Yves here. Note that Öncü’s article is looking at events during the financial crisis that did (or didn’t) produce liquidity crunches. One squeeze that is not on his list ins November-December 2007, and that is because it was not triggered by a particular event. Liquidity in financial markets becomes thin at year end because many investors try to minimize or halt trading after December 15 so they can settle things up for the year without undue stress.

In 2007, trading conditions in credit markets were becoming difficult in early November. At least part of the reason was concern about structured investment vehicles, which had been buyers of subprime debt and depended on short-term funding. Recall that Hank Paulson spent weeks flailing around trying to orchestrate a private sector rescue plan which we correctly predicted would never get off the ground. The Fed announced its first emergency program, the Term Auction Facility, on December 12.

Of course, another issue is that is it not yet clear what Brexit means….but that was also true of some of the events during the crisis.

By Sabri Öncü (sabri.oncu@gmail.com), an economist based in Istanbul, Turkey. This article was written on 2 July 2016 and first published in the Indian journal EPW on 16 July 2016

The Lehman moment is the moment when Lehman Brothers—one of the largest investment banks in the United States (US) at the time—collapsed. The collapse happened on 15 September 2008. Almost nobody disagrees with that the Lehman moment has been the most important moment in the ongoing global financial crisis that started in the summer of 2007, at least, up until the Brexit moment.

What is Brexit Moment?

The Brexit moment refers to the 23 June 2016 referendum in the United Kingdom (UK) in which the Britons voted on whether to remain in or to leave the European Union (EU). Its outcome became official on 24 June 2016.

Naturally, there were two sides. The “Bremain” side, supported remaining in the EU, and the “Brexit” side, supported leaving the EU. The Brexit side beat the Bremain side 51.9% to 48.1% on 23 June, unexpectedly. The next day, the Brexit moment hit the global financial markets leading to major drops in almost every equity market around the globe. And, since then, the internet has been flooded with unidentifiably many articles analysing sociological, psychological, political, geopolitical, economic, financial and other difficult-to-imagine aspects of Brexit

This article comes from two of those articles. There was one statement from each that struck me. The statement from the first article, attributed to the Allianz Chief Economic Advisor Mohamed El-Erian, is: “Brexit: Not a Lehman moment.” The statement from the second article is: “Brexit is a Bear Stearns moment, not a Lehman moment.”

Prior to Lehman moment, there were three other important moments. The first Bear Stearns moment (20 June 2007), BNP Paribas moment (9 August 2007) and the second Bear Stearns moment (14 March 2008).

Shadow Banking

Simply put, shadow banks are non-bank financial institutions which behave like banks. They borrow in rollover debt markets, leverage themselves significantly, and lend and invest in longer-term and illiquid assets. The difference between the two is that, unlike banks, shadow banks cannot create deposits—that is, money. If we leave this aside, then the two are more or less the same.

The significance of this is that just as bank runs can occur on banks, shadow bank runs can occur on shadow banks.

A bank run is rioting of the bank’s depositors—the most important and largest section of the bank’s short-term creditors—at the bank’s door to get their money out. A shadow bank run is more or less the same. Except that, since shadow banks have no depositors, it is their short-term creditors who riot at the door. This riot takes place electronically at a virtual door. It is not visible, because it is not physical.

The reason why those who claimed Brexit was not a Lehman moment must have been that there was neither a bank nor a shadow bank run at Brexit moment.

First Bear Stearns Moment

The signals of the first Bear Stearns moment became noticeable early 2007. Like Lehman, Bear Stearns was one of the largest investment banks in the US at the time. When the real estate bubble in the US started to burst in the first quarter of 2006, the subprime mortgage market began to deteriorate.

The first casualty were two highly levered Bear Stearns hedge funds. They were shadow banks speculating in subprime mortgages by borrowing short-term funds in the repo market and pledging their mortgages as collateral.

With the deterioration of the subprime market in early 2007, creditors began asking these funds to post more collateral by June 2007. When the funds failed to post more collateral, Merrill Lynch seized $850 million of their assets and tried to auction them on 19 June 2007. When Merrill Lynch was able sell only about $100 million of these assets, the illiquid nature and the declining value of subprime assets became evident. The next day, these funds collapsed.

This is the first Bear Stearns moment.

BNP Paribas Moment

Although the collapse of these two funds did not freeze the repo market, it increased the fears of counterparty risk and made the problem systemic.

Here, the key word is fear. When fear hits financial markets, it spreads.

In early August 2007, a run started on the assets of three special investment vehicles (SIVs) of BNP Paribas. These SIVs were bankruptcy-remote entities financing their subprime holdings through issuance of asset backed commercial paper (ABCP). On August 9, BNP Paribas suspended redemptions from these SIVs when their ABCPs lost their liquidity and became non-tradable. This caused the entire ABCP market to freeze. When fears of counterparty risk spread through markets, all short-term debt markets froze, only to open after central banks injected massive amounts of liquidity (Acharya and Öncü, 2013).

This is the BNP Paribas moment.

The BNP Paribas moment is what started the ongoing global financial crisis. The reason why most people do not know about BNP Paribas moment is that it effected the US markets mostly. Lehman moment is better known, because it globalised the crisis.

Second Bear Stearns Moment

It is all about fears and, beginning late Monday, 10 March 2008, fears spread about liquidity problems at Bear Stearns, freezing the repo markets in which Bear Stearns was funding its illiquid assets.

This happened on 13 March 2008. Then, on Friday, 14 March 2008, on the second Bears Stearns moment came.

On 14 March, the Federal Reserve Bank of New York agreed to provide a $25 billion loan to Bear Stearns to save it, sending the signal to markets that Bear Stearns was dead. Failing to save Bear Stearns on Friday, the Federal Reserve Bank of New York arranged a costly marriage between Bear Stearns and JP Morgan Chase on Sunday, 15 March 2008, about two years after which Bear Stearns name went into oblivion.

This is the second Bear Stearns moment which laid the ground for Lehman moment.

Fear Indices

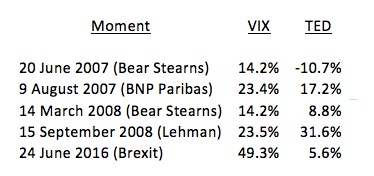

There are many fear indices in the global financial markets and I will compare the above described four moments—namely, the two Bear Stearns, BNP Paribas and Lehman moments—with the Brexit moment based on two indices— VIX and the TED Spread.

Their main significance is that they are publicly available and daily data for these indices go way before the onset of the ongoing global financial crisis.

A third index I will touch upon is SKEW, but unfortunately, its daily history I was able to obtain starts only after 2010.

VIX: VIX is the ticker symbol for the Chicago Board Options Exchange Volatility Index, a measure of the 30-day volatility of S&P 500 index options. It is constructed using the implied volatilities of a wide range of S&P 500 index call and put options, and meant to be a forward looking measure of volatility. It was introduced by Whaley, a Vanderbilt University finance professor, and had gone through several modifications since its introduction in 1993. Often referred to as the fear index, it has been considered by many to be the world’s premier barometer of investor sentiment and market volatility.

TED Spread: The TED spread was born after Chicago Mercantile Exchange developed and introduced the Eurodollar futures contract in December 1981. When first defined, and traded, the TED spread was the difference between the interest rates for the 3-month Eurodollar futures and 3-month Treasury bill futures contracts. Indeed, ED is the ticker symbol of the Eurodollar futures contract. These days, the TED spread is the spread between the 3-month LIBOR and 3-month US Treasury bill rate. The TED spread is viewed as another fear index, because many view it as a measure of the perceived difference between the safety of lending to other banks and the safety of lending to the default risk free US Treasury by the banks of concern. A big jump in it indicates funding liquidity freezes, that is, “bank runs”, in money and credit markets.

SKEW: SKEW is the ticker symbol for the Chicago Board Options Exchange Skew Index, a measure of tail risk—that is, the risk of extreme events such as major crashes in equity markets. SKEW is calculated from a wide range of (out-of-the-money) S&P 500 index options and considered by many as the real fear index. Historically, it fluctuates between 100 and 130 and its historical maximum is 151. Its values beyond 130 usually indicates increased risk avoidance in financial markets.

Comparison of the Moments

Let me now compare the five moments based on VIX and the TED Spread as percent changes from a day earlier in the table below.

The very first conclusion from the table may be that Brexit moment is neither any of the two Bear Stearns moments nor the BNP Paribas moment nor the Lehman moment. It is a new moment. While based on VIX, the Brexit moment is the worst (given its impact on the global equity markets, this is expected), based on the TED Spread, the Lehman moment is the worst and the Brexit moment is just an ordinary event (given that the UK is neither a bank nor a shadow bank, this is expected also).

Two other observations are as follows. The first is that from 23 June to 30 June, the TED Spread jumped about 17.7%, which may indicate some funding liquidity issues. The second is that SKEW reached its all-time high of 151 on 28 June, which may indicate increased risk avoidance and market expectation of an extreme event, that is, growing fears.

Apart from all of these, most European banks are zombies. Since 23 June, the Italian bank shares crashed more than 20% and the Italian banks are dying one by one these days. Furthermore, the International Monetary Fund called Deutsche Bank (the largest German bank) the riskiest financial institution in the world as a potential source of external shocks to the financial system on 30 June. With few exceptions, the government interest rates are falling in almost every country, and even the long term Japanese, German and Swiss interest rates are in the negative territory. True, the world equity markets recovered their losses after the Brexit moment. But, this was because of the expected coordinated interventions by the world’s major central banks, which they fulfilled.

Now, what should we conclude from all of these?

La Sagrada Familia

One of my favourite albums of all times is Gaudi album by Alan Parson’s Project. One of its song is La Sagrada Familia. Here is a part of the lyrics.

Who knows where the road may lead us, only a fool would say

Who knows wha’s been lost along the way

Look for the promised land in all of the dreams we share

How will we know when we are there? how will we know?

Only a fool would say

Reference

V.V. Acharya and T.S. Öncü (2013), “A Proposal for the Resolution of Systemically Important Assets and Liabilities: The Case of the Repo Market,” International Journal of Central Banking, January, pp. 291-349

Fear….fear??

Given that the banks….created the bubble through the hoodwinking of public and purchasing of the elected class……created the bubble from which they became ‘fearful’. One must ask what they feared.

Maybe they feared themselves to be found out and sent to prison….cause they, without a doubt knew of their own misdeeds and felonies. …..it is why they held fast to their proclamations of……nobody saw it coming.

Perhaps they feared their own shadows……as the bank’s and investment houses proclaimed their brave hard nosed business acumen. ..when reality shows them to be cowardice and stupid.

FEAR….a company has no soul, no emotion…why measure something that does not exist in business?

Fear was removed from the craven and guilty parties when the US government decided to bail the very criminals who profited from the bubble and the bust’s frauds upon the very table they set for themselves.

Maybe a closer inspection of those who proclaim fear and telescope fear….cause if history is any indication……?

– Now, what should we conclude from all of these?

That it’s all speculation.

First, in the sense of we cannot interpolate from past data because conditions are not the same. What is the history of negative interest rates? How’d that work out before?

Also, in the sense of pushing cash into riskier investments, like speculating on stock markets.

Which does not give a practical conclusion to the evaluation of what to do with actual money.

As for past performance, thanks for the reminder about the Alan Parsons Project. Thanks to Alan Parsons for looking at Gaudi, and particularly La Sagrada Familia. It’s a fine metaphor for the world: a magnificent construction, still undone, yet there is hope it will be fulfilled. And when it is, there will be parts of its artistry that will no longer be able to be seen, the view obstructed by subsequent works.

What is the history of negative interest rates? How’d that work out before?

NRP is a sign of utter failure of Global Banking in complicit with CBers and regulatory capture. This will be obvious in retrospect probably in a decade if not sooner.

‘The only wrinkle in an otherwise spectacularly hostile investment environment is that speculators appear to be so possessed by collapsing global interest rates that the immediacy of a market loss may be deferred until this fresh round of yield-seeking exhausts itself. As one observer told Bloomberg last week, “they’re out there scrounging through the dumpster looking for yield.”

http://www.hussmanfunds.com/wmc/wmc160718.htm

The problem with this article is that the “Lehman moment” was not the “Lehman moment”

As economist Dean Baker has pointed out many times before, the Fed intentionally ignored tightening in the money markets and commercial paper markets which it addressed shortly after congress caved in and passed TARP.

In other words, Lehman was a planned demolition not the unavoidable collapse that most people assume.

The reason Paulson (at least I think it was Paulson and not Bernanke) pushed Lehman off the ledge was because –as Bernanke revealed later in testimony before the commission–12 of the 13 largest banks in the country were busted.

Bottom line: They needed capital fast so they created a crisis. …which means the generally-accepted history of the event remains fundamentally flawed.

It’s all a lie.

Oh well.

’12 of the 13 largest banks in the country were busted’ Barnake (2009?)

Are they healthy, NOW, as of July 2016, if one, excludes M to Model accounting standard?

Well. The only moment I did not describe in the article was the “Lehman Moment” as you may have noticed. That was for a reason :)

Seemingly, SoftBank’s announced acquisition offer for the UK’s ARM Holdings was hastened along by the 30% premium of ¥-to-£ since the Brexit vote, perhaps signaling more currency-favourable M&A activity in this sphere.

Are we sure that it is correct to compare the Brexit moment with the Lehman moment? What I mean is that: for sure, looking at the numbers, we can compare both of the events; but, beyond all of the data, I do not think that is correct this kind of comparison.

We live in a very different world today, even if the Lehman moment was just in 2008. And I am talking about economy, finance, social, political, ecc.

There has been no armageddon in UK after the Brexit moment, and in the rest of the world the Brexit was just an excuse to sell a lot of stocks (especially of the banking sector) for hiding the real problem: they are not selling stocks because of Brexit, they are selling stocks because there is no room for further growth.

All this just demonstrates how the economists and finance sector has internalized the idea of eternal compound growth. Anything that makes them even for a second question that idea has them running around like headless chicken, screaming that the sky is falling.

Sorry bub, but infinite compound growth and a finite planet just don’t mix!

The only similarity between Lehman/BNP Paribus/Bear Stearns and Brexit is fear. In the former instances, the fear was driven by proven adverse market conditions (e.g. illiquidity of MBS). In Brexit, the fear is primarily driven by uncertainty. While there has been an adverse FX market, the initial NYSE market correction ended quickly, followed by a substantial rally.

Given that the U.S. housing market has re-entered bubble territory in many markets, and the ongoing stress in the high-yield corporate bond market, the next Lehman moment is more likely to come from these real issues, not whose picture in on UK currency.

… Whoa!!… multiple layers and a whole lotta depth to this post: Gaudi’s “cathedral for the poor”, a metaphor for man’s organic spiritual growth… and a somewhat survivor of the Spanish Civil War, “It will never be finished.”

It is in currencies, not equities, that “Brexit” appears to have legs. And it is in currencies that I suspect the effects on the economy… the real economy… will be revealed over time… the VIX, TED and SKEW largely irrelevant other than registering as occasional transient symptoms, much like the digital screen display of a heart monitor (although there is some evidence that an extremely high VIX display on the monitor itself can trigger alarm in the patient that contributes to panic and potentially cardiac arrest. Hence, VIX suppression by the market managers in the overnight futures markets; i.e., who ever said that neoliberal “free markets” meant they wouldn’t require nurturing, care and feeding in the form of repeated central bank cash infusions and active intervention, as Draghi, Kuroda and Carney have themselves repeatedly stated they would do; and as occurred following the Brexi vote, as the author observed?).

Was the “Brexit moment” a “Minsky moment”?… as the author, through his choice of language, evidently invites us to consider. Is a Minsky moment in turn a snapshot, a sudden, brief and intense time period when awareness and reactive panic set in, or is it more accurately described as a series of actions, developments and revelations that gradually culminate in awareness and reaction much like the slow motion replay of the sequence of events in 2007-08 the author described? Or were culminating events of 2008 engineered? as plantman posed above.

And what are we to make of the conversation about “shadow banks”? Aren’t they “money creators” too, financial intermediaries that should now be treated as traditional banks given the nature of the repo, securities and negotiable instruments markets? Are the “traditional banks” still the choke points?

Think I would have alternatively chosen lyrics from Lily Allen’s song “The Fear” as evoking the general sense:

I don’t know what’s right and what’s real anymore

I don’t know how I’m meant to feel anymore

When do you think it will all become clear

And I’ll be taken over by the fear?

So long as the money is coming in from the central banks, and confidence in the system and greed exceed fear, “everything’s cool”. That’s why the BOE’s Mark Carney an the ECB’s Mario Draghi were all over the MSM financial infotainment channels in the immediate aftermath of the Brexit vote with “Whatever it takes” messaging (including the artful framing as icons of their own digital images). Reminded me of Richard DeVoe’s statement back in 1995 that has so informed the thinking of the central bankers of our time: “So long as the money is coming in, everything’s fine.”

Shadow banks cannot create money. That is the difference between banks and shadow banks. Only banks can create money.

By the way, central banks cannot create money either, other than the banknotes they can print and, in some countries, the coints they can mint. For example, in Turkey, it is the Prime MInistry that mints the coins, not the central bank. QEs and other similar mechanisms may allow central banks to create money through the banks, but under the current arrangements, central banks cannot create money on their own. They just create reserves, which are not money.

Thanks for responding, Sabri. So what do the Fed, ECB, BOJ and BOE central banks use to purchase securities from the primary dealers pursuant to their “quantitative easing’ programs and their repo purchases? IMO it is “money” they create out of thin air, and reserves are the other side of the accounting entry.

And why wouldn’t mortgage-backed securities or other asset-backed securities created by shadow banks and pledged as collateral under repurchase agreements or to back their issuance of commercial paper be considered “money” as well? The sole point of differentiation from traditional banks that I see is that customer deposits are typically the largest liability on traditional banks’ balance sheets.

Just my thoughts. I really appreciate your post and hope all is well there.

As long as there are banks involved, you are right. Almost all (if not all) primary dealers, at least in the US, are non-banks. Non-banks cannot create money (deposits). Below is something I wrote a while ago in a conversation with a friend. It may help clarify a few things. I think, I am right in my discussion below.

The key paragraph below is this:

“Once these auctions are concluded, the trades are cleared on some clearing platform (Fedwire Securities System) where the auction counter-parties swap bonds for deposits (clearly not demand deposits) with their clearing platform member bank and that bank swaps the bonds for reserves with the Fed. Indeed, even the Fed open market operations happen this way.”

It is the clearing member bank that creates the deposits, that is, money- Not the involved non-bank in the transaction. I hope, I am not getting too technical. The whole correspondence is below and I mentioned the above paragraph to show you where to look at in the below conversation to see what I mean.

+++++++++++++

The QEs were not about reserves for bonds swaps between banks and the Fed. In the first place, this is legally impossible in the US, if you know some about the US laws and regulations. The Fed can only transact with the Primary Dealers in its bond transactions by law. Indeed, this was what happened. All of the Primary Dealers are non-banks. They are the usual suspects like Goldman, Morgan Stanley, etc. These Primary Dealers made competitive bids in the QE auctions either in their own name or in their clients name as the Fed says here, for example:

https://www.newyorkfed.org/markets/pomo_faq.html

Unless the Primary Dealers in all of the QE auctions made their bids only in their clients name and all of these clients were banks, the QEs could not have been reserves for bonds swaps between banks and the Fed. There is no publicly available official information about the identities of the counterparties of the Fed in these auctions, but we know that what I just said was not the case from the news and other unofficial sources. There may have been some Primary Dealer clients which were banks, but most of them were not (indeed, there were many hedge funds, pension funds and the like, not to mention the Primary Dealers themselves).

Once these auctions are concluded, the trades are cleared on some clearing platform (Fedwire Securities System) where the auction counter-parties swap bonds for deposits (clearly not demand deposits) with their clearing platform member bank and that bank swaps the bonds for reserves with the Fed. Indeed, even the Fed open market operations happen this way.

Of course, if an auction counter-party was a bank on the Fedwire Securities System, a pure reserves for bonds swap may have occurred, but most of the counter-parties were not banks as we know from the news and other unofficial sources.

wtf, VIX just go back to pre-brexit level. Nobody is buying puts. this market is insane, I hope they lose all their money after crash. fuck