Yves here. The article makes a comment in passing that bears teasing out. The inflation that started in the later 1960s was substantially if not entirely the result of Lyndon Johnson refusing to raise taxes because it would be perceived to be to pay for the unpopular Vietnam War. Richard Nixon followed that approach.

By Michael Bordo, Professor of Economics, Rutgers University. Originally published at VoxEU

Scholars and policymakers interested in the reform of the international financial system have always looked back to the Bretton Woods system as an example of a man-made system that brought both exemplary and stable economic performance to the world in the 1950s and 1960s. Yet Bretton Woods was short-lived, undone by both flaws in its basic structure and the unwillingness of key sovereign members to follow its rules. Many commentators hark back to the lessons of Bretton Woods as an example to possibly restore greater order and stability to the present international monetary system. In a recent paper, I revisit these issues from over a half century ago (Bordo 2017).

The Bretton Woods system was created by the 1944 Articles of Agreement at a global conference organised by the US Treasury at the Mount Washington Hotel in Bretton Woods, New Hampshire, at the height of WWII. It was established to design a new international monetary order for the post war, and to avoid the perceived problems of the interwar period: protectionism, beggar-thy-neighbour devaluations, hot money flows, and unstable exchange rates. It also sought to provide a framework of monetary and financial stability to foster global economic growth and the growth of international trade.

The system was a compromise between the fixed exchange rates of the gold standard, seen as conducive to rebuilding the network of global trade and finance, and the greater flexibility to which countries had resorted in the 1930s to restore and maintain domestic economic and financial stability. The Articles represented a compromise between the American plan of Harry Dexter White and the British plan of John Maynard Keynes. The compromise created an adjustable peg system based on the US dollar convertible into gold at $35 per ounce along with capital controls. The compromise gave members both exchange rate stability and the independence for their monetary authorities to maintain full employment. The IMF, based on the principle of a credit union, whereby members could withdraw more than their original gold quotas, was established to provide relief for temporary current account shortfalls.

It took close to 15 years to get the Bretton Woods system fully operating. As it evolved into a gold dollar standard, the three big problems of the interwar gold exchange standard re-emerged: adjustment, confidence, and liquidity problems.

The adjustment problem in Bretton Woods reflected downward rigidity in wages and prices which prevented the normal price adjustment of the gold standard price specie flow mechanism to operate. Consequently, payment deficits would be associated with rising unemployment and recessions. This was the problem faced by the UK, which alternated between expansionary monetary and fiscal policy, and then in the face of a currency crisis, austerity – a policy referred to as ‘stop-go’. For countries in surplus, inflationary pressure would ensure, which they would try to block by sterilisation and capital controls.

A second aspect of the adjustment problem was asymmetric adjustment between the US and the rest of the world. In the pegged exchange rate system, the US served as central reserve country and did not have to adjust to its balance of payments deficit. It was the n-1th currency in the system of n currencies (Mundell 1969). This asymmetry of adjustment was resented by the Europeans.

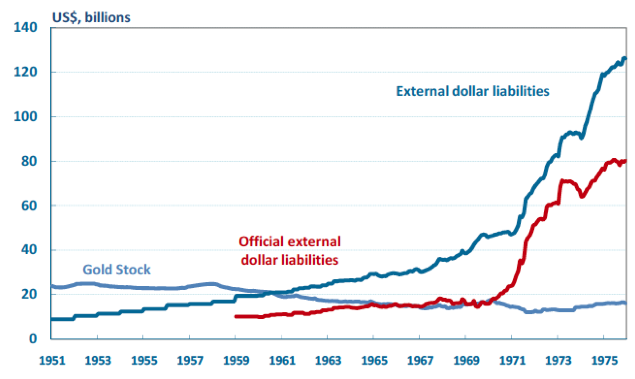

The US monetary authorities began to worry about the balance of payments deficit because of its effect on confidence. As official dollar liabilities held abroad mounted with successive deficits, the likelihood increased that these dollars would be converted into gold and that the US monetary gold stock would eventually reach a point low enough to trigger a run. Indeed by 1959, the US monetary gold stock equalled total external dollar liabilities, and the rest of the world’s monetary gold stock exceeded that of the US. By 1964, official dollar liabilities held by foreign monetary authorities exceeded that of the US monetary gold stock (Figure 1).

Figure 1. US gold stock and external liabilities, 1951-1975

Source: Banking and Monetary Statistics 1941‐1970, Washington DC Board of Governors of the Federal Reserve System, September 1976, Table 14.1, 15.1.

A second source of concern was the dollar’s role in providing liquidity to the rest of the world. Elimination of the US balance of payments deficits (as the French and Germans were urging) could create a global liquidity shortage. There was much concern through the 1960s as to how to provide this liquidity.

Robert Triffin (1960) captured the problems in his famous dilemma. Because the Bretton Woods parities, which were declared in the 1940s, had undervalued the price of gold, gold production would be insufficient to provide the resources to finance the growth of global trade. The shortfall would be met by capital outflows from the US, manifest in its balance of payments deficit. Triffin posited that as outstanding US dollar liabilities mounted, they would increase the likelihood of a classic bank run when the rest of the world’s monetary authorities would convert their dollar holdings into gold (Garber 1993). According to Triffin when the tipping point occurred, the US monetary authorities would tighten monetary policy and this would lead to global deflationary pressure. Triffin’s solution was to create a form of global liquidity like Keynes’ (1943) bancor to act as a substitute for US dollars in international reserves.

Policies to Shore Up the System

The problems of the Bretton Woods system were dealt with by the IMF, the G10 plus Switzerland, and by US monetary authorities. The remedies that followed often worked in the short run but not in the long run. The main threat to the system as a whole was the Triffin problem, which was exacerbated after 1965 by expansionary US monetary and fiscal policy which led to rising inflation.

After a spike in the London price of gold to $40.50 in October 1960 – based on fears that John F Kennedy, if elected, would pursue inflationary policies – led the Treasury to develop policies to discourage Europeans from conversing dollars into gold. These included:

- Moral suasion on Germany with the threat of pulling out US troops;

- The creation of the Gold Pool in 1961, in which eight central banks pooled their gold reserves in order to keep the London price of gold close to the $35 per ounce parity price;

- The issue of Roosa bonds (foreign currency denominated bonds);

- The General Arrangements to Borrow in 1961, which was an IMF facility large enough to offer substantial credit to the US;

- Operation Twist in 1962, in which the US Treasury bought long term debt to lower long term interest rates and encourage investment, while the Federal Reserve simultaneously sold short-term Treasury bills to raise short-term rates and attract capital inflows; and

- The Interest Equalization Tax in 1963, which imposed a tax on capital outflows.

The US Treasury, aided by the Federal Reserve, also engaged in sterilised exchange market intervention.

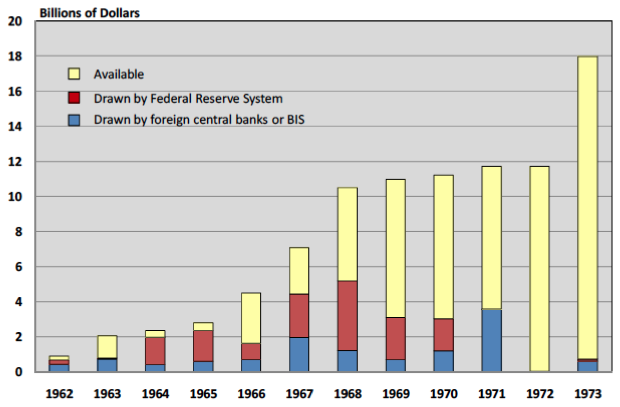

The main instrument used by the Fed to protect the gold stock was the swap network. It was designed to protect the US gold stock by temporarily providing an alternative to foreign central bank conversion of their dollar holdings into gold. In a typical swap transaction, the Federal Reserve and a foreign central bank would undertake simultaneous and offsetting spot and forward exchange transactions, typically at the same exchange rate and equal interest rate. The Federal Reserve swap line increased from $900 million to $11.2 billion between March 1962 and the closing of the gold window in August 1971 (see Figure 2 and Bordo et al. 2015)

Figure 2. Federal Reserve swap lines, 1962 –1973

Source: Federal Reserve System.

The swaps and ancillary Treasury policies protected the US gold reserves until the mid-1960s, and were viewed at the time as a successful policy.

The Breakdown of Bretton Woods, 1968 to 1971

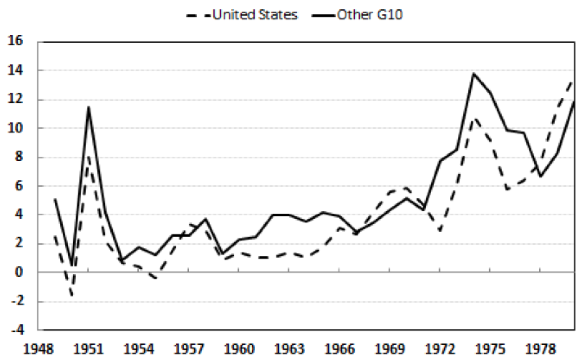

A key force that led to the breakdown of Bretton Woods was the rise in inflation in the US that began in 1965. Until that year, the Federal Reserve Chairman, William McChesney Martin, had maintained low inflation. The Fed also attached high importance to the balance of payments deficit and the US monetary gold stock in its deliberations (Bordo and Eichengreen 2013). Beginning in 1965 the Martin Fed shifted to an inflationary policy which continued until the early 1980s, and in the 1970s became known as the Great Inflation (see figure 3).

Figure 3. Inflation rates

Source: US Bureau of Labor Statistics, IMF (various issues).

The shift in policy mirrored the accommodation of fiscal deficits reflecting the increasing expense of the Vietnam War and Lyndon Johnson’s Great Society.

The Federal Reserve shifted its stance in the mid-1960s away from monetary orthodoxy in response to the growing influence of Keynesian economics in the Kennedy and Johnson administrations, with its emphasis on the primary objective of full employment and the belief that the Fed could manage the Phillips Curve trade-off between inflation and unemployment (Meltzer 2010).

Increasing US monetary growth led to rising inflation, which spread to the rest of the world through growing US balance of payments deficits. This led to growing balance of payments surpluses in Germany and other countries. The German monetary authorities (and other surplus countries) attempted to sterilise the inflows but were eventually unsuccessful, leading to growing inflationary pressure (Darby et al. 1983).

After the devaluation of sterling in November 1967, pressure mounted against the dollar via the London gold market. In the face of this pressure, the Gold Pool was disbanded on 17 March 1968 and a two-tier arrangement put in its place. In the following three years, the US put considerable pressure on other monetary authorities to refrain from converting their dollars into gold.

The decision to suspend gold convertibility by President Richard Nixon on 15 August 1971 was triggered by French and British intentions to convert dollars into gold in early August. The US decision to suspend gold convertibility ended a key aspect of the Bretton Woods system. The remaining part of the System, the adjustable peg disappeared by March 1973.

A key reason for Bretton Woods’ collapse was the inflationary monetary policy that was inappropriate for the key currency country of the system. The Bretton Woods system was based on rules, the most important of which was to follow monetary and fiscal policies consistent with the official peg. The US violated this rule after 1965 (Bordo 1993).

Conclusion

The collapse of the Bretton Woods system between 1971 and 1973 led to the general adoption by advanced countries of a managed floating exchange rate system, which is still with us. Yet this outcome (at least at the time) was not inevitable. As was argued by Despres et al. (1966) in contradistinction to Triffin, the ongoing US balance of payments deficit was not really a problem. The rest of the world voluntarily held dollar balances because of their valuable service flow – the deficit was demand-determined. In their view, the Bretton Woods system could have continued indefinitely. This of course was not the case, but although the par value system ended in 1973 the dollar standard without gold is still with us, as McKinnon (1969, 1988, 2014) has long argued.

The dollar standard was resented by the French in the 1960s and referred to as conferring “the exorbitant privilege” on the US, and the same argument was made in 2010 by the Governor of the Central Bank of China. However, the likelihood that the dollar will be replaced as the dominant international currency in the foreseeable future remains remote. The dollar standard and the legacy of the Bretton Woods system will be with us for a long time.

See original post for references

‘Because the Bretton Woods parities, which were declared in the 1940s, had undervalued the price of gold, gold production would be insufficient to provide the resources to finance the growth of global trade.’

Twenty years on from Britain’s “lost decade” of the 1920s — caused by repegging sterling to gold at the pre-World War I parity — the same mistake was repeated at Bretton Woods. (The US had made the identical error in 1871, which required 25 years of relentless deflation to sweat out Civil War greenback inflation.)

Even as the Bretton Woods conference was underway in 1944, it went unnoticed that the US Federal Reserve had embarked on a vast buying spree of US Treasuries. This was done to peg their yield at 2.5% or below, in order to finance WW II at negative real yields. By 1945, US Treasuries (shown in blue and orange on this chart) loomed larger in the Fed’s balance sheet than gold (shown in chartreuse):

Obviously a fixed gold price is utterly incompatible with a central bank expanding its balance sheet with government debt, reducing its gold holdings to the tiny residual that they constitute today.

Bretton Woods might have worked by limiting central banks’ ability to monetize gov’t securities. Or it might have worked with the gold price allowed to float with expanding central bank assets, according to a formula.

What was lost with Bretton Woods was fixed exchange rates, which are conducive to trade. Armies of traders seeking to extract rents from fluctuations between fiat currencies are a pure deadweight loss to the global economy.

In North America, sharp depreciations of the Mexican and Canadian currencies against the USD are fanning US protectionism, in forms ranging from a proposed border wall to countervailing duties on Canadian lumber and dairy products. What a mess.

Irredeemable fiat currencies are a tribulation visited on humanity. When the central bank blown Bubble III explodes in our fool faces, this insight will be more widely appreciated.

Fiat currency is a tribulation visited on capitalist trade advocates and their financial backers.

International trade, which is hobbled by fiat currencies as you say, was a rounding error in most peoples lives until the Thatcher/Reagan neoliberal innovations.

Since then that rounding error has rounded away most of the distributive properties of the economic systems so distorted to facilitate capital profits through long distance trade that they are impoverishing enough people that Brits vote Brexit, Yanks vote Trump and French vote Le Pen.

Bretton Woods would have worked a lot better if Keynes had won the argument in favor of “bancor”, but he was arguing from a position of weakness and lost out.

And yes, when this blows, as it will, it will all become more widely appreciated.

+1.

missing from the article is the decision to raise the price of oil in order to put most of the 3rd world into debt slavery. This exasperated the inflation mentioned, caused by US deficits. Because the US was still a manufacturing leader and the Unions were strong – we had the wage price stagflation of the 70’s,. The elites solution – Nixon went to China – not to open up a market of a billion people but to make use of a disciplined labor force that would work for cheap – breaking the power of the unions with globalisation aided by computers. The Republicans in the US and Thatcher in England broke the unions in the 80s.Clinton went along in the 90s. Was that plan a factor in the decision to leave the gold standard?

Pegging Sterling at $4.8675 in 1925 was Spencer-Churchill’s stupidity but it was insisted on by The City focused on repaying loans to J P Morgan.

It was not simply the absurd exchange rate – corrected in 1949 – but also the Bank Rate being raised in 1921 and the collapse of Commodity Prices worldwide. The UK economy had been so dependent upon exporting coal and cotton that cheaper German coal (to pay for Versailles) and Indian cotton made the UK non-viable

This was most interesting for its lack of regret for losing a dollar pegged to $35 oz. gold. It is almost a rationale for letting inflation and deficit spending occur because in the end the system using a reserve currency works as good as anything. I do think the expense of the Vietnam war and the obvious policy that it was necessary to allow inflation (from the 70s onward) was incomplete, looking at everything today, because it was based on an assumption that we humans could just aggressively keep growing our way into the future like we had always done. Already in 1970 there were environmental concerns, well-reasoned ones, and global warming was being anticipated. If it had been possible to use a hard gold standard we might not be in this ecological disaster today, but there would have been some serious poverty, etc. The obvious policy today is to put our money into the environment and fix it and by doing that put people to work for a good and urgent cause. As opposed to bombing North Korea; building a Wall to nowhere; giving money to corporations which do not contribute to repairing the planet; and impoverishing people unnecessarily, etc. Money, in the end, is only as valuable as the things it accomplishes.

Wrong on your poverty concept. It is the inflation associated with a reckless fiat monetary system that causes much of the poverty. Prior the fiat era there was minimal inflation. As Keynes explained in his prophetic criticism of the Treaty of Versailles, The Economic Consequences of the Peace, when he called attention to Lenin, of all people:

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method, they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls . . . become ‘profiteers’, who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished not less than the proletariat. As the inflation proceeds . . . all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless.

Lenin was certainly right. There is no subtler, nor surer means of overturning the existing basis of society that to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

The core problem with hard currency is the power asymmetry of the fixed interest contract in whatever form.

Because costs are constant and growing under such contracts, income requirements become “sticky”: in a market reverse, wage earners, renters, mortgage holders etc are obligated by these contracts and cannot accept a cut in their wage unless they have adequate financial reserves. Recessions soak these reserves from debtors to creditors despite the loose underwriting of creditors in the speculative and ponzi phases of the Minsky cycle being the root cause of the business cycle, not profligacy or irresponsibility by wage earners and small business people. In a depression, this liquidationist dynamic starts working its way up the the industrial supply chain, dismantling the actual means of production.

The main potential public benefit of fiat currency is that in such conditions it costs the state nothing to preserve the wealth of those not implicated in causing the collapse and to preserve those means of production. Unfortunately, what we saw in 2008 was Bush/Obama using the innocent victims of the business cycle to “foam the runway” for the institutions that caused it.

Poverty is a simple result of being cut off from possible income sources. To the extent that inflation is managed with what Keynes called “a reserve army of the unemployed”, high levels of poverty are assured. In the high wage, high cost era of the New Deal, the intent was take what burden of financial risk could be taken off of workers and small producers and to provide good paying opportunities for one cycle’s economic losers to get back on their feet in the next cycle. But this only works with full employment where labor has the power to bid for a share of the overall returns on investments.

I found this fascinating and quite persuasive.

But unless you can posit the existence of a state that will reliably act to “preserve the wealth of those not implicated in causing the collapse and to preserve those means of production” it is just a useless academic exercise. I do not see any such state anywhere in view, with the possible exception of the Chinese, who seem to understand “preserving the means of production” as a state priority. For the West however that idea is a real howler.

No inflation can also lead to a form of confiscation where you are not letting new entrants (the young) into the game.

No inflation could reflect a form of protectionism.

One of the things that probably made inflation the preferred solution to our war debt was that it monetized it, and we did borrow that money to do our Vietnam fiasco from our own private banksters. It is disconcerting to think that it would be more “economical” to go to war on sovereign spending, incurring no debt except to ourselves, because it would make war more enticing to all the profiteers, but I agree that inflation certainly had its profiteers too. Money itself really is just another incomplete concept.

Some serious poverty only if because the elites would have been even more neoliberal.

The last gold-standard-free 50 years of innovation and growth have made extinct

1. Shoes that last more than a few months

2. Clothes that you can pass on to future generations

3. Likewise, furniture

4. Milk or Coke in glass bottles

etc.

Isn’t that because we have evicted competition from our global commercial model and replaced it with planned production so every factory knows the size of its likely market?

At what point would China, for example, be able to assert more of a reserve currency, or at least alternative, role based on its economic and trade power and build-up of hard and financial assets? Or is their near-term internal surplus recycling through uneconomic lending enough to keep them off-balance for quite a while on the world financial stage? Many in the West are watching the development of the One Belt/One Road infrastructure and shifting country linkages and alliances with grave concern.

The key to reserve status is large external holdings of your monetary instruments: for foreigners to transact in your currency they must have it. China, thus far, fails profoundly on this count, no one has its currency.

The inverse of this is that the best way for the US to end the dollars reserve status is to eliminate the “National Debt”, which is in fact nothing other than the inventory if dollar instruments the rest of the world holds in order to be able to spend dollars into our system: eliminate that inventory and the dollar will no longer be a reserve currency.

This raises the large question of whether “reserve status” is actually beneficial. Apparently it consists largely of being enormously in debt – and in fact, it’s been a way for Japanese and Chinese to buy up large chunks of our “means of production.” The prosperity of my original home town, Columbus, IN, rests on Japanese “investment.” It does mean some good Japanese restaurants in town.

To me the question is, who benefits from it? It has been of great benefit to a very particular set of people here in the US and quite destructive since the 70s to most everyone else.

It is a power relationship that has been used for imperial aims rather than for the good of citizens. It needn’t be that way, but as US power has become increasingly unaccountable its abuse of this particular tool has grown.

@jsn, you get it!

No, no, no, no, this is 100% wrong.

First, the US could just as easily deficit spend. We are not “in debt” because the US can always create more dollars to retire Treasury bonds.

The requirement for being a reserve currency is running trade deficits. That does require that furriners take and hold your paper. They prefer bonds or other investments to cash to get some yield.

Running ongoing trade deficits also means that you are using your domestic demand to support jobs overseas. That is the problematic feature, not all of this other noise.

Hear, hear!

The concept of a reserve currency came about from resolution 9 of the Genoa Monetary Conference of 1922. The idea was that any currency that was convertible to gold was de facto equivalent to gold and therefore an acceptable central bank reserve asset. In other words there is really no such thing as an international reserve currency without gold in the system according to the very reasoning that established the idea. The U.S. pulled off the greatest bait and switch in history when it “suspended” the gold window in 1971. The whole system because an enormous debt based Ponzi scheme after that and we are now dealing with the consequences.

And yes the key to reserve status: is large external holdings of your monetary instruments for foreigners to transact in”. But what incentive do they have to hold such a currency and transact in it? Remember they don’t need it since they generally run trade surpluses. The answer was, because that currency was convertible to gold. What about now when it is not tied to gold? Why hold the currency of profligate debtor nation? Answer provided in post below.

And anyone who thinks that running large trade and budget deficits is the secret to reserve currency status is a moron. Argentina or Paraguay could just as easily produce the necessary surplus liquidity under that logic.

” But what incentive do they have to hold such a currency and transact in it? Remember they don’t need it since they generally run trade surpluses. ”

Restart back at the very beginning, forget everything you know, and try again.

“They” got foreign reserve currency by selling to the US and getting paid in dollars. Their banks then traded the dollars to the PBoC central bank for freshly printed renimbi.

yes, but why would the central bank endlessly collect another country’s debt?

And you inadvertently point out one of the key frauds in the system. The dollar supports a double pyramid of credit, one domestic and the other foreign. There is also a third pyramid of credit, the euro dollar market, which is built on top of the U.S. domestic pyramid of credit, but lets ignore that for now.

So “they” give us real stuff made of raw material and labor inputs and we give them wampum!!! Greatest scam in history.

Greatest scam in history.

It absolutely is. It’s as much an advance on the British Empire as that was on the Roman system.

“The dollar supports a double pyramid of credit, one domestic and the other foreign. ”

Except the PBoC prints the Many Yuan to buy dollars from the Chinese banking system. The value of the Many Yuan is backed by sales of exports, in that case. A tiny little subset where MMT (The imaginary version) is actually in force. Then the PBoC buys our debt with these foreign reserves, which we wisely spend on our country and citizens.

Next, the Chinese banking system, thru the power of The Money Multiplier, uses that base money to make loans and expand credit to Chinese.

” The value of the Many Yuan is backed by sales of exports, in that case.”

WTF? The value the “Many Yuan” is backed by the sale of exports which yields wampum, uh I mean dollars, and they purchase the dollars with the many yuan they created. The PBoC expands its balance sheet to buy those dollars with yuan created from nothing, hence the double pyramid of credit. The dollars get lent back to us in the form of U.S. government securities because we issue the word’s “boomerang” currency.

And yes you can run a system like this; for how long? That is the big question.

No, you have this wrong.

They want the jobs!

And you have misunderstood what those reserves are for. The Fed also can’t spend all of those US assets it holds on its balance sheet either, now can it?

The use of foreign currency reserves is to defend the currency and keep the IMF away. Having a currency depreciate rapidly leads to a big inflation spike (unless you are close to being an autarky) due to the prices of foreign goods, in particular commodities, going up in your currency.

China is not self sufficient in a whole bunch of things, including in particular energy.

It had a spell last year when it was running through its FX reserves at such a rate that it would have breached the IMF trouble level for an economy of its size if it had persisted for 4-6 months more.

You sound like you must be an economist.

A chemist, a physicist and economist are ship wrecked on a deserted island with only some canned goods for food. They sit down to figure out how they are going to open the cans. To which the economist says: “assume we have a can opener”

Three MMT Economists are stranded on a desert island.

They say, “WTF’s a can opener? That sounds like work!” and live 3 months and are then rescued by Skipper, Gillian, Mary Ann and the Perfesser too, on an Easter Break Tour. Ginger and Mr. Howe are downstairs busy downstairs knocking up.

They are living happily ever after in Kansas City, Mo.

So the British Empire running on Sterling and The City funding the Empire did not imply a Reserve Backing to the Indian Rupee despite Sterling being the coinage throughout the Empire after 1825 Order in Council

>The dollar standard … will be with us for a long time.

Why?

That struck me as “famous last words” material.

Seems to me the dollar system will work until it doesn’t. And those who run it have been doing all within their power for about 15 years to encourage anyone who can to come up with an alternative.

None look viable, and they won’t until suddenly one is.

There isn’t a viable alternative.

The euro isn’t one due to the mess its banking system is in. Japan doesn’t want the job and in any event is a military protectorate of the US.

China is a minimum of 20 years away. Even though it would like the status of being the reserve currency, it most decidedly does not want the attendant obligations, which are running ongoing trade deficits, which is tantamount to exporting jobs. Maintaining high levels of employment and wage growth are the paramount goals for China’s leaders. There are underreported riots pretty much all the time in China due to dissatisfaction over labor conditions now. The officialdom is not going to commit political suicide. Domestic needs always trump foreign goals.

I would never guess about time frames, and that was the real point of my comment. Yes, now China is not viable for reasons you and I have both listed.

China, however, has potentially enormous import needs to ameliorate the comparatively loud and strident demands of their huge population. Should they implement their One Belt, One Road strategy along the lines of The Marshall Plan, they have the opportunity to charge a large number of their trading partners with their currency through deficits that would be targeted to integrate a regional economy with theirs.

Beyond that, their needs and those of the US have some considerable overlap: we want manufacturing back, have labor slack and natural resources, they want rising material living standards and western style stuff. It didn’t take the Marshall Plan long to work, but I’ll grant the post war alignment of political motives and the fact that rebuilding could only be done where the destruction had been made a much cleaner policy space that what we see abroad now.

Just getting around to reading Piketty’s doorstopper and was struck by his argument that prior to WWI there had been very little inflation worldwide for centuries. It was the need to pay off all the war debt that shook things up.

Graeber’s book on debt also makes the argument that money as physical circulating metal currency came about because of the need to pay for wars.

Something similar seems to have been going on with the Bretton Woods agreement.

I know it’s crazy but I’m just going to throw it out there – maybe if we’d like a more stable economy we could try starting fewer very destabilizing, extremely expensive wars???

That is exactly my thought. There is a disturbing cycle of war, monetary expansion to pay for the war, post-war deflation leading to political instability, leading to a repeat of the cycle, at least in Europe and the U.S.

One can see this even in the period between the creation of the Bank of England through the end of the Napoleonic wars.

It is evident as well in the United States pre- and post-Civil war.

Deficit hawks never seem to have a problem with war-time deficit spending, only general welfare deficit spending.

We could have a system where the fiscal power of the state is fully harnessed for the general welfare, but that would threaten the current system which allows a small minority to overwhelmingly reap the benefits of the money creation power of the state and private banks.

This renders the issue a political one more than a purely economic one. If history is any guide, we will continue to have the kind of political uncertainty we’ve experienced until there has been enough war spending to start the cycle over again. :(

Wander no more Mind, you have struck on the bedrock of reality

Wandering Mind,

You have wandered right into the crux of the issue. If you have the time it is worth reading Andrew Jackson’s veto statement from 1832 on the renewal of the Charter for the Second Bank of the United States. Fascinating reading. Monroe, Madison, Jefferson were all against creating a central bank.

http://avalon.law.yale.edu/19th_century/ajveto01.asp

And we started down this path in 1862 when Treasury Secretary Samuel P. Chase pulled a fast one on J.P. Morgan to finance the civil war. He went to Morgan and took a large loan which Morgan granted. Once Chase had the money he then went back to Morgan and said give me all the gold backing the money. Morgan wasn’t happy but had no choice but to comply. Chase then used the gold to buy war goods from Europe. Shortly thereafter the U.S. needed more money but there was no longer any gold so Chase and Morgan came up with the scheme that serves as the foundation for the modern system. Chase issued government bonds to Morgan and Morgan issued money and the die was cast.

Of course all this was a long time ago, but it provides a lot context for today.

” The inflation that started in the later 1960s was substantially if not entirely the result of Lyndon Johnson refusing to raise taxes…”

I’m almost afraid to ask, but how does this make sense? Any increase in taxes will be passed on to the consumer to increase prices even more. If you doubt this, watch what Trump’s import taxes do to prices.

No, you have been propagandized by the right wing anti tax people.

Taxes drains demand from the economy. Lower demand means more slack, more merchants having to compete with each other, some headcount cuts, etc.

By deficit spending in an economy that was already at full employment, Johnson basically guaranteed inflation. Both his own former economist, Walter Heller, and Milton Friedman warned against it. But because Heller was a Dem and an outlier (most Dems weren’t gonna challenge their own party’s policies), it was Friedman’s warnings that were publicized.

Merchants will attempt to pass on an increase in taxes to the consumer. But that assumes that the consumer has enough money. Do merchants also increase wages in order to give consumers enough money? Not by a long shot. Even if merchants increase prices enough to offset the tax increase, that does not mean that demand will remain constant. Inflation requires that the prices of everything increase, and that includes wages.

Another subject that is relevant to the current post 2008 collapse and FED shenanigans to save the day. i.e. save their cronies. And what it is completely missing in this piece written by the insiders is exactly that Bretton Woods; Cui Bono:namely US ruling elite and new world order after WWII.

Bretton Woods was a monetary session of the overall conference 1944-1945 of new world order namely a formal switch from British empire global dominance system into American global dominance system and trade/monetary policies were just an important but small part of overall new global political and military arrangement.

Global pound was killed, global dollar has been created and blessed by western sphere of influence and defended by supposedly the most powerful US militarily in the world, [as was British navy before] US military of global reach via US navy and air force.

The political symbolism of Bretton Woods conference correlated with invasion of Normandy in June 1944, the last step in defeating Nazism in Europe cannot be understated.

Also the dominance of two figures of White and Keynes in this conference is an exemplification of closing era of British empire as a world [decaying at that time] leader which was accelerated by the role of Japanese and German/Italian aggression in colonial Asia, Africa [also helped by French surrender to Nazis that spurred western support for independent French colony of Algeria] and ME boosted up the anti-colonial movements and political parties, which like in Vietnam even US supported during WWII.

Little known fact is that Nazis championed themselves as anti-colonial force in ME while they attempted to colonize eastern Europe.The many Arabs fell for this propaganda siding with Nazis against British colonialism in Palestine setting themselves against Jews vehemently anti Nazi at that time.

In other words Bretton Woods was a consequence of the fact that British empire was collapsing fast ironically with the help of its allies and that Included Soviets. Also helped that British were broke and all the British Gold was already in the US as a payment for bankrolling British defenses in Europe since 1940 and elsewhere, so were Soviet gold payments for military technology and materiel they received from US and allies.

The political void had to be filled or it would have been filled by Soviets, and hence the Bretton Woods system was not based on unfettered exploitation of slaves of newly expanded US empire what US Oligarchy would have liked and was freely practicing before 1929, but for ideological reason was aimed for economic improvements in order to stem massive anti-capitalist, communist and anti-colonist movements that threatened western hegemony over the world and hence the dreaded anti-capitalist words used by in Bretton Woods system like fixed exchange rate or blasphemous capital controls, things the would crucify you if you utter them today during a seminar in any Ivy league economy department.

Bretton Woods was primarily a tool into an ideological war west and Soviets knew they would have to fight, cold or hot.

This [economic dominance] war ended in mid nineteen sixties when seeds of collapse of Soviet Union and betrayal of leftist ideals and socialist/communists movements all over the world were sawed and hence Bretton Woods was no longer needed and brutality of unfettered capitalist could begin to return starting with Kennedy tax cut freeing capital in private hands and then FED going full fiat in later 1960-ties, capital flow deregulation, free floating currencies, all that for benefit of oligarchic class and of colossal detriment to American workers, devastating result of which we are experiencing now.

One of the great ironies of Bretton Woods is that Harry Dexter White, the US rep at the talks was in fact a Soviet agent. I wonder if he understood monetary economics enough to hope that the Bretton Woods gold standard system, as opposed to Keynes bancor proposal, would self immolate with a run on US gold stocks and take the West down with it.

Let’s think of “root causes”, both Keynes and White were big fans of Soviet-style command and control top-down planned economies (“I have seen the future…and it works!”). So that’s what they divined and devised for money: a top-down price-fixing regime.

So while people would laugh themselves silly if you told them we were going to price things the way the Soviets did (“we’ll raise X number of cows because we’ll need Y quantity of shoe leather”), we somehow accept central planning for the price of the most important item of all: money itself. The supreme geniuses at the Fed et al, with their supreme formulae, can divine at any moment precisely what the price of money should be. This, of course, is folly.

And people should understand that the gold standard (not the gold-exchange standard it is often confused with) was not designed, was not somehow imposed, and was not agreed upon by some collective body. It simply arose organically because time and again through painful experience throughout history it was shown that any system where people can simply vote themselves more money ends in tears. Not usually, but always. You’d think that a 100% historical failure rate would clue people in to rethink the head-hammer-hitting approach.

And as Dr. Haygood points out above, “everything floating against everything else” is nothing but a colossal waste of time and money. You wouldn’t attempt to build or make something without an agreed and immutable unit of measure.

Completely untrue of Keynes. He ran the UK Treasury twice very pointedly in the interests of industrial capitalists. He was however very opposed to financial rents, a real classicist in that regard.

Keynes ran the UK treasury twice more or less along classical lines: in favor of industrial capitalism and against financial rents. Not top down, not Soviet. Its not clear where you get your facts, fiat systems have lasted hundreds of years many times. They tend to arise in empires with secure borders. They depend on the productive relations of their societies for the value of their money rather than a commodity hedge.

Warfare favors the commodity hedge because the productive relations in a society are frequently destroyed by war. Because of the stickyness of wages, hard currency tends to choke economic growth because a fixed money supply has to be spread increasingly thin as more real wealth is created to be denominated with a fixed quantity of specie, requiring wages to drop because there is more stuff to purchase.

Each has benefits and costs, both are tools and while the one favors growth and the other war, neither must be used for either. A representative system will use either as its constituencies direct, an authoritarian one according to the intent of the authority. It isn’t tools that make the problems, though some are better for some purposes than others. It is the intent of the powerful that is expressed and from which others suffer.

@jsn ” fiat systems have lasted hundreds of years many times.”

what? can you please back that statement up. Only major fiat system in history that I have ever seen written about is the one that existed in China several hundred years ago. If there were others you need to give some examples.

Split Tally sticks.

Yes! For most of human history something like that was the form money took. Coin was invented in Greece IIRC about 2500 years ago: urbanized, monetary economies date back five or six thousand years before that and mostly they used tallies or temple registers with only foreign trade denominated with gold.

Hudson, Graeber and Mitchell-Inness are all good on this.

https://en.wikipedia.org/wiki/Fiat_money#China

thanks jsn for link, but I stand by my point, the only “major” periods of fiat currency are the present and China several hundred years ago. The others were temporary blips in commodity based systems.

See particularly Part 5:

http://www.levyinstitute.org/pubs/wp_832.pdf

I think you objected to my comments without actually refuting them:

1. We have a top-down price fixing money system;

2. Keynes and White were a big fans of Soviet central planning (see The Battle for Bretton Woods for chapter and verse);

3. And I’ve never understood the “fixed quantity of specie” argument. Surely it’s about price, not physical quantity. You could easily run the world economy on 100 tons of gold…if it was priced accordingly.

(3)

Where the problem comes in is with credit creation by banks in a fractional reserve banking system.

You could make the interest rate on debt variable and indexed to ease the strains of monetary “deflation”, or “inflation”, if you could measure that in a meaningful way to be relevant to everyone’s cost of real goods and services and financial assets, both on the cost they paid for stuff with old debt they are presently servicing and any new purchases coming up. [fat chance – MMT has the same problem because it uses monetary inflation as it’s thermometer stuck up the economy’s GDP.]

But the “principal” of the debt is still denominated in gold, so this becomes a very heavy deflationary load for existing debt holders.

However, people theoretically may have gotten smarter about loading up on the stuff in an alternate reality past, and we probably wouldn’t have had the 300% increase in consumer debt with all the corporate, state and local, and Federal debt piled on top. The evil twin – the taxpayer -, is also ultimately on the hook for that.

But, borrowing from the future is good for this year’s GDP!

I agree with you, mostly, with regard to the financial markets. With regard to the consumer economy a modest inflation is simply a depreciation of an underutilized asset: money. But, per my sticky wages comment above, the real economy has very real problems with static or deflationary prices as fixed interest contracts load all temporal risk onto those least able to tolerate it and when the market stalls sucks assets from those who have least first.

I was focusing on the top level macro view, but of course the micro view addresses the distribution of the problem. However, when we do get a recession, wages aren’t so sticky for those who are laid off, and we’ve seen the general rule where after being laid off from a fairly good job, it’s getting common that even if you quickly get another, chances are pay is no where the same, and may even be a part time gig job. It sucks to be poor or less than middle-upper class.

I suppose you are right, I’ll try to stay on point here.

1. The dollar is a tool of the United States government which through monetary policy does set the price of the dollar. It is innumerable other policies both of intent and neglect that establish the distribution of price across other things.

2. Central planning is necessary for an industrial society or no one’s nuts fit anyone else’s bolts: Keynes preferred central planning for public goods, at present we prefer to let The Fed, Wall Street, Uber, Google, Facebook, Amazon and the Five Eyes do all of our planning.

3. Your 100 tons of gold would be constantly appreciating in value against everything else as a result of any growth: the same amount of gold would be subdivided to proportionally represent more stuff. If a quantity of gold is the price measure of all things and more things are constantly being measured, each piece of gold is constantly being cut into smaller and smaller units to extend the measure so the gold is becoming relatively more valuable. It is about price, but price is always relative.

Keynes NEVER ran the UK Treasury

Senior moment, my bad: during WW1 Keynes advised Lloyd George; during the Second he was on the Board of the Bank of England, a notoriously Soviet lot.

Thanks for the fact check, memory needs refreshing: Govt. policy during both wars was Keynsian and important dissent to both the Treaty of Versailles and the post war Gold Standard reintroduction were his voice.

He didn’t run Treasury, I stand corrected, but it was run to his precepts.

I need to re-read Skidelsky, it’s been a while!

Keynes was NO fan of Soviet-style (actually WW1 Germany under Ludendorff) planning and Harry Dexter White was a Communist and an agent for Stalin.

Michael Hudson’s book Superimperialism, published astonishingly in 1972, nailed it. Details some great history of FDR’s economic diplomacy during the late Depression and WW2 period that preceded the Bretton Woods settlement. Worth a read.

More than worth a read. Essential.

yes Michael Hudson is great, but that is why he must be marginalized/ignored. Can’t maintain control of the official narrative if people like Hudson were to ever be taken seriously..

“However, the likelihood that the dollar will be replaced as the dominant international currency in the foreseeable future remains remote. The dollar standard and the legacy of the Bretton Woods system will be with us for a long time.”

That is the BIG question and the answer remains to be seen. I for one don’t believe it will continue much longer, but then again nobody knows. Bordo also leaves out a critical part of the narrative, i.e., the U.S. secret deal with Saudi Arabia in 1974 to officially tie the dollar to oil. See link below for details. Without this secret arrangement the dollar would have never survived as the international reserve currency. The Saudis reportedly pushed for greater use of the SDR, but the U.S. made them a deal they couldn’t refuse and the Saudi royal family realized that if they didn’t go along with U.S. demands the CIA would find some other branch of the family that would.

https://www.bloomberg.com/news/features/2016-05-30/the-untold-story-behind-saudi-arabia-s-41-year-u-s-debt-secret

The system is a mess and it is retarded to allow one country’s currency to serve as the main reserve asset for the system. That is the ultimate free lunch and the equivalent to believing in a perpetual motion machine. It is hard to believe in can continue much longer despite of Bordo’s view that it will. It has reached a point where it has created massive problems that can not continue.

So, it’s not ‘out of thin air.

It’s back by the might of the Pentagon…mightier than gold.

Exactly! But nobody at the Fed is going to explain this to anyone, anytime soon.

MyLessThanPrimeBeef wrote: So, it’s not ‘out of thin air. It’s back by the might of the Pentagon…mightier than gold.

And in turn the seignorage on that ability to create as much of the global reserve currency as the U.S. likes pays for the Pentagon.

https://en.wikipedia.org/wiki/Seigniorage

So in a sense when China and Russia are forced to hold dollars for global trade, they’re essentially paying for the Pentagon to do what it’s doing. You can see why they’d be mad.

They could barter instead, but it really is very inconvenient, and they could end up like Milo Minderbinder with his Egyptian Cotton* or equivalent.

Plus. when you have one eye on the door in preparation to exit the regime in a hurry due to the concomitant and eminently potential existential challenges, gold in large quantities is a real drag.

Better to have digits in some bank account somewhere, – you know where.

Pip Pip!

* in Catch22 – the book that gives and gives.

The value of the dollar comes from productive relationships globally denominated with dollars: goods and services produced in those relationships are traded for dollars.

That one of the main US exports is now arms combines with the erosion of the US ability to collect taxes, not via the IRS but via Congress which legislates less and less taxes for the pool of existing reserves of wealth while always piling a higher tax burden on real production and real services in the real world, these are the main reasons I disagree with Yves about how quickly the reserve status of the Dollar could erode.

I’m probably wrong…

It is almost a gift from heaven when fixing a single problem offers the chance to fix a whole bunch of them. This IMHO is very possibly one of those gifts. Without this “ultimate free lunch” the globalization scam of allowing this country’s and the world’s 1% to keep adding zeros to their bank accounts (“to keep score” as Pres. Trump puts it) would not have been possible. Without countries like Saudi Arabia willing to keep accepting more “debt that can’t be repaid (and) won’t be”, the US military industrial complex would not be able to keep increasing its threat to world peace and threatening the survival of humanity. Without the Saudi stranglehold over politics and US Middle Eastern policy the US could stop killing Muslims in its bogus ‘war on terror’. It could get busy replacing its fossil fuel energy sources with renewable ones and its oil-powered transportation system with an electrified one (yes, maybe even a few EVs)

@Robert NYC – Thanks for the link.

It is hard to believe in can continue much longer despite of Bordo’s view that it will.

And yet where is the dollar’s replacement?

If you’d told me ten years that the petrodollar as an institution enforcing compliance w. the dollar as global reserve currency could end and yet the dollar would continue with that status, I’d have laughed at you. However, that increasingly looks like it might happen.

Yes, yes, I know — we await the basket of currencies solution pushed by China and Russia, and others sick of the situation. We’ve been waiting for a while now.

I’m thinking globalization has something to do with the dollar’s longevity. Strip a country of the ability to support itself by exporting its jobs and it’s people become dependent on a strong military to insure it’s money continues to be “accepted” even when it’s people no longer have anything to trade for what they really need.

I think there is indeed a link between the usd as reserve currency and the military budget.

@Moneta, these numbers are roughly correct. The U.S. defense budget is about $600 billion, the trade deficit is about $600 billion and last year we issued $1.4 trillion in incremental debt. Foreigners own about 40% of U.S. debt. 40% of of $1.4 trillion is $560 billion so yes there is a pretty strong correlation. Massive defense budget wouldn’t be possible without reserve currency scam.

@Mark P.

yes that is the conundrum. It doesn’t make a lot of sense but it goes on and on. Another 50 years? Unlikely.

“And yet where is the dollar’s replacement?”

Prolly “Dollar Lite. Clean, crisp, but less filling!”

The global elites will want to preserve their wealth – the majority of it denominated in old debt. So I can see a likely scenario where we just get a deadlock of squabbles between the powers holding the debt and the rest of us, plus governments, that are rooting for Michael Hudson’s description of economic reality, “Debt that can’t be repaid, won’t be.”

The two choices here would be inflating out of the debt or debt write downs and defaults – which are inflationary too because in that case the central banks won’t be exercising their powers to reduce the quantity of money when they sell debt they own on the balance sheet and then this high power money still circulates in the banking system which does support new credit creation and demand. Tho at least temporarily banks would stop most lending and probably go under in the intermediate term (2 days?). Plus, when the system starts collapsing, there is no way the central banks would just sit still, anyway. It would be back to using the same old tool to excess again.

The only question is whether it happens slow or fast, and whether the Buck does settle out at some much lower equilibrium, or really does do a swan dive all the way down.

Then the is the conundrum of the interaction between monetary inflation and deflation and the knock on effect on the real economy and asset values. (think stocks, then associated real asset values)

This is where things get really hard to predict – other than just scream out, “Chaos!”, and put your head between your knees.

+1

“The global elites will want to preserve their wealth – the majority of it denominated in old debt.” And you also nailed the paradox between inflation and deflation.

I’m completely confused. Anything available in plain English for laypeople?

“The adjustment problem in Bretton Woods reflected downward rigidity in wages and prices which prevented the normal price adjustment of the gold standard price specie flow mechanism to operate” …

A currency (or gold) may drop in value very rapidly, whereas people do not get wage increases or decreases nearly so quickly.

Oh, I meant that as a sample. I’m confused by the whole article. I wanna know more about the pre-Reaganomics period but any time I see reference to Bretton Woods it’ll be written for someone on another level. Other than there were fixed exchange rates and the dollar was convertible to gold etc. In contrast the free-marketeers have always been popularising their ideas in simple language

Partially convertible

Tariffs would have assisted……Capital Controls did

That fiat currencies have lasted hundreds of years jsn is simply not true. I was thinking forty but here we see 27!

http://georgewashington2.blogspot.com/2011/08/average-life-expectancy-for-fiat.html

And it’s the US and Canada being the only countries globally not marking their gold holdings to market. (or audit) Reserve currency indeed!

http://marketupdate.nl/en/analysis-china-marks-gold-reserve-at-market-value/

Canada which was one of the founding members of Bretton Woods pulled out as early as 1949 in order to move to a floating exchange rate and full capital mobility. Bretton Woods was dead before it ever began.

Bretton Woods had a system of Tariffs to punish persistent trade surpluses but the US chose to protect the Cold War border states such as Japan and Germany, the latter running persistent trade surpluses since 1952.

This forced all the adjustment on the deficit nations who were forced into inflationary cycles through devaluing currencies yet obliged to run trade deficits to sustain global liquidity as reserve currency nations.

The EuroZone is supposed to have a similar mechanism but it will take BreXit with the UK cancelling 25% German trade surplus through tariffs to re-balance the EuroZone

What am I missing here? Both nationally and globally, money’s principal use is as a medium of exchange. When the money supply is properly managed, it can serve as a store of value. But money is NOT wealth, it is a claim on wealth. From the perspective of the community in which that money is accepted it is debt, i.e. an obligation to furnish wealth equivalent in value that the holder of money had to (presumably) give up in exchange for that money.

In the case of reserve currencies, that ‘community’ is the entire world. And in the case of the U.S. government’s dollar-denominated debt (and the debt it guarantees) it is pretty obvious we are dealing with ‘debt that can’t be repaid (and) won’t be’. At some point, the rest of the world is going to have to stop ‘throwing good money after bad’ – and maybe also own up to the fact it has been had, i.e. that much of the world’s 1%’s ‘wealth’ (money) consists of un-payable debt. It is going to have to say ‘NO’ to this gigantic fraud and help the US return to producing real wealth the world needs, e.g. renewable energy, more energy and resource-saving inventions like the Internet, instead of more bombs to keep its Empire of Debt in tact.

This would be if everyone was reading and understanding Naked Capitalism… In the meantime, it is debt bondage for the 99 percent… Just look at Greece – most of them still want the Euro… ?