By Andrew Horowitz of The Disciplined Investor

I always thought that record would stand until it was broken. Yogi Berra

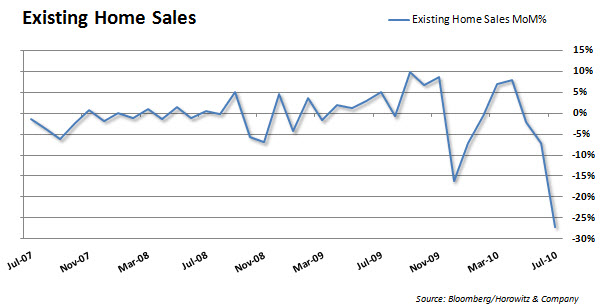

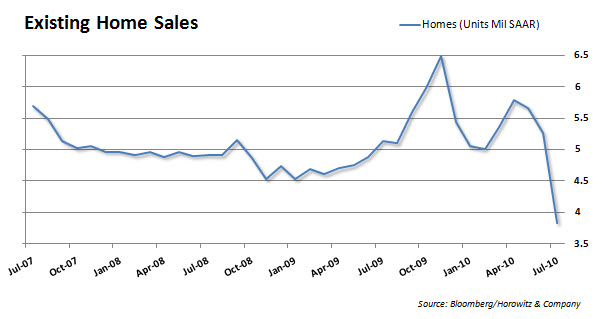

Let’s get right to the point…There is nothing good that can be said about the report that came out earlier. Existing home sales dropped off a cliff. – It is that simple.

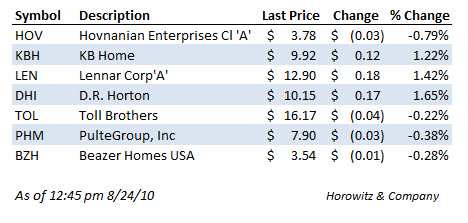

But, once the news broke that home-buyers are nowhere to be found, a strange thing happened; Several of the companies within the homebuilders space started to run higher.

Is it that the report was no worse than anyone expected? Probably not as there was an expectation of a -13.5% month-over-month change and a 4.65 million annual pace. Both actual measure fell well short of all estimates.

But, in the spirit of optimism, investors may have clung to the comments made by President Obama shortly after the report. He came out today and mentioned that there was a lot more that needs to be done in the area of the housing market.

Is he hinting at:

Perhaps more stimulus?

Maybe another credit?

Another tax benefit to the homebuilders possibly?

Free money for all?

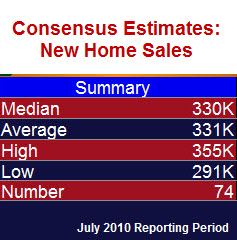

Tomorrow’s report on NEW home sales shows that expectations are coming in at NO CHANGE on a month-over-month basis. But many of those estimates will probably change overnight as when considering the awful housing report seen today.

Still, it is strange that the homebuilders started to climb. The best explanation is that perhaps they have hit bottom and a touch of short-covering is going on. Or, maybe the idea that an industry consolidation is become more of a likelihood is sparking some interest.

Existing Home Sales Reveal Deep Payback Period

The call of a short and sweet payback period following the expiration of the homebuyer tax credit went out the window with July’s existing home sales data.Total home sales fell 27.2% from 5.260 mln in June to 3.830 mln in July. Both the rate of decline and the actual sales level were the worst since records began in 1999. The Briefing.com consensus forecast expected sales to fall to “only” 4.72 mln.

Surprisingly, the median existing home price was up 0.7%, but this doesn’t necessarily suggest that prices are still on the rise. Since the price is not a repeat sales index, the rise in the median price suggests that first time homebuyers did not have as much of an impact on existing home sales as they did in prior months. Rather, existing home owners were the main purchaser and they stepped up to more expensive properties that were made more affordable by the drop in mortgage rates.

Unfortunately, the purchases of more expensive properties may actually hurt the new home sector. Since the end of 2009, homebuilders changed their building strategies to compete for first time homebuyers by building smaller homes. According to the existing home sales data, these homes are currently not the most desirable. That may result in a further downturn in new home sales as the new home inventories do not match what is being currently demanded over the coming months.

As a result, tomorrow’s new home sales numbers may come in much lower than expected, with a drop below 300,000 homes being very plausible (Briefing Consensus 334,000).

Hope for more government bailoutetry is a very convincing reason for home builder stocks to appreciate today.

When I realized that the new way to beat the market was to successfully predict the whims and decisions of key individuals in DC, I didn’t want to be in the market anymore.

I couldn’t agree with you more…..it always amazes me when there is such negative news but the market goes up anyway….is the government buying the market to keep up it’s charade or requiring those with bailouts to do so or am I just crazy…

The summer of recovery rolls on.

What is the greatest number of congressional seats an incumbent party has lost in a mid-term election? Just wondering.

Why are you wondering? What difference do you think it will make? Enlighten us, answer man. Fill the response with as much schadenfreude as possible. We feed on hate around here. It’s like a drug.

I vote for even better tax carryback values that will pad their numbers.

Even since March 2009 (that recently!) stock prices have been a function of the input from the Fed, both through direct stock futures purchases and through its affiliates.

While the stock market has always been a rigged auction, it functions according to auction conventions. With money chasing the stocks and no orders about selling, there’s no movement in the stock price. But again, bad news has no effect. This sort of thing is blatant enough to make small investors nervous: they’d get in on a rigged game, but not one where they’re not in with the riggers.

The Fed needs a lesson in optics. The “activity on news” sham has been around long enough they should do a bit to keep it almost credible. Maybe a book like If It’s Raining in Brazil, Buy Starbucks by Peter Navarro for what it’s supposed to look like. Allowing stocks to fall to their real price would look bad (wouldn’t bother most of us, though) so they should make it look like the stock market’s a real market or we’ll all think it’s a function of Fed money.

Ride the wave up through October, and sell just before the elections, if the money hasn’t been allocated for a second bailout by then.

That’s just a guess.

For any that are interested, here is my take on the EHS numbers. EHS are not that important in and of themselves, but are important when they give a clue to the future direction of housing prices. With months supply of inventories now up over a year, the direction is down. That is going to have nasty consequenses as more and more folk find themselves underwater (the country is turning into Pakistan) on their mortgages.

Much more here: http://zacks.com/stock/news/39208/Home+Sales+Plunge%2C+Prices+to+Follow

Where are the economists without ideology?

Looks that the demand curve isnt afecting prices, right? This is the inflation showing the firsts signals that something could happen in USA: hyperinflation.

One these days we will see the resultats of the Zimbabwe School of Economics: rocketing prices.

Pork bellies, wheat or even gold are showing what could be the generalised uprising of prices.

The problem is simple: economics isnt science but only ideology. Keynesians, monetarists, austrian and son on, are the subproduct of voodoo economics. Only ideology. Not rational analysis. Ok. Even logic has his own limits, as Gödel teached us. But where are the objective analysis of economics facts today?

For some who didnt understand the lesson of Thirties I let you a link. Nothing more. Just a link. Others should study better what hapenned in the past.

http://upload.wikimedia.org/wikipedia/commons/b/be/Us_savings_rate_history.jpg

Have a good night.

PJM,

My friend, I hope you’re right about hyperinflation. I’d love nothing more than to see the dollar and the euro go down to zero, while my gold and silver goes toward infinity. That works for me.

Psychoanalystus (still waiting for that Porto wine :)

Dear Psychoanalystus,

The wine is going to you as you wish. ;)

Anyway, I dont believe hyperinflation in Europe because the governments here are fighting the fiscal deficits. To have a uprising in prices in triple digits I believe we must to have huge fiscal deficits. In USA the government needs the printing machine to stay alive and in coma. As the world realise the risk of colase from the dollar the prices will rise at high velocity. I think the fall of dollar will trigger the uprising in prices and the colapse of bond market.

I dont think gold will the best hedge against hyperinflation, if that will hapen.

Kind regards and enjoy the Porto. Put some fresh lemon juice as the british do and you will be more surprise. :)

INFLATION? Where in your fantasy world? We are so far from “inflation” it is sad.

People like you need your citizenship revoked.

“People like you need your citizenship revoked.”

Better yet, everyone who stands in the way of banksters looting this country dry should have their citizenship revoked… ;)

The expectation for a midterm election change is nothing short of deep belief in suicide. We really don’t need the Republican voodoo in addition to the major crisis we are in.

The Obama crowd may be weak in its sorry attempts to fix the economy, but the Republicans and their oligarchs caused the crisis. More money for the rich will send most of us to mud hats and the country to Central America.

Housing will pick up when unemployment will go down. Republican rich drug smoking will just increase the haze we live in.

“More money for the rich will send most of us to mud hats and the country to Central America.”

True, but think about all the “fun” we’d have bitching about it on this site… :)

Psychoanalystus

The two-party system is a mere distraction from the real power(s) behind the curtain – to get the sheeple to believe there is a choice. Corporations/military industrial complex/banks/the privately-held Fed are running the country. You think Obama is representing the truth in the GoM in regards to BP? Did he take down the insurance companies with the health care bill? How about the banks with FinReg?

Republicans/Fox, Dems/MSNBC – it’s all a distraction. There’s no difference between the two.

The Great Depression and all subsequent recessions including the current one led to consolidation of the finance industry in its many different parts. That is what is happening to housing, which is completely dependent upon the finance market. Without vigorous Government intervention, the ultimate end is an economy governed by a collective of huge oligarchies, reducing choice and increasing prices.

The teapartiers fail to realize that politics, like nature, abhors a vacuum. You eliminate the Federal Government and of course the multinationals will dance with joy and quickly dictate the rules of the economy. The average citizen will enjoy the same quality of life of the typical banana republic. Reality check.

The multi-nationals already rule the economy.

“Total home sales fell 27.2% from 5.260 mln in June to 3.830 mln in July. Both the rate of decline and the actual sales level were the worst since records began in 1999.”

“…since records began in 1999”. Say what, 1999? Though a prior millenium, 12 years seems a bit of a short span to be tracking data on a critical leg of the US economy. Did the reverend economists overlook a minor metric in their mathematical black box? Oops.

Regarding the disconnect between plummeting sales and (slightly) rising prices, there is always a measurable lag between sales volume and prices in either direction. It’s a known characteristic of housing, so briefing.com’s confusion is puzzling. To expect immediate correlation for housing as for widgets betrays surprising cluelessness.

Doctor Housing Bubble explains the sales as leading indicator to prices, which typically lag 12-18 months:

http://www.doctorhousingbubble.com/the-anatomy-of-a-housing-bubble-city-pasadena-ca-real-estate-in-bubble-and-will-correct/

In a theoretically free-market, prices are certain to follow sales over the free-fall edge, probably faster now than the usual lag time. Though fraudulent action by the “plunge protection team” is now de rigueur, it may be a little busy just now propping up other assets.

Don’t run out to buy a house just yet, especially not on Obama’s advice.

PPT will break all their fingers soon, smashing that button so hard (like milliseconds after the report came out).

As was said here by a commenter some time ago “Houses are a consumable” not a quality investment, land yes, house no. How people, do to urban sprawl, sold ever smaller parcels of land upon which to erect a domicile and call it a quality investment is beyond me.

Skippy…hay we have a 40% decline yet to feel….wheeee!

Cough…#1 in both house hold indebtedness and[!] RE affordability.

Skippy…can’t see what all the fuss over who wants the reins of government right now (in skippy land)…like walking in front of a train if you ask me. The smart party polie will be the one falling down all the time, independents are going to get baptism of fire and then take it out on the party polies!

PS. overnight GM debt roll over here we come…^^^^^hay Uncle Sam got a quarter.

“Don’t run out to buy a house just yet, especially not on Obama’s advice.”

Not now, not ever. It’s time to rent forever, my friend.

Psychoanalystus

Posts like this tend to bring out the contrarian in me.

First, sales of existing homes relate to mid and lower income households. We all know these are the people who are getting hammered.

Second, new homes are most likely being built in places like Texas, which largely avoided the sand-state mess for interesting reasons, and/or for high-income households who have been largely immune to the Mess again for interesting reasons.

Third, how far have these particular homebuilders been beaten down, how are their cash-flows, where are they active, what are they building? It’s not as if a lousy print today was unexpected; volumes traded over the past month through today might be revealing.

I’m into the view from eighty thousand feet, not day by day market action. But it seems reasonable that residential markets are becoming more local; also seems reasonable that algos happened to find some firms worth more at the close than at the open but this has absolutely zip zero nada to do with concrete and 2X4s.

The main key stocks in housing began breaking down, you really whiffed on this post.

“sales of existing homes relate to mid and lower income households. We all know these are the people who are getting hammered”

Yep, I’m sure homes for the rich are still selling like hotcakes.

Psychoanalystus

I’ve got a MM house in Carefree, AZ. for you. All ya got to do is take over and settle less than a year of back payments.

Personaly I think they will be needing your services around there soon…think of all the $$$$$$ whoops make them pay in your favorite metal, you can even convert pool area for your clinic!

Yep, I’ll call that “credit counseling”…lol

Psychoanalystus

Short covering is a partial anwser. Shorting into what most expected to be miserable to ugly numbers ( Wow – they were worse than the ugly expectations )and, thereafter covering for a good gain is pretty much what is happening these days to this sector and, names therein. Which goes to the point made about “investors” in those names; there are very few…even the Hedge Fund industry — the bigger names long the area are, there for the ride ( whether it be a one or two year holding period). Can you blame the “poor Joe” that has no idea, no control nor, ability to effect the absolutley miserable returns these share-holders! Y-T-D most flat to losing money, again! 3 yr annualized returns — losing money, again…AND ALL OF THIS FOR A FEE !!

yesterday everyone was expecting a big drop in existing home sales and even though it was much lower than expected, anyone who was long probably already knew the numbers were going to be crap and were willing to hold. As for the shorts, well they had to cover, simple. Buy rumor, sell fact.

Today’s new home sales though were utterly shocking and even though some may have been punting a weaker number I doubt many would have thought we get 276

Equities AND bonds reversed HARD right away on the data.

Perhaps sentiment towards a weaker economy and housing data is already priced in…