt to retain this obviously wrong hypothesis it becomes a cycle (wave)? What is it with economists who cling to obviously wrong ideas? Neoclassical economics is full of this nonsense. Why do they cling to simplistic models that are internally inconsistent? Why do they attempt to salvage simplistic equilibrium theories that are shown to be wrong? (see Steve Keen for more on this.) Complex non-linear systems with resource boundaries that limit behavior will form random walks in the system space. Calling it a cycle explains nothing. Economists need to grow up and embrace the complex non-linear differential calculus needed to approximate economic systems. They need to give up on their simplistic algebraic formulations of equilibrium economics. Of course such a course of investigation will demonstrate that economic systems are chaotic and unpredictable – and therefore economists won’t be able to claim they can chart the future with their models – like we didn’t already know this. But I guess what such honesty would really do is eliminate them from the halls of power since politicians would no longer be able to point to the “expert” economists who claim that the chosen policies, which benefit the 1%, are the best course for the future. They could no longer claim that “inequality” is a natural state controlled by the invisible hand of the market, with no one to blame for the political decisions that created that inequality.

Looks like they moved Anne Elk’s theory of the Brontosaurus – here is the new link.

https://www.youtube.com/watch?v=U6zWjUhfj-M

Thanks! A fantastic comment with an equally enjoyable Monty Python clip as an accompaniment.

Ditto. Fantastic comment, J.McF. I’d like to know more. What kinds of new images and graphs might describe complex, inherently unpredictable systems, boundary conditions, and so forth? Is there a resource you recommend for the beginner?

Here are two books I’ve recently read.

Steve Keen’s “Debunking Economics”

Jack Rasmus’ “Systemic Fragility in the Global Economy”

It appears that this approach to gaining insight into capitalist economics is in the beginning phase. Like many complex physics problems, the predictive powers of this approach are likely to very limited (butterfly effect). However, it should still provide some insight. The most difficult part will be modeling herd behavior – psychology of groups – and it may prove impossible. However, if one changed the economic rules – and there are basically an infinite number of possible economic systems – one might construct a more equitable and stable system. As far as images and graphs – Keen has a few. But I think graphical representations are generally in the realm of linear algebraic approaches to equilibrium economics – which is just plain wrong.

!! X1000!!

Kudos for your explanation of why these Elkian dogmatists continue their nonsensical nattering:

This comment is a great illustration of how even meaningless drivel has value added here by the fantastic NC commentariat!

A highbrow “Kuznits” for the lowbrow “cycle”; makes it easier to take a platitude seriously. I’m always suspicious of explanations that fail to investigate agency. Do we just ignore the funding given to conservative think tanks and neoclassical economic institutions, and popularization of these ideas in the MSM over the last 70 years, as having no consequence? And that all that funding was spent without purpose? Do we just pretend that the role of public policy in reducing inequality hasn’t been denigrated? Conspiracy theorist? You betcha.

Any “cycle” that doesn’t recover in less than a decade WILL have a serious impact on the lives of the society. Maybe in the end we’re all dead, but it would be nice to have joy in between.

You are quite right about agency. As washunate says above, we as a society have created and consented to the obscene inequality that exists today.

But nothing lasts forever… you can feel the first tremors of discontent.

In every crisis, opportunities beckon.

It’s possible we emerge from a new order, thus shaping the world for the next 50 years or more, with a bunch of Constitutional amendments, new political parties and a term-limit 15 member Supreme Court.

Looking past Trump and Sanders, that’s what I envision…huddled masses yearning for genuine change.

Let’s hope…

People have been voting according to patently foolish conventional wisdom under the rationale that we simply don’t know as much as the elite experts, so we should follow them blindly. Trump and Sanders are being naughty, saying, no, actually you DO know enough, current policies really do NOT make sense, and we should be trying to benefit society as a whole. Openly discussing these issues presents a revolutionary challenge to our propaganda edifice. Short term, in the Democratic Party, a battle is going on to see whether PR experts can keep up the continuous repackaging of Hillary’s brand and denigration of Bernie’s; for Republicans, Trump appears to be the generic box on the shelf, with very little surface appeal but what a lot of people think they want inside. After 2016, expect some sort of “New Politics” elite reorganization to channel popular discontent into ineffective directions, so this doesn’t happen again. (Then again, Trump, like Obama, might just be a lightning rod…)

Global Existential Isms

It really doesn’t matter if Google is building robots to man the Amazon assembly line, to deliver product to robots, all going nowhere, or if the empire dispatches a million drones to confirm itself. This majority is breeding itself out, just like the last. The property, the money, the different colored tennis shoes are just arbitrary obsessions reflecting the process.

If you were paying attention, you can freely operate in and out of the empire at will, without the empire ever seeing you. Generally, what happens is that you gain so many skills that it doesn’t matter whether the empire sees you or not. The empire builds itself to replace you and yet it cannot exist without you, because somebody has to do the work, so all those consumers can consume.

The empire can take your children, and it will if it sees you, but the DNA is already cast, and then shuffled. You miss out on the pleasure of watching your children grow into themselves, but empire is not a threat otherwise. And at the end of the cycle, the empire kills itself, only to be replaced by the next, latest and greatest empire.

Until the upper middle class, working for the apes to keep the monkeys replicating – lawyers, doctors, accountants, psychologists, the lot – is itself threatened, all you see in the empire is crisis for the sake of crisis. And when the upper middle class is threatened, it’s all over anyway, with nothing left to do but watch the train wreck, on your break. Empire needs you to clean up the messes.

I just happen to be a german electrician from a very long line, watching moneychangers do stupid for thousands of years, who earned his father’s trust, and the best way I found to think about electricity is heat under quantum pressure, V & T. My wife comes from Sweden and Mexico, so naturally her family threw her to the wolves, but she isn’t judgmental, even though the State, her community and her family won’t let up for a second. She’s getting on with her life, and they hate that, because their excuse for their behavior is avoiding her fate, the weight of empire.

As for Grace, Grace is a bright shining light, in a field of disgrace.

Regardless of what the gossiping monkeys, waiting in line to fetch bananas for apes, have to say, it’s about the DNA. Either you have an advantage or you don’t; either you are going to work to pass on an advantage to your children or you are not; and equal rights is noise, in a divide and conquer echo chamber. If you are going to join empire, join early and comply, so you are not always at the back of the line, getting further behind.

The empire counterweight always begins with RE control and ends with RE control, and debt as money is employed to grow the middle class on top, in a Pavlov Swap, trinkets for compliance instead of work for life. Goldman Sachs is built upon such disgruntled children, giving their family’s wealth away. When the mop-up operation begins, as you see now, it’s far too late to be arguing about who spilt the milk; everyone is responsible so no one is responsible, that’s communism.

The foundation is already being installed, to be dressed at a later date by those who are prepared for the next wave of development, and take it. If you are a young person with few to no relevant skills, you have to go to where the work is, not where you want it to be, in the derivative developments. I’m old, and my day is done, so I can’t tell you what will work for you.

I can tell you that wherever I look, I see boomers behaving like teenagers, and I can see my wife from a mile away. You would be better off buying Rubles than anything American. But the very best bet you can make is on your spouse.

This empire too shall pass. What the lot is about to find out from its accountants is that the bank can no longer pay it to sit on dead real estate, because no one capable of work will work for an organization that kidnaps children. Technology is largely busy work, keeping monkeys busy watching blinking lights on an arbitrary black box, easily shorted into itself; leave it be and wire forward.

Tools and skills add to your perceptive capability; collect them until you can build them. Physics has the same metering problem as every other trade; build yourself a signal generator accordingly. How you build an elevator depends upon where you want to go, and only you know that, and in order to run a business, even Donald Trump needs an elevator, that much he knows.

Modernize away. If you need a place to rent, your best bet is that farmer positioned atop the sheave, but your next best bet is the critter just waking up to dead RE with no way to pay the bill, finding that all the Inns are closed. And gold bought with a credit card isn’t money, unless you say it is.

The reactors don’t see the new economy until it’s the old economy, and erroneously project the wrong future again, generating event horizons always behind the curve, while you are already jumping the next gap. Draw a sin wave and tangents at points of recognition in time, adjusted for gravity, to see the escalator to the cliff, from the trough. The Wyle E Coyote market can’t see the cliff because it can only see itself, in a self-fulfilling prophesy.

The bean counters efficiently liquidate into insolvency, exchanging debt for natural resources, while the hoarders sell into the artificial scarcity, until they can’t, surprise.

Thank you for so many gems of wisdom tucked away in your comment! E.g.,

“Observable” Kuznets waves over 6 or 7 centuries of European history? I think not, and data points are so few and far between, and attempts to determine income, wealth, everything else are so inferential and endlessly arguable for the precapitalist era that I find it hard to take seriously anything that makes such a claim.

Also tends to make inequality into something very like the weather. Several “cycles” of rising inequality were, after all, terminated by mass popular struggles, not by some sort of automatic adjustments.

Whether Kuznets waves, Kondratieff cycles or Schlesinger’s even less plausible “cycles of American history”,

I’m inclined to see instead a series of one-offs with differing reasons each time.

I think we need to focus on an economics for the people, not the 1%. That would be a revolution in itself.

A revolution of the mind that directs personal energy toward finding a proper place in the world, not based on selfishness and exploitation but by care and stewardship for all.

We don’t need better graphs or explanations of the neoliberal model, we need to expunge it form our minds.