By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

It’s not contained.

There are over $1.8 trillion of US junk bonds outstanding. It’s the lifeblood of over-indebted corporate America. When yields began to soar over a year ago, and liquidity began to dry up at the bottom of the scale, it was “contained.”

Yet contagion has spread from energy, metals, and mining to other industries and up the scale. According to UBS, about $1 trillion of these junk bonds are now “stressed” or “distressed.” And the entire corporate bond market, which is far larger than the stock market, is getting antsy.

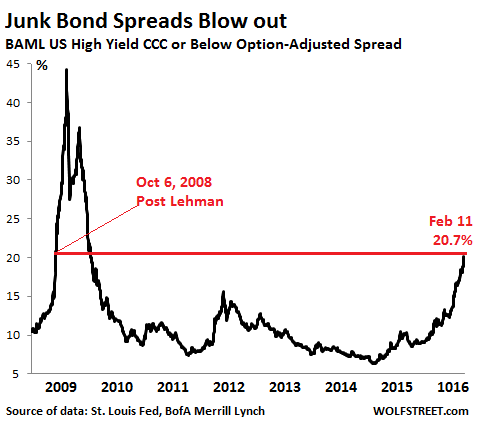

The average yield of CCC or lower-rated junk bonds hit the 20% mark a week ago. The last time yields had jumped to that level was on September 20, 2008, in the panic after the Lehman bankruptcy, as we pointed out. Today, that average yield is nearly 22%!

Today even the average yield spread between those bonds and US Treasuries has breached the 20% mark. Last time this happened was on October 6, 2008, during the post-Lehman panic:

At this cost of capital, companies can no longer borrow. Since they’re cash-flow negative, they’ll run out of liquidity sooner or later. When that happens, defaults jump, which blows out spreads even further, which is what happened during the Financial Crisis. The market seizes. Financial chaos ensues.

It didn’t help that Standard & Poor’s just went on a “down-grade binge,” as S&P Capital IQ LCD called it, hammering 25 energy companies deeper into junk, 11 of them into the “substantial-risk” category of CCC+ or below.

Back in the summer of 2014, during the peak of the wild credit bubble beautifully conjured up by the Fed, companies in this category had no problems issuing new debt in order to service existing debt, fill cash-flow holes, blow it on special dividends to their private-equity owners, and what not. The average yield of CCC or lower rated bonds at the time was around 8%.

Today the scenario is punctuated by defaults, debt restructurings with big haircuts, and bankruptcy filings. These risks had been there all along. But “consensual hallucination,” as we’ve come to call the phenomenon, blinded investors, among them hedge funds, private equity firms, bond mutual funds for retail investors, and other honorable members of the “smart money.”

But now that they’ve opened their eyes, they’re running away. And so the market for new issuance is grinding down.

“Another tough week,” S&P Capital IQ LCD said on Thursday in its HY Weekly. There was one small deal earlier this week: Manitowoc Cranes’ $260 million B+ rated second-lien notes that mature in 2021 sold at a yield of 14%!

The M&A-related bond issue by Endurance International Group couldn’t be syndicated and ended up on the balance sheets of the underwriters. LeasePlan has a $500 million deal on the calendar. If it goes today, it will bring the total this week to a measly $760 million, down 90% from the four-year average for the second week in February. According to S&P Capital IQ LCD, it would be “the lowest amount of early-February issuance since the credit crisis in 2009.”

In the secondary market, where the high-yield bonds are traded, it’s equally gloomy. S&P Capital IQ LCD:

The market was hit hard again this week amid solid volume trading as oil prices plunged anew. There was a meager attempt at stability on Wednesday, but some participants described it as similar to the calm at the eye of a hurricane.

That proved true today, as markets fell further. There was red across the board with losses in dollar terms ranging 1–5 points, depending on the credit and sector. The huge U.S. Treasury market rally gave no technical support, even as the yield on the 10-year note, for one, pierced 1.6%, a 4.5-year low.

And retail investors are catching on. Over the past three sessions alone, they pulled $488 million out of the largest high-yield ETF, the iShares HYG, which on Thursday closed at 75.59, down 21% from its high in June 2014, and the lowest level since May 2009.

On a broader scale, investors yanked $5.6 billion out of that asset class in January, the fourth month in a row of outflows.

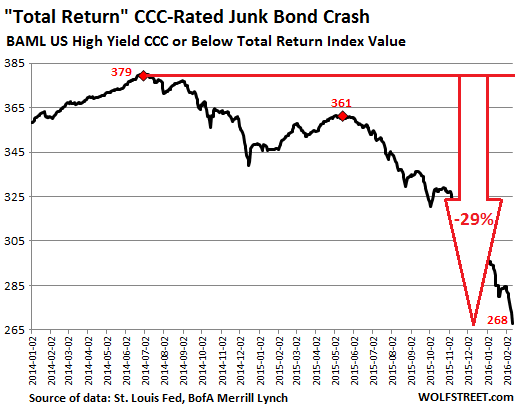

All grades of junk bonds have been losing ground: the S&P High-Yield Index is down 3.9% year-to-date. But it’s in the CCC-and-lower category where real bloodletting is occurring.

This chart shows the return from interest payments and price changes of that category. Since June 2014, the index has lost 28%. During the panic of the Financial Crisis, it plunged 48%. But now the volume of junk bonds outstanding is twice as large and the credit bubble is far bigger than it had been before the Financial Crisis. So this might just be the beginning:

It’s not just energy. The category includes all kinds of companies, among them brick-and-mortar retailers and restaurants, hit hard by excessive debt, slack demand, consumer preference for online shopping, and other scourges. Unlike oil and gas drillers, these companies have no assets to sell. Standard & Poor’s “believes these trends will accelerate in the coming year and lead to further retail defaults.”

S&P now expects the overall default rate to reach 3.9% by the end of 2016. But it may be the rosy scenario; last March, S&P still thought the default rate at the end of 2016 would be 2.8%. Credits are deteriorating fast.

Among these CCC-rated retailers and restaurants are Claire’s Stores, Logan’s Roadhouse, and the Bon-Ton Department Stores. Others, at B-, are just a downgrade away, such as Toys “R” Us, 99 Cents Only Stores, or P.F. Chang’s China Bistro. Some are rated B, such as Men’s Wearhouse and Neiman Marcus. If these companies need money, it’s going to get very expensive.

And contagion is spreading to high-grade bonds: issuance so far in February plunged 90% to just $5 billion, from the same period a year ago. Year-to-date issuance was inflated by one monster deal carried over from last year, the $46-billion M&A-driven trade for Anheuser-Busch InBev, bringing the total to $126.5 billion, still down 13%. S&P Capital IQ LCD:

Severe broad market volatility shuttered the investment-grade primary market for a fifth consecutive session Thursday, as secondary-market spreads continued to widen.

But when there is blood in the streets, there are opportunities though perhaps not in the usual corners. Read… What’s Booming in this Economy? Bankruptcy & Restructuring Business “Highest Since Great Recession”

If policy makers wanted to understand the irrelevance of ZIRP or NIRP in the world where real businesses and people live, they only have to read this article.

Obviously, if the Fed does a -2% NIRP, then we can get the average junk bond down from 22% to 20%. It’s all just simple math.

And don’t forget the risk that’s posed by the sovereign debt issued by the EU PIIGS:

Are The EU PIIGS About To Start Squealing?

As the migrant crisis in Europe worsens serious steps to address it are being considered.

One proposal is for passports to be required in order to cross from one EU country to another.

Would such a drastic move spell the beginning of the end for the Eurozone as a viable entity?

And if so what will happen to the piles of sovereign debt that’s been issued by the economically vulnerable EU PIIGS, and to the investors who have been pouring money into them at what appear to be ridiculously low yields?

Read the story and check out the historical yield chart at the article ‘EU PIIGS: Are These 10-Year Sovereign Bond Yields Either Warranted Or Sustainable?’ here: https://www.linkedin.com/pulse/eu-piigs-10-year-sovereign-bond-yields-either-michael-haltman?trk=prof-post

Bring in nonsense economics globally and let it destroy everything.

Today’s nonsense economics:

1) Ignores the true nature of money and debt

Debt is just taking money from the future to spend today.

The loan/mortgage is taken out and spent; the repayments come in the future.

Today’s boom is tomorrow’s penury and tomorrow is here.

One of the fundamental flaws in the economists’ models is the way they treat money, they do not understand the very nature of this most basic of fundamentals.

They see it as a medium enabling trade that exists in steady state without being created, destroyed or hoarded by the wealthy.

They see banks as intermediaries where the money of savers is leant out to borrowers.

When you know how money is created and destroyed on bank balance sheets, you can immediately see the problems of banks lending into asset bubbles and how massive amounts of fictitious, asset bubble wealth can disappear over-night.

When you take into account debt and compound interest, you quickly realise how debt can over-whelm the system especially as debt accumulates with those that can least afford it.

a) Those with excess capital invest it and collect interest, dividends and rent.

b) Those with insufficient capital borrow money and pay interest and rent.

Add to this the fact that new money can only be created from new debt and the picture gets worse again.

With this ignorance at the heart of today’s economics, bankers worked out how they could create more

and more debt whilst taking no responsibility for it. They invented securitisation and complex financial instruments to package up their debt and sell it on to other suckers (the heart of 2008).

2) Doesn’t differentiate between “earned” and “unearned” wealth

Adam Smith:

“The Labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money. But every savage has the full fruits of his own labours; there are no landlords, no usurers and no tax gatherers.”

Like most classical economists he differentiated between “earned” and “unearned” wealth and noted how the wealthy maintained themselves in idleness and luxury via “unearned”, rentier income from their land and capital.

We can no longer see the difference between the productive side of the economy and the unproductive, parasitic, rentier side.

The FIRE (finance, insurance and real estate) sectors now dominate the UK economy and these are actually parasites on the real economy.

Constant rent seeking, parasitic activity from the financial sector.

Siphoning off the “earned” wealth of generation rent to provide “unearned” income for those with more Capital, via BTL.

Housing booms across the world sucking purchasing power from the real economy through high rents and mortgage payments.

Michael Hudson “Killing the Host”

3) Today’s ideal is unregulated, trickledown Capitalism.

We had un-regulated, trickledown Capitalism in the UK in the 19th Century.

We know what it looks like.

1) Those at the top were very wealthy

2) Those lower down lived in grinding poverty, paid just enough to keep them alive to work with as little time off as possible.

3) Slavery

4) Child Labour

Immense wealth at the top with nothing trickling down, just like today.

This is what Capitalism maximized for profit looks like.

Labour costs are reduced to the absolute minimum to maximise profit.

(The majority got a larger slice of the pie through organised Labour movements.)

The beginnings of regulation to deal with the wealthy UK businessman seeking to maximise profit, the abolition of slavery and child labour.

Where regulation is lax today?

Apple factories with suicide nets in China.

The modern business person chases around the world to find the poorest nation with the laxest regulations so they can exploit these people in the same way they used to exploit the citizens of their own nations two hundred years ago.

Labour costs are reduced to the absolute minimum to maximise profit.

Capitalism in its natural state sucks everything up to the top.

Capitalism in its natural state doesn’t create much demand.

There is more than one version of Capitalism, and today’s version is an upside down version of the one we had 40 years ago that produced the lowest levels of inequality in history within the developed world.

40 years ago most economists and almost everyone else believed the economy was demand driven and the system naturally trickled up.

Now most economists and almost everyone else believes the economy is supply driven and the system naturally trickles down.

Economics has been turned upside down in the last 40 years.

All the Central Bank stimulus programs have been Neo-Keynesian, in line with the new economics. The money is pushed into the top of the economic pyramid, the banks, and according to the new economics it should trickle down.

What we have seen is that the money stays at the top inflating asset bubbles in stocks, fine art, classic cars and top end property.

Businessmen believe in the new economics when it comes to keeping all the rewards for themselves and shareholders.

Businessmen believe in the old economics when it come to investing and won’t invest until demand rises.

The new economics has taken us back to a disastrous past.

1920s/2000s – high inequality, high banker pay, low regulation, low taxes for the wealthy, robber barons (CEOs), reckless bankers, globalisation phase

1929/2008 – Wall Street crash

1930s/2010s – Global recession, currency wars, rising nationalism and extremism

You think the 1930s is bad?

In the 1940s you get global war.

I see a storm brewing. A huge economic tsunami will occur when the financial sector collapses. The question is not if this will occur but when and how bad it will be. The severity is bound to be intense and long term as Congress is hidebound by ideological stances that are the origination of the Tsunami. The Fed has run out of strategies that actually have any positive effect.

Not to diminish the concerns Wolf has expressed here or the related causal factors, but staff at the Atlanta Fed is forecasting sharply improving economic activity this quarter. Although I only began tracking their work during the past year, I have been impressed by the accuracy of their recent GDP forecasts:

https://www.frbatlanta.org/cqer/research/gdpnow.aspx

Should their forecast be accurate and have legs, perhaps it will reduce the severity of the issues Wolf discussed, at least in the short term.

Please explain how “smart money” is losing on this “hallucination.” Oh, maybe you mean the Private Equity LPs or the retail investors in the Mutual Funds, or the investors in the hedge funds. They aren’t the smart money. The smart money is playing this game for all it is worth and is not losing out.

The melody to “19th Nervous Breakdown” by the Rolling Stones should be playing in the background of this post.

Now you have me to scared too fund the next rung of my corporate bond ladder!