Thanks to Tax Justice Network for putting us onto this great find: an accessible and humorous (believe it or not) overview of legal tax evasion strategies, presented by the subversive Australian show, The Undercurrent.

From Tax Justice Network:

We’re happy to share a rather brilliant explanation of corporate tax reduction erm, elimination shennanigans from the news and political satire show in Australia, The Undercurrent. In their words:

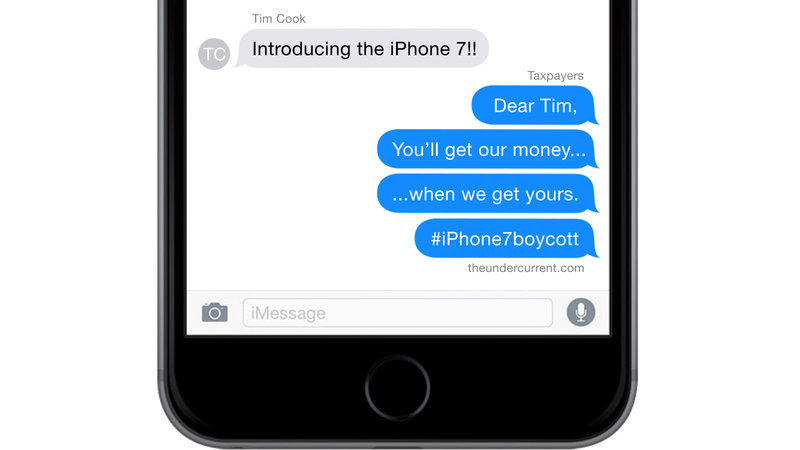

“Thousands of global companies avoid paying tax. That leaves us, taxpaying citizens, to pick up the tab. So we humbly present to you The Undercurrent Guide to Legal Tax Evasion. If you’re as pissed off as we are, you can do something about it here.” (More on their #iPhone7Boycott petition below.)

As they say in the video, you don’t really need Apple’s next iPhone, do you? Their Boycott Apple petition will be delivered to the CEO of Apple Inc. Tim Cook…

#iPhone7boycott

Here’s the wording of their petition, which we wholeheartedly endorse. Please sign and share widely:

Apple is one of the richest companies in history, but it doesn’t pay anything close to it’s fair share of tax in the countries from which it generates enormous profits. While the tax evasion strategies that Apple uses are currently legal in most countries, they are far from ethical, and leave huge holes in national budgets. Since our governments prefer to cut basic services rather than pursue multinational tax evasion, it’s up to ordinary citizens to use the last weapon at our disposal – purchasing power.

Thousands of multinational corporations use the same strategies and should be held to account. But we have to start somewhere, and a highly visible consumer products company is the perfect place.

So until Apple pays it’s fair share in tax within each jurisdiction it operates from, and ceases to use strategies such as transfer pricing and debt loading (i.e. thin capitalisation), signatories to this petition commit to boycott Apple products – starting with the iPhone 7.

Which is why I’m using a refurbished PC that’s 11 years old. Thing still works, so I’m keeping it.

Take that, Apple.

And Chinese cos are now making smartphones 80-90% as good as the iPhone at a fraction of Apple’s price.

http://www.zdnet.com/article/made-in-china-four-horsemen-of-the-iphone-apocalypse/?ftag=TRE17cfd61&bhid=22293505075082242411452950795158

My smartphone is much cheaper than an iPhone. Does everything I want it to do.

That’s what’s funny about this. Microsoft’s anti-competitive practices with MS-DOS, in particular using that market power illegally to favor adoption of Windows and then build out a symbiotic relationship with Office, is one of the primary early stories in building our contemporary age of intellectual property claims combined with anti-competitive practices by large corporations getting out of control.

Apple has never had a dominant position in market share, not with the Apple line, not with the Macintosh line, and not with the iPhone line. It has had leaner and bigger years over time based upon whether customers actually want to buy its products. Which is of course a radical and treasonous idea in the Wall Street financial predation view that says you’re supposed to pay your feudal rent to [insert company here] regardless of how good or crappy the product is.

But, in the US at least, taxes don’t fund spending, so this idea promotes misunderstanding of how the system actually works. Never mind, that level of understanding will never be in the mainstream, words that shall never be spoken.

It does make sense though to tax the bejabbers out of the rich, because they don’t come close to recycling their surpluses, the money just piles up extracting higher and higher rents (as interest) and buying government(s) becomes trivial.

The added benefit is that deficits would be reduced, which doesn’t matter a whit but everyone is terrified of them anyway so it’s a win.

Then we could be taxed less, increasing aggregate demand and improving our quality of life.

Legal tax evasion is an oxymoron (at least in the US). Tax avoidance is legal; evasion is not.

In this case, though, it feels and looks far more like legal tax evasion. Legal definitions be damned, if it looks like a duck, walks like a duck, and quacks like a duck, then…

I hear your point, but that’s not the way the law works. There is some small part of our legal system based on common sense principles.

However, most of the vast scale of it is technicalities. Definitions are what matter. The difference between even a major act like murder and not has some substantive, social meaning; mostly, though, it’s a legal definition. Induced abortion is either genocide on a truly historic scale or the most commonly performed medical surgery on women in the US. Definitions.

More relevant here, the difference between taxable wage income, taxable commissions, taxable carried interest, taxable capital gains, taxable dividends, taxable qualified dividends, nontaxable capital gains, nontaxable retirement contributions, nontaxable charitable contributions, etc., are definitions. Nothing more. There is no science or logic or connection to the real world. There’s no substantive reason that the law taxes some income differently than other income.

It’s just how public policy choices have been made, to purposefully undermine progressive income taxation so that higher income people can accumulate more wealth over time.

There’s a lot of effort made by servants of power to make it appear that the law has some deeper meaning, but that is spin – talking their book – not reality. We can change the tax laws however we want. In fact, most people across the ideological spectrum want a simpler, more progressive tax code.

this is all well and good for joe schmoe maximizing his deductions but I think this dichotomy is basically false for companies like Apple BECAUSE they can buy the legislators that actually make tax policy (and by off enforcement as well), making it much more than just tax avoidance legal or not.

Apple actually spends less on lobbying than most large corporations. And they’re not getting their money’s worth. For example, the DOJ went after Apple over ebook pricing when Amazon is the company that controls market share and influence.

P.S., check out this linkif you’re curious. (Alphabet is Google). The biggest spenders aren’t computer companies, they’re in other industries. Apple, despite being one of the largest companies on the planet, doesn’t even make the list.

Apple’s CEO Tim Cook hosted a fund raiser for Paul Ryan.

Funny thing is, I could only find articles about him GOING to host it.

Nothing after the event took place.

Paul Ryan’s budget slashes and privatizes Social Security. (ongoing)

Which means Tim Cook supports that.

http://www.politico.com/story/2016/06/tim-cook-apple-paul-ryan-fundraiser-224554

Like this post.

Interestingly, some of these tax deals were arranged at the highest levels of government. Jean-Claude Juncker, the current President of the European Commission, is currently being accused of arranging secret tax deals for Amazon when he was Prime Minister of Luxembourg:

http://www.dailymail.co.uk/news/article-3688861/Jean-Claude-Juncker-held-secret-meetings-Amazon-officials-involved-tax-avoidance-strategy-president-Luxembourg-legal-papers-reveal.html

Great googly-moogly. You people all really think if Apple owes a tax it doesn’t pass that cost onto consumers???? We pay it no matter what! Those of you who don’t pay taxes -or pay very little – should be all for abolishing the corporate tax system. That way the rich can pay more of your bill for you.

Did you miss that Apple has a staggering amount of actual hard cash on its balance sheet, which means its profit margins are enormous? And that taxes come out of profit and therefore are affordable? And that in general, corporate profits are at a level that is 2x the level that Warren Buffett to be unsustainably high a decade ago? Companies can get by perfectly well with lower profits since they have for pretty much all of corporate history until recently.

“You people all really think if Apple owes a tax it doesn’t pass that cost onto consumers????”

They don’t, though they might use it as an excuse to jack up their already obscene prices further. But it would be just that: an excuse. Just like increasing the minimum wage doesn’t increase prices to any meaningful degree. You really have no conception of the sheer amount of pure profit modern corporations are making, do you?

Did that Undercurrent video have a shirtless Vlad Putin pop up on screen as their example of a dictator whose tax avoidance was revealed by the Panama leaks? Not that I’m a big fan of Putin but that kind of undermines the show’s credibility right from the get go. Still, worth watching though.

Did that Undercurrent video have a shirtless Vlad Putin pop up on screen as their example of a dictator whose tax avoidance was revealed by the Panama leaks? Not that I’m a big fan of Putin but that kind of undermines the show’s credibility right from the get go. Still, worth watching though.

I suppose I could still sign on to the iPhone 7 boycott though. After all, it’s not like Apple knows I had no intention of buying one anyways… My current laptop may be the last Apple computer I buy however. The decline in functionality, loss of features I liked and Apple’s attitude of “Shut up and do things our way idiot! We know better than you you’re own needs and you should consider yourself fortunate that we allow you the privilege using our wonderful machines” is the main reason for that decision but their generally sleazy actions when they think no one is looking (tax evasion, labor practices in places such as China etc.) play their part in my decision too.

I have a new Apple laptop that is now seven months old that I am afraid to use because I know I’ll despise the new OS. I hope Linux has a GUI and enough apps for mere mortals 5 years from now.

Facebook doesn’t want to be left out of the tax dodging

Why the IRS Is Suing Facebook Over Asset Transfers in Ireland

http://fortune.com/2016/07/07/facebook-irs/?iid=sr-link2

Facebook May Owe $5 Billion in Federal Taxes

http://fortune.com/2016/07/29/facebook-irs-taxes/?iid=sr-link1

I think the proper response to this is lol, not a wholehearted endorsement.

The notion that individual corporations, rather than the system overall, is the core problem is a misdiagnosis of the situation. “We have to start somewhere” suggests willful obtuseness to the fact that Apple was an underdog, not a prime driver, of the rise of inequality generally and predatory corporate behavior specifically over the past few decades. Apple has been the target of a lot of disdain because they exemplified focusing on what customers want rather than preying upon customers. The fact that this strategy became rather effective in quantitative Wall Street financial terms once the illegal – and government sanctioned – dominance of MS-DOS and Windows began to be overrun by technological developments is now being used against Apple. It’s hilarious if you’ve been following things for awhile. First, Apple was doomed because nobody wanted their products and they should just close down to let the real corporations handle things. Then, Apple is doomed today because it’s so successful that clearly it’s responsible for how corporate America behaves. Never mind that Apple isn’t even a member of the US Chamber of Commerce, for example, or that it competes in one of the few parts of our economy where customers have actual, meaningful choices. Yves has gone after the problems of excessive usage of ‘shareholder value’ again and again and again. Apple perhaps more than any other major public American company is a model of focusing on corporate values other than share price. The company nearly went bankrupt in the 1990s. It was despised by Wall Street and mocked by executives and journalists in and covering corporate America.

Further, the disconnect from reality on this specific issue is pretty astounding. The optics of boycotting Apple are nonsensical: a boycott, by definition, has to be done by people who buy Apple products. From the days of MS-DOS market power when Apple products were mocked as toys, to the present era when Apple critics call Apple users terms like fanbois, these are disputes between different groups of people. This is divide and conquer, not unifying against a system of political economy that systematically transfers wealth upward. People who don’t like Apple products will think this is a great idea, and people who like Apple products will continue using them. It will have no actual impact because Apple is focused on its customers, not its non-customers. We might as well be warmongering about Russia, or stoking racial tensions, or talking sports, or any of the other tribal things we do that help the actual power structure in this country maintain a system of massive and growing inequality.

Why won’t this work? Because to do this for real, you can’t simply boycott Apple. You need to boycott the entire computer and telecommunications industry. Good luck engaging in civil society while not having a phone, computer, or internet access. If anyone wants to argue that Google, Microsoft, Amazon, ATT, Verizon, whatever are notably better US corporate citizens than Apple, or get into foreign companies in the space, like Samsung, now that would be a fun debate.

This link was a red flag for Viper malware detection. Is there another link?

” If you’re as pissed off as we are, you can do something about it here.”

Stiglitz Calls Apple’s Profit Reporting in Ireland ‘a Fraud’

https://www.bloomberg.com/news/articles/2016-07-28/stiglitz-calls-apple-s-profit-reporting-in-ireland-a-fraud

But does Clinton care?

Apple’s CEO Tim Cook Hosts $50,000-per-Ticket Hillary Fundraiser

http://www.breitbart.com/2016-presidential-race/2016/07/31/apples-ceo-hosts-50000-ticket-hillary-clinton-fundraiser/

Paulmeli, what number qualifies as bejabbers? (40%/50%/60% top rate? :)

More seriously, governments should get rid of the corporate tax and tax individuals directly. Much harder to avoid. See Thurow Zero Sum Society or

Beardsley Ruml Taxes for Revenue are obsolete.” Link: https://www.scribd.com/document/47336694/Taxes-for-Revenue-Are-Obsolete-Ruml-1946