Yves here. Even though this talk took place in January, it has just been released and remains timely.

An interview of Michael Hudson, a research professor of Economics at University of Missouri, Kansas City, and a research associate at the Levy Economics Institute of Bard College, whose latest book is KILLING THE HOST: How Financial Parasites and Debt Bondage Destroy the Global Economy, by Antti J. Ronkainen for Revalvaatio (Finland). Edited transcript of a January 11, 2016 session.

The Federal Reserve is the most significant central bank in the world. How does it contribute to the domestic policy of the United States?

The Federal Reserve supports the status quo. It would not want to create a crisis before the election. Today it is part of the Democratic Party’s re-election campaign, and its job is to serve Hillary Clinton’s campaign contributors on Wall Street. It is trying to spur recovery by resuming its Bubble Economy subsidy for Wall Street, not by supporting the industrial economy. What the economy needs is a debt writedown, not more debt leveraging such as Quantitative Easing has aimed to promote. But the Fed is in a state of denial that the U.S. and European economies are plagued by debt deflation.

The Fed uses only one policy: influencing interest rates by creating bank reserves at low give-away charges. It enables banks to make easy gains simply by borrowing from it and leaving the money on deposit to earn interest (which has been paid since the 2008 crisis to help subsidize the banks, mainly the largest ones). The effect is to fund the asset markets – bonds, stocks and real estate – not the economy at large. Banks also are heavy arbitrage players in foreign exchange markets. But this doesn’t help the economy recover, any more than the ZIRP (Zero Interest-Rate Policy) since 2001 has done for Japan. Financial markets are the liabilities side of the economy’s balance sheet, not the asset side.

The last thing either U.S. party wants is for the election to focus on this policy failure. The Fed, Treasury and Justice Department will be just as pro-Wall Street under Hillary. There would be no prosecutions of bank fraud, there would be another bank-friendly Attorney General, and a willingness to subsidize banks now that the Dodd-Frank bank reform has been diluted from what it originally promised to be.

So let’s go back to beginning. When the Great Financial Crisis escalated in 2008 the Fed’s response was to lower its main interest rate to nearly zero. Why?

The aim of lowering interest rates was to provide banks with cheap credit. The pretense was that banks might lend to help the economy get going again. But the Fed’s idea was simply to re-inflate the Bubble Economy. It aimed at restoring the value of the mortgages that banks had in their loan portfolios. The hope was that easy credit would spur new mortgage lending to bid housing prices back up – as if this would help the economy rather than simply raising the price of home ownership.

But banks weren’t going to make mortgage loans to a housing market that already was over-lent. Instead, homeowners had to start paying down the mortgages they had taken out. Banks also reduced their credit-card exposure by a few hundred billion dollars. So instead of receiving new credit, the economy was saddled with having to repay debts.

Banks did make money, but not by lending into the “real” production and consumption economy. They mainly engaged in arbitrage and speculation, and lending to hedge funds and companies to buy their own stocks yielding higher dividend returns than the low interest rates that were available.

In addition to the near zero interest rates, the Fed bought US Treasury bonds and mortgage backed securities (MBS) with almost $4 trillion during three rounds of Quantitative Easing stimulus. How have these measures affected the real economy and financial markets?

In 2008 the Federal Reserve had a choice: It could save the economy, or it could save the banks. It might have used a fraction of what became the vast QE credit – for example $1 trillion – to pay off the bad mortgages and write them down. That would have helped save the economy from debt deflation. Instead, the Fed simply wanted to re-inflate the bubble, to save banks from having to suffer losses on their junk mortgages and other bad loans.

Keeping these debts on the books, in full, let banks foreclose on defaulting homeowners. This intensified the debt-deflation, pushing the economy into its present post-2008 depression. The debt overhead is keeping it depressed.

One therefore can speak of a financial war waged by Wall Street against the economy. The Fed is a major weapon in this war. Its constituency is Wall Street. Like the Justice and Treasury Departments, it has been captured and taken hostage.

Federal Reserve chairwoman Janet Yellen’s husband, George Akerlof, has written a good article about looting and fraud as ways to make money. But instead of saying that looting and fraud are bad, the Fed has refused to regulate or move against such activities. It evidently recognizes that looting and fraud are what Wall Street is all about – or at least that the financial system would come crashing down if an attempt were made to clean it up!

So neither the Fed nor the Justice Department or other U.S. Government agencies has sanctioned or arrested a single banker for the trillions of dollars of financial fraud. Just the opposite: The big banks where the fraud was concentrated have been made even larger and more dominant. The effect has been to drive out of business the smaller banks not so involved in derivative bets and other speculation.

The bottom line is that banks made much more by getting Alan Greenspan and the Clinton-Bush Treasury officials to deregulate fraud than they could have made by traditional safe lending. But their gains have increased the economy’s overhead.

Do you believe Mike Whitney’s argument that QE was about a tradeoff between the Fed and the government: the Fed pumped the new bubble and saved the banks that the government didn’t need to bail out more banks. The government’s role was to impose austerity so that inflation and employment didn’t rise – which would have forced the Fed to raise interest rates, ending its QE program?

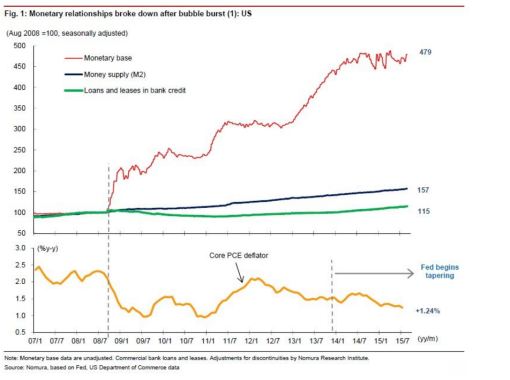

That was a great chart that Mike put up from Richard Koo, and you should reproduce it here. It shows that the Fed’s enormous credit creation had zero effect on raising commodity prices or wages. But stock market prices doubled in just six years, 2008-15, and bond prices rose to new peaks. Banks left much of the QE credit on deposit with the Fed, earning an interest giveaway premium.

(Richard Koo: “The struggle between markets and central banks has only just begun,”

The important point is that the Fed (backed by the Obama Administration) refused to use this $4 trillion to revive the production-and-consumption economy. It claimed that such a policy would be “inflationary,” by which it meant raising employment and wage levels. The Fed thus accepted the neoliberal junk economics proposing austerity as the answer to any problem – austerity for the industrial economy, not the Fed’s own Wall Street constituency.

According to a Fed staff report, QE would lower the exchange rate of dollar to the other currencies causing competitiveness boost for the U.S. firms. Former finance minister of Brazil Guido Mantega, as well as the chairman of Central Bank of India Raghuram Rajan, have described the Fed’s QE as a “currency war.” What’s your take?

The Fed’s aim was simply to provide banks with low-interest credit. Banks lent to hedge funds to buy securities or make financial bets that yielded more than 0.1 percent. They also lent to companies to buy their own stock, and to corporate raiders for debt-financed mergers and acquisitions. But banks didn’t lend to the economy at large, because it already was “loaned up,” and indeed, overburdened with debt.

Lower interest rates did spur the “carry trade,” as they had done in Japan after 1990. Banks and hedge funds bought foreign bonds paying higher rates. The dollar drifted down as bank arbitrageurs could borrow from the Fed at 0.1 percent to lend to Brazil at 9 percent. Buying these foreign bonds pushed up foreign exchange rates against the dollar. That was a side effect of the Fed’s attempt to help Wall Street make financial gains. It simply didn’t give much consideration to how its QE flooding the global economy with surplus dollars would affect U.S. exports – or foreign countries.

Exchange rate shifts don’t affect export trends as much as textbook models claim. U.S. arms exports to the Near East, and many technology exports are non-competitive. However, a looming problem for most countries is what may happen when ending QE increases the dollar’s exchange rate. If U.S. interest rates go back up, the dollar will strengthen. That would increase the cost to foreign countries of paying dollar-denominated debts. Countries that borrowed all dollars at low interest will need to pay more in their own currencies to service these debts. Imagine what would happen if the Federal Reserve let interest rates rise back to a normal level of 4 or 5 percent. The soaring dollar would push debtor economies toward depression on capital account much more than it would help their exports on trade account.

You have said that QE is fracturing the global economy. What do you mean by that?

Part of the flood of dollar credit is used to buy shares of foreign companies yielding 15 to 20 percent, and foreign bonds. These dollars are turned over to foreign central banks for domestic currency. But central banks are only able to use these dollars to buy U.S. Treasury securities, yielding about 1 percent. When the People’s Bank of China buys U.S. Treasury bonds, it’s financing America’s dual budget and balance-of-payment deficits, both of which stem largely from military encirclement of Eurasia – while letting U.S. investors and the U.S. economy get a free ride.

Instead of buying U.S. Treasury securities, China would prefer to buy American companies, just like U.S. investors are buying Chinese industry. But America’s government won’t permit China even to buy gas station companies. The result is a double standard. Americans feel insecure having Chinese ownership in their companies. It is the same attitude that was directed against Japan in the late 1980s.

I wrote about this financial warfare and America’s free lunch via the dollar standard in Super Imperialism (2002) and The Bubble and Beyond (2012), and about how today’s New Cold War is being waged financially in Killing the Host (2015).

The Democrats loudly criticized the Bush administration’s $700 billion TARP-program, but backed the Fed’s QE purchases worth of almost $4 trillion during the Obama administration. How does this relate to the fact that officially, QE purchases were intended to support economic recovery?

I think you’ve got the history wrong. My Killing the Host describes how the Democrats supported TARP, while the Republican Congress opposed it on populist grounds. Republican Treasury Secretary Hank Paulson offered to use some of the money to aid over-indebted homeowners, but President-elect Obama blocked that – and then appointed Tim Geithner as Treasury Secretary. FDIC head Sheila Bair and by SIGTARP head Neil Barofsky have written good books about Geithner’s support for Wall Street (and especially for Citigroup and Goldman Sachs) against the interests of the economy at large.

If you are going to serve Wall Street – your major campaign contributors – you are going to need a cover story pretending that this will help the economy. Politicians start with “Column A”: their agenda to reimburse their campaign contributors – Wall Street and other special interests. Their public relations team and speechwriters then draw up “Column B”: what public voters want. To get votes, a rhetorical cover story is crafted. I describe this in my forthcoming J is for Junk Economics, to be published in March. It’s a dictionary of Orwellian doublethink, political and economic euphemisms to turn the vocabulary around and mean the opposite of what actually is meant.

How do TARP and QE relate to the Federal Reserve’s mandate about price stability?

There are two sets of prices: asset prices and commodity prices and wages. By “price stability” the Fed means keeping wages and commodity prices down. Calling depressed wage levels “price stability” diverts attention from the phenomenon of debt deflation – and also from the asset-price inflation that has increased the advantages of the One Percent over the 99 Percent. From 1980 to the present, the Fed has inflated the largest bond rally in history as a result of driving down interest rates from 20 percent in 1980 to nearly zero today, as you have noted.

Chicago School monetarism ignores asset prices. It pretends that when you increase the money supply, this increases consumer prices, commodity prices and wages proportionally. But that’s not what happens. When banks created credit (money), they don’t lend much to people to buy goods and services or for companies to make capital investments to employ more workers. They lend money mainly to transfer ownership of assets already in place. About 80 percent of bank loans are mortgages, and the rest are largely for stocks and bond purchases, including corporate takeovers and stock buybacks or debt-leveraged purchases. The effect is to bid up asset prices, while loading down the economy with debt in the process. This pushes up the break-even cost of doing business, while imposing debt deflation on the economy at large.

Wall Street isn’t so interested in exploiting wage labour by hiring it to produce goods for sale, as was the case under industrial capitalism in its heyday. It makes its gains by riding the wave of asset inflation. Banks also gain by making labour pay more interest, fees and penalties on mortgages, and for student loans, credit cards and auto loans. That’s the postindustrial financial mode of exploiting labor and the overall economy. The Fed’s QE program increases the price at which stocks, bonds and real estate exchange for labour, and also promotes debt leverage throughout the economy.

Why don’t economists distinguish between asset-price and commodity price inflation?

The economics curriculum has been turned into an exercise for students to pretend that a hypothetical parallel universe exists in which the rentier classes are job creators, necessary to help economies recover. The reality is that financial modes of getting rich by debt leveraging creates a Bubble Economy – a Ponzi scheme leading to austerity and shrinking markets, which always ends in a convulsion of bankruptcy.

The explanation for why this is not central to today’s economic theory is that the discipline has been captured by this neoliberal tunnel vision that overlooks the financial sector’s maneuvering to make quick trading profits in stocks, bonds, mortgages and derivatives, not to take the time and effort to develop long-term markets. Rentiers seek to throw a cloak of invisibility around how they make money. They know that if economists don’t measure their wealth and the public does not see it, voters will be less likely to bring pressure to regulate and tax it.

Today’s central economic problem is that inflating asset prices by debt leveraging extracts more interest and financial charges. When the resulting debt deflation ends up hollowing out the economy, creditors try to blame labour, or government spending (except for bailouts and QE to help Wall Street). It is as if debtors are exploiting their creditors.

If there is a new class war, what is the current growth model?

It’s an austerity model, as you can see from the eurozone and from the neoliberal consensus that cites Latvia as a success story rather than a disaster leading to de-industrialization and emigration. In real democracies, if economies polarize like they are doing today, you would expect the 99 Percent to fight back by electing representatives to enact progressive taxation, regulate finance and monopolies, and make public investment to raise wages and living standards. In the 19th century this drive led parliaments to rewrite the tax rules to fall more on landlords and monopolists.

Industrial capitalism plowed profits back into new means of production to expand the economy. But today’s rentier model is based on austerity and privatization. The main way the financial sector always has obtained wealth has been by privatizing it from the public domain by insider dealing and indebting governments.

The ultimate financial business plan also is to lend with an eye to end up with the debtor’s property, from governments to companies and families. In Greece the European Central Bank, European Commission and IMF demanded that if the nation’s elected representatives did not sell off the nation’s ports, land, islands, roads, schools, sewer systems, water systems, television stations and even museums to reimburse the dreaded austerity troika for its bailout of bondholders and bankers, the country would be isolated from Europe and faced with a crash. That forced Greece to capitulate.

What seems at first glance to be democracy has been hijacked by politicians who accept the financial class war ideology that the way for an economy to get rich is by austerity. That means lowering wages, unemployment, and dismantling government by turning the public domain over to the financial sector.

By supporting the banking sector even in its predatory and outright fraudulent behavior, U.S. and European governments are reversing the trajectory along which 19th-century progressive industrial capitalism and socialism were moving. Today’s rentier class is not concerned with long-term tangible investment to earn profits by hiring workers to produce goods. Under finance capitalism, an emerging financial over-class makes money by stripping income and assets from economies driven deeper into debt. Attacking “big government” when it is democratic, the wealthy are all in favor of government when it is oligarchic and serves their interests by rolling back the past two centuries of democratic reforms.

Does the Fed realize global turbulences what its unconventional policies have caused?

Sure. But the Fed has painted itself in a corner: If it raises interest rates, this will cause the stock and bond markets to go down. That would reverse the debt leveraging that has kept these markets up. Higher interest rates also would bankrupt Third World debtors, which will not be able to pay their dollar debts if dollars become more expensive in their currencies.

But if the Fed keeps interest rates low, pension funds and insurance companies will have difficulty making the paper gains that their plans imagined could continue exponentially ad infinitum. So whatever it does, it will destabilize the global economy.

China’s stock market has crashed, western markets are very volatile, and George Soros has said that the current financial environment reminds him of the 2008 crash. Should we be worried?

News reports make it sound as if debt-ridden capitalist economies will face collapse if the socialist countries don’t rescue them from their shrinking domestic markets. I think Soros means that the current financial environment is fragile and highly debt-leveraged, with heavy losses on bad loans, junk bonds and derivatives about to be recognized. Regulators may permit banks to “extend and pretend” that bad loans will turn good someday. But it is clear that most government reports and central bankers are whistling in the dark. Changes in any direction may pull down derivatives. That will cause a break in the chain of payments when losers can’t pay. The break may spread and this time public opinion is more organized against 2008-type bailouts.

The moral is that debts that can’t be paid, won’t be. The question is, how won’t they be paid? By writing down debts, or by foreclosures and distress sell-offs turning the financial class into a ruling oligarchy? That is the political fight being waged today – and as Warren Buffet has said, his billionaire class is winning it.

That’s all for now. Thank you Michael!

Excellent. Thank you, Yves, for posting this.

We have the 1% and the next 15-20%. Those 15-20% are those with pensions. Another few years of ZIRP and their pensions will fail. And US ZIRP is leading to global NIRP itself pushing the dollar up.

For me it is obvious that rates need to go up to 3% but I think we are being led by a generation that only knows how to cut rates so we are going to see more of them… It’s hard to show an old dog new tricks.

That would be boomers Volker, Greenspan, Bernanke and Yellen?

Yeah, Volcker that old rate-cutter…oh wait, that’s not right…

Gotta raise ’em before you can cut ’em.

I wouldn’t include Volcker with the “Gang of Three”. See: http://www.theatlantic.com/business/archive/2013/12/paul-volcker-first-he-challenged-obama-then-he-changed-wall-street/282259/

True. Seemed Volker did at least try to rein in Wall Street a bit. Even so, the “Volker Rule” was pretty weak tea relative to what’s really necessary.

If you have ever fantasized about living to 100, at 0.5% a year, I think you need at least a $5 million, or more, nest egg when you retire at 65.

And you’d be afraid to touch that egg, lest you accidentally live past the century mark.

Luckily, that kind of stress is self-ameliorating. It ensures you will not live that long.

The problem is not the would be pensioners themselves, but the funds etc that claim to represent them on the various boards and such around the world.

They are a large driving force behind the short-term-ism that is plaguing the corporate world these days.

This because they do not take a wager on how long their clients will live, they just have a duty to keep as much money in the pot for when said clients wants to cash in.

As regards the Fed’s discount rate. When I look at the alarm bells Wolf Richter is ringing (ongoing junk bond collapse) and declining asset and commodity prices (the result of a collapsing bubble caused by ZIRP/QE) and the general timidity of the FOMC, I would be very surprised to see them raise rates. Then, when I read Karl Denninger’s argument that every assured liability entity (insurance companies, pensions) that build bond-ladders to meet their obligations is losing money, as well as long-term surety, it seems the Fed must raise rates. Oh bother. My own view is they should raise rates – and be prepared to restructure some major banks. That is, they should do their job.

The AAA Team. “I love it when a plan comes together!”

Call me petty but I found the digs of Hillary “I never found a fundraiser I didn’t like” Clinton much to my liking. People really need to take a bold look at her relationship to the plutocrats, like quick.

#RepubliKKKratsInDonkeySuits

Excellent article. I purchased Killing the Host per your reference in an earlier article. Thank you. Keep up the good work.

Editing note: the following para should be bolded

This line as well:

Obviously because all the theories they learned would be wrong.

That line caught my attention too.

Attempts have been made to incorporate asset prices into an inflation measure. Problem is, they are too volatile.

Unless mixed in at a tiny weighting (say 5% asset prices, 95% goods prices), every dip in stocks sends the combined index into deflation. Stock prices are noisy. So are property prices, properly measured.

A belief that central planning can fine tune the economy (rather than aim at the more modest goal of simply maintaining price stability) is the underlying error. The FOMC fortune tellers’ response is to select from a motley grab bag of indices — CPI, core CPI, PCE, core PCE, ECI (Employment Cost Index), etc. — to support whatever fool thing they wanna do. Secretly they look at forex rates too, though they can’t say so, cuz those are the Treasury’s turf.

I could code an iPhone app to replace the FOMC’s PhD palm readers.

A belief that central planning can fine tune the economy (rather than aim at the more modest goal of simply maintaining price stability)

In a Chaotic system, neither is possible. That one can generate a temporary illusion of stability is possible, until the next crash (chaotic event).

That occurred back in 2011 and 2012. Ben’s response was to tell the ROW to use “capital controls”. Now the shoe is on the other foot – and the Fed isn’t supposed to rate interest rates because that would be hard on the ROW debtors (but export price competitiveness for them is good!) – and whomever is still a US manufacturer using domestic labor (but you can be a US manufacturer that doesn’t use much domestic labor!)

So the only path to world prosperity is negative interest rates, and driving all currencies to zero, but making lots of it available to who knows who with QE. QED and you get an honorary degree from the Chicago School.

On my list, too.

Agree. That one point confirms the whole ‘race to the bottom’ nature of the Fed’s policy – what, only 8 years of denial later?

Thanks for another enlightening article, yves. Over the last couple of weeks,I, like others I’m sure, have been harangued to submit that I would vote for HRC if she’s the nominee, and I have steadfastly refused on the basis that “lesser evilism” is no longer operable, but what came along in argumentation was that HRC is the present evil, most likely to sell my interests down the river, literally because don’t kid yourself they have some nefarious plan behind their privatized prisons likely having some connection to odious debt (“are there no workhouses…”?)

One excellent point of many in this article…

“The ultimate financial business plan also is to lend with an eye to end up with the debtor’s property, from governments to companies and families. In Greece the European Central Bank, European Commission and IMF demanded that if the nation’s elected representatives did not sell off the nation’s ports, land, islands, roads, schools, sewer systems, water systems, television stations and even museums to reimburse the dreaded austerity troika for its bailout of bondholders and bankers, the country would be isolated from Europe and faced with a crash. That forced Greece to capitulate.”

See medicaid clawbacks for a current example, or having your social security garnished for non dischargeable student loans, or bulk purchases of foreclosed homes by QE enabled blackstone.

The current President and HRC are supply side Reagan republicans, and they should be abandoned to the dustbin of history.

When was lesser-evilism ever “operable”? It’s given us what we have today, which is proof enough that it’s a failed strategy.

I think it worked as a strategy before it failed and I fell into the trap myself unfortunately. In all these arguments I’m having it’s always brought up would I rather have mitt when I say I shouldn’t have voted for Obama a second time, and in hindsight I can forcefully posit that Obama has implemented cheney’s total info awareness program among other things so now it’s just “evilism”, a Mitt or a Trump would/will have more trouble getting things done, so in harmfulness terms HRC is the worst, Trump or whoever second worst, and Sanders as the least worst, otherwise known as the best, so I guess I’m still operating in a sense on lesser evilism but recognizing the evil in a different way or something.

I was perfectly content to dump Obama in the last election. There was one thing that kept me 2nd guessing: his potential for a deal with Iran. He’s made that a lynchpin of his foreign policy legacy in his 2nd term and he deserves credit for that. I saw potential, but didn’t believe in him on that front. I don’t think Romney would have done the same on Iran as he had too many rotten billionaires baying for Iranian blood who were throwing cash at him. However, I do think Romney’s Syria policy would have been similarly horrendous.

I suspect that progress on Cuba and Iranian relations will be more enduring no matter who wins next election. There’s too much logic there to go back now.

The US already is an oligarchy, and the Fed is the oligarchs’ toy poodle.

I think you can understand all of their actions if you start from the premise that they refuse to do anything that would leave the oligarchy relatively poorer v. the masses.

Marc Faber elaborated on this theme a couple of days ago:

Thx for that. Faber is a smart guy and I always like listening to him.

BTW I was reading Aldous Huxley the other day, who commented that all societies naturally tend toward oligarchy, and require periodic, explicit and voluntary actions to correct that inevitable decay. I suppose this is the wisdom of the 50 year debt jubilee. Clearly, we are there again and we need to do something.

One perception of the QE asset price inflation is that the policy helped homeowners. The house price inflation helped to rebuild homeowner equity that had eroded or vanished in the Great Recession.

That provided a type of expectation of wealth effect, enabling owners to feel less impoverished. While that might not offset declines in fixed income due to ZIRP, it had a benefit of calming a portion of the populace that was jumpy after prior assaults on their castles and livelihoods. The Fed policy includes a choice: why not keep potential voters calm instead of stirring them to brandish pitchforks and torches.

The Fed policy includes a choice: why not keep potential voters calm instead of stirring them to brandish pitchforks and torches.

I agree entirely. Hence, they are the protectors of the established order. But what if the established order needs fundamental change? What if, as Bernanke often repeated, monetary policy cannot solve all economic problems, and there must be fiscal engagement? When do the Fed’s ‘extraordinary measures’ become the enabling of Congressional dereliction of duty, and, in essence, a usurpation of Congress’s role? I submit to you we have long since passed that point.

This guy Hudson really gets it!

We are living through a fascinating period right now whereby the grifter class is slowly being exposed by the likes of Hudson, David Stockman, Yves, Zero Hedge, Paul Craig Roberts, etc. Of course the grifter class still controls all the levels of power and they are desperate to keep the system intact. So they count on the corporate media and their political agents like HRC, Rubio or Bush to keep the masses in line. The problem is that there are cracks forming in their control mechanisms. There are sites like this and people like Sanders and Trump, yes Trump, who aren’t part of the game plan. Then you have the young people, who have woken up for whatever reason and who seem to be immune to the messaging and propaganda campaigns.

No telling what will happen. The whole system is so booby trapped with leverage that it could blow-up at any time and there is no easy solution to thirty years of excessive credit creation. We are in the midst of a major historical moment which is both fascinating and also quite scary. War is a very real possibility in the near future for numerous reasons.

The fact that Jamie Dimon’s bank recently lent little Timmy G. several million dollars to make a leveraged equity investment in his firm’s latest leverage buyout fund which will take over some productive companies with yet more credit provided by Jamie’s bank perfectly sums up the state of the American economic system. These people are so divorced from reality it would be comical if it weren’t so disgusting.

This system can’t continue for much longer but God help us when it implodes!

If you like Hudson there are also a few others to research, such as his UM-KC colleague

William K. Black (see the blog NewEconomicPerspectives.org),

Steve Keen at Kingston University (DebtDeflation.com/blogs/),

and Adair Turner, prior Chair of the UK Financial Services Authority, and author of Between Debt and the Devil.

Great stuff from the great Hudson.

Act. Don’t React

Money is an arbitrary compliance tool, to enforce arbitrary RE control to the end of natural resource exploitation, drugs maintain the so-impoverished populations, and prison is the other side of the coin. Why do you suppose the psychologists are so determined to eliminate private enterprise and its parents, and what do you suppose happens to the participating populations, which are incapable of raising their own children.

If you are going to habituate frogs to boiling water, which frog is the critical path, and what is the outcome of the RE tile game?

The idea that people are going to be dependent upon arbitrary technology to which they may be selectively denied access, without becoming accomplices to the extortion activity, is insane. Fortunately, technology is largely noise. If you act, instead of react, the system shorts itself into a black hole, leaving the critters to argue among themselves about the illusion.

If you want to see how money works, give everyone $5k with chips in the money (yes), and watch the money seek itself, with critters competing to be at the destination. The self-obsessed nature of observation cannot be controlled out, and thus gets stronger. And life simply will not yield to an arbitrary sign.

So, a no trespassing sign is placed in a vacant field for an absentee owner, with no noticed authority. A couple comes by, the woman refuses to disobey the sign and becomes hysterical when the man does, who retreats and follows her onto a highway with no walk space. A father and a son proceed down the same path, the son objects, and the father tells the son to ignore the sign, because the path is an established easement and nothing is being communicated but loss of liberty.

We can expect police power, social norming upon majority obeyance, and individual penalty to set up the control feedback loop. From the perspective of empire, which owns all property, liberty is an easement at cost, on the irrational assumption of arbitrary control. The farmer will let you take a peach, and a bushel upon earnest request, but don’t show up with a harvester; like weeding and pruning, property comes with personal responsibility, to nature, and the law, the alternative most fall into, is a sledge hammer looking for a nail.

Money efficiently liquidates old processes chasing it, removing the old before installing the new. As a regulator, you do want to keep the drains clear, but bank margin and its regulation can only hinder growth of new processes, until it can’t. The CBs are bringing in new garbage without removing the old garbage, and are surprised to find no growth, on the assumption of expert knowledge in the status quo, of garbage inflation.

The CBs assumed that arbitrary dc technology was the future, and find themselves shorted back into the old petrodollar regime, building scale on top of demographic deceleration, hoping for an exit to present itself, to another phase of controlled extortion. NIRP, interest rate differential translation, and removal of anonymous cash temporarily buttresses the accounting, while the economy collapses and the participants strangle each other.

Don’t get me wrong; language and mathematics are fascinating, and they add color to our lives, separating us from other species on a unique frequency band, but they don’t actually do any work from the perspective of the planet, they certainly aren’t getting anyone off this planet, and artificial intelligence is just a derivative of the derivatives. Linear time is once again collapsing upon the empire. Frequency has all day.

Meanwhile, control proliferation continues in the shrinking cashless society, crowded by its own garbage, and it is built to run on automatic, systematically replacing participants from the bottom up, including the programmers themselves. The US has by far the least effective healthcare system on the planet, gobbling up the economy, run by the same psychologists serving as experts to the law, pushing AI. And no matter which way you approach, there is a no trespassing sign, saying experts for experts only, telling experts to tell you how to raise your children, to efficiently comply with the mythology of control.

The psychologists could just as easily habituate the frogs to boil in their own debt with a flash light, rather than nuclear, financial and infrastructure MAD, but the problem of reshuffling the clone DNA remains. Trapped in prisoners dilemma, the machine just keeps burning nature, to create a market for climate change money. Nothing essential has changed about empire since Moses loaded some gold onto a wagon and took off with refugees, with a map to nowhere.

Whether the response to collapse is MMT or any other theory makes no difference to labor, so long as the regulators understand that on the growth side it’s all mythology. The Millennials are well-equipped to watch the empire spiral out of control, trying to exercise greater control. Empire is just an efficient counterweight, and quantum mechanics is just timing of recognition, on the stroke.

More credit in the hands of consumers changes nothing, and for the life of it, the empire has no say in production. Corporate RE has stacked the deck against private business, and the Internet is primarily a tool of propaganda and surveillance, enveloping the implosion with virtual space. Once again, the genetic engineers have engineered DNA meltdown, with selfish genes reflecting themselves in an artificial amplifier.

What the empire needs but does not want is a RE plumber. Anyone who doesn’t have a meter is noise, anyone who has a meter and no relay map is noise, and anyone who has a relay map and no physics, loaded and ready to go, is noise. Now, you are down to a tiny percentage of the population, the frogs the psychologist has been trying to replace in the DNA shuffle, who can also wire right around AI, yet another arbitrary proprietary controller.

Riff Raff like Tech Exec wouldn’t last a minute in a revolution, and would be far better off keeping his f-ing mouth shut and playing with the monopoly money provided, which put those people out onto the street, looking at empty buildings, built with monopoly money.

“The Fed uses only one policy: influencing interest rates by creating bank reserves at low give-away charges. It enables banks to make easy gains simply by borrowing from it and leaving the money on deposit to earn interest ”

thank you Mr Hudson.

i am so glad someone can write in simple and clear terms here, unlike MMT craponomists here who keep claiming reserves do not affect rates and are not money because they are keystrokes.

Honest question: is economics the most brain-dead of academic fields? Most of them still can’t satisfactorily explain where money comes from (or what it even is), and it took a guy who never even planned to be an economist (Hudson here) to actually look at history and realize ‘hey, massive amounts of private debt…probably not a good thing’. And looking at economic history is key, hardly anyone does it and huge amounts of already discovered knowledge is simply ignored, left to rot on bookshelves. Looking at how people actually behave, as opposed to how fancy models claim they behave, is apparently such a novel approach it warrants its own sub-field (behavioral economics).

How do other fields view economics? Do historians and anthropologists (and psychologists) lament their complete lack of understanding of history and human nature? Do the members of maths departments secretly mock them behind their backs? Are actual scientists embarrassed by their pretense of being a hard science rather than a social study?

Economists are widely mocked and ridiculed, and are generally held in the same esteem as witch doctors and astrologers. They only take themselves seriously. Behavioral economics is a big improvement because it deals with humans as they really are and not as some eggheaded academic clowns imagine them to be. I read Shiller’s and Akerlof’s book Phishing for Phools last years and thought it was quite good in terms of its ideas about how economic actors actually behave. It didn’t go quite far enough in my mind in discussing human irrationality. I exchanged a few e-mails with Shiller and he is quite well read on the topic of human nature and is very familiar with the work of Edward O. Wilson, Steven Pinker, Robert Trivers and Daniel Kahneman amongst others, so that tells you that some of these guys get it. It’s bizarre that the field is only now starting to come to grips with reality.

In any case we are on the precipice of an immense economic disaster because of these clowns. Yves’s book Ecconned is excellent if you haven’t read it.

From Keynes

. . .If economists could manage to get themselves thought of as humble, competent people, on the level with dentists, that would be splendid!

“Federal Reserve chairwoman Janet Yellen’s husband, George Akerlof, has written a good article about looting and fraud as ways to make money.”

Does anyone know what paper Hudson is referring to and better yet have a link to it?

A Google search for “Looting: The Economic Underworld of Bankruptcy for Profit” should find it. It was written in 1993. I just skimmed the first couple of pages and it appears to be quite relevant today. Quote from page 2: “Our theoretical analysis shows that an economic underground can come to life if firms have an incentive to go broke for profit at society’s expense (to loot) instead of to go for broke (to gamble on success).”

thanks,

I read the first ten pages and had to laugh to myself. They didn’t use the pirate equity industry as one their case studies but that is the best example of all.

http://www.brookings.edu/~/media/projects/bpea/1993%202/1993b_bpea_akerlof_romer_hall_mankiw.pdf

Great post.

This para caught my attention:

“Wall Street isn’t so interested in exploiting wage labour by hiring it to produce goods for sale, as was the case under industrial capitalism in its heyday. It makes its gains by riding the wave of asset inflation. Banks also gain by making labour pay more interest, fees and penalties on mortgages, and for student loans, credit cards and auto loans. That’s the postindustrial financial mode of exploiting labor and the overall economy. The Fed’s QE program increases the price at which stocks, bonds and real estate exchange for labour, and also promotes debt leverage throughout the economy.”

Labor’s response to industrial exploitation was unionizing and collective bargaining.

What is an effect labor/consumer response to postindustrial financial exploitation by Wall St. and TBTF banks?