Yves here. While commercial bankruptcies are still below the level of late 2013, Wolf is correct to point out that the spike during this year’s bankruptcy season is bigger and longer-lived than in recent years. Presumably a fair bit of the change is due to stress in oil producing areas, but it may also include an intensification of the ongoing shakeout in bricks and mortar retailers.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

This year through June, there have been 91 corporate defaults globally, the highest first-half total since 2009, according to Standard and Poor’s. Of them, 60 occurred in the US. Some of them are going to end up in bankruptcy. Others are restructuring their debts outside of bankruptcy court by holding the bankruptcy gun to creditors’ heads. In the process, stockholders will often get wiped out.

These are credit fiascos at larger corporations – those that pay Standard and Poor’s to rate their credit so that they can sell bonds in the credit markets.

But in the vast universe of 19 million American businesses, there are only about 3,025 companies, or 0.02% of the total, with annual revenues over $1 billion; they’re big enough to pay Standard & Poor’s for a credit rating.

About 183,000 businesses, or less than 1% of the total, are medium-size with sales between $10 million and $1 billion. Only a fraction of them have an S&P credit rating, and only those figure into S&P’s measure of defaults. The rest, the vast majority, are flying under S&P’s radar. About 99% of all businesses in the US are small, with less than $10 million a year in revenues. None of them are S&P rated and none of them figure into S&P’s default measurements.

So how are these small and medium-size businesses doing – the core or American enterprise?

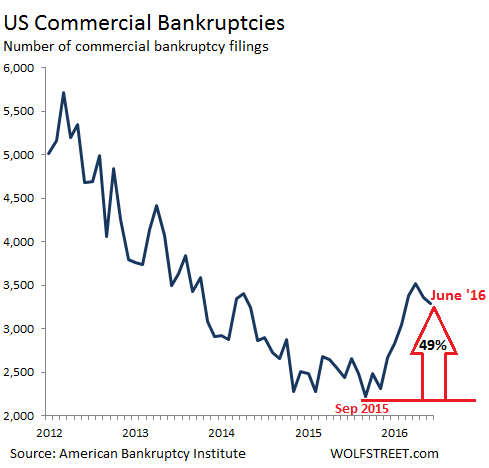

Total US commercial bankruptcy filings in June soared 35% from a year ago, to 3,294, the eighth month in a row of year-over-year increases, the American Bankruptcy Institute (in partnership with Epiq Systems) reported today. During the first half, commercial bankruptcy filings soared 29% to 19,470. Among the various filing categories:

Chapter 11 filings (company “restructures” its debt at the expense of stockholders and unsecured creditors by shifting ownership to creditors, but continues to operate) soared 36% to 499 in June and 25% in the first half to 3,220.

Chapter 7 filings (company throws in the towel and “liquidates” by selling its assets and distributing the proceeds to creditors) jumped 28% in June to 1,909, and 25% in the first half to 11,211.

Like so many things, bankruptcy is a seasonal business – and one of the few truly booming businesses in the US at the moment. While stockholders and some creditors pay the price, lawyers and many others on the inside track, including hedge funds and private equity firms that are able to pick up assets for cents on the dollar, have a lot to gain. And if a company emerges with a more manageable debt load, it too might eventually prosper, though multiple bankruptcies are not uncommon.

Commercial bankruptcy filings reach their annual peaks in March or April, and this year is no different. While June filings edged down by 64 from May, the five-year average seasonal decline for the period, at 275, is over four times higher. And the seasonal decline in June was the lowest for any June since the Financial Crisis.

This chart shows the seasonality and how bankruptcies have fallen since the Financial Crisis, until they hit the low point in September 2015. In June, the worst June since 2014, bankruptcy filings were up 49% from September:

Defaults and bankruptcies are indicators of the “credit cycle.” Easy credit with record low interest rates – the handiwork of the Fed with QE and ZIRP – has allowed businesses to borrow beyond their ability to carry this debt as everyone had been drinking the “escape velocity” Kool-Aid, the notion that growth in the economy would finally and very soon kick in and reach escape velocity. Year after year, for six years straight, it failed to kick in.

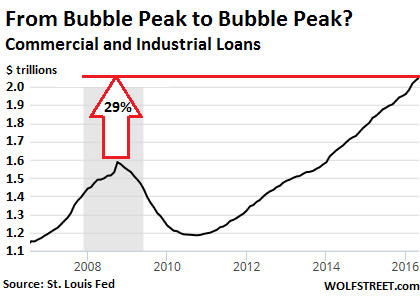

Hopes are now running into reality, which is a slowing economy in the US and globally, just when corporate debt has reached previously unimaginable levels, as this chart of total commercial and industrial loans at all commercial banks in the US shows:

In October 2008, there were $1.59 trillion of these commercial and industrial loans outstanding. As of May 2015, there were $2.05 trillion outstanding, a 29% jump from the peak of the prior craziest credit bubble the world had ever seen to this even crazier credit bubble. And so, instead of that promised “escape velocity,” the bankruptcies have started to kick in.

Junk bonds swooned late last year and early this year as a consequence of billowing credit problems. But if you bought the crappiest of them on February 10, you’ve made a killing unless the company defaulted, in which case you got killed. So much money poured into junk bonds since then that prices soared even for the riskiest near-default issues. But is that honeymoon already over? Bad breath of reality next? Read… What the Heck is Happening to Junk Bonds?

I always have a bit of trouble wrapping my head around the way Economists think, but it seems to me that they believe that supply is willed into existence by demand; you go into business to fill a demand. I’d love to know how they are coping with the fact that today supply is willed into existence by debt, specifically loans created by commercial banks. Do they acknowledge this? Can they? Or does the whole house of intellectual cards they’ve built up fall down if they do?

They substituted for wages with two income households, credit cards, HELOCs, and asset bubbles. All were used to prop up demand. Perhaps they have run out of substitutes for wage increases?

Imo… they substituted wages for – ***expectations*** – of income or cash flow from investment[s…

Disheveled Marsupial… Drama – is – as Engels feared… those expectations ™ have zip rights of recourse…

James Levy

July 6, 2016 at 6:02 am

I agree Even at only 2% inflation, do that for 30 years and one loses a tremendous amount of purchasing power.

But economists have an obstinate refusal to consider anything but aggregate GDP – it is against their RELIGION* to think about DISTRIBUTION of all the wealth created.

*the religion of obsequious sycophantry….

https://fred.stlouisfed.org/series/W270RE1A156NBEA

The rich have completed their objective of scooping up all rewards of the economy….and are supposedly surprised to find there is no one with any income to buy their stuff….

Goose…meet ‘shattered’ golden egg!

Geese ……they’re what’s for dinner!

Many economists are little more than bought-and-paid-for wh#res. To continue collecting their salaries, these economists are required to ignore the negative impact on stagnant wage growth. In truth, most of these charlatans who call themselves economists know FULL WELL what wage growth can do to boost a Nation’s economy. They are paid to ignore it and so they do.

Not sure about the theory that companies loaded on up to much debt due to cheap credit. That theory might be correct in specific industries like the oil-industry. But even in that industry I think that the large swings in price is more to blame.

Or is there evidence that small- and medium-sized businesses has borrowed a lot to make capital investments?

Small- and medium-sized businesses would be helped if the credit-terms was set in law and the law enforced. Anyone who has ever been a small supplier to a large company is likely to have experienced the pain of getting paid 3-4 months after delivery/work being completed. Banks love it though, they get to borrow cheaply from large companies while then lending it out more expensively to smaller companies – > therefore it is unlikely that things as important as cashflow for small businesses will continue to be ignored since banks prefer the current situation…

This ties into The Economist wailing over the fact that millennials aren’t buying diamonds. Actually, most people aren’t buying anything they don’t absolutely need. And why are small businesses going broke? Well, for example I just emptied my bank account to pay property and school taxes. So there goes the money I would have used to fix the roof and plumbing. The small contractors I would have hired now get nothing. Geez, even the rich are feeling the pinch.

. . . I just emptied my bank account to pay property and school taxes . . .

And a sizable amount of that ends up in pirate equity’s pockets so that they can further destroy the tax base. Public sector unions are stupid for investing in pirate equity, and demanding they be pinched by the rich.

Public sector unions would be the reason why those property and school taxes are so high.

They’ve sh*t their own nest.

The real reason property taxes are so high is because business pays the same rate as homeowners (who are not earning revenue with their property). The property tax service costs are spread to each household, collectively paying the majority share while business writes the property tax expense off before claiming any revenue. Nice scam.

Individuals also get to write off local taxes

Not $ for $ like business.

So all the customers using the services at the businesses writing off 100% of their property taxes are doing so with money from those customers, but that money is woefully short for the use.

I don’t see the difference. On my individual 1040, I subtract my local taxes from my gross. On my corporate 1120, I subtract my local taxes from my gross. There’s no difference.

That’s really curious. Not sure where you are from, but local taxes are part of the regular business expenses. So you are saying you deduct local taxes twice on your corporate ? Once for the full expense on your income statement and then again on your tax return ?

Local taxes are deducted once whether business or personal. So I’m trying to understand how business gets a benefit that individuals don’t get.

Businesses, their subcontractors and their clients USE the government services provided by local taxes. When a business does not pay according to it’s revenue, that means they are taking advantage of those services at the residential rate. Does that help you understand ?

Whether there are unions or not, the work of running a city still needs to be done and when the tax base is destroyed through forces beyond the city’s control, the burden of paying for it all, falls on fewer and weaker shoulders. That public sector workers have a union, and then union leadership decides to invest in pirate equity is ultimately self defeating. My sense is that a better place for these unions to invest is in small cap index funds which might support a business or two in the community, expanding or at least not shrinking the tax base.

We all know the record of pirate equity. Use someone else’s money to asset strip whatever they get their grubby mitts on and keep most of the loot for themselves, sharing a few drops with their investors. The result is one less company that pays any taxes.

and those kids should get off your lawn…

One reason for higher school taxes is the explosion of highly paid administrative jobs. In many states, lower level administrators can belong to unions, but the higher level administrators can not.

Nah, the money paid to union members is put back into the local to near local community. The reason why taxes are so high have to mostly due with Wall Street. Heck, if Detroit didn’t sign that interest rate swap, they would of still been solvent. The politicians who signed the crappy deal were jailed for corruption attached to the deal. Even though the interest rate swap was signed under fraudulent circumstances, the courts wouldn’t let Detroit abandon it. Funny how the city was allowed to screw its pensioners. On the other hand, the lack of low risk safe investments has contributed imensely to the pension debacle. As long as the pension funds have to seek returns on capital with low rate, low risk options, discounting doesn’t work, and pension contributions have to grow to make up for the shortfall, which means that more tax dollars have to be funneled into maintaining pension promises. Our taxes are high because our government refuses to met out the investment that is necessary to maintain a first world society. My utility bills have increased more than my taxes, and why would that be? Maybe because of all of these highly financed merger and aquisition deals that add debt to these companies that in turn show up on my utility bill in the form of higher fees, for the same service. Want to go find another provider, you can’t because the utility companies are local monopolies. There are so many ways they skim from all of us, it’s ridiculous, so wages don’t grow because companies have to always meet some profit hurdle or their stock price will collapse, the alternative, people use their credit cards to make it until they can get the cash, no worries because the bank that demanded that your company increase its per share profit level, is the one you owe 20% too on credit card debt that you can’t pay due to the crappy wages that have been bestowed on you. What about the people that received pensions as part of their pay package in the good old days? Well, those pension’s assets have been raided by hedge funds, then turned over to the government because they were insolvent, and who pays for that, our taxes and our pensioners. Our taxes go up and our retirement income reduces significantly. Bernie was right, the whole business model of Wall Street is fraud.

bravo!!

It won’t be just bankruptcies, but increasingly, higher levels of bad debt. It’s simply the byproduct of mankind’s stupidity. The current economic climate (and stagflation), was predicted in the late 1950’s. I.e., the commercial banks (CBs, MSBs, CUs, S&Ls, etc.) all create new money and credit whenever they lend/invest. Thus, the DFIs, depository financial institutions, do not loan out existing deposits, saved or otherwise. In fact, the source of all time/savings deposits to the CB system is other bank deposits, directly or indirectly via the currency route or thru the CB’s undivided profits accounts. I.e., rather than being a source of loan-funds for the system (as Alton Gilbert pontificated), time/savings deposits are the indirect consequence of prior bank credit creation. And the growth of all deposits is traceable to the expansion of bank credit.

Thus as FDIC insurance coverage increases, and other commercial bank competitive policies incent savers to hold their funds within the CBs, a depressing economic impact is exerted. I.e., all CB time/savings deposits are lost to investment, to consumption, indeed to any type of payment or expenditure until their owners opt to spend/invest directly or indirectly. Thus a long-term corrosive degeneration is proliferated which impacts the demand for capital goods and down that road decreases CAPEX.