We’ve been following litigation against Lender Processing Services, which among other things is the leading provider of default management services to mortgage services in the US, handling over 50% of foreclosures. The complaint that is moving forward the fastest (and fast in litigation land is not all that fast) is the Mississippi Northern District Bankruptcy court and alleges that Lender Processing Services along with another service provider in the default services space, Prommis Solutions both engaged in impermissible sharing of legal fees (only law firms are permitted to do legal work; even referral fees are consider not-kosher fee splitting). This case is seeking class action certification, and the Chapter 13 Trustee for the Northern District has joined the plaintiffs on her own behalf and for all Chapter 13 Trustees as a class.

Lender Processing Services continues to give investors the impression that there is nothing to see here. In a conference call last week, its only mention of this case was that its motion for summary judgment was “outstanding” which is technically accurate but more than a bit misleading. Consider: while LPS has tried to depict this case as a mere “fishing expedition”, its general counsel attended a procedural hearing in late January. How often do general counsels of public companies sit in on unimportant litigation in geographically disadvantaged location?

And the hearing did not go well for the defendants. LPS tried to argue that the plaintiffs were mistaken and it had nothing to do with the case. The judge authorized limited discovery so that the plaintiffs could connect the dots. More important, the judge also advised plaintiffs’ counsel that if they couldn’t tie this particular bankruptcy to Lender Processing Services, they should file another case. Um, sound like he’d like to see this matter tried.

Prommis Solutions argued that it was a holding company and wasn’t engaged in trade or business. The plaintiffs said that 100% of Prommis Solutions revenues came from subsidiaries that were engaged in impermissible legal fee sharing. The judge said “Add that to the complaint,” and the result is a doozy, once you get past the boilerplate at the beginning.

LPS February 5 Amended Complaint – Northern District of MIssissippi Bankruptcy Court

I do encourage you to read it; it provides considerable detail about the contracts between LPS and network law firms. Some key extracts:

In its own sworn testimony LPS Default acknowledges that it does not charge the mortgage servicer clients of its parent, LPS, any fee of any type for the services LPS Default provides to them through its contract with the mortgage servicers called a “Default Services Agreement” or DSA…..

In Schedule B to the DSA there is a document titled “The servicer Addendum to the Fidelity Network Agreement” and states in pertinent part that “Fidelity (LPS) and the Network Firm have entered into a network agreement” and “Fidelity has entered into an agreement (the “agreement”) with the servicer whereby Fidelity (LPS) has agreed to perform various legal services (emphasis supplied) for the servicer that include mortgage foreclosures, bankruptcies and other loan default

services (the “services”).Section 3.3 of the DSA states that both the servicer and LPS Default agree not to disclose the DSA outside of their respective organizations without the prior, written permission of the other party….

LPS Default has previously given sworn testimony to the effect that there is a DSA between each mortgage servicer and LPS Default for whom LPS Default provides services….

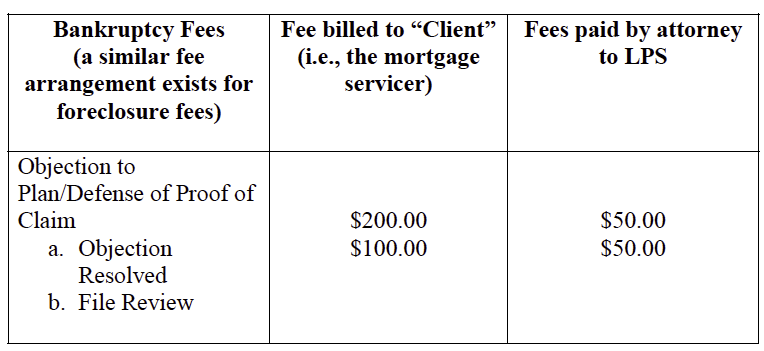

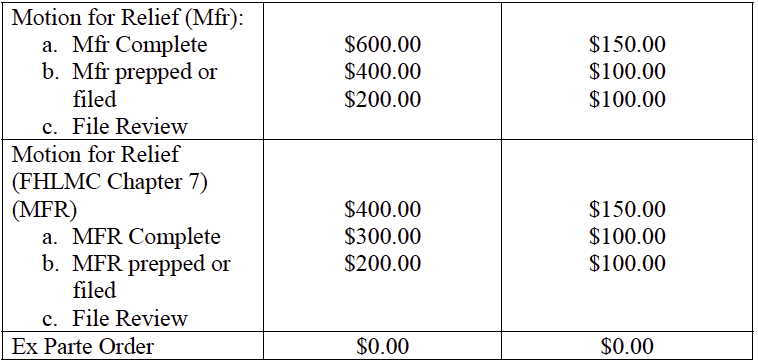

Under a typical LPS Default “Network Agreement” there is an express fee splitting arrangement such as the following (the actual fees in a particular Network Agreement depend on factors such as the fees permitted by such quasi-governmental entities such as Fannie Mae at any particular time in addition to the fees negotiated in the DSA by LPS Default for the Network Firms which become “exhibits” to the Network Agreements [click to enlarge]).

….

However, the relationship created by Great Hill’s founding and funding of Prommis Holding and Prommis Solutions skews this picture further and creates another level of fee splitting and undisclosed sharing of compensation that while modeled after LPS Default’s relationship is even

more blatant and brazen.The scenario created by Prommis’ interjection into the equation is now further slanted as follows:

LPS –> (referral of legal matter) –> Prommis Solutions–> (referral to Prommis Solutions firm which is also a network firm) –> Johnson & Freedman –>(Payment of Referral Fees by Johnson & Freedman) –>Prommis Solutions –> (Payment of Referral fees to LPS Default by Prommis Solutions) Prommis Solutions –> (Payment of Referral fees to LPS Default by Prommis Solutions)…It is believed and therefore contended and alleged by the Plaintiffs that with the introduction of the Prommis entity into this transaction that the lawyers in the network firms now actually retain less

than 1/3 of the fees which they seek approval for from the Court without disclosing these sharing arrangements to the Court.The plaintiffs believe and allege that under the present relationship the fees of the defendants in this litigation the $450 MFR [Motion for Relief of Stay] fee approved in the Thorne’s motion for relief from stay is split with $150 to LPS Default, at least $150 to Prommis Solutions and no more than $150 to Johnson and Freedman…

Furthermore, the attorneys represent to the Court that the fees sought are “reasonable and necessary” which also indicates that the fees are sought for time spent on the work by the attorney.

Both the representation that the fees are reasonable and necessary and that the fees are being paid for the attorneys work on the case are untrue.

The actual structure of the arrangements in these transactions is such that with the advent of electronic filings and “e-signatures” most of the filings made in the cases are from documents produced by non-lawyers and filed by non-lawyers without the actual involvement of the attorneys in the filings until such time as a matter is contested or a hearing is needed.

Depending upon how much time the Court wishes the parties to spend “mining” the electronic data of the transactions between the parties, the plaintiffs expect to demonstrate that a substantial majority of the law firm filings are undertaken in such a compressed timeframe from referral by LPS Default to Prommis Solutions to the law firms that meaningful review or involvement by the attorneys who have electronically signed the filings is either clearly absent or highly suspect.

This is because the business model created by the defendants stresses two things and two things only, speed of processing and volume of processing.

The law firm defendants Johnson & Freedman, and every other network firm who has executed such an agreement, owe this Court and the profession an apology.

I rather like the indignation. There as been far too little given the magnitude of conduct in bad faith.

Now this looks a tad grim for the defendants, given that the remedy for payment of impermissible legal fees is disgorgement and there appears to be no limit on the lookback period. Since Default Services is nearly half of LPS’s revenue, a finding in favor of the plaintiffs means LPS is toast. In addition, bankruptcy courts require that every disbursement by law firms be reported, even as small as reimbursing buying a cup of coffee. The idea that fees have been paid to LPS and not reported to the court is another potential gaping wound.

I will take folks in prison over judicial indignation any day.

There is a known culture of greed and rule-of-law-for-little-people which is currently running roughshod over indignation and has been for over a decade on some matters.

That said, Yves, keep your foot on their throat, please and thank you!

Again many thanks Yves!

In your final paragraph shouldn’t it look a tad grim for the “defendants”?

… and the dragline from Aberdeen MS to Boston is particularly evocative. Isn’t there a Great Hill somewhere down on the Cape?

The judge authorized limited discovery so that the plaintiffs could connect the dots.

Always a good sign, since the best place to crush legal accountability is by barring the door to the court itself.

More important, the judge also advised plaintiffs’ counsel that if they couldn’t tie this particular bankruptcy to Lender Processing Services, they should file another case. Um, sound like he’d like to see this matter tried.

There’s an example refuting those who claim that just because Florida’s (and elsewhere) crooked judges find against information-disadvantaged debtors even in the case of obvious fraud on the part of the foreclosers doesn’t mean the judges are corrupt, since “they have no choice.”

On the contrary, a judge who takes the public interest seriously has plenty of options as well as an equitable duty to give at least a modicum of advice to a plaintiff who is about to get crushed only because he’s the victim of lies and misinformation and financial imbalances. (The very fact that money has such access to the courts in itself renders them illegitimate. But there’s no way to fix that short of abolishing wealth concentration itself. So if one wills democracy, freedom, rule of law, human dignity as ends, there’s the means one must will. Otherwise it’s all empty words.)

This is a treasure trove. “98. According to information published by Great Hill Partners, the investment firm began seeking an opportunity to capitalize on the expected collapse of the American housing market as early as 2005.”

So people knew back in 2005 this would end badly.

toxymoron: Good call a home run! This business model is built around VOLUME! clearly the financial services industry understood the coming windfall of foreclosure business and created a volume model to take advantage of a little understood market niche. I have been wondering about the relationship between the foreclosure business and technology consolidation which I call financial junkyard business. High levels of technology application in business, think new manufacturing automation generates immediate winners and losers in any given market segment. Normally those with greater capital resources win and the financial junkyard crowd then moves into the picture and ships older equipment off to 3rd world business and sells off land etc.

Well, what a great steaming pile of legal horseshit! Those of us with historical connections to the so called legal profession understand that, at bottom, rules prohibiting “unauthorized practice of law” serve only to protect the licensed predators shrouded in their bar association monopolies. Does anyone believe that the “services” for which the various corporate entities deducted payment in these cases could conceivably have been performed on a one at a time basis by licensed professionals? Have you ever met a lawyer who could do anything for $600, which today buys no more than three hours of any competent attorney’s time? Anyone can see that mortgage securitization could not exist without some high technology approach to the problem of default and foreclosure.

What we really need is elimination of lawyer monopolies. There is no reason why anyone should be prevented from “practicing law”. This being said, I look forword to watching the judicial process dig its way out from under the problems associated with this case.

What about licensing don’t you understand? We don’t allow people who aren’t licensed practice medicine or accounting either, or drive trucks (and in most state, give a manicure).

And in case you missed it, the reason for not allowing fee sharing is to prevent the fomenting of litigation!

What exactly makes you think you can stand outside the legal system and understand it so perfectly? Do you really think legal ethics exists to protect non-lawyers? Is there any reason why attorney self regulation should work any better than securities industry self regulation?

William Gaddis described law as a ‘self regulating conspiracy’. Bar committees are pompous self aggrandizing buffoons enunciating Talmudic rules to protect their own corporate sincecures while making life next to impossible for practitioners representing flesh and blood clients whose interests you tirelessly flog on blog.

Do you really think banking is a racket but law isn’t?

Yves simply believes that your solution- eliminating licensing- is not the solution to all the crimes she is helping to uncover. She has slogged through impenetrable thickets and pulled out the relevant bits for us, please leave her alone.

Yves – Perhaps you have already noted this somewhere but attorneys are generally forbidden to share fees with non-attorneys. This is an important ethics rule and up there with having to make sure clients’ funds are held in a segregated account and not the attorney’s personal account.

Attorneys can generally pay other attorneys for referrals. They label it “fee-sharing” while the rest of the world would call it “commissions”. There are obvious reasons why legal ethics prohibit lawyers from paying sales and marketing commissions to non-lawyers.

It would appear that this may be an elaborate construct to avoid at least the appearance of a material ethics issue for the attorneys who handle the foreclosure proceedings.

I do not know about MS but in all PA Bankruptcy Courts the following LPS fees structure was observed with regard to MFRs as late as early 2009.

Upon receiving the referral the law firm was permitted to bill $200.00 dollars and the law firm paid LPS a $40.00 “technology fee”. The MFR had to be filed the same day the referral was received (in the MDPA you received a one day grace period as a result of local rules requiring 24 hour notice to the opposing attorney of an intent to file a MFR) and once filed the law firm was permitted to bill the remainder of their fee but were required to pay LPS an additional $50.00 technology fee (total fees billed by the law firm would be between $450.00 to $800.00 depending on the client).

In addition, in NJ the following LPS fees structure was observed with regard to MFRs as late as late 2009. Upon receiving the referral the law firm was permitted to bill $200.00 dollars and the law firm paid LPS a $40.00 “technology fee”. The required client certifications were prepared and uploaded via LPS at which point the law firm could bill an additional $200.00 and LPS would receive an additional $10.00 “technology fee”. Finally, once the executed certifications were returned via LPS the MFR had to be filed that day and once filed the law firm was permitted to bill the remainder of their fee but were required to pay LPS an additional $40.00 technology fee (total fees billed by the law firm would be between $550.00 to $650.00 depending on the client).

There is much productive litigation taking place in Fed BK courts. The case referenced here is one example.

Another BK case involving Fidelity/LPS is In Re Wilson in Louisiana. In brief the case involves a Fidelity/LPS employee, Dory Goebel, having submitted a falsely sworn affidavit (Hmm, LPS telling lies in a BK court. Imagine that.) Subsequently LPS has done everything possible to stop the Trustee from bringing that to light, including some rather ham fisted efforts to cover up the first lies by telling more lies. Fortunately the Trustee hasbeen particularly dogged, and presiding Judge Magner has been open to the issue, and the efforts of the Trustee.

The case has been ongoing for 2-3 years. Most recently there has been a hearing on a Motion for Sanctions against Fidelity/LPS that was filed by the US Trustee. The hearing was in December of last year, and I believe that Trustees motion was filed in May of last year.

Each of the parties, pursuant to court order, have submitted post trial, or post hearing, briefs. After reading the post trial brief submitted by the US Trustee I wait with baited breath for the transcript of that hearing to become available.

US Trustees Post Trial Brief is available here:

http://www.scribd.com/doc/48428649/296-Post-Trial-Brief-Filed-by-Office-of-Us-Trustee

The full docket of the case, up to 2-7-2011, is available here:

http://www.scribd.com/doc/48428916/Docket-in-RE-Wilson-2-7-2011

The Post Trial Brief submitted by Fidelity/LPS is available here:

http://www.scribd.com/doc/48443033/In-Re-Wilson-LPS-Post-Trial-Brief-01-Feb-2011

Many other case documents are available here:

http://www.scribd.com/my_document_collections/2703232

Each of these cases takes on additional import and significance when read together.

Does it bother any one else that we have lost touch with the actual work of these subject companies? I want to beg your pardon for shouting, but

THEY CREATE FICTIONAL DOCUMENTS TO SUBSTITUTE FOR THE REAL DOCUMENTS THEIR CLIENTS DESTROYED.

Sorry, when the discovery gets to the point, wait….

It has gotten to that point and the legal semantics are hiding the moose, spotlighting on a flea.

Please restrain yourself. if there are any more outbursts like this I will clear the courtroom! The jury will disregard the mention of “fictional documents”.

You have no idea about the illegal stuff going on at this company. The employees are not trained at all on how to handle these files. Employees are constantly told to swim or drown when questions about outdated files are asked. Employees are given answers to certification test required by law. Files are passed around from processor to processor until foreclosure dates are set. If a borrower requests a call back, processors and supervisors take down borrower’s contact info fully knowing they have no intention of calling these borrowers back. There is no sense of helping anyone and the majority of time, employees are told to give borrowers incorrect information concerning HAFA requirements. It’s a nightmare. How do I know? I work there.