The New York Times’ Dealbook has managed to outdo itself, and not in a good way.

On Monday, the Grey Lady published This is Your Life, Brought to You by Private Equity, a slide show apparently intended to stand in place of a bona fide reported story to close off a recent series on the industry.

The disgrace isn’t just that it took so many writers (four) and such a clearly costly presentation to convey so little substance. The style of presentation, the at best mildly concerned tone, the inaccuracies and understatements, and the thinness of information were worse than a whitewash or conventional agnotology. The story came off as an arch promotional piece for private equity, with a few necessary ugly disclosures worked in, as if the reporters had been pwned. As a lawyer who has written extensively on private equity said, “Did David Rubenstein [of Carlyle Group] write this?”

Overarching Story Line Faithfully Echoes, and Therefore Evokes, Classic Corporate Do Gooder Pitch: “Our Company Touches Your Lives in So Many Ways” A long standing staple of corporate advertising, going back to before World War II, is the seeminlgy faceless major corporation such as “Better Living Through Chemistry” DuPont, showing citizens how its products, unbeknown to viewers, supposedly improved their daily lives. This trope is so widely recognized as a classic that it’s even incorporated casually in movies. For instance, Michael Clayton, about evil Monsanto-like company U North, shows this commercial, in which U North depicts itself as playing a far-reaching, positive role:

U-North, for the film Michael Clayton from Victor Melton on Vimeo.

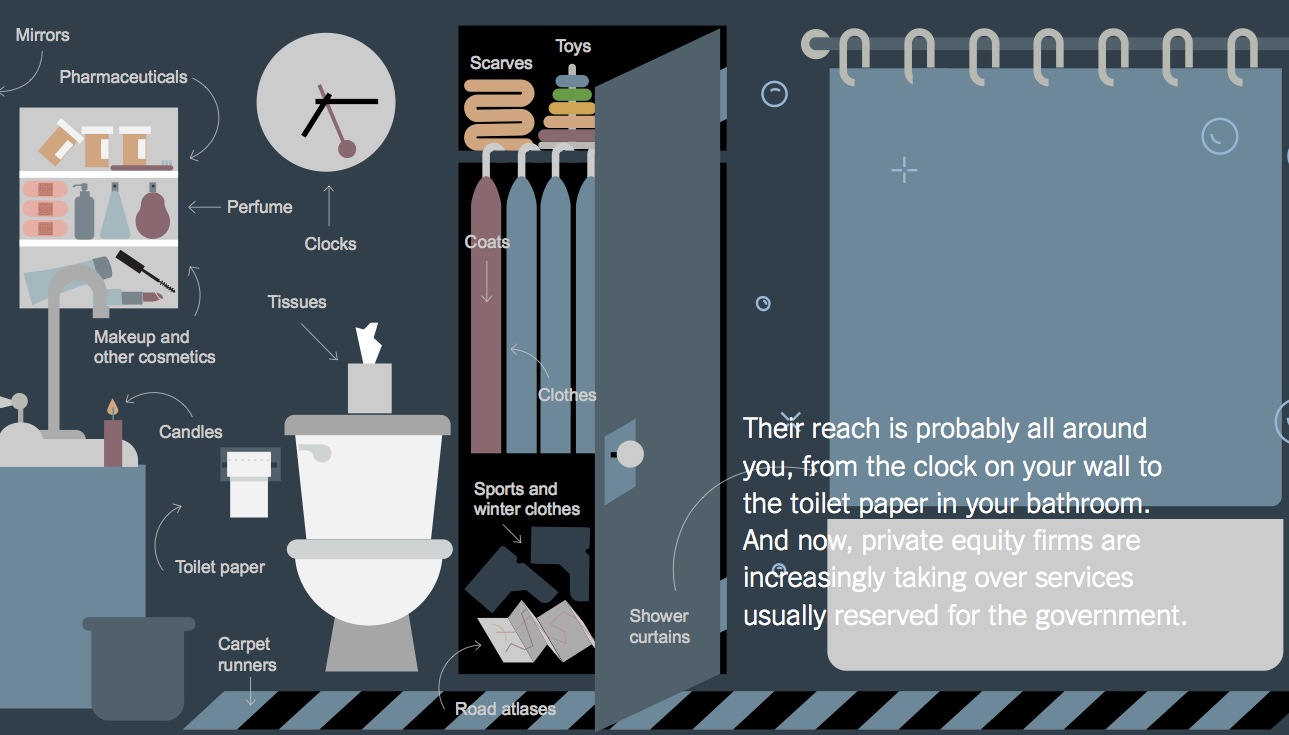

In other words, corporate influence is pervasive…but consumers are told again and again and again all and only for the good. Thus in the absence of concrete information otherwise, the fact that private equity firms now have their fingers in lots of pies the way, say a conglomerate like GE does, won’t sound any alarms.* From the standpoint of the overwhelming majority of readers, it’s at worst dog bites man. For instance (each mini-paragraph is a separate slide, with a fitting cute image with the text:

Let’s say that, like most Americans, you drive to work.

These roads, bridges and highways are increasingly maintained by Wall Street investors. They either own the road, or manage it on the government’s behalf.

Isn’t this just swell? Nowhere does it describe, as we have, that toll road projects are almost always construction projects, and the process is so flawed that they have, without exception, resulted in bankruptcies? And worse, that when these roads are built as essential infrastructure (replacing existing roads or to serve rapidly growing suburbs or exurbs), the communities served by them are left with a mess, since the roads are typically maintenance-starved before they go belly up?

A key slide:

So should consumers be worried that Revlon is owned by raider Ron Perlman of MacAndrews & Forbes? The slick image doesn’t even show which private equity owned company is associated with each of the products it shows, so the reader has no idea whether they are dominant or minor players. Indeed, the message looks an awful lot like, “You need private equity to get you through your day.”

Children’s Story Book Visual Style Makes Private Equity Look Kind and Talks Down to Readers. Was this weird format used to hide the lack of newsworthy information or to soft-pedal what little the Times team had to convey? The result is childish and anesthetizing, as if the intent was to tell a comforting bedtime story. True to the form, the slides go from someone waking up in the morning to get their first glass of water, and closes with:

Notice the palette: calming, institutional, with a lot of blue undertones, the sort of thing you might see in a dentist’s office or an upscale retirement facility.

And the presentation adheres closely to the tried and true presentation style of first grade teachers: no more than one sentence per slide, the shorter and simpler, the better.

The Story Omits and Minimizes Negative Information. Whitewash is too kind a word. Let’s start with the opening text:

You wake up thirsty. [Mind you, that is a single slide]

A few years ago, that glass of water might have come from your local government. Today, it could be courtesy of a private equity firm. It may taste the same, but there’s a good chance your bill has gone up.

This leaves readers with close to nothing. How many local municipal water works have been bought by infrastructure funds (which are treated by investors not as “private equity” but as “infrastructure” funds, with risk and expected returns that are distinct from private equity, revealing lazy, sloppy reporting)? Are there any estimates of what proportion of water supply nationwide is now under corporate control? Is this trend growing or has it fallen off with the bad press infrastructure plays have gotten recent years? And how much have prices gone up?

With only a vague threat mentioned and no supporting details, this winds up being the reverse of an alarm. It numbs the reader to accept the incursion of investors as a given, and probably benign, since he never knew about it before and the Times gives him no reason to be particularly bothered.

Here’s the next slide:

First, by carrying over the water discussion through the water glass image, the text promotes the privatization messaging that government services should be regarded and run with an eye to efficiency, as opposed to supporting communities on an affordable basis. And it therefore blandly treats turning critical public services over to profiteers as perfectly reasonable. In fact, as we wrote in 2013:

As we’ve discussed at length earlier, these schemes are simply exercises in extraction. Investors in mature infrastructure deals expect 15% to 20% returns on their investment. And that also includes the payment of all the (considerable) fees and costs of putting these transactions together. The result is tantamount to selling the family china and then renting it back in order to eat. There is no way that adding unnecessary middlemen with high return expectations improves the results to the public. In fact, the evidence is overwhelmingly the reverse: investors jack up usage fees and skimp on maintenance. And their deals are full of sneaky features to guarantee their returns.

The Flint water supply disaster is a stark reminder of the danger of a focus on costs n providing critical services. It also pushes the private equity line that they are smart and by implication, that their historical outsized returns were the result of their investment acumen. In fact, the profits of the general partners come overwhelmingly from fees that have nothing to do with investment success, and the returns they do earn depend heavily on tax avoidance. As tax expert Lee Sheppard wrote, “Private equity often resembles a tax reduction scheme with an acquisition attached.”

The next slide is inaccurate:

These investors have lots of money at their disposal, mainly from rich individuals and pension funds. They also face fewer regulations than banks. Since the 2008 financial crisis, they’ve expanded their horizons and begun shopping for bargains in new places.

This perpetuates the canard that most of the money in private equity comes from high end retail investors, who are assumed to be big boys and able to walk on the wild side, when that’s demonstrably false and again shows obviously deficient reporting. The biggest single investor group in private equity is government investors, meaning public pension funds like CalPERS. Historically, the next biggest group has been private pension funds, but recent news stories suggest that sovereign wealth funds may have surpassed private pension funds. Other big investors in private equity are life insurers, endowments, foundations and fund of funds (which take money from smaller public and private pension funds, endowments, foundations, and individuals; fund of funds are large investors in private equity in aggregate). The idea that private equity buys on the cheap is not a given, despite the Times hammering that claim; the industry at the end of cycles (late 1980s, 2006 to 2007) does a huge volume of deals at peak prices at the end of stock market cycles. And as we’ve pointed out over the last year, private equity has been buying companies at multiples that are richer than at the peak of the last cycle, leading experts to fall back on the cliche that the deals are “priced to perfection,” meaning everything needs to work out for them to turn a profit.

The authors even tone down their tame findings from earlier stories in the series. For instance:

You call 911 and Wall Street answers.

You might think that you paid for your fire department with your taxes. But yours happens to be run by a private-equity-owned company, and you’ll likely receive a bill for their services …

… even if they show up late.

The paramedics who treat you for smoke inhalation might show up late, too. Response times for some ambulance companies under private-equity control have worsened.

This is a synopsis of sorts of the first flabby article in their series, which we deigned to shred. The cheery images, with the cartoonish grey smoke balloon and a mere “Oops” signaling an emergency, presumably a fire (with no people, and therefore no reminder of harm, not even a prostrate figure and an obligatory X over each eye to show he’s passed out) and a cute teeny red fire engine running across the screen, trivialize the issue. And again, the warnings are so general as to again deaden any personal reaction. Why should anyone think this warning might apply to them? You “might” be in a town where private equity has take over these services. If so, you’ll “likely” be charged. But is the tab “likely” to be serious? You’ve got no idea. As we wrote:

Another factor impeding dealing with these articles crisply isn’t that they are wrongheaded, but that they are flabby and inconclusive. They are reminiscent of a McKinsey progress review where the team got a ton of data but didn’t figure out the “so what’s” so they instead dumped a ton of slides in a semi-organized manner on the client to show they had done a lot of digging and initial analysis. You might call this the “Here is a lot of shit, I am sure you can find a pony” school of journalism.

The worst of this is that the fact that the Times appears to regard these pieces as impressive (among other things, they created custom graphics for each, as well as giving them lots of real estate) when the basic issues are all old news. Yes, private equity regularly crapifies their offerings through via overly-aggressive cost-cutting and installing know-nothing managers. Yes, alternative investors have been providing public services via infrastructure deals and other types of outsourcing, and their business model virtually requires that they provide a lower level of service at a higher cost to citizens. And yes, they regularly bankrupt companies.

Did any of those “old hat” facts get into the super dumbed-down children’s tale? You tell me.

Agnotology, New York Times Style: A Google Search (or One of Our Archives) Tells You More About Private Equity Than a Big Series Did. Agnotology is defined as “the study of culturally induced ignorance or doubt.” This series is a classic example. The Times made it clear that it regarded these stories as a major journalistic exercise by investing lots of reporter resources and flagging their importance by their length and the use of large, original graphics at the beginning of each one.

Yet the series averted its eyes from most of the bad aspects of private equity by taking only the neoliberal frame of impact on consumers. That meant the writers would be dealing only with anecdotes, since private equity targets narrow niches. Putting on my consulting hat, it’s a major exercise to make even a crude assessment of basic trends across a sector since there are almost never any third party sources of data. So a large swathe of private equity’s bad conduct – stripping and bankrupting companies, tax avoidance, lowered employment, and abusing investors – completely out of the story’s frame. Thus the reporting team chose to cover results would never be able to investigate well.

To illustrate, the second story in their series, on the role of private equity in real estate, was such an embarrassment that I didn’t dare go near it, since addressing all of the errors and misleading simplifications would easily have run to over 10,000 words and readers would not have patience for it. But a few examples: it failed to make any kind of clear distinction for a lay reader of the role played by lenders versus mortgage servicers. It acted as if private equity firms buying foreclosed properties “ought” to have bought in low income neighborhoods or older properties, when that was never the expectation of experts and insiders (I attended industry conferences when the trend was just getting started).

This gives a high-level sense of how wrong-headed the series is:

Private equity can follow you back home when you pay your monthly mortgage. After the 2008 housing crisis, private equity firms expanded dramatically into the mortgage business, as the nation’s banks struggled.

They helped stabilize America’s housing market. But at the same time, some private-equity-controlled mortgage firms have repeated the kinds of mistakes that got big banks into trouble in the first place.

Private equity did not get into servicing and rental purchases in a big way until well after 2009, when the banks had been bailed out and after Obama and Geithner had given them what amounted to a second bailout, the National Mortgage Settlement of 2012. Yes, Bank of America was still saddled with a lot of legacy mortgage costs, but that was more a big drag on profits than a threat to survival.

But the Big Lie is “repeated the same mistakes” which the original article features prominently on its first page, with its jazzy image. Again, no reasonable observer expected better results. The one exception was small, independent “combat” or default servicers, which were high-touch operations that had the expertise and manpower to modify mortgages, since that is much more work than foreclosing. But those economics worked only because regulators for a while had their boots on the necks of the major servicers, in particular Bank of America, which it forced to use third-party servicers for many delinquent mortgages. This salutary development had nothing to do with private equity and there was no reason to expect private equity to emulate it, save for a few bottom-fishers who might buy a portfolio of defaulted mortgages and might work some of them out. You’ve never expect a servicer, whether owed by private equity or a bank, to do that because servicing contracts pay servicers to foreclose, and not to modify mortgages. The underlying problem has yet to be addressed.

A simple example of how big a fail this big ticket series is: you will learn more about private equity, including how it hurts consumers as well as lots of other innocent bystanders, from one article by a lone writer, David Stockman, in 2012 than this entire series with a whole team on it. A representative section:

Except Mitt Romney was not a businessman; he was a master financial speculator who bought, sold, flipped, and stripped businesses. He did not build enterprises the old-fashioned way—out of inspiration, perspiration, and a long slog in the free market fostering a new product, service, or process of production. Instead, he spent his 15 years raising debt in prodigious amounts on Wall Street so that Bain could purchase the pots and pans and castoffs of corporate America, leverage them to the hilt, gussy them up as reborn “roll-ups,” and then deliver them back to Wall Street for resale—the faster the better.

That is the modus operandi of the leveraged-buyout business, and in an honest free-market economy, there wouldn’t be much scope for it because it creates little of economic value. But we have a rigged system—a regime of crony capitalism—where the tax code heavily favors debt and capital gains, and the central bank purposefully enables rampant speculation by propping up the price of financial assets and battering down the cost of leveraged finance.

So the vast outpouring of LBOs in recent decades has been the consequence of bad policy, not the product of capitalist enterprise. I know this from 17 years of experience doing leveraged buyouts at one of the pioneering private-equity houses, Blackstone, and then my own firm. I know the pitfalls of private equity. The whole business was about maximizing debt, extracting cash, cutting head counts, skimping on capital spending, outsourcing production, and dressing up the deal for the earliest, highest-profit exit possible. Occasionally, we did invest in genuine growth companies, but without cheap debt and deep tax subsidies, most deals would not make economic sense.

Yes, Stockman has the considerable advantage of being an ex-practioner, but there is now a large literature on the damage done by private equity, as well as accessible insiders and other experts, like Eileen Appelbaum and Rosemary Batt, whom we’ve regularly cited.

Resorting to Google would have produced better results at far less cost. Yet rather than build on existing knowledge, these reporters delivered a mediocre piece that they seem to believe was a bona fide journalistic exercise. As one maven put it, “At every juncture, the reporters went to some length to reach the most favorable conclusion to private equity possible. The result is that these articles leave you thinking, ‘If that’s all the Times can get on private equity, it’s really not that bad.'”

This series is also a big warning about the state of journalism. It appears that younger reporters so regularly take dictation from sources that have honed access journalism to a fine art that they have lost most if not all of the sense that reporting is often a blood sport, and that the proper relationship between a writer and the object of his investigation is inevitably adversarial if the reporter has found real dirt.

Contrast this series with the Wall Street Journal’s intrepid work on Theranos, where the company sent a team of big-ticket lawyers to intimidate the paper into dropping its investigation. The Journal nevertheless dug in and went toe-to-toe with a company with the blue-chippiest of boards and a peak valuation of $9 billion. By contrast, what passes for business reporting at the New York Times, like this feeble series, is largely out of Dealbook, which will never do more than nip the hand that feeds it.

____

* That before you get to the fact that the possible concern, of monopoly or oligopoly power, isn’t even alluded to here. “Private equity” is not a monolith with a single powerful actor at the top, like JP Morgan’s trusts, where he achieved concentrated economic power in steel, railroads and electricity, as well as owning other important industrial concerns, often related to these core industries. Private equity firms regularly seek to obtain dominant positions in niche businesses, which gives them similar pricing power, but that concern was absent from this series.

I thought it was ridiculous too. They don’t have time for real reporting.

Big difference between reporting the news and making the news. Guess which one most mainstream outlets prefer? Any guesses as to why that preference?

“A few years ago, that glass of water might have come from your local government. Today, it could be courtesy of a private equity firm. It may taste the same, but there’s a good chance your bill has gone up.”

Yes, courtesy is certainly at the top of private equity’s goals. Ha!

“So relax, drink a glass of water and go to bed. Sweet dreams, tomorrow will be a new day with private equity.”

The “new day” bit reminds me a lot of Turnbull’s “new economy” that he keeps talking about. As far as I can tell, no one in Australia (excluding the upper echelons of the financial sector I presume, but those in control of that industry are not really human), really knows what he is talking about, though I could make a pretty good guess.

Fuck these subhuman people and their lies.

Adding: there is also some sort of physiological programming going on with the “You wake up thirsty” opening slide.

And wouldn’t you know it, those great folks involved in private equity come to the rescue with a courteous glass of water!

Fuck ’em.

The Trumpster’s emphasis on negotiating “the deal” reminds me of private equity vultures…

Oh, no, these guys make Trump look like an utter amateur. For instance, there is a great scene in George Anders’ book The Merchants of Debt, which was the result of Henry Kravis and George Roberts letting Anders inside the tent. They were apparently very upset about the title but not so much about the book, which was not flattering, but a lot of the press then managed to be both fascinated and horrified.

In a key scene, Kravis and Roberts go to pitch the RJ Reynolds board on their LBO. They have the board eating out of their hand by the end of the meeting. They gave such a convincing pitch about their plans for the company, their sensitivity to various hot button issues that the board agreed to the deal.

KKR bought the company and did the usual leverage, breakup, and flip game.

Anders has some later, embittered comments from the board members, how they had been persuaded that Kravis and Roberts were gentlemen, as in members in good standing of their class/club, and were horrified to learn otherwise.

The key to negotiating is to get the other side to agree to lots of principles and make admissions against interest, seducing them so they forget that you are or will soon be negotiating with them. You lull them into thinking you are on their side, not an adversary. Trump’s “deal” posture, with its emphasis on mano a mano bravura. leaves a lot of money on the table.

Its amazing that supposedly sophisticated large corporate board members are so easily taken by what are essentially grifters.

The top 1% -.1% have their blind spot. PE has perfected its exploitation.

So why do we, 99%-ers, care? If PE is para-parasitical, I’d take that to be a problem for the first order parasites, not for us, the host organism.

Perhaps we should address the PE para-parasites by eliminating parasitism altogether. The issue is the private ownership of the means of production – there, I said it.

There are 2 parts to this answer.

First: not all the 1% are parasites and many still have notions of fiduciary duty, build for the future, strong communities are good for business, don’t eat the seed corn, etc. The 1% isn’t monolithic in outlook. Board members with this long term outlook are getting played by PE General Partners who have only a short term outlook.

Second:

Because PE, formerly called vulture funds, is destroying good companies and jobs. Because PE is now moving into taking over publicly built and operated utilities and infrastructures with negative consequences for the public and the utility payer.

If it was just the parasite portions of 1% vs 1%, with their own money, I’d say have at it. But now it’s usually with the 99%’s pension money, public utilities and infrastructure, and public services. And beyond the money (if that’s possible in this context), it’s also destroying the social contract, such as it is/was. My 2¢.

adding: PE control of pension fund investments has produced anemic returns in exchange for high risk, illiguidity and fee gouging pensions by PE firms. So PE isn’t even offering the real returns they sweetly promise.

Yes, Martin Finnucane, it may be a problem for us. PE finds the healthcare market very attractive. I’m especially concerned with acquisitions and non-organic growth of Beacon Health Options. Funded first by Diamond Castle Holdings, they have been joined by Bain & Co.

From Bain’s “Global Healthcare Private Equity Report 2015”,

Beacon has gained a huge share of patients in this market (they now serve 50 million people). Claiming they are now the ‘Premier’ organization in behavioral and mental health, they seem to be expanding their role beyond a payers and services intermediary.

Do any readers have experiences with Beacon?

To some extant, that’s why they’re on the board. They’re chosen to be sycophants and believers in the idea that some “great CEO” will save us and deserving of a hyuge benefit package. The foxes may not be watching the hen house, but you can be darned sure that they’ve hired Sgt Schultz to do it.

HRC’s emphasis on raising money from private equity reminds me of how screwed we are…

Blackstone, one of the nation’s largest private equity firms, will hold an official reception in Philadelphia on Thursday featuring its president, Tony James, sometimes mentioned as a possible Treasury Secretary in a Clinton administration.

http://libertyblitzkrieg.com/2016/07/25/hillary-clinton-is-in-deep-trouble-hordes-of-wall-street-executives-descend-upon-philly/#more-36251

As Chris Hedges argues, how do you build a progressive movement with hrc?

Video of the Day – What Should Bernie Sanders Supporters Do? Chris Hedges vs. Robert Reich

http://libertyblitzkrieg.com/2016/08/01/video-of-the-day-what-should-bernie-sanders-supporters-do-chris-hedges-vs-robert-reich/#more-36374

It’s only going to get worse for us and better for them.

Okay, I looked at the video-of-the-day. It mostly consists of very smart Robert Reich pleading with a pig-headed Chris Hedges not to be insane and take any action that would allow Donald Trump to become President. rich asks, “how do you build a progressive movement with hrc?” Bernie already pushed the platform to the left. You build it with her, or without her, or in spite of her, but you don’t get anywhere by allowing Donald Trump to be elected (except, perhaps, into hell, where you find out, too late, that there is no exit). And no reader of NC will think I am exaggerating.

not voting for someone who voted for the Iraq war and whose promoters are the very same institutions that promoted the Iraq war. Fuck them. Fucking parasitical liars.

This reminds me very much of a ridiculous “Top 5 Reasons Fracking Regulations are Whack” (yes, you read that correctly) thing I found on youtube:

https://www.youtube.com/watch?v=HU_PBa2JOnI.

With that sort of seamless integration of some “street slang” into the title of their presentation there can be no doubt they are “keeping it real“. (/sarc)

The Gray Lady has been looking pretty Slim of late. Get it? Slim? As in Carlos looting out the shell he got from the Sulzbergers…

Brilliant skewering of this pathetic piece.

Wow. Just WOW. I haven’t viewed the slide show, but, the MSM is calling Trump a fascist? Goebbels and Bernays would be proud. The bit with the spilled water above prompted me to write. The implication that PE makes its profits from increased efficiency is just over the top.

The future is in doubt.

The implication that PE makes its profits from increased efficiency is just over the top.

Yes it sure is, though the sentiment can be corrected with a change of one word:

PE makes its profits from increased

efficiencymisery.The NYT DealBook fawns over local business. In other news, states with large oil/gas income have newspapers that fawn over fracking.

Great post. This is why I read NC.

Between this and NPR I’m starting to be convinced that all of legacy media is now devoted to the sole task of tucking the Boomers into their graves with a soothing lullaby.

NPR had me ready to rip the radio out of the dashboard at points during the Dem primary season. They haven’t gotten much better.

Then you would appreciate this U. Utah Phillips song:

https://www.youtube.com/watch?v=xOQbiWH1mPo

” I’m starting to be convinced that all of legacy media is now devoted to the sole task of tucking the Boomers into their graves with a soothing lullaby.”

That and getting corporate ad dollars.

Declining middle class? >>> declining viewer PBS/NPR support, more suckling of the corporate teat. Self-perpetuating cycle.

I can’t listen to NPR on the radio anymore when I’m in the car. It’s far too upsetting.

Perhaps the Times is looking for some infusion of private equity money, explaining the fawning coverage?.

http://www.nytimes.com/2016/07/29/business/media/new-york-times-co-q2-earnings.html

“The company reported a slight net loss of about $500,000 for the quarter, compared with net income of $16 million in the second quarter of 2015. The company took a charge of roughly $12 million, largely in severance costs related to the Paris closings”

“Total revenue fell 3 percent, to $373 million from $383 million, in the same quarter a year earlier, as The Times continued to struggle with declining advertising revenue. Total advertising revenue fell about 12 percent, to $131 million. Print advertising revenue slid 14 percent in the quarter, and digital advertising revenue dropped 7 percent, to $45 million. Digital advertising revenue now accounts for more than a third of the company’s total ad revenue.”

Falling revenue, even for digital advertising.

Maybe Jeff Bezos will infuse some money into the Times as Carlos Slim did, Bezos could then save money by combining the New York Times and Washington Post.

Both papers already have about the same editorial content and they could lay of some columnists at both papers..

Ummm. I think there’s a bit of irony in that slide show. I actually clicked through it.

Not sure it’s a commercial as much as a form of satire.

It would make a good Saturday Night Live skit — if that show is still on the air. Frankly I don’t know. But what’s her name is hot — the Sarah Palin actress, I can’t remember — Tina Fey! That’s it.

She could present these slides with a dark skirt and glasses. Maybe the New York Times is dipping it’s toe into the dark and satirical social criticism comedy arena. It may be too dry an approach and they need to be good to succeed — just to compete with what they’re already doing without realizing it.

I admit I jumped into commenting without clicking through, but since watching the (cough) Democratic (cough) convention speeches I would not put any level of condescention past the production team that are currently trying to will their favored version of reality into existence. Maybe this is designed to lie (a double entendre, hat tip to Jim Haygood) right on the edge of plausibility and thus separate those who see it into the smart people who know it’s a parody and the dumb people whose worries about PE are fueled by the slideshow. All I know is I am thoroughly fed up with the pervasive dishonesty we are all swimming in.

“I admit I jumped into commenting without clicking through”

Do people actually do that? :-)

I can’t believe it.

This presentation is a slick piece of dada art form, produced obviously by darkly comic writers in a pre-rebellion stage of psychic dissonance caused by making rent as castle serfs polishing silver doing their best to put some cat doo on the rug right before the banquet. There’s a few poo poos in there. Whew! That smell is not fondue!

I liked the zingers about sweet dreams and paying more money for everything and reaching into your bathroom. You can almost feel a hand coming up from the water in the bowl as you sit on the toilet. hahahahah. Just to grab you! You better look next time you sit down. Even behind the shower curtain. Who knows?

Some 30-something dude in corporate casual attire with modest quantitative skills may surprise you from behind the shower curtain with a contract to sign and payment to make before you squeeze one more out. hahahahahahah. Even a public restroom might be more private (no pun intended). I just wrote that by accident. Best to dig a hole in the backyard, or in a local park (but they probably own that too). When you squat in your local park, at least you’re playing dada too. You dont’ have to just watch it on the internet.

It is really well done irony……… created by men who can’t afford to speak their minds about the financial elite. Like someone above mentioned, newspapers in single industry-dominated cities favor that industry, or else. Their writers toe the line, or find themselves “freelancing” with very few, under-remunerated gigs.

Noticeably excessive fawning is their only option for self-defense, honesty, and self-respect. They are courtiers. Lucky denizens of a modern Versailles. We are the powerless, poorly dressed canaille; we can afford some coarse public sneering.

Noticeably excessive fawning is their only option for self-defense, honesty, and self-respect. They are courtiers.

I saw this in the new Simpsons episode (20th Century Fox) that endorses Clinton. Even though Clinton is heavily favored by the narrative, Hillary and Bill are almost unrecognisable. It is like the person who drew the cartoon version of the Clintons went out of their way to make them basically unrecognizable and blur the connection. Trump, on the other hand, is of course unmistakable.

Something is going on here imo, some kind of internal resistance to a loss of artistic freedom or something.

Scott Adams (Dilbert creator) said that his income dropped by 40% when he started writing positively about Donald Trump’s persuasion skills. He was forced to publically endorse Clinton to protect his own life and livelihood! (No joking)

http://blog.dilbert.com/post/147247313346/when-persuasion-turns-deadly

“Mark Cuban: Trump has a cash problem, and he’ll have to ‘grovel’ to donor class”

The title is self explanatory. The Money Men are horrified that Trump is not groveling for their “money”, as all well behaved politicians must do.

http://www.cnbc.com/2016/06/08/mark-cuban-trump-has-a-cash-problem-and-hell-have-to-grovel-to-donor-class.html

The Democratic Party (and it’s Moneyed Rulers) are merely using their international policy techniques; of war, sanctions, denial of access to the banking system (Policy used to threaten or punish, in order to enforce compliance from Foreign States) onto the individual citizens and businesses of the USA. “Grovel and Obey you serfs! (If you want to eat tonight)”

Any person or business or organization that is Pro Donald Trump will be threatened with, or suffer sanctions and boycotts. They are classed and treated as “rogue states” to be taken over, broken up and sold for a profit. IMO

Private Equity is taking over the State. But that is not Fascism, children (plebs). Fascism always has a funny mustache, a german accent, is named “Hitler” and is wrapped in colorful Swastika Flags so you can clearly identify it. Time for bed now. Sleep tight!

*Sigh*

Did you read the series? This piece is meant to convey that PE is some sort of threat, but does it in such a tame way with such cute visuals that it conveys the opposite message. And if you read the three articles before that, you’ll see how slipshod they are and how they consistently pull their punches. I have it from insiders that the Times committed huge resources to this series and is really proud of it.

I got this from another financial writer:

That’s how I saw it. We’d like to report about private equity, but we’re not really allowed, here’s a children’s story with vague hints about how private equity has squoooozen between you and everything

“They helped stabilize America’s housing market. But at the same time, some private-equity-controlled mortgage firms have repeated the kinds of mistakes that got big banks into trouble in the first place.” – WOW!!!

That’s one way to re-brand one of the largest episodes of predatory lending, slum-lording and upward redistribution of wealth the country has seen in generations, possibly ever.

The NYT is basically a public relations firm for anyone with the right advert dollars or connections to the editorial board/board of directors.

Even more galling is that the NYT admonishes readers that “Your support is crucial to our mission” to get people to pay for a subscription.

I imagine that the Times bidness writers somehow forgot that the 2012 Romney candidacy brought forth extremely critical reporting of the activies of Bain Capital, none of which in any way, shape, or form portrayed this prime example of predatory PE in the manner of this current article…yes, “The Children’s Hour” indeed.

I love “Michael Clayton”!

God almighty, what am I looking at? Is it April Fool’s Day? What a splendid example of the crapification of the art of illustration. High fructose con syrup. Are they hoping to lure in the emoji-loving youngsters?

The whole concept of design has been thoroughly polluted by the PR class. In the interests of happy (or god forbid passionate) consumers, it’s now taken for granted that good design can be judged by anyone, based on no more than a surface glance. Does it have that sanitized, MoMA-gift-shop aesthetic? Ok then, it must be for the Smart People!

But design fetishism is an entirely reasonable approach for a culture that has to feel good about the hundreds of false choices we must make every day. When the shelf is stocked with 50 variations of the same toothpaste, the most important attribute is the package design.

God I’d love to hear Edward Tufte’s take on this wretched thing.

Hmm. Does anybody know how to contact Tufte?

I would tweet him, were I on the Twitter.

I much prefer Bill Marsh’s stuff

you’re not afraid — after reading those dada slides — that that a hand might reach up out of the toilet water and grab you right after you sit down? wow. I’m like checking behind the shower curtain, in the medicince cabinet, behind the door (I forgot about those 5 t-shirts, fuk, I wondered where they went)

even under the rug. the dude might be there! these fukkers are slick — right when you’re In the shower lathering up they’ll shove a hand with a contract at you and make you jump halfway to the moon.

it gets my imagination going and then all hell breaks loose. they could be under the kitchen sink or behind the window curtains, It makes it hard to concentrate.

I’m glad the bus system is still owned by the City of New York. It works pretty well, actually. I was just yesterday on a bus with only 2 people in it beside the driver — that went past 13 bus stops like a taxi. Thi was the fastest bus ride in my history ever. The driver was a young dude who was so happy to be a bus driver it was incredible. He was so happy. It was his first Select Bus route. He’d just been assigned from the normal bus. it was like a promotion or something. The bus went fast bouncing up the avenue through all the green lights and I hung by one arm from the holding bar and talked with him about busses. bouncing and keeping my balance like the floor was a surfboard. The whole bus shook and rattled loudly with its metal noise. It was so cool. I was so happy too. That’s my favorite thing in the world to do, riding the bus. It was fantastic to actually talk to the driver about bus driving and busses. He had a clipped beard and he looked like Che Guevera, just a little. I told him this was the best bus ride I’ve ever had and he beamed. No pun intended. Headlights/beam, etc.

Sounds like a great ride — and much more appealing than a self-driving car :)

Great post. Walking down the aisle of a highballing city bus is like walking on a ship during a storm. Three thoughts that came to mind…damn are these roads uneven…impressive suspension on these bus things…it must be fun driving the express routes or late at night when the streets are wide and empty and each dip in the road becomes a swell on the open ocean.

Noticed the subversive side in the NYT slides too…not many others seem to have picked up on the sinister irony for some reason.

Agreed Yves, the piece was pathetic and I while I don’t expect much from the NYT this was down right embarrassing. On the other hand what do you expect from Andrew Ross Sorkin, friend and official hagiographer of the financial oligarchs. The good news is that the NYT is a dying institution and things like this only serve to accelerate its demise.

You have people like Louise Story and Gretchen Morgenson who are trying to fight the good fight but it is a difficult task in an establishment institution like the NYT. Just ask Jim Risen. It’s a slow process but the alternative news media is eating away at media outlets like the NYT as people come to realize just how bad they are.

Thank you for explaining why I was so disgusted and annoyed after reading that pathetic piece by the Times this morning. It was so condescending it made me sick and I know very little about PE. Thankfully I knew (just) enough. But I worry that many Times’ readers who haven’t informed themselves of PE’s rapacious side will swallow that drivel hook line and sinker. Instead of seeing it for what it is, a valentine to the industry designed to allay concerns, many readers will get a warm fuzzy glow and think, “why shouldn’t our municipality sell off our X, Y and Z utilities to those savvy risk-takers? Government’s broke anyway; they sure can’t do much worse.”

This may not be germane – like I said I’m pretty ignorant about finance and PE, etc. but I couldn’t help but think of the Chicago parking meters fiasco.

NYT does PEU Distort.

McAndrews and Forbes has Frances Fragos Townsend, W.’s Homeland Security Advisor during Hurricane Katrina, the occasion when thousands of toilets stopped working altogether.

Fran flew to Saudi Arabia in Katrina’s aftermath to deliver a letter. I wonder if it was about the 28 pages.

After Fran returned she wrote the abysmal “Lessons Learned” report which omitted the hospital with the highest death toll, including 25 deaths at The Carlyle Group’s LifeCare unit on the seventh floor of Memorial Hospital.

The Bush Katrina e-mails remain secret to this day, especially Fran’s.

A year after Fran’s horrific investigation Bush brother Jeb landed a spot on Tenet Healthcare’s board. Tenet owned Memorial Hospital when Katrina turned it into a death trap.

Just a short trip down memory lane, courtesy of PEUReport.

The NYT series inspired this story on Democracy Now!, which I also found strangely vague and inadequate about what PE really is.

http://www.democracynow.org/2016/8/3/when_you_dial_911_and_wall

“strangely vague and inadequate”

I agree, was hoping and expecting a lot more from DN. They usually deliver, not this time.