Dear readers, your blogger feels like death warmed over. Please bear with me if posts are light the next few days.

Dolphins prefer high-energy fish BBC

Neutrino experiments sow seeds of possible revolution Science News

Heedlessly Hijacking Content David Carr, New York Times

California welfare recipients withdrew $1.8 million at casino ATMs over eight months Los Angeles Times (hat tip reader John D)

U.S. officials say Karzai aides are derailing corruption cases involving elite Washington Post. Quelle surprise!

The Market Crash as Double-Entendre Dating Ad Paul Kedrosky

From CNBC Business Journalist to Critic of Bankers on MSNBC New York Times

Fresh moves to unlock loan pool Financial Times

Banks Move Quickly to Blunt U.K. Levy Wall Street Journal

The €442bn question — a guideline FT Alphaville. Alphaville has been nervous for some time re an upcoming termination of an important ECB liquidity facility.

Another summit that disappoints Eurointelligence

Dire warning over impending slide of British manufacturing Independent

Osborne’s first Budget? It’s wrong, wrong, wrong! Independent (hat tip reader John D)

Is monetary policy too expansionary or not expansionary enough? Martin Wolf

The Third Depression Paul Krugman

Austerity: A Prisoner’s Dilemma? Peter Dorman

Gag orders in the Gulf continue Lambert Strether

BP’s Dumb Investors George Monbiot. From last week but still germane.

States Weigh Big Claims Against BP Wall Street Journal

BP oil spill: Barack Obama and David Cameron agree BP must not collapse Telegraph This is appalling. So BP is TBTF? If its liabilities are bigger than its assets, it should be restructured, full stop.

The Mother of All Cross-Border Bankruptcies? Jason Kilborn. Corrects some urban legends on how a BP BK would proceed.

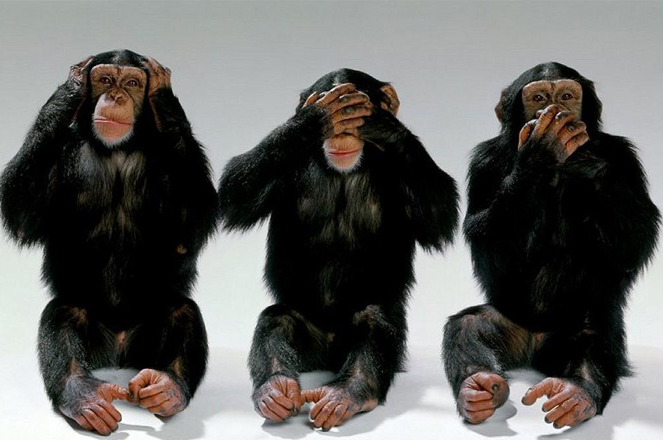

Antidote du jour:

Regarding the WaPo article about Karzai: how long before he goes the way of Diem in vietnam?

I do not know whether they could find another pashtun – and it would need to be a Pashtun leader – to replace him.

In other words, I suspect “replacement”may not be cost-effective.

We foresaw that they’d try to declare BP Too Big To Fail and hoist it onto the Bailout plunder wagon.

Now, even a psychopath like Obama has to know the Bailout can’t carry everyone, and the more parasites you bring aboard the sooner the whole thing collapses. We already had the finance sector, the weapons rackets, and others on board. Obama and the Democrats made it their special project to bring the health insurance rackets on board.

Now they want to make BP a full parasite of the state? (And I assume that means Big Oil as such; ExxonMobil’s not like some weenie small bank that it’s going to stand for having to compete with a BP premium.)

I guess we can call this the “internal contradiction of corporatism”. They’ve handed over the system completely to corporate interests and rig the system in such a way that every attempt at change or just letting the markets take their course (if that means a major failure) immediately triggers an antibody in the form of one or more particular corporate interests asserting the general corporatist prerogative.

But that same rigging makes it harder for them to start throwing lesser members overboard once they’re getting overloaded.

As for Krugman and his place in kleptocracy’s internal squabble over the timing (not the principle) of the “austerity” stage of the looting, I just wrote a longer analysis.

http://attempter.wordpress.com/2010/06/28/krugman-watch-june-28-sarajevo-day/

“Parasite” ought not be so perjorative- over time, symbiosis may be the natural outcome,, and sybiosis can with time may even evolve into actual organic union.

That is, “parasitism” is a living process.

And it has been a most necessary and successful one, at that.

It is not just predation; nor can it be that “photosynthesis” and its analogs are they only “moral”way of life.

Plants photosynthesize; predators predate; and parasites parasitize.

Why judge of the paths of life?

So long as it IS life.

Used as a social analogy, “parasitism” leaves a lot to be desired, regardless of the moral judgment one may bring to bear upon the process itself.

Sorry to parasitiZe your comment like this….

aet says: “Plants photosynthesize; predators predate; and parasites parasitize.

Why judge of the paths of life?

So long as it IS life.”

Yes aet, we are all parasites, and cannibals too, as we all feed off of other humans and other organisms.

Cannibalism is also “a living process”.

We judge of “the paths of life”, aet, because some fucking cannibals — some parasites — take a lot more of life’s pie than other cannibals.

Attempter consistently points that out nicely with his VERY APT social anologies …

Some cannibals however — system shills — consistently and intentionally deflect from that message of excessive and unfair distribution of life’s resource pie that Attempter puts forth by muddying the water.

These are usually little brown nose corporate butt sucking and very insecure shills, like Krugman, that have sold their spirits to their insecurity.

Deception is the strongest political force on the planet.

The article about the California ATM withdrawals at casinos by welfare recipients was interesting. The lawmakers are all up in arms about fraud and the article clearly states that the amount is about ONE PERCENT of welfare payments!

How many places would love for fraud to be ONE PERCENT??!! They just need to STFU and be thankful its not higher.

Besides why should we begrudge welfare folks trying to turn their checks into bigger returns, the banks have gambled trillions of taxpayer money for years.

“Besides why should we begrudge welfare folks trying to turn their checks into bigger returns, the banks have gambled trillions of taxpayer money for years.”

Yes, but the banks are backstopped by the US government and its spoiled stepchild the Federal Reserve. If we could get that deal for welfare recipients they could be as rich as banksters!

Can’t really blame the LAT headline writer for going for it, but I’m disappointed the article didn’t put the $227,000 per month into context. What percent of total payments, in a state of 37,000,0000 people, does this amount to?

Also, tribal casinos were mentioned with respect to some having cash machines but the percent take-out from these machines was not. In my local res, the tribe’s casino is a pillar of that community and it would be no surprise that members would choose that machine over another especially since the location has a gas station which of course members patronize pretty much exclusively.

Whatever proportion Native Americans account for of welfare cash withdrawn at casinos, I suspect its unlikely they spent it on casino gambling (familiarity breeds contempt). That’s not to say the money was used wisely.

The REAL scandal (I hate using all caps but read on please) can be summed up in an experience I had a couple of months ago at a big chain drugstore located across the street from the res. It was a couple of minutes before closing, and the obese woman ahead of me in line seemed to be in her early twenties. Her purchase was about $40 worth of high-fructose (and highly subsidized) corn syrup in the form of various candies and soda pop, but when she swiped her card a package of donuts was denied. She told the clerk to skip the donuts and made her way out, breathing heavily from the effort.

random thought:

someone shd write a piece about how easily people conflate current account deficits with excess borrowing. implicit is the assumption that all deficits are financed by debt (particularly mortgage debt and short-term portfolio investments in bonds). yes, by and large this is how the u.s. and other deficits have been financed in recent years. but it doesn’t need to be like that. what about equity flows and fdi?

it just worries me that by conflating the two, and focusing on the current account “imbalance” as the evil to be rid of, we might be throwing the baby out with the bathwater.

“what about equity flows and fdi?”

What about them? Please elaborate.

“it just worries me that by conflating the two, and focusing on the current account “imbalance” as the evil to be rid of, we might be throwing the baby out with the bathwater.”

Ok, talk trade deficit. About 90% of the current account deficit in the US is the trade deficit, and it’s hurting us big time.

Let’s talk composition of that trade deficit: is it with counterparties which are foreign owned or with such that are themselves subs of US corporations?

Could it be that the “trade deficit”in its composition is actually owed to US interests wearing forign make-up?

As to “equity flows” perhaps he means profits from state-owned enterprises, eg Aramco, or Pemex: althougfh Americans may be ignorant that States may also run profitable and beneficial enterprises.

Certainly, any such the US gov may have owned has been sold off.

So no profits from that equity: not for the gov, anyhow.

To remedy the “imbalance”, many suggest that sthe State sell income-generating assets to themselves- quickly, and cheaply.

i wasn’t trying to make a coherent argument, just to point out the frequent conflation of two separate concepts.

i guess you can think of it like this: a current deficit is the same as a capital surplus. for me, that begs the question, what capital is being exported? i.e. how is that current deficit being financed?

my assumption is that a current account deficit is much less worrying and much more stable depending on how it is financed.

i think there are three key issues here:

1) how liquid is the capital being sold to foreigners? obviously the more cash / govt bonds / liquid securities they own, the easier it is for foreign investors to head for the door.

2) how much are capital exports dominated by “debt” as opposed to “equity”? the issue here is one of loss allocation. if a foreign investor buys shares or cdo equity or makes an fdi investment, they are first in the queue to lose money when things go wrong. this means (a) during a downturn, more of the loss in the country’s capital structure is being allocated to foreigners, and (b) foreign investors are more likely to return even if they take a loss, as the loss was not “unexpected”.

nb, in emerging markets there is also an important distinction between domestic and foreign currency liabilities, but this is essentially a subset of the equity vs debt distinction, where domestic currency is akin to equity. but it has the added kicker that where a country relies too much on foreign currency liabilities, a currency collapse leaves your domestic balance sheet insolvent.

3) is foreign investment financing productive activities? this tells you whether today’s capital surplus is sowing the seeds for tomorrow’s current surplus (and one that is not achieved via a significant contraction in domestic consumption). obviously if foreigners are putting their money into building factories in the u.s. that’s good news. if they are buying treasuries or bank stock, and the government / banking system is recycling that into productive investment, great. but if the money is ending up financing bloated housing construction and consumption, the longer term outlook is not at all sustainable.

so to summarise, my point is people shouldn’t automatically assume current account deficits are bad. they should focus instead on the quality of capital exports. in particular government’s should make sure they are dominated by capital that is:

– illiquid / long term

– equity / domestic currency

– used to increase production

i know all this is pretty obvious stuff, but my point is i think the debate focuses way too much on trade deficits and competitiveness, and not enough on the quality of capital exports.

Food for thought. (Reposting a comment I found on the LA Times.)

————————————————

voiceofreason916 at 11:13 AM June 26, 2010

This article says people withdrew money from ATMs. It DID NOT say that the cash withdrawn was spent at the casino or on gambling–we all just jumped to that conclusion.

Welfare recipients must work or be training for work in order to receive benefits. Did it occur to anybody that if the casino is the main industry (and main employer) in a rural area, people who are working while receiving benefits would use a convenient ATM to get cash? If I worked at the casino, that’s the ATM I would use.

In rural counties, there isn’t an ATM on every corner. Since the government puts cash benefits on a debit card, you have to go to an ATM somewhere to get cash to pay rent, buy clothes for your kids, and to get gas money. The ATM in the casino might be the safest, most convenient location for people who work there.

Illegal aliens are not eligible for welfare cash benefits.

The funds on the card for food stamps can only be used on food–you cannot withdraw cash with the food stamps amount.

————————————————

Well… Dang!! Maureen Dowd writes a column that’s actually really good. I’m shocked! And the ending is the real clincher.

http://www.nytimes.com/2010/06/27/opinion/27dowd.html?src=me&ref=general

I like today’s antidote. They are the top three at the Minerals and Mining Service, right?

One of the most important points, buried in the story after the headline gave Confederate Party their talking point of the day, is the following:

“…which represented far less than 1% of total welfare spending during the eight months for which the department released data, averaged just over $227,392 a month.”

And the Confederate Party leaders already want to cut off the other 99.5% from funds, since after all these people are guilty of being poor, the most hideous crime these sociopaths apparently can imagine.

In economic terms, one could say that their willingness to help with government funds seems quite elastic.

“Welfare recipients must work or be training for work in order to receive benefits.”

Don’t you hate it when people spoil your stereotype about welfare loafers riding the gravy train?

BP pays 12% of all UK firms’ dividends (BP’s Dumb Investors George Monbiot)

I think that BP pays around 12% of the FTSE 100 dividends, not 12% of the dividends from all UK companies.

Sorry to hear you’re still under the weather. May I suggest some complete rest, a real vacation? Ed Harrison could take over for some time like when you were stuck in England. His antidotes aren’t as good but we’ll make do (j/k). Readers could send him links.

Hope you’re well soon.

I second the sympathies.

Here’s hoping plenty of tea, chicken soup, and other soothing remedies will soon improve Yves’ health.

http://brucekrasting.blogspot.com/2010/06/fed-economist-bloggers-are-stupid.html

“A Richmond Va. Federal Reserve Economist, Kartik Athreya wrote a paper recently that trashes economic bloggers. Mr. Artheya has a PhD from the University of Iowa. I’m not so sure a few years in corn land gives him the right to take cheap shots at the new media. I am absolutely convinced that this type of thinking should not be expressed by Fed officials. It proves to me that the Fed is an elitist organization that is out of touch with America in 2010. The full report from Athreya is here. Some of the more offending comments:”

I wish you would include the link to your Antidote du jour photo’s!

The real (authoritarian) agenda of the Democratic Party of the 3rd millenium… and it’s not about helping the “small people”…

recommend reading the whole article…

Senator Feinstein’s whispers http://www.atimes.com/atimes/China/LF29Ad01.html

During 30 years of frequent visits to Beijing, Feinstein developed friendships with Chinese officials as high-ranking as former president Jiang Zemin, former premier Zhu Rongji and Chongqing Party Secretary Bo Xilai – now arguably a rising political star in the country.

Controversially, on most of her trips to China, Feinstein has been accompanied by her investment-banker husband Richard Blum, to whom Feinstein has been married since 1980. Blum has been reported by US media as having extensive business interests with China. Feinstein is often described as one of the most powerful women in US politics. …

On first look, Feinstein has done what one might expect of a high-ranking US Democrat visiting the region: she called on Beijing to “step up” on North Korea over its nuclear program, to adjust the yuan and to sign onto a cyber-security pact.

Apart from this, the strong proponent of closer US-China ties held a speech on the 21st anniversary of the 1989 crackdown in Tiananmen Square. Feinstein commented on the bloody protests in a way that strongly implied that she plays the role of being Beijing’s mouthpiece. In an interview with the Wall Street Journal published June 6, the senator sought to explain the killing of hundreds of reportedly unarmed demonstrators by the People’s Liberation Army (PLA) into relations in a way that put the Chinese Communist Party’s (CCP) leaders of that era into a favorable light.

Here’s something a little shorter you may find useful:

Compilers

The electron must be in multiple places at the same time to balance a system, so the system has a stable foundation for growth, orbits that can react productively, which is enabled by the relativity circuit. You do not want to find the electron. The family law, banking & credit, global HR surveillance certification system is seeking the electron, through algebraic reduction, enabled by the digital software engineers, at the direction of the multinationals. Ultimately, the digital economy asks who is not the electron, effectively locking them in and the current out.

Group behavior is mechanical by nature, because it requires agreement, resulting in mechanical statistics, constantly removing both tails to synthesize that agreement over time, resulting in inertia. Individual behavior emanates from those tails, becoming more unique over time. Learning comes from unique interactions. The group is structurally prohibited from learning; it can only know. Groups provide the scale, and individuals provide the multiplier effects, by injecting new information on the margin, as they pass through the circulatory system. The problem with the economy is that it has lost circulation.

The electrons cannot collect assets, so the salary/asset price ratio determines circulation, and community regulation controls the gates. The multinational credit system now controls community circulation, shutting the gates and cutting off its own food chain. Multinational businesses also control and feed off local communities, driving indigenous populations into bankruptcy, and those local populations naturally reinforce PN gate closure to new entrants.

The multinationals addicted themselves to cannibalizing their own food chain, by borrowing their working capital from central banks, and investing their operating income at no risk in the ponzi markets that liquidate pensions with volatility. Now, the Fed is giving them money, numbers in computers, to continue operations. The multinationals can only crash, right on top of everyone underneath them, because their digital economy eliminated the market for talent, leaving only commoditized labor, supervised by protected labor, and managed by a rigged lottery. Economic slavery doesn’t work because it produces no electrons. No electrons, no voltage, no current, the system liquidates, from the bottom up.

The multinationals will come to an agreement and the analog phase will multiply digital economic activity again, or the analog phase will bypass the multinationals. The outcome rests with the community development, and those gates are still closed. The equity system doesn’t understand digital technology, and the analog economy is building global virtual communities with analog communication systems on the assumption that the multinationals are going to choose to crash.

The older generation asked the multinationals into their community. The boomers went to work for protected labor in government and as management for the multinationals. And the kids opted out. Everyone who did not make those decisions prepared for current outcomes. The economy is a function of net choice. Without generational cooperation within the community, there is no economy.

The corporate stimulus package now follows the government stimulus package … and you are expecting … Passive investment doesn’t work, it never worked, and it never will work. The only people in the stock market should be those capable of adding information for the purpose of price discovery, which requires an actual education system. Everyone else gets eaten by the shark, sooner or later.

The multinationals cannot find final demand because it’s all in the analog circuit, which is isolated, and getting farther away everyday. Force doesn’t work because talent is a function of liberty. The digital economy will only reset at the correct clearing price for talent. Talent doesn’t agree; it’s a compilation of unique compilers. Talent doesn’t try to out-think a particle on the other side of the universe, it cannot be copied into a best business practice, and it certainly does not work for university administrators triple dipping into the trough, while blaming the unemployed janitor for being unemployed.

Another great link. Naked capitalism, indeed:

http://www.latimes.com/news/nationworld/world/la-fg-indonesia-nike-20100628,0,6526123.story

RE: BP disaster (very depressing)…

http://www2.ucar.edu/news/ocean-currents-likely-to-carry-oil-spill-to-atlantic-coast

New bumper sticker: O[IL]BX

Really cool environmental piece.

Our Amazing Planet, top to bottom (realitycheck forums):

http://realitycheck.no-ip.info/smf/index.php?PHPSESSID=trc420nk64ri853clsh1o4ih11&topic=2170.msg5149;topicseen#new

Wildlife officials have picked up one pelican covered in oil and one dead turtle.

However, local residents have expressed their anger that the authorities have not yet begun an extensive clean-up of the oil.

Mississippi state officials says they are waiting for BP contractors to start cleaning up before beginning coordinated work.

Mississippi Department of Environmental Quality spokesman Earl Etheridge says they expect more oil to arrive before clean-up crews start their work.

“We cannot clean up or catch the oil until BP gets here. They have all of our people,” he said.

“We want to clean this up now. Maybe this will amp up BP’s effort, but we can’t do anything because they have all the money.”

Later, a reporter visited seven oil-affected beaches and saw only one clean-up crew at work.

Efforts to contain and clean up oil from the massive spill that began on April 20 are being handled jointly by federal, state and local officials and funded by BP, leading to frustration among people whose coastlines are most at risk. http://www.abc.net.au/news/stories/2010/06/28/2939164.htm?section=world

BP accused of killing endangered sea turtles in cleanup operation http://www.guardian.co.uk/environment/2010/jun/25/bp-accused-of-killing-turtles

The Obama administration, confirming the kills, said BP was under orders to avoid the turtles. “My understanding is that protocols include looking for wildlife prior to igniting of oil,” a spokeswoman for the National Oceanic and Atmospheric Administration (Noaa) said. “We take these things very seriously.”

The agency this week posted a single turtle spotter on the burn vessels, but government scientists are pressing for more wildlife experts to try to rescue the animals before the oil is lit – or at the very least to give them access to the burn fields.

“One can’t just ride through an area where they are burning and expect to be safe while looking for turtles. We don’t expect that, but we would like to access those areas where we suspect there may be turtles,” said Blair Witherington, a sea turtle research scientist at Florida’s Fish and Wildlife Research Institute

The “antidote du jour” is chicken soup and hot lemon-and-honey drinks, surely!

Get well soon!

Recipe to avert/alleviate respiratory distress–not for the faint of heart.

1/2-1 lb chicken leg on the bone

1/2-1 lb raw ginger/sliced thin except for a few chunks

1-2 bunches scallions

7 oz. rice

1 tsp. chicken base

soya sauce to taste

In a large pot w/ steam basket, steam ginger for 1 hr. Put ginger chunks in water and boil at same time. 20 minutes into steam time add chicken. 40 minutes into steam time add chopped scallions, putting white base in boiling watter.

Rice is added to boiling water along with chicken base and soya. Rice, chicken base, soya are added to boiling water at cook’s discretion so that rice finishes at approximately one hour mark.

When finished, EAT ginger and scallions (Yes, eat) with rice and chicken. Have approx 1 quart of water on hand to drink while eating. Diner will experience lots of heat in esophagus and upper respiratory system and shed lots of phlegm fr/ cold.

Enjoy!?

I don’t know how relevant, but this is from a book called, China’s Golden Age, Everyday Life in The Tang Dynasty, for ways to give up drinking:

1) White dog’s milk with ale

2) Sweat off a horse with ale

or

3) Willow blossom powder with a rat’s head skin with ale

Hopefully, some curious, scientific type will let me konw how effective they are.

Re: Krugman

For quite a while now Prof K has sounded to this theoretically untutored person like the ‘sound of one hand clapping.’ He’s advocating tirelessly for stimulus spending without the less pleasant task of calling for the writedown of the insolvent financial institutions.

Keynes’ theory of targeted deficit spending by government during economic downturns makes sense to me. But so does the writedown of the insolvent banks. As I understand the situation, to avoid the writedown of the banks the Fed and Treasury are printing money and borrowing heavily. I don’t see how the government can simultaneously borrow to maintain the fiction of the banks’ solvency and borrow to finance a Keynesian stimulus. It looks to me as though an attempt to do both at the same time will wreck the government’s finances irreparably.

Please, could some of the genuinely learned and experienced readers address this thought. Ad hominems are invited to do anything else except buy a handgun.

I disagree with Krugman, but think he is a serious academic and great writer. I do agree with him that a debt deflation acceleration is upon us. It appears that the worldwide politicians are not as concerned. Where most on this blog would disagree with Krugman is that keynes can fix the problem without causing other greater problems. We will not know the answer to that. What we are discovering is that democracies are unwilling to support unbridled Keynesianism.

You’re telling me, “I don’t believe in Keynes.” Thanks, but it’s a declaration of ideology.

I ‘believe’ in Keynes’ ideas because Keynesian stimuli have worked in the past, for example the US between 1934 to 1937– but not while governments have been propping up insolvent financial institutions.

HELIX PRODUCER I

http://www.marinetraffic.com/ais/shipdetails.aspx?mmsi=311062000

http://ac360.blogs.cnn.com/2010/06/28/evening-buzz-tracking-hurricane-alex/

Tropical Alex is taking aim at South Texas, but it could still cause trouble in the Gulf oil leak zone. Crews need calm seas to bring in a third rig called the Helix Producer to capture an additional 20,000 to 25,000 barrels of oil per day.

BP’s Chief Operating Officer Doug Suttles tells a New Orleans newspaper that knowing how much oil is gushing out of that well is irrelevant.

http://ac360.blogs.cnn.com/2010/06/28/bp-executive-flow-rate-not-relevant-join-the-live-chat/

RBS research note

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/7857595/RBS-tells-clients-to-prepare-for-monster-money-printing-by-the-Federal-Reserve.html

UnREal; something good in the Gulf!!

==> LOS ANGELES, June 28 (Reuters) – U.S. wildlife experts are preparing to collect tens of thousands of endangered sea turtle eggs and move them hundreds of miles away in an unprecedented bid to protect them from the BP Plc (BP.N) (BP.L) oil spill in the Gulf of Mexico.

Plans call for relocating 700 to 800 clutches of eggs left newly buried on the sandy beaches of Alabama and northwestern Florida — accounting for the bulk of turtle nests in the northern Gulf, U.S. Fish and Wildlife Service spokesman Charles Underwood said on Monday.

http://www.reuters.com/article/idUSN2811065720100629