Yves here. Michael Hudson regularly discusses how classical economists were concerned with h rentiers diverted from productive activity and would discuss land rents as a prime example. This article discusses how this line of thinking was abandoned and how that has led to distortions in contemporary economic analysis.

By Josh Ryan-Collins, senior economist at the New Economics Foundation, as well as a visiting research fellow at the University of Southampton Business School. He was the lead author of Where Does Money Come From? Follow him on Twitter: @jryancollins. Originally published at Evonomics

Anyone who has studied economics will be familiar with the ‘factors of production’. The best known ‘are ‘capital’ (machinery, tools, computers) and ‘labour’ (physical effort, knowledge, skills). The standard neo-classical production function is a combination of these two, with capital typically substituting for labour as firms maximize their productivity via technological innovation. The theory of marginal productivity argues that under certain assumptions, including perfect competition, market equilibrium will be attained when the marginal cost of an additional unit of capital or labour is equal to its marginal revenue. The theory has been the subject of considerable controversy, with long debates on what is really meant by capital, the role of interest rates and whether it is neatly substitutable with labour.

But there has always been a third ‘factor’: Land. Neglected, obfuscated but never quite completely forgotten, the story of Land’s marginalization from mainstream economic theory is little known. But it has important implications. Putting it back in to economics, we argue in a new book, ‘Rethinking the Economics of Land and Housing’, could help us better understand many of today’s most pressing social and economic problems, including excessive property prices, rising wealth inequality and stagnant productivity. Land was initially a key part of classical economic theory, so why did it get pushed aside?

Classical Economics, Land and Economic Rent

The classical political economists – David Ricardo, John Stuart Mill and Adam Smith – that shaped the birth of modern economics, emphasized that land had unique qualities, distinct from capital and labour, that had important influence on the dynamics of production.

They recognized that land was inherently fixed and scarce. Ricardo’s concept of ‘economic rent’ referred to the gains accruing to landholders from their exclusive ownership of a scarce resource: desirable agricultural land. Ricardo argued that the landowner was not free to choose the economic rent he or she could charge. Rather, it was determined by the cost to the labourer of farming the next most desirable but un-owned plot. Rent was thus driven by the marginal productivity of land, not labour as the population theorist Thomas Malthus had argued. On the flipside, as Adam Smith (1776: 162) noted, neither did land rents reflect the efforts of the land-owner:

“The rent of land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give.”

The classical economists feared that land-owners would increasingly monopolise the proceeds of growth as nations developed and desirably locational land became relatively more scarce. Eventually, as rents rose, the proportion of profits available for capital investment and wages would become so small as to lead to economic stagnation, inequality and rising unemployment. In other words, economic rent could crowd out productive investment.

Marxist and socialist thinkers proposed to deal with the problem of rent by nationalizing and socializing land: in other words destroying the institution of private property. But the classical economists had a strong attachment to the latter, seeing it as a bulwark of liberal democracy and encouraging of economic progress. They instead proposed to tax it. Indeed, they argued that the majority of taxation of the nation should come from increases in land values that would naturally occur in a developing economy. Mill (1884: 629-630) saw taxation of land as a natural extension of private property:

“In such a case …[land rent]… it would be no violation of the principles on which private property is grounded, if the state should appropriate this increase of wealth, or part of it, as it arises. This would not properly be taking anything from anybody; it would merely be applying an accession of wealth, created by circumstances, to the benefit of society, instead of allowing it to become an unearned appendage to the riches of a particular class.”

Ricardo and Smith were mainly writing about an agrarian economy. But the law of rent applies equally in developed urban areas as the famous Land Value Tax campaigner Henry George argued in his best-selling text ‘Progress and Poverty’. Once all the un-owned land is occupied, economic rent then becomes determined by locational value. Thus the rise of communications technology and globalisation has not meant ‘the end of distance’ as some predicted. Instead, it has driven the economic pre-eminence of a few cities that are best connected to the global economy and offer the best amenities for the knowledge workers and entrepreneurs of the digital economy. The scarcity of these locations has fed a long boom in the value of land in those cities.

Neoclassical Economics and the Obfuscation of Land

The classical economists were ‘political’ in the sense that they saw a key role for the state and in particular taxation in preventing the institution of private property from constraining economic development via rent. But at the turn of the nineteenth century, a group of economists began to develop a new kind of economics, based upon universal scientific laws of supply and demand and free of normative judgements concerning power and state intervention. Land’s uniqueness as an input to production was lost along the way.

John Bates Clark was one of the leading American economists of the time and recognised as the founder of neoclassical capital theory. He argued that Ricardo’s law of rent generated from the marginal productivity of land applied equally to capital and labour. It mattered little what the intrinsic properties of the factors of production were and it was better to consider them ‘…as business men conceive of it, abstractly, as a sum or fund of value in productive uses… the earnings of these funds constitute in each case a differential gain like the product of land.’ (Bates Clark 1891: 144-145)

Clark developed the notion of an all-encompassing ‘fund’ of ‘pure capital’ that is homogeneous across land, labour and capital goods. From this rather fuzzy concept, developed marginal productivity theory. Land still exists in the short-run in this approach – and indeed in microeconomics textbooks – when it is generally assumed that some factors may be fixed. For example, you cannot immediately build a new factory or develop a new product to respond to new demands or changes in technology. But in the long run – which is what counts when thinking about equilibrium – all factors of production will be subject to the same variable marginal returns. All factors can be reduced to equivalent physical quantities – if a firm adds an additional unit of labour, capital good or land to its production process, it will be homogeneous to all previous units.

Early 20th Century English and American economists adopted and developed Clark’s theory in to a comprehensive theory of distribution of income and economic growth that eventually usurped political economy approaches. Clark’s work became the basis for the seminal neoclassical ‘two-factor’ growth models of the 1930s developed by Roy Harrod and Bob Solow. Land –defined as locational space – is absent from such macroeconomic models.

The reasons for this may well be political. Mason Gaffney, an American land economist and scholar of Henry George, has argued that Bates Clark and his followers received substantial financial support from corporate and landed interests who were determined to prevent George’s theories gaining credibility out of concerns that their wealth would be wittled away via a land tax. In contrast, theories of land rent and taxation never found an academic home. In addition, George, primarily a campaigner and journalist, never managed to forge an allegiance with American socialists who were more focused on taxing the profits of the captains of industry and the financial sector.

The result was the burden of taxation came to fall upon capital (corporation tax) and labour (income tax) rather than land. A final factor preventing theories of land rent taking off the U.S. may have been the simple fact that at the beginning of the 20th century, land scarcity and fixity was perhaps less a political issue in the still expanding U.S. than in Europe, were a land value tax came closer to being adopted.

Why Land is Different

At first glance, neoclassical economics’ conflation of land with a broad notion of capital does seem to follow a certain logic. It is clear that both can be thought of as commodities: both can be bought and sold in a mature capitalist market. A firm can have a portfolio of assets that includes land (or property) and shares in a company (the equivalent of owning capital ‘stock’) and swap one for another using established market prices. Both land and capital goods can also be seen as store of value (consider the phrase ‘safe as houses’) and to some extent a source of liquidity, particularly given innovations in finance that have allowed people to engage in home equity withdrawal.

In reality, however, land and capital are fundamentally distinctive phenomena. Land is permanent, cannot be produced or reproduced, cannot be ‘used up’ and does not depreciate. None of these features apply to capital. Capital goods are produced by humans, depreciate over time due to physical wear and tear and innovations in technology (think of computers or mobile phones) and they can be replicated. In any set of national accounts, you will find a sizeable negative number detailing physical capital stock ‘depreciation’: net not gross capital investment is the preferred variable used in calculating a nations’s output. When it comes to land, net and gross values are equal.

The argument made by Bates Clark and his followers was that by removing the complexities of dynamics, the true or pure functioning of the economy will be more clearly revealed. As a result, microeconomic theory generally deals with relations of coexistence or ‘comparative statics’ (how are labour and capital combined in a single point in time to create outputs) rather than dynamic relations. This has led to a neglect of the continued creation and destruction of capital and the continued existence and non-depreciation of land.

Indeed, although land values change with – or some would say drive – economic and financial cycles, in the long run land value usually appreciates rather than depreciates like capital. This is inevitable when you think about it – as the population grows, the economy develops and the capital stock increases, land remains fixed. The result is that land values (ground rents) must rise, unless there is some countervailing non-market intervention.

Indeed, there is good argument that as economies mature, the demand for land relative to other consumer goods increases. Land is a ‘positional good’, the desire for which is related to one’s position in society vis a vis others and thus not subject to diminishing marginal returns like other factors. As technological developments drive down the costs of other goods, so competition over the most prized locational space rises and eats up a greater and greater share of people’s income as Adair Turner has recently argued. A recent study of 14 advanced economies found that 81% of house price increases between 1950 and 2012 can be explained by rising land prices with the remainder attributable to increases in construction costs

Consequences of the neglect of land

Today’s economics textbooks – in particular microeconomics – slavishly follow the tenets of marginal productivity theory. ‘Income’ is understood narrowly as a reward for one’s contribution to production whilst wealth is understood as ‘savings’ due to one’s productive investment effort, not as unearned windfalls from being the owner of land or other naturally scarce sources of value. In many advanced economies land values – and capital gains made from increasing property prices – are not properly measured and tracked over time. As Steve Roth has noted for Evonomics, the U.S.’ National accounts does not properly take in to account capital gains and changes in household’s ‘net worth’, much of which is driven by changes in land values.

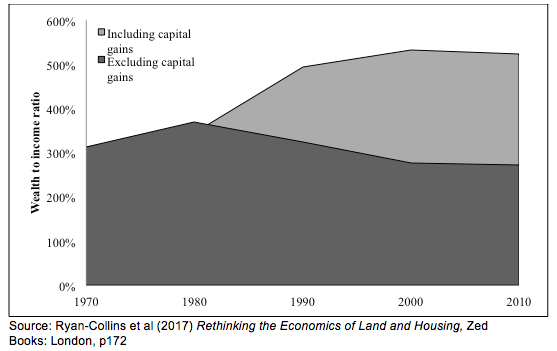

Even progressive economists such as Thomas Piketty have fallen in to this trap. Once you strip out capital gains (mainly on housing), Piketty’s spectacular rise in the wealth-to-income ratio recorded in advanced economics in the last 30 years starts to look very ordinary (Figure 1 shows the comparison for great Britain since 1970).

Figure 1: Piketty’s Wealth to income ratio including and excluding capital gains (Great Britain, 1970-2010)

Source: Ryan-Collins et al (2017) Rethinking the Economics of Land and Housing, Zed Books: London, p172

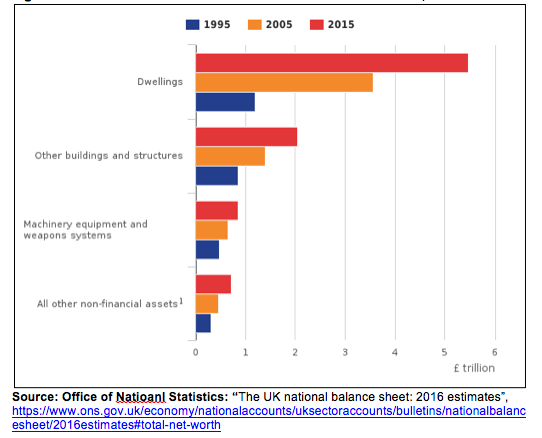

In the UK, land is not included as a distinct asset class in the National Accounts, despite being one of the largest and most important asset classes in the economy. Instead, the value of the underlying land is included in the value of dwellings and other buildings and structures, which are classed as ‘produced non-financial assets’ (Figure 2)

As shown in Figure 2, the value of ‘dwellings’ (homes and the land underneath them) has increased by four times (or 400%) between 1995 and 2015, from £1.2 trillion to £5.5 trillion, largely due to increases in house prices rather than a change in the volume of dwellings. In contrast the forms of ‘capital’ that we associate with increases in wealth and productivity – commercial buildings, machinery, transport, Information and communications technology has grown much more slowly.

Figure 2: Growth in the value of non-financial assets in the UK, 1995-2015

Thus this huge growth in wealth relative to the rest of the economy originates not from the saving of income derived from people’s contribution to production (activity that would have created jobs and raised incomes), but rather from windfalls resulting from exclusive control of a scarce natural resource: land.

This may help us explain – at least in part – the great ‘productivity puzzle’– that is, why productivity (and related average incomes) been flat-lining, even as ‘wealth’ has been increasing. The puzzle is explained by the fact that the majority of the growth in wealth has come from capital gains rather than increased profits (or savings) derived from productive investment, Savings are at a fifty year low in the UK even as the wealth to income ratio hits record highs.

When the value of land under a house goes up, the total productive capacity of the economy is unchanged or diminished because nothing new has been produced: it merely constitutes an increase in the value of the asset. This may increase the wealth of the landowner and they may choose to spend more or drawn down some of that wealth via home equity withdrawal. But they equally many not. Moreover, the rise in the value of that asset has a corresponding cost: someone else in the economy will have to save more for a deposit or see their rents increase and as a result spend less (or, in the case of the firm, invest less).

In current national accounts, however, only the increase in wealth is recorded, whilst the present discounted value of the decreased flow of resources to the rest of the economy is ignored as Joe Stiglitz has pointed out. Rising land values suck purchasing power and demand out of the economy, as the benefits of growth are concentrated in property owners with a low marginal propensity to consume, which in turn reduces spending and investment. In addition, most new credit creation by the banking system now flows in to real estate rather than productive activity. This crowds out productive investment, both by the banking system itself and non-bank investors who see the potential for much higher returns on relatively tax free real estate investment.

Land values also fundamentally effect the impact of monetary policy, particularly in financially liberalized economies. If a central bank lowers interest rates to try and stimulate capital investment and consumption, it is likely to simultaneously drive up land prices and the economic rent attaching to them as more credit flows in to mortgages for domestic and commercial real estate. This has a naturally perverse effect on the capital investment and consumption effects that the lowering of interest rates was intended to achieve.

But for mainstream economists and policy makers these connections between the value of land and the macroeconomy are ignored. Housing demand is assumed to be subject to the same rules that drive desire for any other commodity: its marginal productivity and utility. Rising house prices or rents (relative to incomes) – an urgent problem in countries such as the United Kingdom – can be attributed to insufficient supply of homes or land. As with other policy challenges, such as unemployment, the focus of is on the supply side. The distribution of land and property wealth across the population, its taxation and the role of the banking system in driving up prices through increases in mortgage debt are neglected. Planning rules and other easy targets such as immigration are then blamed for the loss of control people feel as a result of insecure housing rather than its true structural causes in the land economy.

Land Rents: There is a ‘Free Lunch’

Although presented as an objective theory of distribution, in fact marginal productivity theory has a strong normative element. Ultimately it leads us to a world, where, so long as there is sufficient competition and free markets, all will receive their just deserts in relation to their true contribution to society. There will, in Milton Friedman’s famous terms, be ‘no such thing as a free lunch’.

But marginal productivity theory says nothing about the distribution of the ownership of factors of production – not least land. Landed-property is implicitly assumed to be the most efficient organisational form for enabling private exchange and free markets with little questioning of how property and tenure rights are distributed nor of the gains (rents) that possession of such rights grants to its holders. Ultimately, this limits what the theory can say about the distribution of income, particularly in a world where such economic rents are large. Land is the ‘mother of all monopolies’ as Winston Churchill once put it – and hence the most important one for economists to understand.

But if economists are to focus on land, they must get their hands dirty. They must start examining the role of institutions, including systems of land-ownership, property-rights, land taxation and mortgage credit that are historically determined by power and class relations. In fact it is these inherently political, social and cultural developments that determine the way in which economic rent is distributed and with it, macroeconomic dynamics more generally.

Great stuff thanks for the breakdown! That old childhood song “this land was made for you and me” seems to require an update to reflect our neo-feudal society.

Also, love this Thomas Jefferson quote:

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.”

Not all that far from the truth for me unfortunately..

I’m afraid that Jefferson probably didn’t say that. He may have said something similar; that is, it might be a combination of paraphrases of things that he actually said. See:

http://www.snopes.com/quotes/jefferson/banks.asp

https://www.monticello.org/site/jefferson/private-banks-spurious-quotation

Does it really make any difference? The important point is, is what was said accurate (yes), and should we be worried about it and do something (yes).

Your attribution was wrong. Having been gently corrected, you then proceeded to assert that wrong attributions are acceptable if they reflect your understanding of the truth.

I stand with jerry on this one. I love that quote. An idea does not care care who said it first, nor who said it best. And there is more truth in that claim than there is in most of what passes for economic erudition today.

Also, your strawman attempt to claim that jerry “proceeded to assert that wrong attributions are acceptable” is risible and diverts from the point of both of Jerry’s posts.

P.S. People interested in Economics should care more about the fact that nearly all of so-called science is demonstrably wrong in many, many ways. And less about who said what, when. Science is not based on argument from authority.

The real wacko thing is that the banks DO NOT control the issue of currency. The slop from Milton Friedman however has convinced the Congress and the Executive that the banks do control it.

They do, by extending loans.

No, loans are not made from “reserves”.

Agree DG, you borrow $10 for a car, you get a deposit in your bank, bank gets a loan asset. $10 more money in the economy. Is how most money created in Australia and US

They do not have to control the issue of currency, but for the most part they have subjugated the government to private control, since the banks basically own the country.

We need public banking as well as public education about how government finance works, to move past the austerity ignorance.

An estimated 97% of the currency in circulation is bank notes in dollar denominations. These originate with fractional reserve lending — in other words, banks make them out of thin air.

No, we are not in a fractional reserve system. That is the loanable funds theory fallacy.

Penalty flag for quoting song lyrics from a state of ignorance. Woodie Guthrie’s lyrics are not a child ‘s song and are not waht ewe emplie . . . bruce springsteen called that song the greatest song ever written about america

This verse is in the song mr . Guthrie rote but it was cut from popular versions

As I went walking I saw a sign there

And on the sign it said “No Trespassing.”

But on the other side it didn’t say nothing,

That side was made for you and me.

In the shadow of the steeple I saw my people,

By the relief office I seen my people;

As they stood there hungry, I stood there asking

Is this land made for you and me?

Nobody living can ever stop me,

As I go walking that freedom highway;

Nobody living can ever make me turn back

This land was made for you and me.

Art enobles . . . Da boss!!

As i was reedin

That peanut gallery

I saw in front of me

A mental palloury

I saw below me

An endless skyway

And I said this song was made

For you and me

https://www.youtube.com/watch?v=1yuc4BI5NWU

I am out of my depth here and hope to gain more insight from rereading and other people’s comments, but I have to take issue with the statement that land does not depreciate. The things that come to mind include loss of topsoil, loss of species that stabilize soil and maintain various nutrient and water cycles, destabilization by mining, fracking, and other industrial activities, toxic pollution of soil and water, and depletion of the water table. I am sure this is an incomplete list. That these do not occur uniformly or predictably surely does not preclude their being identified as depreciation, and there is no land I can think of that might not be affected by one or more of them.

I agree. A look into civil law will quickly show that

a) some territories cannot be privately owned (e.g. screes, glaciers, lakes);

b) the law has provisions for the creation and loss of land (e.g. when a river changes course, land subsidence).

Yes, if a river changes course or a mountain collapses, you can permanently lose your land — not just physically, legally too.

Conversely, the father of a colleague in Scandinavia owned land in a municipality on the coast. He was also member of some sort of cooperative that regulated the sharing of new land emerging from the sea. This was not some kind of freak idea, but a reality due to the maritime floor slowly lifting up, thousands of years after the downward pressure of a kilometers-thick ice cap disappeared at the end of the last glaciation.

As for land not depreciating. Just have it polluted after an industrial accident, and see it become by law unusable for housing, agriculture, recreation or any other commercial usage.

Land, among other assets, may also at some points have negative value. Look at various degradations or other negative influences that render any practical use of land uneconomic, such as chemical spills, geological events or other reductions in the physical suitability or accessibility of land for any reasonably contemplated active purpose. The cost of remediation or other investment needed may outstrip the current or future value within the planning horizon of humans, rendering the land best for viewing, reclamation by natural forces (e.g., bacteria that eat away at harmful substances although on a time scale too long for us impatient humans) or other ecosystem restabilization effect. Who pays for a zero lower bound assumption?

“Land, among other assets, may also at some points have negative value.”

Good point!

“And where’s all the royalty money they said we would receive? There is none! We are left with abandoned wells, no royalty money, and the land all but destroyed. They promised they would restore the land and put it back the way it was, but we haven’t seen a single tree replanted. I’m 42 years old, I’ll be six feet under before the land ever looks like it did before the gas company showed up.”

http://stopfyldefracking.org.uk/uncategorized/pennsylvania-farmer-warns-of-land-destroyed-from-fracking-and-no-money/

You most assuredly can own a lake. I have a friend that owned a lake, about 47 acres, roughly 9 of which was a spring and stream fed lake. And you could own a glacier by owning the land under it. It would go along with the land the way mineral rights do.

In the state of Ohio today, it is very difficult to buy land that includes the mineral rights. Somebody seems to have got there first. For example: http://www.oilandgaslawreport.com/2013/02/07/who-owns-the-mineral-rights-on-my-property/ and http://www.farmanddairy.com/news/ohio-dormant-mineral-rights-ruling-reversed/367785.html

Readers’ Digest version: It’s a mess!

Land rises and falls along the NW Coast, too, because of subduction. As the pressure from the subduction zone builds, the land humps up – the coast here has been rising, subtly, for a long time. But when it slips and the pressure is released, it drops abruptly. When that happens, whole towns will suddenly submerge.

You can also lose land from sand spits, which offer the largest beaches but can suddenly break through in a storm – this happened at a place called Bayocean on Tillamook Bay; the area is now tightly regulated by the Corp of Engineers, and an entire development disappeared. A number of other developments are just as vulnerable, especially, I suppose, in a tsunami.

I had the same reaction, but then realized that part of problem could also be attributed to misplacing.

Note that the ‘invisibility’ of land as an economic factor, or when considered, the misunderstanding of its role in the economy, is Problem #1.

Problem #2 is that we don’t currently price in misuse or degradation of land.

The costs of fracking, industrial activities, many pollutants (which can take years to show effects), and depletion of water tables are not accurately calculated into pricing in most cases; you pay more for organic foods (as a general rule) in an effort to pay the full costs at the front end.

BTW: I was able to spend an hour in particularly beautiful land yesterday — enjoy! http://www.tulipfestival.org

This deterioration of land is exactly at the heart of Jefferson’s pithy – I set out on this ground which I suppose to be self-evident, that the Earth belongs in usufruct to the living; that the dead have neither powers nor rights over it.

He was a lawyer not an economist. But his thoughts re the three concepts – usus, fructus, abusus – that underline the legal definition of property apply today. Specifically abusus (the right to destroy or alienate) DOES apply to labor (you can take vacation or commit suicide) or capital (you can run machines until they break). But applied to land, it is a theft from future generations and goes beyond the only ownership – usufruct – that can apply to the living. When land is considered full absolute property (like labor and capital), then abusus is legally part of that.

Like the economic concepts of land, the legal concepts have disappeared and make it near impossible to deal with environmental stuff (and public debt as well) now. As well as the corporate ownership of land (since corporations do not die)

His other criteria are also not strictly true. Land is only ‘permanent’ on a very short time scale. Land is added when sea level drops and lost when sea level rises. It can be (and has been) ‘produced’ (and not only recently, most of Philadelphia is built on land fill, never mind volcanic islands rising out of the sea).

The author is overselling his case and he is aware of it. Only two paragraphs on from his statement that land does not depreciate he says:

so he is obviously not being very precise in his language. Also he confounds the ‘value’ of land with its price. The price of land (such as wetland, for example) does not reflect its true value to society, only its potential economic return in “development”.

In spite of all these difficulties, he is trying to say something very important about the difference between land and other forms of capital which I essentially agree with. The important difference is that one unit of financial capital (as an example) is identical to every other unit of financial capital. They are not only substitutable for one another, but essentially identical. This is in large part because they are abstract. But every unit of land is unique, in large part because it is physical, not abstract. That ‘equivalent’ units of land are substitutable in our markets is a precision error: a consequence of our neglect of the actual nature of land and the reification of the economists’ abstract notion that one ‘unit’ of land is just like every other unit of land and can be exchanged fairly based on a limited comparison: on equivalent measures of area, equivalent desirability of location (a complex of physical and abstract factors, i.e. geographic and social), and equivalent state of development.

Every science makes simplifying assumptions. And we always need to understand the utility of making such assumptions and the inherent distortion of reality that follows and whether it creates more problems than it solves. The neoliberal treatment of land is an extreme oversimplification that causes a great many problems.

You are correct in saying that land is not permanent on an infinite timescale; however, for the most part it is over the sorts of time scales that count to human beings.

https://www.irs.gov/publications/p946/ch01.html#en_US_2016_publink1000107320

Tangentially related…can one argue that German housing policy recognizes the problem with “Land” rents or is it more a cultural / historical product related to devastation from war? Germans appear to have side-stepped the modern perversion / fetish of an economy based on selling houses to each other via ever growing out-sized mortgages. It never ceases to amaze me how it is still VERY CHEAP to rent in a world city like Berlin as opposed to other places in Europe or America for that matter.

It is relatively cheap to rent in Berlin and surrounding areas…but try buying. A casual review of real estate prices for single family detached homes in any of the larger German cities over the past 20 years (I have worked there off and on during that period) seems to indicate that single family detached homes have never been particularly a good deal (and I live in SF). Yes, build quality is higher than typical North American standards, but the physical land that is owned is usually much smaller (with less parking and lawns and so on). Apples to apples it is not that much different than SF Bay Area for purchasing.

I think that there might be a connection to Germany’s unique early 20th Century history. As a consequence of the Weimar hyperinflation, property owners who had purchased on credit prior to the inflation basically got their properties for free. The benefits of this windfall, IIRC, were socialized by the imposition of a clawback-for-public-benefit mechanism. I don’t recall the details, but rent controls may have been involved. IIRC, I read this in the introductory sections of Adam Tooze’s “Wages of Destruction: the making and breaking of the Nazi economy.”

German policy thinking with respect to price stability seems still to be strongly influenced by the Weimar inflation. Perhaps there are other traces of that as well.

What’s interesting is how land ownership has (d)evolved these days. You may “own land” but only just so: there are now distinctions between land ownership, mineral and water rights, and even what you can use the land for (zoning and easements). Absolute ownership is on the way out.

There has never been absolute ownership of land. From real estate law, the government has always reserved three rights to itself over land. (1) The right to tax. (2) The right for authorities to enter upon the land for legal matters (quelling disturbances, serving papers, etc.) (3) Eminent domain. Depending upon the type of ownership, there may be other rights reserved, but there are always at least those three.

No absolute individual ownership at least in the US. Some of those private island purchasers may have greater control over their little slice of paradise.

The rules that constrain land ownership are to keep folks from “harming” their neighbors (local) or impinging on natural systems (polluting rivers,streams, or groundwater) that can affect the greater community (region).

The island paradise likely has few neighbors, but if your polluting the offshore reefs Greenpeace may call you out.

At least on the west coast, there has never really been “absolute ownership”. In California, the original Spanish/Mexican land grants seemed to have questionable title issues in most cases from Day One. The subsequent Californian owners always seemed to be unsure about clear title and access to water rights.

Regardless, I have always thought of “land ownership” of more of an agreement between the purchaser and the state… where the purchaser agrees to recognition of title from the state in exchange for legal protection. Along with that protection comes all the encumbrances that the state attaches to the land. The state makes the rules. Take it or leave it.

If the land owner doesn’t hold up their end of the bargain (by paying taxes), the title is sold to the highest bidder after 3 years.

So, in these cases ownership of land is way, way different than ownership of pretty much any other physical asset. Nothing new here.

In my part of the country commercial/multi-family property ends up being taxed at 25-30% of the gross land rents each year through local property taxes. This leaves no income for the average landowner after debt service, insurance and upkeep.

You are confusing land with property. Property taxes tax both land and buildings (development). A land tax just taxes the land. With property taxes, big property holders (‘developers’) can accumulate land and hold it. With a land tax, taxes on most property owners would go down while taxes on land holdings would go up.

Thank you for this. In my economics courses, I was mystified to see land drop out of the equations since it was clearly so important (and, as pointed out here, qualitatively different from the other factors).

The fourth factor of production ignored in almost all economics is energy. Once you include energy in the equation, and the fact that most energy consumed since the Industrial Revolution has been from non-renewable sources, you come to some alarming and inescapable conclusions about our future trajectory.

Steve Keen has been working on energy as a major factor in his economics model. He argues that the largest part of the “Solow productivity residual”, whose empirically measured dimension had been puzzling economists so far, is actually attributable to energy — not capital or labour.

He also argued that the French physiocrats had an initially correct intuition (though erroneous formalization) about the central role of land and energy in the economy.

A very interesting piece as usual.

Let me try another angle on this: economics has not only removed the concept of land and rents, but also any respect for physical reality. That’s certainly not a mistake that Keynes ever made.

This should be carved on stone somewhere: if it is physically impossible for something to happen, it won’t, the marginal rate of taxation on capital gains be damned. Yet modern economics seems to think that human beings have such great productive capabilities that physical limits can be ignored.

It is certainly true that, given time and resources and tools, humans can increase the productivity of a given piece of land. And over centuries, often to a great degree. But this ability is not automatic or unlimited or guaranteed under all conditions or immune to the law of diminishing returns.

My current favorite example is Syria. The government deliberately produced a population explosion, the population doubled every 18 years, and when it hit 22 million the aquifers had been drained and things fell apart. Fresh water is very hard to create, perhaps someday a place like Syria might have networks of fusion power stations and desalinization plants and could support a larger population, but a relatively poor society physically cannot do this in just a few years. It’s impossible! And yet any reference to physical limits is apparently taboo, the notion being regarded as an absurdity even though such examples litter the historical record and are present even today all over the world.

Re: Syria: any problems of “natural” population increase were magnified by a refugee crisis manufactured in Iraq & drought issues raising prices of many foods.

Land can also be destroyed, as well as depreciated. Erosion along rivers and coastlines (as well as sea level rise) does it all the time.

I did raise an eyebrow at that line:

“Land is permanent, cannot be produced or reproduced, cannot be ‘used up’ and does not depreciate.”

In terms of losing land (or of land value depreciating) the erosion you mentioned is one reason. Other reasons are: natural disasters (Montserrat, Fukushima); man-made disasters (Chernobyl); after-effects of war.

In terms of producing land, well we have just witnessed the Chinese do it; there are also the artificial islands in Dubai; and the history of land reclamation in the Netherlands.

Granted those examples may constitute a small percentage of all land at stake, but the view from the continents is different from the view on an island state. Totally understand the point #MH is trying to make, but his statement borders on overreach when there really isn’t need to IMO.

Montserrat, Fukushima and Chernobyl all still appear on the map.

Converting watery land into dry land is not an act of creation. It has no effect on the surface area of the planet.

;-) … well, that’s an extreme interpretation as well. By that assertion, all the “land” in the Mindanoa trench counts as well. C’mon … we’re talking about land that (paraphrasing the article) has “important influence on the dynamics of production”. I fail to see how land rendered unusable by any of the factors I mentioned can wield such influence.

“Land is permanent, cannot be produced or reproduced, cannot be ‘used up’ and does not depreciate.” The dust bowl, depleted mines, and Detroit would be counter-examples… In all three cases the economic value of the land to support agriculture, resource extraction, or to be used for housing has decreased so the value of the land which was based on these uses had depreciated. Now these are all somewhat atypical, but they certainly DO happen.

While in the current times people tend to regard capital as equivalent to land because there is a relatively free market between them, in the middle ages, it was was land and labor that were, for the most part, regarded as inextricably linked, to the degree that serfs were linked to the land, but the idea of simply selling land for money was regarded as abhorrent.

OTOH, in the antebellum US labor was literally much more exchangeable for capital because you could buy and sell slaves.

It is in the limitations in the exchange of various classes of goods that force us to make distinctions. And I would argue that it is in the attempts to remove barriers from the labor markets that ensure that pricing power goes to those buying labor at the expense of those of us who depend on selling our labor find most upsetting.

Indeed, where’s Henry George when you need him?

What’s interesting is many of the concepts of classical economics developed right at the start of industrialization. Over the years “evolving” to give us the world of today and its great economic principles. While smith, ricardo, and Marx saw the beginnings of industrialization, ther’s been another two centuries of forging industrial civilization and it’s values. The forge was technology.

Of course, for the mass majority of human civilization land was not recognized as capital, an industrial value, land was all. It’s only the last 10,000 years of homo sapiens history that agrarian civilization existed, and values such as land ownership developed and then predominate. But they were all, whats the word, supplanted by industrial technology and the values of industrial civilization. Just as this new generation of technology, call it Quantum/Biological is not supplanting – “disrupting” – industrial technologies and values, yet the values of this new age remain, what’s the word, retarded.

But, I think if this new age is going to get very far, time wise not distance, revaluation of land’s industrial value is well nigh, beyond such industrial values as capital, mortgage credie et al. In fact to go on, we might even go back pre-industrial, digg-up some old agrarian era land values, or god forbid some of the land values of those long lost cultures when we padded around for a couple hundred thousand years in cooperative groups.

The two-century old industrial civilization is done, where we gonna go? I guarantee one thing, it ain’t Mars.

I thought this was one of the best analyses of modern capitalism I have read. I’ve been struggling with why capitalism seems to have stopped working and my instincts were telling me it is because there are no easy investments left, things cost more because the jobs required are more technological etc. But this shines a clearer light on the whole subject. The Picketty graph was truly enlightening. And of course this explains why inflation is such a difficult thing to define/control. Josh Ryan-Collins is someone we should read more often. I think he has written this up with a clarity that even Hudson (my favorite) cannot top. I think his last paragraph about changing an entire mindset about land rights and obligations in order to begin to get capital gains from land under control so that it doesn’t skew the economy is a very interesting direction. It has been avoided because who wanted to tax manifest destiny and then who wanted to spoil the party, etc. Great essay. Thanks.

Honestly, this is sheer genius:

Having spent some (crazy making) time around US land use issues, I’d add:

1. The people who make money from property tend to become extremely conservative, and also tend to make a LOT of political contributions — tax-free, via think tanks or other tax dodges.

2. They do this because they realize that things like zoning, infrastructure support (roads, bridges) are essential to their ability to profit from land. They tend to ‘buy’ politicians who don’t know enough to call b.s. on their neoliberal economics, or who are also True Believers. This is a self-reinforcing feedback loop; we might even call it ‘Trumpian economics’.

3. These electeds often then appoint judges — as we’ve seen with Gorsich, amiable people who tend to view things through the lens as the paid-for electeds. These people are not at all evil; they just have some rather dangerous intellectual blinders. Which is why posts like this are extremely important.

4. These property owners, becoming richer via rent, need a place to put that money. I hope future researchers will start taking a closer look at how many property owners (subdivisions, commercial property, parking garages), then put a lot of their money into starting up local banks. To do what? Lend money for homebuyers… the feedback loop gets stronger with every transaction. The rich get richer… and richer… and richer…

5. One week ago, a friend was outbid on a house — someone offered $100,000 over the asking price, at which point, my friend said, “I can’t compete with that.” I responded, “Of course you can’t compete with that – for all that you know, you are up against some tax haven in Taiwan, or else someone buying their kid a home so they can attend school in this nice, upper class neighborhood.” When you layer on capital flight onto the failure of economics to factor in land – more complicated than a simple supply/demand ratio – you get endless problems, including stressed buyers, obscene increases in rents, and growing homelessness.

6. Until economics gets its act together on land issues, and educates more policy makers (including judges!), we are in a world of hurt.

———————

minor quibble: my health is affected by meds; the effects of meds on my health are complex

One is causative; the other explains the downstream results, or ‘effects’

The term “Free Market” as known today had a completely opposite meaning when classic economics was in use.

Free market meant a market free from economic rent – not as today … one where it is free for economic rent.

“In reality, however, land and capital are fundamentally distinctive phenomena. Land is permanent, cannot be produced or reproduced, cannot be ‘used up’ and does not depreciate. ”

Sorry, Michael Hudson, I like a lot of what you have to say, but on this issue…… I know you are only talking about land used for housing, but the economic issues of land are far bigger than that.

Perhaps it’s because Michael Hudson has been steered wrong by Adam Smith:

““The rent of land, therefore, considered as the price paid for the use of the land, is naturally a monopoly price. It is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give.” Obviously what happened in Ireland proved that wrong! But Adam Smith should have known he was wrong long before Ireland happened. If he’d paid the least attention to what was happening wrt serfdom, he would have realized that the landlord could ask anything of the farmers that he wanted, even to the starvation of his farmers. There was never any “what the farmer could afford to give” going on for those people…….

Michael Hudson fails to realize what environmental damage does to land. Perhaps growing up and watching a Superfund Site develop has colored my thinking, but I have seen large tracts of land become “used up and depreciated”. No one is ever going to build a house or farm or put any other industry on a Superfund Site (even though it had been land used for housing, farming, and businesses). That land is useless. No one is ever going to build a house or build a business on the Berkeley Pit. No one is ever going to build a house or farm, or put a business on the old Rocky Flats site, even though the government cleaned it up to “brown field” status. No one is ever going to farm or build homes on the Hanford site, even though before the 40’s it was most definitely productive farmland. No one is ever going to farm or build houses on the land where fracking and their waste ponds are situated. Where in Hudson’s “economics” does he account for this loss of land? Certainly the loss of this land affected the economies of the people who live in those areas, not to mention the ongoing costs to keep the environmental damage contained so that it doesn’t get worse. No amount of “tax money” garnered from the industries who profited from this land will ever pay for the use and destruction of that land. It should be counted as an economic loss to this country, but of course, it isn’t……

And then we have the mother of all looming environmental disasters staring us down. How much will that expensive beachfront Miami land be worth in the next 50 years? What about increasing desertification taking millions and millions of acres of farmland out of the economy? Where is that being accounted for?

Sorry, Michael Hudson, but on the issue of land, you are being very myopic……

Michael Hudson didn’t write the article.

Arrgghh! You are right! My bad! My statements about land and economics still hold. Just replace “Michael Hudson” with “Josh Ryan-Collins”……

To take it one more step, even if we include land as a factor of production and allow for its creation, destruction, improvement, and damage, we’re still considering it a human-owned, inert asset. Some economists are starting to think about “ecosystem services” (like wetlands filtering water and buffering storms) but even that approach perpetuates the settled agriculturalist’s mindset that the Earth belongs to us, rather than the other way around. The planet can live without us, but the reverse is not true.

Two thought that this article brought to mind

Taxing land has the benefit of preventing land owners from holding land in perpetuity without using it for some revenue generating purpose such as farming, housing, or business rental. It also deters land owners from taking land out of circulation to create higher monopoly rents on other land-based assets. This suggests that taxing unused land, such as vacant buildings or unused farmland, at a higher tax rate would could reduce the monopoly rent extractions through market manipulation.

I wonder how much land appreciation is driven by population growth. If we can eventually incentivize ourselves to decrease our population, as education seems to do, and simultaneously reduce our appetite for unnecessary consumption, then the scarcity of land that drives these monopoly prices might also collapse. When combined with a tax system that penalizes unused land, one can imagine a collapse in monopoly rents and a slow process of bringing land back into the commons as land owners give up their unused land to public ownership rather than pay the tax.

On the first thought’s ancestor: see Henry George’s Progress and Poverty, a sensation in the late 19th century.

One of its descendants is the rise of left libertarianism.

See this free review:

Barbara H. Fried, Left-Libertarianism: A Review Essay, 32 Philosophy and Public Affairs 2004

http://law.stanford.edu/wp-content/uploads/sites/default/files/publication/257067/doc/slspublic/32(1)-Philos-&-PubAffairs-66-(2004).pdf

And on the general issue of property rights—

Here is an interesting tidbit from J Mazor’s A Liberal Theory of Natural Resource Property Rights 2009 Harvard dissertation

One of the letter writers was the first author below:

Tideman, Nicolaus, and Peter Vallentyne. “Left-Libertarianism and Global Justice.”

Human Rights in Philosophy & Practice: 443-57.

Consider, however, that land owners who hold land “in perpetuity without using it for some revenue generating purpose such as farming, housing, or business rental” can also be an important support for biodiversity.

While I understand and accept your point to some extent, land that is “doing nothing” economically is not necessarily bad! It depends on the circumstances/location/biosphere. In many places we could do with more land that is “unproductive” in the economic sense, but active from a biological/ecological/diversity perspective.

capital was originally land: land was the “store of value”. capital has moved from the measurement of value on the store to the “store of value” itself. that’s your distortion.

simplistically, the “store” sequence goes land, labour, industry, capital. structures supporting the ownership of the “store of value” remain the same. that’s the problem.

You lost me with this comment.

Unfortunately, the terms “land”, “labor”, “capital”, “value” and so on are used in too many divergent ways by econ-people, banking types, business people, investors, and the general public.

I suspect that the divergent meanings are most likely a “feature, not bug” in most of modern economics (“the only ‘science’ designed to obfuscate rather than enlighten!”). If economists actually wanted to genuinely understand the world, they would be stricter about definitions, among many other things.

I find it most disturbing when credit is conflated with capital.

For instance, if interest rates drop, the *price* (measured in currency or credit) of housing increases, but its usefulness (“value”?) does not. There is no change in the physical property, so in the real world there’s no change in what used to be called capital (no additional surplus of production over consumption). Trading a house for fiat currency at a higher price is therefore NOT really a “capital gain” in any common-sense meaning of the terms.

Similarly, currency or credit may be exchangeable for capital goods in some situations, but credit alone is not capital. Consider a banker stranded on a desert island: no matter how much currency or credit is in the briefcase, he can’t buy a boat to get off the island!

Absolutely.

Capital is not primarily about storing value. It about creating wealth.

Wealth that can be used to create more wealth is capital. (Do I need to mention that money is not wealth?) Land cannot be created or destroyed (aside from the miniscule exceptions that everyone seems to be fixated on; show me a land factory people! the Earth’s radius is fixed!) therefore it is not wealth, therefore it is not capital.

Treating land like capital, in economics and in law, is one of the fundamental distortions in our political economy. I don’t think people here—even here!—have grasped how important this is.

“capital”:

“the wealth, whether in money or property, owned or employed in business by an individual, firm, corporation, etc.

5.

an accumulated stock of such wealth.:”

go back far enough and “wealth” is both land and naturally stored as land. labour converted that store into usable units and hence serfs. the point of land since the agricultural revolution has been capital (“wealth in potential), because post agriculture land becomes useful as a “thing to control” rather than merely being a thing to walk across, worship, observe etc. “land” under that understanding is both the wealth and the embodied store of same. that’s the whole reason for acquisition of land that constitutes the driver of history.

capital as a thing distinct from land comes later, because land is no longer the underpinning source of value, but merely an input. essentially, the thing that’s being measured by asbtractions such as “capital” changes over time. if you’re interested in history, you can track the progress of systems of control and governance over time, by what is regarded is the source of value. that said, “capital” is technically always an abstraction, a measure of something else. it’s not a thing in its own right. what has changed over years is two-fold: firstly, the abstraction “capital” is treated as a transactional unit without consideration for the underlying asset, and secondly, the entities providing standardised measuring have also become the store, because ledgering becomes complicated and it’s better to have that standardised.

part of the problem with modernism – for want of a better term – is that the store is allowed to determine the value of the measure. notionally, the store (in modern parlance, the entire financial services sector and its associated transactional universe) is intended merely to execute an agreement between other parties about the units. ideally, the store merely executes instructions from other social parties about the ownership of value, and adjusts its ledgers accordingly.

anyway. capital was once land. but capital wasn’t necessarily land. land just happened to be what capital measured once upon a time. the problems we’re facing now aren’t because land was no longer measured, but because measuring is now at the mercy of a cascading series of abstractions that is often self-referential.

So land and debt and rentier extraction (not just land rent but cartelization [monopolies] and intellectual propertiy rights) are not given correct valuations (and their effects) in mainstream economic theory. I would add another factor distorting the economy. When fossil fuels energy is added to an economy – look at the Europe during the industrial revolution, or the US in the 19th century, Japan a little later or China in the last 30 years – the economy can expand at 5-10 % a year for a time. Although I don’t have any organized studies to support this – my observations are that mature economies can grow at about 2 % from population growth and sunlight – War and natural disasters can affect this negatively as can technology positively. Elites who rig the system to extract more of the increased wealth get used to these higher rates of growth and look to find ways to continue this rate even when an equilibrium of sorts is reached. These days they manifest as financial manipulations which work for a while but result in the boom and bust cycles so prevalent – bubbles lately. Everybody knows – the poor stay poor and the rich get richer.

Worth considering is that the proceeds of fossil fuel production is called “income” by current accounting standards when a more accurate characterization might be “withdrawal of natural capital.”

To appreciate the difference, imagine a borrower trying to persuade a bank that the $2000 in his savings account was “income”…so he could borrow as though he had an “income” of $2000 a month. The banker would call security to eject such an applicant as a crazy person. Nevertheless, that is modern day fossil fuel accounting.

I’ll admit it I didn’t read the article. But it is at the very core of the philosophy of infinite growth to ignore the fact we reside on a finite planet. That fact must be ignored as long as possible if the religion of infinite growth is to continue on as infallible and therefore there is no alternative to that approach to economics.

to understand the incessant increase in relative value of land, you need to take a look at the exponential growth in debt. What is the collateral? Mostly land.

Under gold standard land prices were almost stable.

I find this unconvincing at a fundamental level because the attempt to treat land as a special class of factor is very weak. The supply of land is not infinite. True. But true of everything else. We have reassessed the comfortable assumptions about the infinite supply of.clean air and water but even today I find it ridiculous to claim there is a specific and special scarcity of land. This is presumably why classic economists ‘moved on’ and I fail to see their error. As other commitments have suggested, land is not even an insert asset. This entire article depends on a differentiation that is not established.

@Tim

You’re only demonstrating that you don’t understand the argument. Air, water, and other natural resources are all considered “land” in terms of economic rent. Indeed, as has been mentioned, any natural monopoly operates in a similar fashion, producing rentier behaviour and unearned income. Fundamentally, this is a discussion about what happens when the Commons is converted into privately held assets.

This is quite right if your conception of ‘land’ is limited to spacial area upon which undifferentiated activity may take place. You are obviously not a farmer. Every farmer knows that different acres of land have different productive capacities. No one ever claimed that simple area is scarce. (Well, no one involved in this discussion… there are population doomsayers who might make that claim.) What is scarce is productive capacity. In times of low population, only the “best” farm land is in use. Under population pressure (or price pressure, when the cost of food rises), less productive land is cultivated. The farmer working the less productive land has to work harder and expect smaller returns. Thus, “land” is scarce actually means units of land have variable productive capacity (not we are running out of space). There is nothing ridiculous about this.

Henry George is mentioned but not his suggestion we should revisit the concept of stake-holding.

There had been several mineral discoveries at that time and the usual way of extracting the metals was for the prospector to register a claim at the local settlement and then work it as long as he wished. When he abandoned his claim it was passed to another. George though that might be a model for land ownership.

“The rent of land… is not at all proportioned to what the landlord may have laid out upon the improvement of the land, or to what he can afford to take; but to what the farmer can afford to give.”

Which is made explicit by tenancy arrangements, in which the farmer’s rent is a portion of the crop. I think it’s unusual to pay a fixed rent for farm land.

My grandfather and “farming brothers” had “tenancy arrangements”: my “farming nephews” pay a “cash rent” for most of their farming acreage (over 2000 acres in central Illinois). Times are a-changing?

As a farm manager back in the “70’s almost all the farms I managed at first were “tenancy arrangements: “Cash renting” farm land began to appear then and has now overcome “tenancy arrangements”. And, cash rental payments for acreage has dramatically increase since the ’90’s.

Central Illinois, near Champagne, is where my family had an ancestral farm. We sold it back in the 90’s, so my information is indeed way out of date. Thanks for the update. Cash rental transfers the risk from the owner to the farmer; crapification?

You sold too soon. Your farm probably sold at around $2,500.00 an acre: that same land is bringing $7,000.00 per acre today. Cash rent is probably near $600.00 per acre unless a wealthy person brought the farm and is hiring labor on an hourly basis to operate it (farming is becoming a wage labor job).

Wonder how hard it would be to go to Russia and farm? Some American farmers who went there are now doing very well. My land on top of the Ozarks plateau is extremely fertile, a bit prone to drought sometimes though. I wouldn’t mind selling it to farm a piece of Russia before I get too old to cut the mustard. Maybe

“The result was the burden of taxation came to fall upon capital (corporation tax) and labour (income tax) rather than land.”

This person has never paid property tax? I just did, and it’s a painful experience. Granted, it isn’t a George tax, since it’s levied on buildings as well as the land itself, but the above sentence still rings like nonsense. It applies ONLY to the federal government.

No. You’re correct that a Georgist land value tax would not apply to buildings and other improvements, but the whole point is that the land-based portion of property taxes do not generally collect the whole economic rent of the land. That’s why unimproved or idle land can be held out of production, used as a capital sink, or used as a source of rental income.

Now if you want to argue that land value taxes should be progressive like income tax, or include a homestead exemption or discount, that’s a different kettle of fish.

Just assessments are enough of a hassle; ” collect the whole economic rent” sounds like a nightmare to administer, which might be why it’s never been tried. I would expect a whole lot of guesswork in that number.

Actually it has been tried, and with a good bit of success. Fairhope, Alabama and Arden, Delaware are two communities that were founded as Georgist experiments and “land value taxes” as Georgist taxes are often called, have been implemented in various places with good results. I don’t have the info at hand, but I believe Philadelphia in the 1970’s was one such case.

The environmental economist Herman Daly concluded that early economists (and I think by this he meant the neo-classical school) had taken sides in the political struggle between landowners and the then-rising merchant class. They chose the merchants, which turned out to be a good bet. In other words, he thinks they were, and are, intellectually corrupt. It’s one reason economics is political ideology, not science.

I’ve long seen the same issue from a somewhat different angle: In omitting land, they omitted the entire category of natural resources. There are in reality at least three “production factors,” all quite different in their implications. Marx made the same “mistake,” which I think was politically motivated. It’s led us into catastrophe, since it encouraged utter profligacy in our use of the natural world. That can usefully be framed as wasting our capita, but actually the distinction between human-created capital (like buildings) and natural capital (the land itself) is extremely important. Nature isn’t making any more land, nor various other resources. Which of course was the point of the classical economists.

However, they were wrong: the land interest faded away, in the end catastrophically, rather than soaking up more and more of the economy. A couple centuries’ worth of British fiction is about that process, right into the present day. So to revive classical economics, you need an explanation for that failed prophecy.

Excellent comment; thanks for contributing!

I agree with several above that mainstream economics would benefit from an ecological or finite-systems perspective, viewing the planet as a whole and processes within it as cycles rather than once-thru processes. Matter is conserved, not consumed, and the entire economics concept of “consumption” is therefore deeply flawed at its physical foundations. For instance, the extraction and combustion of fossil fuels to release stored chemical potential energy and increase the planetary inventory of carbon dioxide, water vapor and assorted other chemicals is not appropriately characterized as “production” and “consumption”. Neither is the assembly and distribution of manufactured goods from factories to families to landfills.

you can systematically measure whatever you like. you don’t need to peg to “land” or any other physical entity to avoid problems. however, once you move away from land and other such entities, which force a constraint by virtue of being physical, you need to account for the real-world attributes of all the inputs to the thing you’re newly measuring. the simple formulation of our error is that when we moved to measuring abstractions rather than concretes, we stopped accounting for the attributes of the concretes. the issue with non-systemic economics is that it treats input-resources as “externalities”, rather than as things with a complete set of attributes, included in which is the attribute of finitude.

No shit. Obvs anti-materialist tendency of capitalist economics is obvs.