From Marshall Auerback, a fund manager and investment analyst who writes for New Deal 2.0:

As reported by Bloomberg:

Goldman Sachs Group Inc., one of the first banks to receive cash injections from the U.S. Treasury during last year’s crisis, doesn’t have an implicit guarantee from the government, Chief Financial Officer David Viniar said today.

“We operate as an independent financial institution that stands on our own two feet,” Viniar, 54, said in a conference call with reporters today after the New York-based firm posted higher third-quarter profit. “We don’t think we have a guarantee.”

That’s the quote from today.

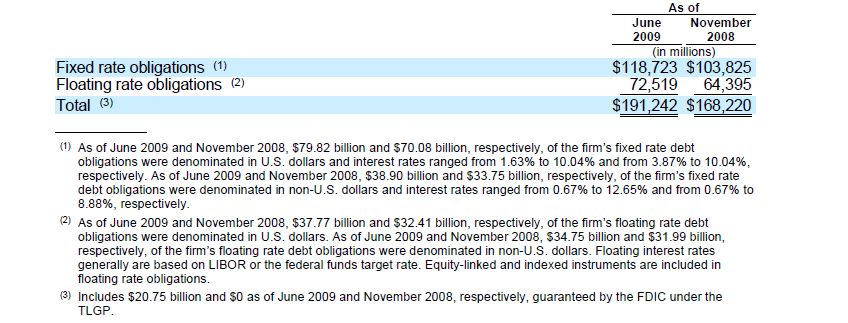

Then see an excerpt from their last 10Q issued less than three months ago.

Note the footnote (3) that $20 billion was guaranteed via the FDIC (click to view full image).

Now tell me something, what if you have received FDIC guarantees in the middle of the crisis and had been able to borrow three year money at 100bp over 3 year notes or a whopping 1.5% interest cost.Might you have taken up the opportunity?

Would that be an implicit guarantee or perhaps more than just implicit?

It is an outright lie to say that they “operate as an independent financial…..”

They should be held accountable for lying to their shareholders.

Where is the outrage in Congress and in the Obama administration?

FDR and Jesse Jones never ever would have tolerated this behavior just 8 months after the bank closings.

You need to look beyond the forest of debits and credits.

This goes to the very heart and soul of the democracy and what we have written about the corruption in the American polity.

Yves here. Ahem, and how pray tell does Goldman rationalize that it was allowed to become a bank in the crisis, which gives it direct access to the Fed? And the government has a clear “no more Lehmans” policy, with Goldman as a larger and therefore treated as an even more important to preserve player.

Another doozy from the conference call was that Goldman CFO David Viniar justified Goldman’s high profits by claiming it was justified by the valuable social role the firm was performing.

Organizations that perform valuable social functions are generally controlled by the state (police) or utilities and subject to heavy government oversight to keep them from abusing their crucial role. But Goldman, along with the rest of the financial services industry, has managed to get itself in the “heads I win, tails you lose” position of privatized gains and socialized losses. And then they have the temerity to act as if we don’t see the result, which is looting.

Viniar’s comments have been especially irritating all through the crisis. The follow-up needs to be, “please do try to enumerate that social value for us, what fraction of your trading profits, for instance, represent value added for society?” The compensation taken last year put to rest any notion that these rewards reflect economic contributions. Heads I win, tails you lose.

GS lying is like the sun rising everyday.

I would be worried by it’s absence.

GS became a casino. The house always wins.

The bankers won. They lied, cheated, committed fraud, and bet like there was no tomorrow. The result was the housing bust and the financial meltdown. Rather than going to prison. They got trillions from the government on gift like terms and not even a slap on the risk. So the obvious lesson they learned from all this is lying, cheating, and stealing work. We should expect more of this, not less.

Last year James Grant discussed why there is no outrage. See http://thematrixnot.blogspot.com/2008/07/how-can-they-do-this.html

Nice scam they’ve got going there. How does one get in on it?

Vinny G.

Viniar, chief Pharisee at Government Sachs, has a brass pair doesn’t he? But I’m quite sure “it riles them to believe that you percieve the web they weave”—and then ‘splain it so plainly to the rest of us (anyway to economics idiots like me). I’m hooked.

Hard-hitting and infuriating exposé.

Goldman Sachs is a financial firm and they always talk their book with no apparent boundaries. Unfortunately, that appears to be acceptable to the SEC, Treasury, and Congress.

It will be interesting to see how the next financial crisis plays out for the “too big to fail” firms. In January I had thought that we would be able to go another generation without a major financial crisis. Now I think it may only be a year or two away.

how do you stop it? I mean really, we’re talking total state capture here. Nothing short of torches and pitchforks would put an end to the rape and pillage by these people. We already tried the “vote for change and hope” deal and that got us nowhere.

Matter of time until a redneck vigilante takes matter in his own hands and loads his scoped 30-30.

And rightly so I must say.

It is a matter of time until a redneck fixes these problems with a scoped 30-30, a la Lee Boyd Malvo.

And rightly so I must say.

Sorry for the repeat post, I realized people could confuse my real name with our illustrious host. I’m not Yves Smith, no.

It seems that the Oligarchs are flaunting their power. Obama is a smoother talking Bush with a slight change in constituency. We need law enforcement that we can believe in. We are a banana republic once the Judiciary becomes significantly corrupt.

My suggestion is to vote against the incumbency. Vote for anyone with a demonstrable capability to produce something of value to the populace at large.

@Vinny “Nice scam they’ve got going there. How does one get in on it?”. You see as long as we make simplistic statement like this no one in the Administration or SEC will care, it is the same here in the UK. We need leaders who can call for action. I hope I was a one who could lead.