Yves here. One minor quibble with this deceptively simple post. Small banks can and do grow more rapidly than big banks. It’s generally a sign that they are being looted. See Bill Black’s The Best Way to Rob a Bank is to Own One for details. Murray’s view is consistent with one that we’ve argued for a long time, that banks should be regulated like utilities.

By Cameron Murray, a professional economist with a background in property development, environmental economics research and economic regulation. Follow him on Twitter: @DrCameronMurray. Originally published at Fresh Economic Thinking

Australian banks are upset. Their $30 billion per year gravy train of profits from the Australian people is finally being slowed down.

A levy on bank liabilities of 0.06% annually was announced as part of the 2017 Federal government budget, and is expected to raise about $1.5 billion per year, or 5% of bank profits.

To be clear, the banking system is a regulated cartel. Its primary function is to provide a public good in the form of the money supply of the country. As such, we would expect it to be uncompetitive, and use tight regulatory controls to ensure that the privileged position of private banks is not being abused.

In my book, Game of Mates, I explain that the result of this uncompetitiveness and lack of adequate regulation in Australia is that over half of the banks’ profits can be considered economic rents, which could be taken back with better regulation and shared with the public at large.

I want to use this blog post to explain in detail the underlying administrative mechanics of why any modern banking system is necessarily uncompetitive.

The first thing to know is that banks do two things. They make money by extending loans, which expands the money supply; a function that is an essential public service in a growing economy. Second, they settle obligations between parties both within their own bank, and between banks, which is another essential public service.

But letting private entities simply make money is risky. So our central banking system constrains the private banking system by making the banks settle payments between each other with a different currency held in accounts at the central bank. In Australia these are called Exchange Settlement Accounts. Every private bank in the system must have an account at the central bank so that they can perform this second function of settling payments.

By controlling the second function of banks by making them use a currency controlled by the central bank, it indirectly controls the former function of money creation. No one bank can rapidly create new money by writing loans faster than the rest of the banks. If they do, when the borrower deposits the money created into an account at a different bank, like when they use the loan to buy a house from someone who banks with another bank, it will require the originating bank to settle this payment flowing from their bank to a different bank with their central bank money.

This process reduces their net asset position and increases their costs. They can’t continue to do this. What limits their rate of money creation through new loans is how fast other banks are creating money and transferring central bank money to them. Each individual bank is constrained in their money creation function by their settlement function.

Keynes wrote as such in his 1930 Treatise on Money:

…it is evident that there is no limit to the amount of bank money which the banks can safely create provided they move forward in step.

The words italicised are the clue to the behaviour of the system. Every movement forward by an individual bank weakens it, but every such movement by one of its neighbour banks strengthens it; so that if all move forward together, no one is weakened on balance.

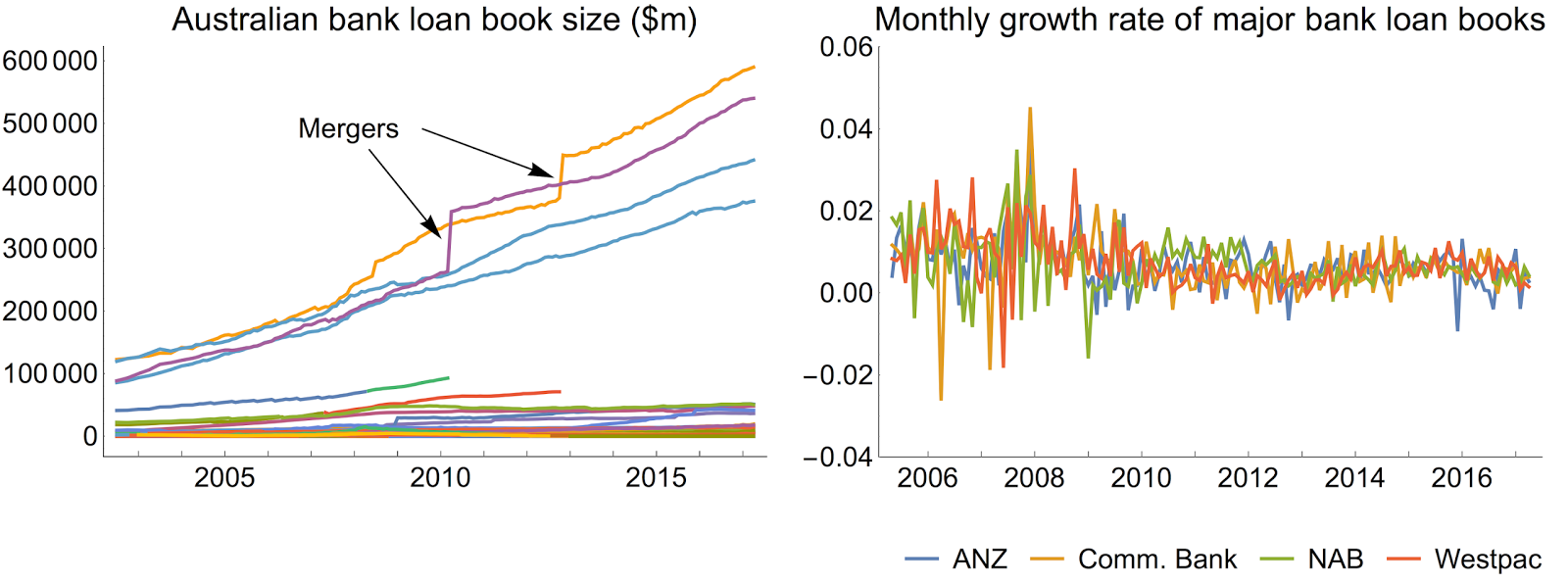

The Australian bank data shows this process in action. Below are two graphs. On the left is the size of the loan book of Australian banks. There is a clear concentration here and a surprising regularity to the trends at all banks. To show these trends more clearly, on the right is the monthly growth of the loans made by the four major Australian banks. As you can see, there is no sustained deviation by any banks from the core growth trend. All banks are moving lock step, as they should.

The whole point of a central banking system is that the growth rate of loans for all banks in the system will quickly equalise. If you are a small bank, this means you can never grow abnormally fast in order to gain market share by competing for loans with the larger banks.

Any central banking system is therefore, by definition, unable to be competitive.

In Game of Mates, the solution proposed to stop the economic losses from the abnormal profits of the protected private banking cartel is to let the central bank itself offer basic low-risk lending and deposit functions directly to the public. Because it has the ability to create for itself its own central bank money, it is the only entity that can grow faster than the existing banks in the system.

Of course, the reality is that the solution would be a far greater hit to bank profits than the small levy proposed. In fact it would likely take back over $20 billion per year in profits from the private banks, which would be shared with the government through its profits on banking operations, and with its bank customers through lower costs. If the banks are upset about a levy of just $1.5 billion a year, they are going to really crack it when they hear this proposal!

*This proposal is actually widely called for by economists, and the idea can be mostly attributed to Nicholas Gruen. See here for example.

Commercial bank credit creation is a “system” process. No bank, or minority group of banks (from an asset standpoint), can expand credit (& the money stock), significantly faster than the majority group are expanding. If the city commercial banks hold 80 percent of total bank assets, an expansion of credit by the country banks, & no expansion by city commercial banks, will result, on the average, of a loss in clearing balances equal to, 80 percent of the amount being checked out of the country banks. I.e., the FED, through controlling the reserves of the city banks, can control the expansion of total bank credit, city, & country.

Professor Richard Werner of Southhampton University in https://www.kreditopferhilfe.net/docs/Richard_Werner__Can_banks_individually_create_money_out_of_nothing__plus_supplemental_material.pdf

His concluding paragraph:

Henceforth, economists need not rely on assertions concerning

banks. We now know, based on empirical evidence, why banks are different,

indeed unique — solving the longstanding puzzle posed by Fama

(1985) and others — and different from both non-bank financial institutions

and corporations: it is because they can individually create money

out of nothing (my emphasis).

Richard Werner has become a hero of mine for raising the lid on Japanese, Korean and Indonesian banking practice and explaining how those countries have succeeded while we in the west seem to atrophy. His old book “Princes of the Yen” should be mandatory reading for all.

Private bankers shouldn’t be given the sovereign and exclusive right to create new money. Ellen Brown, att her “Web of Debt” has some ideas.

The banks should be nationalized. “Competition” is perverse (it singularly creates both stagflation and secular strangulation). By buying their liquidity, instead of following the old fashioned practice of storing their liquidity, the bankers, the system, and the economy, all lose income.

All voluntary savings originate within the commercial banking system. I.e., time (savings) deposits are not a source of loan-funds for the commercial banking system, rather bank-held savings are the indirect consequence of prior bank credit creation (derivative not primary deposits to any bank)– and the source of core bank deposits can largely be accounted for by the expansion of bank credit. In other words, an increase in time/savings accounts depletes demand deposits, etc., by the same amount. Since time deposits originate within the banking system, there cannot be an “inflow” of time deposits and the growth of time deposits cannot, per se, increase the size of the banking system. The expansion of time deposits, per se, adds nothing to total bank liabilities, assets, or earning assets.

Monetary savings are never transferred out of the system (unless currency is hoarded, or converted to other national currencies). But bank-held savings are idle, un-used and un-spent. Bank-held savings are lost to both consumption and investment (as DFIs always create new money whenever they lend/invest).

The only way for the saver/holder to utilize/activate, directly or indirectly, the existing stock of savings is outside of the banking system through non-bank conduits (which increases the supply of loan funds, but not the supply of money). Said savings never leave the system. I.e., non-bank lending/investing is a velocity relationship – where title to commercial bank deposits is transferred (exchanges counter-parties).

Money velocity, MZM velocity, has fallen since 1981 because of two reasons: (1) an increasing proportion of savings have been bottled up. And (2) as professor Lester V. Chandler originally theorized in 1961, viz., that in the beginning: “a shift from demand to time/savings accounts involves a decrease in the demand for money balances, and that this shift will be reflected in an offsetting increase in the velocity of money”. His conjecture was indeed true up until 1981 – up until the saturation of financial innovation for commercial bank deposit accounts (the widespread introduction of ATS, NOW, and MMDA bank deposits).

The remuneration of IBDDs exacerbates the decline in Vt (subpar economic growth). The celestial pulse (what Krugman doesn’t understand and can’t do): As I said on 12-16-12, 01:50 PM (because of the expiration of unlimited FDIC Insurance coverage: “Jan-Apr could be a zinger”, or “predictive success”). As I said: “Raise the remuneration rate and in a twinkling, the economy subsequently suffers. – Apr 28, 2016

What have we done?

Banks lending into asset bubbles and creating credit for financial speculation is very dangerous and will affect the whole economy.

To stop this happening Glass-Steagall was put in place, this separates the credit/money creation side of banking from its speculative side.

When banks can securitize bad debt, like NINJA mortgages and get them off their books you are in trouble.

The BoE on money creation:

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf

“Although commercial banks create money through lending, they cannot do so freely without limit. Banks are limited in how much they can lend if they are to remain profitable in a competitive banking system.”

The limit for money creation holds true when banks keep the debt they issue on their own books.

The BoE’s statement was true, but is not true now as banks can securitize bad loans and get them off their books.

Before 2008, banks were securitising all the sub-prime mortgages, e.g. NINJA mortgages, and getting them off their books.

Money is being created freely and without limit, M3 is going exponential before 2008.

This is the US money supply leading up to 2008:

http://www.whichwayhome.com/skin/frontend/default/wwgcomcatalogarticles/images/articles/whichwayhomes/US-money-supply.jpg

Everything is reflected in the money supply.

The money supply is flat in the recession of the early 1990s.

Then it really starts to take off as the dot.com boom gets going which rapidly morphs into the US housing boom, courtesy of Alan Greenspan’s loose monetary policy.

When M3 gets closer to the vertical, the black swan is coming and you have an out of control credit bubble on your hands (money = debt).

Why does no one seem to know what’s going on?

Monetary theory has been regressing for one hundred years:

“The movement from the accurate credit creation theory to the misleading, inconsistent and incorrect fractional reserve theory to today’s dominant, yet wholly implausible and blatantly wrong financial intermediation theory indicates that economists and finance researchers have not progressed, but instead regressed throughout the past century. That was already Schumpeter’s (1954) assessment, and things have since further moved away from the credit creation theory.”

“A lost century in economics: Three theories of banking and the conclusive evidence” Richard A. Werner

http://www.sciencedirect.com/science/article/pii/S1057521915001477

“…banks make their profits by taking in deposits and lending the funds out at a higher rate of interest” Paul Krugman, 2015.

Wrong, that’s “financial intermediation theory” and this is a Nobel prize winning economist.

In the link you will see the BoE has supported all three theories of money at different times, they don’t seem to know how money and debt work and this is a Central Bank.

Not realising the effect of private debt on the economy has led to these situations developing in the US and UK:

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.53.09.png

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

After deleveraging since 2008, US private debt is slightly higher than it was before the debt deflation of the Great Depression.

Today’s neoclassical economics doesn’t look at private debt in the economy and it exhibited the same problem in the 1920s when it led to the debt deflation of the Great Depression.

You can’t leave private debt out of economics, although we have.

Malfeasance in accounting is the name of the game in white collar crime, going back to Babylon and clay tablet inventory & receipts. Under King Hammurabi, this was punishable by death … all transactions by an individual or their agent, including pawn broking, had to have a witness or a notarized bill of sale/pawn. Arthur Anderson Corp anyone? How about massive accounting fraud as part of the Chinese miracle?

So if it helps the Elite to leave out private assets, or private liquidity, or private debt … it will be. Credits and debits depend on the observer, like Schroedinger’s Cat. A huge quantity of private assets aren’t accounted for in Europe and elsewhere … not just in the Pentagon. Enabling private and public liquidity is the primary job of central banks, particularly liquidity between national banks. Enabling private debt of a certain sort is important to the peasants … and their predatory creditors. There is nothing new under the sun.

We all know what Krugcritter blurts out is usually nonsense!

Thanks for two very helpful posts and links. These days of diminishing middle class numbers, I guess your sound is a slurping one?

I certainly agree that you and NC and its other readers know what to do but I suppose all those in the markets don’t want to wake up until some fellow sees a way out that preserves existing wealth in the same hands.

The writing on the wall became clearer this week with an announcement that China is offering gold investments with payment in actual gold, not like the Comex rip-off of payment in USD. Can you hear that second shoe dropping?

Private banks give the government the plausible deniability, that the government creates money, currency and credit … because the banks are partners in the prejudicial distribution of government largess. Of course banking is too important to be left in the hands of bankers, and government is too important to be left in the hands of politicians … so there is an inherent competition/collusion that happens between banks as a whole and governments as a whole. When liquidity in the form of currency, was limited to money, this created a bottle neck in the operations of banks/governments … but that has been overcome in the last 50 years.

But it is an old story … in Babylon most of the shekels of silver were notional, units of account, not physical bullion. What was currency was the requisition slip to acquire stored grain etc from the temple stores. As has been pointed out, debt slavery is what has always driven wage slavery, since most people were never in a position to acquire independent wealth that was fungible (aka money). It has been a temporary liberalization, since the Classic period of Greece etc … until recent times, that has allowed fungible wealth to be accumulated outside of government/temple control.

This has been ending for two generations … with purely electronic money, at interest, we will have returned to the days of Babylon … and the slavery that went with it.

Which is to say that you disagree with this statement (as do I):

That’s what the banking system’s primary function should be, perhaps, and that’s probably what plenty of people working in the banking system believe, but in reality the banking system is an artifact of a social-control mechanism that is used to benefit primarily those who control its various parts. That’s a feature, not a bug. It’s been that way from the beginning.

I think our rational thought processes, when thinking about society generally, have been greatly hindered by the widely accepted “social contract” theory of government….which kind of ignores the central place of violent coercion in the historical creation of actual governments. The Constitution was not written to put normal people on a level with the elites who created that document and the system it enshrined, and the banking system wasn’t created to provide a public good. Any public good that has resulted is an unintended side-effect. If we’re actually concerned about the public good, I’d think a better way to go about things would be to start from scratch with that intention, rather than try to “reform” the existing system to do something that was never its purpose in the first place. That would no doubt cause a lot of chaos, but uh…look at what we’ve got now, and where we’re heading. It’s chaos everywhere you look.

Besides, I’d trust my mailman to direct capital allocation a heck of a lot more than I trust Jamie Dimon…just sayin’.

I agree. There is no Social Contract. Just as there is/isn’t a Hidden Hand. We need to forget some of these 18th century ideas.

Well…there is a hand and is hidden. This is why most have not ever seen it. To see what is hidden one needs to uncover it

Correction to my above comment. I had cut off the end of lengthly link.

As Marx did not, and I do not subscribe to any monetary theory and as he posited money in itself was nothing but economically unnecessary and even detrimental to economy nevertheless very convenient tool of extracting (alienation of labor from worker i.e stealing) value of past labor (so-called surplus value) and/or projected value of future labor (interest on money lent) in a form of imposed and regulated by the authorities universal commodity (gold, silver) or completely abstract creature of fiat money that amounts to nothing but old good confidence scheme played by one single integrated system wrongly distinguished as private banking cartel and Government monetary functions, a distinction without difference, being itself a deception required by any confidence scheme.

As I see it, at least in current reincarnation of massively, extremely concentrated capital system and global banking system that controls flows of capital, it is all one big confidence scheme.

The assets and asset values are all expressed [and recognized as such] in financial terms [in fiat currency and other terms] which make them even in this seemingly benign form a volatile derivative of fiat money which itself is just a symbol of confidence (or not) in this very confidence game.

The soviet economists removed currency from their models even if they were dealing with permanent ZIPR value-based monetary system i.e. equivalent unlimited credit, almost all businesses in TI(important)TF category and fixed wholesale and retail prices but still using money would skew true economic picture of SU as far as they wanted to really see it, something that cannot be taken for granted also here in the US.

And hence instead of talking about how much money they spent on transportation instead they were talking about how many buses/trucks they produced and how many people/cargo those buses/trucks actually transported in comparison to current and future (planned) needs.

In this case a confidence game of money value was replaced by a confidence game of statistical data and reporting supposedly attached to reality of mainstream economy but in fact as in the US end up to be doctored so certain people and institutions (government and banks of course) get their bonuses regardless of economic reality.

That’s why fiat money was made to also be guaranteed by governments in one form or another but still these are just symbols of confidence in the government guaranties themselves which in this case are guaranties of application of intimidation (courts, law), violence (military and law enforcement) and coercion (rules and regulation base economic advantages) to reinforce contracts’ acceptance of money as expression of value of underlying assets that are being contracted. Money is simply shoved down our throats, under threats and duress like taxes,penalties, fees or rewards.

When last time a law suit or tax bill could have been settled with 50 live chickens?

However you cut it, this financialized (moneyed) economic system is all about a confidence in money scheme, which often takes form of Ponzi confidence scheme if suppose money value of the investment completely detaches itself from underlying assets and becoming simply betting.

And be sure you ain’t running this confidence scheme, the oligarchic ruling elite is, hence they win, we lose.

The real problem with banking system, the problem which no one wants to even talk about, is money itself. The non-existent social construct called money, nobody really needs but those who steal our labor, and is continuously propagandized, conditioned to be desired and used to negotiate sometimes even intimate inter-human relations within society of control.

Here I found a controversial essay about money as purely social construct:

https://contrarianopinion.wordpress.com/2015/04/14/plutus-and-the-myth-of-money/

Banks exist to keep your money safe. The money used in your nation is the national currency.

Bitcoin, SETLcoin, these are currencies created for criminals.

Imports send national currency as money outflow to competing nations. Even paper money takes up space & has weight. Even electronic money takes up space & draws upon energy sources to be accounted.

When your banks no longer serve their primary purpose of keeping your money safe, they have failed from the get go.

The Finance banks now are busy giving your money to just about anybody but you.

In a nation with finite central currency the way to get more money is to export at a profit.

I prefer this modeling for my model nation. I prefer banks that keep my own money safe for my use and gives me some more money for putting my trust in that particular bank.

I prefer that my citizens export more than we import.

That is where I am in my own modeling which admires Glass Steagall.

P.S.

It could well be that the ideal is still two banking utilities in one nation so there is a controlled money supply & controlled competition.

Is this the system that Glass Steagall created?

“I prefer that my citizens export more than we import.”

What do you expect they’ll get for those exports, apart from some other country’s scrip?

I recall a video clip from years ago of Yves putting this utilities point to Bernanke – she was ignored.

To Larry Summers, but thanks for remembering!

Could you post a link please? Would love to watch it.

“But letting private entities simply make money is risky. So our central banking system constrains the private banking system by making the banks settle payments between each other with a different currency held in accounts at the central bank. In Australia these are called Exchange Settlement Accounts. Every private bank in the system must have an account at the central bank so that they can perform this second function of settling payments.”

I took a few political economy classes in college and have a done a lot of reading on my own but never took an econ class, so this one fell in one of my knowledge gaps and I had no idea. What is it called in the US?

United States Clearing System, including Fedwire Funds Service and Automated Clearing Funds ACF … busiest in the world. Trillions of dollars worth change hands ever day, hundreds of trillions of dollars per year. Also a private system is available the Clearing House Interbank Payments system CHIPS settles over a trillion dollars per day. CHIPS is international in composition.

No one will have hundreds of millions in exposure to other institutions during the day, which is what happens with Fedwire, without a central bank backstop.

not sure that banks (or any of many other businesses) really compete. its mostly a smoke screen to say we really arent taking advantage of their customers