Greece continues to suffer horribly on the austerity rack as its European creditors pretend that its unsustainable debts can be paid. The IMF wrote in its latest Greek debt sustainability memo, released this month, that even if Greece does everything asked of it, its growth will be too low for it to be able to manage its debt burden in the long term. That means the IMF under its own rules should not provide further funds unless some of the debt is written off. However, as we explain below, that is something the European lenders, which constitute the bulk of the funding, will never accept.

Normally, regardless of the degree of IMF unhappiness, one would expect, as in the past, the organization would eventually fall into line and participate. But with Trump in, the IMF may be able to wriggle free.

Why the IMF Wants Out of Greece

Last summer, the IMF finally started calling out the charade by signaling it wanted out of future Greek rescues. It’s not clear whether the organization recognized that its standard harsh playbook has much lower odds of working (“working” very narrowly defined) when a country can’t depreciate its currency to get an export boost, or that its conventional analysis showed that Greece was hopeless.

The reason that Greece has become such an important case for the IMF is that Greece is far and away the IMF’s biggest borrower. The IMF is not supposed to be in the business of rescuing sort-of or actual advanced economies. It is in theory a few-year salvage operation for emerging countries that have currency crises. Thus the developing economies that make up nearly half of the votes on the IMF board are very unhappy with how much IMF staff resources and funding capacity is going to Greece.

In addition, the IMF, after a default by Argentina in the early 2000s, has an official “no more Argentinas” policy, meaning it will not extend credit to a country whose program will not result in debt sustainability.

The sticking point with Greece is that the European member states that have been providing most of the funding to successive Greek bailouts have hit the limits of extend and pretend. They have been giving Greece some debt relief in the form of lowering interest rates and extending debt maturities. But maturities so attenuated now that further extensions won’t have much impact in lowering the real debt burden.

Since 2015, the IMF has therefore been calling for principal reductions of Greek debt to make the amount more manageable. But that is utterly unacceptable to the countries lending to Greece. Under their budget rules, the rate reductions and maturity extensions won’t be recognized as losses until years down the road when actual repayments are made, and then they will be spread our over decades. By contrast, if they were to reduce principal, they’d have to show the loss now. And under Maastrict rules, members would further have to raise taxes to fund the loss, which would be contractionary and extremely unpopular.

The IMF has already had two staff-led rebellions, one last year, when a memo was leaked to Wikileaks, and one the year before that. This 2016 post recaps both incidents plus gives more background:

Wikileaks obtained and published an official transcript of a conference call among Poul Thomsen, the program chief for Europe, Delia Velculescu, the head of the mission in Greece, and another official, Iva Petrova, that took place a mere two weeks ago. The conversation makes clear that the IMF team is frustrated by the fact that Brussels, meaning the European Commission, is sticking to fiscal surplus targets for Greece that the IMF regards as unrealistic, meaning there is no way Greece can achieve those goals…

Recall that the IMF had what appears to have been a staff revolt last year, via a leak of a debt sustainability memo for the upcoming, so called “third bailout” of Greece that made it crystal clear that Greece’s debt was not sustainable. “Sustainability” is supposed to be a bedrock requirement for IMF participation. Lagarde managed to tamp down the consternation over the leak and kept the IMF in the negotiations, while also insisting that Greece needs significant debt relief.

Yet here it is, nearly nine months later, and none of the fundamental elements of the impasse of last summer have changed…

The governments of the Eurozone, contrary to the IMF, fantasize that they can make the numbers work by wringing even deeper spending reductions from Greece, even though Greece is proof that lowering fiscal spending, particularly in a weak economy, results in GDP falling so far that the debt to GDP ratios get worse, not better. And that’s before you get to the fact that reducing government services below a certain level results in failed states. Readers speculate that the reason that hasn’t already happened in Greece is the strength of family-based support systems.

The final boundary condition to bear in mind is that Germany, not just the German government but also the Bundestag, which has to approve any deal, regards IMF participation as essential. The Bundestag regards the IMF seal of approval, that the deal passes their debt sustainability analysis, as a precondition for approval. The administration (and the rest of the Troika) wants the IMF in because only it has the manpower and expertise to supervise the compliance of a stage with a “program,” meaning the austerian “reforms” that are a condition of receiving bailout funds.

The short version of what happened next is that Greece was forced to capitulate on key issues and the IMF provided some short term funding while saying it was not satisfied that the Greek plan was viable.

The IMF’s Latest Grim Health Report on Greece

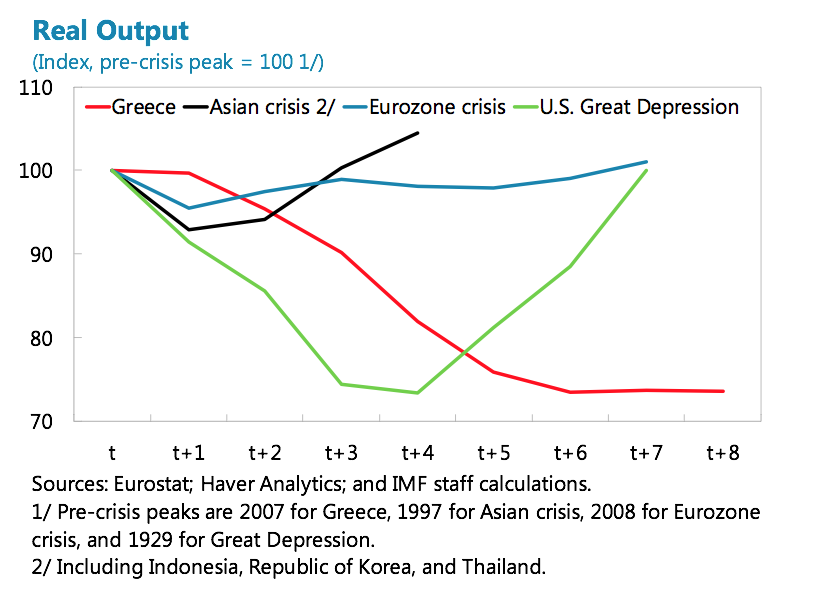

The new sustainability report is a precondition for IMF participation in the next round bailout, which needs €6.2 billion by July so Greece can roll over some maturing debt. It does not make for pretty reading. Earlier versions of this chart have been featured prominently in previous IMF reports on Greece:

This is the IMF’s bottom line. “Fiscal consolidation” is Newspeak for “cutting spending and increasing taxes”:

Fiscal policy: Given its cyclical position, Greece does not require further fiscal consolidation at this time beyond what is currently underway. Medium-run fiscal targets should be supported by preferably fiscally-neutral high quality reforms that broaden the personal income tax base and rationalize pension spending to allow the public sector to provide adequate services and social assistance to vulnerable groups, while creating the conditions for investment and more inclusive growth. Fiscal reforms should be complemented by efforts to address tax evasion and the large tax debt owed to the state.

Financial sector: NPLs should be reduced rapidly and substantially to allow for a resumption of credit and growth. This requires additional efforts to strengthen and implement fully the debt restructuring legal framework and enhance supervisory tools. At the same time, bank governance needs to be further strengthened and capital controls eliminated as soon as prudently possible, while preserving financial stability.

Structural reforms: More ambitious labor, product and service market reforms are needed to enhance competition and support growth. A return to the previous less flexible labor market framework should be avoided, as this would put at risk the potential gains for investment and job creation.

Debt relief: Even with these ambitious policies in place, Greece cannot grow out of its debt problem. Greece requires substantial debt relief from its European partners to restore debt sustainability.

Translation: Even with Greece wearing the austerity hairshirt making reforms, it can’t dig its way out of its hole. The only way is to cut the debt burden.

Naturally, Eurocrats deem this conclusion to be unacceptable and insist the IMF is wrong, even though the IMF has been brought in precisely because it is the supposed expert in these matters. And on top of that, IMF forecasts are routinely wrong by virtue of being far too optimistic, not pessimistic. The Euroskeptic Telegraph reports on the ruckus:

The assessment opens up a fresh split with Europe over how to handle Greece’s massive public debts, as the IMF called on Europe to provide “significant debt relief” to Greece – despite Greece’s EU creditors ruling out any further relief before the current rescue programme expires in 2018.

Jeroen Dijsselbloem, the Eurogroup President repeated that position on Tuesday, saying there would be no Greek debt forgiveness and dismissing the IMF assessment of Greece’s growth prospects as overly pessimistic.

The renewed divisions over how to handle the Greek debt crisis has raised fresh questions over whether the IMF will be a full participant in the next phase of the Greek rescue – a key condition for backing from the German and Dutch parliaments…

Greek GDP has started to grow, expanding by an estimated 0.4 per cent last year, but it is on a very weak path. IMF economists expect the country to grow at less than 1 per cent per year over the long-term, which is too low for it to pay down its debts.

That means Greece’s “public debt remains highly unsustainable, despite generous official relief already provided by its European partners,” the IMF believes.

Normally, IMF participation would be a given because, if all else failed, pressure would be brought to bear at the board level. European countries have about 1/3 of the votes, and the US, 1/6, which together gives them a majority.

But will the US break with its past pattern? Trump is hostile to Germany as a trade competitor. His advisers have also been trying to pursue bi-lateral trade deals with EU members even though that is against EU rules. Trump is seen as so hostile to the EU that Theresa May’s first meeting included a pitch for a strong NATO and Europe.

Thus it isn’t hard to imagine that the Trump Administration won’t pressure the IMF to continue to participate in the upcoming rescue. Admittedly, Steve Mnuchin is likely to take the point of view that market disruption is too high a price and will persuade his boss.

Roubini Global Economics similarly thinks the possibility of the IMF worming its way out or reducing its role isn’t impossible, but is confident Greece will get its funding regardless. From its report today:

At the end of the day, Greece will get its money. Whether the IMF remains part of the program is less clear; but in today’s political climate, Germany cannot afford to cut Greece loose.

This strengthens the hand of the IMF and of Greece in their respective negotiations; but expect talks to go to the wire, with much volatility along the way.

Indeed.

Germay cannot afford to forgive any debts to Greece before its elections in September. The same holds for French and Dutch.

My feeling is that we’re coming to the end of this particular road, but it will be a trigger of larger events – for example, if EU is too busy handling immediate Greek exit from EUR (or another banking crisis), it will pay zero attention to the UK.

On the other hand, the UK could use that to wring concessions from EU. For example, I could see how UK could say buy 10% of Greek debt (about 30m EUR), and in effect freeze it in perpetuity (0 interest infinite maturity), which would mean 10% haircut on the Greek debt – and offset this number (or part of it) against anything that is on the EU divorce bill. This would help EU dealing with the Greek crisis (so UK shows it wants EU/EUR to survive), and give them an incentive to do something nice on trade with the UK.

Germany received a very generous haircut in London Debt Agreement 1952 which allowed it to recover……it has painstakingly set out to deny Greece any similar arrangement. Greek Debt should be written off and Bondholders should learn what Credit Default looks like even if it means the ECB goes down.

IMF has Greece and Ukraine where it has been funding a war……$17.5 bn as latest instalment

http://en.wikipedia.org/wiki/Ukraine–IMF_relations

How it can pump $28bn into Greece as well…….which means UK is bailing out a EuroZone country which was not supposed to be the case as well as being No3 Shareholder in ECB.

Thought is was some trick that deliberately hid (disguised) Greek debt that some large bank had a hand in placing such debt upon Greece until… surprise surprise… ‘how bad the Greek citizens are for allowing the debt to explode’…. ‘we will make the Greek people pay pay pay, sell off all their national treasures and run those people of their lands and tax away everything not nailed down.

The creditors…after charging their vig for the risk taken on their deliberate Greek set-up demand guaranteed full payment….utter rubbish. Great idea to weaponize finance and use it against your fellows in the union – seems to be working out great for criminal creditors but, not so much for a union.

The creditors are going to reap what they sowed – but, they obviously are to stupid to understand what they have sowed.

They are reaping as much as they can but the yield is too low….as they know… so innocent folks die in the field.

The creditors need to choke on their crop

There are (at least) three ways the IMF could interpret its “No More Argentinas” rule:

(1) “We really screwed up Argentina! Let’s change how we intervene in distressed countries, perhaps by following the findings of our own staff that austerity doesn’t work.”

(2) “Argentina was the first country to gaolbreak from our austerity recipes. Let’s make the gaol even stronger so no one follows Argentina’s example!”

(3) “Let’s repeat everything we did in Argentina up to the point of their final loan tranche, because the problem wasn’t that we destroyed their economy with austerity, rather it was our decision to make loans to them once the destruction of their economy was complete”.

IMF says it likes option (3), clearly because they follow the Democrat Party Guidebook on Strategy After Stunning Defeats. That said, even though Yves provides a proper proviso for the Troika with the peanut analogy, this whole conversation is predicated on the fact that even if IMF as the ‘good cop’ in the Troika, does in fact win out and– best possible situation– all of Greece’s bonds are given a haircut, or heck even eliminated in some sort of jubilee– even then, the shackles of austerity would still not be unlocked. Thus the good cop, after calling for haircuts, still calls for the witness to be beaten nonetheless:

Of course as anyone who has studied Argentina knows (or also cf today’s Unbalanced Evolution article on Yugoslavia in links), these austerity measures will be 100% certain to shrink Greece’s GDP, forcing it back to the loan sharks.

Thus it’s mighty sweet of the IMF to Greece a couple of loukoumades during its torture session, but don’t let’s forget that in one hand it offers sweets while in its other hand IMF wields a knout, because while it claims to be offering Option (3) above, its body language is saying No More Argentinas Option (2).

The recent exposure of 2010 IMF documents is also part of this story. These documents reveal how many lies were being told at the time. My favorite part of the linked article:

And they are right. The leaked documents name names and countries. They are unbelievably revealing and reveal deception of such a degree it’s hard to see how the pieces can be put back together–ever.

If Zoe Konstantopoulou were in a position of power things in Greece might make some change. I believe in her integrity, even if there are no soft landings possible.

People will accept hardship if it is combined with integrity, transparency, fairness and compassion. So far the Syriza government has fallen short. So have the EU Commission and the IMF.

“Jeroen Dijsselbloem, the Eurogroup President repeated that position on Tuesday, saying there would be no Greek debt forgiveness and dismissing the IMF assessment of Greece’s growth prospects as overly pessimistic.”

Good to see ol’ Jeb Dieselboom’s still on the case. Hard-headed Dutch and Germans just can’t understand why undisciplined mediterranean types — reeking of olive oil, with flowers in their hair — should be allowed to skate on their solemn debt obligations.

With Greek debt to GDP at a hopeless 175%, the time for such character-based arguments is long since over. It’s a mathematical fact that the Greek economy cannot dig itself out from under this debt burden. It was true after Bailouts I, II and III. And it will still be true after Bailout IV, if there is one.

Eurocrats like Jeb Dieselboom are frozen in their tracks with heels dug in, because they know there’s an excellent chance that Greece is the lit fuse on a tin of Acme Dynamite that explodes the eurozone to bleeding hell.

Good luck, Jeb. You gonna need it son.

Another hardhead chimes in right on cue:

Translated into the American vernacular, Schaeuble seems to be telling the Greeks, “Don’t let the door hit your ass on the way out.” But Greeks reply with the magic password — “TARGET2” — and the door opens to let them out into a nondescript alley in Frankfurt.

That seems very likely but it may depend. If Trump wants to tell Merkel to pound sand, would anybody be surprised if that info made it’s way through the pipeline to Government Sachs ahead of time so they could adjust their positions accordingly before official word got out?

Also I noticed this from your link yesterday –

Any idea what the bolded part is referring to? I couldn’t tell if the payment system referred to was supposed to be for a new currency. maybe they’ve been reading here and decided to get the infrastructure in place before they tell the Troika ‘Oxi’ ?

Prepare the electronic system of transactions through Taxisnet which I had designed, I had started building it and even announced it to the new Minister of Finance, Euclid Tsakalotos, when I delivered the Ministry.

Yes, I noticed that as well. Varoufakis has some good insights on EU economic issues, but nothing in his record suggests to me that he has the knowledge or expertise to oversee a wholesale currency replacement after a hard exit, or even understands the scope of the problem. Note the first person singular. “I” had designed? “I” had started building? Perhaps that’s a translation artifact, but it still doesn’t fill me with confidence.

If Syriza had begun serious planning to dump the Euro 2 years ago when they took power they would, by now, have a workable payments system ready to go online. Varoufakis’ system might not have worked in Summer 15 but if his team had been kept onboard they would have something by now. Give every man, woman and child a cell phone and an app if you have to, it can be done.

Euro-denominated debts could be repudiated at some other convenient date. Or does the EU want to hand Greece over to Turkey on a silver platter? Do they want hundreds of thousands of migrants pouring over the Greek border into their heartland?

Greek government failure to take the proper steps toward de-euroization is malpractice almost as bad as what the ECB, IMF and Germany have done. Italy needs to start today. So does France. Leave the euro to the Germans, where it belongs.