Yves here. This post drills into some of the claims made about the advantages of France leaving the Eurozone, as in a Frexit, and finds many of them wanting. Reader input and reactions are very much encouraged.

From my vantage, author Grégory Claeys needs to get up to speed on Modern Monetary Theory. His third concern, regarding how much deficit spending France could do, is based on the misapprehension that France would need to borrow to run deficits. He’s thus managed to miss the big point of exiting the Euro: as a monetarily sovereign nation, French deficit spending would be limited by the need to avoid generating too much inflation, which in turn reflects how much demand needs to be created to employ otherwise slack resources.

The flip side is his final point focuses on the economic dislocation of a Frexit. As we, aided by many bank IT experts, in particular Clive but also seasoned members of the commentariat, have stressed, the technology implementation of a new currency is a very long lead time process due to the fact that:

1. There is tons of code involved, including lots of legacy code that can only be inspected and changed line by line

2. There are numerous parties involved. Any task requiring coordination is far more cumbersome and time consuming than one that can be accomplished internally

3. Banks are already very thinly staffed in their IT areas and the guys who know their way around the legacy code have been and are continuing to retire, which does not bode well for banks and other financial players being able to mobilize enough resources even if they decided to throw a lot of budget dollars at it

By Grégory Claeys, an Associate Professor at the Conservatoire National des Arts et Métiers in Paris where he is teaching macroeconomics in the Master of Finance. He previously taught undergraduate macroeconomics at Sciences Po in Paris. Originally published at Bruegel

A debate is raging in France about the benefits and drawbacks of the Euro. The argument echoes that of the first half of the 1990s – between those in favour of joining the Euro and those against. However, the parallels are misleading and should not inform today’s debate. The Euro has been the official currency of France for almost two decades now, and exiting it would be very different from choosing not to join in the first place. In this blog post, I expose five myths about the supposed benefits of Frexit.

Myth 1: Frexit Would Unambiguously Boost French Competitiveness

Advocates of leaving the Euro claim that Frexit would provide a competitiveness boost to French exports and essentially solve two alleged problems: the persistent trade deficit and the decline in market share for French goods, especially compared to Germany (see graphs below).

Indeed, in theory, a flexible exchange rate provides an automatic adjustment mechanism to correct external imbalances. It plays the role of a shock absorber for country-specific shocks and allows countries to quickly improve their price competitiveness. And a nominal devaluation should be easier and less painful to achieve than an internal devaluation inside the Eurozone, which would requires a period of lower inflation and wage growth than euro area partners.

First of all, these two problems are largely exaggerated. The decline in export market share since 2000 is not specific to France and is actually the norm across industrialised countries. It is the result of China and other emerging countries joining the global economy. Germany’s stable share is actually an outlier in comparison to other advanced countries. As for the French trade deficit, it has in fact slowly decreased over the last 5 years and its current level (-1.3%) is not a concern.

In addition, the Euro has weakened over the last two years due to the accommodative monetary policy of the ECB. And this has already provided a significant boost in terms of price competiveness. Since mid-2014, the Euro has depreciated by 25% against the US dollar and it cannot be considered overvalued for the euro area as a whole.

In fact, the main issue comes from imbalances within the Eurozone. According to a recent estimation, France is, in real terms, overvalued by 7% with respect to the Eurozone average and by 20% with respect to Germany. A new French currency (let’s called it the Franc for simplicity) would thus probably depreciate against the Euro after its introduction.

At first glance, recent estimations suggest that the French imports and exports are sensitive to price shifts[1], so a nominal depreciation against the Euro would help France improve its trade balance after a few years. Indeed, I am not denying the powerful effects of exchange rate fluctuations on the trade balances (as confirmed again recently in an IMF paper). However, for the effects of a depreciation to be beneficial and long-lasting, inflation needs to be contained and therefore monetary policy needs to be credible to avoid a dis-anchoring of inflation expectations. Otherwise, the inflation spike resulting from a sudden increase in import prices can lead to second-round effects through an upward adjustment in wages and other prices which gradually erode the gains from the nominal depreciation.

Equally important, if France were to leave the Euro, it could be followed by others. In that case, the Franc would depreciate against northern European currencies, but it would probably appreciate against new currencies from Southern Europe. Looking at France’s main trading partners, it is true that Germany represents by far the most important single export market for France – 16% of French exports. But Southern Europe as a whole amounts to a similar percentage.

Given the current sectoral specialisation of French industry, an increase in price competition resulting from an appreciation of the Franc against southern currencies could end up being more detrimental for the French trade balance than the benefits of the depreciation against the currencies of Germany and other Northern countries.

So, overall, it is true that a flexible exchange rate is a helpful adjustment mechanism to absorb temporary shocks and to reduce external imbalances, if combined with a credible monetary policy framework. However, France does not really have an overvaluation problem relative to the rest of the world and within the euro area the country is not very far from the average. Supposed gains in terms of price competitiveness would thus be much less significant than what Frexit supporters suggest.

Myth 2: Frexit Would Lead to a More Appropriate Monetary Policy

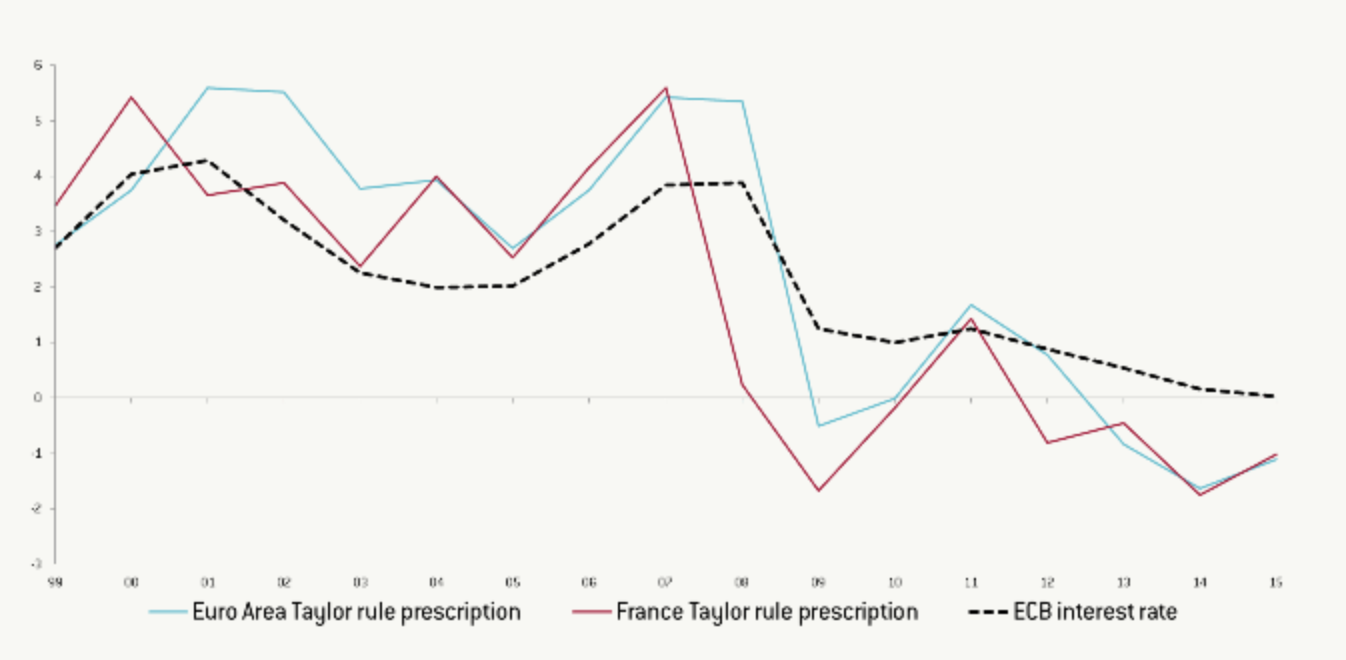

Another major benefit promised by Frexit advocates is an independent monetary policy tailored to the domestic economy and not to the Eurozone average. This argument is valid in theory, but in practice it is once again not relevant for France. France is generally well represented by the Eurozone average because its economy behaves like the average of the euro area. For instance, the interest rate prescriptions provided by simple Taylor rules (see graph below) for France and the euro area are very similar. This suggest that monetary policy decisions made by an independent Banque de France following a mandate similar to the ECB’s would not be so different than the ones taken by the ECB governing council.

Source: Bruegel based on Eurostat, AMECO, Fries et al. (2016), Holston, Laubach and Williams (2016).

An exit from the monetary union could actually make French monetary policy more difficult, especially in the short term, as it might lead to an increase of inflation to undesired levels. Not only would the Franc depreciate, but the experiences of countries abruptly changing exchange rate regimes suggest that some overshooting would take place beyond what fundamentals require.

Depreciations make imports more expensive, and past episodes of rapid currency depreciation (see table below) suggest an immediate surge in inflation. Given the importance of imports in some key sectors in France (energy in particular), a strong depreciation of the Franc would have a negative effect on the economy in the short term and would (at least) lead to a temporary spike in inflation.

To ensure that the spike is only temporary, a credible monetary framework would need to be established quickly. This is, however, incompatible with other policies advocated by the partisans of Frexit, who also want to deprive the Banque de France of its independence and authorise direct financing of the government by the central bank. This appears especially incoherent with the promise by Frexit advocates to keep inflation low after leaving the Euro.

Frexit advocates want to get rid of the Euro to boost French exports, but paradoxically they are also sceptical towards a fully flexible exchange rate regime because they fear excessive volatility in the foreign exchange market. In fact, general public support for flexible rates has always been relatively weak in France. That’s why some Frexit partisans are pleading for the return to the ECU and to the European system of fixed exchange rates that was in place before Maastricht. It is strange to want to leave a common currency only to bind yourself to another currency in a fixed exchange rate system.

Even putting aside this paradox, pegging oneself to a foreign currency requires policy credibility to achieve exchange rate stability. Monetary sovereignty under such a system is in practice illusory because the Banque de France would have to adjust its policies to defend its parity and thus adapt its interest rates in reaction to its neighbour’s cyclical situation (be it the Eurozone or Germany) [2]. In this case, the current shared sovereignty in the Governing Council of the ECB appears preferable in terms of macroeconomic policy performance, as well as sovereignty.

Myth 3: Frexit Would Relax Constraints on Fiscal Policy

Frexit partisans suggest that leaving the Euro could free the country from the constraints of European fiscal rules and allow the French government to pursue a more countercyclical fiscal policy. But countercyclical fiscal policy doesn’t seem to be a French speciality anyway, and leaving the Euro could damage France’s credibility, making it difficult to borrow the money needed for counter-cyclical spending.

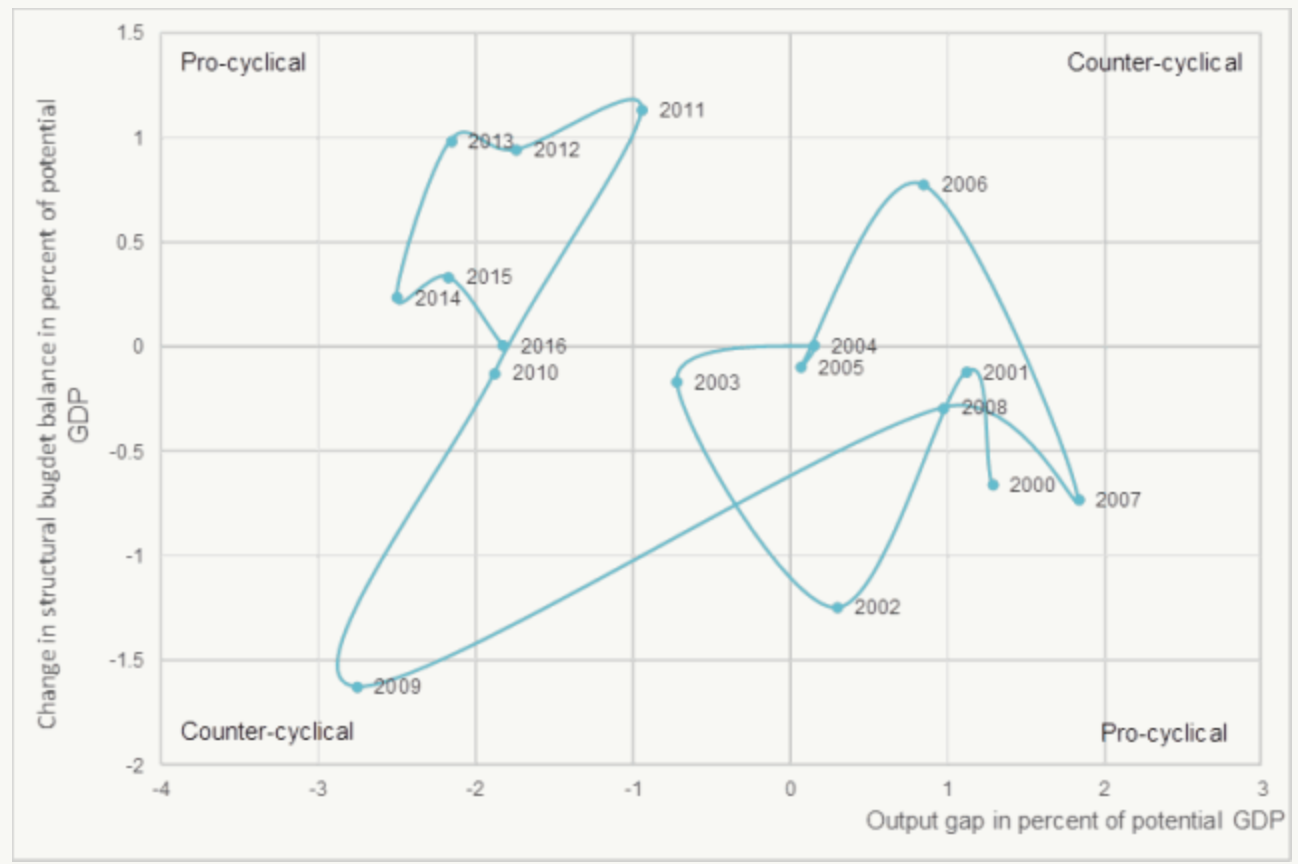

As the graph below shows, over the last 17 years, French fiscal policy has only been countercyclical in 2006 and 2009. The rest of the time fiscal policy is mainly procyclical. In good times the government increases spending or cuts taxes, even if this drives GDP further above potential. In bad times the government increases taxes and cuts expenditures, even if growth is negatively affected.

Figure 4 – Fiscal stance in France

Source: World Economic Outlook (October 2016 – IMF)

But it is difficult to believe that this behaviour is driven by the European fiscal rules. As I explained in a paper published last year, it is true that the current European fiscal framework is highly imperfect. This has led the European Commission to provide mistaken policy recommendations to member states during the crisis. These recommendations might have played a role at the height of the euro crisis (from 2011 to 2013 in particular), encouraging a fiscal tightening at the worst moment. However, most of the time, bad fiscal policy in France seems to be self-inflicted.

Frexit would probably not change that – quite the opposite. The French government might not have to listen to recommendations from the European Commission anymore, but Frexit could also cut off the market access needed to implement countercyclical policies.

Conversion of public debt from Euros to Francs might be possible from a legal perspective[3] but such a drastic change in the conditions of debt instruments could be technically considered as a default by rating agencies. This would make it more costly for the French government to borrow from financial markets, and could even result in France losing access to international markets for a few years.

In any case, it would be logical for international investors to require higher interest rates in new bond issuances to compensate for the depreciation of the currency and to hedge against inflation risk. The French government would also be under much more market scrutiny. In addition, in the long run, franc-denominated debts would lose the benefits of being issued in a reserve currency, a status reserved to countries with a long history of credible and stable monetary policy.

For all these reasons, borrowing from international markets to support the economy when needed could become much more difficult and expensive. And trying to circumvent that by using the central bank to finance budget deficits will not be a good idea at a time where it needs to establish its credibility to anchor inflation at a low level or to defend a stable exchange rate.

Myth 4: Frexit would be painless for French companies

Currency fluctuations affect economies through various channels. Apart from trade, another important channel is the balance sheet channel. The combination of currency mismatches in the balance sheets of some economic agents and unexpected currency fluctuations played an important role in the financial crises that affected emerging markets at the end of 1990s and the beginning of the 2000s.

The main mechanism at work during these crises is pretty simple. The implementation of what were considered credible fixed exchange rate regimes, such as currency boards, led agents to think that it was safe (and cheaper) to have un-hedged positions in foreign currencies. However, the abrupt abandonment of these exchange rate regimes and the subsequent domestic currency depreciation led to a significant increase in the value of the debt issued in foreign currency, making it difficult to repay and sometimes ending in a series of bankruptcies[4].

The French government and French banks, companies and households do not borrow much in foreign currencies. When they do they typically hedge themselves against exchange rate variations. The issue with leaving the Euro would thus not be about existing debts in other (non-euro) currencies. The difficulty would be converting assets and liabilities in Euros into Francs.

The governing law and jurisdiction of the financial contracts would determine whether an instrument can be converted, or if it will remain in Euros. To make it simple, if a debt is contracted under French law, the conversion into Francs should be possible. If it is contracted under foreign law – generally English or American law – it will continue to be denominated in Euros after Frexit. Some actors will therefore end up having to repay their debts in what would become for them a foreign currency, and some un-hedged currency mismatch would appear rapidly in their balance sheets. (Because the Euro was considered irreversible, there was no need to protect oneself against the redenomination risk coming from debts contracted in Euros under foreign law).

Most household and SME debts take the form of loans from French banks (or French subsidiaries of foreign banks) which are therefore contracted under domestic law and should easily be converted into francs. Conversely, assets of French banks in the form of domestic loans would be redenominated in Francs, while on the liability side deposits made by households and corporations would also be converted.

The biggest risk would therefore come from other debt instruments such as cross-border loans from foreign banks and bonds issued under foreign law by French banks and big non-financial corporations. In aggregate, the situation could ex ante appear to be manageable, but many companies would be affected by currency mismatches[5]. In practice, at the micro-level, the transition would be chaotic and lead to thousands of endless legal disputes that would hurt economic activity. These mismatches would lead to many instances of debt restructuring, possible bankruptcies or bailouts of systemic actors, and the subsequent negative impact on creditors, shareholders and taxpayers. Frexit would end up looking like a lottery for all companies in France: having more assets or more liabilities converted into Francs would determine whether they are bankrupt or richer after Frexit.

Myth 5: Frexit Would Be Smooth and Orderly

To anticipate what could happen in such an exceptional situation, it is natural to look at historical experiences of currency break-ups. Rose (2006) offers a database of such departures from currency unions since World War II and counts 69 such occurrences (not taking into account the abandonment of currency boards or hard pegs). This paper is often quoted by Frexit advocates because Rose does not find much difference between the countries leaving and staying in the monetary unions in terms of macroeconomic performance.

The problem is that these data provide little useful information for today’s France. Most monetary union dissolutions in the sample took place after the independence of former European colonies or after the fall of the Soviet block. Current circumstances differ in many relevant ways: the size of the French economy; its financial development; the importance of the financial sector; the financial links between France and other European countries which have been subject to free capital movement for more than two decades. A Eurozone breakup, or even just Frexit, would be an unprecedented event which could not be compared with the currency dissolutions of the last sixty years[6].

In fact, the very idea of quietly organising a referendum in France followed by a calm negotiation with European partners is illusory. The main issue is that a ‘preventative’ bank run and capital flight would take place as soon as people consider Frexit a credible possibility and expect their deposits to be converted into a weakening currency. Depositors participating in a bank run would be perfectly rational in that case[7]. The chart below shows that in Greece, a slow-motion bank run started as soon as people started believing that a euro exit was a credible possibility. This movement accelerated in 2015, and resulted in bank closures and the imposition of capital controls at the end of June. The same would happen in France to avoid a banking meltdown. Again, the Greek example is informative about the negative impact of such a move: after capital controls were put in place, real GDP fell by -1.7% during the third quarter of 2015 alone, as the economy was frozen because of banking restrictions.

In France, a euro exit is still considered as a tail risk by markets and depositors for the moment, but sovereign bond markets have already reacted to changing probabilities of Frexit. If Frexit was becoming more probable, deposit withdrawals and the sovereign risk premium could increase quickly.

Another risk is that Frexit could happen by accident, before it could be properly organised or even before a referendum. Imagine, for instance, a scenario in which the Front National wins the elections and the French government’s rating were downgraded by all major ratings agencies below BBB- (following Fitch and Standard & Poor’s rating system). This would make it difficult for French banks – who could also be facing a bank run at that time – to access the main refinancing operations of the ECB, as they would not be able to use French government bonds as collateral in the Eurosystem monetary operations. In turn, they could be forced to use the – more expansive but also more flexible in terms of collateral – Emergency Liquidity Assistance (ELA) at the Banque de France under limits set by the ECB’s Governing Council.

The situation would then be pretty similar to one in Greece in February 2015. And as in 2015, the ECB would be caught in extremely political discussions about whether it should continue providing liquidity to the French banking sector to face the run or not. The decision would be even more complex for the ECB this time because the ECB would face a government openly favourable to an exit from the monetary union. And if its decision were to stop providing liquidity, the Banque de France and the French government would have no other choice but to decide whether to impose very strict capital controls or to launch a new currency to provide the needed liquidity to the banking sector. The risk of Frexit could thus become a self-fulfilling prophecy.

The probability of such a scenario is today extremely low and the sequence of events to arrive at that point unlikely. But this thought experiment shows how quickly such a situation could spin out of control and lead to a disorderly exit from the monetary union, which could have devastating consequences for the French economy.

Overall, it is important to realize that the French financial system is at the core of the euro area financial system and is tightly interwoven with the global financial system. Frexit would lead to a freezing of financial flows and bring the global financial system to a cardiac arrest. The failure of Lehman brothers could look like a small shock in comparison, and even that had major real economic implications.

Notes

[1] For this depreciation to result in an improvement of the trade balance, French exports and imports need to be sensitive enough to prices. In economic terms, the Marshall-Lerner condition has to be fulfilled, i.e. the sum of the absolute value of price elasticities of import and export has to be bigger than one.

[2] Committing to a fixed rate with the Euro or with a basket of European currencies (in case the Euro would disappear after Frexit) would lead to a come back of the so-called ‘n-1 problem’ inherent to any fixed exchanged rate system. Basically, if n countries participate to a fixed rate system, only n-1 central banks need to defend their fixed rate towards the nth country. This often results in an asymmetric monetary system in which one country, the most credible one generally, can pursue a monetary policy related to its own domestic goals (inflation and/or growth) while other countries adjust their interest rates to maintain the parity without taking into account their internal economic situations. This was mostly the case from 1945 to 1971 with the US at the centre of the Bretton Woods global fixed exchange rate system and after its demise with Germany at the centre of the European ‘currency snake’ from 1972 to 1979, and of the European Monetary System after 1979.

[3] Contrarily to the private sector, redenomination of the French public debt from euro to francs should not be a problem because almost all of it (approximately 95%) is issued under French law, so the value of past debts should not increase in terms of francs if the new currency depreciates.

[4] The case of Argentina at the end of 2001 is a perfect example of this mechanism: the unexpected end of the currency board and the conversion in pesos of deposits held in dollars were followed by a massive depreciation of the peso, by more than 60% in trade-weighted terms. Given this, many debtors saw the value of their debt from abroad explode in terms of local currency, which led to huge losses, difficulties to repay their debt, and in the end a series of defaults.

[5] Several papers have recently attempted to measure the extent of the potential mismatch that would result from Frexit. Durand and Villemot (2016) using macro data from the BIS argue on the contrary that an exit should be manageable on aggregate because French companies and households own enough assets abroad, whose value would be increased in terms of francs by the depreciation, compared to the relevant liabilities that would not be converted. It is true that assets and revenues from abroad could mitigate the negative impact of having debt in a foreign currency. Nevertheless, the issue with using aggregate numbers is that it misses completely potential mismatches in specific firms. For instance, if half of the firms would be vulnerable to Frexit and the other half would benefit from it, on aggregate the economy could ex ante appear to be able to cope well with such a shock even if that’s not the case given that it would be impossible to redistribute positive and negative impacts across firms. To avoid that pitfall, Amiel and Hyppolite (2015) build a comprehensive firm-level dataset of major French banks and non-financial corporations. They show that, in their sample, between 41% (in the best-case scenario) and 59% (worst-case) of euro-denominated marketable debt is issued under foreign law and would therefore not be converted in francs. Moreover, they also show that numerous corporations with ‘foreign debt’ (in the financial sector in particular) would not generate enough income from abroad to be able to cover for the repayment of their debt in euros, which could quickly lead to very serious difficulties for some firms, and ultimately to some defaults, or to some significant bail-outs of systemically-important financial and even non-financial corporations by the government.

[6] The break-up of the Czechoslovak currency union in 1992 is often used as an example of a smooth and orderly currency separation that could be emulated in the Eurozone. But, the two situations are very different. Czechoslovakia had been socialist for more than four decades and its financial system was in its infancy when it happened. Moreover, the negotiated solution between Czechs and Slovaks included massive transfers from the strong currency country towards to the weak currency one. This would be unthinkable today in the Eurozone.

[7] If depositors expect the new currency to depreciate (which again is one of the goals pursued by Frexit advocates), they will have an incentive to take their money out of their bank accounts before the conversion, keep it in cash or put it in a bank of another Eurozone country, wait for the new currency to depreciate, convert their money in francs once it has hit rock bottom, and make a profit (in the new currency) equivalent to the depreciation that has taken place.

It still remains true that France would be better off without the Euro, and the sooner they start the better off they’ll be. If Greece had begun work on a new drachma in 2012 they’d be in a much better position today. Instead, thanks to fear-mongering and do-nothing politicians, they’re in the same hopeless position. Italy too would benefit. Yes there are pain points all over — some of which exist by design — but it simply needs to be done.

As for the EU, it’s a racket and a ratchet. Its main purpose is to destroy unions and wages and the safety net in western Europe. If I lived in one of those countries I wouldn’t be happy about it, but then I don’t belong to the .1%.

Europe has two options: destroy what’s left of democracy via an intrusive police state (well under way in the US) or stop punching the working class quite so hard. Elites never willingly dial down on the latter so I think we can expect quite a bit more of the former, plus relentless propaganda and control of social media. I’m thinking that Trump’s election was duly noted and will not be forgiven.

Also you have an open Bold tag….

You like most others are falling into the fallacy that (allegedly) Yogi Berra pointed out, of treating theory as the same as practice when they are not the same

As we have described, and bank IT experts have repeatedly confirmed, it would be a minimum of three years to do the IT work to get all the many players involved to introduce a new currency, and pretty much everyone agrees in reality you should allow for 2x the time. When the Euro was introduced, it took 8 years of planning and 3 years of implementation for it to go smoothly, and banks had vastly less code then than now.

It is not fear-mongering to point out that the Eurozone is a roach motel, and that getting out will create enormous dislocations that will hit the poorest hardest. People like you who hand-wave it away are irresponsible and reckless.

Look at what happened to Greece. A mere two weeks of having its payments system almost completely non-operative brought the economy to its knees. Food shortages were staring and would have become acute in mere additional week. You are seriously recommending hunger and starvation in a country already on the verge of being a failed state? That is what would have happened within a couple of months. Greece is not self-sufficient in essentials: food, fuel, and pharmaceuticals. No functioning payments system means a seize up of imports. And switchover to a new currency without the groundwork being done means a seize up.

And there’s no way to do this without creating a bank run. You need tons of people involved to get the IT work done, domestically and abroad. Introducing a new currency means forced redenomination of the deposits now in banks. Everyone with an operating brain cells knows drachma/francs will fall in value relative to Euros. So they pull Euros out and/or move funds to banks outside the country. This collapses the banking system. That’s presumably why Modi did his redenomination in such a cack-handed way (although as Jerri-Lynn has described long form, there were parts of his program that were even stupider than necessary and hence did more damage) because you have to keep this all secret to prevent bank runs.

I don’t doubt any of your points. But we all know the currency union was a horrible idea and is bound to fail sooner or later so when and how does that happen? People are suffering now too.

As I said, look at what happened in Greece in a mere two weeks. Not only did things get vastly worse but there would have been no prospect for any improvement for years with a disorderly exit and no planning whatsoever.

You people keep dismissing that bad situations can get vastly worse, and quickly, and no way to go back once you’ve crossed an event horizon.

France with all its problems still has excellent health care and much better social safety nets than here. That goes out the window with a disorderly exit.

If anyone (economists or politicians) were even acknowledging the enormous operational issues and has some plans as to how to mobilize resources, that might be different. But this is worse than the usual economist “assume a can opener”. This is not even seeing you need a can opener and a can, and with lives at stake.

Your thinking leads to conclude that the only way to make joining the Euro reversible without economic collapse, is through a long, careful process where all parties participate in a willing manner and in good faith.

Sadly that is correct. This is basically like disarming a very large bomb. It can be done but it is fraught and takes the cooperation of quite a few parties. Not necessarily all; a consensus of big players might be able to persuade/muscle the smaller fry to go along.

But we’ve had a big decay over a very long time in the caliber of leadership. Even though national leaders always watch out for their personal and state interest, a couple of generations ago, there were more leaders who were well grounded in history and thought over longer-time horizons. One of my favorite examples (admittedly very dated) is Talleyrand, who despite being fabulously corrupt personally, was dedicated to lofty political aims through the entire course of his political career (his priorities even now would be seen as progressive). Above all, he was horrified at the devastation of war and sought to engineer political relations to promote lasting peace. The remarkable brokering he did at the 1815 Congress of Vienna, where who got what in the dismantling of the Napoleonic Empire was up for grabs, set the foundation for an unprecedented 100 years of minimal conflicts in Europe. Keynes similarly recognized that sustained trade surpluses set the foundation for international conflict, but was unable to implement his Bancor remedy at Bretton Woods.

It does not take many visionary and persuasive figures to make a big difference in outcomes. But perversely, it is also seems easier for well placed venial, petty, or simply stupid leaders to do great harm than other well placed individuals to implement lasting beneficial programs and policy architectures.

I agree with you. Probably Varoufakis had a window of opportunity to negotiate an amicable return to the drachma -I remember he could get support from Scheible- but instead it seems he modestly tried to lecture EU bosses on how to run their shop.

Do these comments mean you think the parallel payment system for Grexit would not have worked despite what Varoufakis said about it being ready to go?

I think userfriendly brings up a valid question. So what do you see as the endgame here? This unhappiness with the EU cannot go on forever. The only option for poorer countries is more austerity. Are Spain, Italy, Greece, and now France (?) caught between a rock and a hard spot? Are their only options to choose a fast death or a slow motion death?

Something is bound to happen – what do you see as that “something”?

The possible options are pretty much what has already been played out here in the U.K. with Brexit. A rock-and-a-hard-place choice between leaving the union with huge risks and costs (which will fall heaviest on the poorest) and staying under the auspices of the EU’s insistence on econocracy/ordonomics. It’s worse than neoliberalism.

What isn’t going to be possible — although you’d be forgiven for thinking so if you read the more crazypants sections of the British press — is leaving the EU (or the Euro for that matter) in a pain-free, risk-free, consequences-free way.

It’s vaguely possible that the EU can be reformed — but where is the leverage that can be applied to bring that about going to come from? So put that in the Not Gonna Happen box.

So:

1) Everybody cooperates nicely to allow a country to exit the Euro without chaos. Not going to happen — because nobody (especially Germany) wants to help others to leave the Euro.

Besides, in the mass of EU regulations, treaties and agreements there are no provisions whatsoever to deal with that scenario. Currently, the only formal way to leave the Euro is to leave the EU!

2) A country attempts a solo exit. Chaos will probably ensue, with untold suffering for its population — and other countries may be tempted to exit soon thereafter as well, leading to European-wide turmoil.

So given the risks, not gonna happen either. Everybody is too scared (rightfully so) to take the plunge.

3) Everybody remains in the Euro. A few more Eastern European countries join in. The situation continues degrading, with countries like France, Finland, Spain, Italy de-industrializing, losing jobs, and becoming purveyors of raw labour power and captive markets for countries like Germany, Austria or the Netherlands.

At some point, the system will collapse due to internal pressures and frictions — and we are back to turmoil, chaos, and suffering for the populace.

So it is chaos and suffering now, or chaos and suffering later.

While postponing chaos and suffering is a reasonable strategy, one must keep in mind that when the proverbial manure hits the fan in a distant future, the economic and social structures will have changed and have been degraded so much under the Euro and associated agreements (six-pack, two-pack, budgetary treaty, etc) straightjacket that recovery will be even more difficult — if at all possible — than by attempting an exit earlier.

The solution would be a thorough reform of the EU — but this is not going to happen either.

Clive, Yves and others correctly point out at the sheer difficulty of re-denomination because of all that heap of intricate, inter-connected banking legacy software.

Guess what? The whole EU is a heap of intricate, inter-connection political legacy system — accumulated over 60 years. And no matter how you take it, significant changes require unanimous decisions. And all that talk about “two-speed EU”, or “concentric circles EU” or whatever have been going on for decades — without major effect.

Those countries that chose to be outside the EU, and did not sign the Euro-plus pact were clever (see Sweden). At this point, the Euro looks very much like a suicide pact for the participants.

If the degradation in #3 is sufficiently extended and plays out over a long enough period, I think there will eventually come a point where #1 starts to look like a better idea to everyone in comparison. Absent any leaders with the will to confront the issue now (and I agree with Yves that they are in short supply) I think this is unfortunately the best case scenario.

This could come about altruistically if the EU finally wakes up, pays attention to the evidence, and realizes that austerity doesn’t produce the results they think it does and they have perpetrated a great injustice by forcing it on (e.g.) Greece. Or it could come about selfishly, if a specific problem case brings the contradictions and inconsistencies of the EU into such sharp relief that it becomes worthwhile to assist an exit just to make the problem go away. I don’t think there is any chance that the first outcome will happen publicly given the mental leap it would require from the likes of Germany, but it’s possible that it may be recognized privately by key individuals who will then work quietly to support a sensible resolution. Much like how nobody actually believes any more that the Greeks can pay off their debt, so the game is now about how to stealthily write it down over time while maintaining the fiction for domestic political consumption that it’s being paid.

Apparently, it is now being reported in the German press that Germany was too hard on Greece and maybe Greece should be allowed to exit. This is only a small start but even this line of discussion would have been unthinkable in 2015.

Sweden is in the EU. (But not the eurozone.)

We talk about slow moving death vs. a fast one but the reality is that the population is not homogenous. Every scenario makes each group act differently. France has gone bankrupt many times throughout its history even if many suffered.

There are strong groups who win in disruptions. There will be frictions leading to a black swan event.

The injustice throughout the euro zone will lead to chaos whether the computers are ready or not.

I probably should have written financial woes instead of bankrupt…

The EC is sufficiently freaked out these days to begin to make changes. Watching the coverage on France24 and DW… but it is hard to understand just exactly what they are trying to change – they (Germany and France) have proposed a “two tier” EU wherein members are differentiated somehow. I can only guess it is a way to equalize the effect of the euro across all countries. So that Germany would have to adjust (I assume send some reimbursement to say Italy) for the big free ride it gets by using what amounts to an undervalued euro. So does/would this address the problems?

would this sort of adjustment be as effective as a bunch of sovereign currencies? and isn’t this what Varoufakis wanted the EU to do a few years ago?

War.

On this subject, are you aware that NC, and its series on the difficulties building an entirely new currency infrastructure, were specifically mentioned during a recent TRNN interview with Costas Lapavitsas?

https://www.youtube.com/watch?v=iLrzBujNXTU

He basically brushes aside your entire argument.

He also admits he never read it. So this is hardly worth taking seriously.

To my mind, the solution is to kick Germany out of the Euro.

It won’t cause a bank run in Germany, or anywhere else, and it will reign in a predatory exporter in the Euro zone.

We’re always hearing about the horrors of Communism, with the Holodomor — the man-made famine in Ukraine in 1932-33 — held up as an example of how evil it is and how it leads to crimes against humanity. Yet, when Capitalism causes famines — Ireland in 1845-52, India 1876-78 — or threatens to do so, as in the example above, it gets a free pass. As if it’s just an unfortunate natural event. As if exporting food from the affected country for money (as in the earlier two examples) or cutting the country off from financial services because banks consider getting their loans serviced as more important than people dying of starvation is just a part of the natural world and not the product of deliberate human action.

We need to take this discussion out of the technicalities of finance and IT and put it squarely in the realm of human rights, with those responsible for crippling a country like Greece’s ability to import the food it needs being charged with conspiracy to commit crimes against humanity and treated accordingly.

This notion that we all just exist at the mercy of these greed-crazed monsters has got to end.

You can sit there and say you don’t like it any more than you like our dependence on the internal combustion engine and how it is wrecking the planet. Do you have a solution for auto dependence that will take anything less than a generation to implement? Banking IT as a feature of advanced and even developing economies is every bit as fundamental to day to day provisioning.

Saying it is anti-democratic, which is true does not make it any less a binding constraint.

To put it more bluntly, and I hate to sound mean, but whinging is not a solution and naive idealism will do a tremendous amount of harm, as in kill people even faster than neoliberalism does now. I don’t see any remedies or alternatives from you. I have told you it will take war mobilization and years of planning, and even then the economies involved will take huge costs that will hit their poorest, most vulnerable citizens hardest. You are shooting the messenger.

I’m proposing a simple straightforward solution. Prosecute the people who decided to render Greece’s payment system non-operative. Charge them with conspiracy to commit a crime against humanity. Bring them up before the International Court. Somehow, the Hague has no difficulty prosecuting people like Slobodan Milošević, Milan Babić, Ramush Haradinaj, Radovan Karadžić, Ratko Mladić, Ante Gotovina, and so on. Why do these guys have impunity?

If payment systems are that vital — and I’m not disagreeing with you that they are — then cutting them off is the same as deliberately cutting a community off from food, water, and other necessities. It amounts to a war crime.

If the banking IT code is written so it automatically causes starvation, then it needs to be re-written. If that takes several years, then it takes several years.

If it’s not an automatic feature of the code, then the decision to induce starvation was made by individuals outside of Greece who should be prosecuted. Starvation is not a bargaining chip in negotiations.

I really don’t understand why you’re trying to defend these bastards by deflecting attention away from them and onto the technicalities of how the starvation was to be induced.

The Holocaust couldn’t have occurred without trains to carry all the victims to the concentration camps. But the way to prevent future Holocausts is not to eliminate trains, it’s to establish using them for that purpose is a crime against humanity and those who do so will be prosecuted.

Wowsers.

Please tell me where the totalitarian super-national government comes into place to implement these laws and enforce these sentences? You can’t pronounce actions that were legal when undertaken to be retroactively illegal. That’s what despots do. The actions you don’t like were perfectly permissible operations of the European Central Bank. In fact, we pointed out repeatedly that under its rules, it had been cutting Greece slack for years that it never should have gotten.

Your solution assumes stripping away national sovereignity, which is what leaving the Eurozone was in part mean to achieve.

Moreover, in the case of Greece, it was merely removing ECB support that led to the Greek bank failure. And you miss that word merely leaking out that a Grexit or Frexit were underway would lead to a bank run. So you are again proposing increasing the power of institutions that haven’t succeeded in bucking neoliberalism. How is this supposed to work?

As for bank IT code, your suggestion is even more laughable. We’ve written repeatedly that most large bank IT projects fail. The official rate is over 50%, the unofficial rate is no doubt over 80%, since large organizations work hard to hide or minimize expensive cock-ups.

Banks know they have a legacy code problem. They might be able to fix it but readers have estimated it would take 100% of their profits for several years….with high odds of project failure.

I’ve said repeatedly that banks should be operated utilities because the state subsidies are so large. If we can’t even get executives prosecuted for nearly destroying the global economy, or adequate reforms, there is absolutely no way any deemed to be private institution will be ordered to sacrifice all its profits for a state-ordered fix to something that is not an emergency. It was hard enough just to get Citi, which should have been nationalized, merely to quit paying dividends for a few quarters to rebuild its capital base.

Get a grip. The left is failing to hold the line on universal health care in many countries. Even in the one of the last bastions of popular support for unions, months of strikes in France failed to prevent changes to labor laws that made it easier to fire workers. You’ve got no chance mobilizing people around an issue like this. You can handwave all you want.

And thus leaving the Eurozone without adequate planning (which becomes impossible due to the bank run problem) and cooperation (which is unlikely due to ill will, incompetence, and venality) means ordinary people will wind up much worse off with an exit compared to staying in the Eurozone, as bad as it is, and we aren’t under any illusions about the damage that neoliberalism does.

You do not like hearing that the alternative to bad is worse. The people who win in a sudden exit are speculators who will pick up pieces on the cheap and further consolidate economic power at the top.

So we wait for the next crisis where bank earnings go to zero and then we can invest in the systems without fear of ruining the earnings outlook…

But aren’t European banks nearly there?

I agree bank regulators should be all over banks to Do Something. That is one reason we’ve written about the IT mess every time we have some intel or a good news hook. But it’s clear the authorities don’t want to force the banks to fix it. Everyone seems to be in, “This won’t go critical on my watch, so I don’t care” mode.

Fix what?

Don’t believe the banks have the expense money in their balance sheets to put this in plan, and if they do, it would still mostly fail.

The fact that the finance industry – the banks – operate without adequate regulation at our expense is annoying. How is it that we the people guarantee the value of the dollar with our full faith and credit (aka our promise to tax ourselves into deprivation) when the banks make grandiose braindead deals just for profit and crash the entire world… then we come along and pick up the pieces using our only tool – austerity – and then they do it all over again? I don’t like “ordonomics” that doesn’t even address this inequality – ordonomics should do an adequate amount of industrial policy to keep society working. It’s like private finance has representation without taxation.

“Reader input and reactions are very much encouraged.”

Really, Yves?

It seems to me loyal readers just get slapped down for making comments on this issue that don’t comply with your exacting requirements, which made me very reluctant to participate in this thread at all. But I think UserFriendly and justanotherprogressive asked a perfectly legitimate question that I certainly would like to see a response to: what is the endgame?

Requisition of your national central bank is the endgame.

If you can’t restore your own currency because of the logistic and the IT involved, the only logical solution is to stay in the euro but to take back control your central bank (wich still exists as a part of the eurosystem of central banks) so that it fulfills its mission in accordance with your national needs (and not those of Germany…)

This will break the euro, of course, but the damage will be widespread and not limited to your own country…

Yes, the individual central banks could issue their own euros.

Which would result in an increasing the money in circulation, of the euro, devalue the Euro, and leave the Germans even larger surpluses, due to an undervalued currency.

Which appear to be the opposite of the requirement.

Economics has some wicked feedback loops built into its fabric.

If you can’t get all what you want, you have to settle for the second best option. Requisition of your central bank doesn’t allow to devalue your own currency. But I doubt Germany will take advantage of it : as soon as France begins printing euros, Germany will start its own exit process…

I wrote a comment on this and deleted it.

I think it’s all too clear what the endgame is, on the terms we see here: a complete crash, probably not restricted to Europe. Unfortunately, Yves and various IT people have made an excellent case.

Of course, that’s hardly the only collapse scenario. Norb’s comment, near the end, makes sense: stock up on staples (buying in quantity saves you money, anyway) and get to know your neighbors, because you’re going to need them. Living in a place that can feed itself would be a good plan, too. Ohio probably isn’t a bad bet.

However, the scenario so far ignores a crucial point: France isn’t Greece, or Ireland, or Portugal (which apparently has gamed the system with some success). It’s one of the indispensables, and the most prosperous of the lot, barring Germany. The EU may be able to be vindictive with Britain, always a peripheral player, but as the article implies, if they try that with France, they bring the whole system down on their heads.

Assuming the players are rational, a French decision to exit would trigger a communal effort to reverse the Euro, with enough time and enough money. Not painless, I’m sure, but probably doable. If they need 6 years, they get 6 years. And negotiations to remodel the Euro would begin the same day, because otherwise, the temple comes down. that would also involve big changes in leadership, because of the all-too-public failure. All those countries have parliamentary systems that can change quickly if they have to. And they would need capital controls to minimize the bank runs.

That might be too optimistic; vindictive irrationality is all too likely. But it’s at least possible, because unlike Greece, France has all the leverage it needs. That’s if, say, LePen actually wins the election – the polls are very much against her, and not by the puny margins Hillary was counting on. But the underlying reality, as others have said, is that an unsustainable situation will end, one way or another.

I agree withdrawal from the euro would entail a bank run, etc This is why as you – Yves – have pointed out, the euro is a trap. Here are some general thoughts.

The technicalities in Grégory Claeys’ article are fairly complex, but, projected into the future, highly speculative about alternative hypotheses – and leaving a lot (Germany’s behavior for example) outside or marginal to the conceptual box.

So my comment will be a bit more general.

I believe – and have believed from before it was created – that the euro was a huge mistake – but it will be very difficult, almost impossible, for the countries trapped in it, to disengage and escape from it for all the reasons that Yves and others have outlined. The euro from the beginning was, in my opinion, a large-scale con job, driven by political, not economic imperatives.

I remember (and I am working from memory) back in the late 70s or early 80s, when Italy was contemplating joining a fixed change rate regime – the prelude to the euro – Enrico Berlinguer (National Secretary of the Italian Communist Party) criticized the proposal: With a fixed exchange rate, he said, industries, to protect their competitiveness, would have to be very ‘disciplined’ about wages and costs, and this would weaken the unions – and the working class – because they would no longer have much room to maneuver or negotiate, and this would, obviously, weaken the Communist Party, not only because of the weakness of the unions allied with the Party but also because the Party’s bargaining power vis-a-vis the Government would be weakened [the PCI, even in opposition, had great bargaining power]. I thought he was absolutely right; and I thought too, that a society with the social-economic dynamics of Italy (underdeveloped south, large bureaucracy to support that underdevelopment, heavy internal transfers, high levels of corruption, mass of small and medium industries) would find being locked into a fixed exchange rate regime suicidal. And so it has proved. Radical ‘reforms’ might have provided sufficient flexibility for such a situation, but those reforms were, on the whole, not forthcoming and would have largely been neoliberal in nature and would have fulfilled Berlinguer’s prophecy.

What applies to Italy, applies, in different ways and by different measures, to France. Once proud nations have, in effect, been reduced to dependencies of Berlin and Brussels or the ECB. Citizens instinctively feel this.

Without going into the details of import-export elasticities, and fiscal balance, and competitive devaluations, I think some basic points stand out:

Without a currency, countries are no longer sovereign. [this is much bigger than just exchange rates, fiscal policy is radically constrained – complex argument, but I stand by this]

Emperors and kings have known this for millennia. No coinage, no power, no kingdom.

Without sovereignty governments cannot act (except on marginal issues).

If governments cannot act they cannot respond to needs or desires of their citizens.

If they cannot respond to the desires of their citizens they lose the respect of their citizens.

Hence… the citizens begin to say ‘fuck you!’

In addition, if political leaders cannot act, but cannot admit they cannot act, they indulge, as do the European elites, in elaborate feints and double talk and technical jargon and evasiveness and empty slogans to disguise their impotence. This further reduces their prestige. Then, if the citizens then do revolt, they are ‘reactionaries’ or ‘racists’ or just plain stupid – the ‘deplorables’ of the EU.

Into this void, Populism flows.

The problem with the euro is it is an ill-designed halfway house; it takes away sovereignty and eliminates a whole array of policy instruments – not just exchange rates – from governments’ armories, but does not replace national sovereignty and sovereignty and its policy instruments with a federation with all the common responsibilities – and common policy instruments – and transfers – that come with a federation; thus governments are left in an impotent limbo, and, for this and other reasons (Schengen, premature enlargement east, premature labor mobility, terrorism and the migration crisis), large sectors of the citizenry are in revolt. The ‘accountant’s’ approach – calculated possible losses and gains from staying or going – misses, I think, this bigger picture.

Ideally, France, Italy, and the others should leave the euro.

In fact, trying to leave the euro would be – will be – catastrophic.

So – move towards a federation with fiscal transfers, mutualized debt, etc?

First, no citizens, virtually no citizens, of Europe want this.

And it is unlikely – and, in my opinion, not really desirable: unless Italians become Germans. A consummation in my opinion which neither Italians nor Germans nor anybody else should wish for.

The social, economic, cultural systems are very different, and the values and priorities of the different societies are radically different and homogenization around one model would, I believe, imply a great loss, socially, culturally, psychologically, and creatively, not only for Europe – for which diversity has been a great blessing (competitive social models and styles of creativity) as well as a curse (wars) – but also for humankind.

Also a federal system containing such diversity could easily be much too rigid to accommodate the differences and could explode – as it is already in danger of doing (even with recent hopeful signs, for pro euro pro EU people of Schulz and Macron and etc).

The EU could quite happily exist without the euro. Growth rates for Italy, France, Spain, Portugal, etc were quite solid in many periods before the euro, though declining of course after the ‘miracle’ years. Many problems accumulated – rigidities excessive taxation, role of the state, etc. The euro did not solve any of those problems, it added new even more problems, and made it more difficult to solve the old ones. The euro now that it exists is almost impossible to get out of, that I admit. Hence, I think, a tragedy. [To those who say that exchange rates don’t count anymore, I would reply that I don’t believe it – ask the USA, China, Germany, Japan, Mexico, or, indeed, Canada; exchange rate adjustment is still one of the most powerful and simple of adjustment mechanisms]

As for the policy elites & the euro – one cannot say they were not warned – by many, many people.

Maastricht and All That a classic essay by Wynne Godley – London Review of Books 1992 – is very articulate, cogent, goes down to basics – and it was prophetic, of course.

Thank you for this very full and sensible IMO comment.

Putting matters in a nutshell one could say that the problem lies in the fact that Mitterand did not understand economics (it is an oversimplification but one with some truth to it).He wanted to get France out of a situation where it had to follow the Bundesbank’s lead on interest rates the whole time and thought, I believe, France could retain control of fiscal policy while sharing control of monetary policy, which arguably worked for a few years until it did not.

The only constructive solution is to move the eurozone forward to political union but this we are told is politically impossible, which indeed may be the case. What is needed is political leadership which can change that situation but does that leadership exist?

The eurozone puts me in mind of a rock-climber who is stuck half way up a rock face and is too catatonic with fear to move forward. Going back is all but impossible without falling and serious injury. The danger is that he stays stuck there until he falls from exhaustion or is blown off. The only way he gets out safely is to find the courage and the moves to go forward but that he cannot (at present) do. What worrying times these are.

The closing of the Greek banks in the summer of 2015 (by engendering a liquidity crunch with the cessation of the ELA mechanism) was arguably an illegal action by the ECB. Even Draghi was aware of that and so worried about it that he even commissioned a legal opinion. See here:

The EU treaties mandate that the ECB guarantee the smooth functioning of the payments system of the eurozone. Forcing the closure of the entire banking system of a nation is the exact opposite of that mandate.

The pretext for the ECB cessation of the Greek ELA – Emergency Liquidity Assistance – was the “excessive” amounts of Greek TARGET2 liabilities (fast approaching 100 billion euros) and the corresponding advances of newly created euro reserves by the Greek central bank to the country’s commercial banks, under the terms of the ELA. (Bank clients in Greece were transferring massive amounts of deposits to Germany and Luxembourg because they feared a Grexit). But the pretext was clearly bogus – in 2012 deposit flight from Spanish and Italian banks reached the hundreds of billions of euros and the ECB never threatened a liquidity crunch. Quite the opposite: it offered generous long-term liquidity to the Spanish and Italian banks under special purpose LTROs.

Spain and Italy are big countries and the ECB would never dare a forced closure of their banking sectors. Greece however is a small country and the ECB simply violated its mandate in order to get the country on its knees, ready to accept all of the EU terms for an “agreement”, by suddenly depriving it of a banking sector.

Anyway – in a sense the present situation in Greece is a consequence of wrong choices by the country’s leadership. They did not denounce as illegal the forced closure of the Greek banks (amazingly, it seems that only Draghi was aware of that illegality, of the fact that the ECB must guarantee the functioning of the payments systems of all the eurozone nations!). And – even worse than that – they did not accept the Schäuble proposal for a negotiated exit from the euro with a debt restructuring. That proposal would likely pave the way for an improvement of Greece’s dire economic situation – instead, Greece got a new “aid” package and its economy is now once again in recession.

And the Schäuble proposal would also show other countries that it is possible to leave the euro in a coordinated, negotiated way that prevents the chaotic situations of an unilateral exit. By dismissing it without further consideration Tsipras (and the Syriza leadership) did a disservice not only to his own country but arguably to the whole of Europe and even the world.

Thank you! This really helped to give me a better understanding of the situation.

This part many of us remember well from the schoolyard:

“Spain and Italy are big countries and the ECB would never dare a forced closure of their banking sectors. Greece however is a small country and the ECB simply violated its mandate in order to get the country on its knees”

Bullies only pick on those much smaller and weaker than themselves.

“Right, as the world goes, is only in question between equals in power, while the strong do what they can and the weak suffer what they must.” —Thucydides

It has nothing to do with bullying, an infantilizing trope and a category error on the level of “government is like a household.”

“As for the EU, it’s a racket and a ratchet. Its main purpose is to destroy unions and wages and the safety net in western Europe”.

Sure you feel good writing that, such a purely evil EU, yet your view is grossly simplistic, manichean. Our world is a lot more complex than you are able to grasp at this time.

“Elites never willingly dial down on the latter …”

Yes they do, do not underestimate the will and skill of elites in turning friendlier to the populace when it is necessary.

Ruben: “Sure you feel good writing that, such a purely evil EU, yet your view is grossly simplistic, manichean. Our world is a lot more complex than you are able to grasp at this time.”

Why respond to arguments that you find insufficiently factual or nuanced with ad hominems like “more complex than you are able to grasp? Please try to do better, and/or respond with more concrete objections than these hand-wavy invocations of “complexity” and wishful thinking about (static?) elites’ ability to transcend their myopia only when (you? they? deem it) “necessary”.

I did mean it as ad hominem, I’m sorry it came across that way to you and possibly to others.

Sorry again, it should read: I didn’t mean it is ad hominem …

Because of the complexity, the way it stands now, the elite is so fractured and spread out, I doubt it will give an inch.

It seems to me that fracturing and over-stretching facilitates losing grounds.

The thing is that you have the 1% in Greece, France, Germany, etc.

Which of these will recede to give something to Spain for example?

Ok….. MMT

If the argument is that France would not have to borrow because it is a sovereign nation can someone please explain to me why the U.K. borrows! Presumably to prevent inflation?

Remnant of the gold standard. Also, you might want to note that during major wars and banking crises they immediately drop the pretense that they can’t just create money as needed. The motivation to not create money as needed is to keep unemployment high as this decreases the bargaining power labour. I Suggest Kalecki’s essay on the topic:

Political Aspects of Full Employment

Creditor class lobbying may also be a factor.

1. I don’t know the requirements but it may be a legal holdover from the gold standard era, as with the US.

2. As MMT experts point out in the US, it is also useful to have a risk free asset to serve as the basis for pricing in securities markets. There was a lot of hand-wringing in the US in the 1990s when Bob Rubin was keen to get rid of the Federal debt and with it, Treasury bonds. He and his allies didn’t grok that to keep the economy from contracting, another sector wound up borrowing, hence the unnatural collapse in household savings rates to zero and even negative in at some points in the early 2000s, and the now-famed mortgage/housing bubble.

3. In MMT, taxes for a sovereign currency issuer serve to drain demand (reduce spending), provide incentives and disincentives, and redistribute income.

Lately I’ve just been wording that argument like this:

They don’t borrow money; They print two kinds Pounds and Bonds, they are functionally the same thing but people that don’t intend on using their money immediately trade in their pounds for bonds to earn interest. It is a public service that governments offer, there is no necessity to do it.

I’ve also been saying Nixon taking us off the gold standard made the national debt irrelevant, but none of those geniuses we elect noticed yet.

Lordie. Please read our considerably detailed posts on this.

1. Designing and printing the currency alone takes months.

2. You then have to refit the ATMs to handle two kinds of currency Tell me how long it takes the manufacturers to do that, to kit out the machines, and then to fill them with currency. All these ATMs have delivery schedules, with so many trucks and people to handle routine deliveries. No bank is gonna greatly increase staff and how many trucks it has for a one time event. Clive will hopefully give way more sordid detail on this front.

3. You still have to code all the systems to handle a new type of currency, no matter what you call it. You are back to our “minimum of 3 years, more like 6” problem.

My comment was merely an explanation of how MMT functions, not the perils of switching currency.

Sorry for jumping on you.

It’s ok, I get heated some times too. ;-)

Only 5% of transaction in value in France are made through cash. It is true that 55% of transactions in number are made in cash, but it is strictly for convenience purpose and because retailers frequently asks for a floor for the transaction.

France is debit card country and debit card is systematically offered to retail customer (it is actually compulsory by law). About 80% of these cards are compatible for contactless payment, with a target of 100% by the end of the year.

I would actually be surprised if Francs were printed at all…

You are totally missing the point that the greater dependence on non-cash makes matters much worse. A new physical currency could be designed, printed, and distributed in probably a year. The digital side is bare minimum three years and the best guesstimate is six years plus.

And you need the digital side in place for trade on any scale. We wrote at some length about the utter nightmare of Greek business trying to purchase critical imports with currency. It was barely workable and destined for long term failure as physical cash (Euros) was leaving the country. And recall as we said getting new currency designed and printed is a minimum of six months, and then you have to distribute it. Clive can probably refine the estimate and opine if/how you would prioritize key importers.

But that aside, Clive below says you are making shit up, which is against our written site Policies (see “agnotology”). If you do this again, you go in moderation.

Nice try, but you’re comparing apples and oranges. Business-to-business or business-to-government payments are vastly higher, in value-per-transaction terms, than retail payments. Average retail transaction values are in the tens or low hundreds of euros. Business transactions are typically tens to hundreds of thousands of euros per transaction. So you can’t, when talking about “transaction values” mix up retail and commercial ones willy-nilly.

France is not particularly anti-cash. Please see https://www.ecb.europa.eu/pub/pdf/scpops/ecbocp137.pdf Table 13 on pg. 40. France is not in the top tier or even tier two. It is actually behind countries like the UK in tier three. It is in tier four, alongside notoriously cash-dominant economies like Italy and Greece.

I’m all for using statistics in an argument, but please do not try to bamboozle people by misapplying them. I’ll come down on any such hoodwinking like a tonne of bricks.

The French Banking federation doesn’t agree with you. See http://www.fbf.fr/fr/files/AC3CBC/Les%20Moyens%20de%20Paiement.pdf

First page ” La proportion des transactions faites en espèces est plus faible en France que dans d’autres pays européens. Ainsi on estime à 55 % le nombre des transactions payées en espèces en France contre 89 % en Italie, 75 % en Allemagne et environ 60 % au Royaume-Uni. Seuls des pays nordiques comme la Suède et la Finlande ont des taux inférieurs.”

I translate for you : “the share of cash transaction is lower in France compared to other european countries. Thus one estimate that 55% of transactions are paid in cash in France against 89% in Italy, 76% in Germany and 60% in the UK. Only nordic countries such as Sweden and Finland have lower rates”

They get their figure from the French Treasury who itself got it from McKinsey.

Of course, you can say the French Treasury “Inspection des Finances” and McKinsey are clowns who don’t understand payment systems, but be careful of the “agnotology” curse :-) …

You are now engaging in broken record, which is repeating your original point when Clive rebutted it. That is also an invalid form of argumentation and an explicit violation of our site Policies.

Plus you also ignored the initial point I made, that a higher percent of electronic transactions makes matters worse, not better, for an exit. You can solve the cash part in a year, less if you are lucky and ruthlessly well organized. The electronic part will take way longer.

On this narrow point I fail to understand how in the grand scheme of things the technical headache of changing from one currency to another, as much for long-term political and social reasons rather than just short term economic reasons is a significant reason for not doing so??

Bearing in mind that in the UK for example (I would assume France and others are broadly similar) only 3% of all money or ‘broad money’ is actually circulating notes and coins etc then this should be a relatively simple, but by no means painless, reversal of the 3 year long transitionary process that led to the introduction of the Euro across the EZ in the first place.

This was achieved by the gradual removal from circulation of the various sovereign currencies francs, DM, lire etc at the time.

Both currencies existed in parallel and were both legal tender for a period of three years and ensured a reasonably stable transition if memory serves.

The currency in your pocket doesn’t just change (unseen) in terms of purchasing power, it also changes in terms physical shape and design for various reasons, and inevitably brings technical issues with it – many of which add to GDP too,I’m sure.

I can’t, however, think of any examples where a major economy has gone into prolonged meltdown as a result, but I’m all ears if anyone can think of a good example.

Your memory serves you ill. In the Euro switchover, there was a two-month window when legacy currencies could be used in transactions. After two months, the only place you could take your legacy currency was to a bank to be converted into euros. This was possible for (depending on the country’s policy) up to three years after the euro’s introduction. All electronic payments had to be processed in euros from the day of Euro introduction.

Why respect the rule? Because of euro zone sanctions? That would not be an issue any more. Many countries use the usd why not France the euro?

Dollarisation, Euroisation, baseball-card-isation, whatever clever ruse you are thinking of lands you in the same predicament — you give the currency issuer the same rights over your sovereignty that the ECB (already) has with France.

How does that improve matters?

It gives you the transition period.

Yes indeed, you move from one jailhouse to another. But, alas, you remain incarcerated.

you give the currency issuer the same rights over your sovereignty that the ECB (already) has with France

That is not entirely true. The Banque de France still exists, even if it acts under guidance and supervision of the ECB.

Thus France could perfect requisition its central bank and issue the euros it needs…

This would make for a volatile euro… I could actually see this really bothering those still in the zone and maybe forcing them to be a little more amenable.

‘After two months, the only place you could take your legacy currency was to a bank to be converted into euros. This was possible for (depending on the country’s policy) up to three years after the euro’s introduction.’

Some Portuguese Escudo notes are still exchangeable for Euros until 2022.

I bow before your pedantry Clive, but my point remains the same.

I can also see a scenario with dual currencies until the systems are fixed. It’s amazing what a nation can do when people work together… like going on the moon.

Rose Nylund: “But how can it be impossible? The ancient Egyptians built the pyramids, didn’t they? Why can’t we do this simple thing?”

Dorothy Zbornak: “Sure Rose. If you’ll just give me 10,000 Hebrew slaves, I can, too.”

Dual currency might not bring prosperity but it does eliminate the computer system hurdle.

It only eliminates the computer system hurdle if you are proposing to have the parallel currency managed on a cash-only basis. Otherwise, you’ve increased the hurdle because you’ll need to either remediate the existing legacy computer systems to become dual-currency capable or else introduce a new, entirely ring-fenced, duplicated payment system infrastructure.

Not to mention you’ve turned an entire nation into ForEx day traders. It fails my mother-in-law test, just as a for-instance.

Mother-in-law: Clive, we’re out of cat food and Munch (the cat) is hungry.

Clive: Okay, I’ll go to the store to buy some. Do you want me to pay in Euros or Francs?

Mother-in-law: I don’t know Clive… I’ve got more Francs in my purse so I want to spend those especially now as they seem to buy less each week… but it is cheaper in Euros. What should I do for the best?

Clive: I don’t know really. Let me get my friend craazyman to come over. He runs a class at the University of Magonia “how to trade currency pairs and make your fortune”, it’s suddenly become very popular; I’m sure he can help you decide…

Euro instability… Hmmm… It would definitely give France some bargaining power.

I never thought we’d bailout and QE the way we did. Yet it happened.

Clive, to play the devil’s advocate, because of discrepancies between the official and black market exchange rates, a de facto dual-currency situation exists in many third-word countries, not for short periods but as a chronic thing, too, and yet people somehow manage…

OK, he said, (holding up a target for people to aim at) Lebanon has an extremely sophisticated and proportionately very large financial sector which works in LBP and Dollars interchangeably, from drawing out money from ATMs to paying in restaurants to settling taxi fares with a fistful of notes in two currencies, and nobody bats an eyelid. Accepting that something of the sort in France would be extremely complicated to introduce, the questions then are (1) is it literally impossible and (2) would it partly respond to the demand for a repatriation of economic decision-making which is what is behind this, and on which I’ll try to comment later if I have time.

This is neither here nor there, but they probably didn’t use slaves (who in such numbers would’ve required a standing army of police to keep under control), just corvee, during the non-planting season.

The euro money policy promotes centralization to the detriment of weaker countries and the regions in the stronger countries.

Instead of strengthening the weaker countries, it forces immigration into the stronger ones without proper funding leading to chaos and a gradual weakening of the stronger countries.

….again switching to pedant mode ‘Clive’ and attempting for a moment to occupy your brain space…

Great quotes, but they deliberately and cynically miss the point being made.

From your example, the pyramids weren’t built by 10,000 Hebrew slaves for the greater good (of Hebrews) or as a common goal (of Hebrews)….Yaweh, this is exhausting….,but because not building them was not exactly an attractive or viable alternative (for Hebrews) in the circumstances.

You’ll never persuade these people! They’ve made their minds up and that’s that. Also, Clive is wrong abouut baseball cards, youd have to have soccer cards since they don’t play baseball in Europe. If you called them football cards they’d be confused with U.S. football and the systems wouldd break down. One goal is 6 points in one system and only 1 in the other. And a field goal is 3 in one and maybe only 1 still in the other. What a mess!

To be fair, though, it wouldn’t be at all easy to go back to the Franc — UNLESS (and this the most important and least observed fact) it was part of a broader European-wide political agreement where the nations worked together to stablize introduction of a new currency over time and it was well planned where the systems issues were acknowledged and dealt with carefully over time.

Shocks are only shocks because they’re shocking. If the shock wasn’t a shock it woldn’t be a shock.