Yves here. Notice that Russia is close to being an autarky and the sanctions appear only to have made it more so. Ooops.

By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

If your enemy is waging economic war on you, it’s prudent to camouflage how well your farms and factories are doing. Better the attacker thinks you’re on your last legs, and are too exhausted to fight back. A new report on the Russian economy, published by Jon Hellevig, reveals the folly in the enemy’s calculation.

Who is the audience for this message? US and NATO warfighters against Russia can summon up more will if they think Russia is in retreat than if they must calculate the cost in their own blood and treasure if the Russians strike back. That’s Russian policy on the Syrian front, where professional soldiers are in charge. On the home front, where the civilians call the shots, Hellevig’s message looks like an encouragement for fight-back – the economic policymaker’s equivalent of a no-fly zone for the US and European Union. It’s also a challenge to the Kremlin policy of appeasement.

Hellevig (right), a Finnish lawyer and investment analyst, has been directing businesses in Russia since 1992. His Moscow-based consultancy Awara has published its assessment of Russian economic performance since 2014 with the title, “What Does Not Kill You Makes You Stronger.” The maxim was first coined by the `19th century German philosopher Friedrich Nietzsche. He said it in a pep talk for himself. Subsequent readers think of the maxim as an irony. Knowing now what Nietzsche knew about his own prognosis but kept secret at the time, he did too.

since 1992. His Moscow-based consultancy Awara has published its assessment of Russian economic performance since 2014 with the title, “What Does Not Kill You Makes You Stronger.” The maxim was first coined by the `19th century German philosopher Friedrich Nietzsche. He said it in a pep talk for himself. Subsequent readers think of the maxim as an irony. Knowing now what Nietzsche knew about his own prognosis but kept secret at the time, he did too.

Hellevig’s report can be read in full here.

The headline findings aren’t news to the Kremlin. It has been regularly making the claims at President Vladimir Putin’s semi-annual national talk shows; at businessmen’s conventions like the St. Petersburg International Economic Forum (SPIEF); and in Kremlin-funded propaganda -– lowbrow outlets like Russia Today and Sputnik News, and the highbrow Valdai Club. A charter for a brand-new outlet for the claims, the Russian National Convention Bureau, was agreed at the St. Petersburg forum last month. Government promotion of reciprocal trade and inward investment isn’t exceptional for Russia; it is normal practice throughout the world.

The argument of the Hellevig report is that the US and NATO campaign against Russia has failed to do the damage it was aimed to do, and that their propaganda outlets, media and think-tanks are lying to conceal the failure. Small percentage numbers for the decline in Russian GDP and related measures are summed up by Hellevig as “belt-tightening, not much more”. Logically and arithmetically, similarly small numbers in the measurement of the Russian recovery this year ought to mean “belt expanding, not much more.” But like Nietzsche, Hellevig is more optimistic. Here’s what he concludes:

- “Industrial Production was down merely 0.6%. A handsome recovery is already on its way with an expected growth of 3 to 4% in 2017. In May the industrial production already soared by a promising 5.3%.”

- “Unemployment remained stable all through 2014 – 2016, the hoped-for effect of sanctions causing mass unemployment and social chaos failed to materialize.”

- “GDP was down 2.3% in 2014-2016, expected to more than make up for that in 2017 with 2-3% predicted growth.”

- “The really devastating news for ‘our Western partners’ (as Putin likes to refer to them) must be – which we are the first to report – the extraordinary decrease in the share of oil & gas revenue in Russia’s GDP.”

- “In the years of sanctions, Russia has grown to become an agricultural superpower with the world’s largest wheat exports. Already in the time of the Czars Russia was a big grain exporter, but that was often accompanied with domestic famine. Stalin financed Russia’s industrialization to a large extent by grain exports, but hereby also creating domestic shortages and famine. It is then the first time in Russia’s history when it is under Putin a major grain exporter while ensuring domestic abundance. Russia has made an overall remarkable turnaround in food production and is now virtually self-sufficient.”

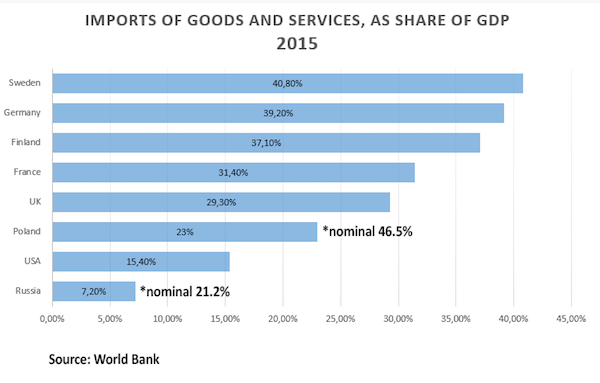

- “Russia has the lowest level of imports (as a share of the GDP) of all major countries… Russia’s very low levels of imports in the global comparison obviously signifies that Russia produces domestically a much higher share of all that it consumes (and invests), this in turn means that the economy is superbly diversified contrary to the claims of the failed experts and policymakers. In fact, it is the most self-sufficient and diversified economy in the world. Our argument that Russia’s economy is the most diversified in the world is easily proven by World Bank statistics on the share of imports of goods and services as a percentage of the GDP. This is illustrated by Chart 17, which compares the levels of import of Russia with a sample of countries.” Hellevig also urges using his purchasing power parity measure (PPP) of real output and goods flows rather than a nominal measure based on devalued currency exchange rates.

- “We predict Russia to push through the 4 trillion level in 2017 and overtake Germany by 2018 to become the world’s fifth biggest economy.”

David Low’s cartoon in the London Evening Standard of October 31, 1939, two months after the Soviet-German Non-Aggression Pact was signed, and after Poland was invaded. Germany is now tied by the US and NATO to the Ukraine, and the guns are drawn openly. Not even guarded rapprochement between Germany and Russia is possible; there is no significant political support for it among German voters.

Hellevig’s point deserves repeating — the Russian economy is far more diversified than the enemy thinks. Naturally, that makes Russian targets less vulnerable, but doesn’t deter the enemy from intensifying his attack. The enemy isn’t as simple-minded as his own propaganda sounds.

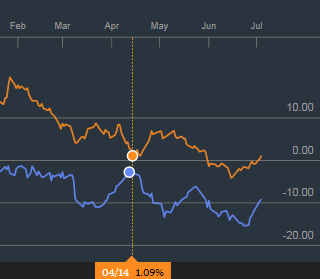

A glance at the way in which the Moscow stock exchange index (MICEX) has been moving in relation to the movement of the Brent marker price for crude oil illustrates how the markets, Russian and international, think. The chart shows positive sentiment for the future of the Russian economy cut its tie to the value of exported energy between November of 2014 and January 2015. Since then the market assessment looks like it has been more aligned with Hellevig than with Washington.

RUSSIAN STOCK MARKET VALUE CROSSED OVER THE OIL EXPORT PRICE AT THE END OF 2014

Key: yellow=MICEX index; blue=Brent oil price. Source: https://www.bloomberg.com/quote/INDEXCF:IND

That’s not what the chart lines mean, according to major institutional investors. They believe the crossover occurred when Donald Trump won the presidential election on November 8; the gap between share price and oil price opened on market optimism that he would order the lifting of sanctions and other warfare measures. Once Trump took the oath of office on January 20, and the oil price started to rise, the lines converged.

Key: yellow=MICEX index; blue=Brent oil price. Source: https://www.bloomberg.com/quote/INDEXCF:IND

Hellevig warns against illusions. “Russia must understand that the Russia containment strategy of the West will be there for years to come, and will only disappear the day when they gather the courage to understand that Russia has overcome. Therefore, Russia must root all its economic strategy and development efforts in a firm understanding of this reality, and never to count on West in anything. Russia must, focus on China, the East, and the rest of the world.”

In war, feats of courage, while awarded medals after the event, are usually irrationally motivated when they happen. Instead of courage to understand, Hellevig may mean something more like cost-benefit analysis, as performed in the minds of voters. When American or European voters calculate that war against Russia is threatening their interests, then there may be a change in the war policy towards Russia. For US voters to turn against war, war must hurt.

Hellevig doesn’t have a programme for that as much as a programme for changing hearts and minds in the policy-making centres of Moscow. Here are his recommendations:

- “All further privatization, based on the failed globalist liberal ideology, must be rejected and instead Russia must strengthen state ownership in key branches of the economy, in order to build globally competitive national champions.”

- “Russia’s highly successful import substitution program [must continue]. This is the kind of thing Russia must continue to invest in, but not forgetting to heed our advice, that state ownership must be guaranteed in the new fledgling industries.”

- “Russia must also speed up investments in transport and other public infrastructure as well as investment in urban renewal and amelioration programs, in the way it has been done in Moscow.”

- “Cut interest rates. In a bewildering policy motivated by inflation targeting, the Russian Central Bank has inflicted record high real interest on the economy ever since end of 2015. Presently the primary real interest rate stands at a stunning 5%. This is an unprecedented situation in a global comparison. On the contrary, the US Federal Reserve and the European Central Bank have fought against recession by bringing the real interest rates to historical lows, even to negative territory. Without this excessive austerity the Russian economy would have fared yet much betters, especially so the consumer…Both charts show that the birth rates have fallen with high real interest rates. The Central Bank therefore must take urgent measures to reduce the gap before the situation worsens further.”

Who does Hellevig think, from Putin on down, believes these things, or is even willing to consider the case for them?

Sergei Glazyev is obvious, but he is window-dressing in the Kremlin wall. Not one of his policy recommendations has been adopted, nor even endorsed in public by the president; for details, click to open. Instead, Glazyev is treated to public dressing-downs from Putin’s spokesman, Dmity Peskov. Glazyev, to be sure, is a prickly, vain character with a voice pitch that compares unfavourably to chalk across a blackboard. Those are not disqualifications for his ideas.

Above, left: Sergei Glazyev with President Putin, Minsk, October 10, 2014.

In his latest presentation on the economy, Putin sounded all of Hellevig’s findings, with the exception of the imports-to-GDP ratio and surpassing Germany. However, Putin committed to none of Hellevig’s recommendations. For the full text of the president’s June 15 “Direct Line” broadcast, read this. Addressing the criticism of Central Bank interest rate policy – the only Russian target Hellevig explicitly attacks — Putin agreed with the critics; he also agreed with the Central Bank.

“I very much hope that the Central Bank continues to move cautiously towards reducing the key interest rate,” Putin started.

“Why has the Central Bank adopted such a cautious approach? Unfortunately, the Russian economy still depends on oil and gas. The price of natural gas depends on the price of oil, and a special formula is used to calculate it. The price of oil has recently exceeded $50, and today it is only $48, I think. The Central Bank believes that if it declines, the key interest rate would have to be adjusted. What matters most for us right now is not the key interest rate itself, but avoiding any sharp fluctuations in the key interest rate. We need to ensure a stable exchange rate for our national currency, the ruble. This is what underpins the Central Bank’s cautious approach. Some may like it, others may not. I am simply trying to explain the Central Bank’s logic. It deserves respect.”

Left to right: Central Bank Governor Elvira Nabiullina; Finance Minister Anton Siluanov; ex-Finance Minister, Putin adviser and patron of the other two, Alexei Kudrin, at their own SPIEF session, June 16, 2016

So who else is Hellewig addressing with the new report? The regrettable answer is noone in particular. Russia’s enemies are in for a long war, Hellevig acknowledges himself. US Congress action to finalize the new sanctions bill may come this month, even before the August summer recess; for details of the new Russian targets and US weapons to be deployed, according to the new statute, read this. A veto by President Trump is unlikely because there are two-thirds majorities in the Senate and House of Representatives to override.

So Hellevig’s “What Doesn’t Kill You” is a report in a vacuum unless it is convincing in the domestic producers’ market, and in foreign investor markets.

Sentiment for the future of the Russian economy is measurable in what Russians with cash and capital say they plan to do. If they are producing, shipping, buying and selling more, that will show in growth rates for electricity consumption, cargo tonnage moved on railroads, and the flow of cash and capital goods inward and outward. The latest measures of the electricity and rail indicators show single-digit growth upon the depressed base numbers prevailing last year. However, the numbers for capital outflow, including Russian businessmen on the run, are also growing. The closer you get to the individuals who are moving their cash abroad, the less confidence in the future you hear.

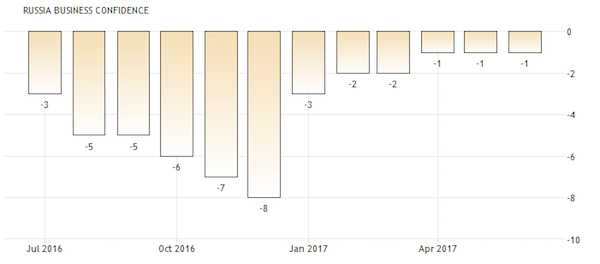

From the regular monthly polling of confidence in the future on the part of Russian businesses, it’s clear there is less optimism than Hellevig’s: the score last month remained negative, as it had been in April and May. The minus-1 score wasn’t as bad as last December, but at minus-8 even that was nowhere near as bad as the all-time low in measured Russian business confidence – minus-20 in 2008. For more details, read this.

Source: https://tradingeconomics.com/russia/business-confidence

The sentiment of foreign investors should be estimated differently. The long money goes into Russian debt; the short or hot money is in Russian equity. Normally, they move in parallel. But for confidence in Russian bonds and confidence in Russian shares, the trend lines this year have been running in opposite directions. By the end of June, foreign buying of Russian debt issues rose sharply, compared to April and May, with an aggregate of $2.8 billion invested last month. For shares the situation has been the reverse. Funds holding Russian shares have been selling steadily for the past four months, and $1.6 billion has been withdrawn over this period, according to EPFR Global.

Hellevig is a peculiar fellow who completely lost is when a opera singer refused to sing when directed by Putin supporting Russia. Hellevig went so far with his attacks that she contacted the police who started an investigation. While Hellevig may be right here, I find that he has a strong emotional commitment to Russia and it clouds his judgement.

Regarding the Spirit of NATO: I’m reminded of the discussion in “The Guns of August” about the French attitude, in the generation leading up to WW I, toward the war they were planning. Lots of General Staff activity, including jockeying for position as the One who would Rule Them All, and the reliance on a supposed “national psyche” of “attack, attack, attack” to be rendered victorious by the Superior Elan of the Nation and its forces.

One view through one lens of those NATO night vision goggles: “Putin’s Russia and US Defense (sic) Strategy,” http://inss.ndu.edu/Portals/82/Documents/conference-reports/Putins-Russia-and-US-Defense-Strategy.pdf

And then there’s this: http://www.nato.int/cps/en/natohq/topics_56626.htm

“None so blind as those who will not see…”

Don’t forget the British calls (around 1910-1913) for a “little war” that would be quickly over – once we showed those Germans who’s the boss… Didn’t quite work out that way. The viciousness with which Germany was punished after WWI hid a lot of French and British (unacknowledged) guilt. It is bloody unbelievable that 100 yrs after that war (plus WWII), the West is still warmongering. China and Russia better hurry up with that changing-the world-order project – lest there’ll be nothing left to change.

But of course, out of it all, a marvelous new tradition and industrial base, Krupp and Fokker and the British and French and Scandinavian, etc. armaments industry, and the inventive new fonancialists that enabled it all… and all that nationalist patriotic fervor! And Bernays, too!

“A certain amount of killing has always been a concomitant of business…”

Unfortunately, China and Russia their own home-grown warmongers whose position is continuously advanced by the kind of bellicose claptrap spewed out in documents like the two cited above. Tuchman’s *The Proud Tower* and *The Guns of August* have never been more relevant than they are today, but maybe it’s her anti war magnum opus, *March of Folly*, that should be required reading for all high school students going forward (I fear previous generations may already be too brainwashed to see the light).

There is without a doubt that both China and Russia have their war parties that are impatient with the diplomatic pace of their governments. They do exert pressure towards a more belligerent pose against the US. Unlike the US, the war parties in those two governments do not have that much influence in making their foreign policies. Unfortunately for the US there is the so called deep state that has infiltrated every branch or our government and is always pushing for more war.

“China and Russia better hurry up with that changing-the world-order project”

From reading a lot of Finian Cunningham and Willem Middelkoop, it appears that is exactly what is happening.

“Hellevig’s point deserves repeating — the Russian economy is far more diversified than the enemy thinks. ”

Hellevig calls the west “our western partners” but Helmer above is calling who the “enemy”? and enemy to whom? From Helmer’s perspective that doesn’t make sense. Is Helmer American? His first paragraph is equally confusing. Is Helmer recommending that a country under Economic Threat by a Stronger power hide economic gains, or the opposite ?

Hellevig: “state ownership must be guaranteed in the new fledgling industries.”

Doesn’t sound like good advice to me. Some subsidies for important fledgling industries sound like a better idea, like solar for instance.

State owned enterprises in key sectors does not sound good to you because decades of relentless junk economics and neoliberal bullshit have had a terrible effect in our perception of the reality.

The truth is that liberalized economies have never been able to compete in the world and never will be.

What’s your definition of a liberalized economy?

I didn’t mention anything about “key sectors” (that was a different recommendation from Hellevig).

I referred to his recommendation about “fledgling industries,” which could be anything.

I guess we could all go to work for the government. That shouldn’t create any problems.

What’s your definition of a liberalized economy?

I didn’t mention anything about “key sectors” (that was different recommendation from Hellevig).

I referred to his recommendation about “fledgling industries” which could be anything.

I guess we could all go to work for the government. That shouldn’t create any problems.

Or we can all change our names to “Galt.” Voluntarily, or by corporatist/financialist fiat. Actually seems to be well under way.

Of course the Galtians do want just that precise amount of “regulation,” to be provided by Philosopher Galts from within the monopoly (sic) on the use of force, just the precise amount that’s needed to make the Galtian system work, and to monopolize the government-protected freedom to loot and cadge subsidies and rents from the rest of us, and make us eat their externalities…

Working so well so far, isn’t it? Checked the outside air temperature and habitability indexes around the place lately? But those who profit from skills at looting and rentier-ing kvetch about the “government” they pervert for personal advantage — nice to have it both ways.

Let us mopes never try to figure out how to have a “government” that embodies both “civil” and “service,” one that’s not immediately captured and twisted by Kochs and Musks and other Robber Barons. So hard to do, when one has the funhouse-mirror image of the Magna Carta as one of the Holy Texts…

No capital controls, no industrial planning, soft banking regulations, privatized utilities, privatized infrastructures, low real estate taxes, private banking, regressive tax code. That’s the receipt to create a neofeudal economy incapable of competing in the international markets.

“incapable of competing in the international markets”: you say that as if it’s a Bad Thing…? And that all the “competition” does not, to greater or lesser degree, manifest every one of those supposed noncompetitive “weaknesses” of failings?

The point, sir, is that if your industries are overwhelmed by imports they will be destroyed, leaving you dependent on external parties. De facto colonization does not run far behind.

I got what he was saying, I think, and if it was not irony, then my point is that all those bad things Hiho cites are happening everywhere, to one degree or another, under neoliberal-neocon globalization. All part of the global race to the bottom, which I believe each of the presumed “bad things” cited by Hiho are part and parcel of. With the burden of militarized attempts to achieve Full Spectrum Dominance laid on top, though it sure is not clear, given the ascendancy of post-supra-national corporations and wealth concentration in the hands of Supra-state individuals with no national ties or loyalties, “cui bono” from that effort.

One wonders who and what the Received Wisdom of pursuit of imperial autarky-hegemony and “global competitiveness”might be expected to benefit…

And the outcome, the industrial output, of the global system-as-it-is seems demonstrably to be killing the habitability of the planet. And of importance to us “top predators,” the “comfort” and sustainability of our own brittle species…

More of the same gets you exactly what, again? Minute local short-term Elites and their self-indulgences, who seem to have the “feudalism creation” process well under way, for their personal benefit…?

“Our Western partners” is Putin’s usual formulation, as Helmer makes clear in the article. It is not Hellevig’s.

FWIW, I have often found Mr. Helmer obscure and difficult to confidently parse, with enough factual errors

that I do take him with a grain of salt.

You need to address this particular article and not engage in a drive-by attack. You apparently can’t find anything wrong but don’t like where this goes. This piece makes clear it depends on a single source and Helmer has written it up. So what, pray tell, is hard to understand about that?

Our Richard Smith writes about scammers and his articles are similarly difficult because the relations among players and mechanisms are complex. That is often why Helmer’s articles are dense: he’s dealing with lots of material from sources with their own motives.

Yves, thank you for adding that. I took “Carey” to be a kind of FUD-peddling troll. Can’t let people start thinking well of folks like Helmer, now can they? Got to impeach whenever there’s the chance.

Of course I could have it all wrong, and “Carey” was commenting in all sincerity … In faceless bitspace, it’s so hard to know…

Glad to see you defending Helmer. He very often comes up with some pretty good insights. But my God he is sometime difficult to follow. Someone who makes the reader work that hard just might be able to use a good copy editor. But, on the other hand,he does make one think.

Helmer’s article triggered some further questions:

To what extent has the effort to punish and damage Russia through the low price of oil and sanctions pushed the Putin regime to increase Russia’s financial, economic and military alliance with China mentioned by Ray McGovern in his article posted in today’s NC Links section?

To what extent has the growing economic relationship between Russia and China reduced the effectiveness of US sanctions on Russia and indirectly led to derivative policy blowback with potentially damaging implications for the US, such as loss of petrodollar hegemony to the Chinese yuan? China is now putting pressure on the Saudis to accept payment for oil in yuan by using China’s oil imports from Russia as negotiating leverage.

Seems like an awful lot of ignorance and miscalculation by the usual suspects to me.

My understanding is that the current government, not their central bank, was thinking about ways to make Russia less dependent on foreign imports before 2014. Unilateral tariffs or other import restrictions were considered but not implemented because of political reasons — they were afraid there would be a consumer backlash. US and EU sanctions solved that problem.. The Russian people were willing to make that sacrifice in the face of an attack on their sovereignty.

To what extent has the effort to punish and damage Russia through the low price of oil and sanctions pushed the Putin regime to increase Russia’s financial, economic and military alliance with China mentioned by Ray McGovern in his article posted in today’s NC Links section?

I’ll add that — as far as I can tell, at least — there’s almost never any news about this issue in the three chief political establishment outlets (NYT, WaPo, and WSJ). You’d think that the editors of those papers regard the nascent Russia-China strategic partnership as verboten. Something unmentionable.

I wonder why.

Helllevig’s report is unabashedly pro – Putin so that doesn’t gel too well with Helmer – a consistent, if generally fair critic.

Hard to know what the essential point of Helmer’s take on the report really is – a warning against perceived Russian hubris vis a vis NATO?

Wariness of Glazeyev’s proposed reforms? Contrary to Helmer, I believe they have not been adopted not because they are perceived to be wrong, but because they are currently too radical for the Russian economy – still very much part of the global system. (Though the SWIFT expulsion threat was challenged vigorously, and a Sino – Russian alternative is being put in place, it would have caused havoc if it had gone ahead.)

The impression that he’s a ‘narcissistic’ attention – w***é is a new one on me…Maybe Helmer is buddies with Kudrin, your standard market ideologue and a dyed-in-the-wool neoliberal (despite his organisation of financial reserves to cushion the effects of sanctions, he is not ideologically a threat to current Western dogma.)

Or is Helmer uneasy at the prospect of major power nationalising it’s central bank?

All in all, a rather rum rumination.

Best read the full report until Helmer publishes an article offering more clarity on his own perspective.

I’ve said in passing that the West expected its sanctions to bring Russia to its knees. They’ve now been on for years. Even though GDP took a hit, the impact appears to be markedly less than what we inflicted on ourselves in the financial crisis, in part because Russia engaged in a muscular response (such as improving domestic industries, like cheese making, where they had chosen before to be significantly dependent on imports). And the sanctions also didn’t hurt Putin’s popularity, in fact they increased it. Even the Moscow intelligensia went quiet for a good year plus. And Putin brought a big increase in living standards. The GDP reduction is a blip compared to where Russia was circa the late 1990s.

So while Helllevig may be overegging the pudding, it’s accurate to say that the sanctions didn’t damage Russia anywhere near as much as the West hoped.

One issue is all the reports I can find easily (thanks to Google crapification) list GDP in $ terms. I’d like to see a GDP series in rouble terms, since that’s what matters to Russians, particularly since Russia isn’t a huge importer.

I did find a report at Barrons which is relatively bullish on Russia, although not at bullish as Hellevig, based on World Bank forecasts:

http://www.barrons.com/articles/russia-rallies-1-3-gdp-growth-55-oil-world-bank-says-1495548544

Another statistic that goes unnoticed in the USA is the extent to which Russia is an outlier among the world’s major economies. Where debt/GDP ratios in the US are 107% along with basket state countries like Italy and Greece, Russia is nearly debt free at 17%—by far the lowest in the world for a major industrial power.

Looks like the military-industrial state war hawks better make sure that the US can continue to impose the dollar as the world reserve currency—–. All those new SUV’s purchased with 7 year loans will get pretty thirsty if the US has to earn the money to import the fuel to run them instead of just having the FED create the money with a key stroke.

In your 107% debt/GDP ratio, how much is sovereign debt, and how much private sector debt?

https://dspace.spbu.ru/bitstream/11701/6341/1/03-Korhonen.pdf

Figure 1. Russian GDP growth, 2000–2016, percent of corresponding period of previous year

S o u r c e: Rosstat. URL: http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/accounts/ (accessed:

14.12.2016).

https://acta.mendelu.cz/media/pdf/actaun_2017065010299.pdf

Volume 65 34 Number 1, 2017

https://doi.org/10.11118/actaun201765010299

THE SUCCESS OF ECONOMIC POLICIES

IN RUSSIA: DEPENDENCE ON CRUDE

OIL VS. EXPORT DIVERSIFICATION

,,,During the analyzed period Russia has been constantly increasing the volumes of mineral exports and despite the fact that in general “oil” exports positively affect the amount of fiscal revenues, the observed dynamics of GDP growth was in fact negative. It means that further economic growth in Russia is not possible at the expense of its natural resources endowments. The observed over the analyzed period dynamics of macroeconomic indicators reveals that Russian economy is still substantially influenced by crude oil prices. Russia needs to diversify its economy away from oil and gas dependency, because significant volumes of “oil” exports are not favorable to the economy in terms of its strategic development. And according to the obtained results, in order to stimulate “non-oil” exports monetary authorities should depreciate national currency on the one hand, whilst on the other hand fiscal burden should be mild towards to “non-oil” producers. Consequently, Russian government should focus on export-oriented development of non-oil sectors and find an optimum ratio between “oil” and “non-oil” exports so that “oil” revenues would have supported “non-oil” exports. This allows us to conclude that crude oil will continue to play, at least in foreseeable future, a dominant role in further development of the Russian economy.

Thank you!

Yr welcome, I’ll look a little closer for gdp info later today

Given the fortuitous results the sanctions have allegedly produced are we to presume Vlad the Impaler (of Political Opponents and Truth Seeking Journalists) spent some time this past week lobbying for their continuation?

On the one hand I agree we have plenty of interests in common. And if the Russian people are content with rule by the siloviki they should be allowed that. We should think long and hard however before accepting the insinuation of their model into our own imbalanced and (hopefully) evolving system. That WAS the implication of the piece wasn’t it? Or did I miss a reference to a downside of kleptocracy.

IMHO the long play is establishing ties with those who will unseat or outlast Vlad and encourage a government and economy of openness and participation.

BTW: Someone should write a piece looking at the similarities between Putin’s agitation of the Orthodox Church to his own advantage and Donald’s winning over of the Christian Right in this country.

“IMHO the long play is establishing ties with those who will unseat or outlast Vlad and encourage a government and economy of openness and participation.”

So Regime Change and All the Openness and Participation the US always brings? And that is your Long Play?

Some people…

> Or did I miss a reference to a downside of kleptocracy.

Perhaps said reference was omitted in deference to the readership, who labor under our own journalist-persecuting kleptocracy and do not need a reminder.

The fall in the Russian economy was brought on by the oil price collapse not the sanctions. In a perverse kind of way the US then forced on Russia a kind of Trumpian make Russia great again set of policies through sanctions which unexpectedly led to an industrial rebirth which fully offset the oil price collapse, if the west had really wanted to undermine Russia then the best way would have been to encourage capital flight by helping the debauched overseas fantasies of the oligarchs they targeted.

I have often said that sanctions only put up prices, based on what I know has occurred historically, but Yves exposes a further risk in one of her comments.

France had a share of the cheese market in Russia until she was persuaded to cease supplying. Since then domestic producers have made many of the cheeses France used to supply. That market has likely gone for France.

Trade is trade, war is war. We should try not to confuse the two.

It is worse than that. Remember those two Mistral-class ships that the French built for the Russian navy until, under pressure from NATO, they reneged on those contracts and were forced to pay a heavy penalty? Now anybody that has contracts with France, particularly military contracts, will have to wonder if France will honour those contracts if put under enough pressure.

Business hates uncertainty and so you wonder how many contracts France has lost since it proved to be an unreliable business partner.

Come to think of it, our mob has signed a $50 billion contract with France for 12 you-bewt submarines. I wonder if-

A- That was under pressure by others to compensate France for the loss of the Mistral contracts and

B- That was why the insistence of the subs being built in Adelaide. Not only for local jobs but also to ensure that there would be no future funny business about actual delivery. Hmmm

Once upon a time my Father was overseeing the building of two LPG tankers in French shipyards, for the soon-to-be owners of the tankers.

The quality was not there and both tankers were refused by the owners.

The shipyard went bankrupt.

Here endeth the lesson.

When I hear about Congress demanding sanctions, I visualize John McCain sputtering. So much of what passes for those great deliberations seems to be in effect more kayfabe. They produce what they think the public expects, as filtered through their minders on K Street, in the media and elsewhere.

Sanctions can be productive, when used thoughtfully and with limited scope. In the present context, there does not appear to be much thought given the ongoing “Russians Hacked, dammit” looped commentary.

http://www.worldstopexports.com/russias-top-10-exports/

https://imrussia.org/en/analysis/politics/2454-russia’s-elites-battle-over-a-shrinking-economic-pie

https://imrussia.org/en/analysis/economy/2787-sergey-aleksashenko-“the-kremlin-s-economic-policy-has-produced-no-growth-whatsoever”

http://iopscience.iop.org/article/10.1088/1755-1315/53/1/012018/pdf

The problems and prospects of the public–private partnership

in the Russian fuel and energy sector

SM Nikitenko1,3 and EV Goosen1,2

1Federal Research Center for Coal and Coal Chemistry, Siberian Branch of the

Russian Academy of Sciences, Kemerovo, Russia

2Kemerovo State University, Kemerovo, Russia

3Kemerovo Institute (Branch) of Plekhanov Russian University of Economics,

Kemerovo, Russia

https://helda.helsinki.fi/bof/bitstream/handle/123456789/14554/w2016.pdf?sequence=1

BOFIT Weekly

Yearbook 2016

plenty of research here…

.http://www.ersj.eu/repec/ers/papers/17_1_p29.pdf

Instruments of Marketing and Credit Support of the Large Industrial Enterprises Development: International Experience

No, I was and am not trolling. It is true that I should have presented specifics. My comment was a general

one, that I often find Helmer obscure and hard to follow.

Perhaps the fault is mine.

http://www.sciencedirect.com/science/article/pii/S2405473916300472

Abstract

This paper addresses Russian economic development and economic policy in 2015–2016. The analysis focuses on external and domestic challenges as well as the anti-crisis policy of the Russian government. Special attention is paid to key elements of the new model of economic growth in Russia. The paper discusses economic policy priorities for sustainable growth that include budget efficiency, structural reforms and import substitution, the encouragement of entrepreneurship, the efficiency of public administration, and the modernization of the welfare state.

If we really wanted to inconvenience Russia we would do two interlocking things. I fully acknowledge that they are politically impossible at present.

Impose a strike price on imported oil at around $50 a barrel. That is, impose a flexible import tariff that maintains the price at $50, no matter what. This would generate about $15 billion a year per $5/bbl.

Take that money and spend it on energy efficiency, conservation, and renewable energy, with a focus on reducing our demand for crude oil. Start with a target of 10% reduction.

The 10% reduction could be achieved with existing technology and without a marked change in lifestyle or behavior for Americans. The price of gasoline and heating oil would remain the same as at present.

A 10% reduction in US demand would be roughly a 2.5% reduction in world demand, which would result in a collapse in the price of oil. This especially if we made noises about going for 20%. We could see oil dropping to $30/bbl, or even $25/bbl.

This would cut Russian state revenue by about a quarter to a third, exports by a third, and GDP by more than one might think. The oil industry has hidden knock on effects in terms of support industries and the percentage of government spending financed by oil. The Russian economy would stop dead and the Russian government would be scavenging for funds.

We would end up with a boost in consumer spending, job growth (energy efficiency work is labor intensive and favors domestic manufacturing), a better trade balance, reduced medical costs (air pollution), and the joy of watching Russia flounder. Our domestic oil producers could sell at $50/bbl and stay in business. Persian Gulf monarchs would have to cut back on solid gold things. Iran would find itself short of funds. And so on.

A man can dream.

Take that money and spend it on

energy efficiency, conservation, and renewable energy, with a focus on reducing our demand for crude oiTax Cuts. Start with a target of 10% reduction.There, fixed. That will work better.