Yves here. It looks as if Chinese flight investors are falling for the latest version of a scam of sorts practiced in the dot-com era: taking otherwise conventional businesses and finding a way to reposition them as Internet plays to get a considerable boost in

pricing.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Money creation in China has gone bonkers. Authorities have opened the valves, and new credit is surging through money pipelines, including state-owned banks and the “shadow banking” system, and so loans in just the first two months this year soared by $1 trillion. Where did this money go?

We don’t know, but we’re getting indications that some of it is showing up right here in the US.

At the same time, “China is getting into the venture capital business in a big way. A really, really big way,” as Bloomberg put it: Government-backed venture funds raised about 1.5 trillion yuan ($231 billion) last year to bring the total to 2.2 trillion yuan. “That’s the biggest pot of money for startups in the world and almost five times the sum raised by other venture firms last year globally….”

While China is drowning in this sea of liquidity, its exports in February crashed 25% in dollar terms year over year. Part of it was due to the Chinese New Year effects. The rest was due to weakening global demand for Chinese goods: It was the 11th month of declines in 12 months.

Exports of goods are crashing, but hey, no problem, exports of money are booming. Capital flight takes on ever fancier dimensions: mansions in Southern California, tony condos in San Francisco, huge commercial and residential development projects, corporate acquisitions, and so on. Prices have surged for seven years and have reached ludicrous heights. So this is a good time to buy.

But this deal marks what everyone has been waiting for: a sign that the Chinese, in their desperate efforts to get these piles of money out of the country, have finally gone nuts.

They fell for WeWork – just when the “valuations” of startup companies are getting chopped in half as they raise new money, a time when this new money has in fact been harder to come by as investors suddenly ask uncomfortable questions about revenues, cash-burn, sustainability, or even survival [It Gets Ugly in the Startup Bust].

WeWork is essentially a real estate company. It leases large office spaces and then sublets smaller sections to whoever needs it – wayward workers of a large corporation, smaller companies, startups, or even individuals, and for whatever time periods – perhaps just a desk for a day.

And all these people get to work in the same cool communal space decked out with couches, snacks, and games. It started in 2010 in Manhattan and has grown to 80 of these coworking spaces in 23 cities mostly in the US with a few around the world. It’s not a bad idea, but it’s nothing fancy.

But WeWork timed the commercial real estate cycle just perfectly.

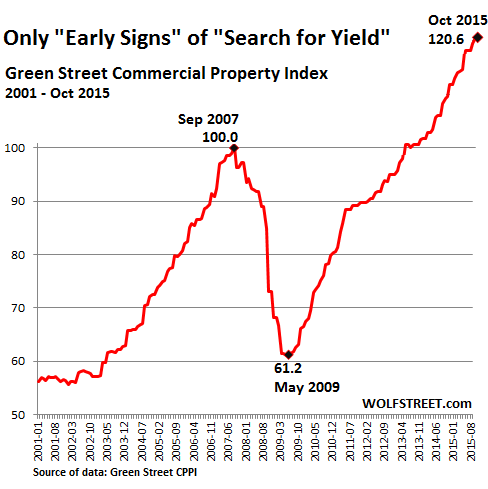

According to the Green Street Commercial Property Price Index, prices for office, retail, and apartment buildings jumped 10% in 2015, after having already jumped 10% in 2014. They’ve more than doubled from their cycle lows in May 2009. Even on an inflation-adjusted basis, prices have risen 12% above the peak of the prior bubble. But over the past few months, prices began stuttering, though they eked out another record in February:

These prices are in a symbiotic relationship with lease rates, which is WeWork’s business: it takes big ones and makes little ones out of them.

Now that the commercial real estate cycle is peaking, Chinese money got really excited about it in all kinds of ways, including WeWork.

Unnamed “WeWork executives” told the Wall Street Journal that the company was able to raise $430 million in a new round of funding led by Chinese investment companies Legend Holdings and Hony Capital Ltd. And the “valuation” these folks decided to attach to the company?

$16 billion.

That’s up 60% from $10 billion the day before, established during the last round of funding in June 2015. The new “valuation” puts the office sublet company in fourth position, along with Snapchat, on the US list of startups with the highest valuations, behind Uber, Airbnb, and Palantir. The company intends to burn some of this new moolah in Asia.

And it has set in motion a new hope in the deflating startup bubble in San Francisco, Silicon Valley, and other places in the US: that the desperate money fleeing China will somehow show up here and give startups more time to breathe and burn cash, while stamping them with totally silly “valuations.” This sort of thing happened before.

The moment when the “dumb money” arrives is also a sign of just how desperate the Chinese have become trying to siphon their liquidity out of China, apparently under the motto: the more, the better, no questions asked.

But even Chinese money might not be able to keep things from unwinding in San Francisco. Read… This Will Crush the Insane San Francisco & Silicon Valley Housing Bubble

Chinese dot com; securitized NPLs; newly equitized corporations selling new shares; great deals and subsidies for real estate; serious pollution and a billion people without a job or entitlements. Sounds like the American Way.

Looks the 80’s all over again but, instead of the Japanese it’s now China. Rockefeller Center may be a “steal” right now.

China looks to be in every way a replay of “Japan as #1” … very sad; extremely foolish.

I got a bell in Philadelphia I’d like to sell. Millions of tourist stare at it every year, with that many eyeballs, it’s gotta be worth $Billion$

Funny you should mention WeWork-style coworking spaces, because I’m sitting in one right now.

While this business model can work very well — there are a lot of individuals and companies seeking collaborative spaces — it requires a TON of promotion to start and keep going.

After all, those oh-so-cool coworking chairs don’t get filled all by themselves. You have to do a lot of advertising just to get people in the door and looking at your space. Getting them to sign a lease is a whole ‘nother adventure.

I’m wondering if the Chinese unicorn money has this level of patiences.

Oops. I meant to say PATIENCE.

This chain of events makes no sense, though. The money showing up in the US is our own dollars that we previously sent abroad, not Chinese currency.

This is the elephant in the room that even many ‘leftist’ economic commentators refuse to address. There is a lot of inflation in our society. Stocks are overpriced. Houses are overpriced. College is overpriced. Healthcare is overpriced. Taking time off from work is overpriced. Whether we choose to call this by some other word than that i word which shall not be named, the concept of a decent standard of living being too expensive for most workers remains.

It’s not the fault of the Chinese, or the Mexicans, or technology, or Martians, or unicorns. It is an unavoidable consequence of the cumulative weight of public policy choices that have concentrated wealth and power at an extreme level.

Ahem, the Chinese can sell yuan and buy dollars….and BTW the yuan has been under so much selling pressure that China’s central bank has spent $100 billion a month defending the currency.

Buy dollars from whom? That to me is the interesting question.

The bank! That’s where I get them.

They still have sizeable dollar reserves although as mentioned in another NC blogpost it won’t be enough to compensate for large scale capital flight (if it occurs). Exports have been dropping but they still have a BoT surplus esp with the US.

I feel pretty bad for the common Chinese guy…they work so hard their govt screws up so badly…its such a shame.

An unrelated query…how does IBM Watson compare with Palantir?

Leftist Schemist. Stocks are overvalued………..right Rothschild shill. Keep on trying to manufacture crisis to break the dollar.

I don’t really agree with him either, but remember that not everyone who disagrees with you is a shill.

Thanks, I appreciate the comment.

I think this demonstrates the value of pseudonymous speech. It raises the level of discourse by requiring one to engage the message rather than use tactics like guilt by association. I made four disputable contentions in that comment (money is coming from US, prices are too high, ‘leftists’ don’t pay enough attention to the cost of living, and it’s not the fault of external forces), but Mike didn’t actually dispute any of them.

Which piques my curiosity since NC is a place where we generally focus on reality, and I’m in the minority on some issues here, so a reasoned argument (one would think) would be more well received than this kind of hilarious comment that isn’t even tailored to my brand of critique. After all, I want to prosecute the fraudsters, break up the banks, stop subsidizing financial assets, audit the fed, return gold held by government to the people, and implement a universal safety net where we send national currency units directly to people in need. Pretty much the opposite of what the banksters want.

I don’t quite follow what you mean by break the dollar? If the dollar declines in value, stock prices would go up.

The last stages of the sub-prime bubble (and the EU periphery bubble) was to a large extent financed by stupid German money. It looks like China is the new Germany.

I guess maybe the F-35 will have a use after all. At least China won’t be able to do what the Germans did to the Greeks and Irish.

Meh, cash is cash. Capitalism requires building of debt and this one has another year. Generally, when the US economy moves into boom phase, the building of debt stops and begins to contract. This also is when things seem to be ‘at its best’. People persistently try to push this forward. I mean, guys, unless a outside shock happens, it isn’t happening anytime soon. I have the push of debt accelerating for another 12-18 months before it levels off. This will also trend to American boom. Then the fuel will run out by 2019, triggering a recession by 2020.

This is capitalism in its nutshell. This is how it MUST expand. The key is to understand you are in boom and be wise about personal incomes and assets.

I guess maybe the F-35 will have a use after all

Target practice for the Chinese copy of the F35.

True dat.

It would have saved everyone a lot of time, money and bother if they just sold the F-35’s directly to China. It would cut out a lot of middlemen.

Either:

1. It inflates the US economy which will reinflate the Chinese economy.

2. Or perhaps, it will exacerbate a future US crash which can then be pointed to as the cause of the Chinese downturn, giving the leadership a free pass for their bad policy.

Looks like a win policy for the Chinese Communist Party.

Meanwhile in libertarian-ville in NV, the TonyHsieh Vegas Downtown Project that included a similar idea – Work in Progress has closed.

Keep in mind that in spite of financial markets the old saying “He who produces shall rule, still applies.

Referring of course to a country not the actual workers.

I think China is still doing most of the producing.

While we do the greeting and bugger flipping.